2026 Student Car Loan: No Credit, No Co-Signer Options

Table of Contents

- Your Fast-Track Summary: What You Absolutely Need to Know

- The Student's Dilemma: Why 'No Credit' Isn't 'Bad Credit'

- The Lender's Scorecard: What They *Really* Look For When You Have No Credit

- The 'Three Pillars' of No-Credit Approval:

- Dealer Financing vs. Credit Unions vs. Online Lenders: The Ultimate Showdown

- Where to Get Your Loan: A Comparison

- The Price of Independence: Deconstructing Your Loan's True Cost

- Beyond the Keys: How This Loan Can Be a Credit-Building Superpower

- Your Roadmap to Approval: A 7-Step Checklist

- Frequently Asked Questions

The classic student catch-22: You need a car to get to your part-time job or internship, but you need a job and credit history to get a car loan. It’s a frustrating cycle that can make you feel like you're stuck in neutral. This guide is designed to break that cycle for good.

This article is your comprehensive roadmap to successfully securing a car loan in Canada as a student with no credit history and without a co-signer. We'll move beyond generic advice to give you actionable strategies, lender insights, and a step-by-step plan for 2026 and beyond.

Your Fast-Track Summary: What You Absolutely Need to Know

- Yes, It's Possible: Securing a car loan with no credit or co-signer is achievable, but requires a different approach focused on income stability and down payments.

- Interest Rates Are Higher: Expect higher interest rates as lenders compensate for increased risk. Your goal is to find the most competitive 'high-risk' rate, not a prime rate.

- Income is Your Superpower: Lenders will scrutinize your ability to pay. Consistent income from part-time jobs, internships, or even documented allowances is critical.

- Dealer vs. Bank vs. Credit Union: In-house dealership financing and specialized online lenders are often more flexible than major banks for students in this situation.

- This is a Credit-Building Tool: A successfully managed car loan is one of the fastest ways to build a strong credit score from scratch, opening doors for future financial products.

The Student's Dilemma: Why 'No Credit' Isn't 'Bad Credit'

Yes, you can get a car loan in Canada with no established credit and no co-signer by focusing on lenders that prioritize income stability and a down payment over credit history. Specialized dealership finance departments and some credit unions are your best options, as they have programs designed for first-time borrowers.

First, let's clear up the biggest misconception in student financing. Having no credit is not the same as having bad credit. Think of it like a blank test paper versus a paper with a failing grade.

A 'thin credit file' or 'credit ghost' status simply means you haven't borrowed money from a traditional lender before. You have no history of payments—good or bad—reported to Canada's credit bureaus, Equifax and TransUnion.

A 'poor credit file,' on the other hand, means you have borrowed money and have a history of missed payments, defaults, or other negative events. This signals to lenders that you may be a high-risk borrower.

In our experience, lenders often view a blank slate more favourably than a damaged one. Why? Because you haven't proven you're unreliable. You're an unknown quantity, not a known risk.

Real-World Scenario: Let's compare two students. Aisha, studying in Edmonton, missed several payments on her first credit card, resulting in a 550 credit score. Ben, a student in Halifax, has never had a credit card or loan in his name. When applying for a $15,000 car loan, Ben is often more likely to get approved. The lender sees Aisha's history of missed payments as a red flag, while Ben's stable part-time job and 10% down payment present a simpler, more predictable risk. For borrowers with a low score, it's still possible to get financed, as we discuss in our guide, 450 Credit? Good. Your Keys Are Ready, Toronto.

The Lender's Scorecard: What They *Really* Look For When You Have No Credit

When a credit score is off the table, lenders pivot. They stop asking "How have you paid your debts in the past?" and start asking "How will you pay this debt in the future?" To answer that, they focus on three core pillars.

The 'Three Pillars' of No-Credit Approval:

-

Income Stability & Proof: This is your most valuable asset. Lenders need to see that you have a consistent, reliable source of income to cover the monthly car payment. Sporadic cash jobs won't cut it. You need to prove it with documentation.

- What You Need: Recent pay stubs (at least 2), bank statements showing regular deposits (last 3 months), and ideally, a letter of employment stating your position, hourly wage/salary, and hours per week.

- Types of Income: Part-time jobs, paid internships, and even consistent gig economy work (like Uber Eats or DoorDash) can count if you can show a history of regular deposits.

-

Debt-to-Income (DTI) Ratio: This is a simple but powerful metric. It's your total monthly debt payments divided by your gross (pre-tax) monthly income. Lenders use it to gauge if you can handle another monthly payment.

Formula: (Total Monthly Debts / Gross Monthly Income) x 100 = DTI

As a student, your "debts" might be minimal—perhaps a cell phone bill. This gives you a massive advantage. A low DTI tells a lender you have plenty of room in your budget for a car payment. For a deeper dive into required documents, our guide Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing has a complete checklist.

-

Down Payment: A significant down payment is the single best way to increase your approval odds. It does two things: it reduces the amount the lender has to risk on you, and it shows you are financially responsible and have skin in the game. Aiming for 10-20% of the vehicle's price is a powerful statement.

Example: For a $15,000 car, a down payment of $1,500 (10%) to $3,000 (20%) will make you a much more attractive applicant.

Pro Tip: Before you apply anywhere, create a 'Financial Snapshot' folder on your computer or in a physical file. Scan and save your last 3 months of bank statements, your 2 most recent pay stubs, and a letter from your employer. Being this organized shows lenders you're a serious, low-risk applicant and speeds up the entire process.

Dealer Financing vs. Credit Unions vs. Online Lenders: The Ultimate Showdown

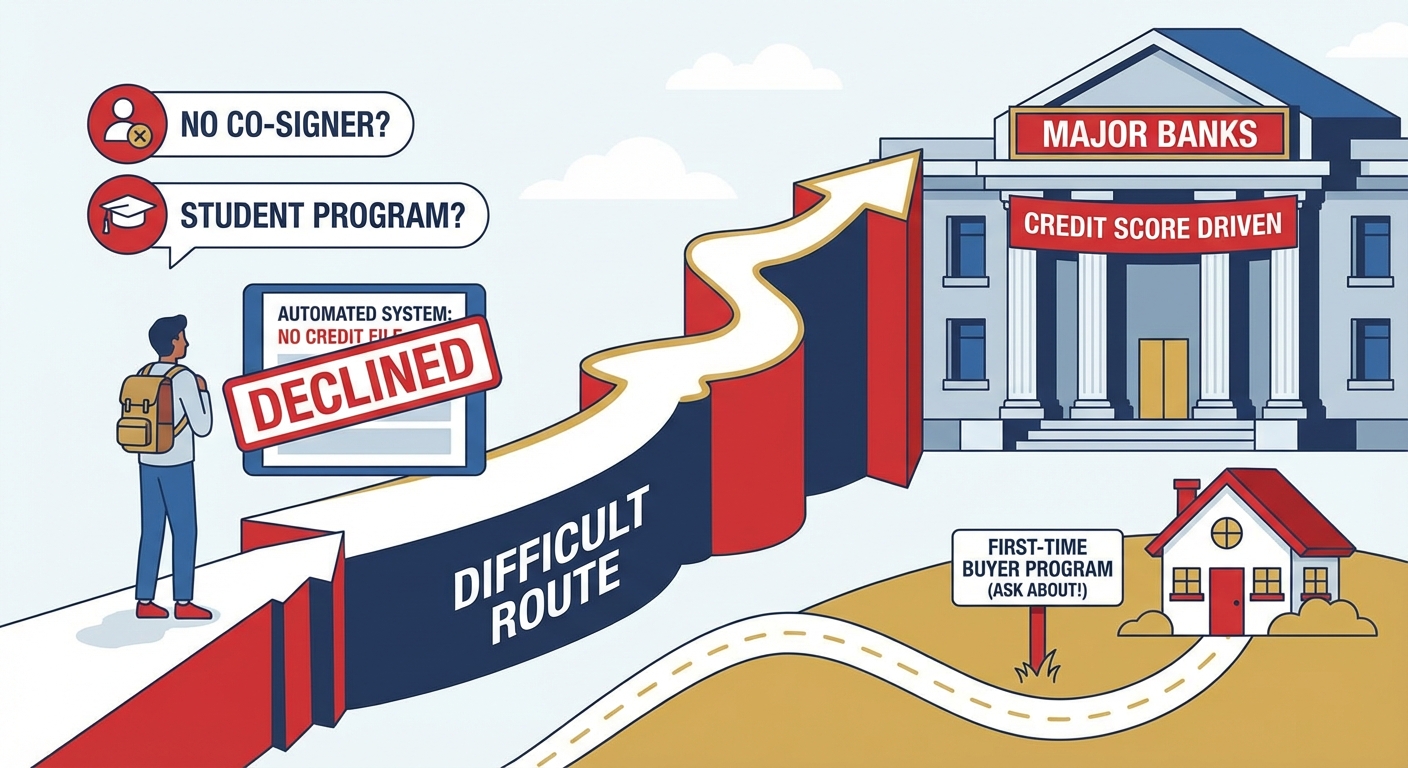

Where you apply matters just as much as what's in your application. For a student with no credit and no co-signer, the front door of a major bank is often a dead end. Here’s a breakdown of your most realistic options.

In-House Dealership Financing: This is often the path of least resistance. Dealerships, especially larger ones in cities like Calgary or Toronto, have dedicated finance departments that work with a wide spectrum of lenders, including those who specialize in first-time buyers.

- Pros: Convenience (one-stop shopping), higher approval rates for the vehicles on their lot, and established relationships with subprime lenders.

- Cons: Rates can be higher, and there can be pressure to bundle warranties or other products into the loan.

Credit Unions: Your local Ontario or B.C. credit union could be your hidden gem. As member-owned, community-focused institutions, they are sometimes more willing to look at the whole picture rather than just a credit score. If you or your parents have an account there, it's a great place to start.

- Pros: Potentially lower interest rates than dealership financing, more personalized assessment, focus on community members.

- Cons: May still be more conservative than specialized lenders; the application process can be slower.

Specialized Online Lenders: Companies like SkipCarDealer.com exist specifically to serve this market. We work with a network of lenders who understand the student demographic and prioritize income over credit history.

- Pros: High approval odds, fast online application process, can get pre-approved before shopping, less pressure.

- Cons: You need to do your research to ensure you're working with a reputable company.

The Big Banks (RBC, TD, Scotiabank, etc.): This is typically the most difficult route. Major banks are very credit-score-driven. Unless they have a specific "first-time buyer" or student program (which you should ask about), an automated system will likely decline an application with no credit file and no co-signer.

Where to Get Your Loan: A Comparison

| Lender Type | Approval Odds (No Credit/Co-signer) | Typical Interest Rates (APR) | Speed | Best For... |

|---|---|---|---|---|

| Dealership Financing | High | 15% - 29.9% | Fast (Same Day) | Convenience and getting a 'yes' quickly. |

| Credit Unions | Moderate | 10% - 20% | Moderate (2-5 Days) | Students with existing banking relationships and a strong income profile. |

| Specialized Online Lenders | Very High | 14% - 29.9% | Very Fast (24-48 Hours) | Getting pre-approved from home and shopping with confidence. |

| Major Banks | Very Low | 8% - 15% (if approved) | Slow (1 Week+) | Students who find a rare, specific 'new borrower' program. |

The Price of Independence: Deconstructing Your Loan's True Cost

Getting approved is only half the battle. Understanding the real cost of your loan is crucial to avoid financial pitfalls. It's about more than just the car's sticker price.

Understanding APR: APR stands for Annual Percentage Rate. It represents the total annual cost of borrowing, including the interest rate and certain fees. When comparing loan offers, always compare the APR, not just the interest rate, as it gives a more complete picture.

Deep Dive: The Fine Print: No-credit loans can sometimes come with extra fees. Be sure to ask about:

- Administration Fees: A fee for processing the loan paperwork.

- PPSA Fees: Personal Property Security Act fees, which register the lender's lien on the car in your province.

- Freight/PDI: For new cars, this is the cost of shipping and pre-delivery inspection. For used cars, ensure you aren't being charged excessive "reconditioning" fees.

Loan Term Traps: A longer loan term (like 84 or 96 months) will give you a temptingly low monthly payment, but it will cost you significantly more in interest over the life of the loan. Lenders offer these because they are more profitable. Let's look at an example for a $18,000 loan at 19.99% APR.

| Loan Term | Monthly Payment | Total Interest Paid | Total Cost of Car |

|---|---|---|---|

| 60 Months (5 Years) | $476 | $10,560 | $28,560 |

| 84 Months (7 Years) | $389 | $15,676 | $33,676 |

| Difference | -$87/month | +$5,116 | +$5,116 |

As you can see, the "cheaper" monthly payment costs over $5,000 more in the long run. Stick to the shortest loan term you can comfortably afford, ideally 72 months or less.

Pro Tip: Always ask the finance manager for the 'total cost of borrowing' or an 'amortization schedule' before you sign anything. This single document cuts through the confusion and shows you, in plain dollars, exactly how much interest you will pay over the entire loan. It's the ultimate transparency check.

Beyond the Keys: How This Loan Can Be a Credit-Building Superpower

Think of this first car loan not just as a way to get from A to B, but as the most powerful credit-building tool you can access. Here's why.

An auto loan is an "installment loan"—a loan with a fixed number of payments over a set period. This type of credit has a strong, positive impact on your credit score for two key reasons:

- Payment History (35% of your score): Simply making your car payment on time, every single month, is the single most important action you can take to build a great credit score.

- Credit Mix (10% of your score): Lenders like to see that you can responsibly manage different types of credit. Having an installment loan (your car) alongside a revolving credit line (like a future credit card) shows financial maturity and boosts your score.

The long-term benefits are huge. A strong credit score built from your car loan will help you qualify for better car insurance rates, get approved for a cell phone plan without a deposit, and eventually, secure a mortgage for your first home.

Strategy Corner: The 'One Year and Refinance' Plan. Your first, high-interest loan isn't a life sentence. The goal is to use it as a stepping stone. After making 12 consecutive on-time payments, you will have established a credit history and a score. At this point, you can approach a bank or credit union to refinance your auto loan at a much lower interest rate, saving you thousands over the remaining term.

Your Roadmap to Approval: A 7-Step Checklist

Ready to get started? Follow this step-by-step plan to navigate the process like a pro.

- The Reality Check: Before anything else, create a realistic budget. Use a spreadsheet to track your monthly income and expenses. Calculate exactly what you can afford for a total monthly car cost—this includes the loan payment, insurance (get quotes!), gas, and maintenance. Don't stretch yourself thin.

- Gather Your Documents: Assemble your 'Financial Snapshot' folder as we discussed earlier. Have your pay stubs, bank statements, and employment letter ready to go.

- Save for a Down Payment: Every dollar you can put down helps. Aim for a minimum of 10% of the car's value. This shows commitment and lowers your monthly payment.

- Get Pre-Approved (If Possible): Apply with a specialized online lender like SkipTheCarDealer or your local credit union *before* you step into a dealership. A pre-approval letter is like cash; it gives you massive negotiating power.

- Choose the Right Car: This isn't the time for a flashy, expensive vehicle. Focus on reliable, fuel-efficient, and affordable used cars that hold their value well. Think Honda Civic, Toyota Corolla, or Hyundai Elantra. They are cheaper to buy, insure, and maintain.

- Negotiate Like a Pro: Always negotiate the price of the car *first*, before you discuss financing. Treat them as two separate transactions. Once you agree on a price for the vehicle, then you can discuss the loan terms.

- Read Everything Before You Sign: Take your time with the final contract. Verify the vehicle price, interest rate (APR), loan term, and monthly payment. Look for any added fees or warranties you didn't agree to. Don't be afraid to ask questions.