Walking into a Canadian car dealership when you have never borrowed money before can feel like trying to solve a puzzle with half the pieces missing. You have the job, you have the savings, and you have the need for a reliable vehicle to get to work or transport your family. Yet, the moment the finance manager looks at your credit profile, they see a "thin file"-a blank slate that, ironically, can sometimes be harder to navigate than a history of missed payments.

Being "credit invisible" is a common reality for thousands of Canadians. Whether you are a newcomer who just landed at Pearson International, a recent graduate from the University of Toronto, or someone who has simply lived a cash-only lifestyle for decades, you are not alone. This guide is designed to pull back the curtain on the Canadian lending industry. You will learn that while the big banks might hesitate, there is a clear, strategic path to getting the keys to your next vehicle while simultaneously building a world-class credit score from scratch.

Key Takeaways

- Income is Your Superpower: For those without a credit history, your employment stability and monthly gross income (ideally $1,800 - $2,500+) are the primary factors lenders use to gauge your ability to repay.

- Newcomer Advantage: Canada has specific "Newcomer to Canada" programs for PR and Work Permit holders that bypass the need for a domestic credit history.

- The 10-20% Rule: A down payment isn't just about lower payments; it's a risk-mitigation tool that makes you significantly more attractive to specialized lenders.

- Strategic Credit Building: An auto loan is an "installment loan," which is one of the fastest ways to move your credit score from zero to 650+ within 12 months.

- Preparation is Everything: Having your T4s, recent pay stubs, and a valid Canadian bank account ready will speed up your approval from days to hours.

1. The "Thin File" Challenge in Canada

In the eyes of the Canadian credit bureaus-Equifax and TransUnion-having no credit history means you have a "thin file." This isn't necessarily a bad thing, but it creates uncertainty. Lenders are in the business of predicting the future based on the past. If you have no past repayment history, they can't easily predict if you will pay back a $30,000 loan.

However, here is a secret the industry doesn't always advertise: No credit is significantly better than bad credit. When you have a blank slate, you aren't fighting against a history of defaults or bankruptcies. You are simply a "question mark" rather than a "red flag." Specialized lenders in Canada view no-credit borrowers as an opportunity to build a long-term relationship. They know that if they help you buy your first car, you are likely to come back to them for your next one.

2. Understanding the "No Credit" Landscape

2.1 No Credit vs. Bad Credit: Why the Distinction Matters

Lenders categorize risk differently. A borrower with a 500 credit score has proven they struggle with debt. A borrower with no score hasn't proven anything yet. This distinction allows you to access "near-prime" or specialized "no-credit" programs that offer much better interest rates than "subprime" loans reserved for those with damaged credit.

2.2 Why Lenders Hesitate (and How to Reassure Them)

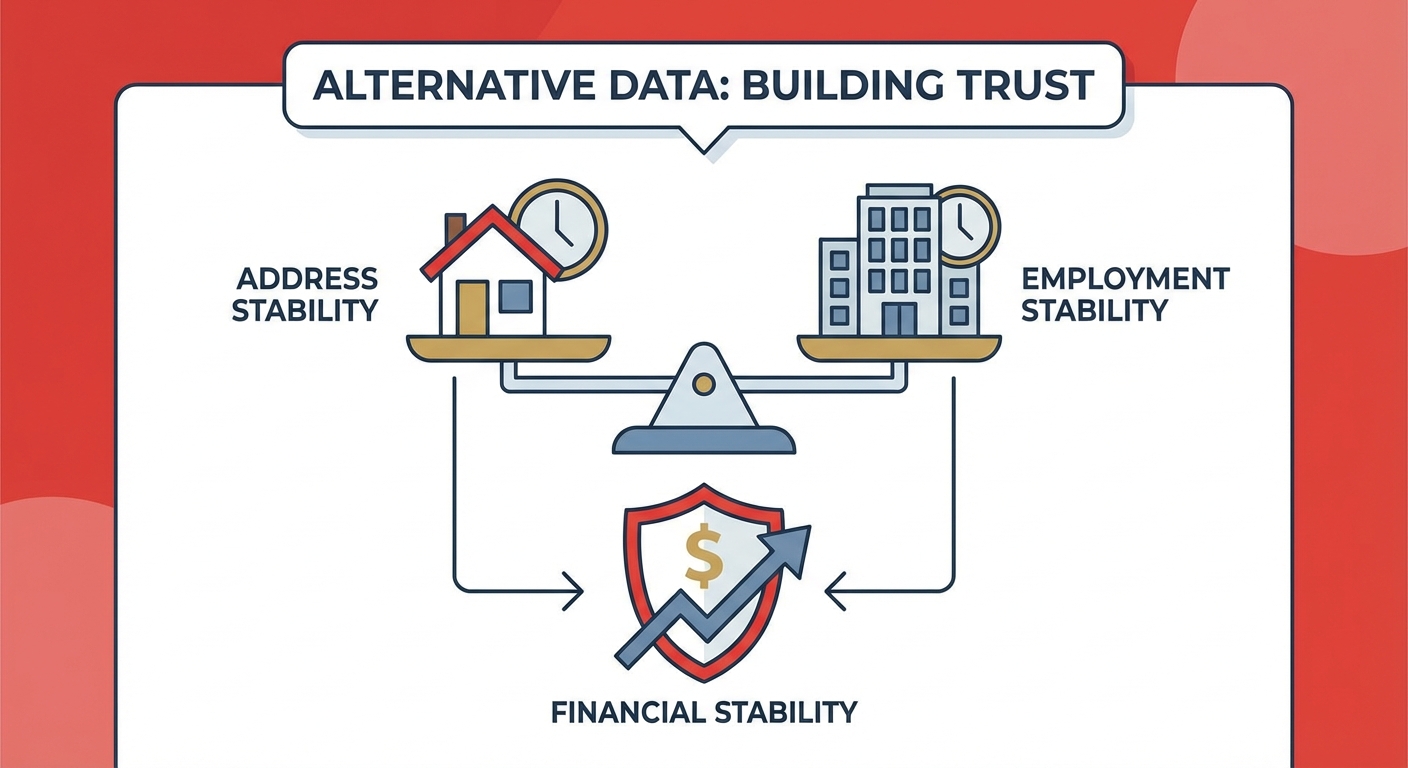

The hesitation stems from a lack of "repayment data." To overcome this, you need to provide alternative data. This includes how long you've lived at your current address and how long you've been with your employer. Stability in your personal life suggests stability in your financial life.

3. Profiles of No-Credit Borrowers in Canada

3.1 Newcomers to Canada (PR & Work Permit Holders)

Canada is a nation of immigrants, and the financial system has evolved to reflect that. Most major manufacturers (like Toyota, Honda, and Ford) and several specialized lenders have specific "Newcomer Programs." These programs often require you to have arrived in Canada within the last 36 months. You will need your Social Insurance Number (SIN) and your Permanent Residency (PR) card or a valid Work Permit.

3.2 Recent Graduates and Students

If you have recently graduated from a recognized Canadian post-secondary institution, you are a prime candidate for a no-credit loan. Lenders recognize that your earning potential is high, even if your current credit file is empty. Many brands offer "Graduate Rebates" that can be applied directly to your down payment.

3.3 The "Cash-Only" Lifestyle

Some Canadians simply prefer to pay for everything in cash. While this is fiscally responsible, it leaves you invisible to lenders. If this is you, your bank statements become your best friend. They prove that while you don't use credit, you have a consistent history of managing your cash flow and maintaining a positive balance.

4. The Core Pillars of Approval: What You Need

4.1 Proof of Income: Your Most Powerful Weapon

When you don't have a credit score, your pay stub is your resume. Most lenders in Ontario and across the provinces look for a minimum gross monthly income of $1,800 to $2,500. This is the "magic number" that ensures you can afford the car payment, insurance, and fuel without financial distress.

| Employment Type | Required Documentation | Lender Confidence |

|---|---|---|

| Full-Time Salaried | 2 Recent Pay Stubs + Employment Letter | High |

| Hourly / Part-Time | Last 3 months of Bank Statements | Medium |

| Self-Employed | Notice of Assessment (NOA) + 6 months of Bank Statements | Medium-High |

4.2 Proof of Residency and Stability

Lenders want to know you aren't going to disappear. A utility bill (hydro, water, or even a cell phone bill) in your name at your current address is vital. If you have lived at the same residence for more than a year, your approval odds increase significantly because it demonstrates a lack of "flight risk."

4.3 The Role of a Canadian Bank Account

You must have a Canadian bank account to secure an auto loan. Lenders use Pre-Authorized Debits (PAD) to collect payments. Having an account that has been active for at least three to six months shows that you are integrated into the local financial system.

5. Strategic Steps to Guarantee Approval

5.1 The Magic of the Down Payment

A down payment is the single most effective way to turn a "No" into a "Yes." By putting money down, you are reducing the Loan-to-Value (LTV) ratio. If you are buying a $20,000 car and you put $4,000 down, the lender is only risking $16,000 on a $20,000 asset. If you stop paying, the lender can easily recover their money by selling the car. This makes them much more comfortable taking a chance on a first-time borrower.

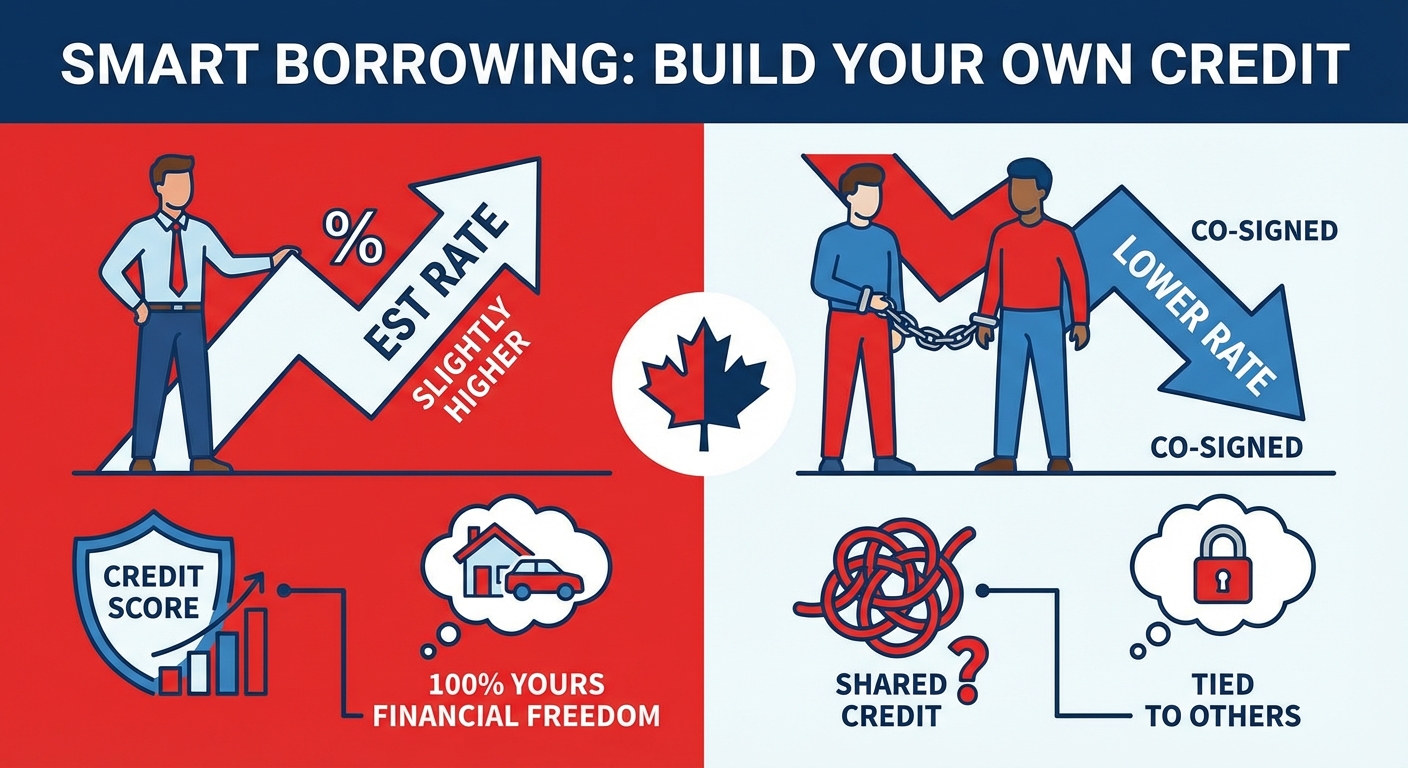

5.2 Finding a Co-Signer: The Fast Track

If you are struggling to get the interest rate you want, a co-signer is your "Fast Pass." A co-signer is someone with established Canadian credit (usually a family member) who signs the loan with you. They are equally responsible for the debt.

6. Selecting the Right Vehicle for Your First Loan

6.1 New vs. Used: Which is Easier to Finance?

You might think a cheap $5,000 car is easier to finance, but the opposite is often true. Lenders prefer "late-model" used cars (2-4 years old) or brand-new vehicles. Why? Because these vehicles have a predictable resale value and are less likely to break down. If your car breaks down and you can't afford the repair, you might stop making the loan payments. Lenders want you in a reliable vehicle to protect their investment.

6.2 Certified Pre-Owned (CPO) Benefits

CPO vehicles are the "sweet spot" for no-credit borrowers. They have been inspected, come with a manufacturer warranty, and often qualify for special financing rates that are lower than standard used car loans. It provides peace of mind for both you and the bank.

7. Navigating the Application Process

7.1 Dealership Financing vs. Big Banks

If you walk into a major bank branch with no credit history, the automated system will likely decline you within seconds. Banks are designed for "prime" borrowers. Dealerships, however, work with a network of dozens of lenders, including specialized finance companies that specifically target "thin file" clients. They know which lender is currently looking to grow their portfolio of first-time buyers.

7.2 The Pre-Approval Process

Never go car shopping without a pre-approval. This allows you to know exactly what your budget is, including taxes and fees. It prevents the heartbreak of falling in love with a vehicle only to find out the financing terms don't fit your monthly budget.

8. Interest Rates and Loan Terms for No-Credit Borrowers

8.1 What is a "Fair" Rate for No Credit?

Interest rates for no-credit borrowers will be higher than for someone with a 800 score, but they shouldn't be predatory. In the current Canadian market, a "fair" rate for a first-time borrower might range from 7.9% to 14.9%, depending on the vehicle and your income.

| Credit Profile | Estimated APR Range | Typical Loan Term |

|---|---|---|

| Prime (750+ Score) | 4.9% - 7.9% | 24 - 84 Months |

| No Credit (Thin File) | 8.9% - 15.9% | 36 - 72 Months |

| Bad Credit (Subprime) | 16.9% - 29.9% | 36 - 60 Months |

8.2 The Refinancing Secret

You are not stuck with your first interest rate forever. If you take a loan at 12% and make every single payment on time for 12 to 18 months, your credit score will skyrocket. At that point, you can return to the dealership or a bank and refinance the remaining balance at a much lower "prime" rate. Think of your first car loan as a bridge to a better financial future.

9. Using Your Car Loan as a Credit Builder

An auto loan is a powerful tool because it is reported to Equifax and TransUnion every month. Unlike a credit card, which can be seen as "revolving" debt, a car loan is an "installment" loan. Having a mix of both types of credit is the fastest way to reach a 700+ score.

To maximize this, never miss a payment. Set up an automatic withdrawal from your bank account the day after your payday. This ensures the money is always there, and you are building a flawless reputation with the credit bureaus.

10. Common Pitfalls to Avoid

While the path to approval is clear, there are traps to watch out for. Avoid "Buy Here Pay Here" lots that don't report your payments to the credit bureaus. If they don't report, you are paying high interest without getting the benefit of building your credit score.

Also, be mindful of your Debt-to-Income (DTI) ratio. Even if a lender approves you for a $600 monthly payment, calculate your own costs first. Remember to factor in insurance (which can be higher for new drivers/newcomers), fuel, and regular maintenance like oil changes and winter tyres.

11. Frequently Asked Questions (FAQ)

Can I get a car loan with a G2 license in Canada?

Yes, you can. Most lenders in Ontario will accept a G2 license for a car loan. However, some specialized or prime lenders may prefer a full G license for larger loan amounts. Keep in mind that your insurance premiums will likely be higher with a G2, which affects your overall affordability.

How much income do I need for a no-credit car loan?

Generally, lenders look for a minimum of $1,800 to $2,000 in gross monthly income (before taxes). If you earn more than $2,500, you will have access to a wider range of lenders and potentially better interest rates.

Does being a Newcomer affect my interest rate?

It can, but often in a positive way. Many Canadian manufacturers have dedicated Newcomer Programs that offer rates very close to prime rates, provided you have a decent down payment and a valid work permit or PR status. It is often a better deal than a standard "no-credit" loan.

Can I get a loan if I'm on a Work Permit?

Absolutely. The main caveat is that lenders usually require the term of the car loan to end before your work permit expires. For example, if you have 3 years left on your permit, they will likely limit your loan term to 36 months.

Will a car loan help me get a mortgage later?

Yes. Mortgage lenders look for a "diverse" credit history. Having a successfully paid or well-maintained auto loan proves you can handle large, fixed monthly payments. It is one of the best ways to prepare your credit profile for a home purchase in 2-3 years.

What happens if I miss a payment on my first loan?

Since you have no other credit history, a single missed payment can have a devastating impact on your nascent score. It is vital to communicate with your lender if you ever anticipate a financial struggle. Most lenders would rather move a payment date than process a default.

12. Taking the First Step

Securing a car loan with no credit history isn't about luck; it's about presenting a stable, well-documented version of your financial life. You are not just buying a vehicle; you are investing in your Canadian future. Every payment you make is a brick in the foundation of your credit score, leading to lower interest rates on future homes, credit cards, and business loans.

Don't let the lack of a three-digit number hold you back from the mobility you need. By focusing on your income, preparing a down payment, and choosing the right vehicle, you can move from "credit invisible" to "proud owner" faster than you think. The Canadian road is open-it's time to start driving.