Your 'Bad Credit' Isn't a Wall. It's a Speed Bump to Your New Car, Toronto.

Table of Contents

- Key Takeaways: Your Fast Track to Understanding Car Loans After Financial Hardship in Toronto

- Introduction: Toronto's Road Ahead – Turning Your Credit Speed Bump into a Smooth Drive

- Beyond Bankruptcy: Unpacking 'Financial Hardship' for Car Lenders in Ontario

- The Nuances of Your Past: From Bankruptcy to Missed Payments – What It All Means

- Pro Tip: Know Your Credit Report Inside Out Before You Apply.

- How Lenders View Your History: Risk Assessment 101 for Non-Prime Applicants

- The Toronto Compass: Navigating Who Offers Car Loans After Financial Hardship

- Specialized Dealership Finance Departments: Your First Stop in the GTA

- Unconventional Routes: Credit Unions and Niche Online Lenders Across Ontario

- Pro Tip: Don't Limit Yourself to Your Primary Bank.

- Comparing Your Options: Dealer vs. Bank vs. Online – The Toronto Perspective on Transparency and Service

- Cracking the Code: What Lenders *Really* Want to See for Approval

- Your Current Financial Snapshot: Income, Employment, and Stability – The New Credit Score

- The Power of Your Down Payment: More Than Just an Initial Cost

- The Co-Signer Conundrum: When a Helping Hand Makes Sense (and When It Doesn't)

- Pro Tip: Demonstrate Stability

- Decoding the Dollars: Understanding Rates, Terms, and the True Cost of Your Toronto Car Loan

- Beyond the Monthly Payment: APR, Interest, and the Long Game

- The Term Trap: Why Longer Isn't Always Cheaper

- Hidden Fees and Charges: What to Watch Out For in Ontario

- Pro Tip: Request a Full Loan Amortization Schedule.

- Beyond Toronto's Skyline: Car Loan Realities Across Ontario

- Ottawa's Options: Navigating the Nation's Capital for Your Vehicle

- Hamilton, London, and Rural Ontario: Finding Your Wheels Outside the GTA

- Pro Tip: Local Credit Unions Can Be Hidden Gems in Smaller Communities.

- Your Car Loan as a Credit Catalyst: Rebuilding Your Financial Future

- The Mechanics of Credit Repair: How On-Time Payments Transform Your Score

- Strategies for Accelerated Credit Improvement: Beyond Just Car Payments

- Choosing Your Chariot: Smart Vehicle Selection for Financial Hardship Buyers

- Reliability Over Luxury: Best Used Car Brands for Your Budget (and Credit)

- New vs. Used: The Cost-Benefit Analysis for Toronto Drivers

- Pro Tip: Always Get a Pre-Purchase Inspection (PPI) from an Independent Mechanic.

- Your Next Steps to Approval: Crafting Your Personalized Toronto Action Plan

- Document Checklist: What to Prepare Before You Walk In (or Click 'Apply')

- Getting Multiple Quotes: The Power of Comparison Shopping in a Competitive Market

- Negotiating Your Best Deal: From Vehicle Price to Protection Packages

- Making the Final Decision: Confidence on the Road Ahead

- Frequently Asked Questions (FAQ): Your Car Loan After Hardship Queries Answered

Key Takeaways: Your Fast Track to Understanding Car Loans After Financial Hardship in Toronto

- Your Credit Score Isn't a Dead End: Financial hardship, including bankruptcy or consumer proposals, doesn't disqualify you from owning a car in Toronto. It just means a different path.

- Specialized Lenders are Your Allies: Many dealerships and online platforms in Ontario specialize in 'bad credit' or 'subprime' car loans, understanding your unique situation.

- Stability Trumps Past Mistakes: Lenders prioritize your current income stability, employment history, and ability to make consistent payments over solely focusing on past credit blips.

- Down Payments & Co-Signers Make a Difference: Even a small down payment or a qualified co-signer can significantly improve your approval odds and potentially lower your interest rate.

- Your Car Loan is a Credit Rebuilder: Successfully managing a car loan is one of the most effective ways to rebuild your credit score and open doors to better financial opportunities in the future.

- Shop Smart, Not Just Hard: Understand the full cost (APR, fees, terms) and compare offers from multiple lenders across Toronto and Ontario to secure the best deal for your situation.

Introduction: Toronto's Road Ahead – Turning Your Credit Speed Bump into a Smooth Drive

Toronto. It's a city of bustling streets, vibrant neighbourhoods, and endless possibilities. But it's also a city where reliable transportation isn't just a convenience; it's often a necessity. Whether you're commuting from Scarborough to downtown, navigating the sprawling suburbs of Mississauga, or simply needing to get groceries in Vaughan, a dependable vehicle opens up your world.

For many Torontonians, the dream of a new car comes with a heavy dose of anxiety, especially if their financial past includes a few speed bumps. Perhaps you've experienced a bankruptcy, navigated a consumer proposal, or simply accumulated some missed payments along the way. The common misconception is that 'bad credit' means the door to car ownership is firmly shut. You might feel stuck, believing your financial history dictates your mobility future. But what if we told you that isn't the case?

At SkipCarDealer.com, we understand these concerns. We know that life happens, and financial challenges can affect anyone. That's why we're here to tell you that your credit isn't a wall; it's merely a speed bump. This comprehensive guide is designed to demystify the process of securing a car loan after financial hardship, specifically for residents of Toronto and across the great province of Ontario. We'll show you how to navigate the lending landscape, understand what lenders are truly looking for, and ultimately, get you behind the wheel of a vehicle that meets your needs. Your financial past doesn't have to dictate your future on the road.

Beyond Bankruptcy: Unpacking 'Financial Hardship' for Car Lenders in Ontario

When you apply for a car loan, lenders don't just see a single number on your credit report. They look at your entire financial story, especially when you've experienced what's commonly referred to as 'financial hardship.' Understanding the nuances of this history is crucial to positioning yourself for success.

The Nuances of Your Past: From Bankruptcy to Missed Payments – What It All Means

- Completed vs. Active Bankruptcy: This is a critical distinction. Being discharged from bankruptcy (meaning your obligations are complete) is viewed far more favourably than being in an active bankruptcy or consumer proposal. Lenders assess risk differently based on where you are in this process. While it's tougher, getting a car loan even with an active consumer proposal is possible, though options might be more limited. For those still in an active consumer proposal, you might find Your Consumer Proposal? We're Handing You Keys to be a helpful resource.

- Past Due Accounts & Collections: Late payments on credit cards, utility bills, or other loans, particularly those that have gone to collections, signal a higher risk. However, the age of these collections matters. Recent collections are a bigger red flag than those from several years ago. Even with active collections, there are pathways to approval. Learn more at Active Collections? Your Car Loan Just Got Active, Toronto!

- Foreclosures & Repossessions: These are considered very severe events, indicating a significant inability to meet financial obligations. A car repossession, in particular, directly impacts a lender's willingness to finance another vehicle. While challenging, it's not an absolute barrier, but it will likely mean higher interest rates and a requirement for a strong down payment or co-signer.

- Low Credit Score Without Specific Events: Sometimes, you might have a low credit score not due to bankruptcy or collections, but from a 'thin credit file' (not much credit history) or simply a history of poor credit management, like carrying high balances or opening too many accounts. Lenders still view this as a risk, but it's often less severe than formal insolvency events.

Pro Tip: Know Your Credit Report Inside Out Before You Apply.

Obtain free copies of your credit report from Equifax and TransUnion Canada. Review them meticulously for accuracy and to understand exactly what lenders will see. This knowledge empowers you to address any discrepancies and explain your financial history confidently.

How Lenders View Your History: Risk Assessment 101 for Non-Prime Applicants

Lending isn't a one-size-fits-all game. For individuals with financial hardship, traditional prime lending criteria simply don't apply. Instead, specialized lenders employ a different kind of risk assessment.

- Not all 'bad credit' is equal: The recency and severity of your financial events play a critical role. A bankruptcy discharged five years ago looks very different from one discharged five months ago. Similarly, a single missed credit card payment is less impactful than multiple accounts in collections.

- The shift from traditional prime lending criteria to subprime (non-prime) considerations: Prime lenders focus heavily on a high credit score and a pristine payment history. Subprime lenders, on the other hand, are designed to lend to those with less-than-perfect credit. Their focus shifts to your current capacity and willingness to pay. They'll scrutinize your income stability, employment history, and ability to manage new debt responsibly.

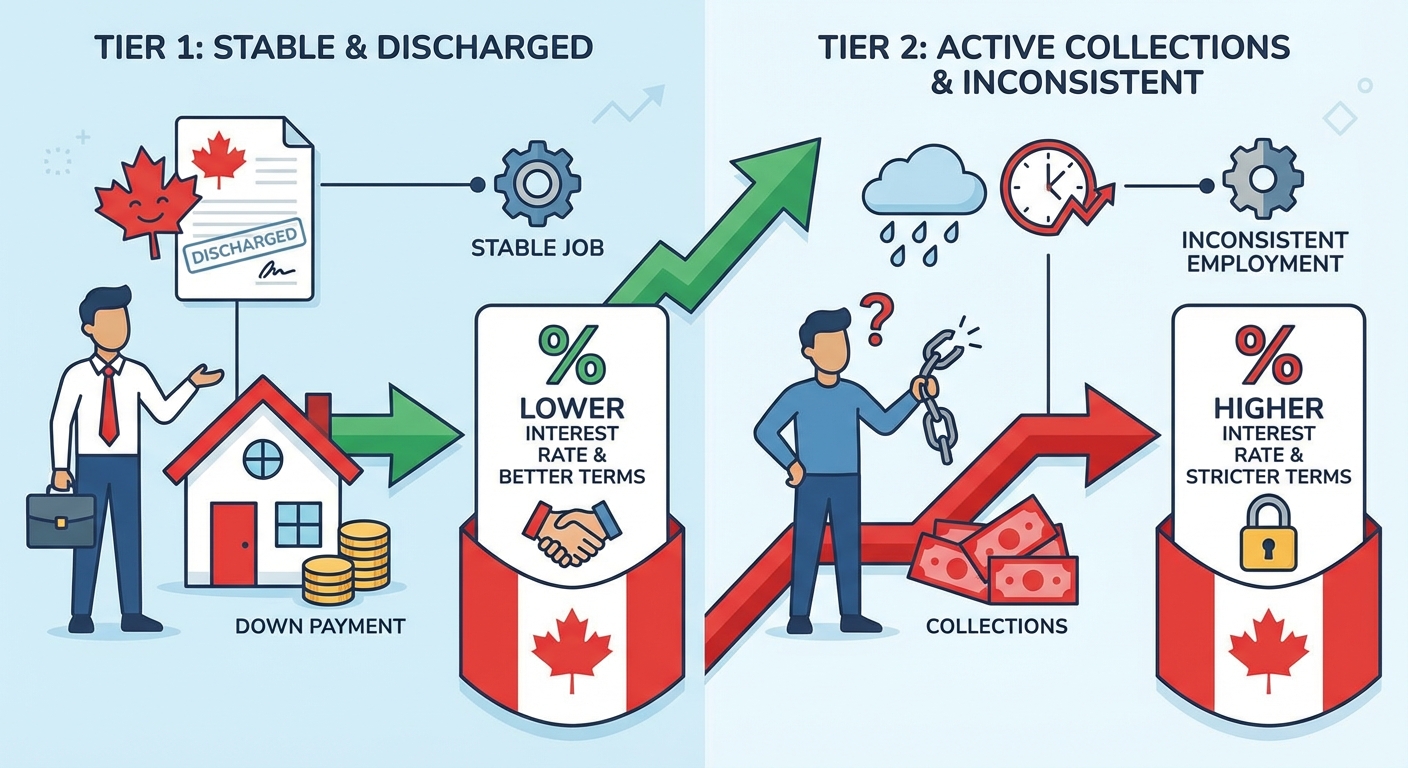

- Understanding 'risk tiers' even within the bad credit spectrum: Even within the subprime market, lenders categorize applicants into different risk tiers. Someone recently discharged from bankruptcy with a stable job and a small down payment might be in a different tier than someone with multiple active collections and inconsistent employment. These tiers influence the interest rate and loan terms you'll be offered.

(Context: A diverse group of people confidently looking at various vehicle types (sedans, SUVs) at a modern, well-lit Toronto dealership, symbolizing accessibility and the possibility of finding the right car after financial challenges. The image should convey professionalism and approachability.)

The Toronto Compass: Navigating Who Offers Car Loans After Financial Hardship

Finding the right lender is half the battle when you're seeking a car loan after financial hardship. Fortunately, Toronto and the wider Ontario region offer a variety of options, each with its own advantages.

Specialized Dealership Finance Departments: Your First Stop in the GTA

For many, the most straightforward path begins at a dealership with a dedicated 'special finance' or 'credit rebuilding' team. These departments are specifically set up to assist individuals who don't fit the mold of traditional prime lenders.

- Focus on dealerships with dedicated 'special finance' or 'credit rebuilding' teams in Toronto, Mississauga, Scarborough, and Vaughan: These dealerships understand the unique challenges faced by non-prime applicants. They have staff trained to work with diverse credit profiles and are equipped with the knowledge to present your application in the best possible light.

- How these departments work as intermediaries, partnering with multiple subprime lenders: Unlike a traditional bank that might only offer its own products, a dealership's finance department acts as a broker. They have established relationships with a network of subprime lenders, including banks with specialized divisions, credit unions, and independent finance companies. This allows them to shop your application around to find a solution tailored to your specific credit profile and financial situation.

- Advantages: often a one-stop shop for vehicle and financing: The convenience of handling both your vehicle selection and financing in one location is a significant benefit. You can test drive cars, get your financing approved, and drive away in your new vehicle, all from the same place.

Unconventional Routes: Credit Unions and Niche Online Lenders Across Ontario

While dealerships are often the first port of call, it's wise to explore other avenues across Ontario to ensure you're getting the best possible terms.

- Exploring smaller, community-focused credit unions (e.g., Meridian Credit Union, Alterna Savings): Credit unions often differentiate themselves from large banks by offering a more personalized assessment. As member-owned institutions, they may have more flexibility and be more willing to look beyond a low credit score if you have a stable financial history with them or can demonstrate strong current income and payment capacity. Their focus is often on community support and helping members rebuild.

- Large banks' subprime divisions: While major banks like RBC, TD, CIBC, or Scotiabank might not lend directly to 'bad credit' individuals through their standard channels, many have separate financing arms or partnerships that specialize in non-prime auto loans. These divisions operate with different risk parameters and can be a significant source of funding.

- The rise of online lenders and aggregators (e.g., LowestRates.ca, LoanConnect): The digital age has brought forth a wave of online platforms specializing in non-prime loans. These aggregators allow you to submit one application and receive multiple quotes from various lenders. This offers unparalleled convenience and the potential to compare several offers quickly, often without a hard credit inquiry initially.

Pro Tip: Don't Limit Yourself to Your Primary Bank.

While convenient, your primary bank may not have the best or most flexible options for bad credit car loans. Explore several options – dealerships, credit unions, and online lenders – as different lenders have varying risk appetites and programs designed for diverse financial situations.

Comparing Your Options: Dealer vs. Bank vs. Online – The Toronto Perspective on Transparency and Service

Each type of lender comes with its own set of pros and cons, especially for someone navigating financial hardship.

| Lender Type | Pros for Bad Credit Applicants | Cons for Bad Credit Applicants |

|---|---|---|

| Specialized Dealerships (GTA) | One-stop shop, access to multiple lenders, staff experienced in bad credit, can match vehicle to financing. | May have higher markups, limited vehicle inventory compared to pure online options, might push add-ons. |

| Credit Unions (Ontario) | Personalized service, potentially more flexible terms, focus on member relationships, community-oriented. | May require existing membership, smaller loan departments, less competitive rates than online for some. |

| Online Lenders/Aggregators (Ontario) | Convenience, multiple quotes quickly, pre-qualification without hard credit check, wide lender network. | Less personal interaction, requires independent vehicle sourcing, potential for less transparent fees. |

Regardless of the source, transparency in terms, rates, and fees is paramount. You should always receive a clear, itemized breakdown of all costs. Additionally, consider the importance of customer service and support throughout the application process. A good lender will answer your questions, explain complex terms, and guide you with patience, not pressure.

Cracking the Code: What Lenders *Really* Want to See for Approval

When your credit score isn't perfect, lenders shift their focus. They're looking for compelling evidence that you're a reliable borrower today, regardless of yesterday's challenges. Your current financial snapshot becomes your new credit score.

Your Current Financial Snapshot: Income, Employment, and Stability – The New Credit Score

This is where you make your case. Lenders want to see stability and capacity to pay.

- Stable Income: Demonstrating consistent earnings is perhaps the most critical factor. This means regular pay stubs from T4 employment. If you're self-employed, the documentation required will be more extensive, often involving tax returns, business bank statements, and invoices. For more in-depth information on this, check out our article Self-Employed? Your Bank Statement is Our 'Income Proof'.

- Length of Employment: Lenders prefer to see a history of stable work with the same employer, ideally for at least six months, but longer is always better. This indicates reliability and consistent income.

- Type of Employment: Full-time employment is generally viewed most favourably. Part-time or contract work is acceptable but might require additional proof of consistent hours or a longer history. Seasonal employment can be trickier but is still manageable with the right documentation and explanation.

- Debt-to-Income Ratio (DTI): This critical metric is often a silent approval killer if too high. DTI is the percentage of your gross monthly income that goes towards debt payments (rent/mortgage, credit cards, existing loans, and the proposed car loan). Lenders typically prefer a DTI below 40-45%. If your DTI is too high, even with stable income, it signals you might be overextended.

- Proof of Residence: Stability in housing is often a good indicator of overall financial stability. Lenders will ask for proof of your current address, and a longer history at the same residence is a positive signal.

The Power of Your Down Payment: More Than Just an Initial Cost

A down payment isn't just money out of your pocket; it's a powerful tool that significantly improves your loan application.

- How a down payment significantly reduces lender risk: By putting money down, you immediately create equity in the vehicle. This means the loan-to-value (LTV) ratio is lower, and the lender has less to lose if you default, as they can more easily recover their costs by repossessing and selling the vehicle.

- Potential benefits: Lower interest rates, reduced monthly payments, shorter loan terms: All these advantages stem from reduced risk. Lenders are often willing to offer better terms when they see a borrower committed enough to make a down payment. Even a small down payment can make a noticeable difference.

- Strategies for saving or finding a down payment, even a small one: Consider selling an old vehicle, setting aside a portion of each paycheck, or even a small loan from a family member. Every dollar counts. While some zero-down options exist for those with financial hardship, they often come with higher interest rates.

The Co-Signer Conundrum: When a Helping Hand Makes Sense (and When It Doesn't)

Bringing a co-signer into the picture can be a game-changer, but it's a decision that requires careful consideration for all parties involved.

- Benefits for the borrower: A qualified co-signer, typically someone with excellent credit and stable income, can dramatically improve your approval odds. Their creditworthiness essentially 'backs' your loan, making you a much lower risk in the eyes of the lender. This can lead to approval when you might otherwise be denied, and potentially secure a much better interest rate.

- Risks for the co-signer: This is crucial. A co-signer is fully and legally responsible for the loan if the primary borrower defaults. Their credit score will be impacted, and they could be sued for the debt. This isn't a favour; it's a serious financial commitment.

- Qualifying criteria for a co-signer: Lenders will scrutinize your co-signer's credit history, income stability, and debt-to-income ratio just as thoroughly as they would a primary borrower. They need to demonstrate an impeccable financial standing.

Pro Tip: Demonstrate Stability

Consistent employment history (ideally 6+ months, but 1-2 years is even better) and a stable residence (1+ year at the same address) are strong indicators of reliability to lenders. These factors show that you have a predictable financial life, even if your credit score has taken a hit.

Decoding the Dollars: Understanding Rates, Terms, and the True Cost of Your Toronto Car Loan

Securing a car loan after financial hardship means you need to be extra vigilant in understanding the fine print. Don't just focus on the monthly payment; delve into the total cost of the loan.

Beyond the Monthly Payment: APR, Interest, and the Long Game

The monthly payment is important for your budget, but it doesn't tell the whole story.

- Explaining Annual Percentage Rate (APR) vs. simple interest rate: The simple interest rate is the cost of borrowing the principal amount. The APR, however, includes the interest rate plus any additional fees or charges associated with the loan, expressed as an annual percentage. It's the true measure of your borrowing cost, providing a more accurate comparison between different loan offers.

- What to expect regarding interest rates for financial hardship loans: It's realistic to expect higher interest rates than someone with prime credit. These rates reflect the increased risk lenders take on. While they might be higher, they should still be manageable and competitive within the subprime market. Be wary of excessively high rates that make the loan unaffordable.

- Fixed vs. Variable rates: For subprime car loans, fixed rates are common and often preferred. A fixed rate means your interest rate and monthly payment remain the same throughout the loan term, providing stability and predictability, which is crucial when rebuilding your finances. Variable rates can fluctuate with market conditions, introducing uncertainty.

The Term Trap: Why Longer Isn't Always Cheaper

A longer loan term might offer a lower monthly payment, but it can be a costly trap in the long run.

- Impact of 60, 72, 84, and even 96-month terms on total interest paid: While a 96-month term will give you a very low monthly payment, you'll end up paying significantly more in total interest over the life of the loan. The longer the term, the more time interest has to accrue, and the slower you pay down the principal.

- Balancing immediate affordability (lower monthly payments) with the long-term cost: It's a trade-off. If a shorter term makes your monthly payments unmanageable, a longer term might be necessary to fit your budget. However, if you can afford a slightly higher payment, opting for a shorter term will save you thousands in interest and help you become debt-free sooner.

- Strategies for paying off a longer-term loan faster: If you do opt for a longer term for affordability, consider making extra payments whenever possible. Even an additional $20-$50 per month can shave months off your loan and significantly reduce the total interest paid. Some lenders also offer bi-weekly payments, which can effectively add one extra monthly payment per year.

Hidden Fees and Charges: What to Watch Out For in Ontario

Beyond the interest rate, various fees can inflate the cost of your car loan. Be diligent in reviewing all documentation.

- PPSA (Personal Property Security Act) fees, administration fees, documentation fees: These are common fees in Ontario. PPSA registers the lender's interest in the vehicle. Administration and documentation fees cover the cost of processing your loan. While some are legitimate, ensure they are reasonable and fully disclosed.

- The push for extended warranties, rustproofing, and other add-ons: Dealerships often offer various protection packages and add-ons. While some might have value (like a comprehensive extended warranty on an older used car), others might be overpriced or unnecessary. Understand their value and impact on your loan. Adding these to your financing increases your principal and, therefore, your interest payments.

- The importance of asking for a full, itemized breakdown of all costs: Before signing anything, demand a complete breakdown of the vehicle price, all fees, taxes, and the total amount to be financed. This transparency is your right as a consumer.

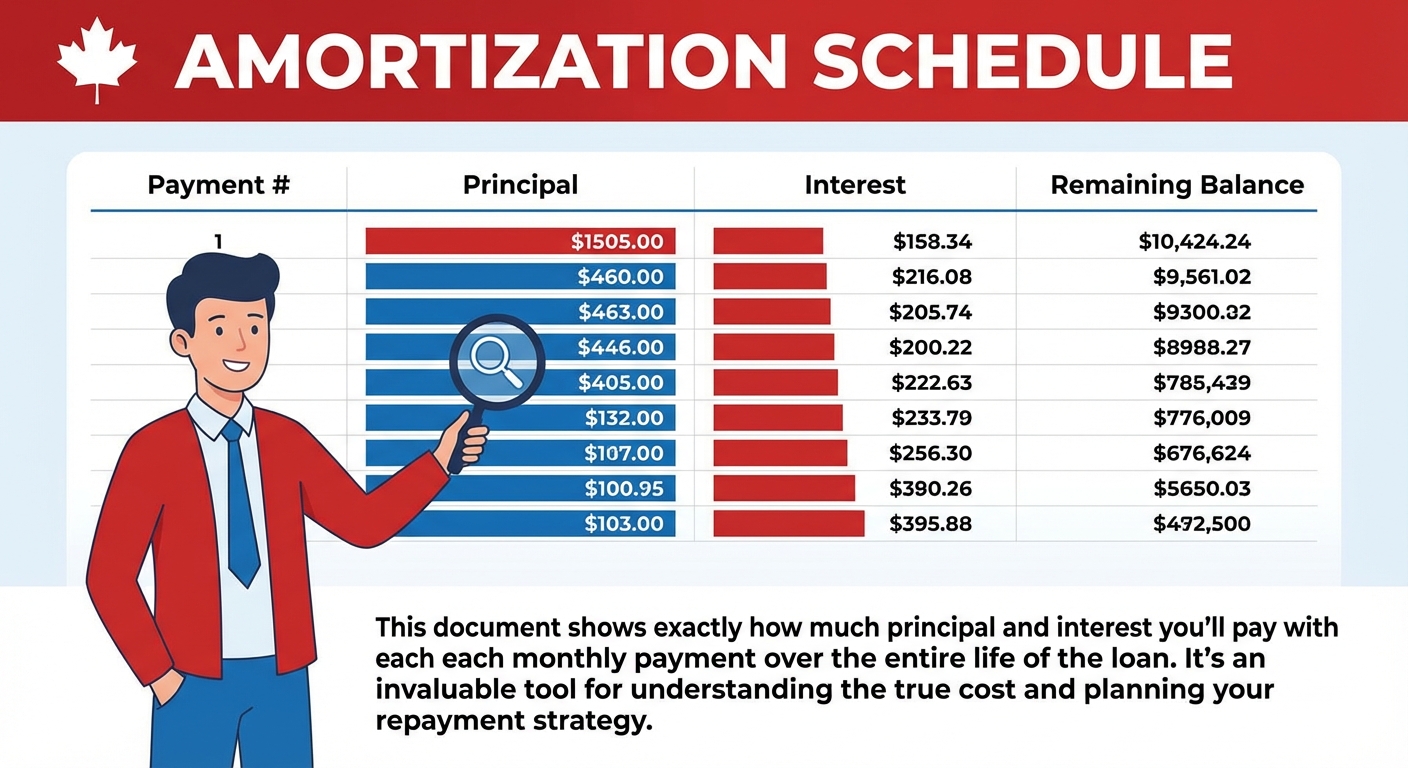

Pro Tip: Request a Full Loan Amortization Schedule.

This document shows exactly how much principal and interest you'll pay with each monthly payment over the entire life of the loan. It's an invaluable tool for understanding the true cost and planning your repayment strategy.

(Context: A clear, professional infographic or data visualization comparing two hypothetical car loan scenarios (e.g., 60-month vs. 84-month term for the same principal amount), clearly showing the difference in total interest paid and monthly payments. This visual should reinforce the 'Decoding the Dollars' section.)

Beyond Toronto's Skyline: Car Loan Realities Across Ontario

While Toronto is a major hub for specialized lending, it's important to understand that options exist and differ across Ontario's diverse urban and rural landscapes.

Ottawa's Options: Navigating the Nation's Capital for Your Vehicle

As the nation's capital, Ottawa offers a robust market for car loans, though with its own unique characteristics compared to the GTA.

- Specific considerations for the Ottawa market: Ottawa might have a slightly smaller pool of specialized subprime lenders compared to the sheer volume found in Toronto. However, it still boasts numerous dealerships with dedicated finance teams and access to a broad network of lenders.

- Highlighting local dealerships and credit unions in the Ottawa region: Look for established dealerships known for their finance departments and strong community presence. Credit unions in Ottawa, much like those in Toronto, can offer a more personalized approach and might be worth exploring, especially if you're already a member.

Hamilton, London, and Rural Ontario: Finding Your Wheels Outside the GTA

Mid-sized cities and rural communities across Ontario present different dynamics for bad credit car loans.

- How lender availability and options might differ in mid-sized cities like Hamilton and London: Cities like Hamilton and London have substantial populations and well-developed automotive markets. You'll find a good selection of dealerships and access to the same major subprime lenders as in Toronto, though perhaps with fewer independent online brokers physically located there. The competition among dealerships can still work in your favour.

- The role of smaller, independent dealerships and local credit unions in rural communities: In smaller towns and rural areas, independent dealerships and local credit unions often play a more prominent role. These establishments may have deeper ties to the community and a greater understanding of local economic conditions, potentially leading to more flexible lending decisions for their residents.

- Challenges and opportunities unique to less densely populated areas: The main challenge might be a smaller selection of vehicles or fewer direct lending options compared to major urban centres. However, the opportunity lies in the personal relationships you can build with local lenders and dealers, who might be more willing to work with you on a case-by-case basis.

Pro Tip: Local Credit Unions Can Be Hidden Gems in Smaller Communities.

They often have a more personal approach to lending and may be more flexible, especially if you have an established relationship with them. Don't overlook these community-focused institutions when exploring your options outside the GTA.

Your Car Loan as a Credit Catalyst: Rebuilding Your Financial Future

A car loan, when managed responsibly, isn't just a means to get from A to B; it's a powerful tool for credit rebuilding. It can be the catalyst that transforms your financial future, opening doors that were once closed.

The Mechanics of Credit Repair: How On-Time Payments Transform Your Score

Understanding how your credit score works is key to improving it.

- Understanding the biggest factor in your credit score: payment history: This accounts for approximately 35% of your credit score. Every on-time payment you make on your car loan is reported to Equifax and TransUnion Canada, signaling to other lenders that you are a reliable borrower.

- How consistent, on-time car loan payments are reported to credit bureaus and positively impact your score: Unlike revolving credit (like credit cards), an installment loan like a car loan demonstrates your ability to make consistent payments over a fixed period. This is a very strong positive indicator for future lenders. As you make payments, your credit utilization (how much debt you have compared to available credit) also improves, further boosting your score.

- Monitoring your credit score and report post-loan approval for accuracy and progress: Regularly check your credit report to ensure payments are being reported correctly. You should see a gradual, but steady, improvement in your score as you consistently make payments.

Strategies for Accelerated Credit Improvement: Beyond Just Car Payments

While your car loan is a major player, other actions can complement your efforts to rebuild credit.

- Complementary actions: Secured credit cards, small personal loans (if manageable): A secured credit card requires a deposit, which becomes your credit limit. Using it responsibly and paying it off in full each month can quickly build positive payment history. Small, manageable personal loans can also diversify your credit mix and demonstrate responsible borrowing.

- Maintaining low credit utilization on other revolving accounts: If you have any credit cards, keep your balances low relative to your credit limits (ideally below 30%). High utilization can negatively impact your score, even if you pay on time.

- The importance of financial literacy and responsible budgeting after securing your loan: This is the foundation. Create a realistic budget, track your spending, and ensure you have enough funds to cover all your monthly obligations, including your car payment, with a buffer for emergencies. This proactive approach prevents future financial hardship.

Choosing Your Chariot: Smart Vehicle Selection for Financial Hardship Buyers

When you're rebuilding credit, your vehicle choice isn't just about personal preference; it's a strategic financial decision. Aim for reliability and affordability.

Reliability Over Luxury: Best Used Car Brands for Your Budget (and Credit)

Focusing on dependable vehicles will save you money in the long run, reducing unexpected repair costs that could jeopardize your loan payments.

- Focus on brands known for affordability, reliability, and lower depreciation: Japanese and Korean manufacturers often excel in this area. Brands like Honda (Civic, CR-V), Toyota (Corolla, RAV4), Mazda (Mazda3, CX-5), Hyundai (Elantra, Kona), and Kia (Forte, Seltos) consistently rank high for reliability and retain their value well.

- Why an older, well-maintained vehicle might be a smarter financial choice than stretching for a new one: New cars depreciate rapidly the moment they're driven off the lot. A slightly older, well-maintained used vehicle offers excellent value, has already absorbed the initial depreciation, and can be financed for a lower principal amount, leading to more manageable payments.

- Understanding Certified Pre-Owned (CPO) programs and their benefits: CPO vehicles are used cars that have undergone a rigorous multi-point inspection, reconditioning, and come with an extended manufacturer-backed warranty. While slightly more expensive than a regular used car, the peace of mind and added protection can be invaluable for someone needing reliability.

New vs. Used: The Cost-Benefit Analysis for Toronto Drivers

The new vs. used debate is particularly relevant for those with financial hardship.

- When a new car *might* make sense: In rare cases, a new car might be a viable option. This could include specific manufacturer programs designed for credit-challenged buyers, or low-interest promotions that, despite your credit, are still competitive. However, these are exceptions, not the rule.

- The value proposition of used cars: For most individuals rebuilding credit, a used car offers significantly lower initial cost, less depreciation, and often lower insurance premiums. This means a smaller loan amount, lower payments, and a faster path to ownership.

- Avoiding the 'Lemon' Trap: The importance of vehicle history reports (CarFax, CarProof): When buying used, always insist on a comprehensive vehicle history report. These reports detail accident history, service records, odometer discrepancies, and previous ownership, helping you avoid costly surprises.

Pro Tip: Always Get a Pre-Purchase Inspection (PPI) from an Independent Mechanic.

This small investment (typically $100-$200) can save you thousands in unexpected repairs. An unbiased mechanic can uncover hidden issues that even a CarFax report might miss, giving you confidence in your purchase.

Your Next Steps to Approval: Crafting Your Personalized Toronto Action Plan

Feeling empowered? Excellent. Now it's time to translate that knowledge into action. A structured approach will make the process smoother and increase your chances of securing the best possible car loan in Toronto.

Document Checklist: What to Prepare Before You Walk In (or Click 'Apply')

Being prepared with all necessary documentation streamlines the application process and shows lenders you're serious and organized.

- Essential documents:

- Pay stubs (2-3 months): Demonstrates consistent income.

- Bank statements (3-6 months): Shows income deposits, spending habits, and ability to manage funds.

- Proof of residence (utility bill, lease agreement): Confirms stable housing.

- Valid photo ID (driver's license, passport): For identity verification.

- Proof of insurance: Required before you drive off the lot.

- Additional documents for self-employed individuals:

- Tax returns (2 years): Verifies declared income.

- Business bank statements: Shows business activity and cash flow.

- Letters from accountants: Can provide additional income verification.

Getting Multiple Quotes: The Power of Comparison Shopping in a Competitive Market

Never settle for the first offer you receive, especially when dealing with financial hardship.

- Don't settle for the first offer: Different lenders have different risk appetites and programs. What one lender denies, another might approve at a reasonable rate.

- Leverage online tools for pre-qualification without impacting your credit score: Many online platforms and dealerships offer "soft credit checks" or pre-qualification forms. These allow you to get an idea of potential loan terms without leaving a hard inquiry on your credit report, which could temporarily lower your score.

- Comparing not just rates, but also terms, fees, and the overall loan structure: A lower interest rate on an 84-month term might cost you more overall than a slightly higher rate on a 60-month term. Look at the total cost of borrowing, including all fees.

Negotiating Your Best Deal: From Vehicle Price to Protection Packages

Negotiation is part of the car-buying process, and it's even more important when you're working with a tighter budget and specific loan constraints.

- Negotiate the vehicle price first, then discuss financing: Separate the two. Get the best possible price on the car before you start discussing loan terms. This prevents the dealer from shifting costs around and ensures you know the true cost of the vehicle itself.

- Understanding and scrutinizing add-ons like extended warranties, paint protection, and rustproofing: Be informed about what these add-ons truly offer. Are they a good value for your specific vehicle and needs, or are they high-profit items for the dealership?

- The art of saying 'no' to unnecessary extras: Don't feel pressured. It's perfectly acceptable to decline add-ons if they don't fit your budget or perceived value.

Making the Final Decision: Confidence on the Road Ahead

The finish line is in sight!

- Reviewing all paperwork carefully before signing, ensuring all agreed-upon terms are reflected: Read every line of the contract. Ensure the interest rate, term, monthly payment, and total financed amount match what you agreed to. Do not sign if anything is unclear or incorrect.

- Trusting your gut and the lender's transparency throughout the process: If a deal feels too good to be true, or if the lender is pressuring you or being evasive, it's a red flag. Work with professionals who are transparent and make you feel comfortable.

- Confirming insurance requirements before driving off the lot: In Ontario, car insurance is mandatory. Ensure you have adequate coverage in place before taking possession of your new vehicle.