Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit

Table of Contents

- Key Takeaways

- Why Bad Credit Doesn’t Have to Mean High Interest Forever

- Defining Car Loan Refinancing in the Canadian Context

- The Psychology of 'Sub-prime' Lending: Moving from Risk to Reliability

- Financial Advantages of Swapping Your Current Loan

- Lowering Your Monthly Installments to Free Up Cash Flow

- Reducing the Total Interest Paid Over the Life of the Loan

- Shortening or Lengthening Your Loan Term: Which is Right for You?

- Beyond the Credit Score: The Approval Criteria

- The Importance of the 12-Month Consistent Payment Rule

- Debt-to-Income (DTI) Ratio: Can You Afford the New Terms?

- Vehicle Requirements: Age, Mileage, and Minimum Value Thresholds

- Strategic Preparation: Setting the Stage for Approval

- Pulling Your Equifax and TransUnion Reports

- Identifying and Disputing Errors on Your Credit Report

- Calculating Your Current Loan Payout vs. Vehicle Black Book Value

- What to Do If You Owe More Than the Car is Worth

- The Impact of Depreciation on Bad Credit Loans

- Strategies for Rolling Negative Equity into a New Loan

- When to Make a Principal Reduction Payment Before Refinancing

- The Step-by-Step Refinancing Process in Canada

- Step 1: Gathering Documentation

- Step 2: Shopping for Lenders

- Step 3: Reviewing the Disclosure Statement

- Step 4: The Payoff Process

- Protecting Yourself During the Refinance Journey

- Beware of 'Upfront Fee' Scams in the Canadian Lending Market

- Understanding 'Add-ons': Should You Keep Your GAP Insurance?

- The Danger of Extending Your Term Too Far

- Turning a Car Loan into a Credit Score Catalyst

- The Role of 'Credit Mix' in Your Canadian Credit Score

- How Lower Payments Reduce Your Overall Credit Utilization

- Moving from Sub-prime to Prime

- Your Questions Answered

- Can I refinance if I am currently in a Consumer Proposal?

- How soon after buying a car can I refinance in Canada?

- Does refinancing my car loan hurt my credit score?

- Are there provincial differences (e.g., Ontario vs. BC) in refinancing laws?

- What if I have a co-signer on my original loan?

- Moving Forward with Confidence

If you are currently driving a vehicle in Canada while paying an interest rate that feels more like a credit card balance than an auto loan, you are not alone. Many Canadians find themselves locked into "sub-prime" loans because of past financial hurdles, a lack of credit history, or perhaps a previous bankruptcy. At the time you signed the papers, that 18% or 24% interest rate might have been your only ticket to getting behind the wheel. But here is the secret the original dealership might not have told you: that loan is not a life sentence.

The Canadian automotive lending market has shifted significantly. Lenders are increasingly looking for "rebounding" borrowers—individuals who may have had a rough patch but have shown consistency over the last year. Refinancing your car loan with bad credit is not just a dream; it is a strategic financial move that can save you thousands of dollars and shave years off your debt. This guide will pull back the curtain on how the approval process works, what lenders like SafeLend actually look for, and how you can position yourself to get a "Yes" even if your credit score isn't perfect yet.

Key Takeaways

- Lower Your Burden: Refinancing is a primary tool to reduce monthly payments and total interest costs, regardless of your sub-prime status.

- Consistency is King: Canadian lenders often value 6–12 months of perfect payment history more than the actual three-digit credit score.

- Watch the Equity: Understanding your vehicle's current value versus your loan balance (Negative Equity) is the first step in any application.

- Credit Catalyst: A successful refinance replaces a high-interest "bad credit" loan with a lower-interest one, accelerating your credit score recovery.

- Professional Guidance: Specialized firms like SafeLend focus specifically on the Canadian sub-prime market, offering paths that traditional big banks often ignore.

Why Bad Credit Doesn’t Have to Mean High Interest Forever

In the world of Canadian finance, "bad credit" is often treated as a static label. However, credit scores are fluid. If you have been making your payments on time for the last twelve months, you are no longer the same "risk" you were when you first bought the car. Lenders see this transition as a move from a high-risk profile to a reliable one. Refinancing allows you to "re-price" your debt based on who you are today, not who you were two years ago.

Defining Car Loan Refinancing in the Canadian Context

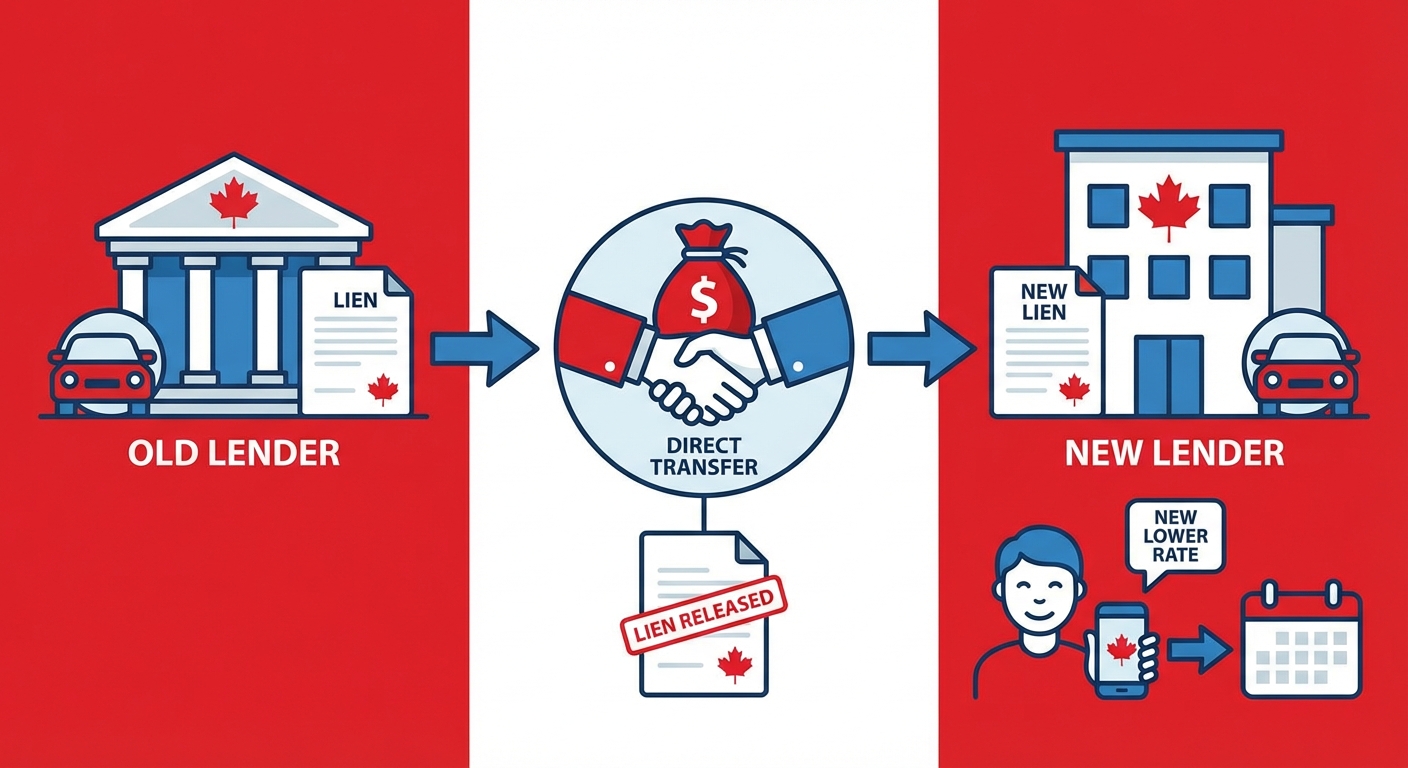

Refinancing is simply the process of taking out a new loan to pay off your existing one. The new loan comes with different terms—ideally a lower interest rate, a different monthly payment, or a shorter duration. In Canada, this process is streamlined but requires a clear understanding of your current payout statement. You aren't just "changing the rate" on your current loan; you are essentially firing your old lender and hiring a new one who offers better terms.

The Psychology of 'Sub-prime' Lending: Moving from Risk to Reliability

Lenders categorize borrowers into "buckets." When you have bad credit, you are placed in the sub-prime bucket, where interest rates are high to offset the perceived risk of default. As you make payments, you demonstrate "reliability." The goal of refinancing is to prove to a new lender that you have outgrown your current bucket. By showing a year of stability, you present a low-risk opportunity for a lender who specializes in helping people rebuild. They want your business because you have proven you can handle the responsibility.

Financial Advantages of Swapping Your Current Loan

Why go through the effort of documentation and applications? The math is the most compelling reason. When you reduce an interest rate from 19% to 11% on a $30,000 loan, the savings aren't just a few dollars—they are life-changing. This extra cash flow can be redirected toward your emergency fund, your mortgage, or even paying down the principal of the car loan even faster.

Lowering Your Monthly Installments to Free Up Cash Flow

For many Canadian families, the monthly budget is tight. Inflation and rising housing costs have made every dollar count. By refinancing to a lower rate or extending the term slightly, you can drop your monthly car payment by $100, $200, or even more. This provides immediate "breathing room" in your bank account every single month.

Reducing the Total Interest Paid Over the Life of the Loan

The "sticker price" of your car isn't what you actually pay; it's the price plus the interest. On a high-interest sub-prime loan, you might end up paying for the car twice. Refinancing attacks the interest component directly. Even if your monthly payment stays the same, a lower interest rate means more of your money goes toward the principal, helping you own the vehicle outright much sooner.

| Loan Feature | Original Sub-prime Loan | Refinanced Loan | Total Savings |

|---|---|---|---|

| Loan Amount | $25,000 | $25,000 | -- |

| Interest Rate (APR) | 21% | 12% | 9% Reduction |

| Monthly Payment | $675 | $556 | $119 / month |

| Total Interest (60 mo) | $15,500 | $8,360 | $7,140 Saved |

Shortening or Lengthening Your Loan Term: Which is Right for You?

Refinancing gives you the steering wheel. If your goal is to get out of debt quickly, you can refinance into a shorter term. If your goal is survival and cash flow, you can lengthen the term. However, be cautious: lengthening the term can sometimes result in paying more interest over time, even with a lower rate. A professional advisor can help you find the "sweet spot" where you save on both monthly costs and total interest.

Beyond the Credit Score: The Approval Criteria

If the credit score isn't the only thing that matters, what are lenders looking at? In Canada, sub-prime refinancing is an "algorithm of stability." Lenders want to see that you have a steady life and a steady habit of paying your bills. They look at your employment, your residence, and, most importantly, your recent history with the specific vehicle you are trying to refinance.

The Importance of the 12-Month Consistent Payment Rule

This is the "Golden Rule" of Canadian refinancing. Almost every reputable lender will want to see that you have made at least 10 to 12 consecutive on-time payments on your current car loan. This proves that despite your credit score, you prioritize this specific debt. If you have missed a payment in the last 90 days, it is often better to wait and build a clean 6-month streak before applying.

Debt-to-Income (DTI) Ratio: Can You Afford the New Terms?

Lenders calculate your Debt-to-Income ratio by adding up all your monthly debt obligations (rent/mortgage, credit card minimums, current car payment) and dividing it by your gross monthly income. In Canada, lenders generally like to see this number below 40-45%. If your income has increased since you first got the car, your chances of approval skyrocket because your DTI has improved.

Vehicle Requirements: Age, Mileage, and Minimum Value Thresholds

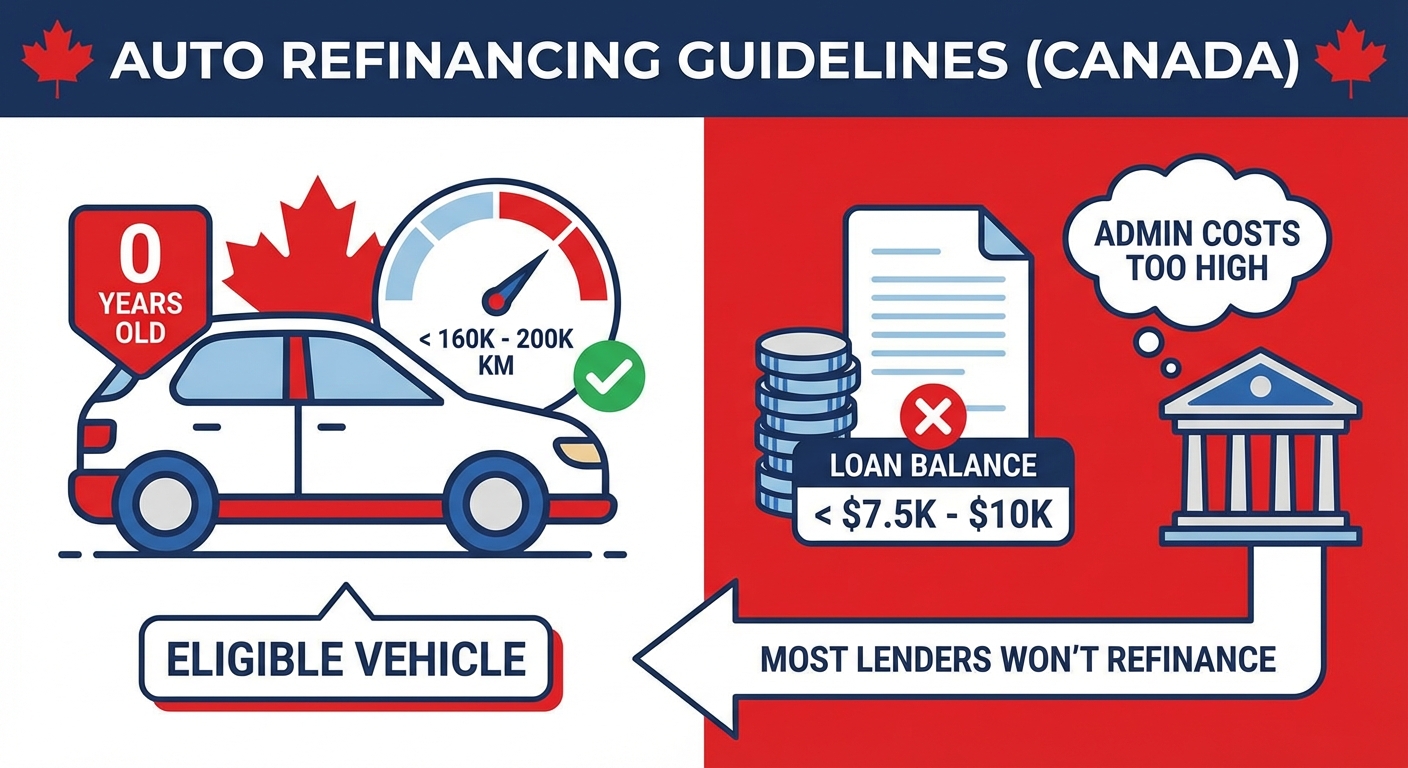

The car itself acts as the collateral. Canadian lenders have specific "unit" requirements. Generally, the vehicle should be less than 10 years old and have fewer than 160,000 to 200,000 kilometres. Additionally, most lenders won't refinance a loan if the remaining balance is less than $7,500 to $10,000, as the administrative costs for them wouldn't make sense for a smaller amount.

Strategic Preparation: Setting the Stage for Approval

Applying for a refinance without preparation is like going into a job interview without a resume. You need to know what the lender is going to see before they see it. This allows you to fix errors and present the strongest possible case for a rate reduction.

Pulling Your Equifax and TransUnion Reports

Canada uses two primary credit bureaus: Equifax and TransUnion. Sometimes, a payment you made on time might be incorrectly reported as "late" on one but not the other. You are entitled to see these reports. Check for any "collections" that you might have already paid off but are still showing as active. Clearing these up before the lender pulls your credit can result in an immediate bump in your score.

Identifying and Disputing Errors on Your Credit Report

It is shockingly common for credit reports to contain errors—wrong addresses, accounts that don't belong to you, or outdated debt information. In Canada, you can file a dispute online with both bureaus. If you can get a "delinquency" removed because it was a bank error, your refinancing options will improve overnight.

Calculating Your Current Loan Payout vs. Vehicle Black Book Value

Lenders use the Canadian Black Book to determine what your car is worth. You need to know if you owe $20,000 on a car that is only worth $15,000. This is known as being "upside down" or having negative equity. While you can still refinance with negative equity, knowing the gap allows you to prepare for how the lender will structure the new loan.

What to Do If You Owe More Than the Car is Worth

Negative equity is the biggest hurdle for bad credit refinancing in Canada. Because cars depreciate quickly, and sub-prime loans often have high interest, many borrowers find that their loan balance drops slower than the car's value. However, this doesn't mean you are stuck.

The Impact of Depreciation on Bad Credit Loans

If you bought a car with $0 down at a high interest rate, you likely entered negative equity the moment you drove off the lot. Canadian lenders are used to this. Most specialized refinance firms can accommodate a "Loan-to-Value" (LTV) ratio of up to 120% or even 130%. This means they are willing to lend you 120% of what the car is worth to help you get into a better interest rate.

Strategies for Rolling Negative Equity into a New Loan

When you refinance, the new loan pays off the old one entirely, including the negative equity. The goal here is to ensure the new interest rate is low enough that the "cost" of carrying that extra debt is mitigated. Over time, with a lower rate, you will pay down the principal faster and eventually "cross the line" into positive equity.

When to Make a Principal Reduction Payment Before Refinancing

If you have some savings, putting $1,000 or $2,000 toward your current loan principal *before* you apply for refinancing can be a brilliant move. It lowers your LTV ratio, which might move you into a different "tier" of lending, potentially qualifying you for an even lower interest rate than if you had applied with the higher balance.

The Step-by-Step Refinancing Process in Canada

Once you have decided to move forward, the process is generally faster than the original car purchase. Because you already have the car, there is no "shopping" for a vehicle—just shopping for the money. Here is the roadmap from your current high-interest headache to your new, manageable loan.

Step 1: Gathering Documentation

Canadian anti-money laundering and lending laws require specific proof. You will need your most recent T4 or at least three months of pay stubs. If you are self-employed, you will likely need your Notices of Assessment (NOA) from the CRA. You’ll also need your current vehicle registration, proof of insurance, and a "10-day payout statement" from your current lender.

Step 2: Shopping for Lenders

Don't just walk into your local branch. Big banks in Canada are notoriously conservative with sub-prime refinancing. Look for specialized firms like SafeLend that have relationships with a wide network of lenders specifically looking for "credit rebuilders." They do the heavy lifting of comparing rates for you.

Step 3: Reviewing the Disclosure Statement

Before you sign, read the disclosure statement. In Canada, lenders are legally required to show you the "Total Cost of Borrowing." Look for hidden fees or "origination fees." Ensure there are no "prepayment penalties"—you want the freedom to pay off this new loan even faster if your credit continues to improve.

Step 4: The Payoff Process

You don't personally take the money and pay the old lender. The new lender handles the transfer of funds directly. They pay off your old loan, the old lender releases the "lien" (their legal claim) on the car, and the new lender places their lien on it. You simply start making payments to the new company at the new, lower rate.

| Feature | Traditional Bank Refinance | Specialized Refinance (SafeLend) |

|---|---|---|

| Credit Score Required | Usually 680+ | 500+ (Focus on history) |

| Negative Equity | Rarely accepted | Up to 120-140% LTV |

| Speed | 1-2 weeks | 24-48 hours |

| Documentation | Extensive / Rigid | Flexible / Digital |

Protecting Yourself During the Refinance Journey

The Canadian lending market is well-regulated, but bad actors still exist, especially targeting those with bad credit. Being informed is your best defense. You are looking for a financial partner, not someone who wants to take advantage of your situation.

Beware of 'Upfront Fee' Scams in the Canadian Lending Market

This is the biggest red flag. In Canada, a legitimate lender will never ask you to e-transfer money for "insurance," "processing," or "security deposits" before you get the loan. Any fees associated with a car loan are typically rolled into the loan balance itself. If someone asks for money upfront, walk away immediately.

Understanding 'Add-ons': Should You Keep Your GAP Insurance?

When you refinance, your old GAP insurance or extended warranty might be cancelled. You need to decide if you want to purchase these for the new loan. If you have significant negative equity, GAP insurance is often a wise choice in Canada, as it protects you if the car is totaled and the insurance payout doesn't cover the full loan balance.

The Danger of Extending Your Term Too Far

It is tempting to take a 72-month or 84-month term to get the lowest possible monthly payment. However, the longer the term, the longer you stay "upside down" on the loan. Try to keep the term as short as your budget allows. The goal is to own the car, not to be in a perpetual state of debt.

Turning a Car Loan into a Credit Score Catalyst

Refinancing is more than just a way to save money; it is a powerful tool for credit rehabilitation. In the Canadian credit scoring model (used by Equifax and TransUnion), your "credit mix" and "payment history" are the two most important factors. A car loan is an installment loan, which looks great on a report when managed correctly.

The Role of 'Credit Mix' in Your Canadian Credit Score

If your only credit is a credit card, your score will struggle to grow. Having a successfully refinanced auto loan adds "diversity" to your credit profile. It shows future lenders (like mortgage providers) that you can handle a large, structured debt over a long period. By replacing a high-interest "predatory" loan with a standard "rebuilding" loan, you are signaling to the market that you are back on track.

How Lower Payments Reduce Your Overall Credit Utilization

While an installment loan isn't the same as a credit card balance, having more cash in your pocket every month allows you to pay down your credit cards. Lowering your credit card utilization (the amount you owe vs. your limit) is the fastest way to jump-start your credit score. The $150 you save on your car payment every month could be the key to clearing your Visa balance, which in turn raises your score, making your *next* refinance or loan even cheaper.

Moving from Sub-prime to Prime

Think of refinancing as a ladder. You might start at 22%. After a year, you refinance to 12%. After another 18 months of perfect payments, your credit score might have risen enough to refinance again—or trade in the car—at a "prime" rate of 6% or 7%. Each step saves you money and strengthens your financial foundation. This is how you move from being a "risky" borrower to a "prime" customer that banks compete for.

Your Questions Answered

Can I refinance if I am currently in a Consumer Proposal?

Yes, it is possible, though more challenging. Some specialized Canadian lenders work specifically with individuals in a Consumer Proposal, provided you have made a certain number of payments toward the proposal and your car payments are up to date. Refinancing can actually help you complete your proposal faster by freeing up monthly cash flow.

How soon after buying a car can I refinance in Canada?

Technically, you can apply at any time. However, most lenders want to see a minimum of 6 months of payment history, and 12 months is the industry standard for getting the best possible rate reduction. If you try to refinance too early, your credit score may not have recovered enough from the "hard inquiry" of the initial purchase to show a significant benefit.

Does refinancing my car loan hurt my credit score?

In the short term, there is a small dip (usually 5-10 points) because the lender performs a "hard inquiry" and you are opening a "new" account. However, in the medium to long term, the effect is overwhelmingly positive. As you pay down the new loan and use the savings to reduce other debts, your score will typically climb much higher than it was before the refinance.

Are there provincial differences (e.g., Ontario vs. BC) in refinancing laws?

While the mechanics of the loan are similar across Canada, consumer protection acts vary by province. For example, Ontario's Consumer Protection Act and BC's Business Practices and Consumer Protection Act provide specific rights regarding disclosure and fees. Most national lenders adhere to the strictest provincial standards to ensure compliance across the board.

What if I have a co-signer on my original loan?

You can refinance a loan that has a co-signer. In fact, many people use refinancing as a way to *remove* a co-signer (like a parent or spouse) from the debt once their own credit has improved enough to carry the loan solo. Alternatively, adding a co-signer with good credit to a refinance application can help you secure an even lower interest rate.

Moving Forward with Confidence

The path to financial freedom in Canada often starts in the driveway. By taking the time to understand the "secrets" of the refinancing world, you are moving from a passive participant in your finances to an active manager of your wealth. You have seen the data: the potential to save over $7,000 in interest and reduce your monthly burden by over $100 is not just a marketing claim—it is a mathematical reality for those who take action.

The Canadian car loan landscape is designed to reward those who show progress. If you have been diligent with your payments, you have already done the hard work. Now, it is simply a matter of filing the paperwork and letting the market work for you. Don't let a mistake from three years ago dictate what you pay today. Whether you choose to work with a specialized firm like SafeLend or explore options on your own, the most important step is the first one: realizing that you have the power to change your terms.

Today is the day to stop overpaying and start rebuilding. Your future self—and your bank account—will thank you for it.