Stepping into a flagship Mercedes-Benz S-Class or feeling the precision of a Porsche 911 isn't just about the drive; it's a statement of achievement. However, in the Canadian market, the path to the driver's seat of a six-figure vehicle is paved with complex financial nuances that differ significantly from buying a standard commuter car. Whether you are navigating the streets of Toronto or cruising the mountain passes of British Columbia, securing luxury car financing requires a strategic approach that goes far beyond simply having a "good" credit score.

The Canadian luxury automotive landscape has shifted. With the introduction of federal luxury taxes on vehicles over $100,000 and fluctuating interest rates, lenders have become more discerning. You aren't just being evaluated on your ability to make a monthly payment; you are being scrutinized on your total financial ecosystem. This guide pulls back the curtain on the "approval secrets" used by high-net-worth individuals and savvy investors to secure the best rates and terms for high-end automotive assets.

Key Takeaways

- Credit Thresholds: Luxury financing typically demands a credit score of 700+, with the most competitive "Prime" rates reserved for those above 780.

- Lender Variety: Specialized boutique lenders and captive finance companies (like Audi Financial Services) often offer more flexibility for exotics than traditional "Big Five" banks.

- The 20% Rule: A down payment of 20% is the industry "sweet spot" that triggers better internal risk ratings and lower interest rates.

- Tax Strategy: Business owners can leverage specific leasing structures to maximize Capital Cost Allowance (CCA) despite the CRA's luxury vehicle limits.

- TCO Awareness: Lenders factor in insurance and maintenance reserves; proving you can afford the upkeep is as vital as proving you can afford the loan.

Understanding the Canadian Luxury Financing Landscape

When you walk into a dealership to finance a $120,000 BMW, the financial machinery working behind the scenes is distinct from a standard loan. In Canada, luxury financing is segmented into three primary avenues: traditional banks, captive finance companies, and independent boutique lenders.

Traditional Banks vs. Captive Finance Companies

The "Big Five" Canadian banks (RBC, TD, Scotiabank, BMO, and CIBC) are excellent for stability, but they are often conservative. They prefer "vanilla" loans-new vehicles with predictable depreciation. If you're looking at a brand-new Lexus, a traditional bank is a solid bet. However, for true high-performance or "niche" luxury, captive finance companies like Porsche Financial Services or Mercedes-Benz Financial Services often have a higher appetite for risk because they understand the intrinsic value and resale market of their own brand better than a generalist bank does.

The Role of Independent Luxury Dealerships

Independent luxury dealerships, particularly in hubs like the GTA, Montreal, and Vancouver, often maintain relationships with private lending circles. These lenders don't just look at a credit bureau report; they look at the asset. If you are eyeing a low-mileage Lamborghini or a vintage Aston Martin, these independent specialists are often the only ones willing to structure a deal because they recognize the car as an appreciating or stable asset rather than just a depreciating "used car."

Private Wealth Lending

For high-net-worth clients, your car might not be financed through a dealership at all. Many Canadians utilize their private banking relationships to secure a Line of Credit (LOC) backed by other assets (like a stock portfolio or real estate equity). This often results in the lowest possible interest rates, as the loan is secured by liquid assets rather than the vehicle itself.

The Pillars of Approval: What Lenders Look For

Why does one person with a $200,000 income get rejected while another with $120,000 gets approved? It comes down to the "Pillars of Approval." In the luxury space, lenders are looking for "stability" and "liquidity" over raw income.

Credit Score Secrets: Moving Beyond the Basic 'Good' Score

In the world of economy cars, a 650 might get you a loan with a high interest rate. In the luxury world, a 650 is often an immediate "thin file" rejection for loans exceeding $80,000. Lenders look at your depth of credit. Have you handled a large loan before? If the largest loan on your history is a $20,000 Ford Focus, jumping to a $110,000 Range Rover is a "tier jump" that scares underwriters. They want to see "comparable credit"-previous history with high-limit trade lines.

Debt-to-Income (DTI) Ratios

Your DTI is the percentage of your gross monthly income that goes toward paying debts. For luxury loans, lenders prefer your total debt obligations (including your mortgage and the new car payment) to stay under 40-45%. If you're pushing a $1,800 monthly car payment, you need a significant "buffer" of unallocated income to prove that a sudden repair or a change in the economy won't result in a default.

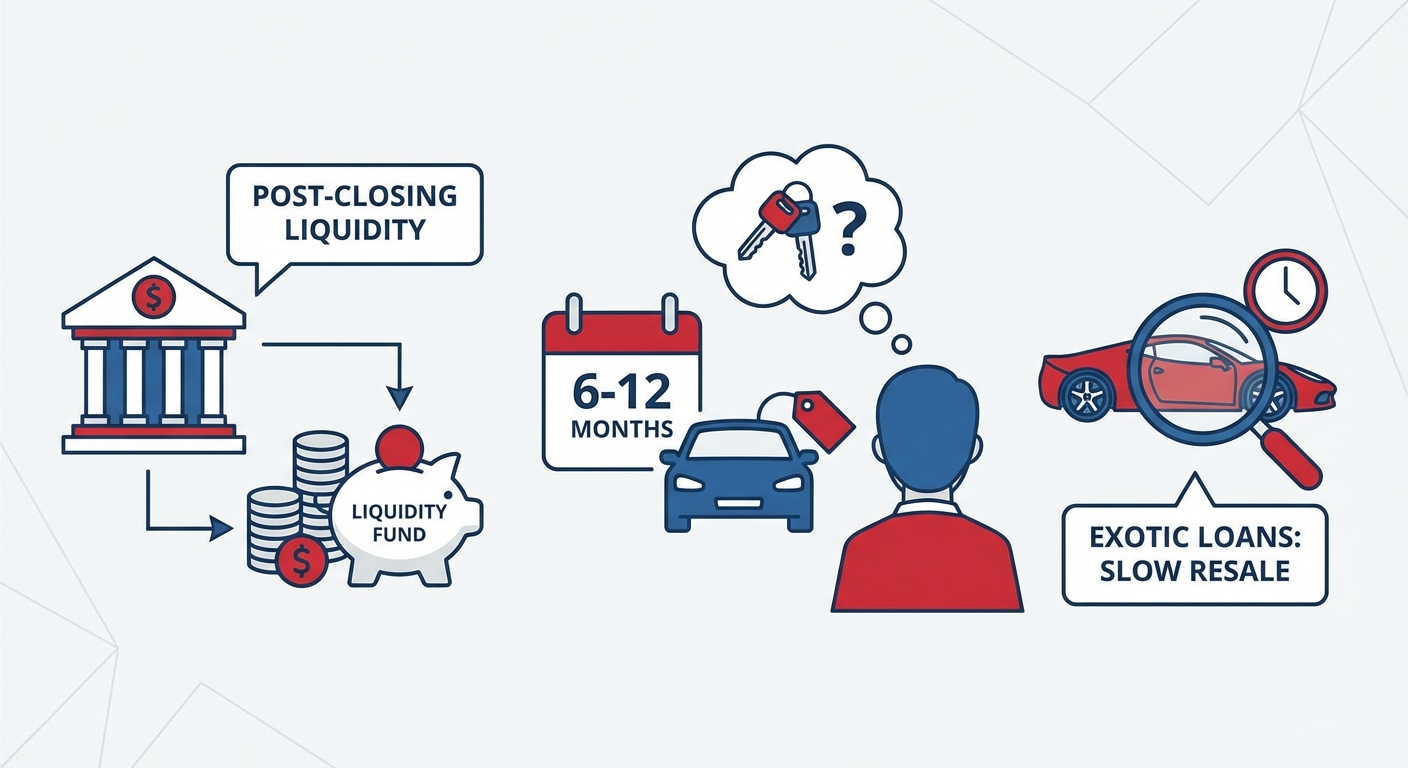

Verifying Liquid Assets

High income is great, but high income with zero savings is a red flag. Lenders may ask for brokerage statements or bank balances. They want to see that you have "post-closing liquidity"-enough cash to cover 6 to 12 months of car payments if your income were to stop tomorrow. This is especially true for loans on exotics where the resale process can be slow.

Strategic Down Payments and Their Impact

In the luxury market, the down payment is your most powerful negotiating lever. While "zero down" is a popular marketing gimmick for mid-range SUVs, it is rarely the best path for a luxury purchase.

How a 20% Down Payment Changes the Risk Profile

When you put 20% down, you immediately offset the initial "drive-off" depreciation. This protects the lender. If they have to repossess the car in six months, they are confident they can sell it for more than the remaining loan balance. This reduced risk translates directly into lower interest rates. In many cases, moving from 10% down to 20% down can drop your interest rate by a full percentage point or more.

The 'Skin in the Game' Philosophy

Lenders operate on a "skin in the game" philosophy. A borrower who has invested $30,000 of their own cash into a Porsche is statistically much less likely to walk away from the loan than someone who financed the tax, freight, and PDI. For non-traditional borrowers-such as those with high net worth but low taxable income-a massive down payment (30-40%) can often override a lack of traditional income verification.

Leasing vs. Financing Luxury Vehicles in Canada

The decision to lease or finance is perhaps more critical in the luxury segment than anywhere else due to the sheer velocity of depreciation and the complexity of Canadian tax laws.

| Feature | Financing (Loan) | Leasing |

|---|---|---|

| Ownership | You own the asset from day one. | The leasing company owns the asset. |

| Monthly Payment | Higher (Paying off total value). | Lower (Paying for usage/depreciation). |

| Tax Treatment | Pay full HST/GST upfront (or financed). | Pay HST/GST on monthly payments. |

| Depreciation Risk | You bear the loss if value plummets. | Lender bears the risk (Closed-end). |

| Best For | Long-term owners (5+ years). | Business owners & those who upgrade often. |

The Depreciation Factor

High-end SUVs like the Range Rover or Audi Q7 are notorious for steep depreciation curves. Financing these vehicles for 7 or 8 years often leads to "negative equity," where you owe more than the car is worth for the majority of the loan term. Leasing protects you from this. At the end of a 36-month lease, if the market for used luxury SUVs has crashed, you simply hand back the keys.

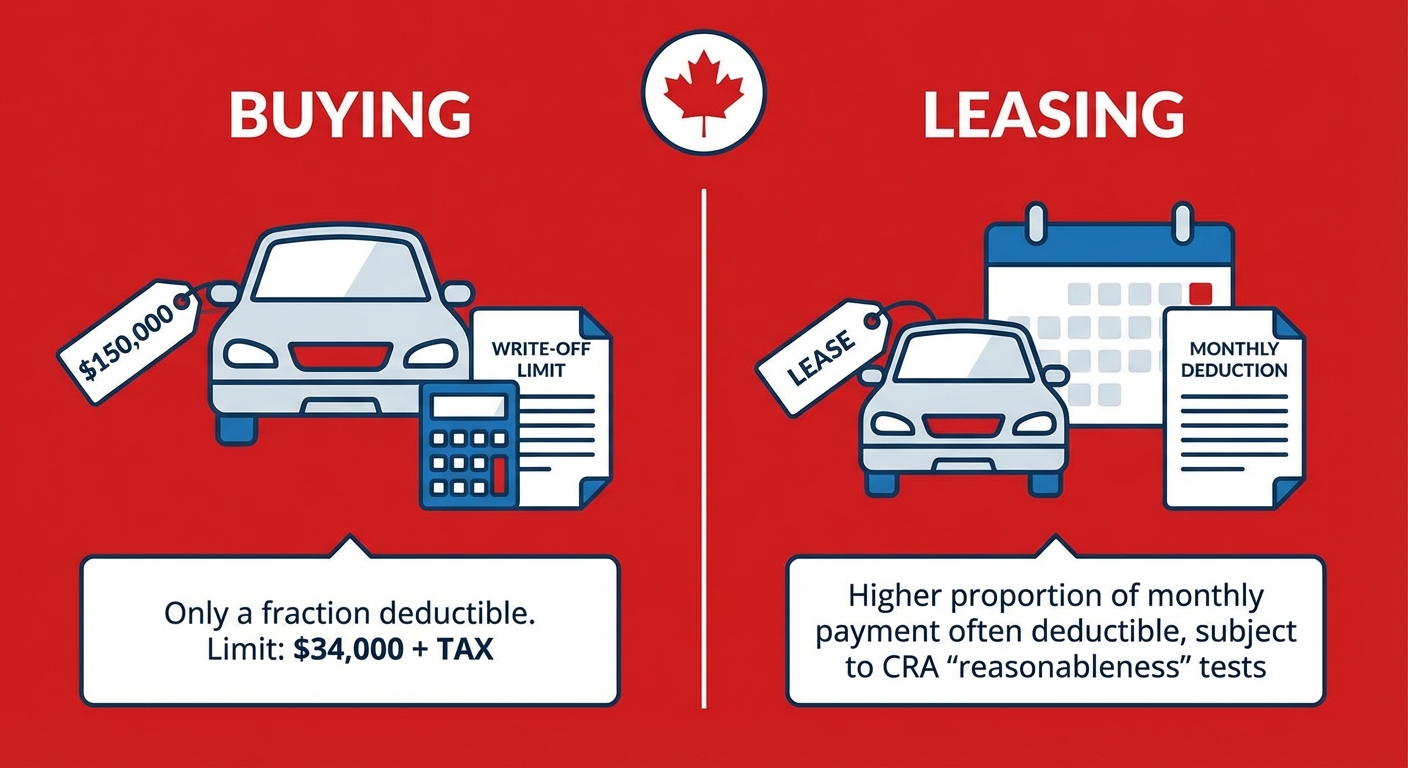

Tax Implications and the CRA

For Canadian business owners, leasing is often the preferred route. The Canada Revenue Agency (CRA) has strict limits on how much of a luxury vehicle purchase price can be depreciated through Capital Cost Allowance (CCA). Currently, the ceiling for Class 10.1 (passenger vehicles) is $34,000 plus tax. If you buy a $150,000 car, you can only write off a fraction of it. However, with a lease, you can often deduct a higher proportion of the monthly payment as a business expense, subject to specific CRA "reasonableness" tests.

Navigating Financing for Exotic and Rare Vehicles

Financing a 2024 Mercedes is straightforward. Financing a 2014 Ferrari 458 Italia is a completely different challenge. Most "Prime" lenders have an "Age of Vehicle" constraint, typically refusing to finance anything older than 7 to 10 years.

Appraisal and Valuation Requirements

For rare or exotic models, the lender won't rely on Canadian Black Book values because they are often inaccurate for low-volume cars. You will likely be required to get a professional third-party appraisal. This ensures the lender isn't over-extending on a car that might have a niche market. Furthermore, they will look closely at the "provenance"-service records and accident history-as these factors swing the value of an exotic car by tens of thousands of dollars.

Specialized Insurance

You cannot secure luxury financing without proof of insurance, and standard providers might refuse to cover a McLaren or a Rolls-Royce. You will likely need to go through a specialty insurer like Hagerty or a high-limit commercial provider. Lenders will require a "Lienholder Protection" clause, ensuring they get paid first in the event of a total loss.

Approval Secrets for Non-Traditional Borrowers

Not every luxury car buyer has a T4 slip and a 9-to-5 job. Many are entrepreneurs, newcomers, or individuals who have faced financial hurdles in the past.

Self-Employed and Business Owners

If you are self-employed, your "taxable income" might be low due to heavy deductions. To get approved for a luxury loan, you need to provide more than just a pay stub. Be prepared to show two years of Notice of Assessments (NOAs) and your corporate financial statements. Lenders will "add back" certain non-cash expenses (like depreciation) to your income to get a more accurate picture of your ability to pay.

Newcomers to Canada

Canada is a destination for global wealth, but a lack of Canadian credit history can stall a luxury purchase. "Newcomer to Canada" programs offered by lenders like Scotiabank or RBC often allow for luxury financing if the borrower can provide a significant down payment (usually 35%+) and proof of international assets or a high-paying Canadian employment contract.

The Step-by-Step Luxury Application Process

To ensure a smooth experience, you should treat a luxury car application like a mini-mortgage application. Preparation is the difference between a 5% interest rate and an 8% rate.

- Secure Pre-Approval: Before you even step into the showroom, get a pre-approval. This tells the dealer you are a "serious buyer" and gives you the upper hand in negotiations. You aren't just negotiating the price of the car; you're negotiating the "buy rate" of the interest.

- Gather Your Documentation: You will need a valid driver's licence, proof of residence (utility bills), and income verification (NOAs or recent pay stubs). For high-ticket items, a "Statement of Net Worth" is often helpful.

- Understand 'Conditions of Approval': Sometimes a lender will approve you with "conditions." This might include paying off a small credit card balance or providing a larger down payment. Do not ignore these; they are the final hurdles to the keys.

Managing the Total Cost of Luxury Ownership

Lenders are increasingly looking at "Total Cost of Ownership" (TCO) when approving loans. They know that if a $2,000 brake job surprises you, you might miss a car payment. In Canada, luxury car insurance premiums are significantly higher, especially in high-theft or high-traffic areas like the GTA.

| Expense Category | Estimated Annual Cost (Luxury) | Why Lenders Care |

|---|---|---|

| Insurance | $3,500 - $7,000+ | High premiums eat into your DTI ratio. |

| Maintenance | $1,500 - $4,000 | Poor maintenance leads to rapid asset depreciation. |

| Fuel (Premium) | $2,500 - $5,000 | Ongoing cash flow requirement. |

| Luxury Tax | 10% - 20% (One-time) | Increases the total amount needed to be financed. |

Maintenance reserves are non-negotiable for luxury owners. Porsche's "Service A" and "Service B" intervals can cost upwards of $1,000 to $3,000 per visit. If you are financing, consider "wrapping" a prepaid maintenance plan into your loan. While this increases the loan amount slightly, it ensures the car is maintained to factory standards, protecting its future trade-in value and your financial standing with the lender.

Extended Warranties: Are They Worth It?

In the luxury world, an out-of-warranty repair can be catastrophic. Lenders often look more favourably on loans for used luxury cars if an extended warranty is included in the contract. It provides an extra layer of security that the borrower won't be hit with a $15,000 engine repair bill while still owing $60,000 on the loan.

Frequently Asked Questions (FAQ)

What is the minimum credit score for luxury car financing in Canada?

While some specialized lenders may consider scores as low as 640 with a massive down payment, the "safe" threshold for luxury financing is 700. To secure the most competitive interest rates (Prime rates), you typically need a score of 750 or higher, along with a history of managing large credit limits.

Can I finance a luxury car through my corporation?

Yes, and many Canadian business owners do so for tax benefits. You will likely need to provide the corporation's Articles of Incorporation, recent financial statements, and a personal guarantee from the business owner. This allows you to potentially write off lease payments or claim Capital Cost Allowance (CCA) as a business expense.

Are interest rates higher for exotic cars than standard cars?

Generally, yes. Exotic cars (Lamborghini, Ferrari, McLaren) carry higher risk for lenders due to volatile resale markets and high repair costs. Interest rates for exotics are often 1% to 3% higher than for a standard luxury car like a Lexus or Mercedes-Benz, unless you are using a private wealth line of credit.

How does car depreciation affect my loan-to-value ratio?

Luxury cars often lose 20-30% of their value in the first year. If you finance with $0 down, you will be "underwater" (owing more than the car is worth) almost immediately. Lenders monitor the Loan-to-Value (LTV) ratio; keeping this ratio below 80% via a down payment is the best way to ensure easy approval and better terms.

Can I pay off my luxury car loan early without penalties?

In Canada, most standard automotive loans are "open-ended," meaning you can pay them off at any time without penalty. However, some boutique or private luxury leases may have "early termination fees." Always review the "Prepayment" section of your contract before signing to ensure you have the flexibility to trade in or sell the car early.

Driving Away with the Best Deal

Securing luxury car financing in Canada is a sophisticated process that rewards the well-prepared. By understanding the nuances between captive finance companies and traditional banks, and by strategically utilizing down payments to trigger manual underwriter reviews, you can move beyond simple "approval" and into the realm of "preferred" borrowing. Remember that in the high-end market, the relationship is king. Building a rapport with a dealership's finance manager and maintaining a transparent financial profile will always yield better results than cold applications.

The allure of the high-end drive is within reach. By focusing on your total cost of ownership, respecting the depreciation curves of specific models, and leveraging the tax advantages available to Canadian professionals, you can ensure that your luxury vehicle is a source of pride rather than a financial burden. Shop your rates, know your score, and prepare your documentation with the same precision that went into engineering the car you're about to drive.