Approval Secrets: Navigating the Best Used Car Finance Options for Ontario's Self-Employed

Table of Contents

- Key Takeaways for Busy Entrepreneurs

- The Entrepreneur’s Dilemma: Why Car Finance is Different for You

- Decoding the Best Used Car Finance Options in Ontario

- The Documentation Toolkit: Proving Your Income Without a T4

- Credit Scores and the Self-Employed Applicant

- Tax Advantages: Turning a Car Payment into a Business Asset

- Maximizing Your Approval Odds: Strategic Moves

- Navigating Ontario-Specific Regulations

- Step-by-Step Approval Strategy

- Phase 1: The Audit

- Phase 2: The Pre-Approval

- Phase 3: The Selection

- Phase 4: Closing the Deal

- Frequently Asked Questions (FAQ)

- Can I get a car loan if I’ve been self-employed for less than 6 months?

- Do I need a separate business bank account to get approved?

- Is it better to finance in my personal name or my business name?

- What is the minimum credit score for self-employed car finance in Ontario?

- Can I finance a used car if I have GST/HST arrears?

You’ve built a business from the ground up. You’ve navigated the complexities of the Ontario market, survived the tax seasons, and managed to create something out of nothing. But when it comes time to upgrade your work vehicle or secure a reliable used car for your daily commute, you hit a brick wall. The bank teller, who was happy to take your business deposits yesterday, suddenly looks at your T1 General and shakes their head. "Your taxable income is too low," they say, ignoring the thousands of dollars in equipment you’ve rightfully written off.

This is the entrepreneur’s paradox in Ontario. The very tax strategies that help your business thrive often make you look "unlendable" to traditional financial institutions. But here is the secret: the "Big Five" banks aren't the only game in town. In fact, for a self-employed individual in Ontario, they are often the worst place to start. Navigating the world of used car finance requires a shift in strategy, moving away from "T4-thinking" and toward a model that rewards cash flow, stability, and business health.

Key Takeaways for Busy Entrepreneurs

- Documentation is King: Your Notice of Assessment (NOA) and T1 General are the foundation of your application. Keep them organized.

- Lender Variety: Specialized used car dealerships in Ontario have access to niche lenders and "stated income" programs that traditional banks simply don't offer.

- Tax Synergy: Financing a used vehicle allows you to leverage Capital Cost Allowance (CCA) and interest deductions, often making it more cost-effective than paying cash.

- Stability Trumps Salary: Lenders are looking for two years of business consistency. If you can prove you’ve survived the startup phase, your odds of approval skyrocket.

- The 15% Rule: A down payment of 15% or more can often bypass rigid income verification requirements by reducing the lender's risk.

The Entrepreneur’s Dilemma: Why Car Finance is Different for You

Why does it feel like the system is rigged against the self-employed? It comes down to how "income" is defined. If you are a T4 employee at a large firm, your income is predictable and verified by a single document. As an Ontario business owner, your income is "net," not "gross." You might bring in $150,000 in revenue, but after expenses, home office deductions, and vehicle write-offs, your taxable income might only show $40,000.

Traditional banks use automated underwriting systems designed for the masses. When the system sees $40,000, it calculates your debt-to-income ratio based on that figure, regardless of the $110,000 you actually had moving through your accounts. This "Paper Income vs. Real Income" gap is the primary reason entrepreneurs get rejected.

There is also the myth of the "Self-Employed Tax." Many freelancers believe they will naturally be charged a higher interest rate just because they don't have a boss. This isn't necessarily true. While some "subprime" lenders do charge a premium for the extra risk, many specialized lenders in Ontario offer competitive rates that mirror prime bank rates, provided you can prove stability. The key is finding a lender that understands how to read a Profit and Loss statement rather than just a single line on a tax return.

Decoding the Best Used Car Finance Options in Ontario

Ontario has one of the most robust used car markets in North America, and with that comes a diverse range of financing vehicles. You aren't limited to the local bank branch. Understanding the landscape is the first step toward getting the keys to your next vehicle.

| Finance Source | Pros for Self-Employed | Cons for Self-Employed |

|---|---|---|

| Specialized Dealerships | Access to "Stated Income" programs; experts at reading business docs. | May require a higher down payment for the best rates. |

| Ontario Credit Unions | More flexible than big banks; value community and business longevity. | Often require you to move your business banking to them. |

| Big Five Banks | Lowest potential rates if you show high personal taxable income. | Extremely rigid; high rejection rates for entrepreneurs with heavy write-offs. |

| Lease-to-Own | High approval rates; excellent for rebuilding business credit. | Higher overall cost of borrowing; limited vehicle selection. |

Specialized dealership finance departments are often the "secret weapon" for the self-employed. These departments have relationships with dozens of lenders, including those that specialize in "B-side" lending. They understand that a contractor in Mississauga or a graphic designer in Ottawa has a fluctuating income. They know how to package your application to highlight your "Gross Deposits" rather than just your "Net Income."

The Documentation Toolkit: Proving Your Income Without a T4

When you walk into a dealership or apply online, you need to be armed with more than just a smile. Lenders want to see a pattern of success. In the world of Ontario car finance, there is a "Holy Trinity" of documents that will do the heavy lifting for you.

First, your Notice of Assessment (NOA). This is the document the CRA sends you after you file your taxes. Lenders use this to verify that you don't owe back taxes (a major red flag) and to see your declared income. Second is the T1 General, which provides a more detailed breakdown of your business activities. Finally, your Business License or Articles of Incorporation proves that you are a legitimate entity operating within the province.

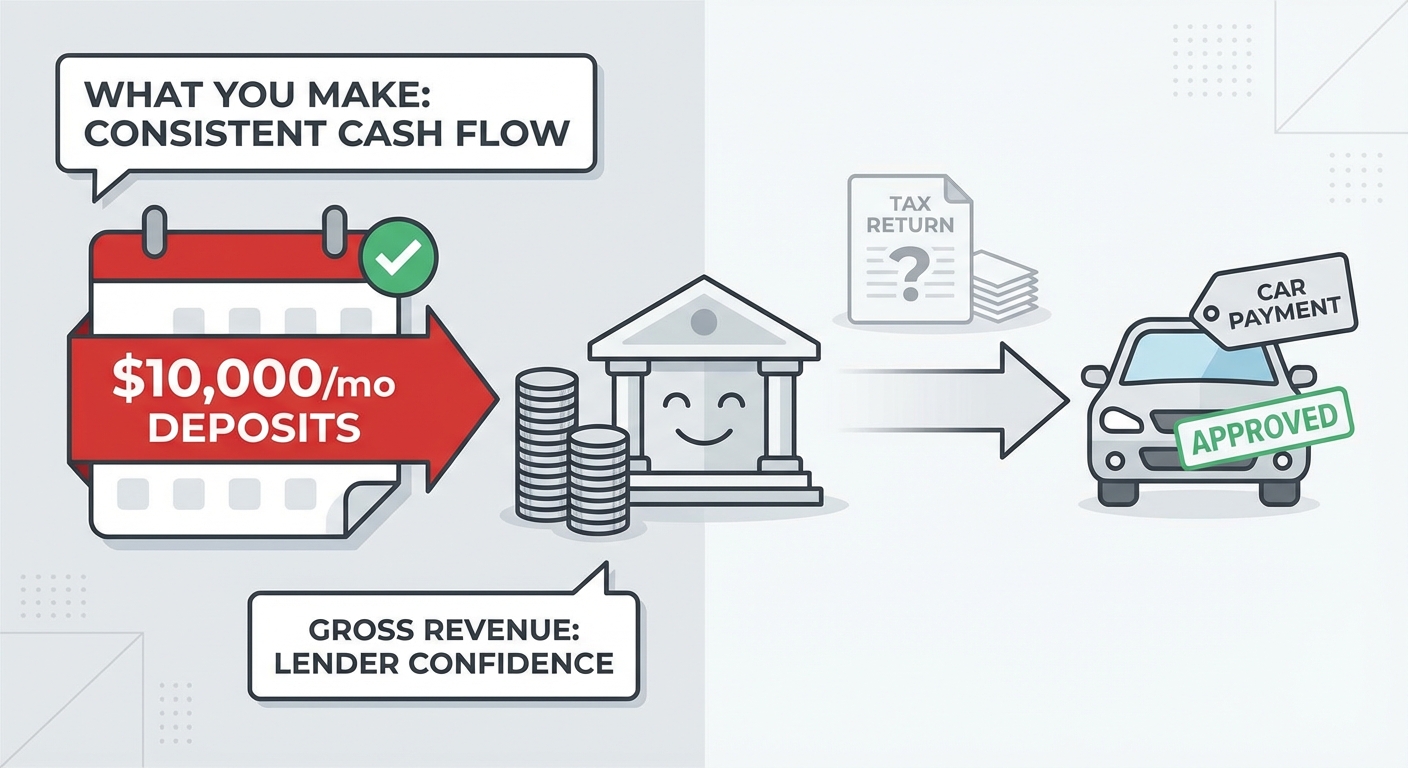

But what if those documents show a low income due to those pesky (but necessary) write-offs? This is where bank statements come in. Many specialized lenders will look at 6 to 12 months of business bank statements. They aren't looking at what you keep; they are looking at what you *make*. If you can show $10,000 in deposits every month like clockwork, that speaks louder than a tax return. It shows "Gross Revenue," which provides the lender with confidence that you have the cash flow to cover a monthly car payment.

Credit Scores and the Self-Employed Applicant

As a business owner, your personal credit and your business credit are often inextricably linked, especially if you are a sole proprietor. When a lender pulls your credit, they are looking for your personal reliability. Have you paid your personal credit cards on time? Is your mortgage in good standing?

If you’ve recently transitioned from being an employee to an owner, you might have a "thin file" for your business. This is normal. In these cases, the lender will lean heavily on your personal credit score. If your personal score is above 680, you are in the "prime" territory. If it’s between 600 and 680, you may be looking at "near-prime" rates. Below 600, and you’ll likely need to work with a subprime lender to rebuild your credit through the vehicle loan itself.

One strategy for those with less-than-perfect credit is to show the longevity of the business. Two years is the magic threshold in Ontario. If you’ve been self-employed for more than 24 months, you are statistically much less likely to fail than a startup. Lenders see that "2-year mark" as a badge of honor and are often willing to overlook a slightly lower credit score if the business is established and stable.

Tax Advantages: Turning a Car Payment into a Business Asset

One of the biggest mistakes Ontario entrepreneurs make is paying for a used car in cash. While it feels good to be debt-free, you might be throwing away significant tax advantages. In Canada, and specifically under Ontario’s tax jurisdiction, financing a vehicle for business use opens up several doors.

The Capital Cost Allowance (CCA) allows you to depreciate the cost of the vehicle over time. For most passenger vehicles (Class 10 or 10.1), you can deduct a percentage of the vehicle's cost from your gross income every year. Furthermore, the interest on your car loan is a deductible business expense. If you use the car 80% for business, you can deduct 80% of the interest paid that year. When you pay cash, you lose the ability to leverage that interest deduction to lower your tax bill.

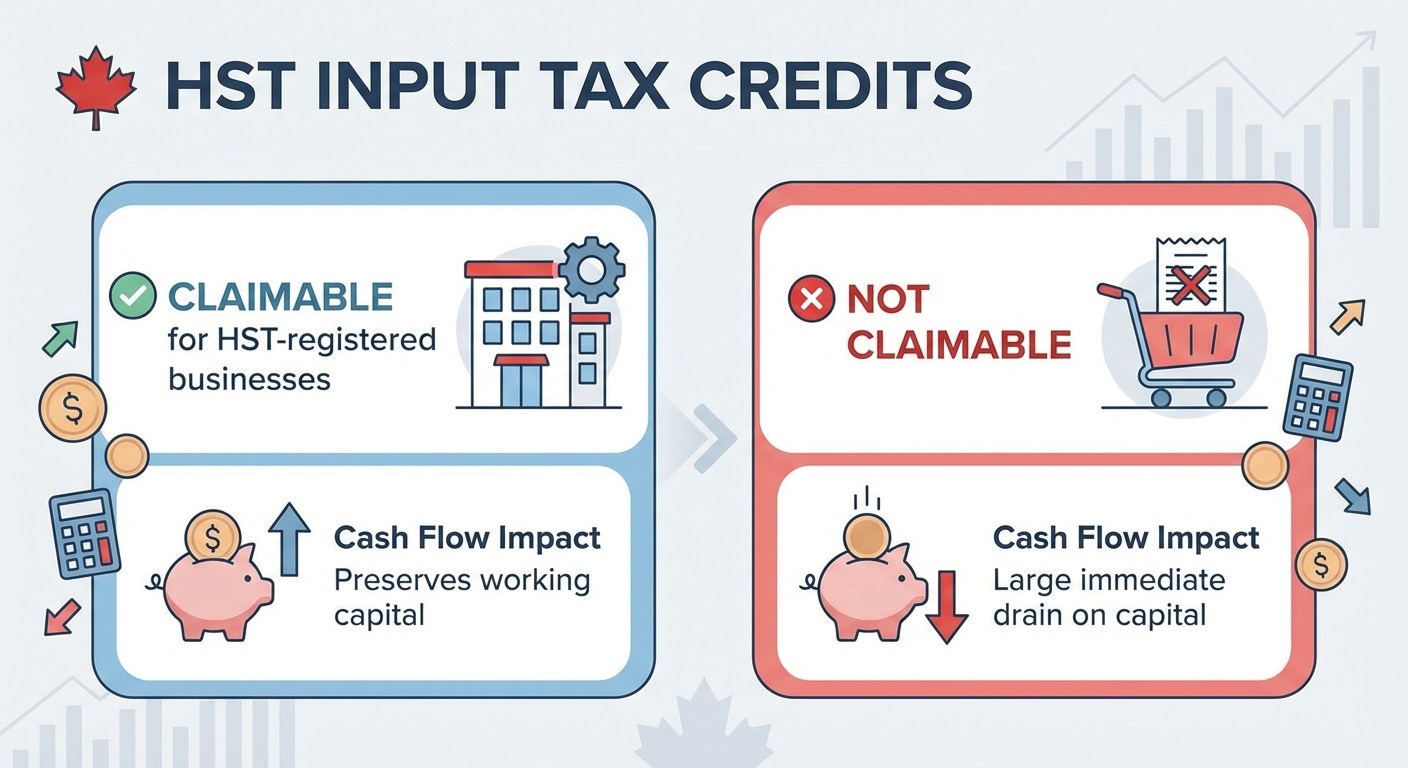

| Expense Category | Financed (Business Use) | Cash Purchase (Personal Use) |

|---|---|---|

| Loan Interest | Deductible (Pro-rated by KM) | Not Deductible |

| Depreciation (CCA) | Yes (Up to prescribed limits) | No |

| HST Input Tax Credits | Claimable for HST-registered businesses | Not Claimable |

| Cash Flow Impact | Preserves working capital | Large immediate drain on capital |

If your business is HST-registered, you can also claim an Input Tax Credit (ITC) for the HST paid on the purchase price of the vehicle. This can result in a significant refund or reduction in the HST you owe the CRA. When you combine the ITC, the CCA, and the interest deduction, the "real cost" of financing a used car in Ontario is often much lower than the sticker price suggests.

Maximizing Your Approval Odds: Strategic Moves

If you want the best possible rate and the smoothest approval process, you need to think like a lender. Lenders are in the business of managing risk. Your goal is to make yourself look like the lowest risk possible.

The most effective tool in your arsenal is the down payment. While "zero-down" deals are popular, they are often difficult for the self-employed to secure without showing high taxable income. By putting 15% to 20% down, you are demonstrating "skin in the game." If the vehicle is worth $30,000 and you put $6,000 down, the lender is only on the hook for $24,000. This lower Loan-to-Value (LTV) ratio often triggers an automatic approval because the lender knows they can recover their money even if you default.

Another strategic move is the trade-in. In Ontario, a trade-in acts as a "tax shield." You only pay HST on the difference between your trade-in value and the new (used) car's price. For example, if you buy a $40,000 truck and trade in your old one for $15,000, you only pay HST on $25,000. This saves you thousands of dollars upfront and reduces the total amount you need to finance.

Finally, consider the vehicle itself. Lenders are more likely to approve a loan for a 3-year-old Honda Civic with 50,000 kilometres than a 10-year-old luxury SUV with 180,000 kilometres. Why? Reliability and resale value. If the lender has to repossess the car, they want something they can sell quickly. Choosing a vehicle known for its longevity makes the lender feel safer about the 60-month term you’re asking for.

Navigating Ontario-Specific Regulations

In Ontario, you are protected by the Ontario Motor Vehicle Industry Council (OMVIC). This is a crucial distinction from buying privately. When you finance through an OMVIC-registered dealer, you are entitled to "All-In Price" advertising. This means the price you see must include all fees except for HST and licensing. There should be no "hidden" financing fees or documentation charges that weren't disclosed upfront.

You should also be aware of the current interest rate environment. While the Bank of Canada’s overnight rate influences car loans, used car rates in Ontario are also affected by the age of the vehicle. Generally, the older the car, the higher the interest rate, as the risk to the lender increases. However, for a self-employed individual, the "spread" between a new car rate and a used car rate is often offset by the lower purchase price and the immediate tax benefits mentioned earlier.

Step-by-Step Approval Strategy

Don't just walk onto a lot and hope for the best. Follow this four-phase strategy to ensure you get the best deal possible.

Phase 1: The Audit

Check your own credit score using a service like Borrowell or Credit Karma. Gather your last two years of NOAs and your most recent 6 months of bank statements. If you see any errors on your credit report, dispute them before you apply for the loan.

Phase 2: The Pre-Approval

Before you fall in love with a specific car, get a pre-approval. This tells you exactly how much a lender is willing to give you and at what rate. It puts the power back in your hands during negotiations. Reach out to a dealership that specializes in self-employed financing to start this process.

Phase 3: The Selection

Find a vehicle that fits the lender’s requirements. Ensure the kilometres aren't too high for the year of the car, as this can affect the LTV ratio. Ask for a CarFax report to ensure the vehicle has a clean history, which also protects the lender's collateral (and your investment).

Phase 4: Closing the Deal

Review the finance contract carefully. Ensure the interest rate matches your pre-approval and that there are no "pre-payment penalties." As a business owner, you may want to pay the loan off early if you have a high-revenue month; make sure your contract allows this without a fee.

Frequently Asked Questions (FAQ)

Can I get a car loan if I’ve been self-employed for less than 6 months?

It is challenging but not impossible. Lenders typically look for two years of history, but if you are in the same industry you were in as an employee (e.g., a plumber who started his own company), some lenders will count your previous employment time toward your "stability" requirement. You will likely need a larger down payment or a co-signer in this scenario.

Do I need a separate business bank account to get approved?

While not strictly required, it is highly recommended. A dedicated business bank account makes it much easier for a lender to verify your "Gross Deposits." If your business and personal expenses are mixed in one account, the lender has to spend more time "cleaning" the data, which can lead to a more conservative (and less favorable) approval.

Is it better to finance in my personal name or my business name?

This depends on your business structure. If you are incorporated, financing in the business name can help build business credit and protect your personal credit score from high debt-utilization ratios. However, most small business loans will still require a "Personal Guarantee." Consult with your accountant to see which option offers the best tax advantage for your specific situation.

What is the minimum credit score for self-employed car finance in Ontario?

There is no "hard" minimum, as different lenders have different appetites for risk. Generally, a score above 600 opens the door to most specialized lenders. If your score is below 600, you can still get approved, but you should expect higher interest rates and a requirement for a significant down payment (20% or more).

Can I finance a used car if I have GST/HST arrears?

This is a major hurdle. Lenders see CRA debt as a "super-priority" lien, meaning the government can seize your assets before the lender can. Most lenders will require proof that you have a payment plan in place with the CRA or that the arrears have been cleared before they will finalize a car loan. Clearing these arrears is the single best thing you can do to improve your approval odds.

Your business success should be an asset, not a hurdle to your personal or professional mobility. The road to approval in Ontario isn't about having a T4; it's about having a strategy. By understanding how lenders view your income, leveraging the tax benefits of financing, and choosing the right specialized partners, you can secure a vehicle that drives your business forward. You’ve done the hard work of building your company—now let that company work for you on the road.