Your Engagement Score Just Qualified Your Car Loan, Toronto.

Table of Contents

- Key Takeaways

- The New Currency of Credit: How Your Digital Influence Drives Car Loan Approval in Toronto

- Decoding Your 'Engagement Score': Beyond Likes and Followers for Loan Qualification

- Architecting Your Application: Crafting a Compelling Financial Narrative for Lenders

- The Hunt for Your Wheels: Finding the Right Car and the Right Loan for Your Creator Lifestyle

- Navigating the Financing Maze: Banks, Dealerships, and Specialized Lenders for Creators Across Ontario

- Local Insights: Car Financing Hotspots and Resources for Creators in Ontario

- Safeguarding Your Future: Post-Approval Strategies for Creators

- Your Next Steps to Driving Success: A Creator's Car Loan Action Plan

- Frequently Asked Questions: Creator Car Loans Edition

The world of finance is constantly evolving, and in 2026, we’re witnessing a fascinating shift: your digital influence is becoming a tangible asset. For the vibrant community of content creators and social media entrepreneurs in Toronto and across Canada, this is revolutionary. Gone are the days when a fluctuating income stream from your YouTube channel or Instagram brand deals was an automatic red flag for car loan lenders. Welcome to an era where your "engagement score" can actually help qualify you for the car you need to drive your creative career forward.

At SkipCarDealer.com, we understand the unique financial narrative of modern creators. We know your income doesn't fit neatly into bi-weekly paycheque boxes, and your creditworthiness is about more than just a traditional FICO score. This comprehensive guide will show you exactly how to leverage your digital success to secure car financing in Toronto and beyond, demystifying the process and equipping you with the knowledge to drive away in your dream vehicle.

Key Takeaways

- Your social media 'engagement score' isn't just for brands; it's a new metric for financial credibility.

- Traditional income documentation is challenging for creators, but not impossible – learn how to present your unique financial narrative.

- Specialized lenders and strategic dealership financing often offer more flexibility than conventional banks for creators.

- Understanding interest rates, hidden fees, and loan terms is crucial to avoid common pitfalls unique to irregular income streams.

- Strategic budgeting and financial planning are paramount for managing car loan payments with fluctuating creator income.

The New Currency of Credit: How Your Digital Influence Drives Car Loan Approval in Toronto

In 2026, securing a car loan as a content creator in Toronto means understanding that lenders are increasingly looking beyond traditional credit scores. They're recognizing the legitimacy and financial power of the creator economy. Your 'engagement score,' encompassing consistent earnings from brand partnerships, ad revenue, and loyal audience monetization, is emerging as a credible indicator of financial stability, especially for those with a strong digital presence.

Beyond the FICO Score: Introducing the paradigm shift where digital engagement translates to financial trust.

For decades, the FICO score and traditional credit history have been the bedrock of lending decisions. These metrics relied heavily on consistent employment, stable income, and a history of managing credit cards and mortgages. But what about the burgeoning creator economy?

The modern creator economy, fuelled by platforms like YouTube, Instagram, TikTok, and Patreon, generates billions of dollars annually. Yet, its participants often find themselves overlooked by conventional financial institutions.

Why the traditional credit system often overlooks the modern creator economy:

- Income volatility: Monthly earnings can fluctuate significantly based on content performance, brand deal cycles, and audience trends.

- Lack of traditional employment: Creators are often self-employed, lacking employer-issued pay stubs or T4s.

- Non-traditional income sources: Revenue comes from diverse streams like ad revenue, affiliate marketing, merchandise sales, and direct audience support, which can be hard for banks to categorize.

- Thin credit files: Many young creators may not have a long history of traditional credit use.

The unique financial landscape of Toronto and how it's adapting to entrepreneurial income streams.

Toronto, a hub of innovation and creativity, is particularly attuned to the rise of the creator economy. The city’s dynamic financial sector, coupled with a high cost of living, encourages lenders to be more innovative in their assessment models. Specialized lenders and forward-thinking dealerships are beginning to adapt, recognizing the wealth and stability that can come from a well-managed digital empire.

These institutions understand that a creator with a robust, engaged audience and diversified income streams can be a very reliable borrower, even if their financial statements look different from a salaried employee's. It's about demonstrating consistent profitability and strategic growth.

Pro Tip: Start thinking of your social media analytics as a supplementary credit report. Consistent growth, high engagement rates, and recurring revenue from established sources can paint a compelling picture of your financial viability for savvy lenders.

Decoding Your 'Engagement Score': Beyond Likes and Followers for Loan Qualification

Your "engagement score" for car loan purposes isn't just about the number of likes or followers you have. While those metrics indicate reach, lenders are far more interested in the monetized aspects of your digital presence – the cold, hard cash your influence generates. It's about proving a reliable income stream, not just popularity.

What Lenders REALLY See: Distinguishing between vanity metrics and financially relevant indicators.

Vanity metrics (likes, followers, views) are important for brand partnerships but don't directly prove income stability. Lenders want to see concrete financial indicators:

- Consistent Brand Deals: Multi-month or annual contracts with reputable brands demonstrate predictable income.

- Ad Revenue: Consistent payouts from platforms like YouTube (AdSense), Twitch, or Facebook indicate a stable audience and content performance.

- Affiliate Commissions: Regular income from affiliate links suggests a loyal, purchasing audience.

- Merchandise Sales: Steady sales through e-commerce platforms show direct consumer spending.

- Patreon/Subscription Income: Recurring payments from dedicated fans are perhaps the most stable form of creator income.

- Speaking Engagements/Consulting: Income from leveraging your expertise offline.

The anatomy of a creator's income: Understanding fluctuating revenue streams and annual averages.

Creator income is often cyclical. There might be peak seasons for brand deals (e.g., holidays) or dips during content breaks. Lenders who understand this will look at your income over a longer period – typically 6 to 12 months, or even 24 months – to calculate an average monthly income. This average provides a more realistic picture of your earning potential than any single month's erratic earnings.

Case studies: How different types of creators (e.g., YouTube vlogger, Instagram influencer, TikTok artist) can demonstrate income stability.

- YouTube Vlogger: A vlogger can present consistent AdSense reports, demonstrating steady viewership. They might also show a portfolio of ongoing brand sponsorships and merchandise sales figures.

- Instagram Influencer: This creator can highlight long-term brand ambassador contracts, direct payment receipts from sponsored posts, and affiliate marketing reports from tools like RewardStyle or Amazon Associates.

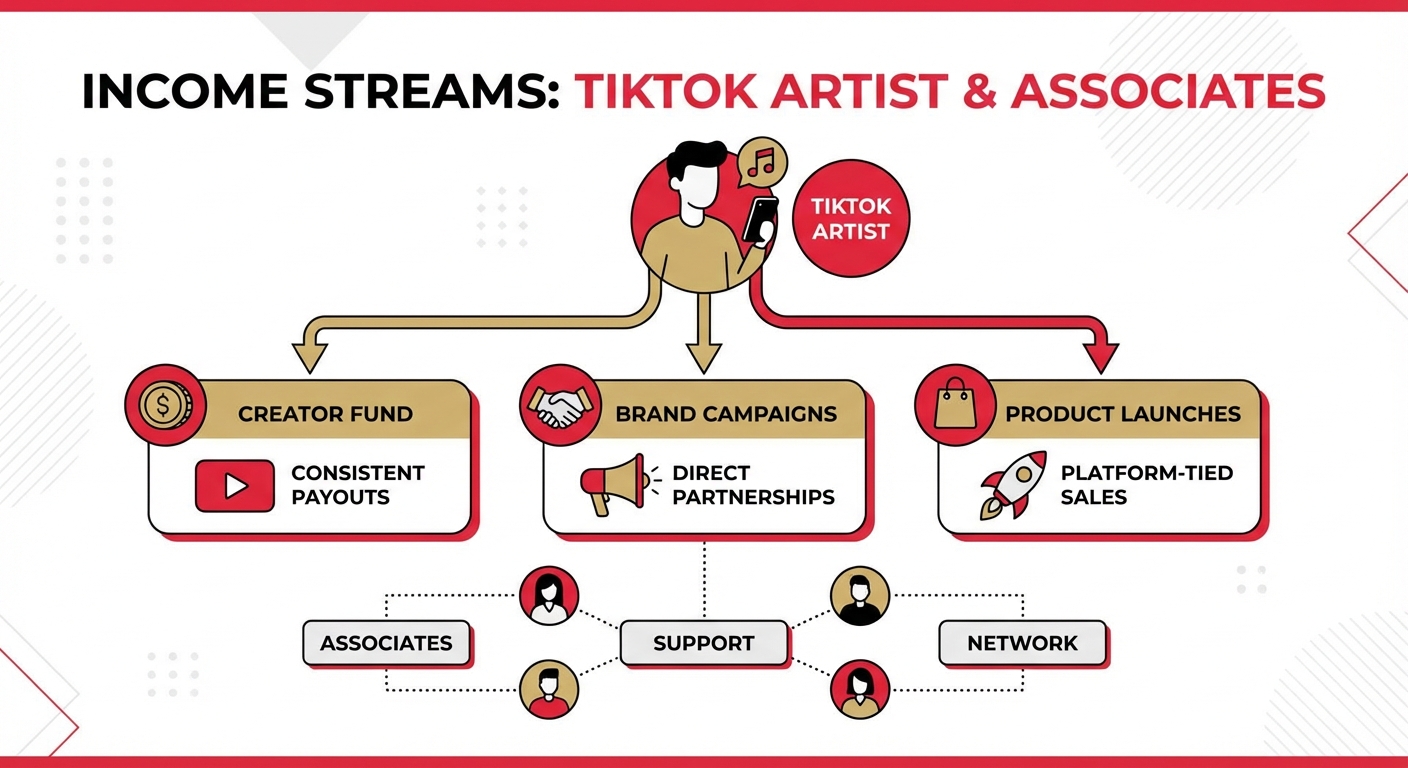

- TikTok Artist: While often seen as more volatile, a TikTok artist with a loyal following can demonstrate income through consistent 'creator fund' payouts, direct brand campaigns, and successful product launches tied to their platform.

(Context: Infographic visually breaking down various social media income streams and their perceived stability/reliability for lenders, perhaps with a 'trust meter').

(Context: Infographic visually breaking down various social media income streams and their perceived stability/reliability for lenders, perhaps with a 'trust meter').

Architecting Your Application: Crafting a Compelling Financial Narrative for Lenders

As a creator, your car loan application isn't just a stack of papers; it's a narrative. It's your opportunity to tell a compelling story about your financial discipline, your thriving business, and your future potential. This requires meticulous organization and strategic presentation.

The Creator's Income Statement: How to compile irregular income.

Since traditional pay stubs are rare, you'll need to create your own comprehensive income statement. This is where your diligent record-keeping pays off. Gather:

- 6-12 Months of Bank Statements: Highlight all incoming payments, clearly identifying sources (e.g., "YouTube AdSense," "Brand XYZ Payment," "Patreon Income").

- Contract Copies: Provide copies of your brand deals, particularly long-term agreements, demonstrating future income.

- Ad Platform Reports: Screenshots or downloadable reports from YouTube Studio, Facebook Creator Studio, or other ad platforms showing consistent payouts.

- PayPal/Stripe/Other Payment Processor Histories: Detailed transaction logs can verify income from sales, subscriptions, or direct client payments.

- Invoices: Copies of professional invoices issued for your services.

- Tax Returns: Your T1 General Statement of Income for the past two years, especially Schedule T2125 (Statement of Business or Professional Activities), will be crucial. This officially verifies your self-employed income.

The Power of the Business Plan (Even for Solopreneurs): Projecting future earnings, audience growth, and diversification strategies to demonstrate long-term viability.

A simple, yet professional, business plan can significantly boost your credibility. It shows lenders you're not just creating content on a whim, but operating a legitimate business. Include:

- An executive summary outlining your brand, niche, and mission.

- An overview of your content strategy and target audience.

- Detailed financial projections (e.g., expected income from upcoming brand deals, subscriber growth, new product launches).

- A diversification strategy (e.g., plans to expand to new platforms, launch new merchandise, offer consulting services) to mitigate risk.

Building Your Personal Brand's Creditworthiness: Strategies for improving perceived reliability.

Treating your creative work as a professional business is key:

- Professional Invoicing: Always use professional invoices for your services.

- Separate Business Accounts: Keep your personal and business finances distinct. This makes income tracking cleaner and demonstrates financial organization.

- Tax Compliance: Filing your taxes accurately and on time, declaring all income, builds a reliable financial history.

- Consistent Savings: Demonstrating a healthy savings account can reassure lenders about your ability to manage finances, particularly during lean periods.

Addressing common lender concerns: Income volatility, lack of traditional employment history, and inconsistent cash flow.

Be proactive in addressing these. Explain your income cycles, highlight your emergency fund, and showcase your strategies for managing fluctuating revenue. Transparency and preparedness are your greatest allies. For more on how to present your self-employed income, check out our guide on Self-Employed? Your Bank Doesn't Need a Resume.

Pro Tip: Treat your social media channels as a legitimate business entity. Keep meticulous records for at least two years prior to applying. This consistent documentation is your strongest evidence of income stability.

The Hunt for Your Wheels: Finding the Right Car and the Right Loan for Your Creator Lifestyle

Choosing a car as a creator isn't just about personal preference; it's a strategic business decision. Your vehicle might be a mobile office, a prop, or essential equipment transport. Balancing your brand image with practical financial considerations is paramount.

Budgeting for the Fluctuating Income: Setting realistic expectations for monthly payments, considering a buffer for lean months.

Before you even look at cars, determine your absolute maximum comfortable monthly payment. Then, subtract a buffer. If your income has unpredictable dips, aim for payments that are comfortably below your average monthly income. For example, if your average income is $5,000/month, don't commit to a $1,000 car payment. Aim for something closer to $500-$600, leaving significant room for flexibility.

New vs. Pre-Owned: What Makes Sense for a Creator's Cash Flow? Analyzing depreciation, insurance costs, and maintenance.

- New Cars: Offer reliability, warranties, and the latest tech. However, they depreciate rapidly, especially in the first few years. Higher purchase price means higher payments and typically higher insurance.

- Pre-Owned Cars: Offer significant savings due to depreciation already absorbed by the first owner. Can be more budget-friendly in terms of purchase price, payments, and insurance. However, maintenance costs might be higher, and warranties shorter.

For creators with fluctuating income, a reliable pre-owned vehicle often makes more financial sense, allowing for lower monthly outlays and less financial pressure.

Vehicle Choices that Reflect Your Brand (Without Breaking the Bank): Balancing image, practicality, and affordability.

Consider your specific needs:

- Fuel Efficiency for Travel: If you travel for content creation (vlogging road trips, event coverage), a hybrid or fuel-efficient compact SUV could save you significant operating costs.

- Cargo Space for Equipment: Photographers, videographers, or crafters might need an SUV or hatchback with ample cargo room for cameras, lighting, props, or products.

- Professional Image: If you attend client meetings or high-profile events, a clean, well-maintained sedan or crossover can project professionalism without necessarily being a luxury brand.

Remember, a car is a tool for your business. Choose one that supports your work efficiently and economically.

Pro Tip: Consider vehicles with lower depreciation rates and strong resale value to protect your investment, especially if your income fluctuates. Japanese brands like Honda and Toyota often excel in this regard.

Navigating the Financing Maze: Banks, Dealerships, and Specialized Lenders for Creators Across Ontario

Securing a car loan as a creator in Ontario involves understanding your options. Not all lenders are created equal, especially when it comes to non-traditional income. Knowing where to look and what to expect is half the battle.

Traditional Banks: The Uphill Battle (and How to Win It): What documents they demand, how to present your case, and the importance of a strong co-signer if available.

Major banks in Canada (e.g., RBC, TD, BMO) are often the most conservative. They prefer clear, consistent T4 income and high credit scores. For creators, this means:

- They will demand extensive proof of income, often 2+ years of tax returns, detailed bank statements, and potentially a formal business plan.

- They may require a significant down payment to mitigate risk.

- A strong co-signer (someone with stable employment and excellent credit) can dramatically improve your chances and secure better rates.

Present your case professionally, emphasizing consistency, growth, and responsible financial management, just as you would for any business loan.

Dealership Financing: Speed, Convenience, and Their Network of Lenders: Understanding the pros and cons, and how to negotiate terms effectively.

Dealerships often have in-house finance departments that work with a wide network of lenders, including subprime lenders who are more accustomed to non-traditional income. This can be a significant advantage for creators.

- Pros: One-stop shop, quicker approval process, access to lenders who specialize in various credit profiles. They often understand the need for flexibility.

- Cons: Rates might be slightly higher than prime bank rates. It's crucial to compare offers as they may present you with only their most profitable option first.

Negotiate! Don't just accept the first offer. Compare their proposed rate and terms with what you might be pre-approved for elsewhere.

The Rise of Niche Lenders: Finding Allies Who Understand the Creator Economy: Exploring alternative financing solutions that are more accustomed to self-employed and non-traditional income.

Specialized lenders, often working through dealerships or online platforms like SkipCarDealer.com, are becoming increasingly common. These lenders are designed to work with unique financial situations, including self-employed individuals and those with fluctuating income or developing credit histories. They use alternative data points and more flexible underwriting criteria.

Comparing Interest Rates and Terms: What to look for beyond the monthly payment – APR, loan duration, early payment penalties.

Always look at the Annual Percentage Rate (APR), which includes all costs of the loan, not just the interest rate. A lower APR means lower total cost. Consider loan duration carefully; longer terms mean lower monthly payments but more interest paid over time. Check for early payment penalties – you want the flexibility to pay off your loan faster if your income spikes.

Here's a comparison of typical interest rate ranges for different credit profiles in 2026 for a car loan in Ontario:

| Credit Profile | Traditional Bank (Prime) | Dealership Financing (Mixed) | Specialized/Subprime Lender |

|---|---|---|---|

| Excellent (760+) | 5.99% - 7.99% | 6.49% - 8.49% | N/A (not their target) |

| Good (660-759) | 7.99% - 9.99% | 8.49% - 11.99% | 10.99% - 14.99% |

| Fair (580-659) | Limited/High Denial | 12.99% - 18.99% | 15.99% - 24.99% |

| Developing/Poor (Below 580) | Rarely Approved | 19.99% - 29.99%+ | 24.99% - 34.99%+ |

Note: These are estimated ranges for 2026 and can vary based on market conditions, specific lender, and vehicle being financed.

Hidden Fees and Charges: Unmasking the True Cost of Your Car Loan in Ontario.

Beyond the interest rate, watch out for these common fees in Ontario:

- Administration Fees: Dealerships may charge a fee for processing paperwork, typically $299 - $699.

- Lien Registration Fee: To register the lien on your vehicle, usually $50 - $100.

- PPSA (Personal Property Security Act) Fees: Similar to lien registration, ensures the lender has a claim on the vehicle, around $10 - $20.

- Loan Origination Fee: Some lenders charge a fee for initiating the loan, often a percentage of the loan amount.

- Extended Warranty/Protection Packages: These are often added to the loan and can significantly increase your total cost. Ensure you understand what you're buying.

Pro Tip: Don't shy away from negotiating. Everything from the vehicle price to the interest rate can be discussed. Get multiple quotes – from your bank (even if just for comparison), other online lenders, and different dealerships – before committing. This empowers you to get the best deal.

Local Insights: Car Financing Hotspots and Resources for Creators in Ontario

Ontario is a vast province, and car financing options can vary. While Toronto leads the way in adapting to the creator economy, other cities across the province also offer viable solutions.

Toronto's Dynamic Lending Landscape: Specific opportunities, dealerships, and financial advisors catering to the city's vibrant freelance and creator community.

As Canada's largest city and a major creative hub, Toronto has a more competitive lending environment. Many dealerships in the Greater Toronto Area (GTA) are increasingly familiar with self-employed income, including that of creators. Financial advisors specializing in self-employed individuals can also help you prepare your financial documentation to maximize your chances. Look for dealerships that actively advertise "self-employed financing" or "flexible income solutions." For ways to get a car loan with no down payment in Toronto, check out our guide on Your Cash Stays Put. Assets Just Bought Your Car, No Down Payment, Toronto.

Beyond the 416/647: Car Financing in Ottawa, Mississauga, and Other Key Ontario Cities: Exploring regional differences in lender availability and competitive rates for creators.

- Ottawa: The nation's capital has a strong professional and government sector, but also a growing tech and creative scene. Lenders here may be slightly more conservative than in Toronto but are still adapting.

- Mississauga: Part of the GTA, Mississauga benefits from Toronto's innovative lending trends. Many dealerships serve both markets, offering similar flexible financing options.

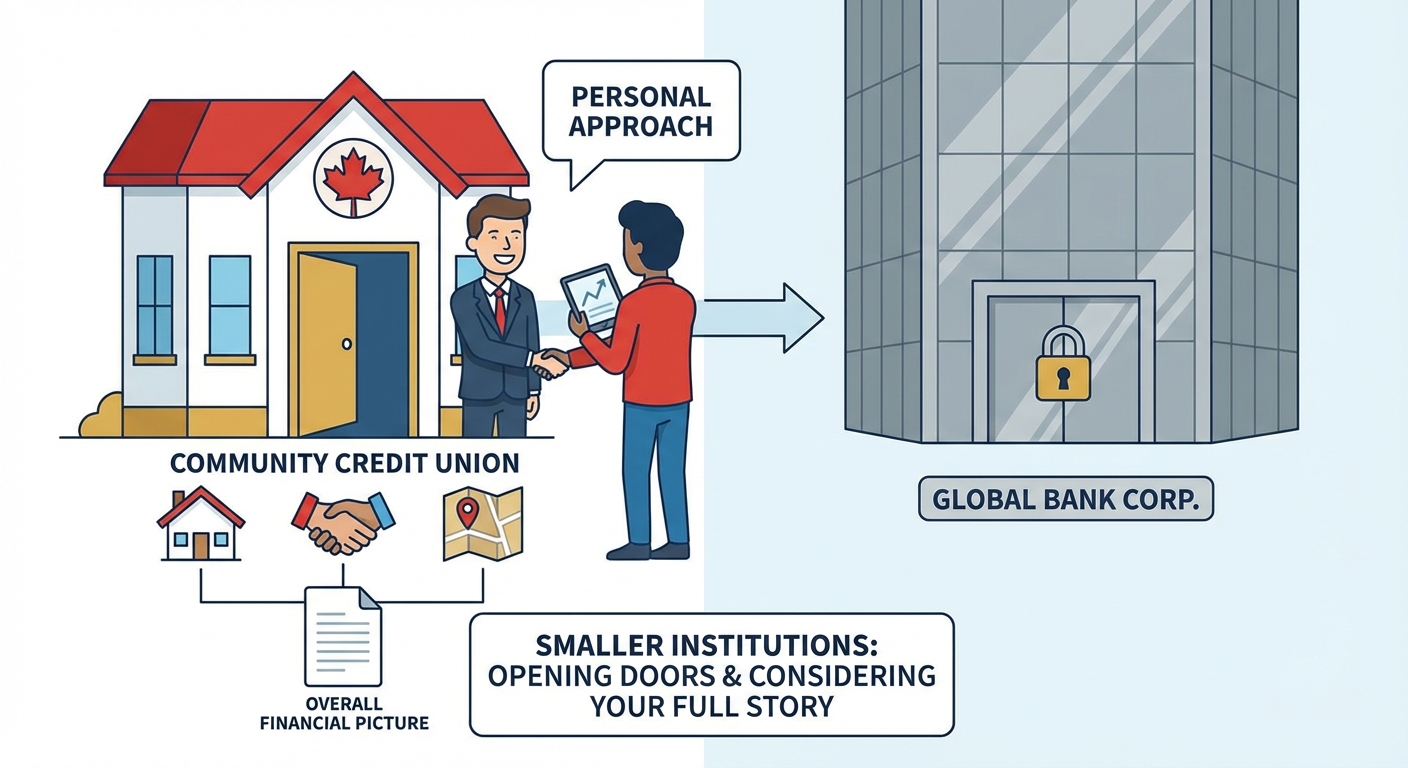

- Hamilton/Niagara Region: These areas are seeing growth in their creative communities. Local credit unions can sometimes be more flexible than large banks, offering personalized service and understanding of local economic nuances.

Navigating Self-Employed Loan Options in Barrie, Oshawa, and Sudbury: How local dealerships and credit unions might offer tailored solutions.

In more regional centres like Barrie, Oshawa, and Sudbury, local dealerships and credit unions often play a vital role. They tend to have a deeper understanding of their local economies and customer bases. Building a personal relationship with a finance manager at a local dealership or a loan officer at a credit union can sometimes open doors that larger, more impersonal institutions might keep closed. They may also be more willing to consider your overall financial picture, including community involvement or long-term residency, alongside your digital income.

(Context: A stylized map of Ontario highlighting Toronto, Ottawa, Mississauga, Barrie, Oshawa, and Sudbury, with callouts for creator-friendly financing hubs or resources in each city).

(Context: A stylized map of Ontario highlighting Toronto, Ottawa, Mississauga, Barrie, Oshawa, and Sudbury, with callouts for creator-friendly financing hubs or resources in each city).

Safeguarding Your Future: Post-Approval Strategies for Creators

Getting your car loan approved is a major milestone, but your financial journey doesn't end there. As a creator with a dynamic income, proactive management of your loan is crucial for long-term financial health and peace of mind in 2026.

Managing Loan Payments with Irregular Income: Strategies for budgeting, setting up automatic payments, and building a dedicated 'car payment buffer' fund.

- Dedicated Buffer Fund: The most critical strategy. Create a separate savings account specifically for your car payments. Aim to have 3-6 months of car payments saved in this fund. If your income dips, you draw from this buffer, ensuring your car payments are always on time.

- Automatic Payments: Set up automatic payments from your buffer fund to ensure you never miss a due date. Late payments can severely damage your credit score.

- Income Allocation: When a large payment comes in (e.g., a major brand deal), immediately allocate a portion to your buffer fund or even make an extra payment on your loan.

- Review and Adjust: Regularly review your budget and income projections. If your average income changes significantly, adjust your savings strategy accordingly.

Building a Stronger Financial Future: How responsibly managing your car loan can positively impact your actual credit score over time, opening more doors.

Consistently making your car loan payments on time is one of the best ways to build or rebuild your traditional credit score. A car loan is an installment loan, and successful repayment demonstrates your ability to manage debt responsibly. Over time, this positive payment history will:

- Increase your credit score.

- Make you eligible for better interest rates on future loans (mortgages, lines of credit).

- Improve your overall financial standing, making it easier to secure other financial products.

Even if you started with a developing or lower credit score, this loan can be your stepping stone to a stronger financial profile. For those starting with no credit, this is an excellent opportunity to establish a positive credit history. Learn more about getting financed with limited credit by reading No Credit? Great. We're Not Your Bank.

The Importance of Comprehensive Insurance for Your Creative Asset: Protecting your vehicle, equipment often carried within it, and your livelihood.

Beyond standard liability, consider:

- Collision and Comprehensive Coverage: Protects your vehicle from damage, theft, or natural disasters.

- Contents Insurance Rider: If you regularly transport expensive equipment (cameras, laptops, drones), ensure your car insurance, or a separate business insurance policy, covers these items in transit or if stolen from your vehicle.

- Loss of Use/Rental Car Coverage: If your car is damaged, this covers the cost of a rental, ensuring your ability to continue working.

Your car is a business tool; protect it and the tools inside it.

When to Refinance: Optimizing Your Loan as Your Influence Grows and Income Stabilizes. Recognizing opportunities to secure better terms.

As your creator business matures, your income may stabilize, and your credit score will likely improve if you've been diligent with payments. This is the perfect time to consider refinancing. Refinancing means getting a new loan to pay off your existing car loan, often at a lower interest rate or with better terms. Look into refinancing if:

- Interest rates have dropped since you originally financed.

- Your credit score has significantly improved.

- You want to shorten your loan term to pay it off faster (if your income allows).

- You want to lower your monthly payments by extending the term (though this means more interest overall).

Refinancing can save you thousands of dollars over the life of your loan. Keep an eye on the market and your credit report.

Pro Tip: Set aside a 'buffer fund' specifically for car payments, ideally covering 3-6 months, to navigate any unexpected dips in your creator income. This financial cushion is essential for creators.

Your Next Steps to Driving Success: A Creator's Car Loan Action Plan

Securing a car loan as a content creator in Toronto or anywhere in Ontario is an achievable goal in 2026. By following a structured approach, you can turn your digital influence into real-world driving power. Here’s your actionable plan:

Step 1: Document Your Digital Empire – Gather all income proof and analytics.

Start today. Collect bank statements, platform payout reports, brand contracts, invoices, and past tax returns. Organize everything meticulously for at least the last 12-24 months. The more comprehensive your documentation, the stronger your case.

Step 2: Define Your Budget – Understand what you can realistically afford.

Calculate your average monthly income and factor in your living expenses. Determine a comfortable monthly car payment that includes a buffer for income fluctuations. Don't forget to account for insurance, fuel, and maintenance.

Step 3: Research Creator-Friendly Lenders – Explore specialized options alongside traditional routes.

While you can check with your bank, prioritize dealerships with strong finance departments and online platforms like SkipCarDealer.com that specialize in non-traditional income. Seek out lenders who understand the creator economy.

Step 4: Get Pre-Approved – Know your buying power before hitting the dealerships.

A pre-approval gives you a clear budget and leverage. It shows dealerships you're a serious buyer and lets you focus on finding the right car, not scrambling for financing. It also allows you to compare rates before you're under pressure.

Step 5: Negotiate Like a Pro – Don't settle for the first offer on the car or the loan.

Once pre-approved, you have a benchmark. Negotiate the vehicle price first, then discuss the financing terms. Ask about all fees and don't be afraid to walk away if the deal isn't right. Multiple quotes are your best negotiation tool.

Step 6: Drive Confidently – With a solid plan and a vehicle that supports your creative journey.

Once you've secured your loan and your new vehicle, maintain your financial discipline. Continue building your buffer fund, make payments on time, and enjoy the freedom and professional support your new car provides to your creative endeavours.