The Canadian automotive landscape has undergone a seismic shift over the last few years. If you are approaching the end of a vehicle lease in 2024 or 2025, you are sitting in a position of power that most drivers a decade ago couldn't have imagined. Gone are the days when handing back the keys was the default move. Today, your driveway likely holds what we call an "Equity Goldmine."

Why the sudden change? Supply chain disruptions and fluctuating new car inventories have sent used car prices soaring. When you signed your lease three or four years ago, the leasing company set a "Residual Value"-a prediction of what the car would be worth today. In the current market, that prediction is often thousands of dollars lower than the actual market value. A lease buyout loan is your ticket to capturing that cash instead of handing it back to the dealership. This guide pulls back the curtain on the Canadian lending industry to show you exactly how to secure the best financing and keep that equity where it belongs: in your pocket.

Key Takeaways

- The Equity Gap: Your vehicle's market value is likely $4,000 to $10,000 higher than your contract's residual price.

- Credit is King: A score above 660 unlocks the most competitive "Tier 1" bank rates in Canada.

- Shop Early: Start your financing search 60 days before your lease expires to avoid "emergency" high-interest dealership loans.

- Tax Strategy: You only pay sales tax on the residual amount, not the original sticker price, but rules vary from Alberta to Ontario.

- Safety First: Most provinces require a fresh Safety Standards Certificate (SSC) to transfer ownership from the leasing company to you.

Understanding the Basics: What is a Lease Buyout Loan?

At its core, a lease buyout loan is a specialized type of used car loan designed to pay off the remaining balance (the residual value) of your lease agreement. While you've been "renting" the car for the past few years, the leasing company (the Lessor) has held the title. To take ownership, you need to pay them the pre-determined amount listed in your original contract.

There are two primary paths you can take. A Lease-End Buyout happens at the very end of your term. An Early Buyout allows you to purchase the vehicle before the term is up, though this often involves paying the remaining monthly payments plus the residual. For most Canadians, the Lease-End Buyout is the most financially sound move because it allows you to maximize the "rent-to-own" benefit of the original low-interest lease rate.

The "Residual Value" is the most important number in this equation. This is a fixed number. Unlike the price of a used car on a lot, the leasing company cannot legally raise this price just because the market is hot. They are contractually obligated to sell it to you at that price. However, they can add fees.

Evaluating the Math: Is a Buyout Loan Right for You?

Before you apply for a loan, you need to prove to yourself that the math makes sense. You calculate your "Instant Equity" by subtracting the Residual Value from the Current Market Value. If your car is worth $25,000 on the open market and your buyout is $17,000, you have $8,000 in equity. Financing that $17,000 is essentially buying a $25,000 asset at a massive discount.

Compare this to the cost of a new lease. In 2024, lease factors (interest rates) on new vehicles have climbed significantly. You might find that financing your current, reliable vehicle for $400 a month is far superior to leasing a brand-new version of the same car for $750 a month.

Consider the table below, which illustrates a typical Canadian scenario for a compact SUV:

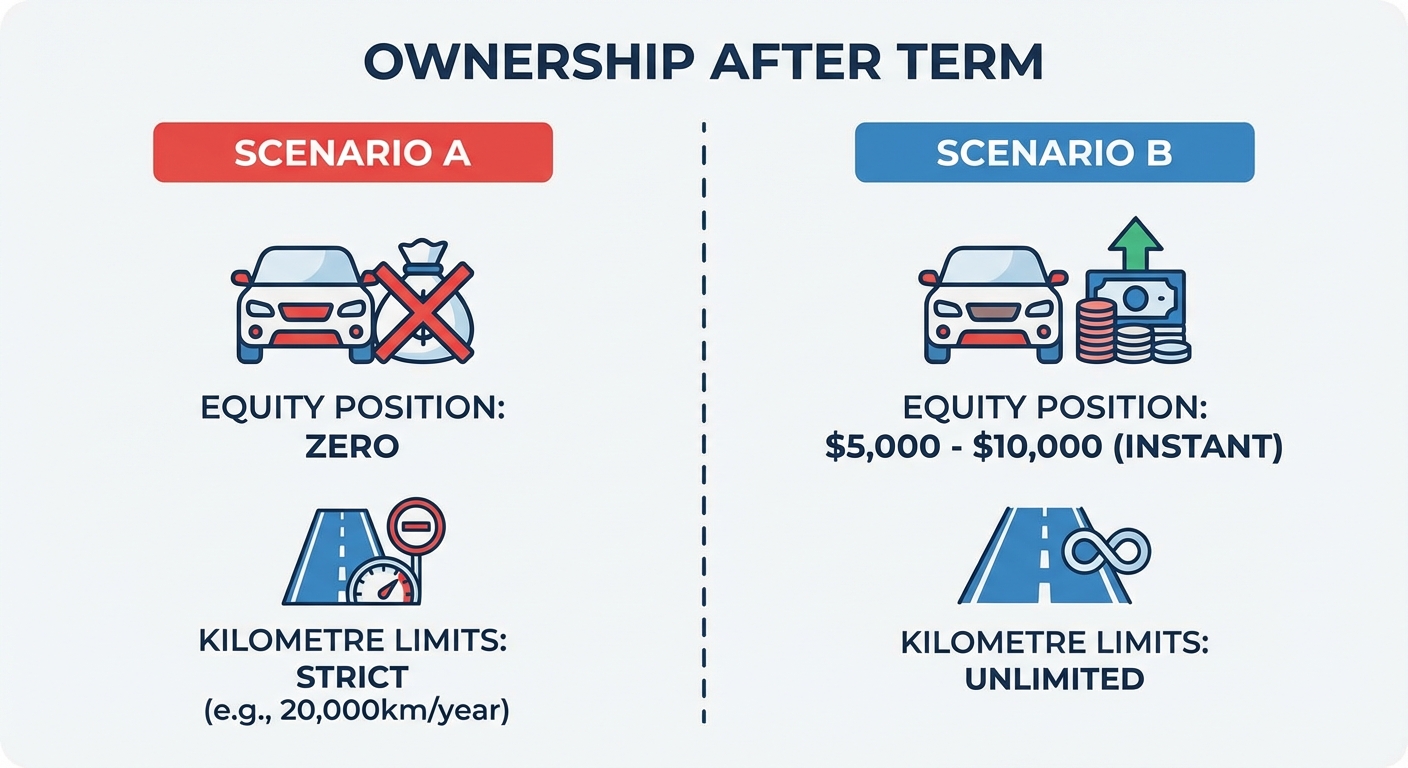

| Feature | New Lease (2024/2025 Model) | Lease Buyout Financing |

|---|---|---|

| Monthly Payment | $650 - $800 | $350 - $500 |

| Interest Rate (APR) | 6.9% - 9.9% | 7.5% - 8.5% (Used Loan) |

| Ownership | None (Returning in 3 years) | Full Ownership after term |

| Equity Position | Zero | $5,000 - $10,000 (Instant) |

| Kilometre Limits | Strict (e.g., 20,000km/year) | Unlimited |

When you look at the total cost over 36 months, the buyout loan almost always wins in the current economy. You are financing a smaller principal amount on a vehicle whose history you already know. You know how it was driven, you know the maintenance record, and you know it hasn't been in an undisclosed accident.

The Approval Secrets: How to Secure the Best Rates

Securing a buyout loan isn't just about walking into a bank; it's about strategy. Lenders view lease buyouts differently than standard used car purchases because the "borrower" is already in possession of the "collateral." This reduces their risk, and you should use that to your advantage.

Secret 1: The 'Pre-Approval' Power Play

Never let the dealership be your first stop for financing. Dealerships often use "indirect lending," where they send your application to a bank and then add a percentage point (a "reserve") to the rate for themselves. By getting a pre-approval from a bank or an online specialist first, you set a "ceiling" on your interest rate. If the dealer can't beat it, you already have your funding ready.

Secret 2: Timing the Bank of Canada

Keep a close eye on the Bank of Canada's policy rate announcements. If the central bank signals a rate hold or a cut, wait a few days for that to filter down to prime lending rates. Conversely, if a hike is imminent, lock in your pre-approval immediately. A 0.5% difference might seem small, but over a 60-month loan, it adds up to hundreds of dollars.

Secret 3: Credit Score Optimization

In Canada, credit scores are tiered. A score of 680 might get you a decent rate, but 720+ unlocks the "Prime" rates. In the month leading up to your application, pay down your credit card balances to below 30% of their limits. This "utilization" boost can jump your score by 20-40 points in a single billing cycle, potentially moving you into a lower interest bracket.

Secret 4: The Debt-to-Income (DTI) Ratio

Canadian lenders look at your Total Debt Service (TDS) ratio. They want to see that your total monthly debt obligations (mortgage, credit cards, and the new car loan) don't exceed 40-44% of your gross monthly income. If you are on the edge, consider a longer loan term to lower the monthly payment and satisfy the DTI requirement, even if you plan to pay the loan off early.

Types of Buyout Financing Options in Canada

You have several avenues to explore when looking for the cash to buy your car. Each has its own set of hurdles and benefits.

Major Canadian Banks

RBC, TD, Scotiabank, and BMO are the heavy hitters. They offer stability and competitive rates for those with "A-tier" credit. The downside? They can be slow and often require you to go into a branch to sign physical paperwork. They also tend to have stricter "Year and Kilometre" limits on the vehicles they will finance.

Credit Unions

Organizations like Vancity, Meridian, or Desjardins often offer more personalized service. Because they are member-owned, their profit margins are lower, which sometimes translates to interest rates that are 0.5% to 1% lower than the big banks. They are also more likely to look at the "whole person" rather than just a credit score.

Online Lenders and Fintechs

This is where the market is moving. Online platforms specialize in speed. You can often get an approval in minutes rather than days. They are also more flexible with "B-tier" credit or self-employed individuals who might struggle with the rigid documentation requirements of a traditional bank.

| Lender Type | Best For... | Pros | Cons |

|---|---|---|---|

| Big Banks | Excellent Credit | Reliability, bundled services | Slow process, rigid rules |

| Credit Unions | Local/Personal touch | Lower rates, flexible terms | Membership required |

| Online Lenders | Speed & Convenience | Fast approval, high tech | Higher rates for subprime |

| Dealerships | One-stop shop | Very convenient | Hidden markups and fees |

Navigating the Canadian Tax and Fee Landscape

One of the most confusing parts of a lease buyout is the "double taxation" myth. When you leased the car, you only paid sales tax on the monthly payments. You haven't paid tax on the remaining residual value yet. Therefore, when you buy the car, you must pay GST/HST/PST on that buyout price.

In Ontario, you'll pay 13% HST. In Alberta, it's just 5% GST. In BC and Quebec, the rules for private transfers and provincial taxes can get more complex. It is vital to budget for this tax because it is added to the loan amount. If your buyout is $20,000 and you live in Ontario, your actual loan will be $22,600 plus fees.

Then there is the Safety Standards Certificate (SSC). In many provinces, a lease buyout is legally considered a "transfer of ownership" from the leasing company to you. Even though you've been driving the car, the government requires a licensed mechanic to sign off that the vehicle is safe for the road before the new permit is issued. This usually costs between $100 and $200, plus the cost of any necessary repairs (like worn brake pads or tires).

Step-by-Step Guide to Securing Your Buyout Loan

Don't wing it. Follow this roadmap to ensure a smooth transition from lessee to owner.

- Request the Payoff Quote: Contact your leasing company (not the dealer, but the actual financial institution like Honda Financial Services or Ford Credit). Ask for a "Total Payoff Quote" including taxes and fees. This is your "magic number."

- Market Value Assessment: Use Canadian Black Book or AutoTrader to see what your car is selling for in your specific postal code. This confirms your equity position.

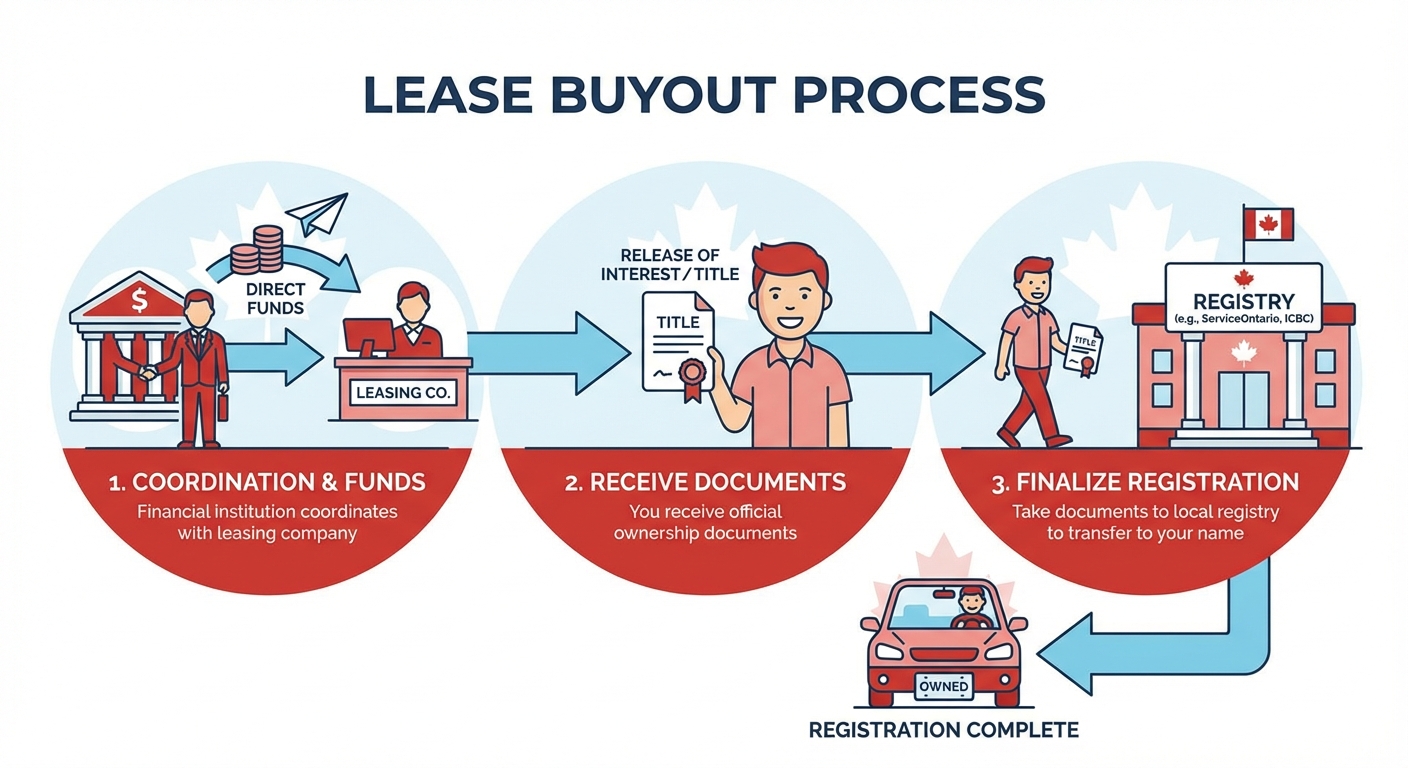

- Secure Pre-Approval: Apply for your loan. Ensure the lender knows this is a "Lease Buyout" so they can categorize the loan correctly.

- The Safety Inspection: Take your car to a trusted mechanic for the Safety Standards Certificate. Do this a week or two before the lease ends.

- Finalize the Paperwork: Your lender will usually coordinate with the leasing company to send the funds directly. You will then receive the "Release of Interest" or "Title" which you take to your local registry (like ServiceOntario or ICBC) to finalize the registration in your name.

Common Pitfalls to Avoid

The biggest mistake Canadians make is waiting until the last minute. If your lease expires on Friday and you start looking for a loan on Wednesday, you are at the mercy of the dealership's in-house rates. They know you are in a time crunch and will use that leverage to sell you add-ons like extended warranties or high-interest gap insurance.

Another pitfall is financing for too long. While an 84-month loan makes the monthly payment look tiny, you might end up "underwater" (owing more than the car is worth) as the vehicle ages and requires more repairs. Aim for a term of 36 to 60 months for a used vehicle buyout.

Special Circumstances

What if your credit isn't perfect? Bad credit lease buyouts are still possible in Canada. Subprime lenders specialize in these scenarios. They will look at the vehicle's equity as their primary security. If the car is worth much more than the loan amount, they are often happy to lend because their risk is covered by the car's value. You might pay a higher interest rate (12% to 18%), but it allows you to keep the vehicle and rebuild your credit.

For small business owners, the buyout loan can be a tax advantage. While lease payments are deductible, once you own the vehicle, you can claim Capital Cost Allowance (CCA) to depreciate the asset against your business income. Consult with a Canadian tax professional to see which method provides the larger write-off for your specific situation.

Frequently Asked Questions

Can I negotiate the residual value at the end of the lease?

The short answer is no. The residual value is a legally binding number set at the beginning of the lease. Large leasing companies (like Toyota Financial or GM Financial) use standardized contracts that do not allow for individual negotiation. The price is the price. However, you can negotiate the interest rate on the loan you use to pay that price.

Do I have to go back to the original dealership to buy out my lease?

Technically, no. You are dealing with the leasing company, not the dealer. Most leasing companies allow you to handle the buyout directly through them and a third-party lender. Some brands may require a "grounding dealer" to facilitate the paperwork, but you can often choose any dealership of that same brand, not just the one where you originally signed.

Is it better to use a Personal Line of Credit (PLOC) or a car loan?

A Personal Line of Credit often has a lower interest rate if you have excellent credit, but it is usually a "variable" rate. If the Bank of Canada raises rates, your payment goes up. A dedicated car loan is usually a "fixed" rate, providing more stability. Also, using a car loan keeps your PLOC open for emergencies or home renovations.

How does a lease buyout affect my insurance premiums in Canada?

When you lease, the leasing company requires you to carry high liability limits (usually $1 million to $2 million) and low deductibles. Once you own the car via a buyout loan, the lender will still require "Full Coverage" (Collision and Comprehensive), but you may have more flexibility in choosing your deductible levels, which can slightly lower your monthly premium.

What happens if the car has been in an accident during the lease term?

If the car was repaired properly, it doesn't change your buyout price. However, it does lower the market value. If the accident was major, your "Equity Goldmine" might have vanished. In this case, you should compare the buyout price to the *new* lower market value. If the car is worth less than the buyout, you are better off returning it to the dealer and letting them take the loss on the resale value.

Taking control of your automotive equity is one of the smartest financial moves you can make in today's economy. By securing your own financing and understanding the provincial tax nuances, you transform from a "renter" into a savvy owner with thousands of dollars in instant net worth. Don't let the dealership dictate the terms of your exit-use these secrets to lock in a rate that works for your budget and keeps you on the road for years to come.