No Credit? Your Student Card Just Unlocked a Car Loan in Toronto.

Table of Contents

- Key Takeaways

- The Toronto Student's Driving Dream: Navigating No Credit in a Big City

- The Urban Challenge: Why a Car in Toronto is More Than Just a Convenience

- Unlocking the Student Advantage: Why Lenders *Do* Look at You Differently (Even Without Credit)

- Beyond the Blank Slate: Understanding 'No Credit' vs. 'Bad Credit' for Students

- The 'Future Potential' Factor: How Your Student Status Can Be a Credit Asset

- Deconstructing the Application: What Lenders *Really* Want from a Student with No Credit

- The Pillars of Trust: What You *Must* Showcase

- The Co-Signer Conundrum: When a Second Signature is a Game-Changer (and When it's Not)

- Your Loan Strategy: Navigating the Toronto Car Market and Beyond

- Dealership Financing vs. Bank Loans vs. Online Lenders: Which Path for a Student?

- The Down Payment Advantage: How Even a Small Contribution Can Boost Your Odds

- Choosing Your Ride Wisely: Car Types and Their Impact on Loan Approval & Affordability

- Beyond the Loan: Understanding the Full Cost of Car Ownership in Toronto and Other Canadian Cities

- Decoding the Fine Print: APR, Loan Terms, and Hidden Fees for Student Loans

- The True Cost: Insurance, Maintenance, Fuel, and Parking in Ontario's Capital (and other major cities)

- Budgeting for Success: Creating a Realistic Car Ownership Plan

- Building Your Credit Foundation: The Long-Term Benefits of a Student Car Loan

- Your First Major Credit Line: How a Car Loan Shapes Your Financial Future

- Beyond the Car: Leveraging Your New Credit for Future Financial Goals

- Smart Credit Habits to Adopt While You Drive

- Your Roadmap to Driving Away: Final Steps and Future Credit Building

- Recap: The Essential Checklist for Toronto Student Car Loan Approval

- What to Do After Graduation: Refinancing and Upgrading

- Final Encouragement for Aspiring Drivers in Toronto, Vancouver, Montreal, Calgary, Ottawa, and Halifax

- Frequently Asked Questions (FAQ) for Students Seeking Car Loans

Toronto, a city of endless possibilities, bustling streets, and vibrant student life. For many students navigating its sprawling campuses and diverse neighbourhoods, the dream of owning a car can seem distant, especially when faced with the common hurdle of having no credit history. You might have heard the discouraging whispers: "No credit means no car loan." But what if we told you that your student card isn't just for library access and campus discounts? What if it's the key to unlocking a car loan, right here in Toronto?

At SkipCarDealer.com, we understand the unique challenges and immense potential of students in Canada. We know that a blank credit slate isn't a red flag; it's an opportunity. This comprehensive guide will shatter the myth that you can't get a car loan without an established credit history, showing you exactly how your student status, combined with strategic planning, can put you in the driver's seat.

Key Takeaways

- A blank credit slate is not a 'no' for student car loans; lenders understand your unique situation.

- Your student status, proof of enrollment, and steady (even part-time) income are powerful assets.

- Strategically choosing between dealership financing, banks, and online lenders can significantly impact your terms.

- A co-signer can boost approval odds and lower rates, but isn't always essential.

- Beyond the loan, factor in Toronto's high insurance costs, fuel, and parking into your budget.

- An approved student car loan is your first major step towards building a robust credit history in Canada.

The Toronto Student's Driving Dream: Navigating No Credit in a Big City

The Urban Challenge: Why a Car in Toronto is More Than Just a Convenience

Life as a student in Toronto is dynamic, but it also comes with its logistical hurdles. While the TTC offers extensive coverage, its limitations become apparent when you need to commute across the city for a co-op placement in Markham, a part-time job in Mississauga, or simply crave the freedom to explore beyond the subway lines. Imagine the convenience of spontaneous weekend trips to Niagara Falls or cottage country, or simply getting groceries without battling crowded transit. For many students, a car isn't just about luxury; it's about expanding opportunities, gaining independence, and managing a demanding schedule.

However, this dream often collides with a significant misconception: "No credit means no car loan." This belief can be a major roadblock, leading students to postpone their car ownership goals unnecessarily. The truth is, while traditional lenders often rely heavily on credit history, there are specialized financing options and strategies available for students who are new to the world of credit. This article aims to debunk that myth, providing you with a clear roadmap to secure your first car loan.

(Context: A vibrant shot of a diverse group of students in a busy Toronto streetscape, some looking thoughtfully at a modern, affordable car parked nearby, symbolizing aspiration and the blend of student life with urban mobility needs.)

Unlocking the Student Advantage: Why Lenders *Do* Look at You Differently (Even Without Credit)

Beyond the Blank Slate: Understanding 'No Credit' vs. 'Bad Credit' for Students

This is a crucial distinction that often gets overlooked. A lack of credit history, common for students and recent immigrants to Canada, is fundamentally different from having a poor credit score. A poor credit score indicates past financial mismanagement – missed payments, defaults, or high debt. It signals risk to lenders. A blank slate, however, simply means you haven't had the opportunity to build credit yet. Lenders, especially those specializing in non-traditional financing like SkipCarDealer.com, recognize this difference.

They understand that students are often just starting their financial journeys and haven't had credit cards, mortgages, or other loans that typically build a credit report. Because of this, many lenders have specific programs or more lenient criteria for individuals new to credit, particularly students whom they view as having significant future potential.

The 'Future Potential' Factor: How Your Student Status Can Be a Credit Asset

Being a student in a recognized educational institution in Canada holds inherent value for lenders. They often look beyond your current financial standing to your future earning potential. A degree or diploma from a Canadian university or college signals a commitment to future career stability and increased income, making you a more attractive borrower in the long run. Lenders consider the investment you're making in your education as a positive indicator of your future ability to repay a loan.

Your enrollment demonstrates a degree of stability and future planning that can outweigh the immediate lack of credit history. It's a testament to your ambition and capacity for responsibility. This 'future potential' factor, combined with other indicators of stability, helps lenders assess your creditworthiness without relying solely on a traditional credit score. For more insights into how non-traditional credit assessments work, you might find our article No Credit? Great. We're Not Your Bank. particularly helpful.

Deconstructing the Application: What Lenders *Really* Want from a Student with No Credit

The Pillars of Trust: What You *Must* Showcase

Without a credit score, lenders rely on other indicators to assess your reliability. Your ability to provide thorough and organized documentation speaks volumes about your responsibility. Here’s what you’ll need to showcase:

- Proof of Enrollment & Academic Standing: Lenders need to confirm your student status. This typically includes a valid student ID, an official acceptance letter, a confirmation of enrollment letter from your registrar's office, and sometimes even official transcripts demonstrating satisfactory academic progress. Clearly state whether you are a full-time or part-time student, as this can influence the perceived stability of your academic journey.

-

Income & Employment Stability: Even if it's part-time, consistent income is critical. Lenders want to see that you have a reliable source of funds to cover your monthly payments. This can include:

- Pay stubs from a part-time job or internship (typically the last 2-3 months).

- An employment letter from your employer, detailing your position, hours, and wages.

- Proof of scholarships, grants, or bursaries.

- Documentation of reliable parental contributions (e.g., bank statements showing regular transfers).

- Any other consistent income, even if it seems small, helps to build a stronger financial picture.

Even if your income fluctuates, demonstrating a consistent pattern of earnings over several months can be very persuasive. For students navigating income documentation for car loans, even with a 'ramen budget', our guide on Ramen Budget? Drive a Real Car. Student Loan Approved. offers more practical advice.

- Residency Stability: A stable living situation indicates reliability. Provide copies of your lease agreement, utility bills (hydro, internet) in your name, or a letter from your landlord. For international students, this is particularly important, along with your valid study permit and visa status. Demonstrating a consistent address history in Toronto or elsewhere in Canada helps establish your roots.

- Driver's License & Insurance History: You'll need a valid Ontario driver's license (G1, G2, or full G). While a G1 might limit options, a G2 or full G is generally preferred. Even a short, clean driving record (if you've had a license for a while) can be beneficial, as it suggests a lower insurance risk. Lenders want to know you're legally able to drive the vehicle you're financing.

The Co-Signer Conundrum: When a Second Signature is a Game-Changer (and When it's Not)

A co-signer can be a powerful tool in securing a student car loan, particularly if you have no credit history or limited income. However, it's a decision with significant implications for both parties.

Pros of a Co-Signer:

- Significantly Boosts Approval Odds: A co-signer with a strong credit history and stable income mitigates the risk for the lender. Their financial strength essentially backs your application.

- Potentially Unlocks Lower Interest Rates: With reduced risk, lenders are often willing to offer more favourable interest rates, saving you money over the life of the loan.

- Provides Peace of Mind for the Lender: Knowing there's another responsible party on the hook makes them more comfortable approving your loan.

Cons of a Co-Signer:

- Full Responsibility for Default: If you miss payments or default on the loan, the co-signer is legally obligated to make those payments. This can strain personal relationships.

- Impact on Co-Signer's Credit Score: Any missed payments by you will negatively impact your co-signer's credit score, even if they're not the primary driver. The loan also appears on their credit report, potentially affecting their ability to secure other loans.

Who Makes a Good Co-Signer?

An ideal co-signer is typically a parent, guardian, or close family member with:

- A stable, verifiable income.

- An excellent credit history.

- A strong, trusting relationship with you, where both parties fully understand the responsibilities involved.

Alternatives if a Co-Signer Isn't an Option:

If a co-signer isn't feasible, don't despair. You can still strengthen your application by:

- Making a larger down payment.

- Choosing a less expensive, more reliable vehicle.

- Focusing on lenders who specialize in no-credit or student loans (like SkipCarDealer.com).

- Providing extensive documentation of all available income sources, no matter how small.

Your Loan Strategy: Navigating the Toronto Car Market and Beyond

Dealership Financing vs. Bank Loans vs. Online Lenders: Which Path for a Student?

Understanding your financing options is key to securing the best terms. Each type of lender offers different advantages, especially for students with no credit.

| Lender Type | Advantages for Students | Considerations for Students |

|---|---|---|

| Dealership Financing (e.g., SkipCarDealer.com) |

|

|

| Traditional Banks (e.g., RBC, TD, Scotiabank, CIBC in Ontario) |

|

|

| Online Lenders (e.g., Canada Drives, AutoCanada) |

|

|

The Down Payment Advantage: How Even a Small Contribution Can Boost Your Odds

A down payment, even a modest one, significantly strengthens your car loan application. Here’s why:

- Reduces Lender's Risk: By putting money down, you immediately reduce the amount of money the lender needs to finance, making the loan less risky for them.

- Demonstrates Financial Commitment: A down payment shows lenders that you're serious about the purchase and have the discipline to save money, indicating greater financial responsibility.

- Lowers Monthly Payments & Total Interest: A larger down payment means you finance less, resulting in lower monthly payments and less interest paid over the life of the loan.

Practical strategies for students to save for a down payment include dedicated summer jobs, consistent part-time work during the academic year, strict budgeting, or even financial gifts from family members who wish to support your independence. Even 5-10% of the car's purchase price can make a substantial difference in approval odds and overall loan cost.

Choosing Your Ride Wisely: Car Types and Their Impact on Loan Approval & Affordability

Your choice of vehicle is more than just a preference; it's a strategic decision that impacts your loan approval and long-term affordability.

- New vs. Used: For students with no credit, a reliable used car is almost always the most financially sensible option. New cars depreciate rapidly (losing a significant portion of their value in the first few years), making them a higher risk for lenders who are already cautious about no-credit applicants. Used cars offer better value, lower initial costs, and often more manageable insurance premiums.

- Reliability vs. Flash: Prioritize practical, fuel-efficient, and easily insurable cars over luxury or high-performance models. Given Toronto's notoriously high insurance rates, a modest, safe vehicle will be significantly cheaper to insure. Lenders are also more comfortable financing a car that aligns with your apparent income and student status.

- Examples Suitable for Students: Think compact sedans or small SUVs known for their reliability and low running costs. Popular choices in Canada include models like the Honda Civic, Toyota Corolla, Mazda3, Hyundai Elantra, or smaller SUVs like the Honda HR-V or Mazda CX-3. These vehicles strike a good balance between affordability, fuel economy, reliability, and manageable insurance costs.

Beyond the Loan: Understanding the Full Cost of Car Ownership in Toronto and Other Canadian Cities

Decoding the Fine Print: APR, Loan Terms, and Hidden Fees for Student Loans

Securing the loan is just one part of the equation. Understanding the financial intricacies of your car loan is crucial for responsible ownership.

- Annual Percentage Rate (APR): This is the true annual cost of borrowing, encompassing the interest rate plus any other fees. A lower APR means you pay less overall. For students with no credit, APRs might initially be higher, but making consistent payments can open doors to refinancing at better rates later on.

-

Loan Term: This refers to the duration of your loan (e.g., 60, 72, or 84 months).

Loan Term Pros Cons Shorter Term (e.g., 48-60 months) - Higher monthly payments.

- Less total interest paid over the life of the loan.

- Faster path to ownership and equity.

- May be harder to fit into a student budget.

Longer Term (e.g., 72-84 months) - Lower monthly payments, making it more affordable for students.

- More total interest paid over the life of the loan.

- Slower equity build-up; risk of negative equity (owing more than the car is worth).

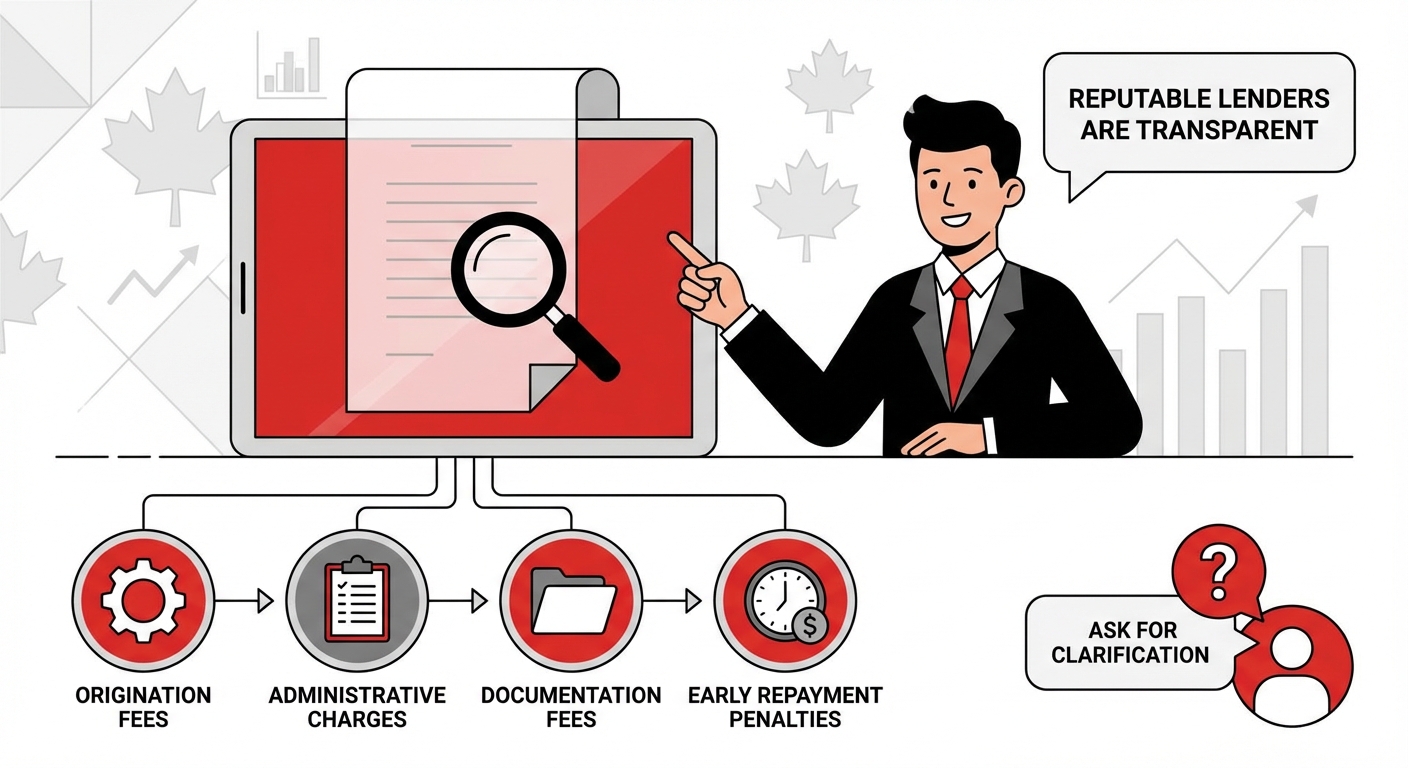

- Hidden Fees: Always read your contract carefully. Look out for origination fees, administrative charges, documentation fees, or early repayment penalties. Reputable lenders will be transparent about all costs. Don't hesitate to ask for clarification on any line item you don't understand.

(Context: An infographic illustrating a 'Car Ownership Budget Breakdown for a Toronto Student'. It visually compares monthly costs for loan payments, insurance, fuel, and parking for a typical student-friendly car, possibly showing a pie chart or bar graph.)

The True Cost: Insurance, Maintenance, Fuel, and Parking in Ontario's Capital (and other major cities)

The purchase price and loan payment are just the beginning. Owning a car in a major Canadian city, particularly Toronto, comes with significant ongoing expenses.

-

Car Insurance in Toronto: Toronto has some of the highest car insurance rates in Canada. Factors affecting student rates include your age, driving record, the type of vehicle you drive, your specific Toronto postal code, and even gender (though this factor is becoming less impactful). Tips for lowering premiums include:

- Choosing a vehicle with good safety ratings and low theft risk.

- Maintaining a clean driving record.

- Considering a G2 or full G license over a G1.

- Bundling with other insurance policies (e.g., tenant insurance).

- Asking about student discounts or good student discounts.

- Increasing your deductible if you can afford to.

Comparison shopping for insurance is just as important as shopping for a loan. Rates can vary by hundreds of dollars between providers.

- Maintenance & Repairs: Budget for routine servicing (oil changes, tire rotations), unexpected repairs, and seasonal tire changes. While not mandatory in Ontario, winter tires are highly recommended for safety and can even qualify you for insurance discounts. Factor in at least $50-100 per month for these costs, even for a reliable used car.

- Fuel Costs: Gas prices in urban centres like Toronto, Vancouver, and Calgary can fluctuate dramatically. Estimate your monthly fuel expenses based on your commute and expected usage. A fuel-efficient car will save you hundreds of dollars annually.

- Parking: Navigating Toronto's parking landscape can be a challenge. Street parking permits can be costly and limited, university parking fees are often substantial, and downtown lot costs can quickly add up. Compare this to cities like Ottawa or Edmonton, where parking might be slightly more affordable or readily available. Factor these costs into your monthly budget, especially if you plan to drive to campus or work frequently.

Budgeting for Success: Creating a Realistic Car Ownership Plan

To avoid financial stress, create a comprehensive budget worksheet. List all your income sources (part-time job, scholarships, parental contributions) and then itemize all potential car expenses: loan payments, insurance, fuel, maintenance, parking, and an emergency fund. An emergency fund is crucial for unexpected car issues (like a flat tire or a dead battery) or unforeseen job loss. Aim to have at least 3-6 months' worth of car expenses saved. This proactive approach will empower you to manage your new responsibility confidently.

Building Your Credit Foundation: The Long-Term Benefits of a Student Car Loan

Your First Major Credit Line: How a Car Loan Shapes Your Financial Future

Getting approved for a car loan as a student with no credit is a significant achievement, but it's also your first major step towards building a robust financial future in Canada. By consistently making your car loan payments on time, every time, you are actively building a positive payment history that is reported to major Canadian credit bureaus like Equifax and TransUnion. This establishes your first significant 'credit tradeline' and proves your ability to manage debt responsibly.

A well-managed car loan demonstrates to future lenders that you are a reliable borrower, capable of honouring financial commitments. This positive history will be crucial as you move beyond student life.

Beyond the Car: Leveraging Your New Credit for Future Financial Goals

The benefits of a strong credit history extend far beyond your first car. The responsible credit management you demonstrate with your student car loan can unlock better rates and easier approvals for a multitude of future financial goals, including:

- Securing better interest rates on credit cards.

- Accessing student lines of credit with more favourable terms.

- Qualifying for a mortgage when you're ready to buy your first home.

- Obtaining business loans if you decide to pursue entrepreneurship.

Your car loan, therefore, isn't just about getting from point A to point B; it's an investment in your financial future, paving the way for greater opportunities and financial stability.

Smart Credit Habits to Adopt While You Drive

As you begin to build your credit history with your car loan, it's wise to adopt other smart credit habits:

- Regularly Monitor Your Credit Report: Periodically check your credit report from Equifax and TransUnion for any errors or fraudulent activity. You are entitled to a free copy of your credit report annually.

- Avoid Excessive New Credit Applications: While comparing loan offers is good, applying for too many new credit lines in a short period can lead to multiple 'hard inquiries' on your credit report, which can temporarily lower your score.

- Understand Credit Utilization: If you get a credit card, aim to keep your credit utilization ratio low (ideally below 30% of your available credit). This shows lenders you're not over-reliant on credit.

Your Roadmap to Driving Away: Final Steps and Future Credit Building

Recap: The Essential Checklist for Toronto Student Car Loan Approval

To ensure you're fully prepared to secure your student car loan in Toronto or any major Canadian city, here's a concise, actionable summary:

- Gather All Documents: Have your proof of enrollment, income, residency, and driver's license ready.

- Understand Your Budget: Know exactly what you can afford for monthly payments, insurance, fuel, and other costs.

- Explore Lender Types: Compare offers from dealerships like SkipCarDealer.com, traditional banks, and online lenders.

- Consider a Down Payment/Co-Signer: Utilize these tools if possible to strengthen your application and potentially lower your rates.

- Choose Your Car Wisely: Opt for a reliable, fuel-efficient used vehicle that aligns with your budget.

What to Do After Graduation: Refinancing and Upgrading

Your financial situation will likely improve significantly after graduation. Once you've secured a full-time job and continued to build your credit history, you'll have several advantageous options:

- Refinancing for Better Rates: With a stable income and an improved credit score, you can often refinance your existing car loan at a lower interest rate, saving you a substantial amount of money.

- Trading In for a New Vehicle: If your needs or desires change, your well-maintained first car can be traded in, and its equity can serve as a down payment for a newer, perhaps more luxurious, vehicle.

- Continuing to Build Credit: Even if you keep your first car, you can continue to build on the strong credit foundation you've established, paving the way for other major life purchases.

Final Encouragement for Aspiring Drivers in Toronto, Vancouver, Montreal, Calgary, Ottawa, and Halifax

The journey to car ownership as a student with no credit might seem daunting, but it is absolutely achievable. With the right strategy, diligent preparation, and responsible planning, you can unlock the independence and opportunities that come with having your own vehicle in Toronto, Vancouver, Montreal, Calgary, Ottawa, Halifax, or any other Canadian urban centre. Your student card is more powerful than you think, and with SkipCarDealer.com, your driving dream is closer than ever.