Car Finance After Medical Leave Ontario | 2026 Solutions.

Table of Contents

- Key Takeaways

- The Post-Leave Financial Landscape: Understanding Your Starting Point in Ontario

- How Prolonged Medical Leave Can Impact Your Financial Profile

- Re-establishing Income Stability: What Lenders Look For

- Building Your Foundation: Pre-Application Strategies for Ontario Drivers

- Assessing Your True Financial Health: Beyond the Paycheck

- Credit Score Rehabilitation: Strategies to Strengthen Your Profile

- Gathering Your Arsenal: Essential Documentation for a Strong Application

- Navigating Lender Options: Who to Approach for Car Finance in Ontario

- Traditional Banks and Credit Unions: Your First Stop

- Dealership Financing: Convenience vs. Cost Considerations

- Specialty Lenders & Subprime Options: When Traditional Routes Are Challenging

- Decoding the Numbers: Interest Rates, APR, and Hidden Costs in Ontario Car Loans

- Factors Influencing Your Interest Rate After Medical Leave

- Unmasking Common Hidden Fees in Ontario Car Loans

- The True Cost of a Car Loan: APR vs. Interest Rate Explained

- Beyond the Loan: Protecting Your Investment and Your Future

- Revisiting Car Loan Disability Insurance: Is It Worth It for You?

- Gap Insurance: A Critical Consideration in Ontario

- Extended Warranties: Weighing the Pros and Cons for Long-Term Peace of Mind

- Choosing the Right Vehicle for Your Post-Leave Reality in Ontario

- Practicality Over Prestige: Matching Car to Budget and Needs

- New vs. Used: The Financial Implications and Smart Choices

- The Application Process: Presenting Your Best Case to Ontario Lenders

- Highlighting Stability: Re-employment Letters and Consistent Income

- Addressing Gaps in Employment History Transparently

- Post-Approval: Managing Your Car Loan and Future Financial Health

- Setting Up Automated Payments and Monitoring Your Loan

- Strategies for Early Loan Repayment and Rebuilding Credit

- When to Consider Refinancing Your Car Loan in Ontario

- Your Roadmap to Driving Away: Final Steps and Future Planning

- Frequently Asked Questions (FAQ) About Car Finance After Medical Leave in Ontario

Returning to work after prolonged medical leave is a significant milestone. As you regain your footing, securing reliable transportation often becomes a priority, but navigating car finance can feel daunting when your financial history has been impacted. This deep-dive article provides a comprehensive, Ontario-specific guide for individuals looking to secure car financing after a period of medical absence, offering practical strategies and forward-thinking solutions for 2026 and beyond.

Key Takeaways

- Proactive Documentation is Power: Gather all return-to-work letters, income statements, and medical documentation *before* applying. A well-prepared application signals responsibility and helps lenders understand your situation.

- Rebuild & Reassure: Focus on re-establishing stable income and, if necessary, addressing any credit score dips from your leave. Lenders prioritize consistent income and a demonstrated commitment to financial recovery.

- Budget Beyond the Payment: Factor in insurance (especially critical in Ontario, where rates can vary wildly), maintenance, and fuel costs specific to your vehicle choice. A holistic budget prevents unexpected financial strain.

- Explore All Avenues: Don't limit yourself to one type of lender; consider banks, credit unions, and specialty finance options. Each has different criteria and may be more accommodating to your unique circumstances.

- Disability Insurance Revisited: Understand if car loan disability insurance is truly beneficial for *your* specific post-leave financial situation, rather than just a default add-on. Evaluate your existing coverage.

- Transparency is Key: Be upfront with lenders about your medical leave; a clear, concise explanation often builds trust and helps them assess your current stability more accurately.

- Geographic Nuances Matter: Be aware of Ontario's unique insurance landscape, consumer protection laws, and regional economic factors that can influence loan terms and vehicle costs.

The Post-Leave Financial Landscape: Understanding Your Starting Point in Ontario

Securing a car loan after medical leave in Ontario often means addressing a temporary but impactful shift in your financial profile. Lenders prioritize stability, and while your medical leave was a necessary step, it can temporarily affect how they view your creditworthiness and income consistency. However, with the right approach and documentation, you can effectively demonstrate your renewed financial strength and secure the financing you need.

How Prolonged Medical Leave Can Impact Your Financial Profile

A medical leave, while necessary, can create ripples in your financial history. During periods of reduced income or unemployment, it's common for individuals to experience challenges in maintaining their regular financial obligations. This can lead to missed payments on credit cards, utility bills, or other loans, directly impacting your credit score. Even if you maintained all payments, an employment gap is often flagged by lenders as a potential risk factor.

Lenders use your credit report to gauge your payment history, credit utilization, and overall reliability. A dip in your score due to late payments or increased reliance on credit during your leave can push you into a higher-risk category, potentially leading to higher interest rates or more stringent approval conditions. Furthermore, your debt-to-income ratio might have temporarily widened if income decreased while debts remained constant. Understanding these potential effects is the first step in actively mitigating them and presenting a stronger application.

Re-establishing Income Stability: What Lenders Look For

Lenders prioritize consistent, verifiable income as the cornerstone of loan approval. After a medical leave, your primary goal is to effectively demonstrate your renewed earning capacity. This means providing clear evidence that you are back at work and receiving a steady income.

An official employment letter from your employer, confirming your return-to-work date, position, and salary, is invaluable. Recent pay stubs (typically 2-3 consecutive ones) showing regular earnings further solidify your case. If your medical leave involved long-term disability benefits that are now continuing as part of your income (e.g., partial disability), provide statements that clearly outline these ongoing payments. Lenders want to see stability, and generally, they prefer applicants who have been back at work for a consistent period, often 3 to 6 months, though some specialty lenders may be more flexible depending on your overall profile.

Here's a look at how different income sources might be perceived:

| Income Type | Lender Perception | Documentation Required |

|---|---|---|

| Full-Time Employment (Post-Leave) | Strongest. Demonstrates re-established stability. | Employment letter, 2-3 recent pay stubs, T4s. |

| Part-Time Employment (Post-Leave) | Good, but may require higher income or co-signer. | Employment letter, 2-3 recent pay stubs, T4s. |

| Ongoing Disability Benefits (e.g., ODSP, LTD) | Variable. Often accepted if stable & long-term. | Official benefit statements, bank statements showing deposits. |

| Self-Employment (Post-Leave) | Challenging. Requires 1-2 years of tax returns, business stability. | Business registration, 2 years of NOAs, bank statements. |

Building Your Foundation: Pre-Application Strategies for Ontario Drivers

Before you even begin to browse vehicles, laying a strong financial foundation is critical. This proactive approach not only increases your chances of approval but also ensures you secure terms that genuinely fit your post-leave budget.

Assessing Your True Financial Health: Beyond the Paycheck

A thorough self-assessment is crucial. This involves evaluating your current savings, outstanding debts, and a realistic projection of your post-leave expenses. Don't just look at your take-home pay; consider every dollar. What are your monthly fixed expenses (rent/mortgage, utilities, existing loan payments)? What are your variable expenses (groceries, transportation, entertainment)? Creating a robust personal budget that accounts for all aspects of car ownership in Ontario, including potentially high insurance premiums in cities like Toronto or Brampton, is your first line of defense against financial strain.

Consider this simplified budget framework:

| Category | Pre-Car Purchase (Example Monthly) | Post-Car Purchase (Projection) |

|---|---|---|

| Net Income | $3,500 | $3,500 |

| Housing (Rent/Mortgage) | $1,200 | $1,200 |

| Utilities & Internet | $250 | $250 |

| Groceries | $400 | $400 |

| Existing Debt Payments | $300 | $300 |

| Insurance (Current) | $100 (e.g., tenant) | $100 |

| New Car Loan Payment | $0 | $450 (Estimate) |

| New Car Insurance (Ontario) | $0 | $250 (Estimate) |

| Fuel & Maintenance | $0 | $200 (Estimate) |

| Miscellaneous/Savings | $1,250 | $350 |

| Total Expenses | $2,250 | $2,950 |

| Surplus/Deficit | $1,250 | $550 |

Credit Score Rehabilitation: Strategies to Strengthen Your Profile

If your credit score took a hit during your leave, immediate action is necessary. Start by obtaining a free copy of your credit report from both Equifax and TransUnion Canada. Scrutinize every entry for errors; even small inaccuracies can negatively impact your score. Dispute any errors promptly.

Next, focus on making timely payments on all existing debts. Consistency is paramount. Even small credit lines, like a secured credit card or a low-limit credit card, used responsibly and paid off in full each month, can demonstrate positive payment behaviour. Avoid applying for multiple lines of credit simultaneously, as this can temporarily lower your score. For more in-depth guidance on improving your credit, check out our guide on Flat Tire, Flat Credit? Toronto, We've Got Your Fix. If you're struggling, non-profit credit counselling agencies across Ontario, such as Credit Canada Debt Solutions, offer free advice and resources to help you create a debt management plan.

Gathering Your Arsenal: Essential Documentation for a Strong Application

Lenders need proof, and being thoroughly prepared signals responsibility and foresight. Before you even submit an application, have these documents ready:

- Letter of Return to Work: An official letter from your employer confirming your re-employment, start date, position, and annual salary.

- Recent Pay Stubs: Typically the last 2-3 consecutive pay stubs to demonstrate consistent income.

- Income Tax Assessments (NOAs): Your Canada Revenue Agency (CRA) Notice of Assessment for the past one or two years can verify past income.

- Bank Statements: Recent statements (3-6 months) showing consistent income deposits and responsible money management.

- Medical Documentation (Optional/Limited): While you don't need to overshare private medical details, a brief letter from a doctor or employer confirming the period of your leave due to medical reasons can explain the employment gap without excessive personal information.

- Driver's License & Proof of Residency: Standard identification and proof of your Ontario address.

- Explanation Letter: A brief, honest, and professional letter explaining the reason for your medical leave, confirming your full recovery, and highlighting your stable return to work.

Pro Tip: Documenting Your Recovery & Return-to-Work: Keep a detailed record of your medical leave, including dates, the nature of your illness/injury (without oversharing private medical details), and, most importantly, your confirmed return-to-work date and expected income. A letter from your employer confirming your re-employment and salary is invaluable for loan applications. This proactive transparency helps lenders understand your situation and builds trust.

Navigating Lender Options: Who to Approach for Car Finance in Ontario

Understanding the different types of lenders available in Ontario is crucial for finding the right fit for your post-medical leave situation. Each has its own criteria and advantages.

Traditional Banks and Credit Unions: Your First Stop

Major banks like RBC, TD, CIBC, and Scotiabank, along with local credit unions such as Meridian Credit Union or Alterna Savings, are often the first choice for car loans. They typically offer the most competitive interest rates for borrowers with strong credit and stable employment histories. However, they can also be the most stringent, often requiring a longer period of consistent employment (e.g., 6 months to 1 year post-leave) and a solid credit score.

Credit unions, being member-owned, sometimes offer slightly more flexible terms or a more personalized approach, especially if you have an existing banking relationship with them. They might be more willing to consider your overall financial picture rather than solely relying on a credit score. For prime borrowers, rates can range from 6.99% to 8.99%, but for those with recent employment gaps or credit challenges, these institutions might present higher hurdles.

Dealership Financing: Convenience vs. Cost Considerations

Dealerships offer immense convenience, acting as a one-stop shop for both vehicle purchase and financing. They often work with a network of various lenders, including captive finance companies (e.g., Ford Credit, Toyota Financial Services) and third-party banks, allowing them to present multiple financing options. This can be beneficial if you're looking for special manufacturer rates or incentives.

However, this convenience can come with a cost. Dealerships might mark up interest rates offered by their partner lenders to increase their profit margin. While they can sometimes approve applicants with less-than-perfect credit, it's crucial to be vigilant about the terms. Negotiate not just the vehicle price, but also the interest rate, and scrutinize all fees. Don't be pressured into a deal that doesn't feel right. For insights into bypassing dealership financing entirely, consider reading our article on Ontario Private Car Loan 2026: Skip the Dealership Drama.

Specialty Lenders & Subprime Options: When Traditional Routes Are Challenging

For those with more significant credit challenges, a shorter time back at work, or a history of missed payments during their medical leave, specialty lenders (often referred to as subprime lenders) might be the most viable option. Companies like SkipCarDealer.com specialize in connecting individuals with lenders who are more understanding of unique financial situations. These lenders focus on your ability to repay now, often looking beyond just your credit score to your current income and employment stability.

The trade-off for this flexibility is generally higher interest rates, often ranging from 15.99% to 29.99% or even higher, depending on your risk profile. However, securing a subprime loan and making consistent, on-time payments can be a stepping stone to rebuilding your credit and qualifying for better rates in the future. The role of a co-signer can also significantly improve approval odds and secure a lower rate in these scenarios. A co-signer with strong credit essentially guarantees the loan, reducing the lender's risk. For more on navigating loans when your credit isn't perfect, you might find our article Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto. helpful.

Here's a comparison of typical interest rate ranges based on credit profiles in Ontario:

| Credit Profile | Typical Interest Rate Range (APR) | Common Lender Types |

|---|---|---|

| Excellent (760+) | 5.99% - 8.99% | Banks, Credit Unions, Captive Lenders |

| Good (660-759) | 8.99% - 14.99% | Banks, Credit Unions, Dealerships |

| Fair (580-659) | 14.99% - 21.99% | Dealerships, Specialty Lenders |

| Poor (Below 580) | 21.99% - 29.99%+ | Specialty Lenders, Subprime Lenders |

Decoding the Numbers: Interest Rates, APR, and Hidden Costs in Ontario Car Loans

Understanding the financial specifics of your car loan is paramount, especially after a period of medical leave where every dollar counts. Don't just look at the monthly payment; delve into the total cost of borrowing.

Factors Influencing Your Interest Rate After Medical Leave

Your interest rate isn't random; it's a reflection of the lender's perceived risk. After a medical leave, several factors will heavily influence the rate you're offered:

- Credit Score: The lower your score, the higher the perceived risk, and thus, the higher the interest rate.

- Employment Stability: Lenders look for consistent income. A shorter time back at work (e.g., less than 6 months) may result in a higher rate compared to someone with a year or more of stable re-employment. Your 2026 Contract: New Job Car Loan Proof, Ontario could be critical here.

- Down Payment: A larger down payment reduces the loan amount and the lender's risk, often qualifying you for a lower rate. Aim for 10-20% if possible.

- Loan Term: Longer loan terms (e.g., 72 or 84 months) typically come with higher interest rates, even though they result in lower monthly payments.

- Vehicle Age & Type: Older vehicles or those with a history of reliability issues may carry higher rates due to increased risk of default or repossession issues.

Consider this example of how a down payment can impact your monthly payments and total interest paid on a $25,000 loan over 60 months at a 12% APR:

| Down Payment | Loan Amount | Monthly Payment (12% APR) | Total Interest Paid |

|---|---|---|---|

| $0 | $25,000 | $556.11 | $8,366.60 |

| $2,500 (10%) | $22,500 | $500.50 | $7,530.00 |

| $5,000 (20%) | $20,000 | $444.89 | $6,700.00 |

Unmasking Common Hidden Fees in Ontario Car Loans

Beyond the advertised interest rate, car loans can come with various fees that inflate the true cost of borrowing. In Ontario, be vigilant for:

- Administrative Fees: Often charged by dealerships for processing paperwork. These can range from $200 to $500.

- PPSA Registration Fee: The Personal Property Security Act (PPSA) registers the lender's interest in your vehicle. This is a mandatory fee, usually between $50 and $100.

- Documentation Fees: Similar to admin fees, these cover the cost of preparing loan documents.

- Loan Origination Fees: Some lenders charge a fee for initiating the loan, typically a percentage of the loan amount or a flat fee.

- Licensing and Registration Fees: While not part of the loan itself, these are mandatory costs when buying a car in Ontario.

Always ask for a detailed breakdown of all fees before signing any agreement. These can add hundreds, if not thousands, of dollars to your total cost.

The True Cost of a Car Loan: APR vs. Interest Rate Explained

Understanding the difference between the nominal interest rate and the Annual Percentage Rate (APR) is critical. The interest rate is simply the cost of borrowing the principal amount. The APR, however, provides a more accurate picture of the total cost of borrowing because it includes the interest rate PLUS any mandatory fees or additional charges wrapped into the loan. For example, if a loan has a 10% interest rate but includes a $500 origination fee, the APR will be higher than 10%.

Always compare loans based on their APR, as this allows for a true apples-to-apples comparison between different lenders and offers. It's the most comprehensive measure of how much you'll pay annually for the privilege of borrowing money.

Pro Tip: Negotiating Beyond the Sticker Price: Remember that almost everything is negotiable. Don't just focus on the monthly payment. Negotiate the total vehicle price, your trade-in value (if applicable), the interest rate, and scrutinize every single fee. Ask for an itemized list and challenge anything you don't understand or that seems excessive. Be prepared to walk away if the terms aren't right for your post-leave budget; another deal will always come along.

Beyond the Loan: Protecting Your Investment and Your Future

A car loan is just one part of car ownership. Especially after a medical leave, protecting your financial recovery means considering additional protections for your new vehicle and your peace of mind.

Revisiting Car Loan Disability Insurance: Is It Worth It for You?

Car loan disability insurance is often offered by dealerships or lenders. It's designed to cover your car loan payments if you become disabled and unable to work. However, its value is highly subjective, especially for someone who has just returned from a medical leave. Instead of a generic 'yes' or 'no,' evaluate if this specific product aligns with your personal risk tolerance and existing coverage.

Do you have employer-provided long-term disability (LTD) benefits? Do you have a personal disability insurance policy? If so, the car loan specific insurance might be redundant and an unnecessary added cost. Always read the fine print: what are the waiting periods? What conditions are covered? What are the maximum payouts? Often, the cost of this insurance, when added to your loan, significantly increases your total interest paid. Compare its benefits to your existing income protection plans before committing.

Gap Insurance: A Critical Consideration in Ontario

If your car is totaled or stolen, your primary auto insurance policy typically pays out the actual cash value (ACV) of the vehicle at the time of the incident. This ACV is almost always less than what you paid for the car, especially for new vehicles due to rapid depreciation. If you owe more on your car loan than the ACV your insurer pays, you're left with a "gap" – you still owe the lender money for a car you no longer have.

Gap insurance covers this difference. It's particularly important for newer vehicles, vehicles with high loan-to-value ratios (e.g., little or no down payment), or longer loan terms. Given Ontario's sometimes high accident rates and mandatory insurance requirements, Gap insurance can be a vital safety net for many Ontarians, preventing you from being upside down on your loan after an unfortunate event.

Extended Warranties: Weighing the Pros and Cons for Long-Term Peace of Mind

After a medical leave, unexpected repair costs can be financially devastating. An extended warranty, also known as a vehicle service contract, covers certain repairs after the manufacturer's basic warranty expires. This section analyzes when it might be a wise investment, particularly for used vehicles or those with known reliability concerns.

Pros: Peace of mind, protection against major repair bills, budget predictability. Cons: Can be expensive, may have exclusions or high deductibles, not always transferable. For a reliable used car, an extended warranty might be a smart choice to mitigate unforeseen expenses. However, for a brand-new car with a comprehensive manufacturer warranty, it might be an unnecessary expense that duplicates existing coverage. Always compare the cost of the warranty against the potential cost of repairs and your personal comfort level with risk.

Choosing the Right Vehicle for Your Post-Leave Reality in Ontario

Your choice of vehicle significantly impacts your overall financial commitment. After a medical leave, prioritizing smart choices over aspirational purchases is key to maintaining financial stability.

Practicality Over Prestige: Matching Car to Budget and Needs

After a medical leave, financial recovery is paramount. This section guides you in prioritizing practical, reliable, and affordable vehicles over aspirational ones. Focus on vehicles that offer excellent fuel efficiency, which can save you hundreds, if not thousands, of dollars annually, especially with fluctuating gas prices in Ontario. Research insurance costs extensively; these vary significantly not only by vehicle type but also by specific Ontario cities. For example, insuring the same vehicle could be vastly more expensive in Toronto or Brampton compared to Ottawa or a smaller rural community due to differing accident rates and theft statistics.

Consider the vehicle's maintenance history and projected reliability. Opt for models known for their dependability and lower repair costs. A thorough pre-purchase inspection by an independent mechanic is non-negotiable for used vehicles.

Here's a snapshot of how insurance costs can vary in Ontario (estimates for a typical driver profile):

| Ontario City/Region | Average Annual Insurance Cost (Estimate) | Factors Influencing Cost |

|---|---|---|

| Toronto / Brampton | $2,500 - $4,000+ | High population density, traffic, accident rates, theft. |

| Mississauga / Markham | $2,200 - $3,500 | Similar to Toronto, but slightly lower in some areas. |

| Ottawa | $1,500 - $2,500 | Lower population density, less traffic congestion. |

| London / Windsor | $1,800 - $2,800 | Mid-range rates, influenced by local claims history. |

| Rural Ontario | $1,200 - $2,000 | Lower traffic, fewer claims, but distance can be a factor. |

New vs. Used: The Financial Implications and Smart Choices

The new vs. used debate takes on new significance after medical leave. New cars offer the latest technology, full manufacturer warranties, and the peace of mind of being the first owner. However, they suffer from rapid depreciation, losing a significant portion of their value in the first few years. This means you could quickly owe more than the car is worth, especially with a low down payment.

Used cars, on the other hand, offer substantial savings on the purchase price and depreciation has already occurred. This typically means a lower loan amount, lower payments, and potentially lower insurance premiums. While used cars carry a higher risk of unexpected repairs, a thorough pre-purchase inspection and a reliable vehicle history report (like CARFAX Canada) can mitigate many of these concerns. Many certified pre-owned (CPO) programs from dealerships also offer extended warranties, bridging the gap between new and purely used vehicles. For someone focused on financial recovery, a carefully chosen used vehicle often presents the best value.

Pro Tip: Test Driving for Comfort and Accessibility: If your medical leave involved a physical injury or condition, your choice of vehicle might also need to consider accessibility and comfort. Pay close attention to seat ergonomics, ease of entry/exit, and the layout and reach of controls during your test drive. Don't hesitate to spend extra time in the driver's seat. A small investment in vehicle modifications, if necessary, could also be considered to ensure long-term comfort and safety.

The Application Process: Presenting Your Best Case to Ontario Lenders

Once you've done your homework and chosen a vehicle, the application process itself is your opportunity to present your renewed financial stability to lenders effectively.

Highlighting Stability: Re-employment Letters and Consistent Income

This section provides detailed advice on how to structure your application to emphasize your current stability. Your re-employment letter is a cornerstone document. Ensure it's on company letterhead, clearly states your start date, current position, and annual salary, and ideally, includes a contact number for verification. Presenting recent, consecutive pay stubs (at least two, preferably three) alongside this letter shows a clear pattern of consistent income, which is what lenders value most after an employment gap. If you've received a raise or promotion since returning, highlight this as it demonstrates career progression and increased earning potential.

Addressing Gaps in Employment History Transparently

Do not hide your medical leave. Lenders will see the gap in your employment history on your credit report or application. This segment advises on how to honestly and professionally explain employment gaps. Frame it positively: explain that you had a medical leave, that you have fully recovered, and that you are now back at work in a stable position. Focus on your recovery and successful return to work, demonstrating resilience and commitment. Transparency often builds trust with lenders, who appreciate honesty and a clear narrative over evasiveness.

Pro Tip: Be Honest and Proactive with Your Story: Lenders appreciate honesty. Instead of letting them guess about an employment gap on your application, proactively provide a brief, professional explanation of your medical leave and successful return to work. Frame it as a temporary setback that you've overcome, demonstrating your resilience and current stability. This takes control of the narrative and presents you as a responsible borrower.

Post-Approval: Managing Your Car Loan and Future Financial Health

Getting approved for a car loan after medical leave is a significant achievement. The next step is diligent management to ensure you maintain your financial health and continue rebuilding your credit.

Setting Up Automated Payments and Monitoring Your Loan

Once approved, setting up automated payments is crucial to avoid missed payments, which can severely damage your credit score. Arrange for payments to be automatically deducted from your bank account on your due date. This ensures consistency and prevents oversight. Regularly review your loan statements to ensure accuracy, verify that payments are applied correctly, and track your principal balance. Understanding your payment schedule and how much interest you're paying helps you stay in control of your finances.

Strategies for Early Loan Repayment and Rebuilding Credit

If your financial situation improves, paying off your loan early can save you significant interest over the life of the loan. Strategies for accelerated payments include making bi-weekly payments (which results in one extra monthly payment per year) or rounding up your monthly payment. Even small extra payments can make a difference. Consistent, on-time payments contribute significantly to rebuilding a strong credit profile, opening doors to better rates on future loans and other financial goals. A strong payment history on your car loan demonstrates reliability to all future creditors.

When to Consider Refinancing Your Car Loan in Ontario

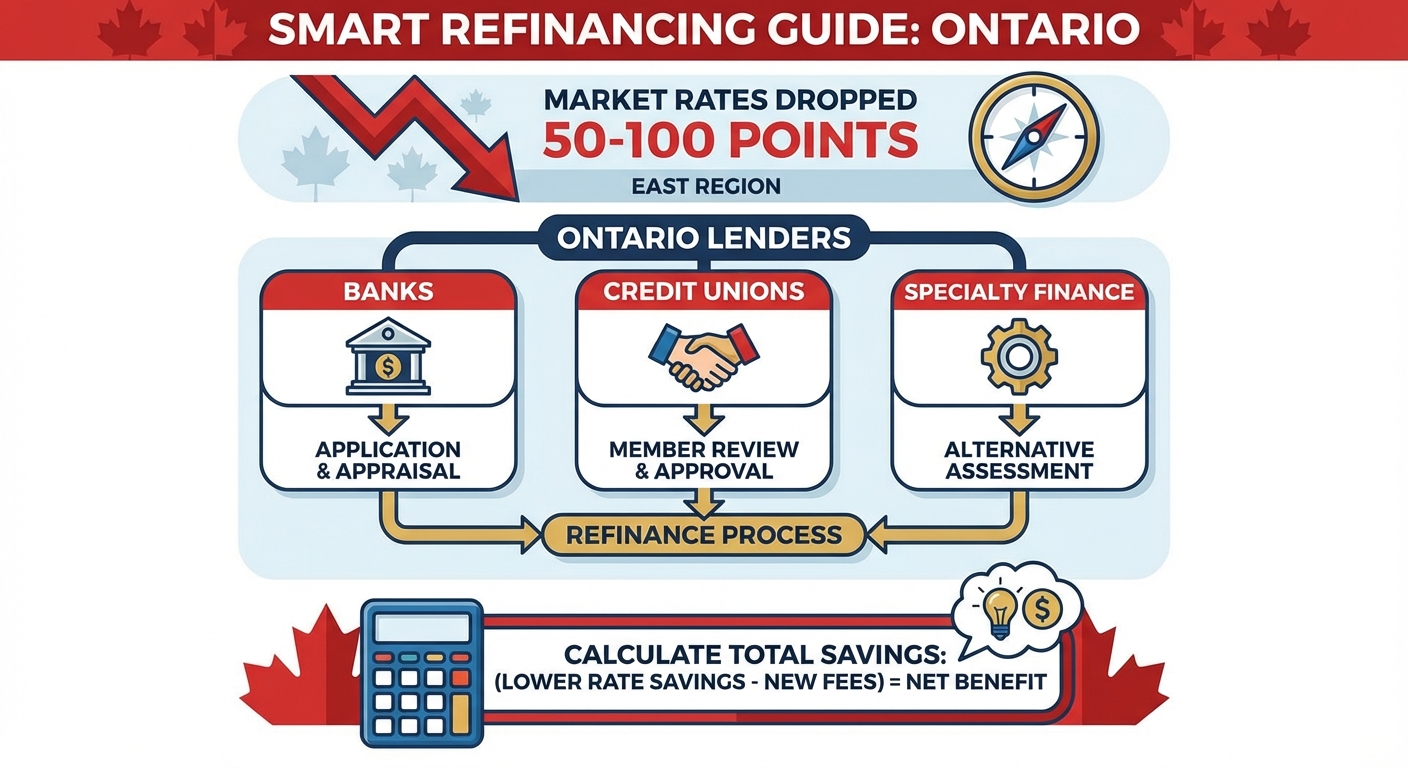

As your credit score improves and income stabilizes (typically 12-18 months after securing your initial loan), you might qualify for a lower interest rate. Refinancing your car loan means taking out a new loan to pay off your existing one, ideally at a more favourable rate. This can significantly reduce your monthly payments or the total interest paid over the loan term. We'll discuss the conditions under which refinancing makes sense – typically when your credit score has improved by at least 50-100 points, or market rates have dropped – and the process for doing so with Ontario lenders, including banks, credit unions, and specialty finance companies. Always calculate the total savings, including any new fees, before refinancing.

Your Roadmap to Driving Away: Final Steps and Future Planning

Securing car finance after medical leave is not just about getting the loan; it's about re-establishing financial independence and stability. By meticulously preparing your documentation, understanding your financial landscape, exploring all lender options, and diligently managing your loan, you empower yourself to drive forward. This journey emphasizes ongoing financial vigilance, strategic planning, and consistent effort to ensure a secure and independent future on Ontario's roads. Remember, your medical leave was a temporary chapter, and your financial future is now in your hands to write.