DMP Done? Your 2026 Car Loan Awaits. Canada.

Table of Contents

- DMP Done? Your 2026 Car Loan Awaits. Canada.

- Key Takeaways

- The Fresh Start After Debt: Your 2026 Car Loan Dream in Canada

- From Debt Management to Driving Freedom: Is a Car Loan Possible Post-DMP?

- Why 2026 is Your Target: Understanding the Credit Rebuilding Timeline

- Your Compass for the Road Ahead: Key Takeaways for Auto Financing Post-DMP

- Key Takeaway 1: Your Credit Score *Will* Rebound – With Active Effort

- Key Takeaway 2: Lenders Value Stability, Not Just a Score

- Key Takeaway 3: Embrace Subprime as a Stepping Stone, Not a Stigma

- Key Takeaway 4: Preparation is Your Ultimate Power

- Key Takeaway 5: Geography Matters (Slightly) in the Canadian Auto Market

- Decoding Your Credit Score Post-DMP: The Foundation of Your Application

- The DMP's Footprint: How It Appears on Your Equifax and TransUnion Reports

- Beyond the Numbers: What Canadian Lenders *Really* See in Your History

- Accelerating Your Credit Rebound: Post-DMP Strategies That Work in Canada

- The Lender's Lens: How Canadian Financial Institutions View Post-DMP Applicants

- Prime vs. Subprime Lenders: Knowing Your Lane for Initial Approval

- The 'Four C's' of Lending: Your Application's Core Strengths Post-DMP

- The Power of a Down Payment: More Than Just Money Off the Price Tag

- Navigating the Canadian Auto Loan Maze: Rates, Terms, and Hidden Costs

- Understanding Interest Rates Post-DMP: Expecting the Initial Premium

- The Long and Short of Loan Terms: Finding Your Sweet Spot

- Unmasking Hidden Fees & Charges: What to Watch Out For in Canada

- The Pre-Approval Power Play: Your Financial Shield Before You Shop

- The Art of the Deal: Securing Your 2026 Vehicle Smartly

- Choosing the Right Vehicle for Your Rebuilding Journey: New vs. Used

- Recommended Models: Reliability and Lower Insurance Costs in Canada

- Where to Shop: Dealerships vs. Private Sales (and the Loan Implications)

- Negotiating Like a Pro (Even with Imperfect Credit)

- Provincial Pointers: How Geography Shapes Your Canadian Car Loan Experience

- Ontario's Dynamic Market: High Insurance, Many Lenders

- British Columbia's Unique Landscape: ICBC and Urban Pricing

- Alberta's Resource-Driven Economy: Lender Appetite and Economic Shifts

- Quebec's Distinct Financial System: Consumer Protection and Local Players

- Atlantic Canada & The Prairies: Local Credit Unions as Key Allies

- Beyond the First Loan: Building a Brighter Financial Future

- The Unbeatable Power of On-Time Payments: Your Credit's Best Friend

- Refinancing Opportunities: Lowering Your Interest Rate Down the Road

- Avoiding the Debt Cycle Trap: Lessons Learned from Your DMP

- Your Next Steps to Driving Away Confidently in 2026:

- Your Burning Questions Answered: Post-DMP Auto Financing FAQ

DMP Done? Your 2026 Car Loan Awaits. Canada.

You've successfully navigated a Debt Management Plan (DMP) – a significant achievement that speaks volumes about your commitment to financial health. Now, as you look towards 2026, the practical question arises: can you secure an auto loan in Canada and put your past financial challenges behind you? This deep-dive article confirms that not only is it possible, but with strategic planning and the right approach, you can be driving a new or new-to-you vehicle sooner than you think. We'll cut through the myths and provide a clear roadmap for auto financing after your DMP, helping you understand the specific mechanics and opportunities available across Canada.

Key Takeaways

- A completed Debt Management Plan is a significant step towards financial recovery, but active credit rebuilding is essential for securing favourable auto loan terms in Canada.

- Lenders prioritize consistent income, stable employment, and a tangible down payment, even more so for post-DMP applicants.

- Embrace subprime lenders as a vital stepping stone; they specialize in helping individuals rebuild credit and are often your first point of approval.

- Proactive preparation, including understanding your budget and credit report, is your most powerful tool when approaching lenders or dealerships in 2026.

- Geography matters slightly in Canada, with provincial differences impacting insurance costs, lender availability, and market dynamics.

- On-time payments and strategic refinancing opportunities are crucial for continuously improving your credit score and lowering your loan costs over time.

The Fresh Start After Debt: Your 2026 Car Loan Dream in Canada

From Debt Management to Driving Freedom: Is a Car Loan Possible Post-DMP?

Yes, securing a car loan in Canada after completing a Debt Management Plan is absolutely possible. A DMP demonstrates a proactive effort to manage and resolve your debts, which, while impacting your credit history, is often viewed more favourably by lenders than an unresolved debt situation. Your 2026 goal is realistic, provided you employ the right strategies for credit rebuilding and smart vehicle shopping.

Why 2026 is Your Target: Understanding the Credit Rebuilding Timeline

While a DMP completion is a huge milestone, lenders need to see a consistent period of responsible credit behaviour following its conclusion. 2026 offers a realistic and achievable timeframe for significant credit rebuilding. Typically, the negative impact of a DMP on your credit score begins to diminish after 12-24 months of clean financial behaviour. By targeting 2026, you're allowing sufficient time to establish a new, positive credit history, which enables you to present a stronger application and secure more favourable terms compared to applying immediately after completion.

Your Compass for the Road Ahead: Key Takeaways for Auto Financing Post-DMP

Key Takeaway 1: Your Credit Score *Will* Rebound – With Active Effort

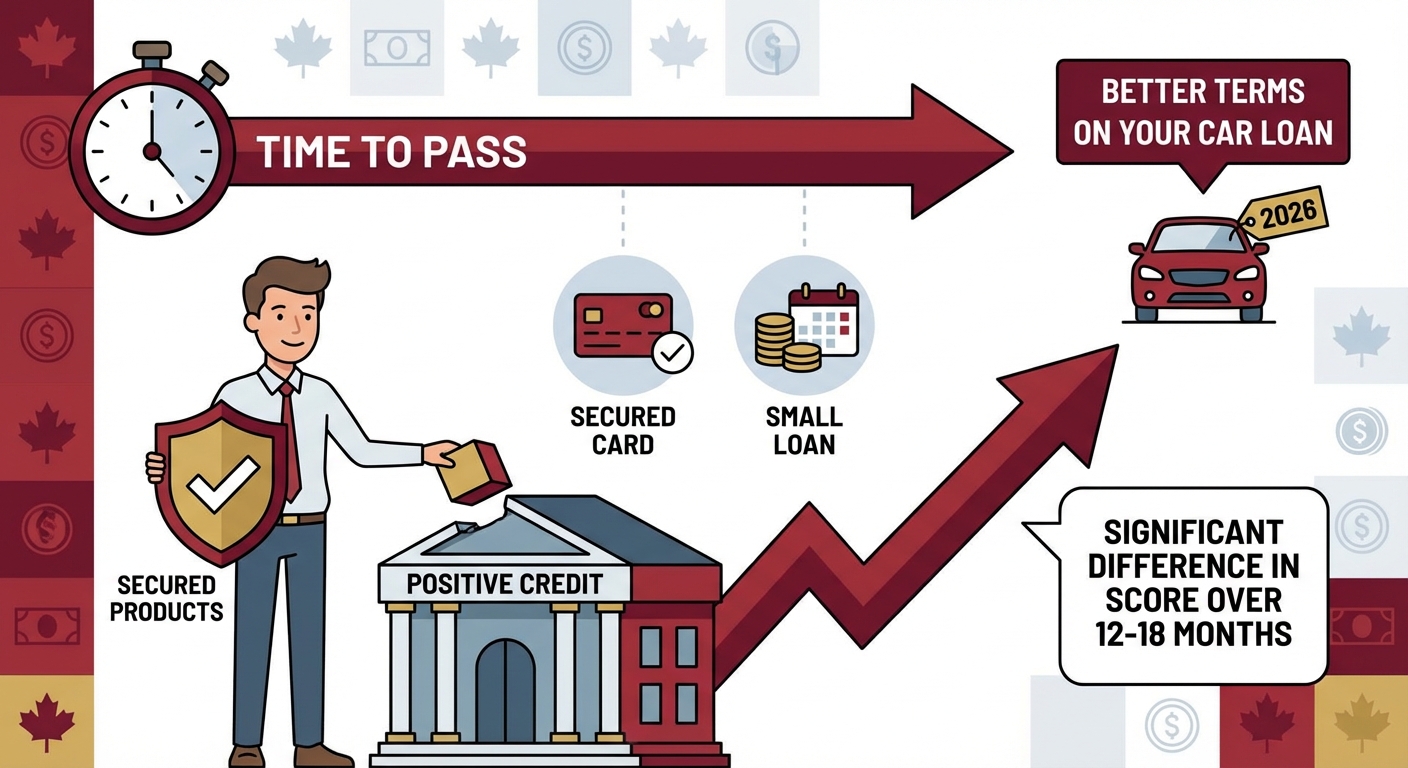

A completed DMP is not a permanent barrier to obtaining credit. While it remains on your credit report for several years, its impact lessens significantly over time, especially when overshadowed by new, positive credit activity. Proactive steps to rebuild credit post-DMP are crucial and highly effective. This isn't about waiting for time to pass; it's about actively demonstrating new financial responsibility.

Key Takeaway 2: Lenders Value Stability, Not Just a Score

Beyond your raw credit score, Canadian lenders prioritize stability. They want to see consistent income, stable employment (ideally for two years or more with the same employer), and a tangible down payment. These factors act as strong indicators of your reliability and your ability to comfortably manage new debt, often outweighing a less-than-perfect credit score in the initial assessment.

Key Takeaway 3: Embrace Subprime as a Stepping Stone, Not a Stigma

Specialized lenders catering to individuals rebuilding credit are your initial allies in the post-DMP landscape. These "subprime" lenders understand that people make financial mistakes and are willing to offer loans at higher interest rates, recognizing the increased risk. Understanding their role is key to securing your first post-DMP loan and, with diligent payments, eventually transitioning to prime rates and more conventional financing options.

Key Takeaway 4: Preparation is Your Ultimate Power

Knowing your budget inside and out, thoroughly understanding your credit report, and clearly defining your vehicle needs *before* approaching any lender or dealership will empower your negotiations. This level of preparation demonstrates responsibility and helps you avoid high-pressure sales tactics, ensuring you make informed decisions that align with your financial goals.

Key Takeaway 5: Geography Matters (Slightly) in the Canadian Auto Market

While core lending principles are national, provincial nuances can influence your car ownership experience. Factors like higher auto insurance costs in provinces such as Ontario, Alberta, and parts of British Columbia, specific lender availability (e.g., Desjardins' prominence in Quebec), and regional market dynamics (e.g., vehicle pricing differences between Toronto and Saskatoon) can all play a role in your overall car ownership budget and financing options.

Decoding Your Credit Score Post-DMP: The Foundation of Your Application

The DMP's Footprint: How It Appears on Your Equifax and TransUnion Reports

In Canada, a Debt Management Plan is recorded on your credit reports (Equifax and TransUnion) as an R7 rating, indicating a consolidation order or payments made under a special arrangement. It generally remains on your Equifax report for 6 years from the date of completion and on your TransUnion report for 7 years from the date of filing. This differs significantly from a Consumer Proposal (R7 for 3 years after completion, or 6 years from filing, whichever is sooner) or Bankruptcy (R9 for 6-7 years for a first-time bankruptcy after discharge). The good news is that its negative impact diminishes over time, especially as positive credit entries begin to accumulate and age.

Beyond the Numbers: What Canadian Lenders *Really* See in Your History

Lenders look far beyond just the DMP entry. They scrutinize your payment history *since* the DMP's completion, looking for consistent, on-time payments on any new credit accounts you've opened. They also assess your current debt-to-income ratio, which indicates how much of your gross monthly income is going towards debt payments. Your recent financial behaviour speaks volumes about your current financial stability and your commitment to responsible borrowing.

Accelerating Your Credit Rebound: Post-DMP Strategies That Work in Canada

Practical, actionable steps can significantly boost your credit score post-DMP. Here's what works:

- Secured Credit Cards: These cards require a deposit that acts as your credit limit (e.g., $300 deposit for a $300 limit). Companies like Capital One (Guaranteed Mastercard) and Home Trust (Secured Visa) are popular Canadian options. Use it for small, regular purchases (e.g., gas, groceries) and pay the balance in full every month. This builds a consistent record of on-time payments.

- Small, Manageable Installment Loans: Consider a credit builder loan from a credit union or specialized lender. With these, the loan amount is held in a savings account while you make regular payments. Once paid off, you get access to the funds and have a positive payment history reported.

- Authorized User Status: If you have a trusted individual with excellent credit, becoming an authorized user on their credit card can allow their positive payment history to appear on your report. Ensure they maintain a low balance and always pay on time.

- Regular Bill Payments: While not always reported to credit bureaus, consistently paying rent, utilities, and phone bills on time demonstrates financial responsibility. Some services, like RentMoola, can report rent payments to credit bureaus for a fee.

Pro Tip 1: Don't just wait for time to pass. Actively build positive credit with secured products. Even a small, regularly paid loan or secured credit card can make a significant difference in your score over 12-18 months, setting you up for better terms on your 2026 car loan.

The Lender's Lens: How Canadian Financial Institutions View Post-DMP Applicants

Prime vs. Subprime Lenders: Knowing Your Lane for Initial Approval

It's crucial to distinguish between prime and subprime lenders. Prime lenders, which include major banks like RBC, TD, BMO, Scotiabank, and CIBC, typically require higher credit scores (often 680+) and longer clean credit histories. They offer the lowest interest rates. For post-DMP applicants, especially in the initial years, subprime lenders or specialized auto finance companies are your primary avenue. These include credit unions across provinces (e.g., Desjardins in Quebec, Coast Capital Savings in BC, Meridian Credit Union in Ontario, Steinbach Credit Union in Manitoba) and independent finance companies (e.g., AutoCapital Canada, Fairstone, or specific dealership finance departments). They are more open to applicants rebuilding credit, though they will charge higher interest rates to offset the perceived risk.

For more on navigating challenging credit situations, check out our guide on Your 'Bad Credit' Isn't a Wall. It's a Speed Bump to Your New Car, Toronto.

The 'Four C's' of Lending: Your Application's Core Strengths Post-DMP

Lenders, regardless of their prime or subprime status, assess your application based on the 'Four C's':

- Character: Your willingness to pay. This is demonstrated by your post-DMP behaviour – consistent payments on new credit, stability in employment, and a responsible approach to your finances.

- Capacity: Your ability to pay. This is determined by your stable income, low debt-to-income ratio, and other financial obligations. Lenders look for a consistent income stream that can comfortably cover car payments, insurance, and other living expenses.

- Capital: Your down payment. This signifies your commitment to the loan and reduces the lender's risk. The more money you put down, the less you need to borrow, and the more serious you appear as a borrower.

- Collateral: The car itself. The vehicle serves as security for the loan. Lenders assess its value, age, and marketability to ensure it can be sold to recover costs if you default.

The Power of a Down Payment: More Than Just Money Off the Price Tag

A substantial down payment (aim for 10-20% or more) is arguably your strongest asset when applying for an auto loan post-DMP. It does several things:

- Reduces Loan-to-Value (LTV) Ratio: A lower LTV means the lender is taking on less risk, as the amount borrowed is closer to or below the vehicle's actual value.

- Signals Financial Responsibility: Saving a significant down payment demonstrates discipline and financial planning, which are highly valued by lenders.

- Improves Approval Odds: With less risk, lenders are more likely to approve your application, even with a rebuilding credit history.

- Secures Better Rates: A strong down payment can often lead to a lower interest rate, saving you thousands over the life of the loan. This is especially true in competitive markets like Toronto or Vancouver where lenders have many applicants to choose from.

Pro Tip 2: Aim for at least a 10-15% down payment. It's your strongest bargaining chip, signaling financial responsibility and reducing the loan-to-value ratio, which lenders love. For a $20,000 car, that's $2,000-$3,000 – a realistic goal for 2026 if you start saving now.

Navigating the Canadian Auto Loan Maze: Rates, Terms, and Hidden Costs

Understanding Interest Rates Post-DMP: Expecting the Initial Premium

It's important to set realistic expectations for interest rates immediately after a DMP. Your initial rate will likely be higher than someone with prime credit. However, this is part of the rebuilding process. Here’s a general idea of what to expect in the 2025/2026 market:

| Credit Profile | Typical APR Range (2025/2026) | Notes for Post-DMP |

|---|---|---|

| Prime (700+) | 6.99% - 9.99% | Excellent credit, long history. |

| Near Prime (620-699) | 10.00% - 15.99% | Good credit, minor blemishes. May be achievable 2-3 years post-DMP with active rebuilding. |

| Subprime (550-619) | 16.00% - 24.99% | Initial target for post-DMP applicants, especially within 1-2 years of completion. Requires strong income and down payment. |

| High-Risk Subprime (Below 550) | 25.00% - 39.99%+ | For those with very recent DMPs, limited credit rebuilding, or other significant financial challenges. |

The Annual Percentage Rate (APR) includes the interest rate plus certain fees, giving you a more accurate total cost of borrowing. Always compare APRs when evaluating offers.

The Long and Short of Loan Terms: Finding Your Sweet Spot

Loan terms can range from 36 to 84 months, or even longer. While a longer term (e.g., 72 or 84 months) will result in lower monthly payments, it significantly increases the total interest paid over the life of the loan. For someone rebuilding credit, a shorter term (48-60 months) is often a better choice, as it helps you pay off the vehicle faster, build equity sooner, and reduces the risk of being "underwater" (owing more than the car is worth). Here's a comparison for an $18,000 loan at 18% APR:

| Loan Term | Estimated Monthly Payment | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|

| 36 Months | ~$648 | ~$5,328 | ~$23,328 |

| 48 Months | ~$517 | ~$6,816 | ~$24,816 |

| 60 Months | ~$438 | ~$8,280 | ~$26,280 |

| 72 Months | ~$386 | ~$9,792 | ~$27,792 |

Pro Tip 3: Resist the urge for the longest possible term just to lower monthly payments. Calculate the total interest paid over the loan's life. A 60-month term is often a good balance for rebuilding credit and managing costs, allowing you to pay it down faster and save on interest.

Unmasking Hidden Fees & Charges: What to Watch Out For in Canada

Beyond the sticker price and interest rate, be aware of additional fees that can inflate your car loan:

- Administration/Documentation Fees: Dealerships often charge these for processing paperwork. They can range from $300 to $700.

- PPSA (Personal Property Security Act) Registration Fees: This fee registers the lender's security interest in the vehicle. It's usually a small provincial fee (e.g., $10-$60 in Ontario).

- Optional Add-ons: Be wary of high-pressure sales for rustproofing, paint protection, extended warranties, and credit insurance. While some may offer value (e.g., a reputable extended warranty for an older used car), many are high-profit centres for dealerships. Assess your genuine need and shop around for these services if you decide you want them. For example, credit insurance (which pays your loan if you lose your job or become disabled) is often very expensive through a dealership; you might find better terms from an independent insurance provider.

The Pre-Approval Power Play: Your Financial Shield Before You Shop

Getting pre-approved by a lender *before* you visit dealerships is a game-changer, especially for post-DMP applicants. This empowers you in several ways:

- Know Your Budget: You'll know exactly how much you can borrow, preventing you from falling in love with a car outside your price range.

- Negotiate Separately: With pre-approval in hand, you can negotiate the car's price separately from the financing. Dealerships prefer to bundle these, but you can insist on getting the best price for the vehicle first, then present your pre-approved financing.

- Clear Upper Hand: You walk into the dealership as a cash buyer (from the dealer's perspective), giving you significant leverage. If the dealership can beat your pre-approved rate, great! If not, you already have financing secured.

The Art of the Deal: Securing Your 2026 Vehicle Smartly

Choosing the Right Vehicle for Your Rebuilding Journey: New vs. Used

For post-DMP applicants, a reliable, slightly used vehicle (3-5 years old) almost always makes more financial sense than a new one. New cars depreciate rapidly – often losing 20-30% of their value in the first year alone. Buying used allows someone else to absorb that initial depreciation. Remember to budget beyond the loan payment, including fuel, maintenance, licensing, and especially insurance. Insurance costs can be exceptionally high in provinces like Ontario, Alberta, and parts of British Columbia, potentially adding hundreds of dollars to your monthly expenses.

For those interested in how other financial situations impact car loans, consider reading The Consumer Proposal Car Loan You Were Told Was Impossible.

Recommended Models: Reliability and Lower Insurance Costs in Canada

When rebuilding credit, prioritize vehicles known for reliability, good fuel economy, and potentially lower insurance premiums. Some excellent choices popular across Canada include:

- Honda Civic: Consistently a top seller, known for reliability and relatively affordable parts.

- Toyota Corolla: Similar to the Civic, a workhorse with a reputation for longevity and low maintenance.

- Mazda 3: Offers a more engaging driving experience with good reliability ratings.

- Hyundai Elantra/Kona: Newer models offer great value, features, and good warranties.

- Kia Forte/Seltos: Also strong contenders for value and reliability.

Always research specific model years for known issues and insurance costs in your province.

Where to Shop: Dealerships vs. Private Sales (and the Loan Implications)

- Dealerships: Offer convenience, access to a network of finance companies (including subprime lenders), certified pre-owned (CPO) options with warranties, and trade-in services. This is often the easier route for post-DMP financing.

- Private Sellers: Can offer lower prices because they don't have dealership overhead. However, securing financing for a private sale can be much harder post-DMP, as lenders prefer to work with established dealerships and have collateral they can easily verify. You'd likely need to secure a personal loan, which can be even more challenging.

Negotiating Like a Pro (Even with Imperfect Credit)

Even with imperfect credit, you have negotiating power, especially if you have a pre-approval and a down payment:

- Focus on the Total Price: Always negotiate the *total price* of the car, not just the monthly payment. A dealer can easily extend the loan term to lower payments while increasing the total cost.

- Separate Discussions: Keep trade-in discussions separate from the purchase price. Get the best price for your new car first, then negotiate your trade-in value.

- Be Prepared to Walk Away: Your greatest power is the ability to say "no." If the deal isn't right, be prepared to walk away. There are always other vehicles and other dealerships.

Pro Tip 4: Don't disclose your post-DMP status until *after* you've established interest in a vehicle and discussed pricing. Let them offer financing first, then reveal your situation if necessary, armed with your pre-approval. This keeps the focus on the car's value, not your credit history.

Provincial Pointers: How Geography Shapes Your Canadian Car Loan Experience

Ontario's Dynamic Market: High Insurance, Many Lenders

Ontario boasts Canada's largest and most competitive auto market, with numerous lenders and dealerships. However, it also has some of the highest auto insurance costs in the country, which can significantly impact your overall car ownership budget. Be sure to get insurance quotes *before* finalizing any purchase. Specific credit unions like Meridian Credit Union and Libro Credit Union can sometimes offer more flexible lending criteria for their members, including those rebuilding credit.

British Columbia's Unique Landscape: ICBC and Urban Pricing

British Columbia's auto insurance is primarily managed by ICBC, a crown corporation, which has its own rate structures and discounts. Vehicle prices, especially in urban centres like Vancouver, tend to be higher due to demand and import costs. Credit unions such as Vancity and Coast Capital Savings are prominent and often have a community-focused approach that can be beneficial for those with rebuilding credit. Remember to factor in BC's carbon tax when estimating fuel costs.

Alberta's Resource-Driven Economy: Lender Appetite and Economic Shifts

Alberta's economy, often influenced by the energy sector, can see fluctuations that impact lender appetite. When the economy is strong, lenders may be more aggressive; during downturns, they might tighten criteria. Major cities like Edmonton and Calgary have competitive markets. Auto insurance in Alberta is also privatized and can be costly. Local credit unions, such as Servus Credit Union, can be valuable resources.

For those relying on specific benefits, our article on Alberta's WCB Benefits: Your Car Loan's Secret Income. Drive Now. might offer additional insights into unique income considerations.

Quebec's Distinct Financial System: Consumer Protection and Local Players

Quebec has unique consumer protection laws that differ from other provinces, particularly regarding contracts and financing. The prominence of institutions like Desjardins, a major cooperative financial group, means they are a key player in auto financing. Ensure you understand all contract terms, ideally in French, as it is the official language. Quebec also has stricter rules around interest rates and disclosure.

Atlantic Canada & The Prairies: Local Credit Unions as Key Allies

In smaller markets across Atlantic Canada (e.g., Nova Scotia, New Brunswick, Newfoundland, PEI) and the Prairies (Manitoba, Saskatchewan), local credit unions often play a significant role. They can be more community-focused and flexible in their lending criteria for members rebuilding credit, often looking at your overall financial picture rather than solely relying on a credit score. Examples include Steinbach Credit Union in Manitoba and various regional credit unions throughout Saskatchewan.

Pro Tip 5: Research local credit unions in your province (e.g., Vancity in BC, Steinbach Credit Union in Manitoba). They often have more flexible lending criteria and a community-focused approach for members rebuilding credit compared to larger national banks.

Beyond the First Loan: Building a Brighter Financial Future

The Unbeatable Power of On-Time Payments: Your Credit's Best Friend

Once you secure your auto loan, the single most important action you can take to continue improving your credit is making consistent, on-time payments. Every payment reported positively to the credit bureaus actively rebuilds your score, demonstrating your reliability to future lenders. This discipline will open doors to better financial products, lower interest rates, and greater financial freedom down the road.

Refinancing Opportunities: Lowering Your Interest Rate Down the Road

After 12-24 months of responsible, on-time payments on your initial car loan, your credit score should have improved significantly. At this point, you may qualify to refinance your loan at a significantly lower interest rate. Refinancing can save you thousands of dollars over the loan's life by reducing your monthly payments or allowing you to pay off the loan faster. It's a smart strategy to re-evaluate your loan terms periodically, especially after a period of positive credit behaviour. For example, if you started at 18% and can refinance to 10% on an $18,000 loan over 48 months, you could save over $2,800 in interest.

If you find yourself in a situation where your current loan isn't working for you, our article Underwater Car Loan? Perfect. We'll Refinance It, Toronto! might provide useful guidance.

Avoiding the Debt Cycle Trap: Lessons Learned from Your DMP

The financial discipline gained from successfully completing your DMP is invaluable. Apply these lessons to all future financial decisions. Avoid taking on excessive new debt, always live within your means, and maintain an emergency fund. Your DMP was a reset; ensure you prevent falling back into the debt cycle by making informed, responsible choices moving forward.

Your Next Steps to Driving Away Confidently in 2026:

Here’s a concise, actionable checklist to get you on the road:

- Review Your Credit Report Regularly: Get free copies from Equifax and TransUnion annually. Dispute any errors immediately.

- Set a Realistic Budget: Account for all car ownership costs: loan payment, insurance, fuel, maintenance, and licensing.

- Aggressively Save for a Down Payment: The more you save, the better your chances and interest rates.

- Actively Rebuild Your Credit *Today*: Utilize secured credit cards and small installment loans to establish a positive payment history.

- Research Lenders and Secure Pre-Approval: Know your borrowing power before stepping onto a dealership lot.

- Shop Smart and Negotiate Hard: Focus on the total price, compare vehicles, and be prepared to walk away if the deal isn't right.