Your Consumer Proposal Just Qualified You. For a Porsche.

Table of Contents

- Key Takeaways

- I. The Unbelievable Truth: From Consumer Proposal to Convertible Dreams

- Acknowledge the Audacity: Why This Title Isn't Clickbait

- The Paradigm Shift: Re-envisioning Your Financial Future Post-CP

- Key Takeaways: Your Fast Track to Luxury Car Loan Eligibility (Even After a CP)

- II. Decoding the Consumer Proposal: A Lender's New Perspective on Your Credit Story

- Beyond the Stigma: Why a CP Differs from Bankruptcy in a Lender's Eyes

- The Structure Advantage: How a Legally Binding Repayment Plan Signals Commitment

- Understanding the Credit Score Hit (and the Rebound Potential): The Initial Dip and the Ascent

- III. The Luxury Conundrum: Why a Porsche isn't a Prius (for Lenders)

- Higher Stakes, Higher Scrutiny: What Makes Luxury Car Financing Inherently Different

- Beyond the Sticker Price: Insurance, Maintenance, and Depreciation – The Hidden Costs Lenders Consider

- The 'Risk Profile' of a High-Value Asset: Why Lenders Need More Assurance

- IV. Your Financial Foundation: Building the Bridge to a Bentley (or BMW)

- Rebuilding Your Credit Score, Post-CP: Actionable Steps Beyond Just Completion

- The Debt-to-Income (DTI) Ratio: Your Golden Ticket to Lender Confidence

- Proof of Income & Stability: More Than Just a Pay Stub – The Holistic View

- V. Navigating the Lender Landscape: Who Will Say 'Yes' to Your Dream Car?

- Specialized Subprime Lenders: Your Primary Allies in Challenging Credit Situations

- Dealership Finance Departments: A Direct Route (with Caveats and Connections)

- Credit Unions & Smaller Banks: The Local Advantage (Sometimes Offering Flexibility)

- Why Major Banks Might Still Be a Stretch (for now): Understanding Their Stricter Criteria

- VI. The Application Arsenal: Crafting Your Irresistible Offer

- Document Checklist: Leave No Stone Unturned for a Seamless Application

- The Art of Explanation: Addressing Your Credit History Head-On, Not Hiding From It

The idea of transitioning from a consumer proposal to the driver's seat of a Porsche might sound like a plot twist from a Hollywood movie, not a financial reality. Yet, here at SkipCarDealer.com, we're here to tell you it's not just possible – it's a journey many Canadians are successfully navigating. This isn't about magical thinking; it's about strategic planning, demonstrating renewed financial responsibility, and knowing precisely how to leverage your post-consumer proposal status.

For too long, a consumer proposal has been unfairly stigmatized as a financial dead-end, a scarlet letter that bars you from future aspirations like luxury car ownership. We're here to shatter that myth. A consumer proposal, when completed, can actually be seen by certain lenders as a definitive step towards financial rehabilitation, a clear demarcation point from past debt struggles. It signifies that you've faced your challenges head-on, committed to a repayment plan, and emerged with a cleaner slate.

So, if you've completed your consumer proposal and found yourself dreaming of a Cayenne, a 911, or even an entry-level Macan, understand that this dream is within reach. It requires a nuanced understanding of how lenders perceive your credit story, a disciplined approach to rebuilding, and the right guidance to navigate the specialized financing landscape. Let's shift your perspective from 'impossible' to 'imminent'.

Key Takeaways

- Strategic credit rebuilding is paramount – it's not about luck, but a deliberate plan.

- Specialized subprime and dealership lenders are your primary allies, not traditional banks.

- Demonstrating consistent financial responsibility and stability is non-negotiable.

- A substantial down payment acts as your most powerful negotiating tool.

- Patience, persistence, and meticulous documentation are your greatest virtues.

I. The Unbelievable Truth: From Consumer Proposal to Convertible Dreams

Acknowledge the Audacity: Why This Title Isn't Clickbait

We get it. The headline, "Your Consumer Proposal Just Qualified You. For a Porsche," probably raised an eyebrow or two. In a world where financial narratives often paint consumer proposals as a last resort, the idea of linking one to a luxury car purchase seems counter-intuitive, almost audacious. But this isn't clickbait; it's a testament to a financial reality many Canadians overlook. A consumer proposal, contrary to popular belief, isn't a permanent roadblock to your aspirations. Instead, it can be viewed as a strategic reset button. For individuals who have successfully completed their proposal, it signifies a structured approach to debt resolution, a commitment to repayment, and a fresh start. This demonstrates a level of responsibility and discipline that, when combined with diligent credit rebuilding, can impress the right lenders. It’s about leveraging your journey, not being defined by a past hiccup.

The Paradigm Shift: Re-envisioning Your Financial Future Post-CP

Imagine your financial journey as a road trip. A consumer proposal might feel like a significant detour, but it’s not the end of the road. It’s a strategic pivot point. By successfully completing a consumer proposal, you've proven your ability to adhere to a financial plan, manage your obligations, and emerge stronger. This critical step lays the groundwork for significant credit rebuilding. It allows you to re-envision your financial future, not as one limited by past debt, but as one empowered by lessons learned and disciplined action. Lenders, particularly those specializing in non-traditional credit, are increasingly recognizing the value of a completed consumer proposal as evidence of an individual's renewed commitment to financial health. They understand that life happens, and a consumer proposal is often a proactive solution rather than a complete surrender. Your financial future, even with luxury aspirations, can be brighter than you think.

Key Takeaways: Your Fast Track to Luxury Car Loan Eligibility (Even After a CP)

- Strategic credit rebuilding is paramount – it's not about luck, but a deliberate plan. Simply waiting for time to pass isn't enough. You need an active, structured approach to re-establish a positive credit history.

- Specialized subprime and dealership lenders are your primary allies, not traditional banks. Major banks often have rigid criteria. Subprime lenders and dealership finance departments are equipped to assess your unique situation and find solutions.

- Demonstrating consistent financial responsibility and stability is non-negotiable. This means on-time payments, stable employment, and a healthy debt-to-income ratio.

- A substantial down payment acts as your most powerful negotiating tool. It significantly reduces the lender's risk and shows your serious commitment to the purchase. For more on how a down payment can change your car loan prospects, even if it's not a huge one, consider reading Your Down Payment Just Called In Sick. Get Your Car.

- Patience, persistence, and meticulous documentation are your greatest virtues. The process may take time, require effort, and demand thorough preparation.

II. Decoding the Consumer Proposal: A Lender's New Perspective on Your Credit Story

Beyond the Stigma: Why a CP Differs from Bankruptcy in a Lender's Eyes

For many, the terms "consumer proposal" and "bankruptcy" are used interchangeably, both carrying a heavy stigma. However, from a lender's perspective, they are fundamentally different, particularly regarding your eligibility for future loans. A consumer proposal is a formal, legally binding agreement between you and your creditors to repay a portion of your debt, typically over a period of up to five years. It's a proactive step, demonstrating your willingness to address your financial challenges and take responsibility. Bankruptcy, on the other hand, is generally seen as a complete liquidation of assets to satisfy debts, often with less direct repayment to creditors. Lenders tend to view a completed consumer proposal more favourably because it shows a commitment to repayment and a structured resolution, rather than a full discharge of debt. This distinction is crucial when you're looking to finance a significant purchase like a luxury car.

Here's a quick comparison:

| Feature | Consumer Proposal | Bankruptcy |

|---|---|---|

| Nature | Structured repayment plan for a portion of debt. | Legal process to eliminate most debts, often liquidating assets. |

| Lender Perception | Demonstrates commitment to repay; proactive resolution. | Often viewed as a last resort, less direct repayment. |

| Credit Impact Duration | Stays on credit report for 3 years after completion (or 6 years from filing, whichever is sooner). | Stays on credit report for 6-7 years after discharge (first bankruptcy). |

| Asset Impact | Generally allows you to keep assets (e.g., home, car). | Assets may be seized and sold to pay creditors. |

| Future Credit | Easier to rebuild credit and secure loans post-completion. | More challenging to rebuild credit and secure loans post-discharge. |

For a deeper dive into how bankruptcy impacts car loans, you might find our article Bankruptcy Discharge: Your Car Loan's Starting Line helpful, though remember a consumer proposal offers a different path.

The Structure Advantage: How a Legally Binding Repayment Plan Signals Commitment

The very essence of a consumer proposal is its structure and legal binding nature. When you enter a consumer proposal, you're not just making a verbal promise; you're entering into a formal agreement, overseen by a Licensed Insolvency Trustee (LIT), to repay a specific amount to your creditors. This isn't a casual arrangement; it's a commitment with legal ramifications. For lenders, this structured repayment plan is a powerful signal. It demonstrates that you acknowledged your financial difficulties, sought professional help, and committed to a disciplined path of resolution. This level of commitment and follow-through is a significant positive indicator, showing that you are capable of managing financial obligations, even after experiencing hardship. It's a clear sign that you're not one to walk away from your debts without a fight, which is exactly the kind of borrower a lender wants to see.

Understanding the Credit Score Hit (and the Rebound Potential): The Initial Dip and the Ascent

There's no sugarcoating it: filing a consumer proposal will initially impact your credit score. Your score will likely drop significantly, and the proposal will remain on your credit report for three years after it's completed, or six years from the date you filed, whichever comes first. This initial dip can feel disheartening, but it's a temporary phase, not a permanent state. The good news is that once your consumer proposal is completed and discharged, you are in a prime position to begin rebuilding your credit. Every on-time payment you make on new credit, every responsible financial decision, contributes to your credit score's ascent. The key is to understand that the completion of your proposal marks a new beginning, a fresh slate from which to build a stronger credit profile. This rebound potential is what lenders are looking for – a clear trajectory of improvement and responsible financial behaviour post-proposal.

The single most important document you will possess after completing your consumer proposal is the Certificate of Full Performance. This official document, issued by your Licensed Insolvency Trustee, is your undeniable proof that you have fulfilled all obligations of your proposal. It's your 'get out of jail free' card, signifying a fresh financial slate. Keep this document safe and readily available. When applying for a luxury car loan, presenting this certificate immediately tells lenders that your consumer proposal is behind you, not an ongoing concern. It streamlines their assessment and validates your commitment to financial resolution, making you a much more attractive applicant.

III. The Luxury Conundrum: Why a Porsche isn't a Prius (for Lenders)

Higher Stakes, Higher Scrutiny: What Makes Luxury Car Financing Inherently Different

Financing a luxury car like a Porsche is inherently different from financing a more economical vehicle. For lenders, the stakes are significantly higher. A Porsche, even a pre-owned model, represents a substantial principal amount compared to, say, a Honda Civic or a Toyota Prius. This higher loan value means increased risk for the lender. If you default, they stand to lose more. Consequently, lenders apply a much stricter lens to luxury car loans. They're not just assessing your ability to make payments; they're scrutinizing your overall financial stability, your long-term income prospects, and your perceived reliability as a borrower. Your credit history, even post-consumer proposal, will be examined with greater intensity, as will your debt-to-income ratio and your asset base. It's not just about qualifying for *a* car loan; it's about qualifying for a *high-value* car loan, which demands a more robust financial profile.

Beyond the Sticker Price: Insurance, Maintenance, and Depreciation – The Hidden Costs Lenders Consider

Lenders are astute. They understand that the cost of luxury car ownership extends far beyond the sticker price or monthly loan payment. They factor in the additional financial burdens that come with a high-end vehicle. Insurance premiums for a Porsche, for instance, are substantially higher than for a standard sedan due to the vehicle's value, performance capabilities, and higher theft risk. Maintenance costs are also significantly elevated; luxury brands often require specialized parts, highly trained technicians, and more frequent servicing, all of which come with a premium price tag. Furthermore, while all vehicles depreciate, luxury cars can sometimes experience rapid depreciation, especially in the initial years. Lenders consider these hidden costs because they impact your overall financial capacity to manage the car. If you're struggling to afford the insurance or maintenance, your ability to make loan payments could be compromised. Demonstrating you've accounted for these aspects strengthens your application.

The 'Risk Profile' of a High-Value Asset: Why Lenders Need More Assurance

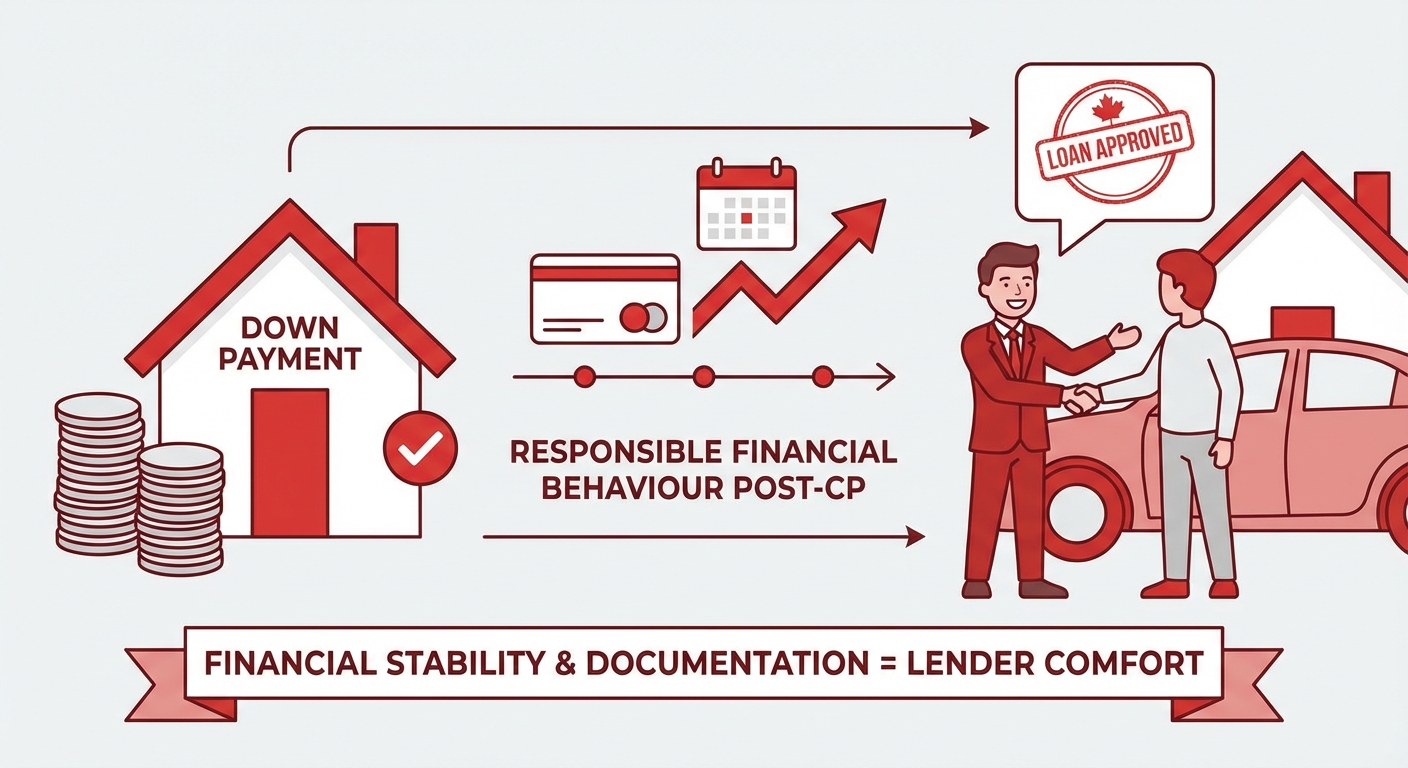

A luxury vehicle is a high-value asset, and this elevates its risk profile in the eyes of a lender. The higher resale value means a greater potential loss if the vehicle is repossessed and sold. The appeal of such vehicles can also make them targets for theft or vandalism, leading to potential insurance claims and further complications. For these reasons, lenders require more assurance from applicants seeking luxury car loans, especially those with a consumer proposal in their history. They want to see a strong, stable applicant profile that minimizes these inherent risks. This means a robust income, a low debt-to-income ratio, a significant down payment, and a clear history of responsible financial behaviour post-CP. The more assurance you can provide through your financial stability and documentation, the more comfortable lenders will be in approving a loan for a high-value asset.

(Context: A sleek luxury car (e.g., a Porsche 911) parked in front of a modern, aspirational setting, symbolizing the dream becoming reality after strategic financial restructuring and credit rebuilding.)

(Context: A sleek luxury car (e.g., a Porsche 911) parked in front of a modern, aspirational setting, symbolizing the dream becoming reality after strategic financial restructuring and credit rebuilding.)

IV. Your Financial Foundation: Building the Bridge to a Bentley (or BMW)

Rebuilding Your Credit Score, Post-CP: Actionable Steps Beyond Just Completion

Completing your consumer proposal is a monumental first step, but it's just the beginning of your credit rebuilding journey. To bridge the gap to luxury car ownership, you need an active, strategic approach to elevate your credit score. This isn't about passive waiting; it's about disciplined action.

- Secured Credit Cards: Your First Rung on the Ladder: A secured credit card is an excellent tool for post-CP credit rebuilding. You provide a deposit, which becomes your credit limit, and you use the card like a regular credit card. The key is to use it sparingly, keep your utilization below 30% of the limit, and pay the balance in full, on time, every single month. This demonstrates new creditworthiness and responsible management of credit.

- Credit Builder Loans: A Disciplined Approach to Demonstrating Repayment: These specialized loans are designed specifically for credit repair. A lender will hold the loan amount in a savings account while you make regular payments. Once the loan is paid off, you receive the funds. It’s a low-risk way to demonstrate consistent repayment history to credit bureaus, which is vital for improving your score.

- Consistent Bill Payments: The Unsung Hero of Credit Repair: It's not just credit accounts that matter. Paying *all* your bills on time – rent, utilities, phone, internet – is crucial. While not all these payments directly impact your credit score, consistent punctuality demonstrates overall financial responsibility. Lenders often look at bank statements to verify this, and a history of missed utility payments can raise red flags, even if your credit accounts are perfect.

The Debt-to-Income (DTI) Ratio: Your Golden Ticket to Lender Confidence

Your Debt-to-Income (DTI) ratio is one of the most critical metrics lenders use to assess your ability to take on new debt. It's a direct indicator of how much of your gross monthly income goes towards servicing your existing debt obligations. A lower DTI ratio signals to lenders that you have ample disposable income to comfortably manage new car payments, even for a luxury vehicle, reducing their perceived risk.

- Calculating Your DTI: What Lenders Are Looking For: To calculate your DTI, sum up all your monthly debt payments (car loans, student loans, credit card minimums, mortgage/rent, etc.) and divide that by your gross monthly income. For example, if your total monthly debt payments are $1,500 and your gross monthly income is $5,000, your DTI is 30% ($1,500 / $5,000). Most lenders prefer a DTI ratio below 36%, and for luxury car loans, they might prefer it even lower, perhaps below 30%.

- Strategies to Lower Your DTI: Debt Consolidation, Income Generation, and Lifestyle Adjustments:

- Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single, lower-interest loan can reduce your overall monthly payments, thereby lowering your DTI.

- Income Generation: Actively seeking ways to increase your gross monthly income through a raise, a promotion, or a legitimate side hustle is a direct way to improve your DTI. If you're leveraging gig work, make sure it's properly documented, as explored in EI Benefits? Your Car Loan Just Got Its Paycheck or similar articles for varied income streams.

- Lifestyle Adjustments: Reducing discretionary spending and applying those savings to pay down existing debts faster is another effective strategy. Even small reductions in your monthly debt obligations can cumulatively improve your DTI.

Proof of Income & Stability: More Than Just a Pay Stub – The Holistic View

Lenders need to be confident in your ability to make consistent payments over the entire loan term. This goes beyond simply showing a recent pay stub; it's about demonstrating a holistic picture of financial stability.

- Consistent Employment History: Lenders look for stability. A long, uninterrupted employment history with the same employer, or within the same industry, shows reliability and a steady income stream. Aim for at least 2-3 years of consistent employment.

- Side Hustles and Secondary Income (with Proper Documentation): If you have legitimate side hustles or secondary income streams, ensure they are well-documented. This means proper tax returns, invoices, and bank statements that clearly show consistent additional income. This can significantly bolster your application, especially if your primary income is modest.

- Savings & Assets: Your Financial Cushion: Demonstrating a healthy savings account and other liquid assets (e.g., investments) provides an invaluable financial cushion. It signals to lenders that you have reserves to fall back on in case of unexpected expenses or temporary income disruptions, making you a less risky borrower.

A substantial down payment, ideally 20% or more, is your secret weapon when seeking a luxury car loan after a consumer proposal. While it obviously reduces the principal amount you need to borrow, its strategic value goes much deeper. Firstly, it significantly reduces the lender's risk – they have less capital at stake. Secondly, it demonstrates serious commitment and financial discipline on your part; it shows you've been able to save a significant sum of money. This not only makes you a more attractive borrower but can also open doors to better interest rates and more flexible terms, even with your credit history. It communicates, without words, that you are a responsible and dedicated buyer.

V. Navigating the Lender Landscape: Who Will Say 'Yes' to Your Dream Car?

The traditional banking system often operates with strict, automated credit scoring models that can be unforgiving to anyone with a consumer proposal on their record, even after completion. This is where you need to shift your focus and understand the alternative lending landscape. Your dream car might not come from a big bank, but it can absolutely come from the right specialized lender.

Specialized Subprime Lenders: Your Primary Allies in Challenging Credit Situations

Specialized subprime lenders are designed precisely for individuals who may not meet the stringent criteria of traditional banks. They are your primary allies in this journey because their business model is built around assessing risk differently and providing financing solutions for unique credit situations, including post-consumer proposal. They understand that a credit score doesn't always tell the whole story.

- Understanding Their Business Model and Higher Interest Rates: Subprime lenders take on more risk, and they compensate for this risk with higher interest rates compared to prime lenders. This is a trade-off you should expect. However, their rates are typically competitive within the subprime market, and the goal is to use this loan to rebuild your credit to eventually qualify for lower rates.

- How to Identify Reputable Subprime Lenders (and Avoid Predatory Ones): Due diligence is crucial. Look for lenders with transparent terms, clear fees, and positive customer reviews. Avoid any lender that guarantees approval without checking your financial situation, demands upfront fees before approval, or pressures you into signing without reading the fine print. Reputable subprime lenders will still conduct a thorough assessment and explain all terms clearly.

For more on overcoming perceived impossibilities in car loans, check out The Consumer Proposal Car Loan You Were Told Was Impossible.

Dealership Finance Departments: A Direct Route (with Caveats and Connections)

Dealership finance departments are often an excellent starting point, especially for luxury vehicles. They have direct access to a wide network of lenders, including those specializing in unique credit situations. This can often streamline the application process and provide you with multiple options.

- Their Network of Lenders, Including Those Specializing in Unique Credit Situations: Dealerships work with a variety of banks, credit unions, and subprime lenders. Their finance managers are experts at matching applicants with the most suitable lenders based on their credit profile. They can often present your case directly to lenders, highlighting your strengths (e.g., strong income, large down payment, completed CP) that might be overlooked by an automated system.

- The Convenience vs. Potential for Less Competitive Rates: The convenience of one-stop shopping at a dealership is undeniable. However, be aware that while they can secure approval, the rates might not always be the absolute lowest available. It's essential to compare any offers with pre-approvals you might have secured independently.

Credit Unions & Smaller Banks: The Local Advantage (Sometimes Offering Flexibility)

Don't overlook credit unions and smaller, local banks. They often operate with a more community-focused approach and may have more flexible lending criteria compared to the large national institutions.

- Relationship Banking and Personalized Assessment: If you have an existing relationship with a local credit union or small bank, they might be more willing to consider your application. They often emphasize "relationship banking," where they take into account your overall financial history with them, rather than just relying solely on your credit score.

- Their Potential Flexibility Compared to Major Institutions: These smaller institutions sometimes have greater autonomy in their lending decisions and may be more inclined to offer personalized assessments, allowing them to see beyond the consumer proposal mark on your credit report.

Before you even set foot on a dealership lot, seek pre-approval from a specialized lender. This gives you a clear understanding of your borrowing capacity, including the maximum loan amount and estimated interest rate. Walking into a dealership with a pre-approval in hand transforms you from a hopeful shopper into a qualified buyer. It empowers you to negotiate not just the price of the car, but also the terms of the loan itself, as you have an alternative offer. Even if the pre-approval isn't from a major bank, it's a powerful leverage point.

Why Major Banks Might Still Be a Stretch (for now): Understanding Their Stricter Criteria

While the goal is to eventually qualify for prime rates from major banks, it's important to set realistic expectations for your initial luxury car loan post-CP. Large financial institutions are inherently conservative. Their lending models are typically designed to minimize risk, and they often rely heavily on automated credit scoring systems that favour applicants with prime (excellent) credit scores. A consumer proposal, even completed, signals a higher risk in their traditional framework. While it's not impossible to get approved by a major bank down the line, especially after several years of impeccable credit rebuilding, it's generally a stretch for your immediate luxury car purchase. Focusing on specialized lenders initially will save you time and potential disappointment.

Here's a comparison of typical lender types and their suitability for post-CP luxury car loans:

| Lender Type | Pros for Post-CP Luxury Loan | Cons for Post-CP Luxury Loan | Interest Rate Expectation |

|---|---|---|---|

| Specialized Subprime Lenders | High approval odds, understand unique credit situations, focus on current ability to pay. | Higher interest rates, require careful selection to avoid predatory lenders. | Higher (e.g., 8-25%+) |

| Dealership Finance Departments | Access to a network of lenders (including subprime), convenient, can advocate for you. | Rates might not always be the absolute best, limited to their network. | Moderate to Higher (e.g., 6-20%+) |

| Credit Unions & Smaller Banks | Personalized assessment, relationship banking, potentially more flexible. | Approval can still be challenging without existing relationship, may not specialize in subprime. | Moderate (e.g., 5-15%+) |

| Major Banks | Lowest interest rates (if approved), widely accessible. | Very strict criteria, low approval odds for post-CP, often rely on automated systems. | Lowest (e.g., 3-8%) - unlikely initially |

VI. The Application Arsenal: Crafting Your Irresistible Offer

Securing a luxury car loan after a consumer proposal isn't just about finding the right lender; it's about presenting yourself as an irresistible applicant. This means meticulous preparation, transparent communication, and a well-organized application arsenal. Every piece of documentation and every explanation you provide contributes to the narrative of your renewed financial strength.

Document Checklist: Leave No Stone Unturned for a Seamless Application

A complete and organized set of documents is critical for a smooth application process. It demonstrates your seriousness and allows lenders to quickly verify your financial standing. Here’s what you should gather:

- Proof of identity: Valid driver's license, passport, or other government-issued ID.

- Proof of income: Recent pay stubs (typically 2-3 months), T4s, tax returns (Notice of Assessment for the last 2 years), and an employment letter confirming your position, salary, and start date. For self-employed individuals, detailed financial statements and tax returns are crucial.

- Proof of residency: Utility bills (electricity, gas, internet) or a lease agreement with your current address. Lenders want to see stability.

- Consumer Proposal completion certificate: This is paramount. The official Certificate of Full Performance from your Licensed Insolvency Trustee.

- Bank statements: Recent bank statements (3-6 months) demonstrating consistent income deposits, responsible spending habits, and healthy savings.

- Current credit report: Obtain a copy of your credit report from Equifax and TransUnion. Review it for accuracy and be prepared to discuss any discrepancies. This proactive approach shows responsibility.

The Art of Explanation: Addressing Your Credit History Head-On, Not Hiding From It

One of the biggest mistakes applicants make is trying to hide or downplay their consumer proposal. Instead, embrace it as part of your financial journey and frame it as a positive learning experience. When speaking with lenders or finance managers, be professional, confident, and honest. Explain the circumstances that led to the consumer proposal (e.g., unexpected job loss