Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers

Table of Contents

- Key Takeaways

- Understanding the Alberta Car Loan Landscape

- The RBC Newcomer Program: A Benchmark

- The Anatomy of a 'Newcomer' Car Loan

- Eligibility Criteria: What You Need Before You Apply

- Permanent Residents (PR) vs. Work Permit Holders

- The 'No Canadian Credit' Workaround

- Step-by-Step Strategy to Secure the Best Rates

- Step 1: The Pre-Approval Phase

- Step 2: Documentation Excellence

- Step 3: The Strategic Down Payment

- Step 4: Selecting the Right Vehicle

- Approval Secrets: The 'Hidden' Factors Dealerships Don't Mention

- Secret 1: The 'Soft Pull' Strategy

- Secret 2: The Co-signer Advantage

- Secret 3: Gap Insurance

- The Alberta Advantage: Regional Nuances

- The 'No PST' Benefit

- Avoiding the Newcomer 'Trap': Predatory Lending

- Total Cost of Ownership in Alberta

- Frequently Asked Questions (FAQ)

- Can I get a car loan with a 0% down payment as a newcomer?

- How long do I need to be in Alberta before I can apply for a loan?

- Does my international driving record affect my loan rate?

- Can I refinance my newcomer car loan once I build credit history?

- What happens to my loan if I decide to leave Canada?

- Driving Your Future in Alberta

Stepping off the plane at YYC in Calgary or YEG in Edmonton is the beginning of a massive adventure. You’ve got your papers, your ambition, and perhaps a few suitcases. But very quickly, the reality of life in Wild Rose Country sets in: Alberta is vast. Whether you are commuting from Airdrie to a downtown Calgary office, heading to a site in Fort McMurray, or simply trying to get groceries in a suburban Edmonton neighborhood during a -30°C cold snap, a reliable vehicle isn't a luxury—it’s a lifeline.

For many newcomers, the first major hurdle is the "Credit Catch-22." You need a car to get to a good job, but you need a Canadian credit history to get a car loan. Traditional banks often look at a thin credit file and see risk, leading to sky-high interest rates or outright rejections. This guide is designed to blow those doors wide open. We aren't just looking for "any" loan; we are looking for the absolute best rates available in the Alberta market today, leveraging provincial advantages that most national guides completely overlook.

Key Takeaways

- Specialized Newcomer Programs: Major banks like RBC and Scotiabank, along with Alberta credit unions (ATB, Servus), have specific programs that ignore a lack of Canadian credit history if you have the right residency status.

- The 10-20% Rule: A down payment in this range is the single most effective way to drop your interest rate by 2-4 percentage points.

- Alberta’s "No PST" Advantage: Buying in Alberta saves you 5-8% compared to other provinces, meaning you borrow less and pay less interest over time.

- Work Permit Alignment: If you are on a work permit, your loan term must usually end before your permit expires. Planning for this prevents last-minute approval denials.

- Total Cost of Ownership: Always factor in "The Winter Tax"—winter tires and block heaters are non-negotiable for Alberta survival and should be considered in your total budget.

Understanding the Alberta Car Loan Landscape

Alberta’s economy operates differently than the rest of Canada. Our reliance on sectors like Oil & Gas, Agriculture, and a booming Tech scene creates a unique lending environment. Because incomes in Alberta are historically higher than the national average, lenders are often more aggressive in competing for your business, even if you are a newcomer. They know that a newcomer working as an engineer in the oil patch or a nurse in an Edmonton hospital is a "high-potential" client, even if their Canadian credit score is currently zero.

In Alberta, you have two main paths: The "Big Five" national banks and the provincial powerhouses. While RBC and TD have massive newcomer packages, Alberta-specific institutions like ATB Financial (owned by the province) and Servus Credit Union often have a more nuanced understanding of the local job market. They might be more willing to look at your international professional credentials or your specific Alberta employment contract than a national lender sitting in a Toronto skyscraper.

When shopping for a loan in Calgary or Edmonton, dealerships will often quote you a "monthly payment" that sounds affordable. Ignore it. Always ask for the APR (Annual Percentage Rate). The APR includes the interest plus any mandatory fees. A "low" monthly payment spread over 96 months can actually cost you double the car's value in interest. Always compare APR to APR.

The RBC Newcomer Program: A Benchmark

One of the most popular routes for newcomers in Alberta is the RBC Newcomer Automotive Loan. They currently offer terms up to 96 months with loan amounts reaching as high as $75,000 for those who qualify. The beauty of this program is that it is specifically designed for Permanent Residents and workers who have been in Canada for less than three years. They look at your "potential" rather than your "past," which is exactly what a newcomer needs.

The Anatomy of a 'Newcomer' Car Loan

Why do lenders even give loans to people with no credit? It’s simple: data. Lenders have found that newcomers to Canada are statistically some of the most reliable borrowers. You’ve moved across the world to build a life; you aren't likely to ruin your future over a car payment. However, because there is no "score" to verify this, the loan is structured differently.

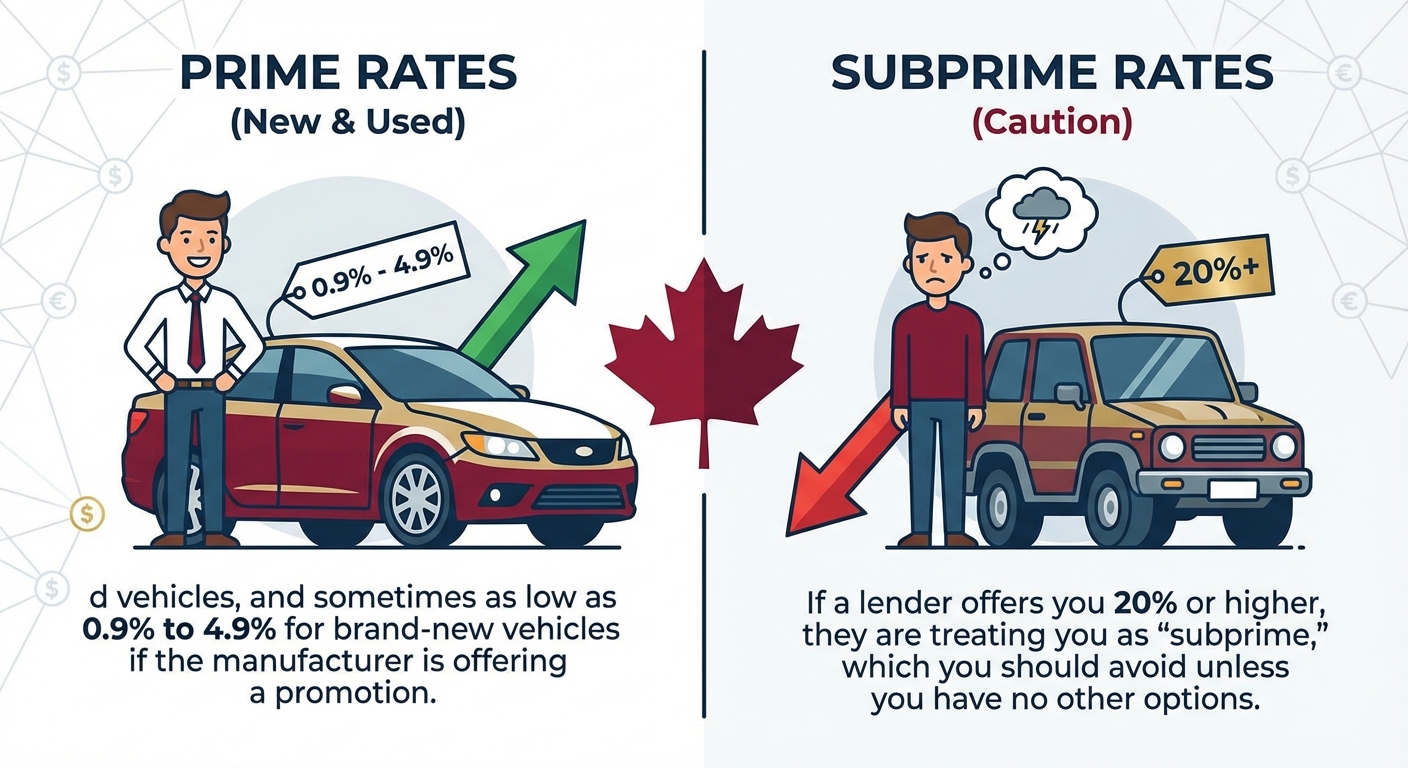

Interest rates for newcomers in the current Alberta market generally range from 7.99% to 12.99% for used vehicles, and sometimes as low as 0.9% to 4.9% for brand-new vehicles if the manufacturer is offering a promotion. If a lender offers you 20% or higher, they are treating you as "subprime," which you should avoid unless you have no other options.

The table below illustrates how the length of your loan (the "term") impacts the total amount of money you leave on the table in interest. While a 96-month loan makes the monthly payment small, the total interest paid is staggering.

| Loan Amount | APR | Term (Months) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| $30,000 | 8.99% | 48 | $746.50 | $5,832.00 |

| $30,000 | 8.99% | 60 | $622.50 | $7,350.00 |

| $30,000 | 8.99% | 72 | $540.30 | $8,901.60 |

| $30,000 | 8.99% | 96 | $439.10 | $12,153.60 |

As you can see, jumping from a 48-month term to a 96-month term more than doubles the interest you pay. For a newcomer, staying in the 60-month range is often the "sweet spot" for balancing affordability with long-term financial health.

Eligibility Criteria: What You Need Before You Apply

Don't walk into a dealership or a bank without your paperwork in order. Alberta lenders are methodical. They want to see that you are legally allowed to be here and that you have the means to pay them back. Your status in Canada dictates your loan options more than almost any other factor.

Permanent Residents (PR) vs. Work Permit Holders

If you have your PR card, you are viewed almost exactly like a Canadian citizen, just with a shorter credit history. You can access the longest loan terms and the highest loan amounts. However, if you are on a Work Permit, there is a hard rule: Your loan term cannot exceed the expiry date of your work permit.

If you have 24 months left on your permit, the bank will not give you a 60-month loan. This means your monthly payments will be very high because you have to pay the car off quickly. If you find yourself in this situation, you should look for a less expensive, reliable used vehicle rather than a brand-new SUV.

If you just started your job last week, most banks will hesitate. However, if you have a "Letter of Offer" that is non-conditional and states your annual salary, many Alberta lenders will accept this as proof of income. Ensure the letter is on company letterhead and signed by HR.

The 'No Canadian Credit' Workaround

Did you know some lenders will look at your international credit history? While it isn't common for "standard" loans, specialized newcomer departments at the Big Five banks can sometimes use reports from countries like the US, UK, or Australia. Additionally, showing a history of timely rent payments in Alberta or a utility bill in your name can act as "alternative data" to prove your reliability.

Step-by-Step Strategy to Secure the Best Rates

Getting a great rate isn't about luck; it's about positioning yourself as the ideal borrower. Follow these steps to ensure you don't overpay.

Step 1: The Pre-Approval Phase

Never let the dealership be the first place you talk about money. Visit your bank or a credit union first. Get a written pre-approval. This gives you a "ceiling" for your interest rate. When you eventually go to the dealer, if they offer you 10% interest but you have a pre-approval for 8%, you can force them to beat the bank's rate. Dealerships have access to "wholesale" lending rates and can often shave a point or two off if they know they are competing.

Step 2: Documentation Excellence

Create a "Loan Passport" folder. Include:

- Your PR Card or Work Permit.

- Your Alberta Driver’s License (get this as soon as you land!).

- Two most recent pay stubs.

- A copy of your employment contract.

- A utility bill or lease agreement showing your Alberta address.

Having this ready makes you look organized and stable, which subconsciously influences the loan officer's decision.

Step 3: The Strategic Down Payment

In the world of lending, "Skin in the game" matters. If you buy a $30,000 car with $0 down, the bank owns 100% of the risk. If the car loses value (depreciation) and you stop paying, the bank loses money. If you put $6,000 (20%) down, the bank only has $24,000 at risk. This lower "Loan-to-Value" ratio almost always triggers a lower interest rate tier. For newcomers, 10% is the minimum you should aim for, but 20% is the magic number for the best rates.

Step 4: Selecting the Right Vehicle

Interest rates are generally lower on new cars than on used cars. This is because manufacturers (like Toyota, Honda, or Ford) "subsidize" the interest rates to move inventory. You might find a brand-new car at 3.9% interest, while a 3-year-old used version of the same car costs 8.9% at the bank. Sometimes, the lower interest rate on a new car makes the monthly payment nearly identical to a cheaper used car.

Approval Secrets: The 'Hidden' Factors Dealerships Don't Mention

There are mechanics to the car business that happen behind the scenes. Knowing these can save you thousands.

Secret 1: The 'Soft Pull' Strategy

Every time a lender checks your credit, your score can drop a few points. If you visit five different dealerships and they all "run your credit," you could damage your brand-new Canadian credit score before it even has a chance to grow. Ask the dealer if they can do a "soft pull" or a "pre-qualification" first. This gives them an idea of your eligibility without a hard inquiry on your credit report.

Secret 2: The Co-signer Advantage

If you have a relative or a very close friend who has been in Alberta for several years and has a strong credit score, they can co-sign the loan. This means the bank uses *their* credit score to determine the interest rate. Warning: If you miss a payment, it ruins their credit too. Only do this with someone you trust implicitly and if you are 100% sure of your job stability.

Dealership managers in Calgary and Edmonton have targets to hit every month, but the quarterly targets (March, June, September, December) are the most intense. If you shop for a car in the last three days of these months, the dealership is much more likely to "buy down" your interest rate or trim their profit margin just to get the unit off the lot.

Secret 3: Gap Insurance

Alberta is the truck capital of the world, and vehicles are expensive. If you take a 7-year (84-month) loan on a vehicle and it gets totaled in an accident in year two, you will likely owe the bank more than the insurance company will pay you. This is called being "underwater." Gap insurance covers that difference. For newcomers with small down payments, this is a vital safety net.

The Alberta Advantage: Regional Nuances

Where you live in Alberta actually changes your vehicle needs and, by extension, your loan. In Calgary and Edmonton, the market is saturated with SUVs and sedans. Competition is fierce, and rates are standard. However, if you move to rural Alberta—places like Red Deer, Lethbridge, or Grande Prairie—the demand for "Work Trucks" (F-150s, RAM 1500s) is astronomical.

Lenders in these areas are very comfortable financing high-value trucks because they know the resale value remains high in the Alberta market. If you are a newcomer moving for a job in the trades, don't be afraid to look at specialized "truck centers" which may have better lending connections for those specific vehicles.

The 'No PST' Benefit

This cannot be overstated. In Ontario, you pay 13% HST. In BC, you pay up to 12% in combined tax. In Alberta, you pay 5% GST. On a $40,000 car, you are saving roughly $3,200 just by being in Alberta. This means your total loan amount is lower, which lowers your monthly payment and the total interest you’ll pay over the life of the loan. It is one of the single biggest financial advantages for newcomers in this province.

Avoiding the Newcomer 'Trap': Predatory Lending

When you are frustrated by a bank rejection, you might see signs that say "100% Approval!" or "No Credit? No Problem!" Be very careful. These are often "Buy Here, Pay Here" lots. They act as the lender themselves, and they often charge interest rates of 25% to 30%.

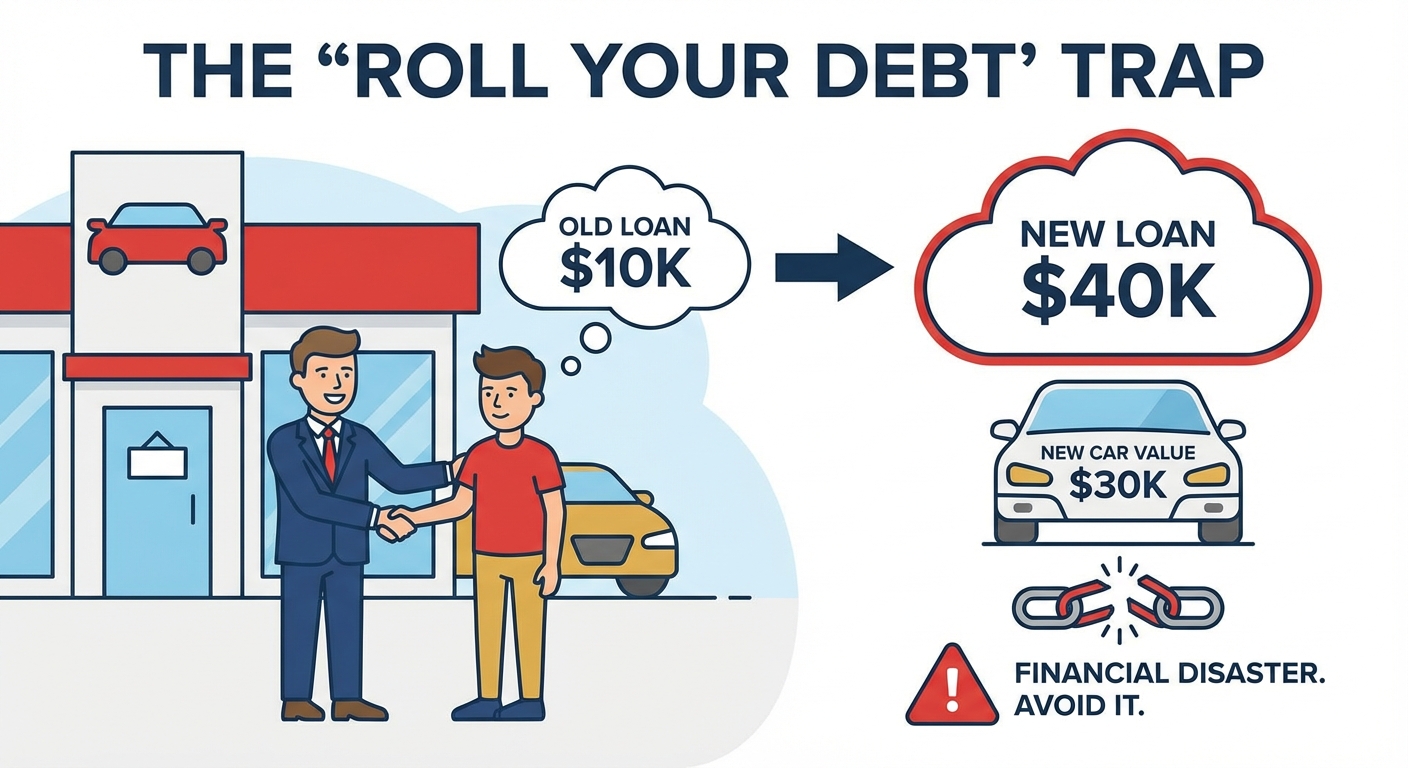

Another trap is "Negative Equity." This happens when a dealer offers to "pay off your old loan" or "roll your debt" into a new car. You end up borrowing $40,000 for a car that is only worth $30,000. For a newcomer trying to build a financial foundation, this is a disaster. Avoid it at all costs.

| Red Flag | Why It's Dangerous | What to Do Instead |

|---|---|---|

| Weekly Payments | Makes a high interest rate look small ($150/week sounds better than $650/month). | Calculate the monthly and annual total. |

| Pre-payment Penalties | Prevents you from refinancing when your credit score improves. | Only sign "Open-Ended" loans. |

| Mandatory Add-ons | Etching, fabric protection, or nitrogen tires added to the loan principal. | Refuse these; they are pure profit for the dealer. |

Total Cost of Ownership in Alberta

Securing the loan is only half the battle. You need to budget for the reality of Alberta driving. Our climate is extreme, and it affects your wallet.

- Private Insurance: Unlike BC or Saskatchewan, Alberta has a private insurance market. As a newcomer, you have no Canadian driving history. Expect your insurance to be high—potentially $200 to $400 per month. Some companies will give you credit for your driving years in your home country if you provide a "Claims Experience Letter" from your previous insurer.

- The Winter Tax: You must have winter tires. All-season tires turn into hockey pucks at -20°C. A good set of tires on rims will cost $1,000 to $1,500. Also, ensure your car has a block heater installed (standard in Alberta, but check if you’re buying a car brought in from BC or Ontario).

- Maintenance: The extreme temperature fluctuations (-40°C in winter to +30°C in summer) are hard on batteries, fluids, and suspension. Budget for more frequent oil changes and battery checks.

Frequently Asked Questions (FAQ)

Can I get a car loan with a 0% down payment as a newcomer?

While it is technically possible through some "No Credit" programs, it is rarely advisable. Without a down payment, your interest rate will be significantly higher, and you will immediately be "upside down" on the loan (owing more than the car is worth). Aiming for at least 10% down is the secret to getting a competitive rate.

How long do I need to be in Alberta before I can apply for a loan?

There is no legal waiting period. You can apply the day you arrive if you have a Permanent Resident card and a signed employment contract. However, having 3-6 months of Alberta bank statements showing your salary deposits will make the process much smoother and potentially land you a better rate.

Does my international driving record affect my loan rate?

No, your driving record does not affect your car loan interest rate. The lender only cares about your creditworthiness and income. However, your driving record will heavily influence your insurance premiums, which you must have to drive the car off the lot.

Can I refinance my newcomer car loan once I build credit history?

Yes! This is a brilliant strategy. Many newcomers take a loan at 10% interest, pay it perfectly for 12 to 18 months to build their Canadian credit score, and then refinance with a major bank at a much lower rate (like 5% or 6%). Just ensure your initial loan has no "pre-payment penalties."

What happens to my loan if I decide to leave Canada?

A car loan is a legal contract. If you leave Canada, you are still responsible for the debt. You would typically sell the car, use the proceeds to pay off the loan balance, and pay the difference if the car's value is less than what you owe. If you simply abandon the car, it will destroy your Canadian credit score, making it nearly impossible to return or get a visa in the future.

Driving Your Future in Alberta

Securing a car loan as a newcomer in Alberta doesn't have to be a source of stress. By understanding that lenders in this province see you as a "high-potential" resident rather than a risk, you can negotiate from a position of strength. Focus on the APR, bring a solid down payment, and keep your documentation organized.

Your first car loan is more than just a way to get from Calgary to the Rocky Mountains; it is the foundation of your Canadian credit legacy. Every on-time payment you make is a brick in the wall of your financial future, leading to lower mortgage rates and better credit cards down the road. Welcome to Alberta—now let's get you on the road.