Zero Credit Score. Zero Problem. Your Car Loan Starts Now, Vancouver.

Table of Contents

- Key Takeaways: Your Fast Track to Car Ownership in Vancouver (Without a Credit Score)

- The Credit Conundrum: Why 'No Credit' Isn't 'Bad Credit' – But Still a Hurdle

- Dispelling Myths: The Critical Difference Between Zero and Poor Credit

- Who Are the 'Credit-Invisible'? Navigating Auto Loans as a New Canadian or Young Adult

- The Lender's Perspective: Why History (or Lack Thereof) Dictates Trust

- Building Your Financial Bridge: Concrete Strategies for Securing Your First Car Loan

- Show Them the Money: Leveraging Income, Employment, and Down Payments

- The Co-Pilot Advantage: Partnering for Approval with a Co-Signer

- Unlocking Options: Secured Loans and Leveraging Collateral

- Navigating the Lending Landscape: Where to Find Your No-Credit Car Loan

- The Dealership Advantage: In-House Financing for Credit-Invisible Buyers

- Beyond the Banks: Credit Unions and Specialized Lenders

- The Starter Credit Strategy: Building Your Score While You Drive

- Decoding the Dollars: Interest Rates, Hidden Costs, and Smart Negotiations

- What to Expect: Understanding Interest Rates for No-Credit Loans

- The True Cost of Car Ownership: Beyond the Monthly Payment

- Empowering Yourself: Negotiating Your Loan Terms

- Choosing Your Ride: Practical Considerations for Your First No-Credit Purchase

- New vs. Used: Which Vehicle Path Offers Better Approval Odds?

- The 'Sensible' Car: Maximizing Your Chances with a Realistic Choice

- Beyond the First Loan: Cultivating a Strong Financial Future

- Your Payment History: The Cornerstone of Future Credit

- The Refinancing Advantage: Lowering Your Rates as Your Credit Grows

- Opening New Doors: How a Car Loan Builds Your Overall Credit Profile

- Your Personalized Road Map: Securing Your Car Loan in Vancouver

- Preparing Your Application: The Essential Documentation Checklist

- Local Support & Resources: Where to Turn for Guidance in Metro Vancouver

- Taking Action: Your Step-by-Step Guide to Approval

- Frequently Asked Questions (FAQ) About No-Credit Car Loans in Canada

Navigating the bustling streets of Vancouver, from the scenic drive along the Sea-to-Sky Highway to the daily commute across the Lions Gate Bridge, often requires a reliable vehicle. But what if your financial journey hasn't yet included building a credit history? For many, the idea of securing a car loan without a credit score feels like an insurmountable challenge, a classic financial catch-22. You need credit to get a loan, but how do you get credit without a loan?

At SkipCarDealer.com, we understand this dilemma is a common reality for many Canadians, especially in dynamic cities like Vancouver. Whether you're a recent graduate, a new immigrant starting fresh in British Columbia, or simply someone who has always preferred cash transactions, we're here to tell you that "zero credit score" does not mean "zero chance." In fact, it's often "zero problem" when you know how to navigate the lending landscape.

This comprehensive guide is designed to empower you with the knowledge, strategies, and confidence to secure your car loan, even without a traditional credit score. We'll demystify the process, highlight your strengths, and show you exactly how to get behind the wheel in Vancouver and beyond, using your unique financial story as your advantage.

Key Takeaways: Your Fast Track to Car Ownership in Vancouver (Without a Credit Score)

- No Credit ≠ Bad Credit: Understand this crucial distinction to approach lenders effectively.

- Income is Your New Credit Score: Prove financial stability through consistent employment and a healthy income.

- Down Payments Speak Volumes: A significant down payment reduces lender risk and improves your chances.

- Co-Signers Are Your Allies: Leverage trusted relationships to secure better terms and approval.

- Explore All Avenues: Don't limit yourself to traditional banks; consider dealerships, credit unions, and specialized lenders.

- Build While You Borrow: Use your first car loan as a strategic tool to establish and grow your credit history for future financial opportunities.

- Know Your Numbers: Understand interest rates, hidden fees, and the total cost of your loan to avoid pitfalls.

The Credit Conundrum: Why 'No Credit' Isn't 'Bad Credit' – But Still a Hurdle

The concept of a credit score can seem like an invisible barrier, especially when you're just starting out. It's often the first thing lenders look at, yet for a significant portion of the population, that score simply doesn't exist. This isn't a reflection of irresponsibility; it's a reflection of a lack of financial history that traditional systems can track.

Dispelling Myths: The Critical Difference Between Zero and Poor Credit

It's vital to understand that having no credit history, often referred to as a "thin file," is fundamentally different from having a poor credit score. A poor credit score indicates a history of missed payments, defaults, or excessive debt – a track record that suggests higher risk to lenders. Conversely, a thin file simply means there isn't enough data for credit bureaus (like Equifax and TransUnion in Canada) to generate a score. You haven't had loans, credit cards, or other forms of credit that report payment activity.

Lenders view these two scenarios differently. While a poor credit score is a red flag, no credit is more of a blank slate. They don't see a history of missed payments, but they also don't see a history of responsible borrowing. This creates a "catch-22" scenario: you need credit to build credit, similar to how many entry-level jobs require experience that new graduates simply don't have yet. This hurdle isn't insurmountable; it just requires a different approach to demonstrate your creditworthiness.

Who Are the 'Credit-Invisible'? Navigating Auto Loans as a New Canadian or Young Adult

The "credit-invisible" demographic is broader than you might think. Primarily, it includes:

- Young Individuals: Many young adults entering the financial market for the first time, perhaps purchasing their first car after graduating high school or university in cities like Toronto, Montreal, or Calgary, fall into this category. They haven't had the opportunity to build a credit history yet.

- New Immigrants to Canada: Individuals who have recently arrived in Canada, settling in vibrant communities like Vancouver, Ottawa, or Edmonton, often find their excellent credit history from their home country doesn't transfer. They start with a blank slate in the Canadian financial system. For more on this, check out our guide on Approval Secrets: How International Students Get Car Loans in Ontario.

- Cash-Preferred Consumers: Some individuals simply prefer to live debt-free, paying for everything with cash or debit cards. While financially prudent in many ways, this approach doesn't generate a credit history.

Each of these groups faces specific challenges but also possesses unique strengths. Young adults often have stable employment prospects; new Canadians might have strong international financial backgrounds; and cash-preferred individuals often demonstrate excellent budgeting skills. The key is to highlight these strengths to potential lenders.

The Lender's Perspective: Why History (or Lack Thereof) Dictates Trust

Lenders operate on risk assessment. A credit score is their primary tool for predicting how likely you are to repay a loan. It's a snapshot of your past borrowing behaviour, indicating reliability. Without a score, lenders lack this predictive data, making them inherently more cautious. They can't see a pattern of on-time payments or responsible debt management, so they perceive a higher, albeit unknown, risk.

In the absence of a credit score, lenders shift their focus to other indicators of financial stability and capacity to pay. They're looking for proof of:

- Stability: How long have you been employed? How long have you lived at your current address?

- Capacity: Do you have a consistent and sufficient income to comfortably make loan payments? What is your debt-to-income ratio (even if it's just student loans or a phone bill)?

- Intent: Are you serious about repayment? A substantial down payment or a strong co-signer can signal this intent.

Understanding this shift in perspective is the first step towards successfully securing your car loan. You need to provide them with the alternative data points that build trust.

Building Your Financial Bridge: Concrete Strategies for Securing Your First Car Loan

Without a traditional credit score, you'll need to build a compelling case for yourself using other financial indicators. Think of these as the planks of your financial bridge, connecting you to car ownership.

Show Them the Money: Leveraging Income, Employment, and Down Payments

Your Paycheck Speaks Volumes: Proving Stability Without a Score

When a credit score isn't available, your employment and income become paramount. Lenders want to see a history of consistent earnings that clearly demonstrates your ability to make regular loan payments. This serves as a de facto credit score, proving your financial capacity. What are they looking for?

- Stable Employment History: Ideally, you've been in your current job for at least 6-12 months. Longevity in employment signals stability.

- Verifiable Income: Recent pay stubs (typically 2-3 months' worth), employment letters detailing your position, salary, and start date, and even bank statements showing consistent direct deposits are crucial. If you're self-employed, proving income requires a different approach; for more insights, consider reading Self-Employed? Your Income Verification Just Got Fired.

- Sufficient Income: Your income must be high enough to comfortably cover the car loan payment, insurance, and other living expenses. Lenders will calculate your debt-to-income ratio to ensure you're not overextending yourself.

Having all these documents organized and ready will significantly streamline your application process and present you as a responsible, prepared borrower.

The Power of the Down Payment: Reducing Lender Risk and Your Interest

A down payment is arguably one of the most powerful tools in a no-credit buyer's arsenal. It's a clear signal of your commitment and financial strength. Here's why it's so impactful:

- Reduces Lender Risk: A larger down payment means you're borrowing less money. If you default, the lender's potential loss is smaller because they've financed a smaller portion of the vehicle's value. This reduced risk makes them more likely to approve your loan.

- Lower Monthly Payments: Borrowing less means your monthly payments will be lower, making the loan more affordable and sustainable.

- Better Interest Rates: Because the risk is lower, lenders are often willing to offer more favourable interest rates, saving you a significant amount over the life of the loan.

- Equity from Day One: You'll have immediate equity in the vehicle, protecting you from negative equity (owing more than the car is worth) early in the loan term.

What constitutes a 'good' down payment? While any amount helps, aiming for 10-20% of the vehicle's purchase price is generally considered strong. For a $20,000 vehicle, a $2,000 to $4,000 down payment can make a substantial difference. For some specific situations, such as temporary residents, down payments are even more critical; learn more here: Temporary Resident? Your Down Payment Just Took a Vacation.

The Co-Pilot Advantage: Partnering for Approval with a Co-Signer

Who Can Co-Sign? Understanding the Responsibilities and Benefits

If you're struggling to secure a loan on your own, a co-signer can be a game-changer. A co-signer is someone with a strong credit history and stable income who agrees to be equally responsible for the loan. If you fail to make payments, the lender can pursue the co-signer for the outstanding balance. This shared legal responsibility significantly reduces the lender's risk.

For you, the borrower, the benefits are clear:

- Increased Approval Chances: The lender is now assessing the creditworthiness of two individuals, making approval much more likely.

- Better Terms and Rates: With the added security of a co-signer, you're often eligible for lower interest rates and more favourable loan terms than you would get on your own.

- Opportunity to Build Credit: By making all your payments on time, both your credit history and your co-signer's will benefit.

Finding a Willing and Eligible Co-Signer: A Practical Guide

Approaching someone to co-sign for you requires trust and transparency. Typically, co-signers are close family members (parents, siblings, spouses) or trusted friends. When seeking a co-signer, consider someone who:

- Has Excellent Credit: Their strong credit score will be the primary factor influencing the loan terms.

- Has Stable Income: They should have a verifiable income that demonstrates their ability to repay the loan if you cannot.

- Understands the Risk: It's crucial that your co-signer fully comprehends their legal obligation. They are on the hook for the loan if you default, and it will appear on their credit report.

Have an open and honest conversation about your financial situation and your commitment to making payments. Reassure them of your plan to repay the loan diligently. A co-signer is a significant favour, and their trust should be respected.

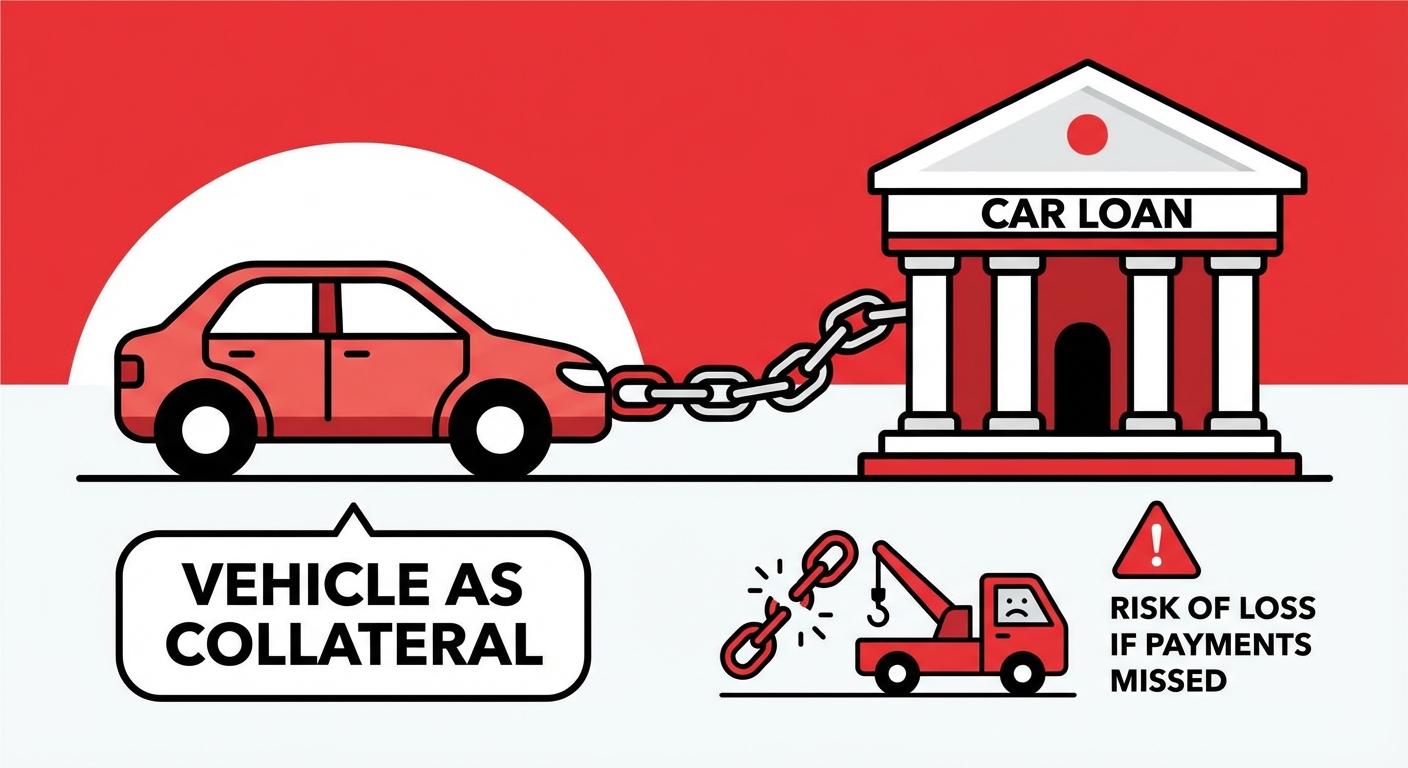

Unlocking Options: Secured Loans and Leveraging Collateral

How Secured Car Loans Work: Using Your Assets to Get Approved

A secured loan is one where an asset, known as collateral, is pledged to the lender. If you fail to repay the loan, the lender has the right to seize that asset to recover their losses. For car loans, the vehicle you are purchasing often serves as the collateral itself. This significantly reduces the lender's risk, making them more willing to approve applicants with no credit history.

With a secured car loan, the lender registers a lien against the vehicle's title. Once the loan is fully repaid, the lien is removed, and you own the car free and clear. This approach can open doors to financing that might otherwise be closed, though interest rates might still be higher than for those with established credit.

Beyond the Car: Other Forms of Collateral to Consider

While the car itself is the most common collateral for an auto loan, for other types of secured loans, other assets could potentially be used. This could include real estate (for a home equity loan, not a car loan), or even high-value personal property. However, for the specific purpose of a car loan, the vehicle itself is almost always the collateral. It's important to understand the implications of using any asset as collateral, as you risk losing it if you can't make your payments.

Pro Tip: Gathering your income and employment documents (recent pay stubs, employment verification letter, bank statements) before applying significantly speeds up the process and signals preparedness to lenders. This is your 'credit report' when you don't have one.

Pro Tip: If considering a co-signer, ensure they fully understand their legal obligations. A clear conversation upfront can prevent future misunderstandings and protect relationships.

Navigating the Lending Landscape: Where to Find Your No-Credit Car Loan

The good news is that the lending landscape for car loans is diverse, offering more options than just traditional banks. Knowing where to look can make all the difference when you have no credit history.

The Dealership Advantage: In-House Financing for Credit-Invisible Buyers

Exploring Dealer Networks: How Vancouver Dealerships Can Be Your Ally

Many dealerships, especially larger ones with dedicated finance departments, are often your best bet for securing a car loan with no credit. Why? Because they don't just work with one bank; they have relationships with a vast network of lenders, including prime banks, credit unions, and specialized non-prime lenders.

This extensive network allows them to shop around for you, finding a lender that's willing to work with your specific situation. Dealership finance managers are skilled at packaging applications to highlight your strengths (like stable employment or a good down payment) and mitigate the perceived risk of a lack of credit history. They understand the nuances of the no-credit market better than many individual bank branches.

In a competitive market like Vancouver, dealerships are motivated to make a sale, and they often have programs and expertise specifically designed for credit-challenged or credit-invisible buyers.

Spotlight on British Columbia: Understanding Provincial Dealer Regulations

British Columbia has robust consumer protection laws that benefit car buyers. The Motor Vehicle Sales Authority of British Columbia (VSA) regulates vehicle sales and leasing, ensuring transparency and fair practices. For buyers with no credit, it's reassuring to know that these regulations require dealers to disclose all fees and terms clearly. Always ensure any dealership you work with is VSA-licensed, providing an extra layer of protection and accountability during your car buying journey in British Columbia.

Beyond the Banks: Credit Unions and Specialized Lenders

Credit Unions in Alberta and Ontario: A Community-Focused Approach to Lending

Credit unions are member-owned financial institutions, and their community-focused approach often translates into more flexible and personalized lending solutions. Unlike large commercial banks, which might adhere strictly to credit score algorithms, credit unions sometimes take a more holistic view of an applicant's financial situation. They may be more willing to consider your individual story, employment history, and relationship with the credit union as a member.

While we're focusing on Vancouver, it's worth noting that credit unions across Canada, such as those in Alberta (e.g., Servus Credit Union, ConnectFirst Credit Union) and Ontario (e.g., Meridian Credit Union, Alterna Savings), are known for being more accessible to those with limited credit history. If you're a member or considering becoming one, a credit union could be a valuable option for your first car loan.

Specialized No-Credit Lenders: Understanding the Terms and Conditions

When traditional avenues are not viable, specialized non-prime or subprime lenders step in. These lenders focus specifically on individuals with no credit, poor credit, or unique financial situations. They are willing to take on higher risk, but this often comes with higher interest rates and sometimes stricter terms.

These lenders are an excellent option for getting approved when others say no, but it's crucial to understand their business model. Their higher interest rates compensate for the increased risk they undertake. Always read the fine print, understand all fees, and ensure the loan is manageable within your budget. While they provide access, the goal is to use this loan as a stepping stone to better terms in the future. For more on how non-traditional lenders operate, you might find our article No Credit? Great. We're Not Your Bank. insightful.

The Starter Credit Strategy: Building Your Score While You Drive

Secured Credit Cards: Your First Step to a Credit History

A secured credit card is an excellent tool for building credit when you have none. You provide a cash deposit (e.g., $300-$500) that acts as your credit limit and collateral. This deposit minimizes the lender's risk. You use the card like a regular credit card, making small purchases and, most importantly, paying your bill in full and on time every month. These payments are reported to credit bureaus, establishing a positive payment history and building your credit score over time.

Credit Builder Loans: A Strategic Tool for Future Financial Freedom

A credit builder loan is specifically designed to help you establish a credit history. Instead of receiving the money upfront, the loan amount is deposited into a locked savings account. You then make regular monthly payments on the "loan" over a set period (e.g., 6-24 months). Once the loan is fully repaid, you receive access to the funds in the savings account. All your on-time payments are reported to credit bureaus, demonstrating responsible borrowing behaviour and building your credit score without needing an initial lump sum.

Making Your Rent and Utilities Count: Alternative Data for Lenders

The financial world is evolving. Some emerging services and lenders are starting to recognize the value of alternative data points. Consistently paying your rent and utility bills on time demonstrates financial responsibility, even if it doesn't traditionally appear on your credit report. Services exist in Canada that allow you to report your rent payments to credit bureaus, giving you a non-traditional way to build your credit profile. Ask potential lenders if they consider such alternative data, as it could strengthen your application.

Pro Tip: If you're a new Canadian, bring proof of permanent residency and any international credit history you might have. Some specialized lenders or credit unions might consider it, especially if you're coming from a country with a similar credit reporting system.

Pro Tip: When dealing with specialized no-credit lenders, always read the fine print. High-interest rates are common, but look out for excessive fees or unfavorable terms that could make the loan unsustainable.

Decoding the Dollars: Interest Rates, Hidden Costs, and Smart Negotiations

Securing a car loan when you have no credit is a significant achievement, but your financial due diligence doesn't stop there. Understanding the true cost of your loan and negotiating effectively are crucial steps to ensure you get the best possible deal and avoid future financial strain.

What to Expect: Understanding Interest Rates for No-Credit Loans

Factors Influencing Your Rate: Beyond the Credit Score

With no credit score to rely on, lenders assess other risk factors to determine your interest rate. These include:

- Income Stability: A long, consistent employment history with a steady income stream signals lower risk, potentially leading to a better rate.

- Debt-to-Income Ratio: Even without traditional debt, lenders will look at your existing financial obligations (rent, phone bills, student loans) relative to your income. A lower ratio is always better.

- Down Payment Size: As discussed, a larger down payment reduces the loan amount and the lender's exposure, often resulting in a lower interest rate.

- Loan Term: Shorter loan terms generally come with lower interest rates because the lender's risk is spread over a shorter period.

- Vehicle Type and Age: Newer, more reliable vehicles might command slightly better rates than older, high-mileage cars, as they represent less risk of breakdown (and thus, less risk of you defaulting due to unexpected repairs).

For someone with no credit, interest rates are typically higher than for those with excellent credit. Expect rates to range from 8% to 20% or even higher, depending on the lender and your unique profile.

Strategies to Secure the Best Possible Rate (Even Without History)

Even without a credit history, you have leverage:

- Maximize Your Down Payment: This is your strongest tool. The more cash you put down, the less you borrow, and the lower the risk for the lender.

- Shorten the Loan Term: While it means higher monthly payments, a shorter loan term (e.g., 36 or 48 months instead of 60 or 72) often results in a lower interest rate and significantly less interest paid overall.

- Enlist a Strong Co-Signer: A co-signer with excellent credit can dramatically improve your rate by providing the lender with an additional layer of security.

- Shop Around: Don't take the first offer. Get quotes from multiple dealerships, credit unions, and specialized lenders. Competition works in your favour.

The True Cost of Car Ownership: Beyond the Monthly Payment

Unmasking Hidden Fees: Administration, Documentation, and More

The sticker price and interest rate are just part of the equation. Be vigilant about hidden fees that can inflate the total cost of your car loan:

- Administration/Documentation Fees: These are charged by the dealership for processing paperwork. While often legitimate, they can sometimes be negotiable or excessive.

- PPSA Fees (Personal Property Security Act): This is a provincial registration fee for the lien on your vehicle. It's legitimate but ensure it's not marked up.

- Loan Origination Fees: Some lenders charge a fee for setting up the loan.

- Dealer Prep Fees: Fees for cleaning, inspecting, and preparing the car for sale. These are often negotiable.

Always ask for a detailed breakdown of all costs and don't hesitate to question fees you don't understand or feel are excessive. A reputable dealer will be transparent.

Insurance Essentials: Factor in Coverage Costs (e.g., in Greater Toronto Area)

Car insurance is a non-negotiable expense in Canada and can be surprisingly high, especially for new drivers or those with no prior insurance history. Rates vary significantly by province – for example, insurance in the Greater Toronto Area in Ontario is notoriously higher than in many parts of British Columbia or Alberta, due to factors like population density, accident rates, and vehicle theft statistics.

Before committing to a car loan, get insurance quotes for the specific vehicle you're considering. This allows you to factor the true monthly cost of car ownership into your budget. A new driver with no credit might face higher premiums, making a realistic vehicle choice even more critical.

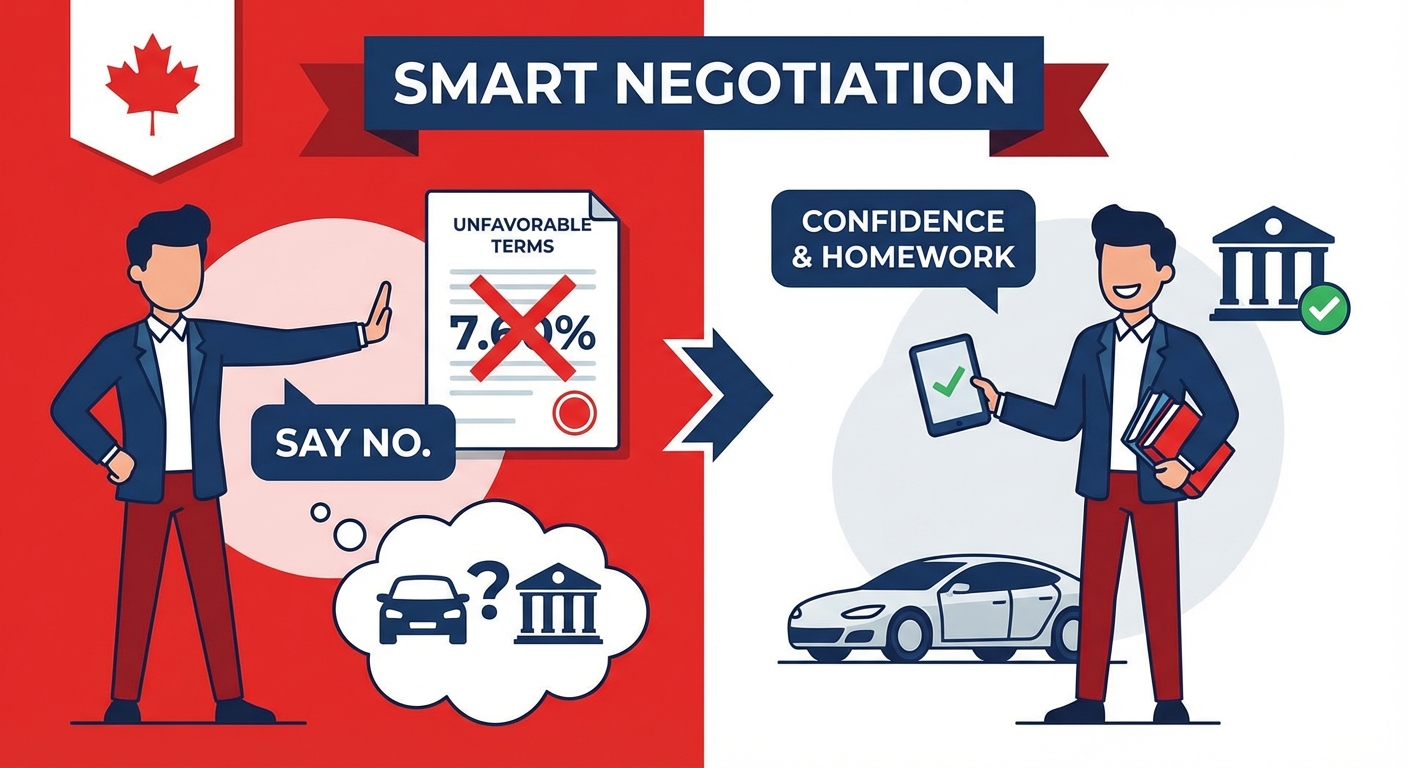

Empowering Yourself: Negotiating Your Loan Terms

Negotiation is not just for the car's price; it extends to the loan terms as well. Even with no credit, you have power if you're informed and prepared.

- Know Your Budget: Understand exactly how much you can afford for a monthly payment, including insurance and fuel.

- Research Car Values: Use resources like Canadian Black Book or Kelley Blue Book to know the fair market value of the car you're interested in.

- Get Multiple Offers: Approach several lenders and dealerships to get pre-approvals. Having multiple offers in hand gives you leverage to ask for better rates or terms.

- Be Prepared to Walk Away: Your most powerful negotiation tool is the willingness to say no if the terms are unfavourable. There's always another car and another lender.

Approach the negotiation process with confidence. You've done your homework, you know your financial standing, and you're ready to make a responsible decision.

Pro Tip: Don't just focus on the monthly payment. Understand the total cost of the loan over its entire term, including all fees and interest. A lower monthly payment over a longer term often means paying significantly more overall.

Pro Tip: Always get a pre-approval from at least two different sources (e.g., a credit union and a dealership) to compare offers before committing. This competitive approach can save you thousands.

Choosing Your Ride: Practical Considerations for Your First No-Credit Purchase

The type of vehicle you choose can significantly impact your approval odds and the overall cost of your first car loan when you have no credit history. Making a sensible choice is key.

New vs. Used: Which Vehicle Path Offers Better Approval Odds?

Benefits of a Reliable Used Car for Your First Loan

For your first car loan with no credit, a reliable used car is almost always the more prudent choice. Here's why it often offers better approval odds:

- Lower Financial Risk: Used cars are less expensive, meaning you'll need to borrow less money. This inherently reduces the lender's risk and makes them more comfortable with your application.

- Reduced Depreciation: New cars lose a significant portion of their value the moment they're driven off the lot. Used cars have already experienced this initial depreciation, meaning your car will hold its value better over the loan term.

- Lower Insurance Costs: Insurance premiums are generally lower for used cars compared to new ones, further reducing your overall monthly expenses.

- Wider Selection: The used car market offers a vast array of options, making it easier to find a dependable vehicle that fits your budget.

Consider a slightly older, reliable used car for your first loan. Lenders see these as lower risk, which can improve your approval chances and potentially lower your initial payments. Think practical, not luxury, for your first step.

The 'Sensible' Car: Maximizing Your Chances with a Realistic Choice

When you have no credit, demonstrating financial prudence is paramount. This means choosing a vehicle that aligns with your actual financial capacity, not just your desires. A modest, reliable car that you can comfortably afford will send a strong signal to lenders about your responsibility. Avoid stretching your budget for a luxury vehicle or a brand-new model, as this will only increase the perceived risk and make approval more challenging. Opt for a car known for its reliability and fuel efficiency, keeping future maintenance and operating costs in mind. This sensible approach sets you up for successful loan repayment and positions you for better financial opportunities down the road.

Beyond the First Loan: Cultivating a Strong Financial Future

Securing your first car loan with no credit isn't just about getting a vehicle; it's a strategic move to build a robust financial future. This loan can be the cornerstone of your credit history, opening doors to many other opportunities.

Your Payment History: The Cornerstone of Future Credit

Every single on-time payment you make on your car loan is a brick in the foundation of your credit history. Lenders report your payment activity to credit bureaus, and a consistent record of timely payments demonstrates reliability and financial responsibility. This positive data is precisely what builds a strong credit score. To ensure timely payments, set up automatic deductions from your bank account, create a detailed budget to track your expenses, and always ensure you have sufficient funds available. Missing even one payment can set back your credit-building efforts.

The Refinancing Advantage: Lowering Your Rates as Your Credit Grows

After 6-12 months of consistently making on-time payments, your credit score will begin to improve significantly. At this point, you can explore the option of refinancing your car loan. Refinancing involves taking out a new loan, often with a different lender, to pay off your existing loan. With your newly established credit history, you'll likely qualify for a lower interest rate, which can save you a substantial amount of money over the remaining term of the loan. This not only reduces your monthly payments or shortens your loan term but also further solidifies your positive credit profile.

Opening New Doors: How a Car Loan Builds Your Overall Credit Profile

Successfully managing an auto loan demonstrates to future lenders that you are a responsible borrower capable of handling a significant financial commitment. This positive track record will make it easier to qualify for other financial products down the line, such as:

- Credit Cards: You'll be eligible for better credit cards with lower interest rates and higher limits.

- Mortgages: When the time comes to purchase a home in Vancouver, Calgary, or any other Canadian city, your strong credit history from your car loan will be a significant asset in securing a mortgage.

- Lines of Credit: Access to flexible credit for emergencies or larger purchases.

Your car loan is more than just a means to get around; it's a powerful tool for transforming your financial landscape and achieving greater financial freedom.

Your Personalized Road Map: Securing Your Car Loan in Vancouver

Ready to take the next step? Here's a concise guide to navigating the process in Metro Vancouver and beyond.

Preparing Your Application: The Essential Documentation Checklist

Having your documents ready before you apply will save you time and demonstrate your preparedness to lenders. Here’s what you’ll typically need as a no-credit applicant in Canada:

- Government-Issued ID: Valid driver's license (from British Columbia or another province) or a passport.

- Proof of Residency: Utility bills, lease agreement, or other official mail showing your current Vancouver address.

- Employment Verification: Recent pay stubs (last 2-3 months), an employment letter from your employer confirming your position, salary, and start date. If self-employed, tax assessments (T1 Generals) or bank statements might be required.

- Bank Statements: Recent statements (last 3-6 months) to show financial activity and stability.

- Down Payment Proof: Bank statements showing the funds for your down payment.

- Co-Signer Details (if applicable): Your co-signer's ID, proof of income, and credit information.

For specific situations, like if you're a temporary resident, additional documentation or considerations for down payments might be necessary. You can find more targeted information on this topic in our article on Temporary Resident? Your Down Payment Just Took a Vacation.

Local Support & Resources: Where to Turn for Guidance in Metro Vancouver

Beyond dealerships and financial institutions, Metro Vancouver offers resources to help you through the process:

- Non-Profit Credit Counselling Agencies: Organizations like Credit Counselling Society offer free advice on budgeting and managing debt, which can indirectly help your loan application.

- Community Financial Literacy Programs: Local community centres or immigrant services in Vancouver often provide workshops on financial literacy, including understanding credit and loans in Canada.

- Vancouver-Based Auto Finance Brokers: Some independent brokers specialize in connecting individuals with no-credit solutions. Do your research to find reputable ones.

Taking Action: Your Step-by-Step Guide to Approval

- Assess Your Financial Situation: Honestly evaluate your income, expenses, and what you can realistically afford for a car payment, including insurance and fuel.

- Gather Your Documents: Use the checklist above to prepare all necessary paperwork.

- Explore Lenders: Research dealerships with strong finance departments, credit unions, and specialized lenders.

- Get Pre-Approvals: Apply to a few different sources to compare offers and rates.

- Choose a Suitable Car: Select a reliable used car that fits your budget and doesn't overextend your finances.

- Finalize the Loan: Read all documents carefully, understand every term and fee, and don't hesitate to ask questions before signing.

With a confident, informed approach, your car loan in Vancouver is well within reach.