Job Offer's Catch? Your Car Loan Just Caught It. Drive to Work, Edmonton.

Table of Contents

- Key Takeaways

- The Edmonton Dream Job: From Celebration to Car Loan Crisis

- Key Takeaways: Your Fast Track to Car Loan Approval with a Contingent Job Offer

- The Contingency Conundrum: Why Your New Job Makes Lenders Nervous (and How to Reassure Them)

- The Lender's Lens: Why 'New Job' Isn't Always a Green Light for Car Loans

- Decoding 'Contingent on Vehicle Ownership': More Than Just a Suggestion

- Your Offer Letter: The Golden Ticket to Future Income Proof (and What it Must Include)

- Building Your Approval Blueprint: Essential Documents Beyond Your Resume

- Proof of Stability: Rent, Utilities, and Your Established Edmonton Address

- Beyond the Pay Stub: Why Bank Statements Tell Your Financial Story (Even Without Recent Income)

- Navigating the Lender Landscape: Who Will Say 'Yes' to Your Contingent Offer?

- Traditional Banks in Alberta: The High Bar for New Employment (e.g., RBC, TD, BMO in Edmonton)

- Credit Unions: Your Local Advantage in Edmonton and Beyond (e.g., Servus Credit Union, ATB Financial)

- Dealership Financing: The Fast Lane (But Mind the Turns)

- Specialized Online Lenders: A Digital Lifeline for Unique Circumstances

- Maximizing Your Approval Odds: Beyond Just a Good Job Offer

- Your Credit Score: The Silent Partner in Your Loan Application

- The Power of a Down Payment: Showing Lenders You're Invested

- The Co-Signer Advantage: When a Second Signature Opens Doors

- Smart Vehicle Choices: Why a Practical Car Boosts Your Chances

- Demystifying Rates, Terms, and Hidden Costs: What to Expect When You're Approved

- Understanding Your APR: The True Cost of Borrowing in Alberta

- Loan Terms: Finding the Sweet Spot Between Monthly Payments and Total Cost

- Beyond the Sticker Price: Unmasking Hidden Fees and Charges

- Insurance Imperatives: Protecting Your Investment (and Meeting Lender Requirements)

- The Edmonton & Alberta Edge: Local Considerations for Your Car Loan Journey

- Edmonton's Automotive Market: Finding Your Wheels Locally

- Alberta Insurance Regulations: What You Need to Know Before You Drive

- Navigating Winter Roads: Why Vehicle Reliability Matters More in Alberta

- Public Transit as a Stop-Gap? The Edmonton Transit System (ETS) Realities

- Your Drive Ahead: Securing Your Ride, Securing Your Future

- From Offer Letter to On-Ramp: The Final Steps to Ownership

- Building Financial Momentum: How This Loan Sets You Up for Success

- Frequently Asked Questions (FAQ): Your Urgent Car Loan Queries Answered

Imagine this: the phone rings, it’s the call you’ve been waiting for. A fantastic new job offer in Edmonton, Alberta, complete with a great salary, benefits, and a clear path for career growth. You’re ecstatic, ready to pack your bags and start your new life in this vibrant Canadian city. But then, you read the fine print. The offer is contingent on immediate vehicle ownership. Suddenly, that celebration turns into a scramble. How do you secure a car loan when your employment hasn't officially started, and your entire future hinges on getting those keys in hand?

This isn't an uncommon scenario in 2026. Many employers, especially those requiring travel, site visits, or shifts outside public transit hours in sprawling cities like Edmonton, mandate reliable transportation from day one. For many, this means a car loan is an immediate, critical necessity, not a future consideration. But here's the catch: lenders typically prefer a stable employment history with recent pay stubs. Your new job offer, while exciting, often looks like a higher risk to them, creating a peculiar Catch-22. You need the car for the job, but you need the job (or proof of it) for the car loan.

Don't despair. Navigating car loan approval for a job offer contingent on vehicle ownership is challenging, but far from impossible. This comprehensive guide will equip you with the specific mechanics, insider strategies, and critical insights you need to turn that job offer into a set of car keys and drive confidently into your new role in Edmonton.

Key Takeaways

- Your Offer Letter is Gold: Ensure your job offer letter is detailed and comprehensive; it's your primary proof of future income for lenders.

- Be Proactive with Lenders: Understand that not all lenders treat contingent offers equally. Target those experienced with unique financial situations.

- Strengthen Your Application: Boost your approval odds with a good credit score, a solid down payment, or a reliable co-signer.

- Document Everything: Gather all possible proof of stability, savings, and future income to present a clear financial picture.

- Know Your Local Market: Edmonton's specific automotive and insurance landscape will influence your vehicle choice and overall costs.

The Edmonton Dream Job: From Celebration to Car Loan Crisis

Securing a new job in Edmonton can be life-changing. Whether you're relocating for a fantastic opportunity or stepping into a new role locally, the excitement is palpable. However, that high can quickly dip when you realize your new employment is conditional on having a vehicle. This isn't just a suggestion; it's often a non-negotiable clause that can delay your start date or even rescind the offer if not met promptly. This sets the stage for the 'catch' mentioned in our title and highlights the urgency of the problem for the eager job seeker.

A contingent job offer on vehicle ownership means you must acquire a car before your official start date. Lenders, however, typically want to see consistent income, usually in the form of several recent pay stubs, which you don't yet have. This unique situation requires a strategic approach to demonstrate your financial reliability and future income potential.

Key Takeaways: Your Fast Track to Car Loan Approval with a Contingent Job Offer

When facing a contingent job offer, securing a car loan requires a precise and informed strategy. You need to act quickly and present your financial situation in the most favourable light possible, even without traditional proof of employment. The following sections will dive deep into each point, offering actionable advice to get you approved and on the road to your new Edmonton job in 2026.

The Contingency Conundrum: Why Your New Job Makes Lenders Nervous (and How to Reassure Them)

A new job offer, while fantastic news for you, can be a red flag for traditional lenders. Why? Because from their perspective, it represents a period of transition and uncertainty. You haven't started earning yet, and the job itself isn't fully established. This perceived risk needs to be proactively addressed in your application.

The Lender's Lens: Why 'New Job' Isn't Always a Green Light for Car Loans

Lenders prioritize stability. They want to see a history of consistent income, usually demonstrated by several months or even years at the same employer, with regular pay stubs. They assess your debt-to-income ratio, your payment history, and your overall financial behaviour. A new or prospective job disrupts these traditional criteria because there's no immediate track record to evaluate. This makes them nervous about your ability to meet future car loan payments.

For example, a lender might look for 3-6 months of continuous employment. If you're starting a new role, you simply don't have that. This is where your strategy needs to shift from proving past income to demonstrating undeniable future income and overall financial responsibility.

Decoding 'Contingent on Vehicle Ownership': More Than Just a Suggestion

When your job offer states it's "contingent on vehicle ownership," it means precisely that: no car, no job. This isn't a recommendation; it's a mandatory prerequisite. Failing to meet this condition can lead to a delayed start or, in worst-case scenarios, the withdrawal of the job offer. This clause underscores the critical urgency for you to secure a car loan quickly and efficiently.

Understanding this urgency is key to communicating your situation to lenders. You're not just buying a car; you're securing your employment and future income. This context can sometimes sway a lender who understands the direct link between the loan and your ability to generate income.

Your Offer Letter: The Golden Ticket to Future Income Proof (and What it Must Include)

Your job offer letter is the single most important document you possess for car loan approval for a job offer contingent on vehicle ownership. It acts as your primary proof of future income. To be effective, it must include specific, verifiable details that lenders will scrutinize:

- Official Company Letterhead: Ensures authenticity.

- Your Full Name and Address: Matches your application details.

- Job Title and Department: Clearly identifies your role.

- Start Date: Crucial for lenders to understand when your income stream begins.

- Annual Salary / Hourly Wage: The specific amount of your guaranteed income.

- Employment Type: Must clearly state "Permanent Full-Time" for the strongest case. Avoid "contract" or "temporary" if possible, as these are harder for lenders to accept as stable income.

- Benefit Details: While not direct income, it shows the stability and value of the position.

- Signature of an Authorized Company Representative: Essential for verification.

- Contact Information for HR/Hiring Manager: So lenders can verify the offer.

Without these details, your offer letter may not be sufficient. Ensure you ask your prospective employer for a letter that includes all these specifics. This document proves your ability to repay the loan once your employment officially begins.

Pro Tip: Pre-Employment Verification – What Lenders Will Check (and How to Prepare)

Lenders won't just take your offer letter at face value. They will likely perform a pre-employment verification. This involves contacting your new employer's HR department or the listed hiring manager to confirm the details in your offer letter. To prepare:

- Inform your HR contact that a lender may call to verify your employment offer.

- Provide the lender with the correct contact person and phone number for verification.

- Ensure the information you’ve provided to the lender (start date, salary, etc.) exactly matches what your employer will confirm.

Building Your Approval Blueprint: Essential Documents Beyond Your Resume

Beyond your offer letter, a strong application requires a comprehensive collection of documents. Think of it as building an undeniable case to show lenders you are a responsible borrower, even with a non-traditional income situation.

Proof of Stability: Rent, Utilities, and Your Established Edmonton Address

Even if your employment status is new, you can demonstrate stability in other areas of your life. Lenders look for indicators that you are rooted and reliable. Providing proof of residential stability in Edmonton (or Calgary, if you're commuting) can significantly offset the perceived instability of a new job. This includes:

- Lease Agreement or Mortgage Statement: Showing consistent residency.

- Utility Bills (Power, Gas, Internet): In your name, demonstrating you manage household expenses.

- Driver's License or Other Government ID: Confirming your current address.

This information helps paint a picture of a responsible individual with established ties to the community, making you a less risky borrower.

Beyond the Pay Stub: Why Bank Statements Tell Your Financial Story (Even Without Recent Income)

While you might not have recent pay stubs, your bank statements offer a window into your financial habits. Lenders will examine them to understand:

- Savings: A healthy savings account indicates financial prudence and an ability to manage money, providing a buffer for unexpected expenses.

- Regular Deposits (Non-Employment): If you have other income sources (e.g., freelance work, investment returns, benefits), these can demonstrate consistent cash flow. For those relying on benefits, understanding how lenders view this can be crucial. For more on this, check out our guide on EI Benefits? Your Car Loan Just Got Its Paycheck.

- Outgoing Payments: Consistent payment of rent, utilities, and other bills shows responsible financial management.

- Emergency Fund: Demonstrates you have a cushion to fall back on if there's a delay in your new income.

Even if your statements show a recent gap in employment income, the overall picture of responsible management and available funds can be very reassuring to a lender.

Navigating the Lender Landscape: Who Will Say 'Yes' to Your Contingent Offer?

Not all lenders are created equal, especially when it comes to unique situations like a contingent job offer. Understanding who to approach is half the battle. In Alberta, you have several options, each with varying appetites for risk.

Traditional Banks in Alberta: The High Bar for New Employment (e.g., RBC, TD, BMO in Edmonton)

Major Canadian banks like RBC, TD, and BMO, with numerous branches across Edmonton and Calgary, are known for their stringent lending criteria. They typically prefer borrowers with established credit histories and consistent, verifiable employment (usually 3-6 months of pay stubs). For someone with a contingent job offer, they represent the highest bar. While not impossible, securing a loan from a traditional bank in this scenario often requires:

- An excellent credit score.

- A substantial down payment.

- A co-signer with impeccable credit and stable income.

- A very clear, well-detailed offer letter with a high salary.

Their approval process can also be slower, which might be an issue given your job's urgency. If you have an existing banking relationship, start there, but be prepared for potential pushback.

Credit Unions: Your Local Advantage in Edmonton and Beyond (e.g., Servus Credit Union, ATB Financial)

Credit unions, such as Servus Credit Union (Alberta's largest) or ATB Financial (Alberta's provincial bank), often offer more flexibility than traditional banks. Because they are member-owned and community-focused, they may be more willing to consider unique financial situations on a case-by-case basis. They often take a more holistic view of your financial picture rather than relying solely on rigid algorithms.

Approaching a credit union in Edmonton or your specific Alberta community could yield better results. They might be more receptive to your offer letter as proof of future income, especially if you have an existing relationship with them. Their local presence means they understand the regional job market and specific needs of Albertans.

Dealership Financing: The Fast Lane (But Mind the Turns)

Financing directly through a car dealership can be one of the fastest routes to approval, especially when time is of the essence. Dealerships often have relationships with a wide network of lenders, including traditional banks, credit unions, and specialized finance companies, all competing for your business. This means they can often find a lender willing to approve unique situations like yours.

Pros:

- Convenience: One-stop shop for car selection and financing.

- Speed: Often quicker approval times.

- Flexibility: Access to lenders who specialize in non-traditional approvals.

Cons:

- Interest Rates: Depending on the lender, rates might be higher for higher-risk profiles.

- Pressure: Sales teams might push for certain add-ons or more expensive vehicles.

Distinguish between in-house financing (where the dealership itself is the lender) and brokered loans (where the dealership acts as an intermediary). In-house options might be more lenient but can come with higher rates. Always compare offers.

Specialized Online Lenders: A Digital Lifeline for Unique Circumstances

Online lenders have carved out a niche by serving borrowers who don't fit traditional lending models. They often use alternative data points and more flexible underwriting criteria, making them a potential lifeline for someone with a contingent job offer. These lenders are often more accustomed to dealing with proof of income that isn't a stack of pay stubs, such as offer letters or bank statements.

Pros:

- Accessibility: Apply from anywhere, often with quick pre-approvals.

- Flexibility: More open to unique income situations.

Cons:

- Higher Interest Rates: Due to the increased risk, rates can be significantly higher than traditional lenders.

- Reputation: Always research their reputation and read reviews carefully.

While they can be a solution, carefully weigh the interest rates and terms. Use them as a strong option if traditional routes prove difficult.

Every "hard inquiry" on your credit report can slightly lower your score. Applying to multiple lenders simultaneously can negatively impact your credit. Instead, consider these strategies:

- Pre-Approval/Soft Inquiries: Many online lenders and some dealerships offer pre-approvals that use a "soft inquiry," which doesn't affect your score. Use these to gauge your eligibility before committing to a full application.

- Targeted Applications: Based on your research (and perhaps a soft inquiry), apply to 2-3 lenders most likely to approve you.

- Dealership's Network: Let a reputable dealership, like SkipCarDealer.com, leverage their network of lenders on your behalf. They can often find the best fit with minimal impact on your credit.

Maximizing Your Approval Odds: Beyond Just a Good Job Offer

While your contingent job offer is central, it’s not the only factor. Several other elements can significantly strengthen your application and increase your chances of car loan approval in 2026, even with a new job on the horizon.

Your Credit Score: The Silent Partner in Your Loan Application

Your credit score is a numerical representation of your creditworthiness. It's the silent partner that speaks volumes to lenders. A higher score indicates a lower risk, potentially unlocking better interest rates and terms. For individuals with a new job offer and no recent pay stubs, a strong credit score becomes even more critical, acting as a compensatory factor for the lack of employment history.

How it's calculated:

- Payment History (35%): Your record of on-time payments.

- Amounts Owed (30%): How much debt you carry relative to your credit limits.

- Length of Credit History (15%): How long you've had credit accounts open.

- New Credit (10%): Recent applications for credit.

- Credit Mix (10%): The types of credit you have (e.g., credit cards, lines of credit, loans).

Steps to improve it quickly (if needed):

- Pay down existing credit card balances.

- Ensure all bills are paid on time.

- Check your credit report for errors and dispute any inaccuracies.

A good credit score can make a significant difference. If you're concerned about your credit, especially after a financial event, understanding your options is key. For more insights, consider reading Your Totaled Car Doesn't Care About Your Credit Score. We Do, Edmonton.

The Power of a Down Payment: Showing Lenders You're Invested

A substantial down payment is one of the most effective ways to reduce lender risk and significantly improve your approval odds. When you put money down, you're immediately reducing the amount you need to borrow, which lowers the lender's exposure. It also shows that you are financially invested in the purchase, making you a more reliable borrower.

- Reduced Loan Amount: Less money borrowed means lower monthly payments and less interest over the loan term.

- Increased Equity: You start with equity in the vehicle, reducing the risk of being "underwater" (owing more than the car is worth).

- Lender Confidence: A down payment signals financial stability and commitment.

Even 10-20% of the vehicle's price can be a game-changer, especially when your employment history is nascent.

The Co-Signer Advantage: When a Second Signature Opens Doors

If your credit isn't perfect or your new job offer isn't enough to satisfy lenders, a co-signer can be your secret weapon. A co-signer is someone with strong credit and stable income who agrees to be equally responsible for the loan if you default. This significantly reduces the lender's risk.

- Who makes a good co-signer? Someone with excellent credit, stable employment, and a low debt-to-income ratio (e.g., a parent, spouse, or close family member).

- Responsibilities: Be aware that a co-signer is legally bound to the loan. If you miss payments, it impacts their credit, and they could be held responsible for the entire debt.

A co-signer can be the difference between approval and rejection, and often leads to better interest rates.

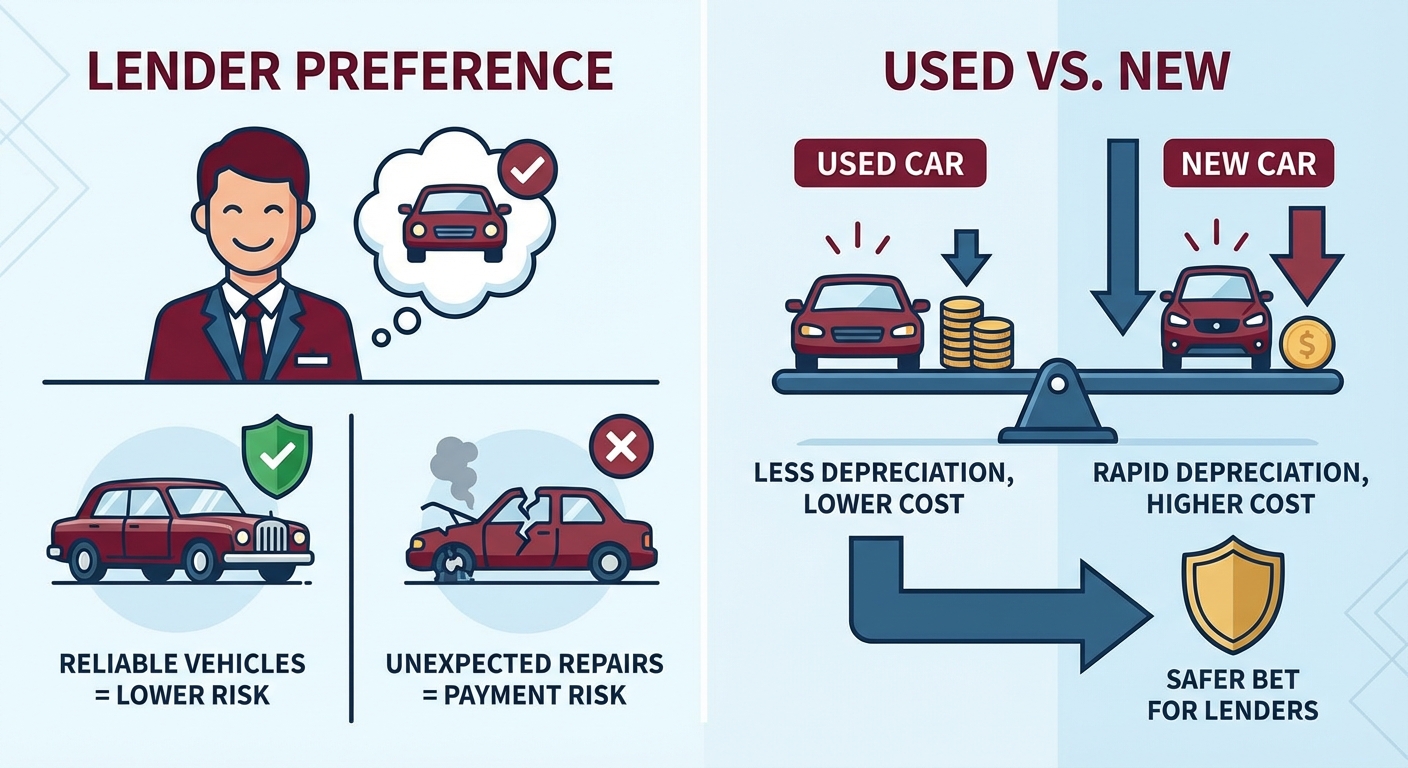

Smart Vehicle Choices: Why a Practical Car Boosts Your Chances

The type of vehicle you choose can also impact your approval. Lenders are more comfortable financing a reliable, affordable used car than an expensive, brand-new luxury SUV, especially for borrowers with unique circumstances. A practical choice demonstrates financial responsibility and reduces the overall risk for the lender.

- Affordable Price Point: Stick to a budget that aligns with your new projected income.

- Reliability: Lenders prefer vehicles that are less likely to break down, as unexpected repair costs can jeopardize your ability to make payments.

- Used vs. New: Used cars typically depreciate less rapidly and are less expensive, making them a safer bet for lenders.

Demystifying Rates, Terms, and Hidden Costs: What to Expect When You're Approved

Getting approved is just the first step. Understanding the financial intricacies of your car loan is crucial to making an informed decision and avoiding unwelcome surprises. This is especially true when you're under pressure to secure a vehicle for a new job.

Understanding Your APR: The True Cost of Borrowing in Alberta

The Annual Percentage Rate (APR) is the true cost of borrowing, encompassing not just the interest rate but also any additional fees or charges rolled into the loan. It's expressed as a yearly percentage. In Alberta, for a borrower with a new job offer and potentially less-than-perfect credit, you should expect a higher APR than someone with a long, stable employment history and excellent credit.

Example APR Ranges (2026 Context):

| Credit Profile | Typical APR Range (New Job Offer) | Example Monthly Payment (on $25,000 over 60 months) |

|---|---|---|

| Excellent Credit (760+) | 6.99% - 8.99% | $495 - $520 |

| Good Credit (660-759) | 9.99% - 14.99% | $530 - $595 |

| Fair/Subprime Credit (580-659) | 15.99% - 24.99% | $605 - $730 |

| Challenged Credit (Below 580) | 25.99% - 39.99%* | $740 - $970 |

*Note: While higher rates are possible for challenged credit, some provincial regulations may cap the maximum allowable APR. Always verify with the lender.

Loan Terms: Finding the Sweet Spot Between Monthly Payments and Total Cost

The loan term is the length of time you have to repay the loan. Common terms range from 36 to 84 months. While a longer term means lower monthly payments, it also means you'll pay more in total interest over the life of the loan. A shorter term results in higher monthly payments but significantly less overall interest paid.

Trade-offs:

- Longer Term (e.g., 72-84 months): Lower monthly payments, but higher total interest paid. Can make an otherwise unaffordable car more accessible.

- Shorter Term (e.g., 36-60 months): Higher monthly payments, but significantly lower total interest paid. You own the car outright faster.

Consider your budget carefully. While a longer term might seem appealing for a lower monthly payment, calculate the total cost to ensure you're making a financially sound decision for your new life in Edmonton.

Beyond the Sticker Price: Unmasking Hidden Fees and Charges

The quoted price of the car and the interest rate aren't the only costs. Be vigilant for hidden fees and charges that can inflate your loan amount and total cost:

- Administrative/Documentation Fees: Fees charged by the dealership for processing paperwork (can range from $200-$800+ in Alberta).

- PPSA Lien Registration Fee: Personal Property Security Act registration, a provincial fee to register the loan against the vehicle (typically $10-$20).

- Tire Recycling Fee: A provincial environmental fee for new tires.

- Extended Warranties/Service Contracts: Often aggressively pushed. Understand if it's truly necessary and compare its cost/benefits.

- Credit Life/Disability Insurance: Optional insurance that pays off your loan in case of death or disability. While it offers protection, it adds to your monthly payment and total cost.

Always ask for a detailed breakdown of all costs and scrutinize the final loan agreement before signing.

Insurance Imperatives: Protecting Your Investment (and Meeting Lender Requirements)

In Alberta, as with the rest of Canada, vehicle insurance is mandatory. Lenders will also require you to carry specific types of coverage to protect their investment (the car). This typically includes collision and comprehensive coverage, which protects against damage to the vehicle itself, regardless of fault.

- Mandatory Coverage: Third-party liability, accident benefits, direct compensation for property damage (in Alberta).

- Lender Requirements: Collision and Comprehensive coverage, often with specific deductible limits.

Obtain insurance quotes before finalizing your car purchase to understand the full cost of ownership. Premiums can vary significantly based on your driving history, the vehicle type, and your Edmonton neighbourhood.

Even when you're under pressure with a contingent job offer, remember that everything is negotiable. Don't be afraid to:

- Shop Around: Get quotes from multiple lenders (dealerships, credit unions, online lenders) to compare interest rates and terms.

- Negotiate Fees: Ask for administrative or documentation fees to be reduced or waived.

- Decline Add-ons: Politely decline extended warranties or other optional insurance if you don't need them or can get them cheaper elsewhere.

- Leverage Your Down Payment/Co-Signer: Remind the lender of these strengths to argue for a better rate.

The Edmonton & Alberta Edge: Local Considerations for Your Car Loan Journey

Securing a car loan in Alberta, particularly for an Edmonton job, comes with unique local considerations. Understanding these can give you a significant advantage.

Edmonton's Automotive Market: Finding Your Wheels Locally

Edmonton boasts a robust automotive market with numerous dealerships catering to all budgets. From the bustling "Auto Row" on Gateway Boulevard to dealerships scattered throughout the city, you'll find a wide selection of new and used vehicles. Popular choices often include SUVs and trucks, given Alberta's rugged terrain and winter conditions. Research local dealerships, read reviews, and compare prices. Seasonal buying trends can also affect prices; for instance, you might find better deals on cars in late fall or winter as dealerships clear inventory.

Alberta Insurance Regulations: What You Need to Know Before You Drive

Alberta has a private auto insurance system, meaning you purchase coverage from private companies (unlike some other provinces). Key things to know:

- Mandatory Coverage: All drivers must have third-party liability, accident benefits, and direct compensation for property damage.

- Factors Influencing Premiums: Your driving record, age, gender, type of vehicle, where you live in Edmonton, and even where you park your car can impact your rates. For instance, premiums might differ between a downtown Edmonton resident and someone in a suburban area.

- No-Fault System: Alberta operates under a "no-fault" system for accident benefits, meaning you deal with your own insurer for medical and rehabilitation costs, regardless of who caused the accident.

Get multiple quotes from different providers to ensure you're getting competitive rates. This is a significant ongoing cost of vehicle ownership.

Navigating Winter Roads: Why Vehicle Reliability Matters More in Alberta

Edmonton's winters are legendary. Extreme cold, heavy snowfall, and icy roads are standard for several months of the year. This makes vehicle reliability not just a convenience, but a critical safety factor. Lenders understand this, and opting for a vehicle known for its reliability and winter performance (e.g., all-wheel drive, good ground clearance, strong heating) can indirectly boost your application's appeal.

Consider:

- Winter Tires: A non-negotiable safety feature, though not always included in the car price.

- Block Heater: Essential for starting your car in sub-zero temperatures.

- Rust Protection: Salted roads can accelerate corrosion.

Prioritizing a vehicle that can safely and reliably get you to your new job, even in the worst weather, is a smart decision for both you and your lender.

Public Transit as a Stop-Gap? The Edmonton Transit System (ETS) Realities

While Edmonton has the Edmonton Transit System (ETS) with bus and LRT services, relying on it as a long-term solution, especially for a job with vehicle contingency, is often unrealistic. ETS provides good coverage in core areas, but suburban routes can be less frequent, and travel times can be extensive, particularly during off-peak hours or for jobs located outside main transit corridors. For many job requirements, especially those involving travel across the city or outside standard business hours, public transit simply won't cut it. This reinforces the urgency of securing your car loan.

Pro Tip: Leveraging Local Dealership Relationships for Faster Approval

Dealerships like SkipCarDealer.com in Edmonton have established relationships with a network of local and national lenders. These relationships can be invaluable when you have a unique situation like a contingent job offer. Lenders who frequently work with specific dealerships may be more familiar with their processes and more inclined to approve applicants referred by them. Explain your situation clearly to the dealership's finance manager; they are often your best advocate in finding a lender willing to say "yes."

Your Drive Ahead: Securing Your Ride, Securing Your Future

The journey from receiving an exciting job offer to confidently driving to your new workplace in Edmonton, especially when vehicle ownership is a contingency, can feel daunting. But with the right strategy, preparation, and understanding of the lending landscape, it's a completely achievable goal.

From Offer Letter to On-Ramp: The Final Steps to Ownership

You've gathered your documents, understood the lender's perspective, navigated the application process, and hopefully, secured approval. The final steps involve finalizing the purchase, arranging insurance, and getting your vehicle registered in Alberta. Remember to double-check all paperwork, ensure all fees are understood, and confirm your insurance is active before you drive off the lot. This comprehensive approach ensures a smooth transition from your offer letter to hitting the Edmonton on-ramp, ready for your new career.

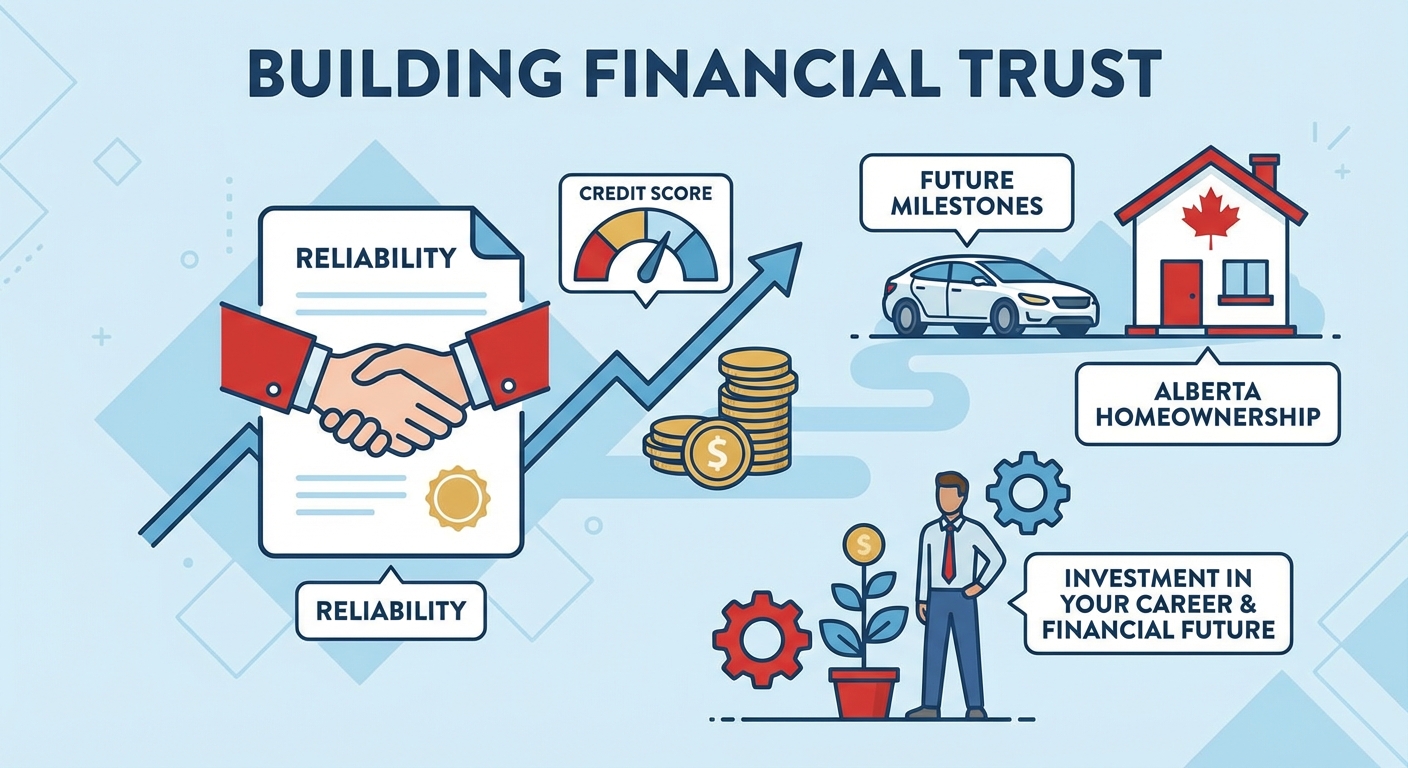

Building Financial Momentum: How This Loan Sets You Up for Success

Securing this car loan isn't just about getting a vehicle; it's about fulfilling a critical job requirement and establishing positive financial momentum. By successfully managing this loan, you'll build or improve your credit history, demonstrating reliability to future lenders. This initial step can pave the way for other significant financial milestones, from future vehicle upgrades to homeownership in Alberta. It's an investment in your career and your financial future.