Rookie Mistake? Not You! Your 2026 Car Loan Questions, Edmonton.

Table of Contents

- Rookie Mistake? Not You! Your 2026 Car Loan Questions, Edmonton.

- Key Takeaways: Your Instant Checklist for Car Loan Confidence

- Before You Even Step Foot in an Edmonton Dealership: The Pre-Game Plan

- Your Credit Score: The Unseen Negotiator in Canada's Financial Landscape

- Budgeting Beyond the Monthly Payment: The True Cost of Car Ownership in Alberta

- Pre-Approval: Your Secret Weapon for Edmonton Dealerships

- Decoding the Loan Offer: The Questions That Save You Thousands

- Understanding the Interest Rate: Fixed vs. Variable in a Shifting 2026 Market

- The Loan Term: Short-Term Pain for Long-Term Gain?

- Down Payment: How Much is Enough to Make a Difference?

- Early Payment Penalties: Can You Pay It Off Sooner?

- Beyond the Basics: Unmasking Hidden Costs and Add-Ons

- Administrative Fees and Documentation Charges: The Nickel and Dimers

- Extended Warranties and Service Packages: Necessity or Upsell?

- Credit Life/Disability Insurance: Do You Really Need It?

- Trade-In Value: Are You Getting a Fair Deal?

- Dealer vs. Bank vs. Credit Union: Where to Seal the Deal in Alberta

- The Dealership's Finance Department: Convenience vs. Cost

- Traditional Banks (RBC, TD, BMO, CIBC, Scotiabank): Stability and Structure

- Credit Unions (e.g., Servus Credit Union, ATB Financial in Alberta): Community Focus

- Online Lenders: The New Frontier

- Navigating the Unexpected: Post-Signing Scenarios

- Refinancing Your Car Loan: When and Why it Makes Sense

- Missed Payments and Default: Understanding the Consequences in Alberta

- Your Rights as a Car Buyer in Alberta: Protection You Can Count On

- Consumer Protection Act (Alberta): Key Provisions for Vehicle Purchases

- The Alberta Motor Vehicle Industry Council (AMVIC): Your Watchdog

- Your Next Steps to Approval: Drive Away Confident in Edmonton

- Frequently Asked Questions (FAQ)

Rookie Mistake? Not You! Your 2026 Car Loan Questions, Edmonton.

Navigating the vehicle financing landscape can feel like a high-stakes game, especially as we look ahead to 2026. With evolving economic conditions, fluctuating interest rates, and the unique dynamics of the Edmonton market, simply signing on the dotted line without thorough understanding is a 'rookie mistake' you're about to avoid. This deep-dive isn't just about asking questions; it's about understanding why those questions are critical to securing the best possible car loan in Alberta, saving you thousands, and driving away with genuine peace of mind. To confidently sign a car loan agreement, you must ask about the Annual Percentage Rate (APR), total cost of the loan including all fees, the loan term, any prepayment penalties, and the true cost of ownership. Understanding these details empowers you to negotiate better terms and avoid hidden expenses, ensuring your 2026 vehicle purchase aligns with your financial goals.

Key Takeaways: Your Instant Checklist for Car Loan Confidence

- Prioritize Pre-Approval: Secure financing terms before falling in love with a car. This gives you concrete negotiating power at any dealership in Edmonton.

- Look Beyond the Monthly Payment: Focus on the total cost of the loan (APR, total interest, fees) and the vehicle's true cost of ownership (insurance, maintenance, fuel).

- Know Your Credit Score's Power: Your credit health directly dictates your interest rate. Understand it, and if possible, improve it before applying.

- Compare Lender Types: Don't limit yourself to dealership financing. Explore traditional banks (e.g., RBC, TD), local credit unions (e.g., Servus Credit Union), and online lenders.

- Leverage Alberta's Consumer Protection: Be aware of your rights under the Alberta Consumer Protection Act and the role of the Alberta Motor Vehicle Industry Council (AMVIC).

Before You Even Step Foot in an Edmonton Dealership: The Pre-Game Plan

The most powerful negotiations begin long before you test drive. Laying the groundwork is crucial for a smooth and cost-effective car loan experience.

Your Credit Score: The Unseen Negotiator in Canada's Financial Landscape

Your credit score is the silent force dictating the interest rates you'll be offered. Understand what it is, why it matters, and how to optimize it. We'll explore how to access your free credit report from Equifax and TransUnion Canada, interpret your score, and identify actionable steps to improve it, potentially saving you thousands on your 2026 car loan. A higher credit score signals lower risk to lenders, directly translating to more favourable interest rates. Conversely, a lower score often means higher rates, as lenders compensate for the perceived increased risk. In 2026, with interest rates still subject to various economic pressures, a strong credit score is more vital than ever for securing prime financing in Edmonton. Here’s a general idea of how credit scores can influence typical car loan APRs in the Canadian market, keeping in mind these are estimates for 2026 and can vary significantly by lender and market conditions:

| Credit Score Range | Credit Profile | Estimated APR Range (2026) | Impact on Loan Cost |

|---|---|---|---|

| 800-900 | Excellent | 4.99% - 7.99% | Lowest interest payments, most flexible terms. |

| 720-799 | Very Good | 6.49% - 9.49% | Very good rates, strong approval odds. |

| 660-719 | Good | 8.99% - 12.99% | Competitive rates, wide range of options. |

| 600-659 | Fair | 13.99% - 19.99% | Higher rates, may require more lender comparison. |

| Below 600 | Poor/Subprime | 20.00% - 29.99%+ | Significantly higher rates, fewer lenders, often requires a co-signer or larger down payment. For more insights on navigating this, you might find our article Alberta Car Loan: What if Your Credit Score Doesn't Matter? helpful. |

Budgeting Beyond the Monthly Payment: The True Cost of Car Ownership in Alberta

A low monthly payment can be deceptive. A deep dive into all associated costs, including insurance rates (which can vary significantly in Alberta compared to, say, Ottawa), fuel consumption, maintenance schedules, and the non-negotiable need for winter tires in Edmonton. We'll guide you through calculating your true affordability, including your Debt-to-Income (DTI) ratio, to ensure your new vehicle doesn't become a financial burden. Your DTI ratio, which compares your total monthly debt payments to your gross monthly income, is a critical factor lenders assess. A DTI below 36% (including your new car payment) is generally considered ideal, but some lenders may approve up to 43% or even higher for certain applicants. Understanding this helps you set realistic payment expectations. Consider the example of a $30,000 vehicle in Edmonton. Here’s a breakdown of potential annual costs beyond the loan payment:

| Cost Category | Estimated Annual Cost (Edmonton, 2026) | Notes |

|---|---|---|

| Insurance | $1,800 - $3,000+ | Varies by age, driving record, vehicle type, and postal code. Alberta has higher average rates than some other provinces. |

| Fuel | $1,500 - $3,500+ | Based on 15,000-20,000 km/year, vehicle fuel efficiency, and fluctuating gas prices. |

| Maintenance & Repairs | $800 - $1,500 | Routine oil changes, tire rotations, filter replacements, and potential minor repairs. Can be higher for older or luxury vehicles. |

| Winter Tires (Replacement/Storage) | $200 - $400 | Cost of replacing tires every 4-5 years, plus potential storage fees if you don't swap them yourself. Essential for Edmonton winters. |

| Registration & Licensing | $90 - $150 | Annual vehicle registration fees in Alberta. |

| Total Estimated Annual Ancillary Costs | $4,390 - $8,550+ | This is in addition to your monthly car payment. |

Pro Tip: Factor in at least 10-15% of your car's value annually for insurance, fuel, and maintenance, especially for a new purchase. Edmonton's climate and driving conditions can impact these costs, making this foresight crucial for your 2026 budget.

Pre-Approval: Your Secret Weapon for Edmonton Dealerships

Securing pre-approval isn't just a suggestion; it's a strategic move. We'll detail what pre-approval means, how it empowers you to negotiate like a cash buyer, and where to obtain it – from major banks like RBC to local Alberta credit unions. Understanding your maximum loan amount and interest rate *before* you start shopping puts you in the driver's seat. Pre-approval provides you with a concrete offer, including the interest rate and maximum loan amount you qualify for, from an independent lender. This allows you to walk into any Edmonton dealership knowing your financial limits and a baseline interest rate, making you a much stronger negotiator. You can then use the dealership's financing department as a comparison point, potentially leveraging your pre-approval to secure an even better deal.

Decoding the Loan Offer: The Questions That Save You Thousands

Once you have a vehicle in mind, the real work of scrutinizing the loan offer begins. This section arms you with the critical questions to ask.

Understanding the Interest Rate: Fixed vs. Variable in a Shifting 2026 Market

Beyond just the number, delve into the nuances of APR (Annual Percentage Rate) versus simple interest rate. We'll discuss the implications of choosing a fixed versus a variable rate, especially with potential economic shifts in 2026, and how your credit score directly influences the rate offered. Learn how to identify a 'good' rate for your credit profile in the current Canadian market. APR is the most important number because it represents the true annual cost of borrowing, including any fees rolled into the loan. A simple interest rate, on the other hand, only reflects the cost of borrowing the principal amount. While most car loans in Canada are fixed-rate, ensuring your monthly payments and total interest remain predictable, some lenders might offer variable options. A variable rate could save you money if rates drop, but it exposes you to risk if rates climb. Consider the impact of even a small difference in APR on a $35,000 car loan over 60 months:

| APR | Monthly Payment (Approx.) | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|

| 6.99% | $692.68 | $6,560.80 | $41,560.80 |

| 7.49% | $700.58 | $7,034.80 | $42,034.80 |

| 7.99% | $708.56 | $7,513.60 | $42,513.60 |

As you can see, a difference of just 1% in APR can add nearly $1,000 to the total cost of your loan over five years. This highlights why negotiating for the lowest possible rate, even a seemingly small fraction of a percent, is so important.

Pro Tip: Don't just accept the first rate offered. Even a half-percent difference can save you hundreds over the life of the loan. Always compare with your pre-approval, and don't hesitate to negotiate with the dealership's finance manager, especially if you have a strong credit profile in 2026.

The Loan Term: Short-Term Pain for Long-Term Gain?

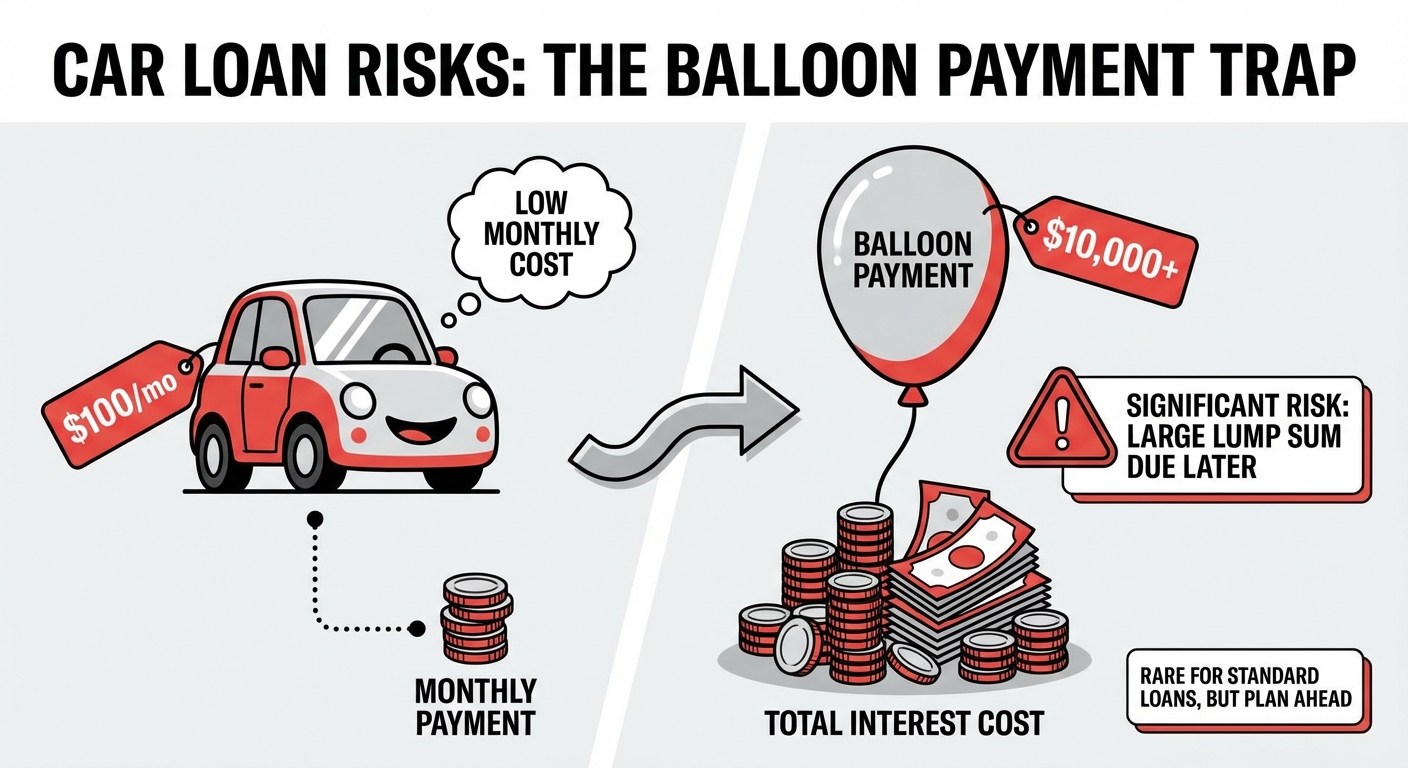

The length of your loan significantly impacts the total interest paid. We'll explore the allure of longer terms (lower monthly payments) versus the hidden costs of extended interest. We'll also touch on less common structures like balloon payments and how they might affect your long-term financial health.

The longer the loan term, the lower your monthly payment, which can be tempting for budget management. However, a longer term means you'll pay significantly more in interest over the life of the loan. For example, extending a loan from 60 to 84 months might reduce your monthly payment by $100, but it could add thousands to your total interest cost. Balloon payments, where a large lump sum is due at the end of the loan, are rare for standard car loans but can carry significant risk if you haven't planned for them.

Here’s an illustration of the total cost difference (principal + interest) between various loan terms for a $35,000 principal amount at a 7.5% APR:

Here’s an illustration of the total cost difference (principal + interest) between various loan terms for a $35,000 principal amount at a 7.5% APR:

| Loan Term | Monthly Payment (Approx.) | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|

| 48 Months (4 Years) | $843.08 | $5,467.84 | $40,467.84 |

| 60 Months (5 Years) | $700.58 | $7,034.80 | $42,034.80 |

| 72 Months (6 Years) | $600.32 | $8,723.04 | $43,723.04 |

| 84 Months (7 Years) | $531.06 | $10,609.04 | $45,609.04 |

This table clearly demonstrates how longer terms, despite offering lower monthly payments, result in significantly more interest paid over time, highlighting the importance of balancing affordability with overall cost.

Down Payment: How Much is Enough to Make a Difference?

Analyze the benefits of a larger down payment – lower principal, reduced interest, and faster equity build-up. Understand when a small or no down payment might be an option, and critically, the associated risks, such as immediate negative equity. A substantial down payment reduces the amount you need to borrow, directly lowering your monthly payments and the total interest you'll pay over the life of the loan. It also helps you build equity faster, meaning the car will be worth more than what you owe on it sooner. With a smaller down payment, or no down payment at all, you risk immediate negative equity, where the car's value depreciates faster than you pay down the loan, leaving you owing more than the car is worth. This can become problematic if you need to sell or trade in the vehicle early. For more on navigating down payments, especially when funds might be tight, consider reading Your Down Payment Just Called In Sick. Get Your Car.

Early Payment Penalties: Can You Pay It Off Sooner?

It's vital to know if your loan is 'open' or 'closed' in Canada. We'll discuss prepayment clauses, any potential fees for early payoff, and why asking this question upfront can save you frustration and money if your financial situation improves. In Canada, most car loans are "open," meaning you can make extra payments or pay off the entire loan early without penalty. However, some lenders, particularly those dealing with subprime loans, may have specific clauses or minor fees. Always confirm this with your lender. A "closed" loan would restrict early payments or impose significant penalties, which is rare for standard car loans but worth verifying.

Pro Tip: Always ask for a full amortization schedule. This document shows exactly how your payments are applied to principal and interest over time, revealing how much interest you'll pay at various stages of the loan. It's a powerful tool for understanding your loan's true cost.

Beyond the Basics: Unmasking Hidden Costs and Add-Ons

Dealerships often present a myriad of optional products. Knowing which questions to ask can prevent unnecessary expenses.

Administrative Fees and Documentation Charges: The Nickel and Dimers

These seemingly small fees can add up. We'll demystify what administrative and documentation charges purportedly cover, whether they are negotiable, and when to challenge them. This is particularly relevant in the competitive Edmonton dealership environment. Administrative fees, sometimes called "doc fees," are charges for processing paperwork, registering the vehicle, and other dealership overheads. While some amount might be standard, excessive fees should be questioned. Always ask for a detailed breakdown of what these fees cover. In Alberta, some fees are capped or regulated, but others are at the dealer's discretion. Don't hesitate to negotiate these down or even request their removal, especially if you're a strong buyer.

Extended Warranties and Service Packages: Necessity or Upsell?

Learn to distinguish between the manufacturer's warranty and often pricey dealer-offered extended warranties or service packages. We'll help you calculate their true value, assess if they're worth the cost, and confirm if they can be removed from the loan or purchased separately. Extended warranties are designed to cover repairs after the manufacturer's warranty expires. Service packages typically cover routine maintenance like oil changes. While they offer peace of mind, they can be expensive and often have exclusions. Before agreeing, compare the cost of the warranty to the potential cost of repairs, especially for reliable vehicles. Can you set aside money for repairs yourself instead? Always ask if these can be purchased separately at a later date or if they must be rolled into the loan immediately. Sometimes, third-party extended warranties offer better value.

Credit Life/Disability Insurance: Do You Really Need It?

Understand the coverage, its cost, and whether it's truly beneficial for your situation. We'll discuss alternative, often more affordable, insurance options (like term life insurance) and emphasize your right to decline these products. Credit life insurance pays off your loan if you die, while credit disability insurance makes payments if you become disabled. While the idea of protecting your family or credit is appealing, these products are often costly and may have limited benefits. Many people already have sufficient life or disability insurance through their employer or private policies. Compare the cost and coverage to what you already have. Remember, these are entirely optional, and you have the right to decline them without affecting your loan approval.

Pro Tip: Never feel pressured to add on insurance or extended warranties. Take the information home, research it independently, and consult with a trusted advisor before committing. A good dealer will respect your decision.

Trade-In Value: Are You Getting a Fair Deal?

Arm yourself with knowledge on how to research your current vehicle's market value using resources like Kelley Blue Book Canada or Canadian Black Book. Learn the critical strategy of separating the trade-in negotiation from the new car price and loan terms, and understand the implications of negative equity. Before you even visit a dealership, research your current vehicle's fair market value. Use online tools and check local listings for comparable models. When negotiating, always discuss the trade-in value *separately* from the price of the new vehicle. Dealers sometimes try to offer a seemingly good trade-in value while inflating the price of the new car, or vice versa. If you owe more on your trade-in than it's worth (negative equity), the outstanding balance will be rolled into your new loan, increasing its total cost. Be aware of this, and explore options like selling your car privately if you can get a better price.

Dealer vs. Bank vs. Credit Union: Where to Seal the Deal in Alberta

Your choice of lender can profoundly impact your loan terms. Explore the pros and cons of each option.

The Dealership's Finance Department: Convenience vs. Cost

While convenient, understanding the dealership's incentives and access to multiple lenders is key. We'll uncover common negotiation tactics used by finance managers and how to counter them effectively. Dealerships offer a one-stop-shop experience, often working with a network of lenders to find you a loan. This can be convenient, especially if you have a complex credit situation. However, dealership finance managers often mark up the interest rate offered by the lender to earn a commission. They might also push additional products like extended warranties or protection packages. Your pre-approval from an external lender is your best tool here, allowing you to directly compare their offer and negotiate for a better rate.

Traditional Banks (RBC, TD, BMO, CIBC, Scotiabank): Stability and Structure

Often offering competitive rates for strong credit profiles, traditional banks leverage your existing banking relationships. We'll discuss how to approach your bank for the best possible terms. Major banks are a reliable source for car loans, especially if you have an established relationship and a good credit score. They generally offer competitive rates and transparent terms. Starting your pre-approval process with your primary bank is a smart move, as they already have your financial history and may offer preferential rates to existing customers.

Credit Unions (e.g., Servus Credit Union, ATB Financial in Alberta): Community Focus

Credit unions, often with a more personalized approach, can be more flexible for unique credit situations and offer member benefits. Explore their local presence and offerings in Edmonton and across Alberta. Credit unions like Servus Credit Union or ATB Financial in Alberta are member-owned and often have a more flexible approach to lending. They may be more willing to work with applicants who have less-than-perfect credit or unique income situations (e.g., self-employed, gig economy workers) because they consider the individual's full financial picture rather than just a credit score. Their rates can be very competitive, and their customer service is often highly personalized. For those with unique income situations, our article Alberta's WCB Benefits: Your Car Loan's Secret Income. Drive Now. might offer relevant context on what lenders consider income.

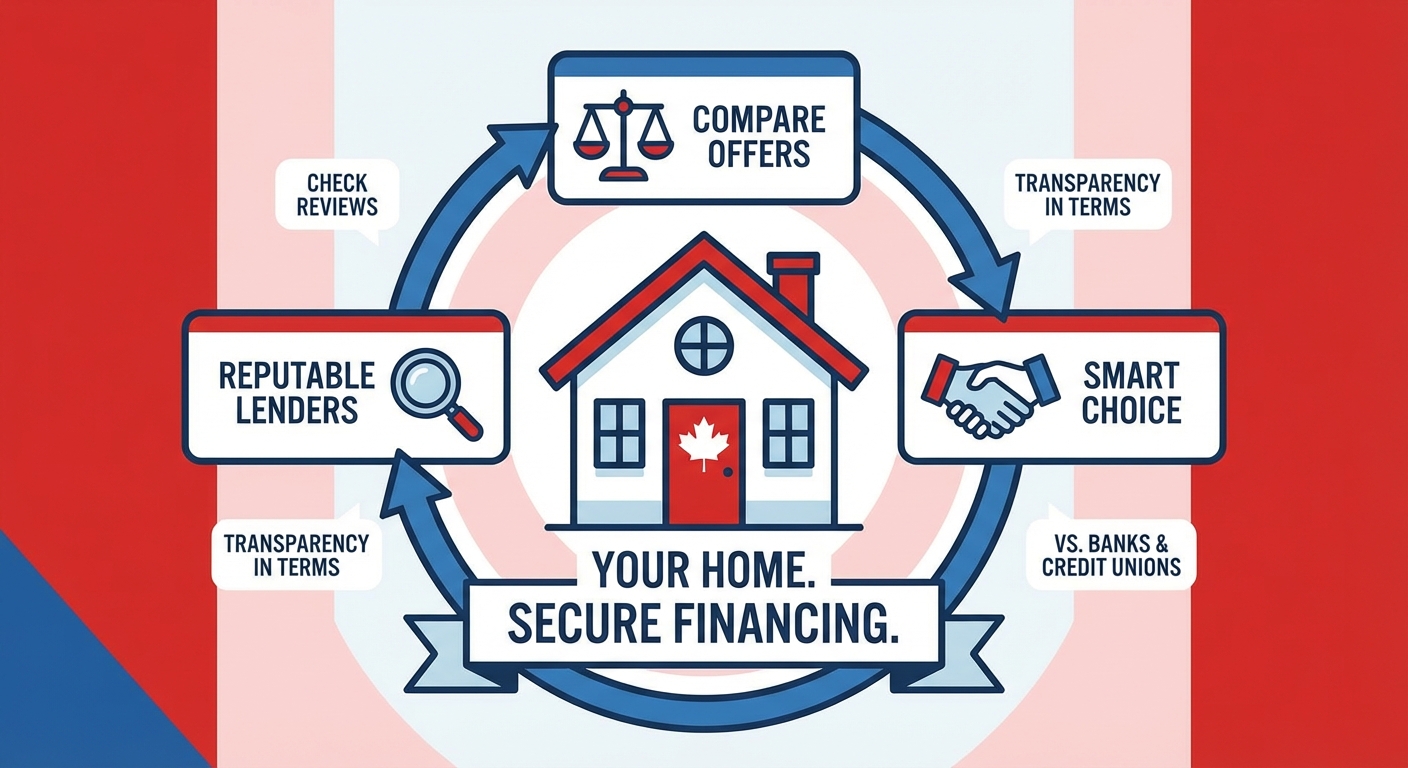

Online Lenders: The New Frontier

Discuss the speed and convenience of online lenders, but also the importance of vigilance and due diligence. Learn how to effectively compare offers from various online and traditional sources.

Online lenders have streamlined the application process, offering quick approvals and competitive rates, often accessible 24/7. They can be a great option for comparing multiple offers quickly and from the comfort of your home. However, it's crucial to ensure you're dealing with reputable lenders. Always check reviews, look for transparency in their terms, and compare their offers thoroughly with those from traditional banks and credit unions before committing.

Here’s a comparison table outlining the key pros and cons of obtaining a car loan through different lender types:

Here’s a comparison table outlining the key pros and cons of obtaining a car loan through different lender types:

| Lender Type | Pros | Cons | Best For |

|---|---|---|---|

| Dealership Finance Department | Convenience, one-stop shop, access to manufacturer incentives, can work with various credit profiles. | Rates may be marked up, pressure to buy add-ons, less transparency on lender choice. | Buyers prioritizing convenience or those with challenging credit needing specialized solutions. |

| Traditional Bank | Competitive rates for strong credit, established relationship benefits, structured and transparent process. | Stricter eligibility, less flexibility for unique credit situations. | Buyers with excellent to good credit and existing banking relationships. |

| Credit Union | Personalized service, potentially flexible terms, competitive rates, member-focused. | May require membership, smaller branch network than major banks. | Buyers seeking personalized service, unique credit situations, or community-focused banking. |

| Online Lender | Speed, convenience, easy comparison of multiple offers, accessible 24/7. | Requires due diligence to verify legitimacy, less personal interaction. | Tech-savvy buyers who prioritize speed and want to compare many options from home. |

Navigating the Unexpected: Post-Signing Scenarios

Life happens. Understand your options and protections if your financial situation changes after signing.

Refinancing Your Car Loan: When and Why it Makes Sense

Explore the scenarios where refinancing could benefit you – lower interest rates, improved credit score, or a need to adjust loan terms (longer or shorter). We'll outline the process and what to watch out for. Refinancing your car loan means taking out a new loan to pay off your existing one, often with a different lender and new terms. This can be highly beneficial if interest rates have dropped since you originally financed, or if your credit score has significantly improved. A lower interest rate can reduce your monthly payments and the total cost of the loan. You might also refinance to extend the loan term for lower monthly payments (though this increases total interest) or shorten it to pay off the car faster. For those who've navigated financial challenges, improving your credit post-proposal could lead to better rates; see our article Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

Missed Payments and Default: Understanding the Consequences in Alberta

A frank discussion on the impact of missed payments on your credit score, the potential for vehicle repossession, and the legal implications under Alberta law. Crucially, we'll provide advice on what steps to take if you anticipate difficulty making payments. Missing even one payment can negatively impact your credit score and trigger late fees. Consistent missed payments can lead to default, allowing the lender to repossess your vehicle. In Alberta, specific laws govern repossession, requiring lenders to follow certain procedures. If you anticipate difficulty making payments, contact your lender immediately. They may be willing to work with you to create a temporary payment plan or defer a payment to avoid default and repossession. Open communication is key to mitigating these severe consequences.

Your Rights as a Car Buyer in Alberta: Protection You Can Count On

Knowledge of your consumer rights is paramount when making a significant purchase like a vehicle.

Consumer Protection Act (Alberta): Key Provisions for Vehicle Purchases

Delve into the specific protections afforded to you under Alberta's Consumer Protection Act, including disclosure requirements, any applicable cooling-off periods for certain sales, and avenues for recourse in cases of misrepresentation or unfair practices. The Alberta Consumer Protection Act provides significant safeguards for vehicle buyers. It mandates that dealerships provide clear, truthful, and comprehensive information about the vehicle and the financing terms. Dealers must disclose all material facts, including the vehicle's history, any damage, and the full cost of the loan. While there isn't a general cooling-off period for all vehicle purchases, specific circumstances (like door-to-door sales) might have one. If you suspect misrepresentation or unfair practices, the Act provides avenues for complaint and resolution.

The Alberta Motor Vehicle Industry Council (AMVIC): Your Watchdog

Understand the vital role of AMVIC in regulating the automotive industry in Alberta. Learn how to verify if a dealer is licensed and how to file a complaint or seek assistance if you encounter issues. AMVIC is Alberta's consumer protection organization for the automotive industry. It licenses and regulates motor vehicle businesses and salespeople, ensuring they operate ethically and professionally. AMVIC provides consumer information and handles complaints against licensed businesses. If you have a dispute with a dealer or feel your rights have been violated, AMVIC is the primary resource for assistance.

Pro Tip: Always verify that any dealership or salesperson you're dealing with is AMVIC licensed. This ensures they adhere to provincial standards and offers you a layer of protection and recourse if issues arise with your 2026 car purchase.

Your Next Steps to Approval: Drive Away Confident in Edmonton

You're now equipped with the knowledge to approach your 2026 car loan with confidence. Remember, the goal isn't just to get a loan; it's to secure the *right* loan for *your* financial future. Start your research, get pre-approved, and remember to ask every single question that crosses your mind. Your diligence now will translate into significant savings and peace of mind on Edmonton's roads. Don't be a rookie; be a savvy car buyer.