Vancouver Luxury Car Loan: No Canadian Credit? (2026)

Table of Contents

- Key Takeaways

- The Aspiring Owner's Conundrum: Understanding Limited Domestic Credit History

- Defining 'Limited Domestic Credit': Who falls into this category (newcomers, expats, those with a nascent financial footprint)

- Why traditional credit scores are a challenge: The absence of a lengthy local financial record

- Dispelling common myths: It's not about your wealth, but your demonstrated local financial responsibility

- The unique appeal of premium vehicles: Why the desire for high-end automotive experiences persists, regardless of credit history

- Unlocking Approval: Strategies for Aspiring High-End Vehicle Owners

- Beyond the Score: What Lenders Really Look For

- Pro Tip: Document everything meticulously.

- The power of a substantial down payment: Reducing lender risk and improving terms.

- Consideration of a co-signer: When a financially established individual can bridge the gap.

- Deconstructing the Costs: Rates, Fees, and the True Price of Ownership

- The Reality of Interest Rates for Limited Credit Profiles:

- Beyond the Monthly Payment: Uncovering All Associated Fees

- The Non-Financing Costs of Premium Vehicle Ownership:

- Pro Tip: Always request a full breakdown of all costs.

- Direct Lenders vs. Dealership Finance Departments: A Strategic Comparison

- The Role of Dealership Finance Departments:

- Exploring Specialized Lending Institutions:

- Traditional Banks and Credit Unions: A more stringent approach?

- The Application Journey: Navigating Pitfalls and Maximizing Your Chances

- Pre-application due diligence: Getting your financial house in order.

- The art of honest disclosure: Transparency builds trust.

- Understanding loan terms and conditions before you commit.

- Negotiation strategies: Don't be afraid to ask for better terms or clarification.

- Pro Tip: Never apply with multiple lenders simultaneously without understanding the impact on your credit profile.

- Leveraging Your Loan to Forge a Stronger Financial Future

- The power of responsible repayment: Building a positive credit history.

- Monitoring your evolving credit profile: What to look for.

- Strategies for improving your credit score post-loan acquisition:

- Premium Mobility in 2026: Anticipating Future Trends in Financing and Vehicles

- The Rise of Luxury Electric Vehicles (EVs): Financing considerations for a new generation of premium cars.

- Digitalization of the financing process: Streamlined applications and AI-driven approvals.

- Personalized financing solutions: Tailoring terms to individual circumstances.

- The increasing importance of sustainable and ethical sourcing in luxury automotive.

- Your Strategic Pathway to Premium Vehicle Ownership: Final Considerations

- Reiterating the possibility: Luxury vehicle ownership is attainable with strategic planning.

- The importance of due diligence and informed decision-making.

- Embracing the journey: From application to responsible ownership.

- Your next steps: Research, prepare, and confidently pursue your automotive aspirations.

- Frequently Asked Questions About Financing a Premium Vehicle with Limited Domestic Credit

Dreaming of a sleek Mercedes-Benz, a powerful BMW, or an elegant Porsche cruising the scenic streets of Vancouver in 2026? Perhaps you’re new to Canada, an expatriate, or simply haven’t had the opportunity to build a robust domestic credit history. The traditional banking system often views a limited Canadian credit footprint as a significant hurdle, potentially placing your luxury automotive aspirations on hold. But what if we told you that the keys to a premium vehicle in Vancouver, even without established Canadian credit, are well within your grasp?

At SkipCarDealer.com, we understand that your financial story is more complex than a single credit score. We recognize the global talent and ambition that flows into Canada, and specifically into vibrant cities like Vancouver, bringing with it a demand for high-quality living and transportation. This comprehensive guide for 2026 is designed to demystify the process, offering a strategic pathway to financing your desired luxury car, even when your Canadian credit history is still in its infancy.

Forget the notion that limited domestic credit means limited options. With the right approach, meticulous preparation, and knowledge of the diverse financing avenues available, you can confidently navigate the market. We'll delve into what lenders truly look for, how to present a compelling financial profile, understand the true costs involved, and ultimately, use your luxury car loan as a powerful tool to build a strong financial future in Canada.

Key Takeaways

- The myth of 'impossible': Why a limited domestic credit history doesn't preclude luxury vehicle ownership. With strategic planning and the right lender, premium cars are accessible even for newcomers or those with a nascent financial footprint.

- Strategic preparation is paramount: Meticulous documentation of income, assets, and alternative financial indicators, coupled with a clear budget, is essential to presenting a strong case to lenders.

- Leveraging diverse financing avenues: Specialized lenders and dealership finance departments often offer more flexibility and understanding for unique credit profiles compared to traditional banks.

- Beyond the sticker price: Deconstructing interest rates, administrative fees, insurance premiums, and ongoing maintenance costs is crucial for understanding the total cost of ownership in 2026.

- Building a future: A responsibly managed premium vehicle loan can be a powerful tool for establishing and strengthening your Canadian credit history, opening doors to future financial opportunities.

The Aspiring Owner's Conundrum: Understanding Limited Domestic Credit History

Limited domestic credit history refers to a situation where an individual lacks a substantial record of borrowing and repayment within the Canadian financial system. This often applies to recent immigrants, temporary residents, international students, or Canadians who have primarily used cash or debit, thus not engaging with credit products like credit cards or loans that build a traditional credit score.

Defining 'Limited Domestic Credit': Who falls into this category (newcomers, expats, those with a nascent financial footprint)

You might fall into the "limited domestic credit" category if you're a newcomer to Canada, an expatriate on a work permit, or even a long-time resident who has simply never taken out a loan or credit card. Your financial diligence in your home country or your wealth isn't the issue; it's the lack of a traceable financial history within Canada's specific credit reporting agencies.

For many professionals and entrepreneurs relocating to Vancouver, establishing a credit footprint is often an unexpected challenge. They arrive with significant assets, stable international careers, and a history of responsible financial management abroad, but Canada's credit system operates independently.

Why traditional credit scores are a challenge: The absence of a lengthy local financial record

Credit scores from agencies like Equifax and TransUnion Canada are built on your payment history, credit utilization, length of credit history, types of credit, and new credit inquiries within Canada. Without a local track record of on-time bill payments, credit card usage, or previous loan repayments, these algorithms have little data to assess your risk, resulting in a low or non-existent score.

Dispelling common myths: It's not about your wealth, but your demonstrated local financial responsibility

A common misconception is that if you have significant assets or a high income, a luxury car loan should be straightforward. While these factors are important, they don't directly substitute for a Canadian credit history in the eyes of traditional lenders. They want to see how you manage credit here. It’s about demonstrating your reliability and responsibility within the Canadian financial landscape.

The unique appeal of premium vehicles: Why the desire for high-end automotive experiences persists, regardless of credit history

The allure of a luxury vehicle is undeniable. It's often more than just transportation; it's about performance, safety, comfort, advanced technology, and a reflection of personal success. For many, a premium car is a statement, a reward, or a necessary tool for their lifestyle, especially in a dynamic city like Vancouver. This desire doesn't diminish just because your Canadian credit profile is new. In fact, for many newcomers, acquiring a high-value asset like a luxury car is a priority, and they are willing to explore non-traditional financing routes to achieve it.

Unlocking Approval: Strategies for Aspiring High-End Vehicle Owners

Securing a luxury car loan with limited Canadian credit in 2026 requires a proactive and strategic approach. It's about building a compelling case that goes beyond a simple credit score. Lenders, especially specialized ones, are increasingly open to evaluating a broader spectrum of financial indicators.

Beyond the Score: What Lenders Really Look For

When your credit score is sparse, lenders shift their focus to other aspects of your financial stability. They want to mitigate risk, and your ability to pay is their primary concern. This means a deep dive into your income, assets, and overall financial behaviour.

Income stability and verifiable employment: The bedrock of your application.

Your ability to consistently make payments is paramount. Lenders need concrete proof that you have a reliable and sufficient income stream.

- Demonstrating consistent earnings: This means providing pay stubs (at least three months), employment contracts detailing your salary and tenure, and official tax assessments (if you've been in Canada long enough to file). If you're self-employed, bank statements showing consistent deposits are crucial. For insights into how self-employed individuals can secure financing, read our article: Self-Employed? Your Bank Statement is Our 'Income Proof'.

- The importance of job tenure: Lenders favour stability. A longer history with your current employer, or a strong professional track record if you're new to Canada but established in your career, signals reliability.

Alternative financial indicators: Painting a holistic picture.

Since traditional credit history is limited, you need to provide alternative evidence of your financial responsibility.

- International credit reports: If you're an expat or newcomer, your credit history from your home country can be highly valuable. Gather reports from agencies like Experian, TransUnion, or Equifax from your previous country of residence. While not directly integrated into Canadian scores, they demonstrate a history of responsible borrowing. For more on leveraging your international financial standing, see: New to Vancouver? Your Global Bank Account is Your Credit Score.

- Rental history and utility payments: Proof of consistent, on-time payments for rent, electricity, internet, and phone bills can serve as powerful indicators of your ability to manage financial obligations. Landlord references or statements from utility providers are excellent supporting documents.

- Savings and asset statements: Substantial savings accounts, investment portfolios, or ownership of other valuable assets (e.g., real estate abroad) demonstrate financial prudence and provide a buffer in case of unexpected expenses. For those with significant assets, our article The Unconventional Key: Your Portfolio, Not Your Pay Stub, Buys the Car in Vancouver offers further insights.

Pro Tip: Document everything meticulously.

A well-organized financial portfolio speaks volumes. Have all your employment letters, pay stubs, bank statements (Canadian and international), utility bills, rental agreements, and any international credit reports ready and neatly compiled. The easier it is for a lender to verify your financial standing, the smoother your application process will be.

The power of a substantial down payment: Reducing lender risk and improving terms.

A significant down payment is perhaps the single most impactful strategy for those with limited credit. It directly reduces the amount of money you need to borrow, thereby lowering the lender's risk. This can translate into a higher likelihood of approval and potentially more favourable interest rates. For a $75,000 luxury vehicle, a 10-20% down payment ($7,500 - $15,000) can make a substantial difference.

Consideration of a co-signer: When a financially established individual can bridge the gap.

If you have a trusted family member or friend with excellent Canadian credit who is willing to co-sign your loan, this can significantly bolster your application. A co-signer essentially guarantees the loan, meaning they are legally responsible for repayment if you default. This greatly reduces the lender's risk, often leading to better terms and easier approval. However, ensure both parties understand the full implications and responsibilities of co-signing.

Deconstructing the Costs: Rates, Fees, and the True Price of Ownership

When considering a luxury car loan with limited Canadian credit in 2026, it's crucial to look beyond the advertised monthly payment. The total cost of ownership involves a complex interplay of interest rates, various fees, and ongoing operational expenses. Understanding these components is key to making an informed and sustainable financial decision.

The Reality of Interest Rates for Limited Credit Profiles:

Lenders assess risk. When a borrower has limited domestic credit, they are perceived as a higher risk, which is reflected in higher interest rates. This compensates the lender for the increased uncertainty regarding repayment.

Why rates may be higher: Compensating for perceived risk.

Traditional banks typically offer their best rates to borrowers with excellent credit histories (e.g., credit scores above 760). For those with limited or no Canadian credit, the rates will naturally be elevated. This isn't punitive; it's a standard risk assessment. However, specialized lenders are often more flexible and willing to work with unique situations, though this flexibility may come with a higher rate than a prime borrower would receive.

- Understanding APR vs. nominal interest rate: The Annual Percentage Rate (APR) is the total cost of borrowing, expressed as a yearly percentage, including the interest rate and certain other fees. The nominal interest rate is just the interest charged on the principal. Always focus on the APR for a true comparison of loan costs.

- The impact of loan term on total interest paid: A longer loan term (e.g., 84 months vs. 60 months) will result in lower monthly payments, but you will pay significantly more in total interest over the life of the loan. Conversely, a shorter term means higher monthly payments but less interest paid overall.

Here’s a snapshot of typical interest rate ranges in Canada for auto loans in 2026, highlighting the variance based on credit profile:

| Credit Profile | Typical APR Range (2026 Estimate) | Example Luxury Car Monthly Payment (CAD) | Total Interest Paid (60-month term, $65,000 loan) |

|---|---|---|---|

| Excellent Credit (760+) | 5.99% - 7.99% | $1,250 - $1,300 | ~$10,000 - $13,000 |

| Good Credit (660-759) | 7.99% - 10.99% | $1,300 - $1,380 | ~$13,000 - $18,000 |

| Limited/No Domestic Credit | 12.99% - 24.99%+ | $1,450 - $1,850+ | ~$22,000 - $46,000+ |

*Note: Payment estimates based on a $65,000 loan amount (e.g., $75,000 vehicle with $10,000 down payment) over a 60-month term. Actual rates and payments will vary based on lender, vehicle, and individual circumstances.

Beyond the Monthly Payment: Uncovering All Associated Fees

The sticker price and interest rate are just two pieces of the puzzle. Several other fees can add up, particularly for a luxury vehicle purchase.

Origination fees and administrative charges.

- Lien registration fees and security interests: These are provincial fees to register the lender's interest (lien) on the vehicle's title, protecting them if you default. They typically range from $50-$100.

- Documentation fees and dealership processing charges: Dealerships charge for processing paperwork, applying for plates, and other administrative tasks. These can range from $300 to $700. Always inquire about these upfront.

The Non-Financing Costs of Premium Vehicle Ownership:

The costs don't stop once you drive off the lot. Luxury vehicles come with higher ongoing expenses.

Insurance premiums: Often higher for luxury models and new drivers.

- Factors influencing luxury car insurance costs: Performance, repair costs (specialized parts and labour), theft risk, and the driver's experience all push luxury car insurance premiums higher. For newcomers, the lack of Canadian driving history can also be a significant factor.

- Strategies for obtaining competitive quotes: Shop around extensively. Use online comparison tools and consider working with an insurance broker who can access multiple providers. Bundling home and auto insurance can sometimes yield discounts.

Maintenance and servicing: The specialized care required for high-performance automobiles.

Luxury vehicles require specialized maintenance, often at brand-specific dealerships, which can be more expensive than servicing a standard car. Parts are pricier, and labour rates are higher for certified technicians.

Fuel efficiency and premium fuel requirements.

Many luxury and performance vehicles require premium-grade gasoline, which is significantly more expensive per litre. Factor in lower fuel efficiency for larger, more powerful engines, and your fuel budget will be substantially higher.

Here's a breakdown of potential additional costs for owning a luxury vehicle in Vancouver in 2026:

| Cost Category | Typical Annual Range (CAD) | Notes for Limited Credit/Luxury |

|---|---|---|

| Provincial Sales Tax (PST/GST) | Varies by Province (e.g., 12% in BC for luxury >$55k) | Applied to the purchase price. Significant for high-value vehicles. |

| Documentation Fees | $300 - $700 (One-time) | Dealership administrative costs. |

| Lien Registration Fee | $50 - $100 (One-time) | Provincial fee to register loan security. |

| Luxury Car Insurance | $3,000 - $8,000+ | Higher for luxury models, performance cars, and new drivers/limited Canadian driving history. |

| Premium Fuel | $1,500 - $3,000+ (Based on usage) | Many luxury cars require higher octane fuel. |

| Scheduled Maintenance | $1,000 - $3,000+ | Specialized parts, higher labour rates, often dealer-specific servicing. |

| Tires | $800 - $2,000+ (Every 2-4 years) | Performance tires for luxury vehicles are expensive. |

Pro Tip: Always request a full breakdown of all costs.

Before signing any agreement, insist on a complete disclosure of the total amount payable over the life of the loan, including all fees, interest, and any optional add-ons. Don't be shy about asking questions and seeking clarification on anything you don't understand.

Direct Lenders vs. Dealership Finance Departments: A Strategic Comparison

When you're navigating the auto loan landscape with limited Canadian credit in 2026, knowing where to apply for financing can be as important as your financial preparedness. You generally have two main avenues: the finance department at a car dealership or independent, direct lending institutions. Each has its advantages and disadvantages.

The Role of Dealership Finance Departments:

Dealerships, especially those specializing in luxury vehicles, are often equipped to handle complex financing situations. They act as intermediaries, connecting you with various lenders.

Access to a network of lenders: Their ability to shop for you.

- Specialized programs for challenging credit situations: Dealerships often work with subprime lenders or those who have specific programs for newcomers, temporary residents, or individuals with non-traditional income. They understand the nuances of limited credit profiles and can advocate on your behalf.

- The convenience of 'one-stop shopping' for vehicle and finance: This is a major advantage. You can select your desired luxury vehicle and arrange financing all under one roof, streamlining the process significantly. Dealership finance managers are skilled at packaging applications to present them most favourably to their network of lenders.

Exploring Specialized Lending Institutions:

Beyond traditional banks and dealership networks, there are niche lenders who specifically cater to unique credit profiles.

Niche lenders focused on unique credit profiles.

- Their assessment criteria and flexibility: These lenders often have more flexible underwriting criteria, looking beyond just a credit score. They might place a greater emphasis on employment stability, income potential, assets, and even international financial history.

- Potential for tailored loan products: Some specialized lenders offer products specifically designed for newcomers or those rebuilding credit, which might include secured loans or loans with higher down payment requirements in exchange for more lenient credit checks.

Traditional Banks and Credit Unions: A more stringent approach?

While often offering the lowest rates to prime borrowers, traditional banks and credit unions can be a tougher nut to crack for individuals with limited Canadian credit.

Why they might be less accessible for limited credit.

- Emphasis on established credit history and higher credit scores: Banks typically rely heavily on a strong, established Canadian credit history. Their algorithms are less flexible in evaluating alternative financial indicators.

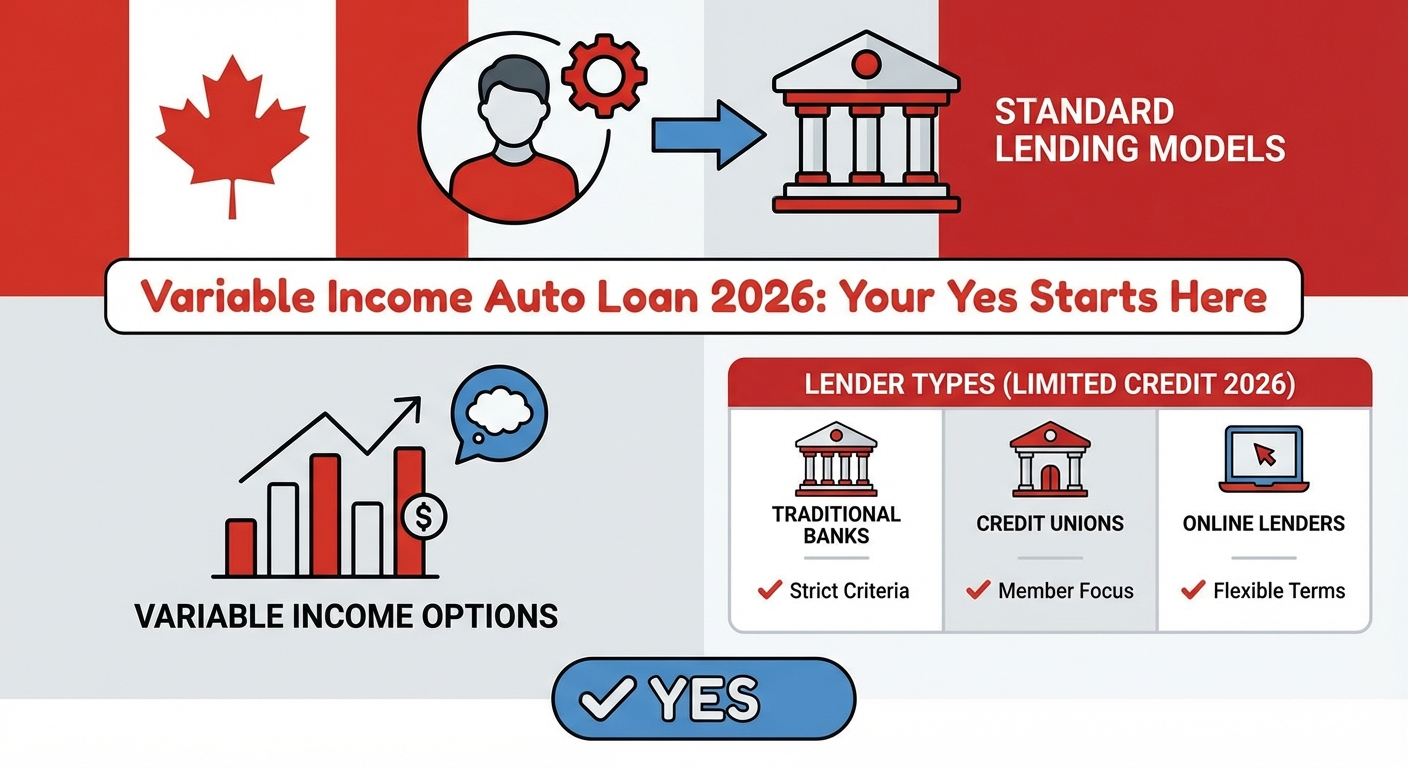

- Limited flexibility for non-traditional income or credit indicators: If your income is variable, or if you're relying heavily on international credit history and assets, traditional banks may struggle to fit your profile into their standard lending models. For individuals with variable income, understanding options is key: Variable Income Auto Loan 2026: Your Yes Starts Here.

Here's a quick comparison of lender types for limited credit situations in 2026:

| Feature | Dealership Finance Department | Specialized Lenders | Traditional Banks/Credit Unions |

|---|---|---|---|

| Flexibility with Limited Credit | High (Access to diverse lenders, strong advocacy) | Very High (Designed for unique credit profiles) | Low (Strict reliance on established credit) |

| Interest Rates (for limited credit) | Moderate to High (Depends on lender network) | Often Higher (Compensates for increased risk) | Lowest (If approved, but approval is difficult) |

| Approval Criteria | Broader (Considers income, assets, job stability, down payment) | Most Flexible (Focus on capacity to pay, alternative data) | Narrow (Primarily credit score, Canadian history) |

| Convenience | Very High (One-stop shopping) | Moderate (Direct application, online processes) | Moderate (May require multiple visits, existing banking relationship helps) |

| Speed of Approval | Fast (Leverages lender relationships) | Fast (Streamlined for niche markets) | Slower (Due to strict underwriting) |

The Application Journey: Navigating Pitfalls and Maximizing Your Chances

Once you've decided on your luxury vehicle and identified potential lending avenues, the application process itself becomes a critical step. A well-prepared and transparent application can significantly increase your chances of approval for a luxury car loan in Vancouver in 2026, even with limited Canadian credit.

Pre-application due diligence: Getting your financial house in order.

Before you even begin filling out forms, take the time to organize your financial life. This preparation will not only make the application smoother but also present you as a responsible and capable borrower.

Gathering essential documentation: Proof of income, residency, and identity.

- Bank statements, utility bills, and rental agreements: These documents verify your income, demonstrate consistent bill payment, and confirm your stable residency in Canada. Aim for at least 3-6 months of statements.

- Work permits or immigration documents for newcomers: For non-permanent residents, providing clear documentation of your legal status and the duration of your stay is crucial. Lenders need to understand your long-term commitment to Canada.

The art of honest disclosure: Transparency builds trust.

Never attempt to conceal or misrepresent information on your application. Lenders conduct thorough checks, and any discrepancies can lead to immediate rejection or even legal consequences. Be upfront about your limited credit history, explain your situation, and highlight all the positive aspects of your financial profile (stable job, high income, substantial assets, international credit history).

Understanding loan terms and conditions before you commit.

The loan agreement is a legally binding contract. Do not sign anything until you fully understand every clause. Pay close attention to the interest rate (APR), loan term, monthly payment amount, any prepayment penalties, and all associated fees. If something isn't clear, ask for clarification. You have the right to understand what you're agreeing to.

Negotiation strategies: Don't be afraid to ask for better terms or clarification.

While limited credit might reduce your negotiation leverage compared to a prime borrower, it doesn't eliminate it entirely. You can still inquire if there's any flexibility on the interest rate, fees, or loan term. A substantial down payment or a strong co-signer can give you more room to negotiate. Remember, the worst they can say is no.

Pro Tip: Never apply with multiple lenders simultaneously without understanding the impact on your credit profile.

Each "hard inquiry" (a formal credit check) can temporarily ding your nascent credit score. Instead, focus on pre-qualification where possible. Pre-qualification involves a "soft inquiry" that doesn't affect your score and gives you an idea of potential terms without commitment. Once you're confident in a lender, then proceed with a full application.

Leveraging Your Loan to Forge a Stronger Financial Future

Acquiring a luxury car loan with limited Canadian credit in 2026 is not just about driving your dream vehicle; it's a strategic move to build a robust financial foundation. Responsible management of this loan can significantly enhance your creditworthiness, opening doors to better financial opportunities down the line.

The power of responsible repayment: Building a positive credit history.

Your auto loan is a powerful credit-building tool. Every on-time payment you make contributes positively to your credit history, which is the cornerstone of your credit score.

Timely payments as the cornerstone of credit building.

- Setting up automatic payments to avoid missed deadlines: This is perhaps the simplest yet most effective strategy. Automate your monthly payments from your bank account to ensure they are always made on time, every time. Missed payments are severely detrimental to your credit score.

- Understanding how payment history is reported to credit bureaus: Lenders report your payment activity to Canadian credit bureaus (Equifax and TransUnion). Consistent, on-time payments demonstrate reliability and responsibility, which are heavily weighted in credit score calculations.

Monitoring your evolving credit profile: What to look for.

Once you have an active loan, start regularly monitoring your credit report. You can obtain free copies of your credit report annually from Equifax and TransUnion. Look for:

- Accuracy of personal information.

- Correct reporting of your loan and payment history.

- Any unfamiliar accounts or inquiries that could indicate fraud.

- Your credit score's gradual improvement over time.

Strategies for improving your credit score post-loan acquisition:

Beyond your auto loan, there are other steps you can take to accelerate your credit-building journey.

- Diversifying your credit mix (e.g., secured credit cards): Once you've demonstrated responsibility with an auto loan, consider applying for a secured credit card. With a secured card, you provide a deposit that acts as your credit limit, allowing you to build credit safely. Using it responsibly (making small purchases and paying them off in full each month) further diversifies your credit profile.

- Keeping credit utilization low: Credit utilization refers to the amount of credit you're using compared to your total available credit. For credit cards, keeping this below 30% is ideal.

- Regularly reviewing your credit report for inaccuracies: Errors on your credit report can negatively impact your score. If you find any, dispute them immediately with the credit bureau.

Premium Mobility in 2026: Anticipating Future Trends in Financing and Vehicles

The automotive and financing landscapes are constantly evolving. As we look towards 2026, several trends will shape the experience of financing a luxury vehicle, particularly for those with unique credit profiles.

The Rise of Luxury Electric Vehicles (EVs): Financing considerations for a new generation of premium cars.

Electric vehicles are no longer a niche market; they are becoming mainstream, with luxury brands leading the charge in innovation. This shift has significant implications for financing.

Government incentives and their impact on luxury EV financing.

- Specific loan products for eco-conscious luxury buyers: As governments encourage EV adoption, expect to see more specialized "green" auto loans with potentially lower interest rates or more favourable terms for electric luxury vehicles. These incentives can offset the higher upfront cost of many premium EVs.

- The evolving landscape of charging infrastructure and its cost: Factor in the cost of installing a home charging station (Level 2) and the ongoing costs of public charging. While fuel savings are significant, these initial infrastructure costs may influence your overall budget and loan considerations.

Digitalization of the financing process: Streamlined applications and AI-driven approvals.

The future of auto financing is increasingly digital. Online applications are becoming more sophisticated, often leveraging AI and big data to expedite approvals.

- This can be a boon for those with limited credit, as AI models can analyze a wider range of alternative data points beyond traditional credit scores, potentially offering faster and more personalized approval processes.

Personalized financing solutions: Tailoring terms to individual circumstances.

Expect a greater shift towards highly personalized loan products. Lenders, especially specialized ones, will increasingly use advanced analytics to tailor interest rates, terms, and conditions based on an individual's complete financial picture, rather than relying solely on a generic credit score. This bodes well for those with strong income and assets but limited Canadian credit.

The increasing importance of sustainable and ethical sourcing in luxury automotive.

Consumers are becoming more conscious of environmental and ethical impacts. Luxury brands are responding with commitments to sustainable materials and production processes. This trend may indirectly influence financing, with some lenders offering preferential terms for vehicles from brands demonstrating strong ESG (Environmental, Social, and Governance) commitments.

Your Strategic Pathway to Premium Vehicle Ownership: Final Considerations

The journey to owning a luxury vehicle in Vancouver in 2026, especially with limited Canadian credit, is a testament to strategic planning and informed decision-making. It's a path that requires diligence, but one that is absolutely achievable.

Reiterating the possibility: Luxury vehicle ownership is attainable with strategic planning.

Let go of the misconception that a lack of established Canadian credit is an insurmountable barrier. With a clear understanding of what lenders prioritize, a meticulously prepared financial profile, and an openness to exploring diverse financing options, your dream of a premium car can indeed become a reality.

The importance of due diligence and informed decision-making.

Never rush into a financing agreement. Take the time to research, compare options, understand all costs, and ask questions. An informed decision protects your financial well-being and ensures that your luxury car experience is one of joy, not stress.

Embracing the journey: From application to responsible ownership.

Consider your luxury car loan as more than just a means to an end. It's an opportunity to establish a strong credit footprint in Canada, demonstrating financial responsibility that will benefit you for years to come. Embrace the discipline of timely payments and proactive credit management.

Your next steps: Research, prepare, and confidently pursue your automotive aspirations.

Start by gathering all necessary documentation. Research luxury models that fit your budget and lifestyle. Then, connect with specialized lenders or dealership finance departments that understand unique credit situations. At SkipCarDealer.com, we are here to guide you through every step of this exciting journey, helping you find the perfect luxury vehicle and the financing solution that works for you, regardless of your Canadian credit history.