Your Lease Is Over. The Car's Story Isn't. Finance Full Residual, Toronto.

Table of Contents

- Key Takeaways: Your Fast Track to Understanding Residual Buyout Financing

- The Lease End Conundrum: Navigating Your Options Beyond the Return

- Returning the Vehicle: The Path of Least Resistance (and Potential Regrets)

- Starting a New Lease: The Cycle Continues, But Is It Always Best?

- Buying Outright: The Cash-Heavy Option

- The Smart Play: Why Financing Your Lease Residual is Gaining Traction in Toronto

- Unlocking Your Car's Next Chapter: The Mechanics of Financing Your Lease Residual

- What Exactly is 'Residual Value' Anyway? A Quick Refresher for the Savvy Canadian Driver

- The 'Full' Story: What 'Finance Full Lease Residual Value' Truly Means

- Why Now? The Economic Drivers Making Residual Buyouts Attractive in 2024 (and Beyond)

- Crunching the Numbers: Is Financing Your Residual a Smart Move for Your Toronto Driveway?

- The Cost Comparison: New Lease vs. New Purchase vs. Residual Buyout Loan

- Understanding Interest Rates in Canada: What to Expect for Your Residual Buyout Loan

- Beyond the Monthly Payment: Unmasking Hidden Costs and Fees in Ontario

- The Equity Advantage: When Your Car is Worth More Than its Residual Value

- The Approval Journey: How to Qualify for a Residual Buyout Loan in Ontario

- Your Credit Score: The Golden Key to Favourable Rates

- Income Verification and Debt-to-Income Ratio: Proving Your Financial Stability

- Required Documentation: What to Prepare for a Smooth Application Process

- Navigating the Lenders: Bank, Dealer, or Broker – Who's Your Best Bet in Toronto?

- The Big Banks: Stability and Competitive Rates (with Conditions)

- Credit Unions: Local Focus, Personalized Service, and Potentially Flexible Terms

- Dealership Financing: Convenience vs. Cost – A Careful Balance

- Independent Auto Finance Brokers: Your Advocate in the Lending Maze

- Beyond the Basics: Special Scenarios and Considerations for Your Lease Buyout

- When Your Car is Worth Less Than the Residual: Navigating Negative Equity

- Mileage Overages and Wear & Tear: The Hidden Traps of Lease Returns (and How Buyout Avoids Them)

- Brand Matters: How Specific Car Manufacturers Influence Residual Values and Financing Options

- The Toronto Edge: Local Nuances for Financing Your Car's Residual Value

- Ontario's HST Impact: Understanding the Sales Tax on Your Residual Buyout

- Provincial Regulations: Consumer Protection for Auto Financing in Ontario

- Finding Reputable Finance Professionals in Toronto and the GTA

- Broader Canadian Context: How Residual Buyouts Differ Across Provinces

- The Paperwork Puzzle: What You'll Need to Finalize Your Residual Buyout

- Your Original Lease Agreement: The Blueprint for Your Buyout

- Proof of Insurance: Protecting Your New Asset

- Vehicle Inspection and Safety Certification: Ontario's Requirements

- Transfer of Ownership: Making It Legally Yours at ServiceOntario

- Your Car, Your Future: What Happens After You Finance the Residual?

- The Freedom of Ownership: Modifications, Maintenance, and Selling Flexibility

- Building Equity and Long-Term Financial Planning

- The Road Ahead: Your Next Steps to Securing Your Car's Future in Toronto

- Frequently Asked Questions (FAQ): Your Residual Buyout Concerns Answered

Your lease agreement is nearing its end, and a familiar question looms: what's next for your beloved vehicle? For many in Toronto and across Canada, the default options seem limited to returning the car or starting a new lease. But there's a powerful, often overlooked path that can turn a leased vehicle into a valuable asset: financing the full lease residual value. This deep-dive article will explore how this strategy can save you money, offer greater control, and keep your trusted vehicle on the road, specifically tailored for the Canadian market with a focus on Toronto's unique financial landscape.

Key Takeaways: Your Fast Track to Understanding Residual Buyout Financing

- Strategic Savings: Financing your lease residual can often be more cost-effective than starting a new lease or buying a new car, especially with current used car market values.

- Unlock Equity: If your car's market value exceeds its residual value, financing allows you to capture that equity, turning a liability into an asset.

- Credit is Key: A strong credit score is crucial for securing the best interest rates on a residual buyout loan.

- Shop Around: Don't settle for the first offer; compare rates from banks, credit unions, and specialized auto lenders in Toronto and across Ontario.

- Hidden Costs Beware: Understand all potential fees, taxes (like Ontario's HST), and administrative charges involved in the buyout process.

- Personalized Decisions: The best option depends on your financial situation, the car's condition, and market conditions. This isn't a one-size-fits-all solution.

The Lease End Conundrum: Navigating Your Options Beyond the Return

The conclusion of a car lease often presents a pivotal moment for drivers. It’s a time to evaluate your needs, your vehicle’s condition, and the prevailing market forces. While the typical paths seem straightforward, a deeper look reveals potential pitfalls and missed opportunities.

Returning the Vehicle: The Path of Least Resistance (and Potential Regrets)

For many, simply handing back the keys to the dealership feels like the easiest option. You avoid the hassle of selling, and you can walk away from the vehicle. However, this seemingly simple choice can come with a host of unexpected costs. Exceeding your agreed-upon mileage limit can result in significant per-kilometre penalties. Similarly, "excessive wear and tear" – which can be subjective – might lead to charges for minor dents, scratches, or interior damage that you might not have considered significant. More importantly, if your car is in excellent condition and current used car market values are strong, returning it means you forgo any positive equity that your vehicle may have accumulated. You essentially leave money on the table, money that could have been yours.

Starting a New Lease: The Cycle Continues, But Is It Always Best?

The allure of a brand-new vehicle with the latest features and a fresh warranty is undeniable. Dealerships often make it easy to transition from one lease to another, promising low monthly payments. However, this option perpetuates the cycle of never truly owning an asset. You continue to make payments without building any equity in the vehicle. While new leases offer predictable costs and the benefit of driving a modern car, they can be more expensive in the long run than financing your current vehicle's residual value, especially if your leased car has proven reliable and efficient. Is the continuous payment cycle always the best financial move for your household budget in Toronto?

Buying Outright: The Cash-Heavy Option

If you have substantial liquid assets, paying cash for your leased vehicle's residual value is certainly an option. It's straightforward, avoids interest payments, and grants you immediate full ownership. However, for many Canadians, tying up a significant sum of capital in a depreciating asset might not be the most strategic financial decision. That money could potentially be invested elsewhere, earning returns, or serving as an emergency fund. While simple, it's worth weighing the opportunity cost of using a large cash sum versus financing at a competitive rate.

The Smart Play: Why Financing Your Lease Residual is Gaining Traction in Toronto

This brings us to the core of our discussion: financing the full lease residual value. This is rapidly becoming a strategic financial move for Canadian drivers, particularly those in bustling urban centres like Toronto. In the current economic climate, marked by high demand for used vehicles and persistent supply chain issues affecting new car availability, the market value of many used cars has surged. If your car's market value is significantly higher than its pre-determined residual value, financing the residual allows you to capture that positive equity. You convert a continuous lease payment into an ownership loan, giving you control, potential savings, and a valuable asset. It's about taking ownership of your car's future, not just making payments on its present.

Unlocking Your Car's Next Chapter: The Mechanics of Financing Your Lease Residual

Understanding the concept of residual value and how it plays into financing is the first step toward making an informed decision. It's more than just a number; it's the gateway to ownership.

What Exactly is 'Residual Value' Anyway? A Quick Refresher for the Savvy Canadian Driver

Simply put, the residual value is the pre-determined estimated value of your leased vehicle at the end of your lease term. This figure is agreed upon at the very beginning of your lease agreement. It represents what the leasing company anticipates the vehicle will be worth after accounting for depreciation over the lease period. When you enter a lease, your payments are essentially covering the difference between the vehicle's initial price and this residual value, plus interest and fees. For Canadian drivers, this figure is a critical component of your lease contract, as it dictates the buyout price should you choose to purchase the vehicle.

The 'Full' Story: What 'Finance Full Lease Residual Value' Truly Means

When we talk about "financing the full lease residual value," we're referring to taking out a new loan to cover the entire amount specified as the residual value in your lease agreement. But it's not just that number. This new loan will also typically include any applicable taxes, such as Ontario's 13% Harmonized Sales Tax (HST) which applies to the purchase price (the residual). Furthermore, it may cover administrative fees charged by the leasing company or dealership for processing the buyout, and potentially any outstanding charges like excess mileage penalties or wear and tear fees that you might otherwise incur by returning the vehicle. Essentially, you're converting your lease obligation into a traditional auto loan, allowing you to pay off the purchase price over a new, agreed-upon term.

Why Now? The Economic Drivers Making Residual Buyouts Attractive in 2024 (and Beyond)

The current economic landscape has created a unique opportunity for lease buyouts. Several factors contribute to this:

- High Demand for Used Vehicles: The market for pre-owned cars in Canada, especially in major urban centres like Toronto, Vancouver, and Montreal, remains incredibly robust. Many buyers are looking for more affordable alternatives to new cars.

- Supply Chain Issues: Global supply chain disruptions continue to impact new vehicle production, leading to longer wait times and often higher prices for new models. This scarcity drives up the value of available used vehicles.

- Inflationary Pressures: The rising cost of living means consumers are increasingly looking for ways to save money, and a residual buyout can often offer a lower monthly payment or a more cost-effective total ownership experience compared to a new lease or purchase.

- Significant Equity Capture: If your vehicle's current market value far exceeds its pre-determined residual value, financing the residual allows you to immediately capture that positive equity. Instead of letting the leasing company benefit from your car's higher-than-expected value, you get to keep it. This is a game-changer for many drivers in cities like Toronto, Ottawa, and Calgary.

This confluence of factors makes reviewing your lease-end options with a focus on financing the residual a particularly smart move right now.

Crunching the Numbers: Is Financing Your Residual a Smart Move for Your Toronto Driveway?

The decision to finance your lease residual isn't just about convenience; it's a financial one. A careful comparison of costs is essential to determine if it's the right choice for your budget and future.

The Cost Comparison: New Lease vs. New Purchase vs. Residual Buyout Loan

Let's break down the financial implications with a hypothetical example for a vehicle in Toronto. Imagine your current leased car has a residual value of $20,000, and its current market value is $25,000. For comparison, a new equivalent vehicle might cost $40,000.

| Factor | New Lease (e.g., 48 months) | New Purchase (e.g., 60 months) | Residual Buyout Loan (e.g., 60 months) |

|---|---|---|---|

| Vehicle Cost Basis | Depreciation + Fees (e.g., $40,000 - $22,000 residual) | Full MSRP (e.g., $40,000) | Residual Value (e.g., $20,000 + HST + Fees) |

| Estimated Monthly Payment (approx.) | $500 - $650 (depending on down payment, term, interest) | $700 - $850 (depending on down payment, term, interest) | $350 - $450 (depending on interest rate, term) |

| Total Cost Over 4 Years (approx.) | $24,000 - $31,200 (no equity) | $33,600 - $40,800 (plus potential equity) | $16,800 - $21,600 (plus equity capture) |

| Equity Building | None | Yes (from day one) | Yes (from day one, capturing existing positive equity) |

| Flexibility / Restrictions | Mileage limits, wear & tear clauses, no modifications | Full ownership, no restrictions | Full ownership, no restrictions |

| Insurance Implications | Typically higher as you don't own the vehicle outright | Standard ownership insurance | Standard ownership insurance |

As you can see, the residual buyout loan often presents the lowest monthly payment and total cost over time, especially when you factor in the immediate equity you capture. This is a significant advantage for drivers in Toronto looking to optimize their vehicle expenses.

Understanding Interest Rates in Canada: What to Expect for Your Residual Buyout Loan

Interest rates on auto loans in Canada are influenced by several factors:

- Prime Rate: This is the benchmark rate set by the Bank of Canada, which influences what commercial banks charge.

- Your Credit Score: A higher credit score signals lower risk to lenders, resulting in more favourable interest rates. Borrowers with excellent credit (e.g., 750+) can expect the most competitive rates.

- Loan Term: Shorter loan terms typically come with slightly lower interest rates but higher monthly payments. Longer terms (e.g., 72 or 84 months) reduce monthly payments but accumulate more interest over the life of the loan.

- Vehicle Age: Older vehicles might sometimes carry slightly higher rates, as they are perceived to have a higher risk of mechanical failure.

- Lender Type: Banks, credit unions, and captive finance companies often have different rate structures.

Current market trends for auto loans in Canada can fluctuate, so it's essential to check with multiple lenders. While rates have seen some upward movement recently, competitive rates are still available for well-qualified borrowers. For more on securing favourable rates, you might find our article Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers helpful, as many of the principles apply across Canada.

Pro Tip: Always get pre-approved for financing before discussing your buyout with the dealership. This gives you leverage and a clear understanding of your borrowing power, allowing you to negotiate from a position of strength.

Beyond the Monthly Payment: Unmasking Hidden Costs and Fees in Ontario

While the residual value is the core of your buyout, several other costs can add up, particularly in Ontario.

- Administrative Fees: The leasing company or dealership may charge a buyout or administrative fee for processing the paperwork. These can range from a few hundred dollars to more.

- Safety Certification: In Ontario, if you're transferring ownership of a used vehicle, it typically requires a valid Safety Standards Certificate. This involves a mechanical inspection, which you'll need to pay for. If issues are found, you'll also be responsible for repair costs to pass the inspection.

- Licensing and Registration Fees: You'll need to pay to register the vehicle in your name and obtain new license plates if you don't already have them.

- Ontario's Harmonized Sales Tax (HST): This is perhaps the most significant "hidden" cost. In Ontario, the 13% HST applies to the residual value (the purchase price) of the vehicle. For example, if your residual is $20,000, you'll pay an additional $2,600 in HST. This amount is typically rolled into your buyout loan, increasing your total financed amount.

Always request a detailed breakdown of all costs associated with the buyout from the leasing company or dealership. Don't be afraid to ask for clarification on anything you don't understand.

The Equity Advantage: When Your Car is Worth More Than its Residual Value

This is where financing your residual truly shines. If the current market value of your vehicle (what you could sell it for today) is higher than its residual value, you have "positive equity."

To assess your vehicle's current market value, use reliable Canadian resources:

- Canadian Black Book: A widely respected industry standard for vehicle valuations in Canada.

- Kelley Blue Book Canada: Another excellent resource for getting estimated trade-in and private sale values.

- Local Dealership Appraisals: Get a few appraisals from different dealerships in Toronto or the Greater Toronto Area. Even if you don't plan to trade it in, these appraisals give you a good benchmark.

- Online Marketplaces: Check listings for similar vehicles (make, model, year, trim, kilometres, condition) on platforms like AutoTrader.ca or Kijiji.ca.

If your car is worth, say, $25,000, but your residual value is only $20,000, that $5,000 difference is your equity. By financing the residual, you essentially "buy" that $5,000 of equity for yourself. Instead of letting the leasing company profit from your car's appreciation, you get to capture that value. This equity can then be used down the line as a trade-in credit for your next vehicle or simply enjoyed as a greater return on your investment when you eventually sell the car. It's a powerful way to turn a potential loss (by returning a valuable asset) into a significant gain.

The Approval Journey: How to Qualify for a Residual Buyout Loan in Ontario

Securing a competitive residual buyout loan involves demonstrating your financial stability to lenders. Your personal financial profile plays a critical role in the terms and rates you'll be offered.

Your Credit Score: The Golden Key to Favourable Rates

In Canada, your credit score is a three-digit number that reflects your creditworthiness. Lenders use scores from credit bureaus like Equifax and TransUnion to assess risk. A higher score (generally 650+ is considered good, 750+ excellent) indicates a responsible borrower and opens the door to the most favourable interest rates and loan terms. Lenders look for:

- Payment History: Consistently making payments on time is paramount. Late payments significantly hurt your score.

- Credit Utilization: How much credit you're using compared to your available credit limit. Keeping this low (below 30%) is ideal.

- Credit Age: The longer your credit accounts have been open and in good standing, the better.

- Types of Credit: A mix of credit (e.g., credit cards, lines of credit, previous auto loans) can be beneficial.

You can check your credit score for free through services like Credit Karma or Borrowell in Canada. Understanding your score is the first step. Even if your credit isn't perfect, options exist. For those with less-than-ideal credit, institutions like SkipCarDealer.com specialize in helping you find financing. For more insights, check out No Credit? Great. We're Not Your Bank.

Income Verification and Debt-to-Income Ratio: Proving Your Financial Stability

Lenders need assurance that you have the financial capacity to comfortably make your monthly loan payments. This involves verifying your income and assessing your debt-to-income (DTI) ratio.

- Income Proof: You'll typically need to provide recent pay stubs (usually 2-3 months), an employment letter, and sometimes T4 slips or tax returns. For self-employed individuals in Ontario, proving income can be a bit different, but it's entirely possible. You can learn more about this in our article Self-Employed Ontario: They Want a Pay Stub? We Want You Driving.

- Debt-to-Income Ratio: This is a key metric lenders use. It compares your total monthly debt payments (including your new car loan, mortgage/rent, credit card minimums, other loans) to your gross monthly income. A lower DTI (ideally below 40-45%) indicates you have sufficient disposable income to manage your new car payment, making you a less risky borrower.

Lenders want to see a stable employment history and a manageable DTI to approve your loan at competitive rates. Be prepared to provide accurate and up-to-date financial documentation.

Pro Tip: Before applying for a residual buyout loan, review your credit report for any inaccuracies and resolve them. A clean credit report can significantly improve your chances for a lower interest rate.

Required Documentation: What to Prepare for a Smooth Application Process

Having all your documents ready in advance can significantly speed up the application process. Expect to provide:

- Original Lease Agreement: This is crucial as it contains the exact residual value and buyout terms.

- Driver's License: Valid and up-to-date.

- Proof of Insurance: You'll need to show you have adequate coverage for an owned vehicle.

- Income Verification: As mentioned, pay stubs, employment letter, or tax documents.

- Proof of Residency: Utility bill or other document showing your current address in Toronto or elsewhere.

- Void Cheque: For setting up direct debit payments for your new loan.

- Trade-in Information (if applicable): If you plan to trade in another vehicle, have its registration and details ready.

Being organized will demonstrate your readiness and professionalism to any prospective lender.

Navigating the Lenders: Bank, Dealer, or Broker – Who's Your Best Bet in Toronto?

When it comes to financing your lease residual, you have several avenues to explore. Each has its own advantages and considerations, and the best choice for you might depend on your financial situation and preferences.

The Big Banks: Stability and Competitive Rates (with Conditions)

Major Canadian banks like RBC, TD, BMO, Scotiabank, and CIBC are often the first stop for many borrowers. They offer a sense of stability and typically provide competitive interest rates for well-qualified applicants, especially those with strong credit scores.

- Requirements: Generally, big banks have stricter lending criteria, requiring a good to excellent credit score, stable income, and a low debt-to-income ratio.

- Approval Process: Their processes can be thorough, sometimes taking a few days for full approval.

- Rates: They often offer some of the lowest rates for prime borrowers.

With a strong presence across Canada, including countless branches throughout Toronto and the GTA, obtaining a quote from your primary banking institution is always a good starting point.

Credit Unions: Local Focus, Personalized Service, and Potentially Flexible Terms

Credit unions, such as Meridian Credit Union and Alterna Savings in Ontario, operate differently from traditional banks. They are member-owned and often prioritize personalized service and community focus.

- Benefits: Credit unions can sometimes be more flexible with their lending criteria, potentially offering better terms to members or those with unique financial situations, even if their credit isn't absolutely perfect. They might also offer slightly lower rates or fewer fees.

- Approach: Their community-centric approach can mean a more understanding and tailored experience.

Don't overlook credit unions in your region. While this article focuses on Toronto, similar benefits can be found with credit unions in British Columbia, Alberta, and Quebec, often providing a local alternative to the big banks.

Dealership Financing: Convenience vs. Cost – A Careful Balance

Many people find it convenient to arrange financing directly through the dealership where they leased their car. Dealerships often work with various lenders, including captive finance companies (like Toyota Financial Services, Honda Financial Services, Ford Credit), and can sometimes offer competitive rates or special promotions.

- Convenience: It's a one-stop shop; they handle all the paperwork for the buyout and the new loan.

- Negotiation: While convenient, it's crucial to negotiate. Dealerships may mark up interest rates to earn a profit, so the rate they initially offer might not be the absolute best you can get.

Always compare their offer with rates you've received from banks or credit unions. You might find that the ease of dealership financing comes at a higher cost if you don't do your homework.

Pro Tip: Don't be afraid to pit lenders against each other. Once you have a strong offer from one institution, use it as leverage to negotiate better terms with others, including the dealership's finance department. Competition works in your favour.

Independent Auto Finance Brokers: Your Advocate in the Lending Maze

An independent auto finance broker acts as an intermediary, working on your behalf to find the best loan terms from a network of lenders.

- Benefits: Brokers are particularly valuable for those with less-than-perfect credit or unique financial circumstances, as they have access to a wider range of lenders, including those specializing in non-prime loans. They can often secure approvals when direct applications to banks might be rejected.

- Expertise: They understand the lending market and can guide you through the process, helping you prepare your application to maximize your chances of approval.

Reputable brokers in Toronto, Montreal, Vancouver, and other major Canadian cities can be invaluable resources, especially if you're looking for the most competitive rates without the legwork of applying to multiple institutions yourself. They can simplify the process and help you navigate various options, ensuring you find a solution tailored to your needs.

Beyond the Basics: Special Scenarios and Considerations for Your Lease Buyout

While the standard financing scenario is often straightforward, specific situations can arise that require careful planning and understanding.

When Your Car is Worth Less Than the Residual: Navigating Negative Equity

Sometimes, despite market trends, your car's current market value might be lower than its residual value. This is known as "negative equity." For example, if your residual is $20,000 but the car is only worth $18,000, you have $2,000 in negative equity.

- Consideration: In this scenario, financing the residual means you'd be borrowing more than the car is worth.

- Strategies: You can choose to pay down the negative equity out-of-pocket, or you could roll it into your new loan. Rolling it in will increase your loan amount and monthly payments, and you'd start your ownership journey "underwater." This isn't always ideal, but if the difference is small and you plan to keep the car for a long time, it might still be a viable option compared to other alternatives.

It's crucial to accurately assess your vehicle's value. If the negative equity is substantial, it might be wiser to reconsider the buyout and explore other options, such as returning the car if the penalties for doing so are less than the negative equity you'd assume. For more on handling negative equity, especially in Toronto, check out Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

Mileage Overages and Wear & Tear: The Hidden Traps of Lease Returns (and How Buyout Avoids Them)

One of the most compelling reasons to finance your lease residual is to completely bypass the often costly penalties associated with mileage overages and excessive wear and tear.

- Mileage Penalties: Leases come with strict annual kilometre limits. Exceeding these can result in charges of $0.10 to $0.20 per kilometre, which can quickly add up to hundreds or even thousands of dollars for high-mileage drivers.

- Wear & Tear: Leasing companies have specific definitions of what constitutes "normal" wear. Dings, scratches, minor upholstery damage, or even worn tires beyond a certain tread depth can result in charges.

By financing the residual, you're buying the car "as is." The leasing company no longer cares about its condition or how many kilometres it has. This can lead to significant savings, making a buyout particularly attractive for those who have driven their car extensively or have accumulated minor cosmetic damage.

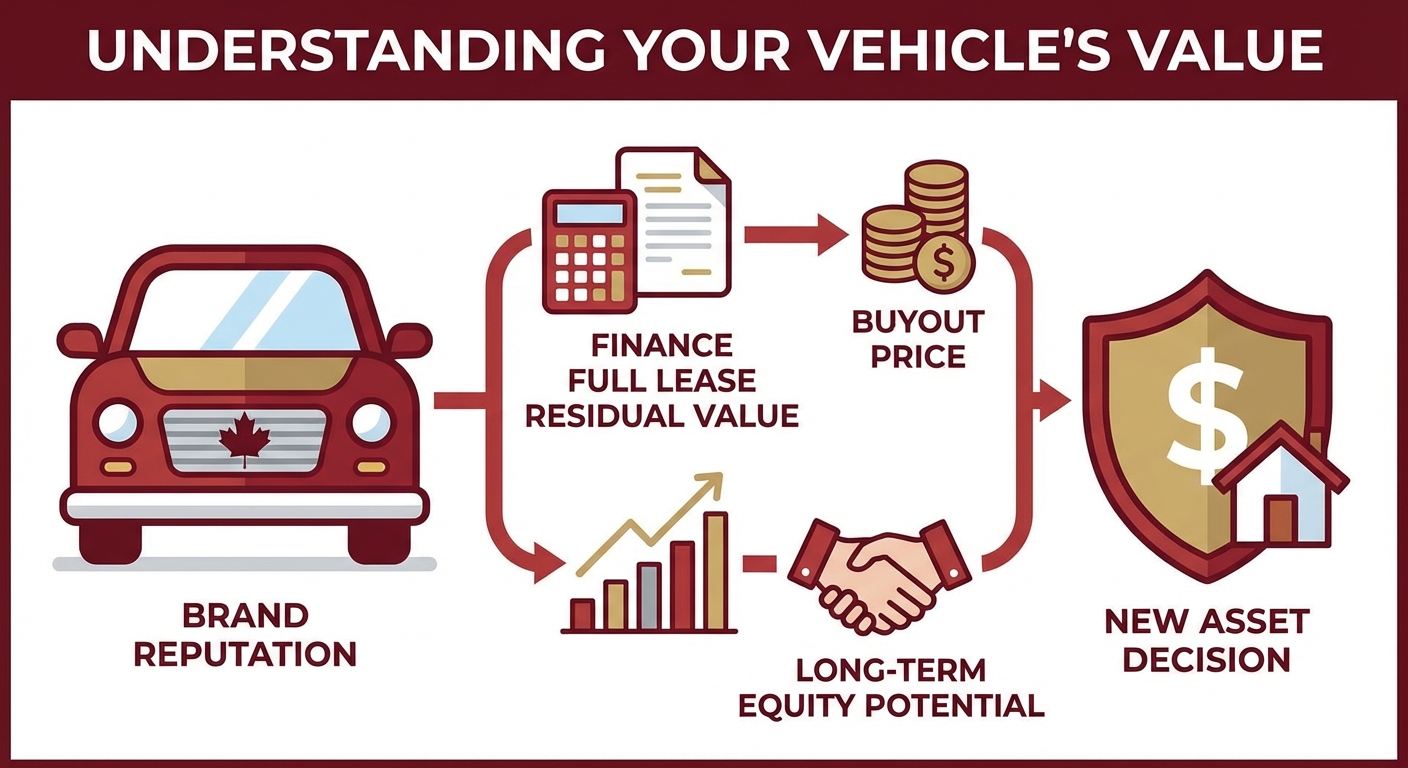

Brand Matters: How Specific Car Manufacturers Influence Residual Values and Financing Options

The make and model of your vehicle can significantly impact its residual value and, consequently, how attractive financing the buyout might be.

- Strong Resale Value: Brands renowned for their reliability and strong resale values, such as Toyota, Honda, and Subaru, often have higher residual values. While this means the buyout price might be higher, it also means your car likely holds its market value well, increasing the chances of positive equity. Financing these vehicles often makes good financial sense.

- Faster Depreciation: Conversely, brands that tend to depreciate faster might have lower residual values. This could mean a lower buyout price, but also a greater risk of negative equity if the market value has fallen significantly.

Understanding your vehicle's brand reputation for resale value is an important factor in your "finance full lease residual value" decision. It influences both the buyout price and the long-term equity potential of your new asset.

The Toronto Edge: Local Nuances for Financing Your Car's Residual Value

While the core principles of lease residual financing apply across Canada, Toronto and Ontario have specific regulations and market conditions that you should be aware of.

Ontario's HST Impact: Understanding the Sales Tax on Your Residual Buyout

As mentioned earlier, the Harmonized Sales Tax (HST) is a critical component of your residual buyout in Ontario. The 13% HST applies directly to the residual value, which is considered the purchase price of the vehicle.

- Calculation Example: If your residual value is $18,000, the HST would be 13% of $18,000, which equals $2,340. Your total purchase price before other fees would then be $20,340.

- Financing: This HST amount is typically rolled into your new loan, increasing the total amount you finance. It's not usually paid separately unless you choose to make a down payment that covers it.

It's essential to factor this into your budget and loan calculations to avoid any surprises. Always ensure your loan quote includes all applicable taxes.

Provincial Regulations: Consumer Protection for Auto Financing in Ontario

Ontario has consumer protection laws and regulations in place to safeguard borrowers in auto financing. These laws aim to ensure transparency and fair practices, requiring lenders to clearly disclose all terms, conditions, and costs associated with the loan. This includes interest rates, administrative fees, and the total cost of borrowing. Familiarize yourself with these rights, as they empower you to challenge any unclear or unfair practices during your financing process.

Finding Reputable Finance Professionals in Toronto and the GTA

Choosing the right financial advisor, broker, or dealership finance manager is crucial for a smooth and beneficial residual buyout.

- Research: Look for professionals with positive reviews and a strong track record. Online reviews (Google, Yelp, etc.) can be a good starting point.

- Credentials: Ensure brokers are licensed and reputable.

- Transparency: A trustworthy professional will be upfront about all costs, interest rates, and terms, and will patiently answer all your questions.

- Local Expertise: Professionals in Toronto, Mississauga, Brampton, and other Greater Toronto Area communities will have a deep understanding of local market conditions and provincial regulations, which can be invaluable.

Don't hesitate to seek multiple opinions and compare offers. Your financial well-being is at stake.

Pro Tip: Seek advice from an independent financial advisor or a trusted auto finance expert in Toronto. They can provide unbiased guidance tailored to your specific situation and help you navigate local market conditions and regulations, ensuring you make the best decision.

Broader Canadian Context: How Residual Buyouts Differ Across Provinces

While our focus is on Toronto, it's worth noting that provincial variations exist across Canada. The most significant difference is in sales tax structures:

- British Columbia: Applies GST (5%) and PST (7%) to the residual value.

- Alberta: Has no provincial sales tax, so only the 5% GST applies.

- Quebec: Applies GST (5%) and QST (9.975%) to the residual.

- Other Provinces: Maritime provinces (New Brunswick, Nova Scotia, Newfoundland and Labrador, Prince Edward Island) all have HST (ranging from 10% to 15%). Manitoba and Saskatchewan have PST in addition to GST.

These differences mean the total cost of your buyout will vary depending on where you reside in Canada, even if the residual value of the car is the same. Always confirm the exact tax implications for your specific province.

The Paperwork Puzzle: What You'll Need to Finalize Your Residual Buyout

Once you've secured financing, the final steps involve navigating the necessary paperwork to officially transfer ownership of your vehicle. Being prepared will make this a seamless process.

Your Original Lease Agreement: The Blueprint for Your Buyout

This document is paramount. It contains the precise residual value, any purchase option fees, buyout clauses, and details on potential end-of-lease fees. You'll need to refer to it to confirm the exact amount you're financing and to ensure the terms align with your expectations. Keep it readily accessible throughout the buyout process, as both your lender and the leasing company will need to reference it.

Proof of Insurance: Protecting Your New Asset

Before you take ownership, you'll need to demonstrate that you have adequate insurance coverage for an owned vehicle. This typically involves updating your policy from a leased vehicle to a personally owned one. Your insurance provider will issue new policy documents reflecting this change, which you'll need to provide to ServiceOntario when registering the car in your name. Ensure your coverage meets Ontario's minimum requirements and also protects your investment and your loan.

Vehicle Inspection and Safety Certification: Ontario's Requirements

In Ontario, if you are transferring ownership of a used vehicle, it generally requires a Safety Standards Certificate. This certificate confirms that the vehicle meets minimum safety requirements.

- When it's Needed: If you're buying the car directly from the leasing company (which is common for buyouts) and registering it in your name, you'll need this certificate. If you're buying it through a dealership, they often handle this as part of the sale.

- Cost and Repairs: You'll be responsible for the cost of the inspection. If the vehicle fails the inspection, you'll also be responsible for any necessary repairs to bring it up to safety standards before the certificate can be issued. Budget for this potential expense, especially if your vehicle has some age or high kilometres.

Transfer of Ownership: Making It Legally Yours at ServiceOntario

The final step in making the car legally yours is transferring ownership at a ServiceOntario centre. You'll need to bring:

- Your original lease agreement and proof of buyout.

- The Safety Standards Certificate.

- Proof of insurance.

- Your valid driver's license.

- Payment for the applicable taxes (if not already rolled into your loan and paid by the lender) and registration fees.

At ServiceOntario, you'll officially register the vehicle in your name, pay any remaining taxes, and receive your updated vehicle permit. If you don't already have one, you'll also obtain new license plates. This completes the legal transition from lessee to owner.

Your Car, Your Future: What Happens After You Finance the Residual?

Once the paperwork is done and the loan is secured, you're no longer just driving a leased car; you're driving *your* car. This shift in ownership brings a new level of freedom and financial opportunity.

The Freedom of Ownership: Modifications, Maintenance, and Selling Flexibility

One of the most immediate benefits of owning your vehicle outright is the unparalleled freedom it affords.

- Modifications: Want to tint the windows, upgrade the stereo, or add custom rims? Go for it! There are no longer any lease restrictions on modifications.

- Maintenance Decisions: You're in charge of where and how your vehicle is serviced. You can choose your trusted local mechanic in Toronto, follow your own maintenance schedule, and select parts based on your budget and preferences, rather than being tied to dealership service requirements.

- Selling Flexibility: You can sell your car whenever you choose, to whomever you choose, without needing permission from a leasing company or worrying about early termination fees. This gives you immense control over your future vehicle plans.

This freedom is a significant psychological and practical benefit that many drivers cherish after years of lease restrictions.

Building Equity and Long-Term Financial Planning

Beyond the immediate freedoms, owning your car outright contributes to your long-term financial health.

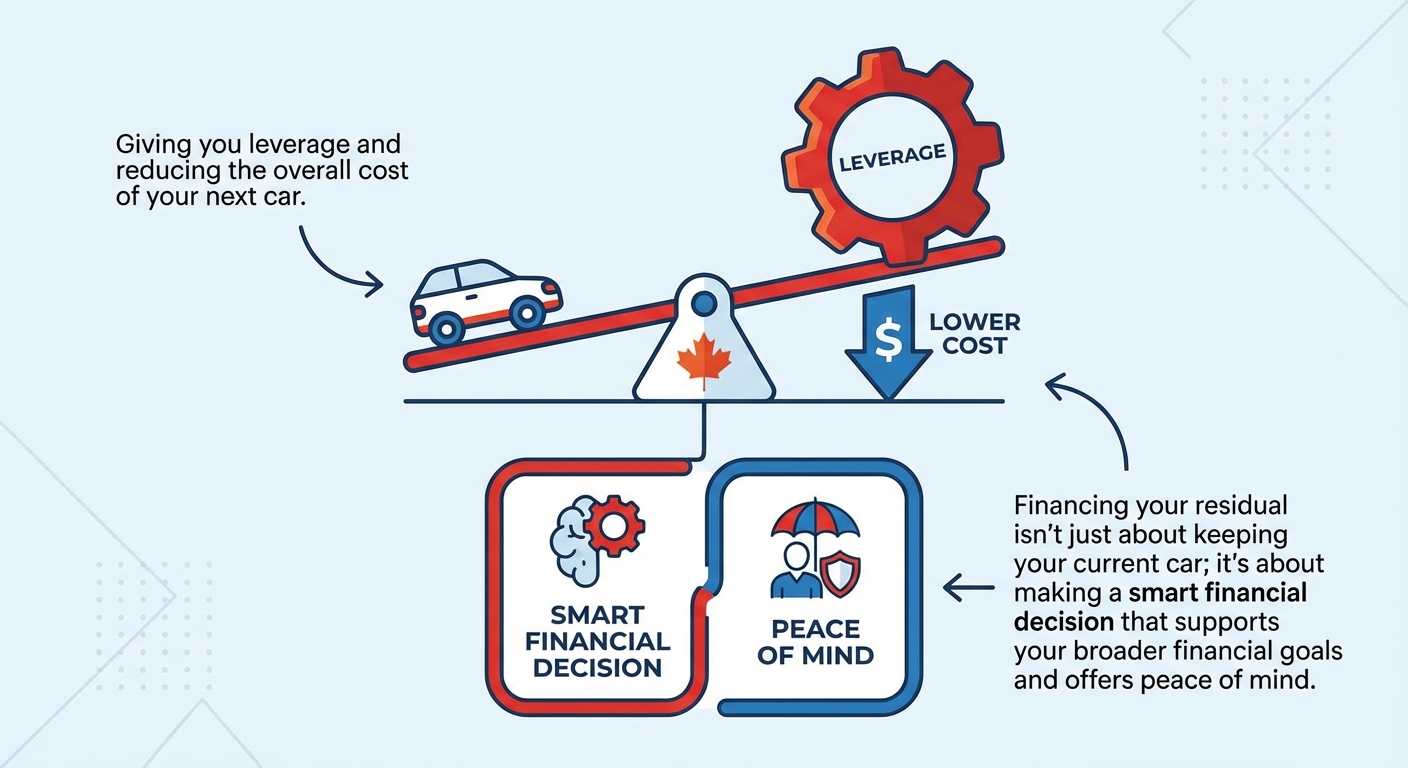

- Building Equity: With each loan payment, you're building equity in an asset. Unlike a lease where payments just cover depreciation, your residual buyout loan is actively increasing your ownership stake. This equity can be a valuable resource for a future down payment on another vehicle or simply an asset on your personal balance sheet.

- Lower Future Costs: Once your residual buyout loan is paid off, you'll have years of payment-free driving, significantly reducing your monthly transportation costs. This frees up funds for other financial goals, whether it's saving for a down payment on a home in Toronto, investing, or retirement planning.

- Strategic Advantage: Owning your vehicle gives you a strategic advantage for future vehicle purchases. You'll have a valuable asset to trade in, giving you leverage and reducing the overall cost of your next car.

Financing your residual isn't just about keeping your current car; it's about making a smart financial decision that supports your broader financial goals and offers peace of mind.

The Road Ahead: Your Next Steps to Securing Your Car's Future in Toronto

Your car's story doesn't end with the lease; it's just beginning a new chapter of ownership. Financing your lease residual offers a compelling pathway to greater control, potential savings, and the satisfaction of owning a valuable asset.

For drivers in Toronto and across Canada, the message is clear: don't automatically default to returning your leased vehicle or entering another lease. Take the time to explore the power of financing your residual. Gather all the necessary information, obtain multiple quotes from various lenders, and consult with financial experts who can provide unbiased guidance tailored to your specific situation. By doing so, you can make an informed decision that aligns with your financial goals and keeps your trusted vehicle on the road, truly making it yours.