The Truth About the Minimum Credit Score for Ontario Car Loans

Table of Contents

- Key Takeaways

- 1. Introduction: The Myth of the "Magic Number"

- 1.1 Understanding the Ontario Lending Landscape

- 1.2 Equifax vs. TransUnion in Canada

- 2. Breaking Down Credit Score Tiers for Ontario Car Loans

- 2.1 Super-Prime (780 - 900)

- 2.2 Prime (661 - 779)

- 2.3 Non-Prime/Near-Prime (601 - 660)

- 2.4 Subprime (501 - 600)

- 2.5 Deep Subprime (300 - 500)

- 3. Factors That Matter More Than Your Credit Score

- 3.1 Income and Employment Stability

- 3.2 Debt-to-Income (DTI) Ratio

- 3.3 The Down Payment Factor

- 3.4 Loan-to-Value (LTV) Ratio

- 4. Navigating the Ontario Subprime Market

- 4.1 The Role of OMVIC (Ontario Motor Vehicle Industry Council)

- 4.2 Second-Chance and Third-Chance Credit

- 5. How to Get a Car Loan in Ontario with Bad Credit

- 5.1 The Co-signer Strategy

- 5.2 Choosing the Right Vehicle

- 5.3 The Importance of a 'G' License

- 6. The Real Cost of Interest: A 5-Year Comparison

- 6.2 The 'Refinance' Exit Strategy

- 7. Improving Your Credit Score Specifically for an Auto Loan

- 7.1 The 30% Utilization Rule

- 7.2 Disputing Errors on Your Equifax Report

- 8. Frequently Asked Questions (FAQ)

- Can I get a car loan in Ontario with a 500 credit score?

- Do Ontario dealerships use Equifax or TransUnion?

- How much down payment do I need for a low credit car loan?

- Will a consumer proposal or bankruptcy prevent me from getting a car loan?

- Does a G2 license affect my car loan approval?

- How long do I need to be at my job to get a car loan in Ontario?

- 9. Your Path Forward

You have likely spent hours scrolling through forums and dealership websites, trying to find one definitive answer: "What is the minimum credit score I need to buy a car in Ontario?" You might have seen 650 mentioned in one place and 300 in another. The reality is that the Ontario automotive lending market is far more nuanced than a single three-digit number. While your credit score is a major factor, it is only one chapter of the story lenders read before deciding to hand over the keys.

In this guide, we are going to strip away the myths and look at how Ontario lenders actually evaluate you. Whether you are shopping in the heart of Toronto, the suburbs of Ottawa, or the rural stretches of Northern Ontario, understanding these mechanics will save you thousands of dollars in interest and hours of frustration at the dealership.

Key Takeaways

- No Universal Minimum: While 650 is often considered the 'prime' threshold, Ontario lenders offer products for scores as low as 300-500.

- Interest Rate Correlation: Your score primarily dictates your interest rate, not just your approval. Lower scores can see rates from 15% to 29.99%.

- The 'Big Three' Factors: In Ontario, lenders prioritize Debt-to-Income (DTI) ratio and employment stability alongside your credit score.

- Ontario Specifics: OMVIC-registered dealers provide a layer of protection for subprime borrowers that varies from other provinces.

1. Introduction: The Myth of the "Magic Number"

1.1 Understanding the Ontario Lending Landscape

There is no law in Ontario—or Canada at large—that mandates a minimum credit score for a vehicle purchase. Instead, the market is a spectrum of risk. Major banks like TD, RBC, and Scotiabank generally look for "Prime" borrowers, typically those with scores above 660. However, Ontario is home to a robust "Subprime" and "Non-Prime" lending market. These specialized lenders are willing to take on more risk in exchange for higher interest rates.

If you have a score of 520, you aren't "banned" from getting a car; you are simply moved into a different category of lending. The "minimum" isn't about whether you can get a loan, but rather what that loan will cost you over five to seven years. In 2025, with vehicle prices remaining high, the focus has shifted from "Can I get approved?" to "Can I afford the approval I'm offered?"

1.2 Equifax vs. TransUnion in Canada

One of the most confusing aspects for Ontario car buyers is why their score looks different on different apps. In Canada, we have two primary credit bureaus: Equifax and TransUnion. Most major Ontario dealerships and the "Big Five" banks lean heavily toward Equifax, specifically the Equifax Beacon 5.0 or 9.0 models tailored for automotive lending.

You might see a 700 on TransUnion (via Credit Karma) but find out the dealer sees a 660 on Equifax. This discrepancy happens because lenders report data at different times, and some creditors only report to one bureau. When preparing for a car loan in Ontario, it is always safer to assume the lender will see your Equifax score, as it remains the dominant force in the provincial automotive sector.

2. Breaking Down Credit Score Tiers for Ontario Car Loans

To understand where you stand, you need to see the world through the eyes of an Ontario finance manager. They categorize applicants into specific tiers. These tiers determine your interest rate, the maximum amount you can borrow, and even the age of the vehicle you are allowed to buy.

| Credit Tier | Score Range | Estimated Interest Rate (2025) | Typical Approval Odds |

|---|---|---|---|

| Super-Prime | 780 - 900 | 0% - 4.99% | Guaranteed (within DTI) |

| Prime | 661 - 779 | 5.99% - 8.99% | High |

| Non-Prime | 601 - 660 | 9.99% - 14.99% | Moderate |

| Subprime | 501 - 600 | 15.99% - 22.99% | Requires specialized lender |

| Deep Subprime | 300 - 500 | 23.99% - 29.99% | Requires down payment/co-signer |

2.1 Super-Prime (780 - 900)

If you fall into this category, you are the "ideal" borrower. You have access to manufacturer-subsidized rates, which can still be as low as 0% to 2.9% on specific new models, even in today’s higher-rate environment. Lenders will compete for your business, and you can often get approved with zero down payment and extended terms up to 84 or 96 months.

2.2 Prime (661 - 779)

Most Ontarians with steady jobs and a clean credit history fall here. You won't get the "teaser" 0% rates often, but you will get the standard bank rates. You have the flexibility to choose almost any vehicle on the lot, provided the payment fits your budget.

2.3 Non-Prime/Near-Prime (601 - 660)

This is the "grey area." Perhaps you had a few late credit card payments or your credit utilization is a bit high. You are still very much bankable, but you might be steered toward "B-lenders." The interest rates will be higher than the prime rate, but usually still under 15%.

2.4 Subprime (501 - 600)

At this level, traditional banks often say no. You will need to work with specialized finance departments that have relationships with lenders like Avante, Eden Park, or Rifco. These lenders focus more on your current income than your past mistakes.

2.5 Deep Subprime (300 - 500)

Approvals here are possible but come with strings attached. You may be limited to older, high-mileage vehicles that the lender considers "safe" collateral. You will almost certainly need a significant down payment to offset the lender's risk.

3. Factors That Matter More Than Your Credit Score

You might be surprised to learn that an Ontario lender might prefer a 580 score over a 720 score in certain situations. How is that possible? Because credit scores are historical, while income and debt ratios are "real-time."

3.1 Income and Employment Stability

In the Ontario market, "Time on Job" is a massive factor. A lender looks at a borrower with a 600 score who has been at the same manufacturing plant in Windsor for 12 years as a much safer bet than a 700-score borrower who just started a freelance gig two months ago. Stability suggests that even if life gets difficult, you have a reliable stream of income to service the debt.

3.2 Debt-to-Income (DTI) Ratio

This is the calculation of your monthly debt obligations divided by your gross monthly income. In Ontario, where housing costs in cities like Brampton or Mississauga are sky-high, lenders are very sensitive to DTI. If 50% of your income is already going to rent or a mortgage, a lender will be hesitant to add a $600 car payment on top of that, regardless of how high your credit score is.

3.3 The Down Payment Factor

Cash is a powerful equalizer. If you have a low credit score but can put down $5,000 on a $20,000 car, you have instantly reduced the lender's "Loan-to-Value" (LTV) ratio. This is called having "skin in the game." It shows the lender you are committed to the vehicle and provides them with a buffer if they ever have to repossess and resell the car.

3.4 Loan-to-Value (LTV) Ratio

Lenders don't just look at you; they look at the car. A lender is much more likely to approve a subprime loan for a 2022 Toyota Corolla than a 2015 BMW 7-Series. Why? Because the Corolla holds its value and is cheap to repair. If you default, the lender can recoup their money. If the BMW breaks down and you can't afford the $3,000 repair bill, you are likely to stop making payments, leaving the lender with a broken, depreciated asset.

4. Navigating the Ontario Subprime Market

4.1 The Role of OMVIC (Ontario Motor Vehicle Industry Council)

One of the best things about buying a car in Ontario is OMVIC. This regulatory body ensures that all registered dealers follow strict rules regarding "all-in pricing" and transparency. When you are dealing with subprime loans, some predatory "curbers" (unlicensed sellers) might try to hide fees or inflate interest rates. By sticking to OMVIC-registered dealers, you have legal recourse and a guarantee that the finance contracts are legitimate.

4.2 Second-Chance and Third-Chance Credit

You may see advertisements for "Second-Chance Credit." In Ontario, this usually refers to specialized lenders who look past bankruptcies or consumer proposals. "Third-Chance" often refers to "Buy Here Pay Here" (BHPH) dealerships where the dealer acts as the bank. While BHPH can get you on the road when everyone else says no, the interest rates are almost always at the legal maximum (around 29.9% in Canada).

5. How to Get a Car Loan in Ontario with Bad Credit

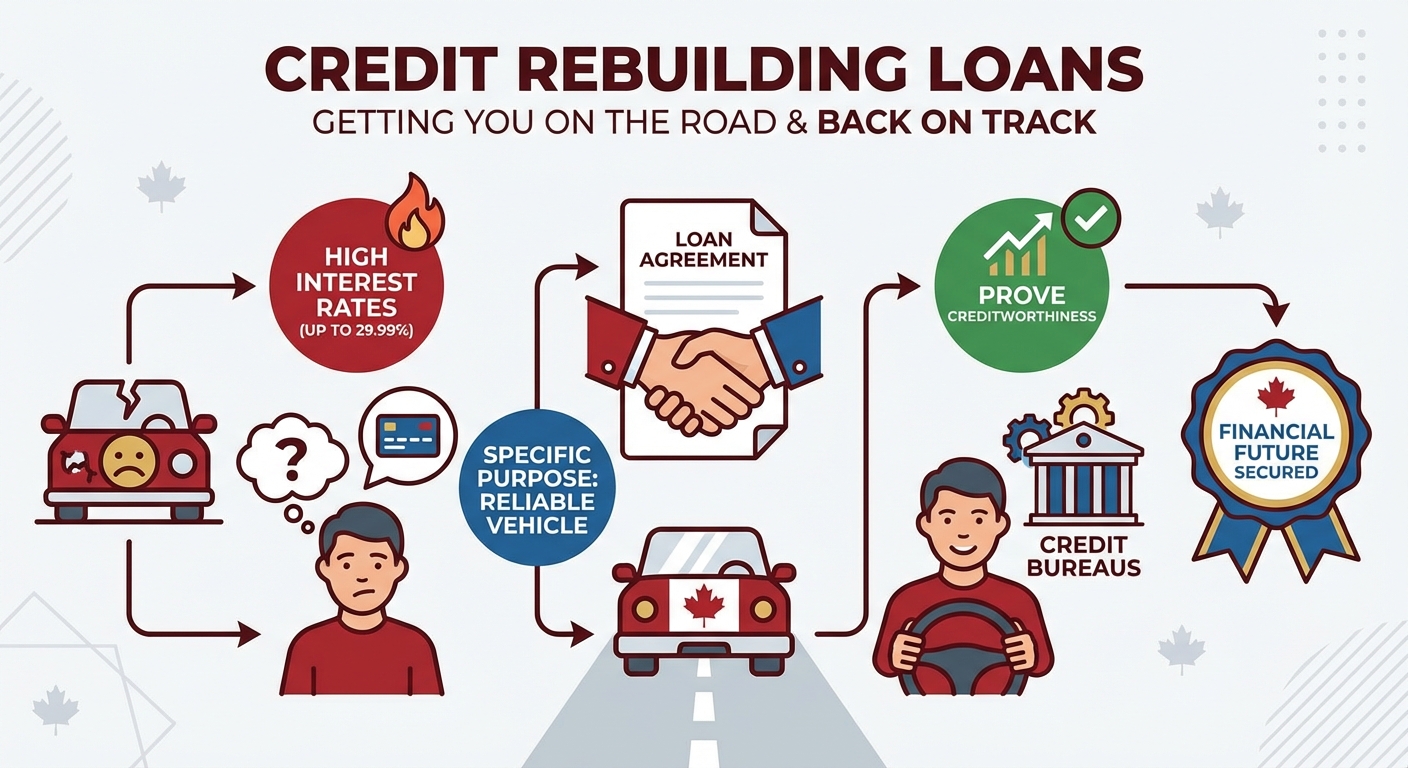

If your score is currently in the 300-500 range, you aren't out of luck. You just need a strategy. The goal is to get a car now while simultaneously rebuilding your credit so that your *next* car loan is at a prime rate.

5.1 The Co-signer Strategy

Adding a co-signer with a 700+ credit score is the fastest way to get prime rates with a subprime score. However, this is a major legal commitment. In Ontario, a co-signer is 100% responsible for the loan if you stop paying. It doesn't just "help" the application; the co-signer is literally signing the contract with you. If you miss a payment, their credit score takes the hit alongside yours.

5.2 Choosing the Right Vehicle

For low-credit applicants, the "boring" choice is the best choice. Lenders love seeing names like Honda, Toyota, and Mazda on subprime applications. These vehicles have high "residual value." Avoid luxury brands or heavily modified trucks, as lenders see these as high-risk assets that are difficult to liquidate if the loan goes south.

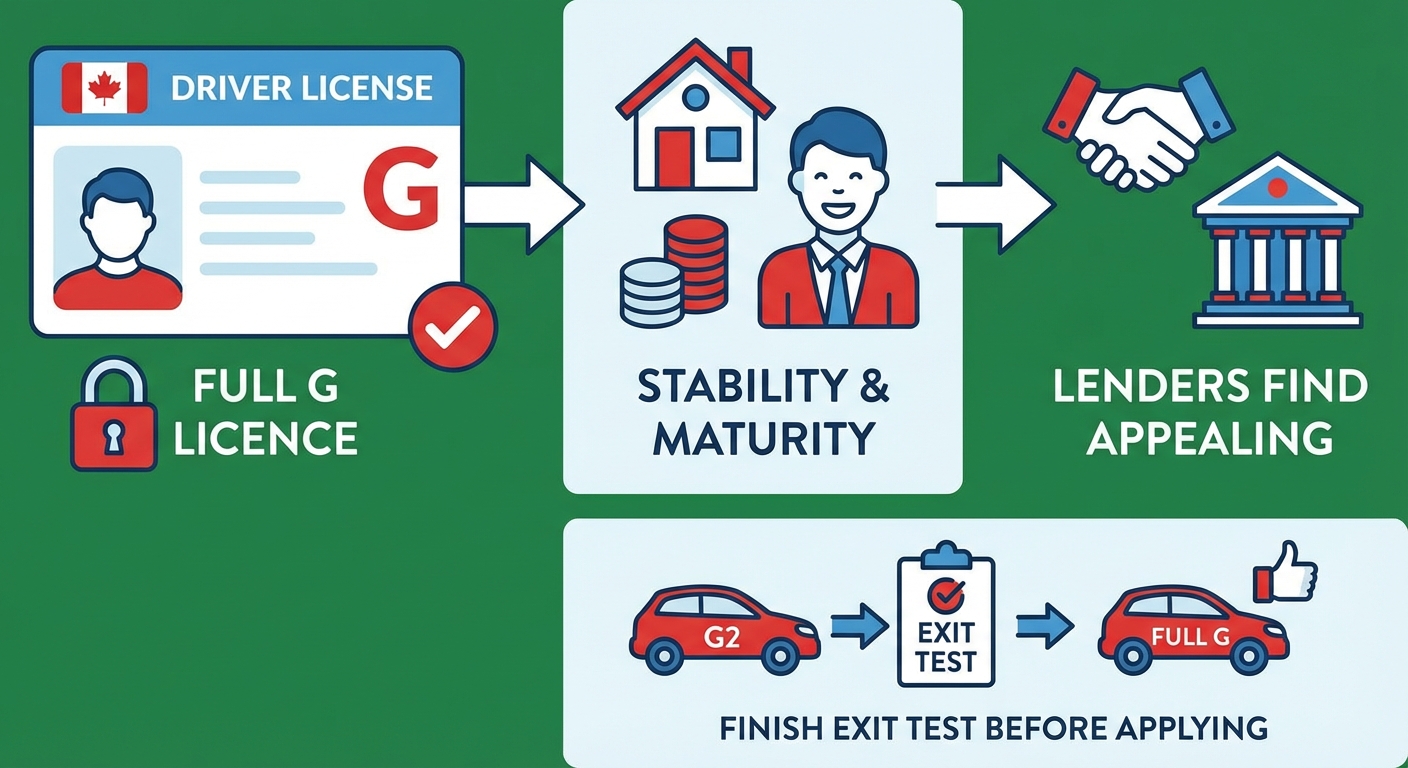

5.3 The Importance of a 'G' License

In Ontario, your driver's license class actually matters to some lenders. Having a full 'G' license demonstrates a level of stability and "adulthood" that a G2 license might not. Some subprime lenders even require a full G license as a condition of approval, as it suggests you are less likely to have your license suspended (which would lead to job loss and loan default).

6. The Real Cost of Interest: A 5-Year Comparison

Many buyers focus on the monthly payment, but the "total cost of borrowing" is where the true story lies. Let's look at how your credit score impacts the total price of a $25,000 vehicle over a 60-month (5-year) term.

| Scenario | Interest Rate | Monthly Payment | Total Interest Paid | Total Cost of Car |

|---|---|---|---|---|

| Prime Buyer | 6.5% | $489 | $4,340 | $29,340 |

| Non-Prime Buyer | 12.0% | $556 | $8,360 | $33,360 |

| Subprime Buyer | 19.0% | $648 | $13,880 | $38,880 |

| Deep Subprime | 28.0% | $775 | $21,500 | $46,500 |

As you can see, a deep subprime borrower ends up paying nearly double the price of the car once interest is factored in. This is why the "Refinance Exit Strategy" is so critical.

6.2 The 'Refinance' Exit Strategy

You don't have to stay in a 25% interest loan for five years. If you take that high-interest loan today and make every single payment on time for 12 to 18 months, your credit score will likely jump by 50 to 100 points. At that point, you can go back to a prime lender (or your bank) and ask to refinance the remaining balance at a much lower rate. This "bridge" strategy is how smart Ontario buyers escape the subprime cycle.

7. Improving Your Credit Score Specifically for an Auto Loan

If you have a few months before you need to buy, you can "groom" your credit profile to move up a tier. This doesn't require a miracle; it requires math.

7.1 The 30% Utilization Rule

Your "Credit Utilization" accounts for 30% of your total score. This is the ratio of your credit card balances to your limits. If you have a $1,000 limit and a $900 balance, your score is being suppressed. If you can pay that balance down to $300 (30%), your score can jump significantly in just one billing cycle. Lenders want to see that you have credit available but aren't desperate enough to use all of it.

7.2 Disputing Errors on Your Equifax Report

Ontario credit files are notoriously prone to errors. Perhaps a Rogers bill you paid three years ago is still showing as "outstanding," or a collection agency has listed the same debt twice under different names. Disputing these through the Equifax Canada website is free and can result in an immediate score boost once the errors are removed.

8. Frequently Asked Questions (FAQ)

Can I get a car loan in Ontario with a 500 credit score?

Yes, it is entirely possible. However, you will likely be restricted to specialized subprime lenders. You should be prepared to provide proof of income (pay stubs), proof of residence (utility bills), and potentially a down payment of $1,000 to $2,000. Your interest rate will likely be in the 18% to 25% range.

Do Ontario dealerships use Equifax or TransUnion?

While some use both, the vast majority of major lenders in Ontario—including TD Auto Finance, Scotiabank, and RBC—rely primarily on Equifax. If you are checking your score on an app that uses TransUnion, be aware that your Equifax score could be 20-40 points higher or lower.

How much down payment do I need for a low credit car loan?

While "zero down" is marketed heavily, most subprime lenders in Ontario prefer to see at least 10% of the vehicle's price as a down payment. If your score is under 550, having a down payment is often the difference between an approval and a rejection.

Will a consumer proposal or bankruptcy prevent me from getting a car loan?

Not necessarily. In fact, many Ontario lenders specialize in "post-bankruptcy" loans. If you have been discharged from your bankruptcy, or if you have been in a consumer proposal for at least 6-12 months and have a perfect payment history on it, you can often get approved for a car loan. The car loan itself is actually one of the best ways to rebuild your credit after a proposal.

Does a G2 license affect my car loan approval?

It can. While most prime lenders don't care as long as your credit is good, some subprime lenders view a G2 as a higher risk. They may require you to have a full G license to prove stability, or they may limit the amount they are willing to lend you. It is always better to have your full G license before applying if possible.

How long do I need to be at my job to get a car loan in Ontario?

Most lenders want to see at least three months of continuous employment (past your probation period). If you have a lower credit score, they may want to see six months to a year. If you are self-employed, you will typically need to provide two years of Notice of Assessments (NOAs) from the CRA.

9. Your Path Forward

The "truth" about the minimum credit score in Ontario is that the number is just a gateway, not a destination. If your score is high, the gate is wide open and the path is cheap. If your score is low, the gate is narrower and the path is more expensive—but it is still a path.

Instead of obsessing over hitting a specific number, focus on your total financial package. Clean up your small debts, ensure your income is documented, and save even a small down payment. Ontario's automotive market is designed to get people moving, regardless of their credit history. By understanding the tiers and the factors beyond the score, you can walk into a dealership with the confidence of someone who knows exactly what they are worth.

Remember, a car loan is a tool. Used correctly, it doesn't just get you from point A to point B; it serves as the foundation for a stronger financial future and a better credit score for years to come.