Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

Table of Contents

- Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

- Key Takeaways

- The Toronto Driver's Dilemma: Navigating an Underwater Car Loan

- Unmasking the 'Underwater' Phenomenon: Why Your Car Loan Might Be Drowning in Ontario

- The Lifeline: How Refinancing Rescues Your Underwater Car Loan in Toronto

- Pro Tip

- Beyond the Basics: The Strategic Advantages of Refinancing When You're Underwater

- The Eligibility Checklist: Are You Ready to Surface in Ontario?

- Pro Tip

- Navigating the Toronto Lender Landscape: Banks, Dealerships, and Digital Options

- Traditional Banks & Credit Unions

- Dealership Refinancing Programs

- Online Lenders & Loan Aggregators

- Pro Tip

- The Fine Print & Potential Pitfalls: What Toronto Borrowers Must Watch Out For

- Pro Tip

- Beyond Refinancing: Alternative Strategies for an Underwater Car Loan in Ontario

- Future-Proofing Your Car Ownership: How to Avoid Drowning Again

- Pro Tip

- Your Next Steps to Approval: A Toronto Action Plan

- Frequently Asked Questions (FAQ) for Toronto Car Owners

Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

Key Takeaways

- An 'underwater' car loan (negative equity) is common, especially in dynamic markets like Toronto, but it's not a dead end.

- Refinancing can be a powerful tool to regain financial control, even when you owe more than your car is worth.

- Understanding your options and the diverse lender landscape in Ontario is crucial for a successful refinance.

The Toronto Driver's Dilemma: Navigating an Underwater Car Loan

Picture this: you're navigating the always-challenging DVP or Gardiner Expressway, and just like the traffic, your car loan feels like it's going nowhere fast. Worse yet, you suspect you owe more on your vehicle than it's actually worth. Sound familiar? You're not alone. For many car owners in Toronto and the wider Greater Toronto Area (GTA), finding yourself with an "underwater" car loan, also known as negative equity, is a frustratingly common reality.

The stress of realizing your vehicle's value has dipped below your outstanding loan balance can be overwhelming. It can feel like being trapped, with limited options and a financial burden that only seems to grow. Whether it's the rapid depreciation inherent in the automotive market, an initial purchase with a high interest rate, or an unexpected change in your personal finances, negative equity can cast a long shadow over your monthly budget. But here’s the crucial point: an underwater car loan is not a dead end. In fact, it's a financial challenge that many Toronto drivers successfully overcome, often through a strategic move like refinancing. Understanding this common dilemma is the first step towards finding your way back to solid ground.

Unmasking the 'Underwater' Phenomenon: Why Your Car Loan Might Be Drowning in Ontario

What exactly does it mean to have an "underwater" car loan, and why is this phenomenon so prevalent, especially for drivers across Ontario? Simply put, your car loan is underwater when the outstanding balance you owe to your lender is greater than your vehicle's current market value. This situation is technically referred to as negative equity. It’s like having a mortgage on a house that's worth less than what you paid for it, but with a rapidly depreciating asset like a car.

Several factors conspire to create this challenging financial scenario. One of the primary culprits is rapid depreciation. From the moment you drive a new car off the lot in Mississauga or Hamilton, its value begins to decline. This initial drop is often the steepest, and if you made a small down payment or financed over a very long term, your loan balance might not decrease as quickly as the car's market value. In Ontario's dynamic market, certain makes and models can depreciate faster due to shifting consumer preferences, new technological advancements, or an influx of similar used vehicles.

Another significant contributor is the initial terms of your loan. If you started with a high interest rate – perhaps due to a challenging credit history at the time of purchase in Ottawa or Kingston – a larger portion of your early payments goes towards interest rather than reducing the principal. This slows down the rate at which you build equity, making it easier for depreciation to outpace your payments. Additionally, extending your loan term to achieve lower monthly payments can also exacerbate negative equity. While a seven or eight-year loan might seem manageable on a month-to-month basis, it significantly prolongs the period during which your vehicle's value will likely fall below your outstanding debt. Unforeseen circumstances, such as an accident that lowers your car's resale value or a sudden need to sell the vehicle earlier than planned, can also leave you underwater.

Understanding these mechanics is crucial to grasping why refinancing a car loan when you owe more than it's worth isn't just possible, but often a smart financial manoeuvre.

The Lifeline: How Refinancing Rescues Your Underwater Car Loan in Toronto

So, you're underwater. Now what? The good news is that refinancing offers a powerful lifeline to help you surface. When you refinance a car loan with negative equity, the process is designed to consolidate your current debt into a new, more manageable loan. How does this magic happen?

Essentially, a new lender agrees to pay off your existing loan, including the portion that represents your negative equity. This outstanding negative balance is then "rolled into" or bundled with your new loan. While this means your new loan amount will be slightly higher than your car's current value, the goal is to secure terms that make this new, larger loan more affordable and sustainable for you. The primary ways refinancing achieves this are by:

- Lowering Your Interest Rate: If your credit score has improved since you first purchased your car, or if market rates have dropped, a new lender might offer you a significantly lower interest rate. A lower rate means less money paid in interest over the life of the loan, freeing up more of your payment to go towards the principal.

- Reducing Your Monthly Payments: This can be achieved through a lower interest rate or by extending the loan term. While extending the term means you'll pay more interest overall (a potential pitfall we'll discuss later), it can provide immediate relief by making your monthly budget more manageable.

- Optimizing Loan Terms: Perhaps your original loan had unfavourable clauses, or you simply want a shorter term to pay off the debt quicker now that your financial situation has improved. Refinancing allows you to negotiate new terms that better align with your current financial goals.

For a Toronto car owner, this could mean reducing your monthly payment by hundreds of dollars, making it easier to cover the city's high cost of living, from rent to groceries. Or, it could mean escaping a predatory high-interest loan that's been draining your finances since you bought your car in Scarborough. The key is that the new loan structure is designed to be a better fit for your financial present, even if it incorporates that pesky negative equity from the past.

Pro Tip

Before approaching any lender, obtain your precise current loan payoff amount and an independent, accurate valuation of your vehicle (e.g., using Canadian Black Book or a reputable local appraiser in Toronto). This upfront knowledge gives you leverage and helps you understand exactly what you're dealing with.

Beyond the Basics: The Strategic Advantages of Refinancing When You're Underwater

While the immediate appeal of lower monthly payments or a reduced interest rate is undeniable, the strategic advantages of refinancing an underwater car loan extend far beyond simple cost savings. For a Toronto resident juggling various expenses, these broader benefits can significantly impact long-term financial health and peace of mind.

- Regaining Financial Breathing Room: Let’s be honest, Toronto is an expensive city. Reducing your car payment can free up critical funds each month, allowing you to allocate money towards other essential expenses, savings, or even tackling higher-interest debts like credit cards. This immediate relief can transform a tight budget into a manageable one, reducing daily financial stress.

- Optimizing Interest Rates in Today's Market: Interest rates fluctuate. If you took out your original loan when rates were higher, or if your credit score has improved since then, refinancing allows you to tap into more favourable current market rates. This isn't just about saving a few dollars; over the life of the loan, even a percentage point difference can save you hundreds, if not thousands, of dollars.

- Improving Long-Term Credit Health: Successfully managing a new, more affordable loan can have a positive ripple effect on your credit score. Consistent, on-time payments demonstrate financial responsibility, which is key to building a strong credit profile. A better credit score opens doors to better rates on future loans, mortgages, and credit products, impacting your financial future far beyond your car.

- Escaping the Burden of High-Interest Loans: Many car purchases, especially for those with less-than-perfect credit, begin with high-interest loans. Refinancing offers a legitimate pathway out of these expensive agreements. By replacing a high-cost loan with a more competitive one, you stop throwing away money on excessive interest and start paying down your principal more effectively.

Consider the cumulative effect: lower monthly payments mean less stress. A better interest rate means more money in your pocket. An improved credit score means greater financial flexibility down the road. These aren't just minor adjustments; they are strategic moves that empower you to take control of your finances and build a more secure future, a particularly valuable prospect in the competitive financial landscape of Ontario.

The Eligibility Checklist: Are You Ready to Surface in Ontario?

Deciding to refinance is one thing; getting approved, especially when you're underwater, is another. Lenders in Ontario, just like anywhere else, have specific criteria they evaluate. Understanding these requirements is your first step towards a successful application.

First and foremost is your credit score. While a strong credit score (typically 680+) will always yield the best rates and terms, don't despair if yours isn't perfect. Many lenders specialize in helping individuals with fair or even challenging credit histories. The key is to demonstrate improvement since your original loan or to have mitigating factors. For more in-depth information on navigating this, check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit.

Income stability is another critical factor. Lenders want to see that you have a consistent and reliable source of income to make your payments. This doesn't necessarily mean a traditional 9-to-5 job; many lenders are now flexible with self-employment income, gig economy earnings, or even government benefits, provided they are stable and verifiable. Your debt-to-income ratio (DTI) will also be assessed, ensuring that your existing debts aren't consuming too much of your monthly earnings.

The vehicle itself plays a significant role. Lenders typically have age and mileage restrictions. Most prefer vehicles that are less than 7-10 years old and have under 150,000-200,000 kilometres on the odometer. The make and model also matter; certain vehicles hold their value better than others, which makes lenders more comfortable with the collateral, even if you currently have negative equity. If your car is too old or has exceptionally high mileage, it might limit your refinancing options.

It's crucial to understand that approval odds can vary significantly between different lenders in Ontario. A large bank in Toronto might have stricter criteria than a specialized finance company in London, Ontario, or an online lender. This is why shopping around and knowing your financial standing before you apply is paramount.

Pro Tip

Gather all necessary documentation *before* applying: recent pay stubs, proof of residence, current loan statements, and your vehicle's registration. Being prepared streamlines the process and shows lenders you're serious, potentially speeding up approval times.

Navigating the Toronto Lender Landscape: Banks, Dealerships, and Digital Options

When you're ready to refinance your underwater car loan in Toronto, you'll find a diverse landscape of lenders, each with its own advantages and disadvantages. Understanding these options is key to finding the best fit for your unique situation.

Traditional Banks & Credit Unions

Major Canadian banks like RBC, TD, Scotiabank, BMO, and CIBC, along with provincial credit unions such as Meridian Credit Union or Alterna Savings (prominent in Ontario), are often the first stop for many. They offer:

- Pros: Stability, established reputation, and often very competitive interest rates for borrowers with excellent credit. They might also offer a more personalized service if you have an existing relationship with them.

- Cons: Generally stricter eligibility criteria, especially regarding credit scores and vehicle age/mileage. Their approval processes can sometimes be slower, and they may be less flexible when dealing with significant negative equity or challenging credit histories.

Dealership Refinancing Programs

Many local dealerships, including those in Toronto, Vaughan, or Burlington, facilitate refinancing. While they might focus on getting you into a new vehicle, some also offer standalone refinancing options through their network of lending partners.

- Pros: Convenience (often a one-stop shop), potential for trade-in options (though this requires careful consideration when underwater), and access to a variety of lenders through their finance departments. They can sometimes be more flexible if you're also looking to upgrade your vehicle.

- Cons: Limited lender choices compared to independent shopping, and there can be pressure to trade in your current vehicle for a newer, more expensive model, which could potentially worsen your financial situation if not handled wisely.

When considering income verification, especially for self-employed individuals, dealerships and specialized lenders often have more flexible approaches than traditional banks. For more insights on this, you might find our article on Self-Employed Ontario: They Want a Pay Stub? We Want You Driving. helpful.

Online Lenders & Loan Aggregators

The digital realm has opened up a plethora of online lenders and loan aggregators operating across Canada. These platforms specialize in speed and accessibility.

- Pros: Quick application processes, rapid approval times (sometimes within hours), and often a willingness to work with a broader range of credit scores and financial situations, including those with negative equity. They can provide multiple offers from different lenders, allowing for easy comparison.

- Cons: Less personalized service, and it's essential to scrutinize terms and conditions carefully, as some online lenders might charge higher interest rates or fees for the convenience and flexibility they offer.

Here’s a simplified comparison:

| Lender Type | Typical Interest Rates | Flexibility for Negative Equity | Speed of Approval | Customer Service |

|---|---|---|---|---|

| Traditional Banks | Lowest (for top credit) | Lower | Slower | Personalized (existing clients) |

| Credit Unions | Competitive | Moderate | Moderate | Community-focused |

| Dealerships | Variable (via partners) | Moderate | Moderate | Convenient (if buying) |

| Online Lenders | Variable (can be higher) | Higher | Fastest | Less personalized |

Pro Tip

Don't settle for the first offer. Comparison shop across at least 3-5 different lender types. A slight difference in interest rate can save you hundreds, if not thousands, of dollars over the life of the loan. Get quotes from banks, credit unions, and online providers to ensure you're getting the best possible terms.

The Fine Print & Potential Pitfalls: What Toronto Borrowers Must Watch Out For

Refinancing an underwater car loan can be a financial game-changer, but like any significant financial decision, it comes with its own set of potential traps. Being aware of these pitfalls is crucial for Toronto borrowers to ensure they truly improve their situation rather than digging a deeper hole.

One of the most common issues to watch out for is hidden fees. Some lenders might charge origination fees, application fees, or even documentation fees that can inflate the total cost of your new loan. Additionally, your old loan might have early repayment penalties, which could negate some of the savings from a lower interest rate on your new loan. Always ask for a clear breakdown of all costs associated with both closing your old loan and initiating the new one.

The double-edged sword of extending the loan term is another significant consideration. While stretching your payments over a longer period (e.g., from 4 to 6 years) will undoubtedly lower your monthly payment, it almost always means you'll pay more in total interest over the life of the loan. This is a trade-off: immediate cash flow relief versus a higher overall cost. For some, the immediate relief is worth the extra long-term cost, but it's vital to make this decision with full awareness.

Beware of the "new car" trap. Sometimes, in the process of seeking refinancing, you might be encouraged by a dealership to simply trade in your underwater vehicle for a brand-new one. While tempting, this often involves rolling your negative equity into an even larger, new car loan. This can significantly increase your total debt and put you in an even worse financial position down the line, especially if you haven't addressed the underlying issues that led to negative equity in the first place.

Finally, understand the temporary impact of credit inquiries. Each time a lender pulls your credit report for an application, it results in a "hard inquiry," which can temporarily ding your credit score. While multiple inquiries within a short period (typically 14-45 days) for the same type of loan are often grouped and treated as a single inquiry, it's still wise to limit your applications to a few serious contenders rather than applying everywhere indiscriminately.

Pro Tip

Always scrutinize the new loan agreement for any prepayment penalties or unexpected fees. Ensure you understand the total cost of borrowing over the entire new loan term, not just the monthly payment. Don't sign anything until you've read every line and had all your questions answered.

Beyond Refinancing: Alternative Strategies for an Underwater Car Loan in Ontario

While refinancing is a powerful tool, it might not be the immediate or best solution for everyone with an underwater car loan in Ontario. Sometimes, credit scores haven't improved enough, or the vehicle's value is simply too low to make refinancing feasible. In such cases, exploring alternative strategies becomes essential.

One approach is to implement aggressive repayment strategies. If you can afford it, making extra payments or increasing your monthly payment can help you chip away at the principal faster. Even bi-weekly payments can accelerate the payoff process, allowing you to build equity more quickly and reduce the time you spend underwater. This requires discipline but can save significant interest over time.

If you need to sell your car but still have negative equity, you'll need to manage selling a car with negative equity. This typically involves paying the difference between the sale price and your outstanding loan balance out of pocket. If you don't have the cash, you might consider taking out a small personal loan to cover the gap. This allows you to sell the vehicle and eliminate the car loan entirely, even if you replace it with a personal loan at a potentially higher interest rate, but without the baggage of negative equity on a depreciating asset.

Strategic considerations for trading in also come into play. If you plan to trade your vehicle for another, the negative equity will be rolled into the new car loan. While convenient, this increases your new loan amount and restarts the cycle of being underwater. Ensure that if you trade in, you're getting a fantastic deal on the new vehicle and the terms are significantly better to offset carrying over the old debt. A substantial down payment on the new vehicle can also help mitigate the impact of rolling over negative equity.

Finally, if your car loan is part of a larger financial picture with other high-interest debts, broader debt consolidation approaches might be more appropriate. Consolidating multiple debts into a single, lower-interest loan can simplify payments and potentially reduce your overall interest burden. This could be a personal loan or a home equity line of credit, if applicable. For individuals who have gone through a consumer proposal, managing existing debts and finding new financing can be challenging but certainly possible. Learn more about navigating this at Your Consumer Proposal? We're Handing You Keys.

Future-Proofing Your Car Ownership: How to Avoid Drowning Again

Having navigated the challenging waters of an underwater car loan, the last thing any Toronto driver wants is to find themselves in the same predicament again. Future-proofing your car ownership involves strategic planning and smart financial habits to maintain positive equity and financial control.

One of the most effective preventive measures is making a substantial down payment when purchasing a vehicle. A larger down payment immediately reduces the amount you need to finance, giving you a head start against depreciation. It ensures you begin your loan term with a significant buffer, making it much harder for your loan balance to exceed the car's value.

Choosing shorter loan terms, if financially feasible, is another excellent strategy. While a 60-month or 72-month loan might offer lower monthly payments, a 36-month or 48-month term allows you to pay off the principal much faster, building equity more quickly. This drastically reduces the window during which your vehicle could fall into negative equity.

It's also crucial to understand depreciation rates for different vehicles. Not all cars lose value at the same pace. Researching models known for better resale value in Canada's diverse market can be a smart move. For instance, some popular Japanese or German brands tend to hold their value better than others. Always factor in projected depreciation when making your initial purchase decision.

Regularly assessing your car's value versus loan balance will keep you informed. Make it a habit to check your car's market value (using online tools or local appraisers) against your loan payoff amount at least once a year. This proactive approach allows you to spot potential negative equity early and take corrective action before it becomes a major problem.

Finally, proper maintenance plays a vital role in preserving resale value. A well-maintained vehicle with a clean service history will always command a higher price than one that has been neglected. Keep up with scheduled maintenance, address minor repairs promptly, and maintain a clean interior and exterior. These efforts not only ensure your car runs well but also protect your investment.

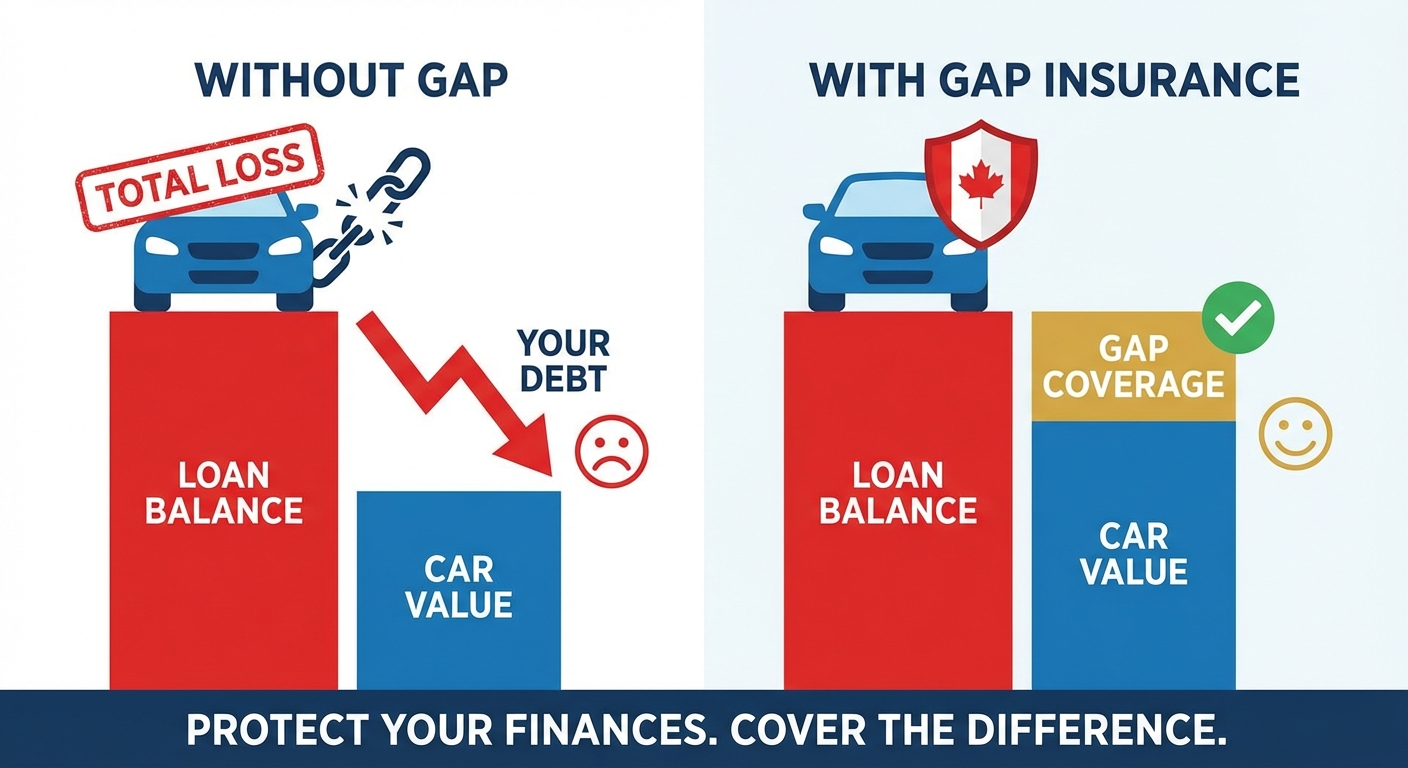

Pro Tip

Consider purchasing GAP (Guaranteed Asset Protection) insurance when buying a new vehicle, especially if you're making a small down payment. It covers the difference between your car's value and what you owe if it's totalled or stolen, preventing you from being stuck with a significant debt on a vehicle you no longer own.

Your Next Steps to Approval: A Toronto Action Plan

Feeling ready to tackle your underwater car loan head-on? Great! For Toronto residents, here’s a concise, actionable plan to guide you through the refinancing process:

- Gather All Necessary Documentation: Before you even speak to a lender, have your recent pay stubs, proof of residence, current loan statements (showing your exact payoff amount), and your vehicle's registration readily available. This preparation demonstrates seriousness and speeds up the entire process.

- Obtain a Current Vehicle Valuation: Use reliable Canadian sources like Canadian Black Book, J.D. Power, or get an appraisal from a reputable local dealership or mechanic in the GTA. Knowing your car's accurate market value is non-negotiable for understanding your negative equity.

- Compare Multiple Offers from Different Lenders: Don't just go with your current bank. Reach out to traditional banks, credit unions, and reputable online lenders. Apply to 3-5 different sources within a short period (14-45 days) to minimize the impact on your credit score. Compare interest rates, loan terms, and any associated fees.

- Negotiate Terms: Once you have a few offers, don't be afraid to negotiate. Leverage competitive offers against each other to try and secure an even better rate or more favourable terms.

- Finalize the Refinance: Carefully review the new loan agreement, paying close attention to the total cost of borrowing, monthly payments, and any prepayment penalties. Once you're comfortable, sign the paperwork, and your new lender will handle paying off your old loan.

Taking these steps will help you move from being weighed down by an underwater car loan to driving with confidence on Toronto's roads. Your financial freedom is within reach.