Walking onto a car lot in Canada today feels different than it did five years ago. You've likely noticed the shifts: inventory shortages that once left lots empty are slowly resolving, but interest rates have climbed to heights many younger buyers have never experienced. The gap between "just looking" and actually driving off the lot with a set of keys is wider than ever. This gap is filled with credit checks, debt ratios, and complex financing terms that can feel like a secondary language.

Why do some Canadians get approved for prime rates at 4.9% while others are stuck with subprime offers at 15% or higher, even with similar incomes? The answer lies in the "Approval Secrets"-the behind-the-scenes mechanics of the Canadian lending system. This guide is designed to be the definitive resource for car buying in Canada, pulling back the curtain on how banks, credit unions, and dealerships actually evaluate you as a borrower. By the time you finish reading, you won't just be a shopper; you'll be a savvy negotiator with a rock-solid financial foundation.

Key Takeaways

- Know Your Score: Your Equifax and TransUnion scores are the primary gatekeepers. Knowing them before you visit a dealer prevents "rate shock."

- The 20/4/10 Rule: This is the gold standard for Canadian budgeting-20% down, a 4-year term, and total costs under 10% of your gross income.

- Pre-Approval is Power: Walking in with a bank or credit union pre-approval forces the dealership to compete for your business.

- Tax Nuances: Trade-ins offer a significant tax advantage in most provinces, effectively lowering the taxable price of your new vehicle.

- Separate the Deals: Always negotiate the vehicle price, the trade-in value, and the financing as three completely separate transactions.

Phase 1: The Financial Foundation (The 'Secrets' to Approval)

Lenders in Canada don't just look at your bank balance; they look at your "borrowing character." This is determined through a combination of your credit history and your current financial obligations. If you want to unlock the lowest interest rates, you need to understand the landscape before the first credit hit is recorded on your file.

Decoding the Canadian Credit Landscape

In Canada, we rely on two major credit bureaus: Equifax and TransUnion. It is a common misconception that they are the same. A dealership might pull your Equifax report, while your personal bank uses TransUnion. Because they use different algorithms and may have different data reported to them, your scores can vary by 50 points or more between the two. If one report contains an error that the other doesn't, you could be unfairly pushed into a higher interest rate tier.

| Credit Score Range | Rating | Impact on Car Financing |

|---|---|---|

| 760 - 900 | Excellent | Access to promotional 0% - 3.9% rates; no down payment usually required. |

| 725 - 759 | Very Good | Qualifies for most prime bank rates; easy approval process. |

| 660 - 724 | Good | Standard bank rates; may require a small down payment. |

| 600 - 659 | Fair | Likely "B-Lender" territory; interest rates will be higher (8% - 12%). |

| 300 - 599 | Poor/Subprime | Requires specialist lenders; rates can exceed 15%; significant down payment needed. |

Check your credit reports for "ghost" debts-accounts you've closed that still show an open balance. Disputing these online with Equifax or TransUnion typically takes 30 days. Clearing just one or two errors can often bump your score by 30+ points, potentially moving you from a "Fair" to a "Good" tier and saving you thousands in interest over the life of the loan.

Debt-to-Income (DTI) and Total Debt Service (TDS) Ratios

Even with a 800 credit score, you can be declined if your "Debt-to-Income" ratio is too high. Canadian lenders calculate your borrowing power by looking at how much of your monthly gross income is already spoken for by rent/mortgage, credit card minimums, and student loans. Most lenders want to see your total debt obligations (including the new car payment) stay below 40% of your gross monthly income. If you are sitting at 38% before the car loan, you will likely be declined or asked for a massive down payment to lower the monthly obligation.

To lower your DTI before applying, consider paying down a high-balance credit card. Even if the total debt remains, lowering the "minimum payment" requirement on your credit report increases your "disposable" income in the eyes of the lender's algorithm.

The Budgeting Blueprint: The 20/4/10 Rule

The biggest mistake Canadian car buyers make is shopping for a "monthly payment" rather than a total cost. Dealerships love this because they can make a $50,000 car look affordable by stretching the loan to 96 months (8 years). You end up "underwater"-owing more than the car is worth-within months. Instead, use the 20/4/10 Rule:

- 20% Down: This covers the immediate depreciation that happens when you drive off the lot.

- 4-Year Term: Shorter terms mean less interest paid and a faster path to equity.

- 10% of Income: Your total vehicle costs (payment, insurance, fuel, maintenance) should not exceed 10% of your gross monthly pay.

Phase 2: Selecting the Vehicle for the Canadian Climate

Choosing a car in Canada isn't just about the badge on the grille; it's about surviving five months of slush, salt, and sub-zero temperatures. Your choice impacts your resale value and your insurance premiums significantly.

New vs. Used vs. Certified Pre-Owned (CPO)

The depreciation curve has shifted. Historically, a new car lost 20% of its value the moment it left the lot. Today, because of high demand for late-model used vehicles, that curve is flatter. However, Certified Pre-Owned (CPO) vehicles remain the "sweet spot" for many. CPO vehicles undergo a manufacturer-mandated inspection and come with extended warranties, giving you the peace of mind of a new car with the lower price tag of a used one.

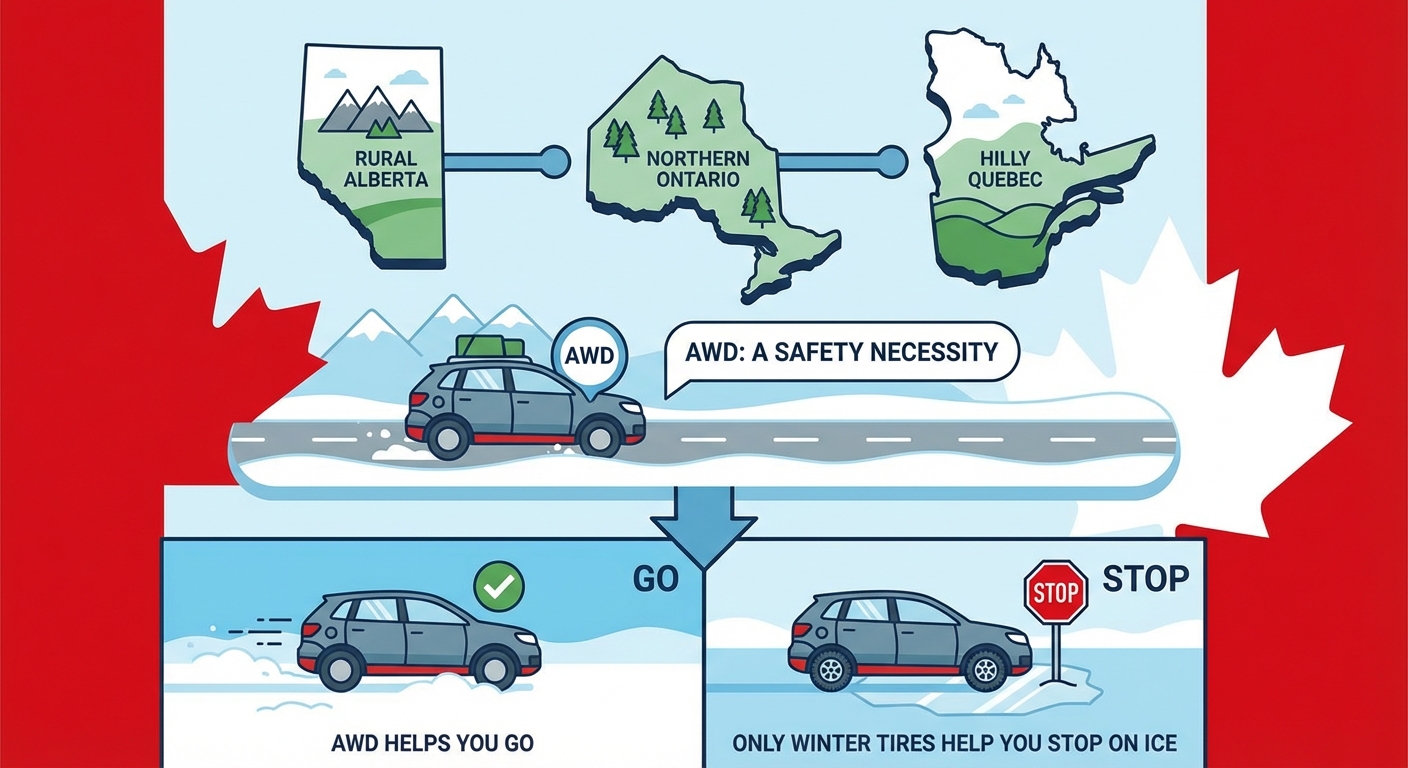

Regional Requirements: The AWD Debate

In urban centres like Toronto or Vancouver, a Front-Wheel Drive (FWD) vehicle paired with a dedicated set of high-quality winter tires is often more than sufficient. However, if you live in rural Alberta, Northern Ontario, or the hilly regions of Quebec, All-Wheel Drive (AWD) becomes a safety necessity rather than a luxury. Remember: AWD helps you *go*, but it doesn't help you *stop* on ice-only winter tires do that.

The EV and Hybrid Shift

Canada is aggressively moving toward electric vehicles. The federal iZEV program offers incentives of up to $5,000 for eligible battery-electric or long-range plug-in hybrid vehicles. Provinces like British Columbia and Quebec offer additional thousands on top of that. When calculating your budget, check the "Eligible Vehicles" list on the Transport Canada website. Be aware that there are MSRP caps; if you choose a luxury trim that pushes the price over the limit, you lose the entire rebate.

Phase 3: Mastering Canadian Financing Options

Where you get your money is just as important as how much you spend. You have three main avenues: Dealerships, Banks, and Credit Unions.

Dealership Financing vs. Bank Loans

Dealerships often offer "subvented rates" (like 0.9% or 1.9%). These are subsidized by the manufacturer to move specific models. However, there is a catch: you often have to choose between the low interest rate OR a cash rebate. If the rebate is $4,000 and the interest savings over five years is only $2,500, you are actually losing money by taking the "cheap" financing. Always ask for the "Cash Purchase" price vs. the "Financed" price to see the hidden cost of that low rate.

The Power of Pre-Approval

Before you ever step foot in a showroom, visit your local bank or credit union. A pre-approval gives you a "ceiling." If the bank offers you 6.5%, and the dealer tries to sell you on 8.9%, you can simply say, "My bank has already cleared me for 6.5%. Can you beat that?" Dealers have access to "rate markups"-they can often go lower than their first offer, but they won't unless they know they have competition.

In a fluctuating economy, interest rates can change while you are still shopping. When you get a pre-approval from a Canadian bank, they typically "hold" that rate for 30 to 90 days. If the Bank of Canada raises rates next week, your pre-approval remains locked at the lower rate, protecting your monthly budget.

Phase 4: The Search and Inspection Protocol

The digital age has made finding a car easier, but it has also made it easier for scammers to hide a vehicle's history. You must be your own detective.

Decoding the CARFAX Canada Report

Never buy a used vehicle in Canada without a CARFAX report. You are looking for more than just accidents. You are looking for "Lien Status." In Canada, a loan is attached to the vehicle, not the owner. If you buy a car privately and the previous owner hasn't paid off their loan, the bank can legally repossess the car from *you*, even if you paid the seller in full. The CARFAX will tell you if there are active liens in any province.

| Feature | What to Look For | Red Flag |

|---|---|---|

| Registration History | Consistent registration in one or two provinces. | Frequent "Out-of-Province" transfers (can hide a salvage title). |

| Service Records | Oil changes every 8,000 - 12,000 km. | Long gaps (2+ years) with no recorded maintenance. |

| Accident Claims | Minor glass or cosmetic repairs. | "Structural" or "Frame" damage; "Rebuilt" status. |

The Professional Inspection (PPI)

A "Safety Standards Certificate" in provinces like Ontario is NOT a mechanical inspection. It only ensures the car meets the bare minimum legal requirements to be on the road (brakes, lights, tires). It does not tell you if the transmission is about to fail or if the engine has a slow leak. Spend the $150 to $200 for a third-party mechanic to perform a Pre-Purchase Inspection (PPI). If a seller refuses to let you take the car to a mechanic, walk away immediately.

Phase 5: The Art of Negotiation and Closing

The negotiation doesn't happen on the showroom floor; it happens in the "F&I" (Finance and Insurance) office. This is where the dealer's most skilled salesperson-the Finance Manager-tries to sell you "back-end" products.

Navigating the 'F&I' Office

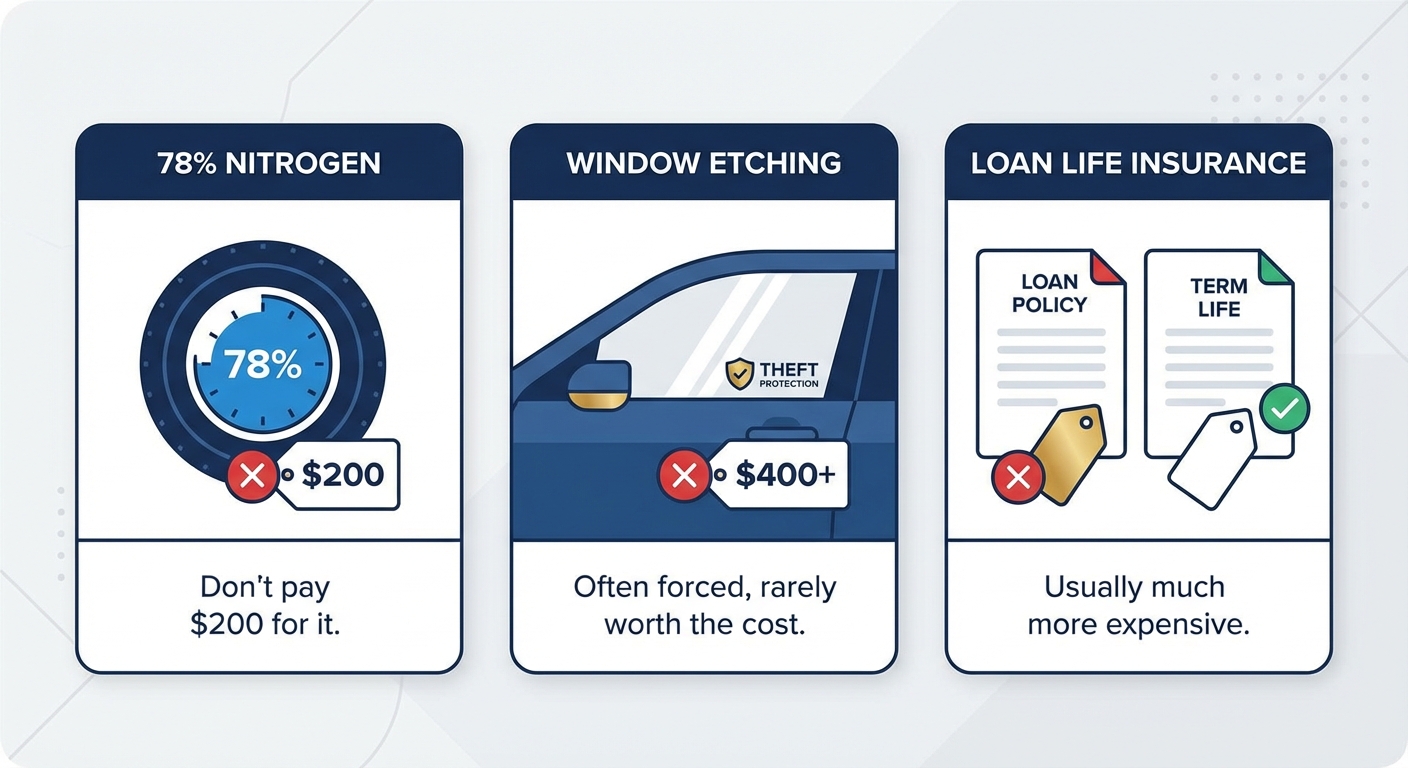

Commonly known as "The Box," this is where the dealership makes the majority of its profit. You will be offered extended warranties, rust protection, fabric protection, and VIN etching. While some products like Gap Insurance are valuable (especially if you are taking a long-term loan on a vehicle that depreciates quickly), most "protection packages" are marked up by 300% or more.

In Ontario (OMVIC) and Alberta (AMVIC), dealerships are legally required to use "All-In Pricing." This means the advertised price must include all fees except for HST/GST and licensing. If you see a car for $25,000 online, but the dealer adds a $900 "Admin Fee" and $400 for "Nitrogen Tires" when you arrive, they are breaking the law. Point this out, and those fees usually vanish.

Fees You Should Never Pay

Legitimate fees include the vehicle price, sales tax, and the provincial licensing fee. Be wary of "Documentation Fees" or "Admin Fees" that exceed $500. Other "junk fees" to strike through on the bill of sale include:

- Nitrogen Air: Regular air is already 78% nitrogen. Don't pay $200 for it.

- Window Etching: Often forced on buyers as "theft protection," but rarely worth the $400+ cost.

- Loan Life Insurance: Usually much more expensive than a simple term life policy from your insurance broker.

Phase 6: Provincial Nuances and Legal Rights

Your rights as a car buyer change depending on which side of the provincial border you stand on. Canada does not have a federal "Lemon Law," so you must rely on provincial consumer protection.

Understanding Sales Tax and Trade-ins

One of the biggest "Approval Secrets" is the tax advantage of a trade-in. In most provinces (excluding some private sales rules in BC), you only pay sales tax on the *difference* between your new car and your trade-in. For example, if you buy a $40,000 truck and trade in a $20,000 SUV, you only pay tax on $20,000. In a 13% HST province, that's a $2,600 saving. If you sell that SUV privately for $21,000, you might actually end up with less money in your pocket after paying the full tax on the new truck.

Consumer Protection Agencies

If a dealer misleads you about a vehicle's history or refuses to honour a contract, you have recourse. OMVIC in Ontario, AMVIC in Alberta, and the VSA in British Columbia are dedicated to regulating motor vehicle sales. They maintain compensation funds for victims of dealer fraud. However, these protections typically do not apply to private sales (Kijiji/Facebook Marketplace), which is why the "Buyer Beware" mantra is so vital for private transactions.

Frequently Asked Questions

Can I get a car loan with a 500 credit score in Canada?

Yes, but it is challenging and expensive. You will need to work with "subprime" lenders who specialize in credit rebuilding. Expect interest rates between 15% and 25%, and be prepared to provide proof of stable employment (usually 6+ months at the same job) and a down payment of at least 10-20%.

Is it better to lease or buy in the current Canadian market?

Leasing is currently less attractive due to higher residual interest rates. However, if you are a business owner who can write off the payments, or if you want a new car every three years without worrying about resale value, leasing still has merits. For the average Canadian looking for the lowest long-term cost, buying and holding for 7-10 years remains the winner.

Do I really need winter tires if I have an AWD vehicle?

Yes. AWD helps with traction when accelerating, but it does nothing to help you turn or stop on ice. Winter tires are made of a softer rubber compound that stays flexible below 7°C, whereas all-season tires turn hard like hockey pucks, losing their grip on the road.

How does a trade-in affect my taxable total?

In most provinces, your trade-in value is subtracted from the purchase price of the new car before taxes are applied. This "tax credit" can often make a dealership's trade-in offer more valuable than a slightly higher private sale price.

Can I return a car in Canada if I change my mind?

Generally, no. There is no "cooling-off period" for vehicle purchases in Canada once you have signed the contract and taken delivery. Some dealerships offer a 24-hour or 48-hour return policy as a courtesy, but it is not a legal requirement. Read every line of the contract before you sign.

Navigating the Canadian automotive market requires more than just a preference for a specific make or model. It requires a strategic approach to credit, an understanding of the hidden math behind interest rates, and the discipline to walk away from a bad deal. By treating your car purchase as a series of financial maneuvers rather than an emotional event, you position yourself to get the best possible terms. Knowledge is the ultimate "Approval Secret"-use it to drive away in a vehicle that fits both your lifestyle and your long-term financial goals.