Car Loan After Consumer Proposal Discharge: The 2026 Greenlight

Table of Contents

- Key Takeaways: Your Fast Track to a New Car in 2026

- Phase 1: The Post-Discharge Diagnosis - What Lenders See on Your Alberta Credit Report

- Decoding the R7 Rating

- The 'Purge' Timeline

- Real-World Scenario (Experience): Meet 'Mark from Red Deer'

- Phase 2: The Rebuilding Blueprint - Your First 6 Months to a Better Rate

- The Secured Credit Card Strategy

- The 'Small, Consistent Wins' Method

- Avoiding New Debt Pitfalls

- Phase 3: Choosing Your Arena - Banks vs. Credit Unions vs. Dealerships in Alberta

- The Big 5 Banks (RBC, TD, Scotiabank, etc.)

- Alberta Credit Unions (ATB, Servus, etc.)

- Specialist 'Non-Prime' Lenders & In-House Dealership Financing

- Expertise Deep Dive: Total Debt Service Ratio (TDSR)

- The 2026 Greenlight: Market Outlook and New Rules for Second-Chance Borrowers

- Interest Rate Forecasts

- The Rise of EV Financing for All

- Data-Driven Lending

- Phase 4: The Application Playbook - Securing Approval Without Hurting Your Score

- The Pre-Approval Advantage

- Your Document Arsenal (The Non-Negotiable Checklist)

- Down Payment Power

- Choosing the Right Car

- Your Next Steps to the Driver's Seat

- Frequently Asked Questions (FAQ)

The 'Discharged' notification has arrived. It’s a financial clean slate, but the question looms: can you actually get the car you need? This isn't just about getting a loan; it's about getting a fair loan and reclaiming your financial independence. This guide is your greenlight for 2026, a deep-dive playbook specifically for Albertans navigating the post-proposal auto financing landscape.

Key Takeaways: Your Fast Track to a New Car in 2026

- The Timeline: You can often get approved for a car loan the same day your discharge certificate is issued, but waiting 3-6 months to rebuild credit can unlock significantly better rates.

- The 'Alberta Advantage': Lenders in cities like Edmonton and Calgary are accustomed to fluctuating economies and are often more flexible with post-proposal applicants compared to other regions.

- Rate Reality: Expect initial interest rates between 9% and 29%. Your goal is to secure a loan at the lower end of this spectrum by following the strategies in this guide.

- Documentation is King: Your Discharge Certificate, proof of income, and a down payment are non-negotiable. Having them ready is your biggest advantage.

- The 2026 Outlook: As the market normalizes, lenders are expected to be more competitive for 'second-chance' borrowers. We'll explore how to leverage this.

Phase 1: The Post-Discharge Diagnosis - What Lenders See on Your Alberta Credit Report

Before you step into a dealership, you need to see what the lenders see. Your consumer proposal leaves a specific footprint on your credit file. Understanding it is the first step to overcoming it.

How quickly can I get a car loan after consumer proposal discharge in Alberta? You can technically get approved the same day you are discharged. However, the best strategy involves a short 3-6 month rebuilding period. This patience allows you to demonstrate new creditworthiness, which directly translates into lower interest rates and better loan terms from a wider range of lenders.

Decoding the R7 Rating

On your Canadian credit report from Equifax or TransUnion, you'll see a rating scale from R1 (perfect) to R9 (bad debt/bankruptcy). A consumer proposal places an 'R7' rating on the accounts that were included in the proposal. This rating signals to lenders that you've entered into a formal arrangement to pay back a portion of your debts over time. It's better than an R9 (bankruptcy), but it's a clear flag that requires a strategic approach to overcome.

The 'Purge' Timeline

Here's a crucial piece of information: the record of your consumer proposal legally remains on your credit report for three years after the date of your final payment and discharge. So, if you finish your proposal in January 2026, the record will stay until January 2029.

Does this mean you can't get a loan for three years? Absolutely not. The impact of the R7 rating diminishes dramatically with each passing month of positive credit history you build post-discharge. Lenders care far more about what you've done *since* the discharge than what happened before it.

Real-World Scenario (Experience): Meet 'Mark from Red Deer'

We often see clients like Mark. A month after receiving his discharge certificate, he pulled his credit report. Here’s what it showed:

- Credit Score: 580. This is typical for someone just out of a proposal.

- Old Accounts: His old credit card and line of credit accounts were listed with a zero balance and a comment like "Included in consumer proposal" or "Debt settled through consolidation order."

- R7 Rating: The R7 rating was clearly visible on these closed accounts.

- New Credit: He had no new credit lines, so there was no recent payment history for lenders to evaluate.

Mark's report tells a story of a past problem that has been resolved. But it doesn't yet tell the story of his comeback. That's what the next phase is all about.

Pro Tip: Your First Move

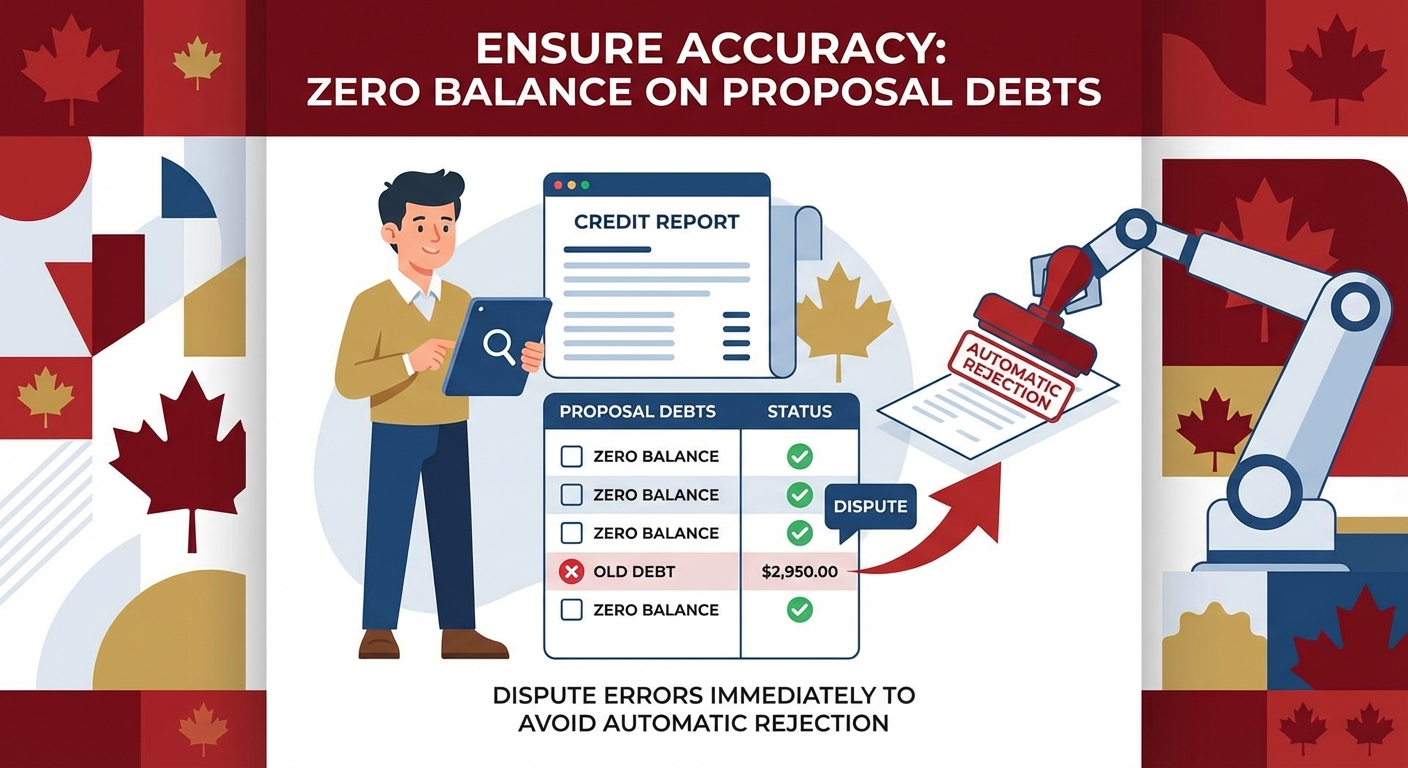

Before you even think about applying for a loan, obtain your free credit reports from both Equifax and TransUnion Canada. Go through them line by line. Ensure all proposal-included debts are marked as having a zero balance. If you see an error—like an old debt still showing a balance—dispute it immediately. An incorrect detail can trigger an automatic rejection from a lender's automated system.

Phase 2: The Rebuilding Blueprint - Your First 6 Months to a Better Rate

Patience is a virtue that pays dividends in interest rates. A few strategic moves in the months immediately following discharge can save you thousands of dollars over the life of your car loan. This is about proving to lenders that the past is truly in the past.

The Secured Credit Card Strategy

This is the single most powerful tool in your credit-rebuilding arsenal. A secured credit card is one where you provide a security deposit (typically $300-$1000), which then becomes your credit limit. To the credit bureaus, it looks and reports just like a regular, unsecured card.

Get a secured card from a provider like Capital One or Home Trust with a limit of at least $500. This is your foundation for building a new track record of reliability.

The 'Small, Consistent Wins' Method

Don't use your new secured card for big purchases. The goal isn't to carry debt; it's to create a positive payment history. Use the card for one small, recurring bill you already pay, like your Netflix, Spotify, or cell phone bill. Set up automatic payments to pay the *full balance* of the card every single month, without fail.

After just 3-4 months of this perfect payment history, your credit score will begin to climb noticeably. This is the signal lenders are looking for.

Avoiding New Debt Pitfalls

In the post-proposal period, you may be targeted by lenders offering high-interest installment loans or payday loans. Avoid these at all costs. They are seen as a major red flag by auto lenders, suggesting you haven't changed your financial habits. Taking on this type of debt can completely sabotage your car loan application, no matter how stable your income is.

Pro Tip: Double Up Your Positive Reporting

Walk into your local Alberta credit union (like Servus or Connect First) and ask about a small, secured 'credit-builder loan'. This works like a secured card but reports as an installment loan. You might deposit $1,000, and they 'lend' you your own money back, which you repay in small monthly installments over a year. This adds a second, different type of positive reporting to your file, which can accelerate your score recovery even faster.

Phase 3: Choosing Your Arena - Banks vs. Credit Unions vs. Dealerships in Alberta

Not all lenders are created equal, especially for 'non-prime' borrowers. Where you apply in Alberta matters just as much as when you apply. We'll break down the pros and cons of your main options.

The Big 5 Banks (RBC, TD, Scotiabank, etc.)

These are the toughest nuts to crack post-proposal. They have the strictest automated lending criteria. In our experience, you'll likely need at least 6-12 months of solid rebuilt credit, a strong and verifiable income, and a significant down payment (15-25%) to even be considered. If you can meet these criteria, you'll be rewarded with the best interest rates.

Alberta Credit Unions (ATB, Servus, etc.)

This is often the sweet spot for post-proposal applicants. Credit unions are member-owned and community-focused. They are more likely to have a human underwriter review your file and look beyond just the credit score. They'll consider your stable employment in places like Fort McMurray's oil sands or Lethbridge's agricultural sector, your relationship with the credit union, and your overall financial picture. They offer competitive rates, often bridging the gap between the big banks and non-prime lenders.

Specialist 'Non-Prime' Lenders & In-House Dealership Financing

This is the path of least resistance. Companies like ours, SkipTheCarDealer, and other dealership finance departments specialize in second-chance credit. We work with lenders who understand consumer proposals and are willing to approve loans the day you are discharged. The trade-off is higher interest rates. It's crucial to be an educated consumer here. For a deeper look into navigating financing as a newcomer to the province, which shares some parallels, check out our guide on Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers.

Here’s a breakdown of what to expect:

| Lender Type | Typical Interest Rate (Post-Proposal) | Approval Likelihood | Pros | Cons |

|---|---|---|---|---|

| Big 5 Banks | 7% - 12% | Low (in first year) | Best rates, builds strong banking relationship | Strict requirements, long credit rebuilding time needed |

| Alberta Credit Unions | 9% - 18% | Medium | Flexible, human review, competitive rates | May require membership, slightly higher rates than banks |

| Dealership / Non-Prime Lenders | 12% - 29.9% | High | Fast approval, can approve with zero new credit history | Highest rates, potential for hidden fees |

Expertise Deep Dive: Total Debt Service Ratio (TDSR)

Lenders use a formula called the Total Debt Service Ratio (TDSR) to assess your ability to repay. It's calculated as: (All Monthly Debt Payments + New Car Payment + Housing Costs) / Gross Monthly Income. Most lenders want this ratio to be under 40-44%. After a proposal, your old debts are gone, which dramatically helps your TDSR. The key is proving your income. If your income is variable, like from WCB, our guide on Alberta's WCB Benefits: Your Car Loan's Secret Income. Drive Now. can show you how to present it effectively.

The 2026 Greenlight: Market Outlook and New Rules for Second-Chance Borrowers

The lending landscape is always shifting. Here’s what we anticipate for 2026 and how you can position yourself to take advantage of upcoming trends in the auto finance market.

Interest Rate Forecasts

After a period of rising prime rates, economists expect more stability in 2026. A stabilizing economy often means increased competition among lenders. For you, this is excellent news. Non-prime lenders who previously had their pick of borrowers may need to compete more aggressively on interest rates and terms to win your business. This could mean rates at the lower end of the non-prime spectrum become more common.

The Rise of EV Financing for All

As electric vehicles become more affordable and mainstream, both government and manufacturers are pushing for wider adoption. We predict this will lead to the creation of new financing programs in 2026 specifically designed to help more people, including those with bruised credit, get into an EV. These programs may feature subsidized rates or special rebates, making them an attractive option.

Data-Driven Lending

Fintech is changing the game. Lenders are increasingly using alternative data to assess risk. Instead of relying solely on your credit score, they may start looking at your history of consistent rent or utility payments through new reporting services. For someone with a thin post-proposal credit file, this could be the difference between an approval and a denial, as it provides a more holistic view of your financial responsibility.

Pro Tip: Plant a Seed for a Prime Rate

Start building a relationship with a local credit union now, even before you need the car loan. Open a chequing account, set up direct deposit for your paycheque, and maybe get that credit-builder loan we mentioned. By the time you're ready to apply in 2026, you'll be a valued member, not just an application number. That history could be the deciding factor that gets you a prime rate instead of a sub-prime one.

Phase 4: The Application Playbook - Securing Approval Without Hurting Your Score

This is where strategy meets execution. A well-prepared application is the difference between a single, successful approval and a series of damaging rejections that lower your credit score with each hard inquiry.

The Pre-Approval Advantage

There's a critical difference between pre-qualification and pre-approval. A 'soft pull' pre-qualification uses basic information to estimate if you'll be approved and doesn't affect your credit score. A 'hard pull' is a formal application that gets recorded on your credit file. Too many hard pulls in a short time can lower your score.

Always start with a provider, like SkipTheCarDealer, that uses a soft pull for the initial pre-approval. This lets you know exactly what you can afford and what your rate will be *before* a hard inquiry is ever made.

Your Document Arsenal (The Non-Negotiable Checklist)

When you're ready to apply, have everything scanned and ready to go. Lenders love organized applicants. It shows you're serious and responsible.

- Certificate of Full Performance: Your consumer proposal discharge certificate. This is non-negotiable proof the old debt is gone.

- Proof of Income: Your most recent T4, plus 2-3 recent pay stubs. If you're self-employed, have your last two Notices of Assessment from the CRA.

- Proof of Address: A recent utility bill or bank statement in your name.

- Proof of Down Payment: A bank statement showing the funds are available in your account.

Down Payment Power

A down payment is the single best way to reduce a lender's risk. From their perspective, if you have your own money in the deal, you're far less likely to default. Putting 10-20% down can drastically improve your approval chances and can often lower your interest rate by several percentage points. It shows you're financially stable and a good risk.

Consider the impact on a $25,000 used vehicle loan over 72 months for a post-proposal applicant:

| Scenario | Down Payment | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| Zero Down | $0 | 19.99% | $663 | $22,736 |

| 20% Down | $5,000 | 15.99% | $486 | $15,002 |

| Total Savings with Down Payment: | $7,734 | |||

Choosing the Right Car

This might seem counterintuitive, but trying to finance a 10-year-old car with 200,000 kilometres can be *harder* than financing a 3-year-old certified pre-owned vehicle. Why? Lenders see the older car as a higher risk for mechanical failure, which could lead you to stop making payments. A newer, reliable vehicle with a warranty is a safer bet for them, and therefore, an easier approval for you. If you have questions about specific vehicles or situations, our guide Rookie Mistake? Not You! Your 2026 Car Loan Questions, Edmonton. answers many common queries.

Your Next Steps to the Driver's Seat

You've done the hard work of completing a consumer proposal. Now, it's time for the reward. Here is your final action plan to turn this knowledge into a set of keys.

- Action 1 (Today): Pull your official Equifax and TransUnion credit reports. Don't use a third-party app; get the official source. Identify the discharge date and check for any errors on old accounts.

- Action 2 (This Week): Apply for a secured credit card with a $500-$1000 limit. Set up an automatic payment for a small recurring bill to start building that positive history.

- Action 3 (In 3 Months): Re-check your credit score. You should see an improvement. Now is the time to start gathering your 'Document Arsenal' so you're ready to act.

- Action 4 (When Ready): Approach a single, well-researched lender or broker (like us!) for a soft-pull pre-approval. Once you know your budget, you can begin your car search with total confidence.

Frequently Asked Questions (FAQ)

Your most pressing questions about getting a car loan in Alberta after a consumer proposal, answered directly.