Walking onto a car lot in Canada today feels different than it did five years ago. The days of effortless 0% financing on every model are largely in the rearview mirror, replaced by a complex landscape of fluctuating interest rates, tighter lending standards, and a massive surge in vehicle prices. If you are looking for a new set of wheels in 2025, you aren't just shopping for a car; you are shopping for money. And the price of that money can vary by thousands of dollars depending on how prepared you are before you even turn a key in an ignition.

Securing the "best" car loan isn't just about finding the lowest Annual Percentage Rate (APR). It's about understanding the total cost of borrowing, the flexibility of your contract, and how your personal financial profile interacts with the algorithms used by Canada's Big Five banks and captive lenders. This guide pulls back the curtain on the Canadian automotive finance industry, giving you the strategic edge needed to move from a passive buyer to a savvy borrower who dictates the terms of the deal.

Key Takeaways

- Rate Environment: While rates have stabilized from their 2023 peaks, expect prime rates to hover between 5.9% and 8.9% for most of 2025, with manufacturer incentives offering lower rates on specific new models.

- The 660 Threshold: A credit score of 660 is the "gatekeeper" for prime lending. Crossing into 720+ territory unlocks the absolute lowest tier of interest rates.

- Sticker Price vs. Borrowing Cost: A $40,000 car can easily cost $55,000 once interest and fees are factored over a long-term loan. Always calculate the total cost, not just the monthly payment.

- Pre-Approval Power: Walking into a dealership with a bank pre-approval forces the finance manager to beat a rate you already have, rather than setting a high baseline.

- The 96-Month Trap: Long-term loans (84-96 months) significantly increase the risk of negative equity, where you owe more than the car is worth for the majority of the loan's life.

Understanding the Mechanics of Canadian Car Loans

Before you sign a bill of sale, you need to speak the language of the finance office. Most Canadians focus on the monthly or bi-weekly payment, but that is the easiest number for a dealership to manipulate. To find the best loan, you have to look at the gears turning behind that number.

Interest Rates (APR) vs. Base Interest

The Annual Percentage Rate (APR) is the most honest number you will see. Unlike the base interest rate, the APR includes the interest plus any mandatory fees or "documentation charges" associated with the loan. In Canada, provincial regulations require lenders to disclose the APR clearly. If a lender quotes you a "base rate" of 6% but the APR is 7.5%, those hidden fees are eating into your budget. Always compare loans based on the APR to ensure an apples-to-apples comparison.

Fixed vs. Variable Rates: Which is safer?

Most car loans in Canada are fixed-rate, meaning your interest rate and payment stay the same for the entire term. However, variable-rate auto loans do exist. In the current 2025 economy, fixed rates offer the security of knowing exactly what your "total cost of borrowing" will be. Variable rates might start lower, but with the Bank of Canada adjusting rates to manage inflation, a variable loan could see your interest costs spike unexpectedly. For most borrowers, the peace of mind of a fixed rate outweighs the potential (and often negligible) savings of a variable one.

Loan Terms: The Rise of the 96-Month Loan

As car prices in Canada have climbed, lenders have introduced 84 and 96-month terms (7 and 8 years) to keep monthly payments "affordable." This is a double-edged sword. While it lowers your immediate cash flow requirements, it drastically increases the total interest you pay. Furthermore, cars depreciate quickly. If you take a 96-month loan on a vehicle, you will likely be "underwater" (owing more than the car's trade-in value) for at least five or six years. This makes it nearly impossible to sell or trade the car early without paying out of pocket to clear the debt.

Open vs. Closed Loans: The Freedom to Pay Off Early

An open loan is your best friend. It allows you to make lump-sum payments or increase your monthly contribution whenever you have extra cash. If you receive a tax refund or a work bonus, putting it toward an open car loan goes directly to the principal, reducing the amount of interest that can accrue. Always verify the "Prepayment Clause" in your contract before signing.

The 5 Pillars of Loan Approval in Canada

Lenders don't just look at your face; they look at a mathematical model of your reliability. Understanding these five pillars allows you to "clean up" your profile before applying.

1. Credit Score: The 300-900 Range

In Canada, your credit score (primarily through Equifax or TransUnion) is the primary determinant of your interest rate. While you can get a loan with a score of 500, you will pay a "subprime" premium. The magic number for "Prime" rates is usually 660. Once you hit 720, you are considered a "Super-Prime" borrower, eligible for the absolute lowest rates the bank offers.

2. Debt-to-Income (DTI) Ratio

Lenders want to know how much of your monthly income is already spoken for. They calculate your Total Debt Service (TDS) ratio. Generally, your total debt obligations (rent/mortgage, credit cards, student loans, and the new car payment) should not exceed 40-45% of your gross monthly income. If you're right on the edge, a lender might decline you even with a perfect credit score.

3. Employment Stability

The "magic threshold" for most Canadian lenders is three months at your current job. This usually coincides with the end of a standard probationary period. If you have just started a new role, wait until you have a few pay stubs showing you are past probation. Lenders value consistency over high income; a steady $50,000 salary for three years looks better than a $100,000 salary that started last week.

4. Down Payment: The 'Skin in the Game' Factor

A down payment reduces the lender's risk. If you put 10% to 20% down, the Loan-to-Value (LTV) ratio improves. This often results in a lower interest rate because the bank knows that if they have to repossess the car, they can easily recoup the loan balance. It also protects you from immediate negative equity the moment you drive off the lot.

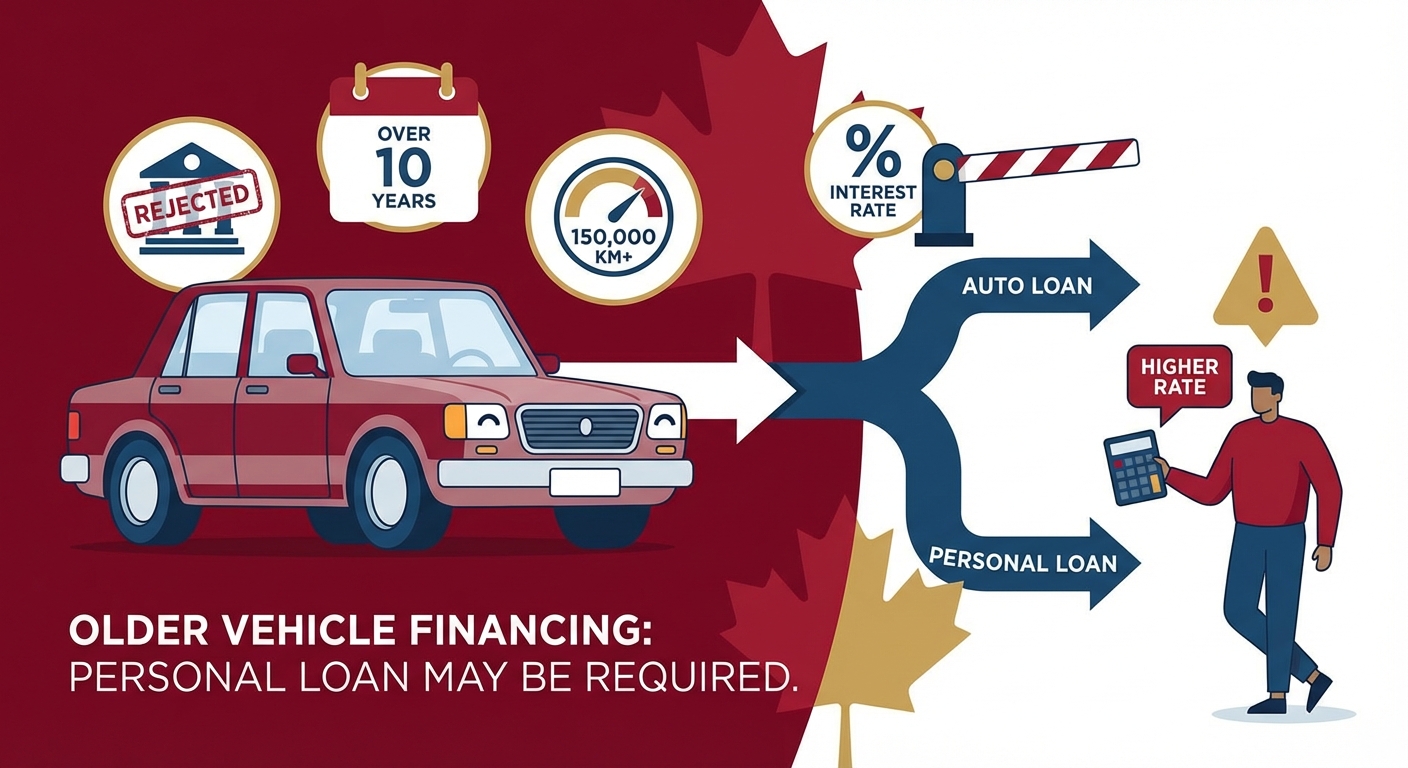

5. Vehicle Age and Mileage

Lenders are pickier about what they finance than most people realize. It is much easier to get a low-rate loan on a 2024 model than a 2014 model. Most banks will not finance vehicles older than 7-10 years or those with over 150,000 kilometres. If you are buying an older vehicle, you may be forced into a "personal loan" rather than an "auto loan," which typically carries much higher interest rates.

| Credit Score Range | Lending Category | Estimated APR (2025) | Impact on $40k Loan |

|---|---|---|---|

| 750 - 900 | Super Prime | 5.4% - 6.5% | Lowest total interest cost. |

| 680 - 749 | Prime | 6.6% - 8.5% | Standard competitive rates. |

| 600 - 679 | Near Prime | 9.0% - 15.0% | Noticeable increase in monthly cost. |

| 300 - 599 | Subprime | 18.0% - 29.0% | High cost; focus on refinancing later. |

Where to Get Your Loan: The Three Main Channels

Where you get your money is just as important as what you buy. Each channel has a specific profile of the "ideal" borrower.

The Big Five Banks

RBC, TD, Scotiabank, BMO, and CIBC dominate the Canadian landscape. They offer stability and very competitive prime rates. If you have an existing relationship with one of these banks, you might get a slight "loyalty" discount. However, their approval criteria are strict. They are the best choice for those with scores above 680.

Captive Lenders (Dealership Financing)

These are the financial arms of the manufacturers (e.g., Honda Financial Services, Toyota Financial Services, Ford Credit). They are unique because they can offer "subsidized" rates, like 0.9% or 2.9%, to move specific inventory. These rates aren't based on market conditions but are marketing tools. If you have great credit and are buying a new car, this is usually your cheapest option.

Online Lenders & Alternative Finance

Companies like Spring Financial or Fig specialize in speed and "B-Paper" borrowers. If you have been turned down by a bank because of a thin credit file or a previous bankruptcy, these lenders provide a bridge. The rates are higher, but they offer a path to vehicle ownership and a way to rebuild your credit score through consistent payments.

The Hidden Strategy: The 'Rate Shopping' Window

Many Canadians are afraid to compare loans because they fear every credit check will tank their score. This is a myth that costs people thousands. The credit scoring models used in Canada (Equifax Beacon and TransUnion FICO) recognize that consumers need to shop around for big-ticket items like cars and mortgages.

When multiple "Hard Inquiries" for an auto loan hit your report within a short window-typically 14 to 45 days-they are treated as a single inquiry for scoring purposes. This "de-duplication" process means you can apply at three different banks and two dealerships in one week, and your score will only take the minor hit of one single inquiry. This window is your greatest weapon. Use it to make lenders compete for your business.

Financing New vs. Used Vehicles in Canada

The math changes depending on the age of the car. It is a common misconception that used cars are always cheaper. While the sticker price is lower, the cost of money is almost always higher for used vehicles.

The 'New Car' Incentive

Manufacturers want to move new metal. To do this, they "buy down" the interest rate. You might see a new SUV offered at 1.9% for 48 months. The bank isn't actually lending at 1.9%; the manufacturer is paying the bank the difference to make the rate attractive to you. This is why, in some cases, a new car with a low interest rate can have a similar monthly payment to a 3-year-old used car with a 9% interest rate.

The 'Used Car' Reality

Used car rates are dictated by the market. Since there is no manufacturer to subsidize the rate, you are at the mercy of the bank's prime rate plus a risk premium. The "sweet spot" for used car financing is typically vehicles that are 3 to 5 years old. These cars have already taken their biggest depreciation hit but are still new enough to qualify for standard auto loan rates rather than high-interest personal loans.

Certified Pre-Owned (CPO) Financing

CPO vehicles offer a middle ground. Because they are inspected and backed by the manufacturer, captive lenders often offer "special" CPO rates that are lower than what you would get on a non-certified used car at a corner lot. If you want a used car but want bank-friendly rates, CPO is the way to go.

The Dark Side of Car Financing: Pitfalls to Avoid

The finance office is often the most profitable part of a dealership. You must stay vigilant against common traps that can turn a good deal into a financial burden.

Negative Equity and 'Rolling Over' Loans

This is the most dangerous cycle in Canadian car buying. If you owe $30,000 on your current car but it's only worth $25,000, you have $5,000 in "negative equity." Dealerships will offer to "roll" that $5,000 into your new loan. Now, you are borrowing $45,000 for a $40,000 car. You are paying interest on debt for a car you no longer own. Avoid this at all costs; it is better to keep your current car longer until the equity evens out.

Add-ons and Back-end Products

Once you agree on a car price and a rate, the finance manager will present a menu of "protections": GAP insurance, extended warranties, rust proofing, and life/disability insurance on the loan. While some (like GAP insurance for long-term loans) can be valuable, they are often marked up significantly. If you want these products, negotiate their price just as you did the car's price. Do not let them simply "fold them into the payment" without seeing the total cost.

The 'Monthly Payment' Trap

A salesperson will ask, "What monthly payment are you looking for?" If you say "$500," they will find a way to give you a $500 payment-even if it means stretching the loan to 96 months and packing it with high-margin extras. Negotiate the Total Purchase Price first, then the Interest Rate, and let the monthly payment be a result of that math, not the starting point.

Step-by-Step Guide: Securing the Best Loan

Follow this sequence to ensure you aren't leaving money on the table.

Step 1: Audit your credit report

Download your reports from Equifax and TransUnion. Look for errors. A single incorrectly reported late payment can drop your score by 50 points, potentially costing you 2% in interest. Dispute any errors before you start shopping.

Step 2: Calculate your 'True' budget (The 20/4/10 Rule)

Don't let the bank tell you what you can afford. Use the 20/4/10 rule as a guideline:

- 20% Down: Put at least 20% down to stay ahead of depreciation.

- 4 Years: Limit the loan term to 48 months (60 at the absolute most).

- 10% of Income: Your total vehicle costs (payment, insurance, fuel, maintenance) should not exceed 10% of your gross monthly income.

Step 3: Secure a Pre-Approval

Visit your bank or an online lender first. Get a written pre-approval. This gives you a "floor" to work from and turns you into a "cash buyer" in the eyes of the salesperson.

Step 4: Compare the Dealer's offer

Once you've picked a car, let the dealer try to beat your pre-approval. Dealerships have access to dozens of lenders and can sometimes find a "rate special" you couldn't find on your own. If they can beat your bank by 0.5%, take it.

Step 5: Review the 'Fine Print'

Before signing, check the "Total Cost of Borrowing" box on the contract. Look for "Documentation Fees" or "Admin Fees." In many provinces, these are negotiable. If the dealer is charging a $800 "documentation fee," ask them to remove it or reduce the price of the car to compensate.

Special Situations: Financing for Non-Prime Borrowers

Not everyone has a 750 credit score, and Canadian lenders have developed specific programs for unique situations.

Newcomers to Canada

If you are new to the country, you have no Canadian credit history, which can be just as difficult as having bad credit. However, banks like Scotiabank and RBC have "Newcomer to Canada" programs that allow you to get an auto loan with a larger down payment (usually 25%) and proof of a work permit or permanent residency, without a local credit history.

Students and Recent Graduates

Many manufacturers (like Mazda, Honda, and VW) offer "Graduate Rebates" ranging from $500 to $1,500. Additionally, they have relaxed credit requirements for those who have graduated within the last 2-3 years and have a letter of employment. This is a great way to build credit early.

Self-Employed Borrowers

Lenders can be nervous about self-employed income because it fluctuates. To get the best rates, be prepared to provide two years of "Notice of Assessments" (NOAs) from the CRA. If your NOAs show consistent income after deductions, you will qualify for the same prime rates as T4 employees.

Frequently Asked Questions (FAQ)

What is a good interest rate for a car loan in Canada right now?

As of 2025, a "good" rate for a prime borrower (700+ score) on a new car is between 5.5% and 7.5%. On a used car, a good rate is between 7.9% and 9.9%. Manufacturer specials may still offer 0.9% to 3.9% on specific new models.

Can I get a car loan with a 500 credit score?

Yes, but it will be a subprime loan. You should expect interest rates between 18% and 29%. The goal for a 500-score borrower should be to take the loan, make perfect payments for 12-18 months to boost their score, and then refinance at a much lower rate.

Is it better to finance through a bank or the dealership?

There is no universal answer. Dealerships are often more convenient and have access to manufacturer-subsidized rates. Banks offer more personalized service and "open" loan structures. The best strategy is to get a bank pre-approval and then ask the dealer to beat it.

Can I refinance my car loan if rates drop?

Yes, provided you have an "open" loan. If interest rates in Canada drop significantly, or if your credit score improves, you can take out a new loan at a lower rate to pay off the old one. This is a common strategy for people who start with subprime loans.

Does a car loan include HST/GST?

Yes. In Canada, the loan amount will cover the purchase price of the vehicle plus the applicable provincial taxes (HST, GST/PST). You also pay interest on that tax amount, which is another reason why a down payment is so beneficial-it covers the tax portion of the bill upfront.

What happens if I want to sell my car before the loan is paid off?

You must pay off the remaining balance of the loan before the ownership can be legally transferred to a new buyer. If you sell the car for $20,000 but owe $22,000, you will have to pay the $2,000 difference to the lender to "clear the title."

Securing the best car loan in Canada requires a shift in mindset. You are not just buying a vehicle; you are managing a significant financial instrument. By auditing your credit, shopping within the 14-day window, and sticking to shorter terms, you ensure that your car remains an asset that serves your life, rather than a debt that dictates it. Prioritize long-term equity over the temporary thrill of a low bi-weekly payment, and you will find yourself in a much stronger financial position when it's time for your next upgrade.