British Columbia Parents: Your Child Tax Benefit Just Cut Your Car Payments.

Table of Contents

- British Columbia Parents: Your Child Tax Benefit Just Cut Your Car Payments.

- Key Takeaways: Your Fast Track to Car Loan Savings in British Columbia

- Unlocking Lower Payments: How Refinancing with CCB Transforms Your British Columbia Budget

- The High Cost of Driving in British Columbia: A Parent's Financial Burden

- Your Canada Child Benefit: More Than Just a Monthly Allowance, It's Stable Income

- Why British Columbia Lenders View CCB as Income (and How to Make Them See It)

- The Promise of Financial Relief: A British Columbia Family's Journey to Lower Car Payments

- The Strategic Playbook: Navigating Car Loan Refinancing in British Columbia, Step-by-Step

- Is Refinancing Your British Columbia Car Loan Right for You? A Self-Assessment for Parents

- The British Columbia Refinancing Journey: A Clear, Actionable Guide

- Beyond the Rate: Unpacking All the Potential Costs of Refinancing in British Columbia

- Finding Your Perfect Match: Lenders, Loans, and Specific Scenarios in British Columbia

- Banks vs. Credit Unions vs. Online Lenders in British Columbia: Who Embraces Your CCB Income?

- Refinancing with Less-Than-Perfect Credit in British Columbia: A Reality Check for Parents

- The Car Itself: How Vehicle Age, Make, and Model Affect Refinancing Eligibility in British Columbia

- From Vancouver to Prince George: Regional Nuances in British Columbia's Lending Landscape

- Beyond Refinancing: Maximizing Your Financial Well-being as a British Columbia Parent

- Building a Stronger Financial Future with Your CCB Savings

- Other Financial Assistance for British Columbia Families: A Quick Look

- Your Next Steps to Approval: Turning Knowledge into Action for British Columbia Parents

- Frequently Asked Questions (FAQ) for British Columbia Parents on Refinancing with CCB

British Columbia Parents: Your Child Tax Benefit Just Cut Your Car Payments.

Many British Columbia parents are unknowingly sitting on a powerful financial tool – their Canada Child Benefit (CCB). This isn't just for daily expenses; it can be the key to significantly reducing your car loan payments. Picture this: the consistent, non-taxable income you receive each month for your children could be recognized as stable, verifiable income by lenders. This recognition opens the door to car loan refinancing, offering substantial financial relief in an expensive province like British Columbia where every dollar counts towards your family's well-being. It's time to transform your CCB from a simple allowance into a strategic financial lever, putting you back in control of your budget.

Key Takeaways: Your Fast Track to Car Loan Savings in British Columbia

- Your Canada Child Benefit (CCB) is often considered stable income by lenders for refinancing, providing a powerful advantage.

- Refinancing can significantly lower interest rates and monthly payments, freeing up crucial funds for other family needs.

- Even with less-than-perfect credit, consistent CCB income can strengthen your application and improve your chances of approval.

- Understanding the nuances of British Columbia's lending landscape is crucial for success, from provincial regulations to local lender preferences.

- This strategy moves beyond quick fixes to long-term financial stability, helping you build a more secure future for your family.

Unlocking Lower Payments: How Refinancing with CCB Transforms Your British Columbia Budget

The High Cost of Driving in British Columbia: A Parent's Financial Burden

Living and driving in British Columbia, especially in bustling centres like Vancouver, Surrey, or Kelowna, comes with its unique set of financial pressures. Parents face an escalating cost of living, from housing to groceries, making every major expense a critical point of focus. Factor in high fuel prices, mandatory provincial insurance through ICBC, and the stress of existing car loans – often secured at higher interest rates due to past credit challenges or initial haste – and it’s clear why finding substantial savings is paramount. A car isn't a luxury for most British Columbia families; it's a necessity for commutes, school runs, and accessing essential services. Reducing a significant monthly outgoing like a car payment can translate directly into more breathing room for your family budget, alleviating stress and allowing for better planning.

Your Canada Child Benefit: More Than Just a Monthly Allowance, It's Stable Income

The Canada Child Benefit (CCB) is a non-taxable amount paid monthly by the Canada Revenue Agency (CRA) to eligible families to help with the cost of raising children under 18 years of age. Its calculation is based on your family's net income from the previous tax year, the number of children you have, and their ages. What makes the CCB particularly appealing to lenders, and what differentiates it from short-term solutions like payday loans, is its unwavering reliability. It's a consistent, predictable income source, deposited directly into your bank account month after month. This stability is the golden ticket. While some might view it merely as pocket money for children's activities or groceries, savvy British Columbia parents are now recognizing its potential as a recognized, verifiable income stream that can significantly impact their financial standing when seeking legitimate, long-term financing solutions for major assets like a vehicle.

Why British Columbia Lenders View CCB as Income (and How to Make Them See It)

Not all income is created equal in the eyes of a lender. While traditional employment income is straightforward, the CCB's non-taxable and consistent nature often makes it a favourable, if sometimes misunderstood, form of income for car loan refinancing. Major banks like RBC or BMO, local credit unions such as Vancity Credit Union or Coast Capital Savings, and online lenders operating in British Columbia each have their own internal policies. Generally, lenders are looking for stability and verifiability. The CCB ticks both boxes. To make sure lenders recognize it, you need to present it effectively. This means demonstrating a consistent history of receiving the benefit, typically through bank statements showing regular deposits over several months. Overcoming potential lender hesitations often involves clear, undeniable proof that the CCB is a reliable part of your monthly income, not a sporadic payment. Some lenders, particularly credit unions and specialized online platforms, are more accustomed to assessing diverse income streams, including government benefits, making them excellent first points of contact for British Columbia parents.

Pro Tip: Gathering Your Official CCB Documentation

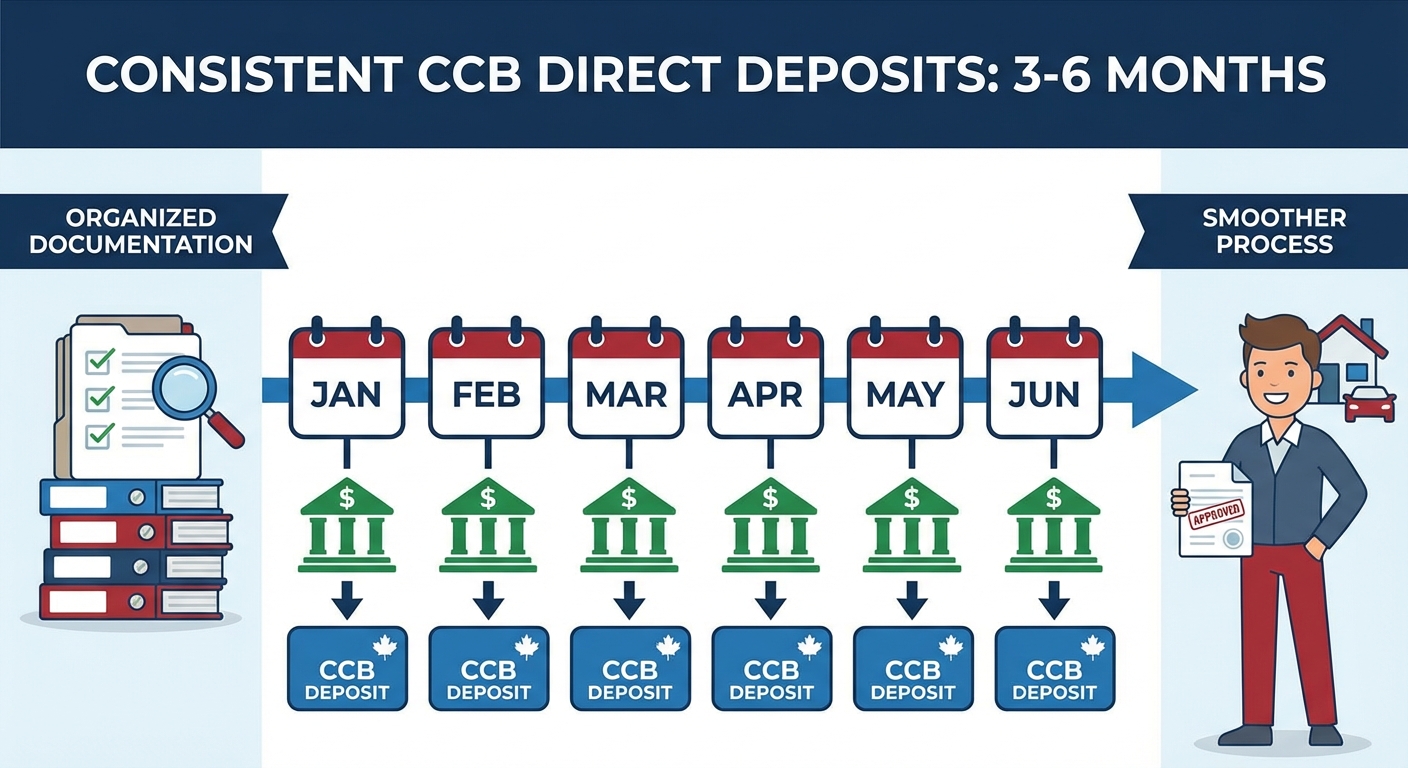

To present the strongest case to lenders, thorough documentation is key. Don't just rely on verbal assurances. Gather your official CRA Canada Child Benefit statements, which clearly outline your eligibility and monthly amounts. Your Notice of Assessment (NOA) from the CRA showing your family net income for the previous year can also support your application by demonstrating the basis of your CCB calculation. Most critically, provide bank statements spanning at least three to six months, clearly highlighting the consistent, direct deposits of your CCB. The more organized and complete your documentation, the smoother the process will be, reducing any doubt a lender might have about your stable income.

The Promise of Financial Relief: A British Columbia Family's Journey to Lower Car Payments

Imagine the weight lifted off your shoulders when your monthly car payment is significantly reduced. This isn't just about saving money; it's about reclaiming financial peace of mind. For a British Columbia family, those savings can translate into so much more – perhaps enrolling your children in that extra-curricular activity, building a stronger emergency fund, or simply enjoying a family outing without the underlying financial stress. Leveraging your CCB for refinancing is a smart move that recognizes your family's unique financial landscape. It's about empowering you to make strategic decisions that lead to tangible improvements in your daily life, transforming a burden into an opportunity for growth and stability. Many families across British Columbia have already discovered this pathway to financial freedom, using their consistent CCB income to unlock better loan terms and more manageable payments, setting a precedent for what's possible when you think differently about your finances.

The Strategic Playbook: Navigating Car Loan Refinancing in British Columbia, Step-by-Step

Is Refinancing Your British Columbia Car Loan Right for You? A Self-Assessment for Parents

Before diving into the refinancing process, it's wise to conduct a self-assessment to determine if it truly makes financial sense for your British Columbia family. Consider your current interest rate: if it's high (say, above 7-8%), there's significant room for savings. Look at the remaining term of your loan; refinancing might extend it, potentially lowering monthly payments but increasing total interest paid, or you could opt for a shorter term to save on interest. Assess your car's current market value in British Columbia; lenders prefer to refinance vehicles where the loan amount is less than or equal to the car's value. Have there been any positive changes in your credit score since you first took out the loan? An improved score can unlock much better rates. Finally, clarify your specific financial goals: are you aiming for a lower monthly payment, a shorter loan term, a better interest rate, or even cash-out refinancing to consolidate other debts? Understanding these factors will guide your refinancing decisions.

The British Columbia Refinancing Journey: A Clear, Actionable Guide

Embarking on the refinancing journey in British Columbia doesn't have to be daunting. Here's a clear, actionable, step-by-step guide for parents:

- Assess Your Current Car Loan: Gather your existing loan documents. Note your current interest rate, remaining balance, monthly payment, and any early repayment penalties.

- Obtain and Review Your Credit Score and Report: Your credit health is crucial. Get a free copy of your credit report from Equifax or TransUnion and review it for accuracy. A higher score means better rates.

- Gather All Required Documentation: This is where your CCB proof comes in! Collect your CRA CCB statements, bank statements showing consistent CCB deposits, proof of identity, proof of residency in British Columbia, and employment details if applicable.

- Research and Shop for Lenders: Don't settle for the first offer. Look for lenders specializing in alternative income sources like CCB. Consider major banks, British Columbia credit unions, and online platforms.

- Submit Your Application: Fill out applications with your chosen lenders. Be honest and thorough with your financial information, clearly stating your CCB as a primary or supplementary income source.

- Carefully Review and Compare Offers: Look beyond just the interest rate. Compare loan terms, total cost, and any fees.

- Finalize the New Loan: Once you've chosen an offer, complete the paperwork. Be mindful of British Columbia-specific considerations like provincial lien registration processes and ensure your old loan is officially paid off.

Beyond the Rate: Unpacking All the Potential Costs of Refinancing in British Columbia

While a lower interest rate is the primary draw of refinancing, it's crucial for British Columbia parents to understand that there can be other costs involved that might erode your savings if not accounted for. These often-overlooked fees can include administrative fees charged by the new lender for processing your loan, or early repayment penalties from your old loan provider if you're breaking the original agreement ahead of schedule. Some lenders might also require an appraisal fee for your vehicle to ascertain its current market value, which is particularly relevant in a dynamic market like British Columbia. Additionally, there are provincial lien registration fees in British Columbia to transfer the lien from your old lender to the new one. Always ask for a detailed breakdown of all associated costs upfront. Strategies to minimize these include negotiating with lenders to waive administrative fees, carefully calculating if early repayment penalties still make refinancing worthwhile, and choosing lenders with transparent fee structures. For more on navigating challenging financial situations, you might find our article Your Consumer Proposal? We're Handing You Keys helpful.

Pro Tip: Boosting Your Credit Score Before You Apply

While your stable CCB income is a powerful asset, a strong credit score remains incredibly influential in securing the best refinancing terms. Before you apply, take proactive steps to improve your score. Pay down any high-interest debts, such as credit cards or lines of credit, to reduce your credit utilization. Make sure all your bill payments – not just loan payments – are made on time, every time, as payment history is the largest factor in your score. Finally, obtain copies of your credit report from both Equifax and TransUnion and dispute any errors immediately. Even a small increase in your score can translate into significantly lower interest rates and better savings. If you've had past credit challenges, don't despair; many lenders understand that circumstances change. For insights on how past payment issues aren't always a roadblock, consider reading Your Missed Payments? We See a Down Payment.

Finding Your Perfect Match: Lenders, Loans, and Specific Scenarios in British Columbia

Banks vs. Credit Unions vs. Online Lenders in British Columbia: Who Embraces Your CCB Income?

When seeking to refinance your car loan with CCB income in British Columbia, knowing where to look is half the battle. Major banks like TD Canada Trust, CIBC, or Scotiabank often have stricter lending criteria and might prefer traditional employment income. While they will consider CCB, it might be viewed as supplementary rather than primary income, potentially affecting the terms offered. British Columbia credit unions, such as Vancity Credit Union, Coast Capital Savings, or Integris Credit Union, often pride themselves on community focus and flexibility. They might be more willing to assess diverse income streams, including CCB, as they understand the unique financial realities of their local members. Online lenders, like CarLoansCanada.com or AutoCapital Canada, often have streamlined processes and sophisticated algorithms that can quickly assess alternative income sources. They frequently specialize in non-traditional applicants and can be highly competitive. It's advisable to get quotes from all three types of institutions to compare their specific approaches and find the lender most amenable to your CCB income.

Refinancing with Less-Than-Perfect Credit in British Columbia: A Reality Check for Parents

Life happens, and sometimes credit scores take a hit. For British Columbia parents with less-than-perfect credit, refinancing might seem like an uphill battle, but it's far from impossible. This is where your stable CCB income truly shines. While a lower credit score might lead to higher interest rates initially, the consistent, verifiable nature of your CCB can significantly strengthen your application, demonstrating a reliable ability to make payments. Lenders specializing in subprime credit, whether specific brokers or divisions within larger institutions, are more likely to consider your overall financial picture rather than solely relying on your credit score. Options like a co-signer with good credit can also bolster your application, or you might explore secured loans where the vehicle itself acts as collateral. The key is transparency and presenting your CCB income clearly. For families navigating challenging credit situations, we have resources like Bad Credit? Private Sale? We're Already Writing the Cheque that can provide further guidance.

The Car Itself: How Vehicle Age, Make, and Model Affect Refinancing Eligibility in British Columbia

Beyond your income and credit, the vehicle you wish to refinance plays a significant role in a lender's decision. Lenders generally prefer to refinance newer vehicles (typically under 7-10 years old) with lower mileage, as these cars hold their value better and are less likely to incur major mechanical issues that could impact your ability to repay the loan. The make and model also matter; popular, reliable brands with good resale value in the British Columbia market (e.g., Honda, Toyota, Ford) are generally easier to refinance than niche or luxury vehicles. Lenders assess the loan-to-value (LTV) ratio, comparing the outstanding loan amount to the car's current market value. If your car is significantly depreciated or has high mileage, you might face stricter terms or require a larger down payment. Understanding your vehicle's current standing is essential for setting realistic expectations for refinancing.

From Vancouver to Prince George: Regional Nuances in British Columbia's Lending Landscape

British Columbia is a vast and diverse province, and while federal and provincial regulations apply universally, lending practices can subtly differ from one region to another. In large metropolitan areas like Vancouver and Surrey, you'll find a wide array of options, from major bank branches to numerous online lenders. The sheer volume of competition might lead to more aggressive interest rates or specialized offers. In smaller cities or more remote communities like Prince George, Nanaimo, or Kamloops, local credit unions often play a more prominent role, sometimes offering more personalized service and a deeper understanding of local economies and individual circumstances. They might be particularly flexible with alternative income sources like CCB or EI, as they serve their specific community members more directly. For instance, an article like British Columbia EI? Your Car Loan Just Called 'Shotgun' highlights how various income types are viewed differently across the province. Always research local lenders in your specific British Columbia region to uncover unique opportunities or criteria.

Pro Tip: Mastering the Art of Negotiation for Your Refinancing Deal

Don't be afraid to negotiate! Once you have multiple refinancing offers in hand, use them to your advantage. Leverage competing quotes to see if one lender is willing to beat another's interest rate or waive certain fees. Confidently highlight your stable CCB income and any positive payment history you have, emphasizing your reliability as a borrower. Be prepared to ask specific questions about all terms, fees, and conditions. If a deal doesn't feel right or doesn't meet your financial goals, be prepared to walk away. The power of choice is yours, and a little negotiation can go a long way in securing the best possible refinancing deal for your British Columbia family.

Beyond Refinancing: Maximizing Your Financial Well-being as a British Columbia Parent

Building a Stronger Financial Future with Your CCB Savings

Once you've successfully refinanced your car loan and secured those lower monthly payments, the real strategic work begins. Don't let those newfound savings simply disappear into daily expenses. Instead, consciously allocate them to build a stronger financial future for your British Columbia family. One excellent strategy is accelerated debt reduction: use the extra cash to pay down other high-interest debts like credit cards or lines of credit, freeing up even more of your income over time. Another critical step is bolstering an emergency fund; aim for three to six months of living expenses to create a vital safety net. Consider making regular contributions to a Registered Education Savings Plan (RESP) to secure your children's future education. Furthermore, consistently making your new, lower car payments on time will further improve your credit score, opening doors to even better financial opportunities down the road. This isn't just about a lower car payment; it's about a holistic approach to long-term financial stability.

Other Financial Assistance for British Columbia Families: A Quick Look

While the Canada Child Benefit is a cornerstone of family financial support, British Columbia parents can explore other provincial and federal programs that can further complement their budget and contribute to overall financial stability. The British Columbia Family Benefit, for instance, provides additional targeted support to low- and moderate-income families. Child care subsidies are available to help offset the high cost of childcare in the province. Various provincial tax credits can also provide relief. While we've focused on leveraging your CCB for car loan refinancing, being aware of these additional support systems can help you build a comprehensive financial strategy, ensuring your family benefits from every available resource. Always check official provincial and federal government websites for the most up-to-date information and eligibility criteria for these programs.

Your Next Steps to Approval: Turning Knowledge into Action for British Columbia Parents

You now possess a powerful insight: your Canada Child Benefit is a legitimate, valuable asset in the eyes of many lenders, capable of unlocking significant savings on your car loan. The path to financial relief for your British Columbia family is clear. Your next steps are crucial: start by gathering your official CCB documentation and recent bank statements. Check your credit score and report for accuracy. Then, confidently begin comparing lenders, focusing on those in British Columbia that are known for their flexibility with alternative income sources. Don't underestimate the power of your consistent CCB income. It's time to turn this knowledge into action and pursue a refinancing solution that truly benefits your family. Financial relief is not just a possibility; it's within your reach.