2026 Student Loan as Income for a Car Loan: The Guide

Table of Contents

- Key Takeaways

- First, The Bottom Line: Key Takeaways for Student Car Buyers

- The Lender's Dilemma: How Banks Scrutinize 'Borrowed' Income

- Income vs. Liability

- Provincial vs. Private Loans

- The 'Living Expenses' Justification

- Deep Dive: The Debt-to-Income (DTI) Math That Decides Your Fate

- Calculating Your 'Income' (The 'I')

- Calculating Your 'Debt' (The 'D')

- A Hypothetical Scenario: University of Alberta Student

- Building Your Approval Package: A Student's Checklist for Success

- The Document Trinity

- The Credit Score Conundrum

- The Power of a Down Payment

- The Co-Signer Conversation

- The Arena: Dealership Financing vs. Bank Pre-Approval

- Dealership Financing: The Path of Convenience

- Bank & Credit Union Pre-Approval: The Path of Power

- A Tale of Two Cities

- Financing Options Comparison: 2026 Student Buyer

- The Rejection Letter: Your Strategic Plan When a Lender Says 'No'

- Step 1: Debrief and Diagnose

- Step 2: Re-Assess the Budget

- Step 3: The Six-Month Plan

- Step 4: Exploring Alternatives

- Your Next Steps to Approval: A 30-Day Action Plan

- Week 1: Financial Reconnaissance

- Week 2: Run the Numbers

- Week 3: The Pre-Approval Push

- Week 4: Smart Shopping

- Frequently Asked Questions

Navigating the world of auto finance is a challenge for anyone, but for a student in Canada, it's a unique maze. Your income isn't a steady paycheque; it's a lump sum from the government or a bank, designed to cover your education and living costs. So, the big question for 2026 is: can you actually leverage that student loan to get a car loan? The answer is a complex "yes," and this guide is your roadmap to turning that possibility into a reality.

You need a reliable vehicle for that crucial co-op placement across town, to get to your part-time job, or simply to manage life outside the campus bubble. You have the funds deposited in your account, but lenders see it differently than a T4 slip. At SkipCarDealer.com, we specialize in navigating these non-traditional income situations. We understand the lender's mindset and know how to position your application for success. This guide will break down the entire process, from the math that matters to the documents you'll need, ensuring you walk into the dealership informed and empowered.

Key Takeaways

- Yes, It's Possible (But Complicated): Lenders may consider the 'living expenses' portion of your student loan as income, but they also view it as future debt, creating a unique challenge.

- DTI is Everything: Your Debt-to-Income (DTI) ratio is the single most important metric. We'll show you how lenders calculate it when your income is a loan.

- Documentation is Your Best Friend: Your loan agreement, proof of enrollment, and a clear budget are non-negotiable.

- A Co-Signer Dramatically Increases Your Odds: If you have a thin credit file, a co-signer (like a parent) can be the key to approval.

- Bank Pre-Approval Gives You Power: Walking into a dealership in Calgary or Toronto with financing already secured from a bank or credit union puts you in the driver's seat during negotiations.

First, The Bottom Line: Key Takeaways for Student Car Buyers

Yes, you can use the living expenses portion of your Canadian student loan as income to qualify for a car loan in 2026. Lenders will verify these funds through your official loan agreement and bank statements. However, they will simultaneously factor in the future repayment of the entire student loan as a liability, making your Debt-to-Income (DTI) ratio the critical factor for approval.

The Lender's Dilemma: How Banks Scrutinize 'Borrowed' Income

Understanding the lender's perspective is your first strategic advantage. When you apply for a car loan, you're not just presenting numbers; you're presenting a risk profile. For a lender, a student application using borrowed funds is one of the most complex profiles to assess. Let's break down their thought process.

Income vs. Liability

In the eyes of a bank, a $10,000 paycheque is earned income—a reward for past work and a reliable indicator of future earnings. A $10,000 student loan deposit, while it spends the same, is fundamentally different. It's an advance on your future. A lender sees it as two things simultaneously:

- Temporary Income: The portion allocated for living expenses can be used in the 'income' side of their calculations.

- Future Liability: The entire loan amount is a debt that will require repayment, adding to the 'debt' side of their calculations.

This duality is the core of the lender's dilemma. They must have confidence that you can manage the new car payment now, while also being able to handle the student loan payments later.

Provincial vs. Private Loans

Not all student loans are created equal. Lenders in provinces like Ontario (with OSAP) or British Columbia (with StudentAid BC) may view government-backed loans slightly more favourably than a private student line of credit. Government loans often have standardized terms, interest-free periods during study, and repayment assistance programs. This built-in structure can provide a small degree of comfort to a lender.

A private line of credit from a major bank, while still viable, might be scrutinized more heavily as it often accrues interest immediately and has less flexible repayment terms. Be prepared to explain the terms of your specific loan, whether it's from the government or a private institution.

The 'Living Expenses' Justification

How you frame the purpose of the vehicle matters immensely. If the car is positioned as a luxury, your application is weaker. If it's framed as a necessary tool for your education and future career, you build a much stronger case. For example:

- Strong Justification: "I need a reliable car to commute 40 kilometres to my mandatory engineering co-op placement, which is not accessible by public transit."

- Weak Justification: "I want a car for weekend trips and to make getting around town easier."

Your goal is to connect the vehicle directly to your ability to complete your studies and increase your future earning potential. This reframes the car from a liability into an investment in your career.

Pro Tip: Frame the Narrative

When speaking to a loan officer, emphasize how the vehicle supports your education and future earning potential. Use phrases like, "This car is essential for my internship at [Company Name]," or "My program requires travel to off-campus practicums." This reframes the purchase from a want to a need, aligning the loan with the intended purpose of your student funding: furthering your education.

If your job offer is contingent on having reliable transportation, you're in an even stronger position. For more on this specific scenario, see our guide on how a Job Offer's Catch? Your Car Loan Just Caught It. Drive to Work, Edmonton.

Deep Dive: The Debt-to-Income (DTI) Math That Decides Your Fate

Forget everything else for a moment. Your approval or denial will almost certainly come down to one number: your Debt-to-Income (DTI) ratio. This is the formula lenders live by. It tells them what percentage of your monthly income is already spoken for by debt payments. For students, the calculation is unique.

Calculating Your 'Income' (The 'I')

First, you need to isolate the 'income' portion of your student loan. Lenders won't count the tuition part. You need your official student loan agreement, which breaks down the funding.

Example:

- Total Loan Disbursement: $15,000 for 8 months (2 semesters)

- Tuition & Fees: $7,000

- Books & Supplies: $1,000

- Living Expenses (Rent, Food, etc.): $7,000

Your usable 'income' is the $7,000 for living expenses, spread over the 8-month academic period. Monthly 'Income' = $7,000 / 8 months = $875/month

If you have a part-time job, that income is added on top. If you earn $800/month from a campus job, your total monthly income for the DTI calculation is $875 + $800 = $1,675.

Calculating Your 'Debt' (The 'D')

This is the tricky part. Even if your student loan is in deferment and you aren't making payments yet, lenders will estimate a future payment. A common industry practice is to estimate the payment as 1% of the total loan balance. They will add this to your other monthly debts (credit cards, etc.) AND the estimated payment for the new car loan.

Let's continue the example:

- Total Student Loan Balance: $30,000 (from previous years + this year)

- Estimated Future Student Loan Payment (1% rule): $300/month

- Credit Card Minimum Payment: $50/month

- Estimated New Car Loan Payment: $400/month

Total Monthly Debt = $300 + $50 + $400 = $750/month

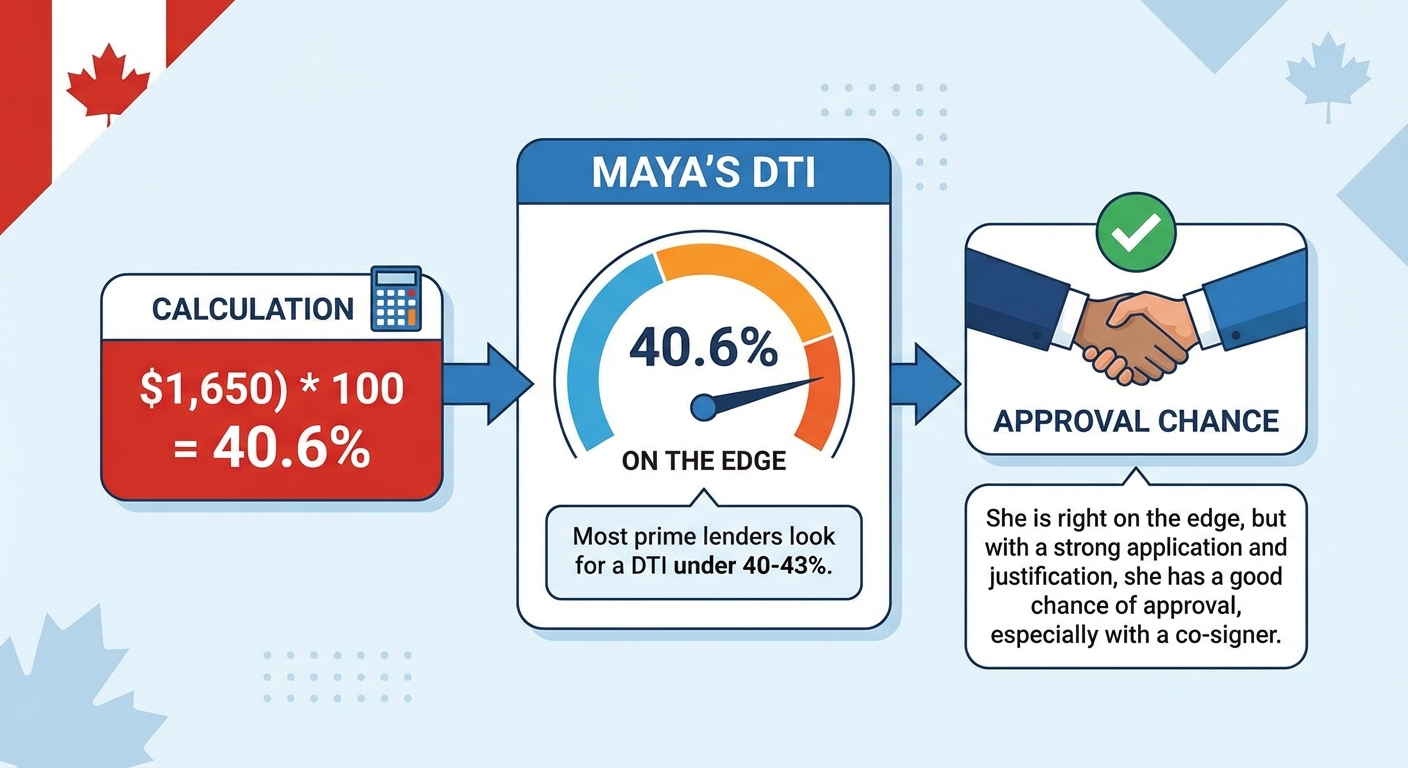

A Hypothetical Scenario: University of Alberta Student

Let's put it all together for Maya, a student in Edmonton.

- Income Sources:

- Alberta Student Aid (Living Portion): $900/month

- Part-time job at the campus bookstore: $750/month

- Total Monthly Income: $1,650

- Debt Obligations:

- Estimated Future Student Loan Payment (on a $25k balance): $250/month

- Credit Card Minimum: $40/month

- Proposed Car Loan for a used Honda Civic: $380/month

- Total Monthly Debt: $670

DTI Calculation: ($670 / $1,650) * 100 = 40.6%

In this scenario, Maya's DTI is 40.6%. Most prime lenders look for a DTI under 40-43%. She is right on the edge, but with a strong application and justification, she has a good chance of approval, especially with a co-signer.

It's also worth noting that other forms of non-traditional income can bolster your application. If you receive grants or scholarships, these are often viewed even more favourably than loans. You can learn more in our specialized guide: Bursary Income? That's Your Car Loan Superpower, British Columbia.

Building Your Approval Package: A Student's Checklist for Success

Walking into a lender's office unprepared is the fastest way to a rejection. To succeed, you need to present a professional, comprehensive package that anticipates their questions and alleviates their concerns. Think of it as an assignment where the grade is a car loan approval.

The Document Trinity

These three documents are non-negotiable. Have them printed and organized before you even start applying.

- Proof of Enrollment: An official letter or transcript from your university or college registrar confirming you are a full-time student in good standing for the current academic year.

- Official Student Loan Agreement: The complete document from your provincial provider (e.g., OSAP, StudentAid BC) or private bank. It must clearly show the total amount, the disbursement dates, and the breakdown between tuition and living expenses.

- Bank Statements: At least two recent months of statements from the account where the student loan was deposited. This proves the funds are in your possession.

The Credit Score Conundrum

Many students have a 'thin file,' meaning little to no credit history. This makes you an unknown quantity to lenders. Here's how to combat that:

- Secured Credit Card: Get a credit card secured by a small deposit ($300-$500). Use it for small purchases (like gas or coffee) and pay it off in full every single month. This builds a positive payment history.

- Report Rent Payments: Services now exist in Canada that allow you to report your monthly rent payments to credit bureaus like Equifax and TransUnion, helping to build your file.

- Cell Phone Bill: Ensure your mobile phone plan is in your name. Timely payments are reported and contribute positively to your score.

If your credit history is more than just thin and has some significant challenges, don't lose hope. Specialized financing is available. Our Car Loan After Bankruptcy & 400 Credit Score 2026 Guide provides strategies for even the toughest credit situations.

The Power of a Down Payment

Using a portion of your student loan's living expense funds for a down payment is a powerful move. A down payment of 10-20% does two crucial things: it reduces the total amount you need to borrow, which lowers the monthly payment and helps your DTI ratio. More importantly, it shows the lender you have 'skin in the game,' which significantly reduces their perceived risk.

Pro Tip: Create a Clean Paper Trail

Open a separate chequing account exclusively for your student loan funds. Have the loan deposited there, and pay your tuition from that account. When you make your down payment, the funds will come directly from this account. This creates an incredibly clean, easy-to-follow paper trail for the lender, removing any ambiguity about where your 'income' and down payment are coming from.

The Co-Signer Conversation

For many students, a co-signer (often a parent or guardian with stable income and good credit) is the key that unlocks approval. However, approaching this conversation requires maturity and preparation. You need to explain their legal responsibilities: they are 100% responsible for the loan if you fail to pay. Present them with your budget, your documentation, and your justification for needing the car. Show them you are treating this as a serious financial commitment, not a casual request.

The Arena: Dealership Financing vs. Bank Pre-Approval

Once your package is ready, you have two primary battlegrounds for securing your loan: the dealership's finance office or your own bank/credit union. Each has distinct advantages and disadvantages for a student buyer.

Dealership Financing: The Path of Convenience

The biggest advantage here is convenience and higher approval odds. Dealerships work with a wide network of lenders, including those who specialize in subprime or 'thin file' applications. They are motivated to get you approved because it leads to a vehicle sale. The downside? This convenience can come at a cost. Interest rates may be higher, and you need to be vigilant against the upselling of unnecessary add-ons like extended warranties or nitrogen-filled tires.

Bank & Credit Union Pre-Approval: The Path of Power

This route requires more upfront work but puts you in a much stronger negotiating position. Securing financing from your bank or a local credit union before you even start shopping means you can walk into any dealership and negotiate like a cash buyer. The requirements are often stricter, and they may be less flexible with student loan income. However, if you are approved, you will almost certainly get a better interest rate.

A Tale of Two Cities

Your location can play a role. A student at McGill in Montreal might find a local caisse populaire (Quebec's credit unions) is more understanding of their situation and offers more competitive rates than a national dealership's financing arm, which uses a one-size-fits-all algorithm. In our experience, local credit unions are often more willing to look at the whole picture rather than just the numbers on a screen.

Financing Options Comparison: 2026 Student Buyer

| Feature | Dealership Financing | Bank/Credit Union Pre-Approval |

|---|---|---|

| Interest Rate (APR) | Generally higher (e.g., 9% - 25%+) | Generally lower (e.g., 7% - 15%) |

| Approval Odds for Students | Higher due to a wider network of subprime lenders. | Lower, as they have stricter, more traditional income requirements. |

| Negotiation Power | Lower. You are negotiating the car price and financing at the same time. | Highest. You are effectively a cash buyer, focused only on the vehicle price. |

| Speed & Convenience | Very high. Can often be completed in a single visit to the dealership. | Lower. Requires a separate application process that can take several days. |

| Potential for Hidden Fees | Higher. Watch for administration fees, financing add-ons, and inflated warranties. | Lower. Terms are generally more transparent and straightforward. |

The Rejection Letter: Your Strategic Plan When a Lender Says 'No'

A 'no' is not a dead end. It's data. A rejection is disappointing, but it provides a clear path forward if you use it strategically. Panicking or giving up is the worst thing you can do.

Step 1: Debrief and Diagnose

You have the right to ask the lender for the specific reason for your denial. They are legally required to provide it. Was your DTI too high? Was your credit file too thin? Was the loan amount for the chosen car too large? This feedback is gold. Write it down and use it as the foundation for your next steps.

Step 2: Re-Assess the Budget

The most common reason for denial is simply trying to buy too much car. If you were looking at a $20,000 used SUV, it's time to re-evaluate. Look at reliable, fuel-efficient certified pre-owned sedans or hatchbacks in the $12,000-$15,000 range. This will lower the required loan amount, reduce the monthly payment, and instantly improve your DTI ratio.

Step 3: The Six-Month Plan

Create a concrete plan to address the rejection reason.

- If DTI was the issue: Focus on increasing your income (more hours at your job, a side hustle) or decreasing debt (aggressively paying down your credit card).

- If credit was the issue: Implement the file-building strategies mentioned earlier (secured card, etc.) and demonstrate six months of perfect, on-time payments.

- If down payment was the issue: Use the next six months to save a larger down payment from your part-time job or a summer job.

This shows future lenders that you are responsible and proactive.

Step 4: Exploring Alternatives

Be honest with yourself: is a car an absolute necessity right now, or a convenience? Calculate the real cost of ownership (payment + insurance + gas + maintenance) and compare it to alternatives.

- Public Transit: A monthly pass is often a fraction of a car payment.

- Car-Sharing Services: Services like Communauto or Evo are perfect for occasional trips.

- Buying a Cheaper Car with Cash: Could you use a portion of your living expense funds to buy a $4,000 "beater" car outright, avoiding a loan altogether? It may not be glamorous, but it could be the most financially prudent decision.

Your Next Steps to Approval: A 30-Day Action Plan

Knowledge is useless without action. Here is a tangible, week-by-week plan to take you from reading this article to getting behind the wheel.

Week 1: Financial Reconnaissance

- Pull your free annual credit report from both Equifax and TransUnion. Check for any errors.

- Gather the 'Document Trinity': proof of enrollment, full student loan agreement, and your last three months of bank statements.

- Create a detailed monthly budget. Know exactly where every dollar is going.

Week 2: Run the Numbers

- Use the DTI formula in this guide to calculate your current ratio. Be brutally honest.

- Based on your DTI, set a realistic all-in budget for a vehicle. Remember to factor in insurance, which can be very high for young drivers. Get an online insurance quote first!

- If necessary, have the co-signer conversation with your parent or guardian.

Week 3: The Pre-Approval Push

- With all your documents in hand, make an appointment at your own bank or a local credit union.

- Apply for a pre-approved car loan based on the budget you set in Week 2.

- If they say yes, you're in the driver's seat. If they say no, get the specific reason and move on to a dealership finance department that has more flexibility.

Week 4: Smart Shopping

- With pre-approval in hand (or a clear understanding of what a dealership can offer), start test-driving cars that fit your budget.

- Focus your negotiation on the 'out-the-door' price of the vehicle. Never negotiate based on the monthly payment, as this allows dealers to hide costs in the loan term.

- Once you agree on a price, you can either use your bank's pre-approval or see if the dealership can beat the interest rate. You have all the power.