Your Car Title: The Only Paperwork That Matters in Vancouver.

Table of Contents

- Key Takeaways

- The Unseen Power of Your Pink Slip in Vancouver: Why Your Car Title Matters Most

- Demystifying the Vancouver Vehicle Title Loan: What It Is (and Isn't) in British Columbia

- Unlocking Your Loan Potential: The Absolute Requirements for Approval in British Columbia

- The Core Pillars: What Lenders Really Look For in Vancouver Applicants.

- Pro Tip: Maximizing Your Car's Perceived Value for a Better Loan Offer – Tips for Maintenance and Presentation.

- Beyond the Blue Book: How Your Car's Specifics Influence Your Loan Amount in Vancouver

- The Depreciation Dilemma: How Age, Mileage, and Wear-and-Tear Erode Your Car's Value Over Time.

- Brand Power: Which Car Models Command Higher Loan Offers in the Vancouver Market?

- The Accident History Report: Why a Clean Carfax or ICBC Claims History Matters.

- Customizations and Modifications: Do they add or detract from your loan potential?

- The Path to Funding: Navigating the Vehicle Title Loan Application Process in British Columbia

- Initial Inquiry to Final Approval: A Step-by-Step Guide for Vancouver Residents.

- The Pre-Application Checklist: Gathering your documents before you start.

- The Vehicle Inspection: What Lenders Look For on Your Car (physical condition, VIN verification).

- Understanding Your Loan Offer: Key terms, principal, interest, and repayment schedule.

- Signing on the Dotted Line: Understanding Your Loan Agreement (Before It's Too Late).

- Pro Tip: Questions to Ask Before Signing Any Title Loan Contract in British Columbia – Focus on hidden fees, early repayment penalties, and default clauses.

- Receiving Your Funds: How quickly can you get the money in Vancouver?

- The True Cost of Convenience: Unmasking Interest Rates, Fees, and Hidden Traps in Vancouver

- The APR Shock: Why Title Loans Are an Expensive Borrowing Option in British Columbia.

- Beyond Interest: Administrative Fees, Origination Costs, Lien Registration Fees, and Other Penalties.

- The Rollover Trap: How Short-Term Loans Can Become Long-Term Burdens (and how to avoid it).

- Calculating the Total Cost of Your Loan: A practical example for a Vancouver borrower.

- Comparing rates: Why a 'low' monthly payment can still mean a sky-high APR.

- Who's Lending in Vancouver? A Deep Dive into the Alternative Lending Landscape

- Why Banks and Credit Unions Say No: Reaffirming their lack of participation in title loans.

- Online vs. Storefront Lenders in British Columbia: Pros and Cons of each approach.

- Licensing and Regulation: Protecting Yourself in British Columbia's Title Loan Market.

- Pro Tip: Verifying a Lender's Legitimacy with Consumer Protection BC Before Committing.

- Red Flags: Identifying predatory lenders and avoiding scams specific to Vancouver.

- The Perilous Path: What Happens If You Can't Pay Back Your Title Loan in Vancouver?

- The Real Risk: Losing Your Vehicle – The ultimate consequence of default.

- Legal Recourse and Repossession Laws in British Columbia: Understanding your rights and the lender's powers.

- Impact on Your Credit Score: Even if it started low, a default can worsen it significantly.

- Seeking Help: Resources for debt counseling and financial advice in Vancouver.

- Smart Alternatives and Strategic Considerations for Vancouver Residents

- When a Title Loan is NOT the Answer: Scenarios where other options are safer and more cost-effective.

- Exploring Other Borrowing Options for Vancouverites:

- Improving Your Financial Health for Future Borrowing: Steps to rebuild credit and create a sustainable budget.

- Pro Tip: Assessing Your Financial Situation Before Committing to Any High-Interest Loan – A Comprehensive Self-Evaluation.

- Your Next Steps to Approval (or Avoidance): A Strategic Checklist for Vancouver Drivers

- A concise, actionable summary for readers making a decision.

- Pre-application checklist: What to have ready and what to research.

- During the application: Questions to ask and red flags to watch for.

- Post-approval: Managing your repayments and potential exit strategies.

- Final thoughts: Empowering Vancouver residents with knowledge for responsible financial choices.

In the bustling, high-stakes financial landscape of Vancouver, where rent prices soar and everyday expenses demand constant attention, unexpected financial needs can hit hard. When traditional banks seem to close their doors, and your credit score feels like a scarlet letter, you might wonder what tangible assets you possess that could offer a lifeline. For many Canadians, particularly those in British Columbia, the answer is often parked right in their driveway: their car.

But it's not just the car itself that holds value; it's the piece of paper that proves you own it outright – your vehicle title. This unassuming document, often tucked away and forgotten, possesses a remarkable power in the alternative lending market. For Vancouverites facing urgent cash needs, a clear, lien-free car title can unlock immediate funds, often bypassing the strict credit checks that trip up so many.

At SkipCarDealer.com, we understand the unique financial pressures faced by residents across Canada, from the vibrant streets of Toronto to the serene landscapes of Calgary and, of course, the dynamic metropolis of Vancouver. We believe in empowering you with knowledge, ensuring you fully grasp the mechanisms, benefits, and significant risks associated with leveraging your most valuable asset for a car title loan. This comprehensive guide will demystify the process, revealing why your car title truly is the only paperwork that matters when seeking quick capital in British Columbia.

Key Takeaways

- In Vancouver, a lien-free vehicle title is the primary requirement for a car title loan, often overshadowing your credit score.

- Title loans offer quick cash but come with high interest rates and significant risks, including vehicle repossession.

- Lenders assess your vehicle's value (make, model, year, condition) to determine loan amounts, not just its existence.

- British Columbia's provincial regulations govern title loan lenders; verifying their legitimacy is crucial.

- Always explore alternatives before committing to a high-cost title loan, understanding all fees and repayment terms.

The Unseen Power of Your Pink Slip in Vancouver: Why Your Car Title Matters Most

You probably think of your car title as a dusty piece of paper, a legal formality. But in the bustling Vancouver economy, where financial pressures can mount quickly, that document holds an extraordinary, often overlooked significance. It's the ultimate proof of ownership for one of your most valuable assets, and in certain financial scenarios, it becomes your most potent tool for accessing capital.

Vancouver, like many major Canadian cities, presents its residents with a unique set of financial challenges. High cost of living, unexpected emergencies, or even the simple need for quick cash to bridge a gap can send individuals searching for solutions. When traditional lending avenues – the big banks, the established credit unions – require pristine credit scores, extensive income verification, and lengthy application processes, many find themselves at a dead end. This is where the concept of alternative financing steps in, and specifically, where your car title takes centre stage.

A car title loan emerges as a compelling option precisely when traditional banks close their doors. It's a lifeline designed for speed and accessibility, often for individuals with less-than-perfect credit or those who are self-employed and find it challenging to prove conventional income. The core premise is elegantly simple: your vehicle's ownership document, your "pink slip," transforms into a tangible asset that you can leverage for borrowing. It’s not about selling your car; it’s about using its inherent value as collateral.

Demystifying the Vancouver Vehicle Title Loan: What It Is (and Isn't) in British Columbia

Let's cut through the jargon and clearly define what a vehicle title loan entails for residents of British Columbia. At its heart, a vehicle title loan is a secured loan. This means that to obtain the funds, you use an asset you own as collateral. In this case, that asset is your car's equity, represented by its clear title. You temporarily sign over the lien on your vehicle to the lender, who then provides you with a lump sum of cash based on your car's appraised value.

The immediate appeal? The "keep your car" promise. Unlike pawning your vehicle, a title loan allows you to continue driving your car while you repay the loan. This freedom is crucial for many, as their vehicle is essential for work, family, and daily life in a city like Vancouver. However, this convenience comes with an underlying risk: if you default on the loan, the lender has the legal right to repossess your vehicle.

It's vital to distinguish title loans from other common lending options. They are not payday loans, which are typically unsecured, smaller amounts, and repaid from your next paycheque. They differ from personal loans, which can be secured or unsecured but often rely more heavily on your credit score. And they are certainly not traditional bank financing, which usually involves rigorous credit checks, lower interest rates, and longer repayment terms. A title loan occupies a unique niche, offering speed and accessibility by prioritizing collateral over creditworthiness.

Common misconceptions abound. It's not a sale of your vehicle; you retain ownership. Instead, it's a temporary transfer of the lien, meaning the lender holds a claim on your car until the loan is fully repaid. Once you've fulfilled your obligations, the lien is released, and your title is returned to its original, unencumbered state.

Unlocking Your Loan Potential: The Absolute Requirements for Approval in British Columbia

The Core Pillars: What Lenders Really Look For in Vancouver Applicants.

When you approach a lender for a vehicle title loan in Vancouver, they aren't primarily concerned with your credit score. While some may perform a soft credit check, their focus is squarely on the value of your collateral and your ability to repay. Understanding these core requirements is your first step towards securing the funds you need.

1. A Clear, Lien-Free Title in Your Name: The Non-Negotiable Prerequisite for Any Title Loan in British Columbia.

This is the bedrock of any title loan. A "lien-free" title means you fully own your vehicle, free and clear of any outstanding loans, leases, or other financial claims. If you still have a car loan with a bank or another lender, your title isn't lien-free, and you won't qualify for a title loan. The title must also be in your name, indicating you are the legal owner.

How to verify your title status with ICBC in Vancouver? The Insurance Corporation of British Columbia (ICBC) is responsible for vehicle registration and licensing in the province. You can contact ICBC directly or check your vehicle registration documents. If there's an active lien, it will be noted on these documents. Clearing any existing liens is essential before you can use your car for a title loan.

2. Your Vehicle's True Worth: Age, Make, Model, and Mileage that Matter.

The amount of money you can borrow directly correlates with your car's market value. Lenders aren't just looking for a car; they're looking for an asset that can secure their investment. Therefore, the age, make, model, and mileage of your vehicle play a critical role.

How lenders appraise vehicles: They utilize various tools and databases, similar to those used by dealerships, to determine your car's wholesale value. This includes consulting industry guides, assessing depreciation based on its year, make, and model, and factoring in its overall condition and mileage. A 2015 Honda Civic with 100,000 kilometres will naturally appraise higher than a 2008 Dodge Caravan with 300,000 kilometres, even if both are "running."

Pro Tip: Maximizing Your Car's Perceived Value for a Better Loan Offer – Tips for Maintenance and Presentation.

Even if your car isn't brand new, you can enhance its appeal to a lender. Ensure it's clean, both inside and out. Address minor cosmetic issues like burnt-out lights or obvious dents. Have recent maintenance records handy to demonstrate you've cared for the vehicle. A well-maintained car signals reliability and a higher resale value, which can translate into a more substantial loan offer. A pre-inspection wash and vacuum can go a long way.

3. Proof of Residency and Identity in Vancouver: Essential Documentation Requirements.

To ensure you're a legitimate applicant and a resident of British Columbia, lenders will require standard identification and proof of address. This typically includes a valid government-issued ID, such as a British Columbia Driver's License or a BC Services Card. For proof of Vancouver residency, you'll need documents like recent utility bills (electricity, gas, internet) or a current rental agreement clearly showing your address.

4. Demonstrating Repayment Capacity: Income Stability Beyond Your Credit Score.

While a low credit score isn't a barrier, demonstrating a consistent and reliable income stream is absolutely key. Lenders need assurance that you can make the scheduled payments. They're not looking for perfection, but rather stability. Acceptable forms of income proof can include recent pay stubs, bank statements showing regular deposits, or an employment letter from your employer. For self-employed individuals, bank statements or tax assessments can serve this purpose. For more on how self-employed individuals can leverage their car's equity, check out our guide on Self-Employed Canada: Your Car's Equity Just Wrote a Cheque. Even if your income comes from government benefits like EI, it can still be considered. For details on this, see our article, EI Income? Your Car Loan Just Said 'Welcome Aboard!'

The importance of a debt-to-income ratio, even for bad credit applicants: Lenders will still assess your existing financial obligations against your income to determine if you can comfortably afford the loan payments. They want to ensure you're not overextending yourself, even if your credit history isn't perfect. This calculation helps them determine a responsible loan amount.

5. Mandatory Insurance: Protecting Your Asset (and the Lender's Investment).

In British Columbia, ICBC requirements for vehicle insurance are stringent. For a title loan, lenders will typically require you to have comprehensive coverage on your vehicle. This protects both your asset and their collateral in the event of an accident, theft, or damage. Proof of current, adequate insurance will be a standard requirement for approval.

Beyond the Blue Book: How Your Car's Specifics Influence Your Loan Amount in Vancouver

While a clear title is non-negotiable, the actual loan amount you receive hinges heavily on the specifics of your vehicle. It's more than just having a car; it's about the kind of car you have, and how well it has been maintained.

The Depreciation Dilemma: How Age, Mileage, and Wear-and-Tear Erode Your Car's Value Over Time.

Cars are depreciating assets. The moment you drive a new car off the lot in Vancouver, its value begins to decline. This depreciation accelerates with age, increased mileage, and the inevitable wear-and-tear of daily driving. Lenders consider these factors meticulously. An older car, even if well-maintained, will generally yield a lower loan amount than a newer model simply because its market value, and thus the collateral's value, is less.

Brand Power: Which Car Models Command Higher Loan Offers in the Vancouver Market?

Not all cars are created equal in the eyes of a title loan lender. Certain brands and models possess stronger resale value, renowned reliability, and higher demand in the Vancouver market, which can directly influence the loan amount you're offered. Think about manufacturers known for longevity and strong resale value, such as Toyota or Honda. These brands often command higher loan offers because they represent a more secure asset for the lender. On the other hand, luxury vehicles, while initially expensive, might depreciate faster or have a smaller market for resale, potentially leading to a lower percentage of their original value being offered. Older domestic brands, depending on their condition and specific model, might also see lower offers due to perceived reliability issues or higher maintenance costs.

For example, a late-model Toyota RAV4 or Honda CR-V will likely secure a higher loan offer than an older, less popular sedan or a vehicle with a history of mechanical issues. Lenders are always assessing the ease with which they could recoup their investment if a repossession became necessary.

The Accident History Report: Why a Clean Carfax or ICBC Claims History Matters.

Just as it would for a private sale, a vehicle's accident history significantly impacts its value. Lenders will often request a Carfax report or an ICBC claims history. A clean record, free of major accidents, flood damage, or salvage titles, reassures the lender about the vehicle's structural integrity and future resale potential. A car with a significant accident history will almost always result in a lower loan offer, if it qualifies at all.

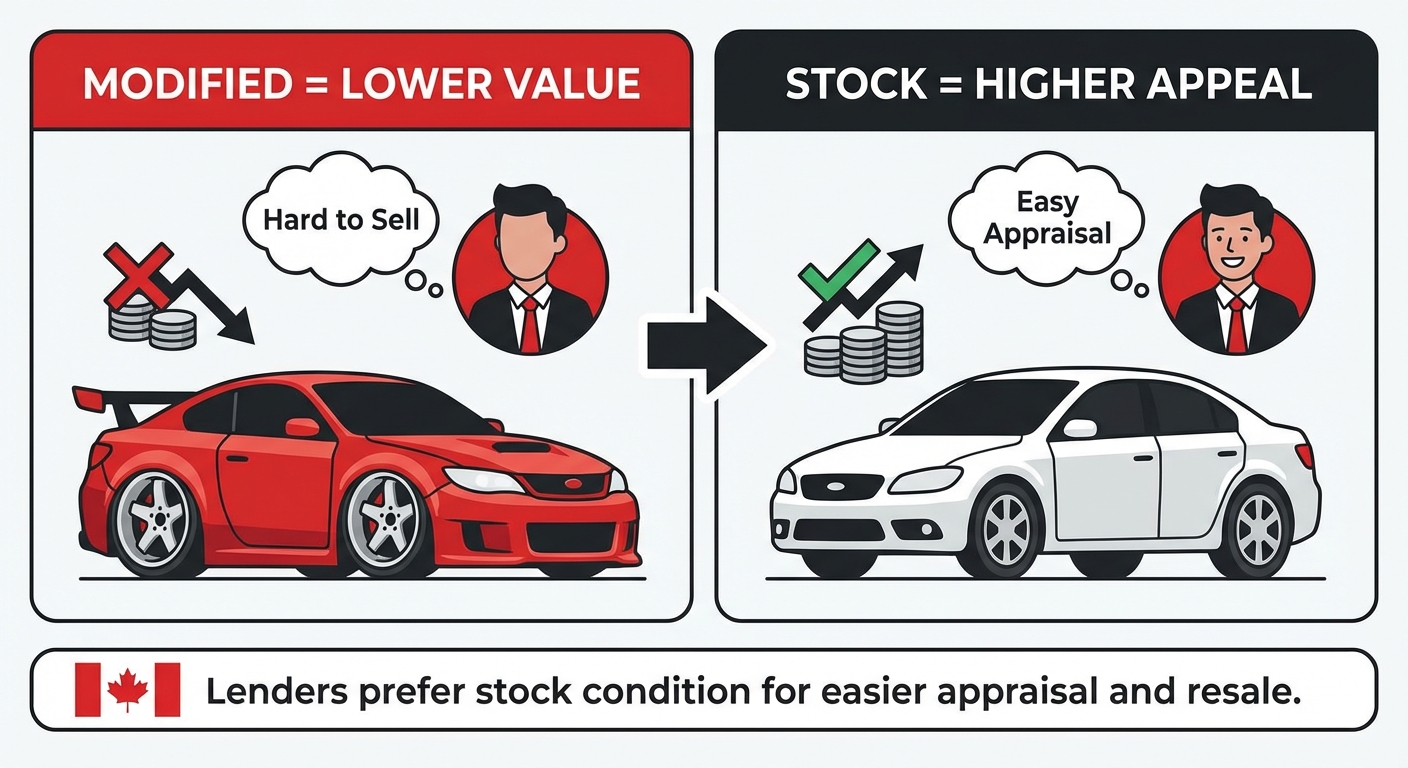

Customizations and Modifications: Do they add or detract from your loan potential?

While you might love your custom rims, performance exhaust, or aftermarket sound system, these modifications rarely add significant value in the eyes of a title loan lender. In fact, some highly specialized customizations could even detract from a car's value by narrowing its appeal to a general market. Lenders prefer vehicles in their stock or near-stock condition, as these are easier to appraise and sell if necessary. Keep this in mind if you've heavily modified your vehicle.

The Path to Funding: Navigating the Vehicle Title Loan Application Process in British Columbia

The process for securing a vehicle title loan in British Columbia is typically designed for speed and efficiency, a key factor for many Vancouver residents seeking quick financial relief. Here’s a step-by-step guide from initial inquiry to final approval.

Initial Inquiry to Final Approval: A Step-by-Step Guide for Vancouver Residents.

- Online Application or In-Person Visit: Most lenders offer an online application form that you can complete from the comfort of your home. This typically involves providing basic personal information, contact details, and specifics about your vehicle (make, model, year, mileage, VIN). Some prefer an in-person visit to a local branch.

- Initial Pre-Approval: Based on the information you provide, the lender will give you a preliminary estimate of your loan eligibility and potential amount. This is not a guaranteed offer but a good indication.

- Document Submission: You'll then be asked to submit the required documents: your clear, lien-free vehicle title, government-issued ID, proof of residency, income verification, and insurance details.

- Vehicle Inspection and Appraisal: This is a crucial step. The lender will conduct a physical inspection of your vehicle to verify its condition, mileage, and VIN. This appraisal confirms its market value and helps finalize the loan amount.

- Loan Offer and Review: Once the appraisal is complete and your documents are verified, the lender will present you with a formal loan offer, detailing the principal amount, interest rate, fees, and repayment schedule.

- Agreement Signing: If you accept the terms, you'll sign the loan agreement, which temporarily transfers the lien on your vehicle to the lender.

- Fund Disbursement: Upon signing, the funds are typically disbursed quickly, often within the same business day, either via e-transfer, direct deposit, or cheque.

The Pre-Application Checklist: Gathering your documents before you start.

Being prepared can significantly speed up the process. Before you even initiate an application, gather these essentials:

- Your original vehicle title (ensure it's lien-free and in your name).

- Valid government-issued photo ID (BC Driver's License or BC Services Card).

- Proof of residency (e.g., utility bill, rental agreement).

- Proof of income (e.g., recent pay stubs, bank statements, employment letter).

- Proof of active vehicle insurance, including comprehensive coverage.

- Vehicle registration and ICBC policy documents.

The Vehicle Inspection: What Lenders Look For on Your Car (physical condition, VIN verification).

During the inspection, lenders are looking for several key things:

- Physical Condition: They'll assess the exterior for dents, scratches, rust, and paint condition. The interior will be checked for cleanliness, tears, and overall wear.

- Mechanical Soundness: While not a full mechanic's inspection, they'll ensure the car appears to be in good running order. Obvious issues like warning lights or strange noises will be noted.

- Tires and Brakes: Condition of tires (tread depth) and often a quick check of brake health.

- Mileage: Verification of the odometer reading.

- VIN Verification: Cross-referencing the Vehicle Identification Number on the car with your title to ensure they match.

Understanding Your Loan Offer: Key terms, principal, interest, and repayment schedule.

Once you receive an offer, it's crucial to understand every detail. The principal is the actual amount of money you're borrowing. The interest is the cost of borrowing that money, usually expressed as an Annual Percentage Rate (APR). The repayment schedule outlines how many payments you'll make, how frequently (weekly, bi-weekly, monthly), and the amount of each payment. Pay close attention to any additional fees.

Signing on the Dotted Line: Understanding Your Loan Agreement (Before It's Too Late).

Never sign a loan agreement without fully understanding its contents. This document is a legally binding contract. Pay particular attention to clauses regarding default, repossession, early repayment penalties, and any additional fees not explicitly mentioned in the initial offer. If anything is unclear, ask for clarification. The time to ask questions is before your signature is on the paper.

Pro Tip: Questions to Ask Before Signing Any Title Loan Contract in British Columbia – Focus on hidden fees, early repayment penalties, and default clauses.

Before you sign, ask: "Are there any hidden fees or charges not listed here?" "What are the penalties if I pay off the loan early?" (Some lenders charge a fee for early repayment). "What exactly constitutes a default, and what is the process if I miss a payment?" "What are the full costs, including all fees, if I pay this loan over the entire term?" Get clear answers in writing if possible. Understanding these details can save you significant money and stress down the line.

Receiving Your Funds: How quickly can you get the money in Vancouver?

One of the primary appeals of a vehicle title loan is its speed. Once all documents are verified and the agreement is signed, funds can often be disbursed within hours, or at most, within one business day. This rapid access to cash is a significant advantage for those facing urgent financial needs in Vancouver.

The True Cost of Convenience: Unmasking Interest Rates, Fees, and Hidden Traps in Vancouver

While vehicle title loans offer undeniable convenience and accessibility, it's paramount to approach them with a clear understanding of their true cost. The speed and leniency on credit scores come at a price, often a steep one.

The APR Shock: Why Title Loans Are an Expensive Borrowing Option in British Columbia.

Title loans are known for having significantly higher Annual Percentage Rates (APRs) compared to traditional loans. These rates can range from high double digits to triple digits, making them one of the most expensive forms of credit available. This high APR is how lenders mitigate the risk associated with lending to individuals who might not qualify for conventional financing. It's crucial to look beyond the monthly payment and understand the full APR, as this reveals the true annual cost of borrowing.

Beyond Interest: Administrative Fees, Origination Costs, Lien Registration Fees, and Other Penalties.

The cost of a title loan isn't just the interest rate. Lenders often levy various additional fees that can inflate the total cost. These might include:

- Administrative Fees: For processing your application.

- Origination Fees: A charge for setting up the loan.

- Lien Registration Fees: Costs associated with registering the lien on your vehicle with ICBC.

- Late Payment Penalties: Fees incurred if you miss a payment.

- Early Repayment Penalties: Some lenders charge if you pay off the loan before the agreed-upon term.

Always ask for a complete breakdown of all fees before committing to any loan. These can add up quickly and make the loan even more expensive than it initially appears.

The Rollover Trap: How Short-Term Loans Can Become Long-Term Burdens (and how to avoid it).

Many title loans are structured as short-term solutions, often with repayment terms of a few months. However, if a borrower struggles to make a payment, some lenders offer a "rollover" or "renewal" option. This allows you to pay only the interest and fees, extending the loan term for another period. While this might seem like a temporary relief, it's a dangerous trap. Rolling over a loan repeatedly means you're constantly paying interest without reducing the principal balance. This can quickly lead to a cycle of debt, where the total cost far exceeds the original loan amount, turning a short-term solution into a long-term burden.

Calculating the Total Cost of Your Loan: A practical example for a Vancouver borrower.

Let's consider a hypothetical example for a Vancouver resident. Suppose you borrow $3,000 with an APR of 99% over 6 months, and there's a $150 origination fee and a $50 lien registration fee. The total amount to repay would be significantly higher than just the $3,000 principal plus basic interest. Over 6 months, an APR of 99% would mean substantial interest charges, easily adding another $1,000 or more to the principal, plus the initial fees. Your total repayment could easily exceed $4,200 for a $3,000 loan. This demonstrates why it’s crucial to calculate the total repayment amount, not just the monthly instalment.

Comparing rates: Why a 'low' monthly payment can still mean a sky-high APR.

Lenders might advertise appealing low weekly or bi-weekly payments. While these might seem manageable, it's crucial to convert them into an APR. A $100 weekly payment on a small loan might seem low, but over a year, this could translate into an extremely high APR, particularly if the principal isn't reducing quickly. Always ask for the APR and compare it with any other borrowing options you might have. Transparency is key.

Who's Lending in Vancouver? A Deep Dive into the Alternative Lending Landscape

The alternative lending landscape in British Columbia is a distinct ecosystem, separate from the traditional financial institutions you might be familiar with. Understanding who operates in this space and how they are regulated is vital for a Vancouver borrower.

Why Banks and Credit Unions Say No: Reaffirming their lack of participation in title loans.

It's a common misconception that major banks or credit unions offer vehicle title loans. In Canada, these traditional financial institutions typically do not engage in this specific type of lending. Their business models are structured around lower-risk, credit-score-dependent loans. Vehicle title loans, by their nature, cater to a higher-risk demographic (those with poor credit or non-traditional income), and the associated high interest rates and repossession mechanisms fall outside their typical offerings and regulatory frameworks. So, if you're looking for a title loan, you'll need to turn to specialized alternative lenders.

Online vs. Storefront Lenders in British Columbia: Pros and Cons of each approach.

You'll generally find two main types of title loan lenders in British Columbia:

| Feature | Online Lenders | Storefront Lenders (Brick-and-Mortar) |

|---|---|---|

| Convenience | High; apply from anywhere, any time. | Lower; requires travel to a physical location during business hours. |

| Speed | Very fast; often same-day approval and e-transfer of funds. | Fast; funds often available on-site, but application might take longer. |

| Personal Interaction | Limited; primarily through email or phone. | Direct; face-to-face interaction, which some borrowers prefer. |

| Documentation | Submitted digitally (scans, photos). | Submitted physically. |

| Vehicle Inspection | May involve photos/videos, or a mobile appraiser visiting your location. | Typically done on-site at their location. |

| Privacy | Can feel more private. | Less private; you're in a public office. |

| Trust Factor | Requires careful verification of legitimacy. | Physical presence can build immediate trust for some. |

For Vancouver residents, both options are available. Online lenders offer unparalleled convenience, especially for those with busy schedules or limited mobility. However, some prefer the personal interaction and perceived accountability of a storefront lender. Whichever you choose, due diligence is critical.

Licensing and Regulation: Protecting Yourself in British Columbia's Title Loan Market.

In British Columbia, lenders, including those offering vehicle title loans, are subject to provincial regulations designed to protect consumers. The primary body overseeing consumer protection in BC is Consumer Protection BC. Legitimate lenders must adhere to provincial laws regarding interest rates (though these can still be very high for title loans), disclosure of terms, and fair practices.

Pro Tip: Verifying a Lender's Legitimacy with Consumer Protection BC Before Committing.

Before you commit to any title loan, take a few minutes to verify the lender's legitimacy. Check if they are registered or licensed with Consumer Protection BC. A quick search on their website can reveal if there are any complaints against the lender or if they are operating without proper authorization. This simple step can save you from predatory practices and potential scams.

Red Flags: Identifying predatory lenders and avoiding scams specific to Vancouver.

Be vigilant for red flags that indicate a predatory lender or a scam:

- Guaranteed Approval Without Any Checks: If a lender promises approval without even asking about your car's condition, income, or title status, be very wary.

- Upfront Fees Before Approval: Legitimate lenders typically don't ask for large upfront fees before a loan is approved and disbursed.

- Aggressive Sales Tactics: Pressure to sign immediately without reading the contract.

- Lack of Transparency: Unwillingness to provide a clear breakdown of all fees, interest rates, and terms.

- Unsolicited Offers: Be cautious of unsolicited calls, emails, or texts offering loans.

- Demand for Your Original Title (and vehicle) Upfront: While they hold the lien, reputable lenders don't usually take physical possession of your car or demand your original title be surrendered until default.

The Perilous Path: What Happens If You Can't Pay Back Your Title Loan in Vancouver?

Understanding the consequences of default is perhaps the most critical aspect of taking out a vehicle title loan. The stakes are high, and the repercussions can be severe.

The Real Risk: Losing Your Vehicle – The ultimate consequence of default.

This is the most significant risk associated with a title loan. Because your car serves as collateral, if you fail to make your agreed-upon payments, the lender has the legal right to repossess your vehicle. This means you could lose your primary mode of transportation, which for many in Vancouver, is essential for work, childcare, and daily life. The convenience of keeping your car during the loan period vanishes the moment you default.

Legal Recourse and Repossession Laws in British Columbia: Understanding your rights and the lender's powers.

In British Columbia, the repossession process is governed by provincial laws, which outline the rights of both the borrower and the lender. Generally, lenders must adhere to specific procedures before repossessing a vehicle:

- Notice of Intent: Lenders are usually required to provide you with a notice of their intent to repossess if you are in default.

- Peaceful Repossession: Repossession must be conducted peacefully, without breaching the peace. Lenders cannot use force or threats.

- Opportunity to Cure: In some cases, you might have a chance to "cure" the default by paying the overdue amount plus any late fees before repossession occurs.

Your rights as a borrower during and after repossession: Even after repossession, you have certain rights. You may have the right to reinstate the loan by paying all overdue amounts and repossession costs. If the vehicle is sold, you generally have a right to any surplus funds after the loan, fees, and sale costs are covered, though this is rare as cars are often sold at auction for less than market value. Conversely, you might still be liable for any deficiency if the sale price doesn't cover the outstanding debt.

Impact on Your Credit Score: Even if it started low, a default can worsen it significantly.

While title loans don't typically require a high credit score for approval, a default will almost certainly have a negative impact. If the lender reports to credit bureaus (many do), a repossession or an unpaid balance will severely damage your credit rating, making it even harder to obtain credit in the future. This can create a deeper financial hole than the one you initially tried to escape.

Seeking Help: Resources for debt counseling and financial advice in Vancouver.

If you find yourself struggling to repay a title loan, do not wait until repossession is imminent. Seek help immediately. Vancouver offers various resources for debt counseling and financial advice. Non-profit credit counselling agencies can help you review your budget, negotiate with creditors, and explore debt management plans. Organizations like Credit Counselling Society are excellent starting points. Early intervention can often prevent the loss of your vehicle and mitigate further financial damage.

Smart Alternatives and Strategic Considerations for Vancouver Residents

Before diving into a vehicle title loan, it's crucial to explore all available alternatives. While title loans offer quick cash, their high cost and significant risk make them a last resort for many. Vancouver residents have several other options worth considering.

When a Title Loan is NOT the Answer: Scenarios where other options are safer and more cost-effective.

A title loan might not be your best option if:

- You have a relatively good credit score and can qualify for a traditional personal loan with a lower interest rate.

- The amount you need is small and can be covered by a responsible credit card, provided you can pay it off quickly.

- You have other assets (like an RRSP, GIC, or home equity) that could be used as collateral for a more favourable secured loan.

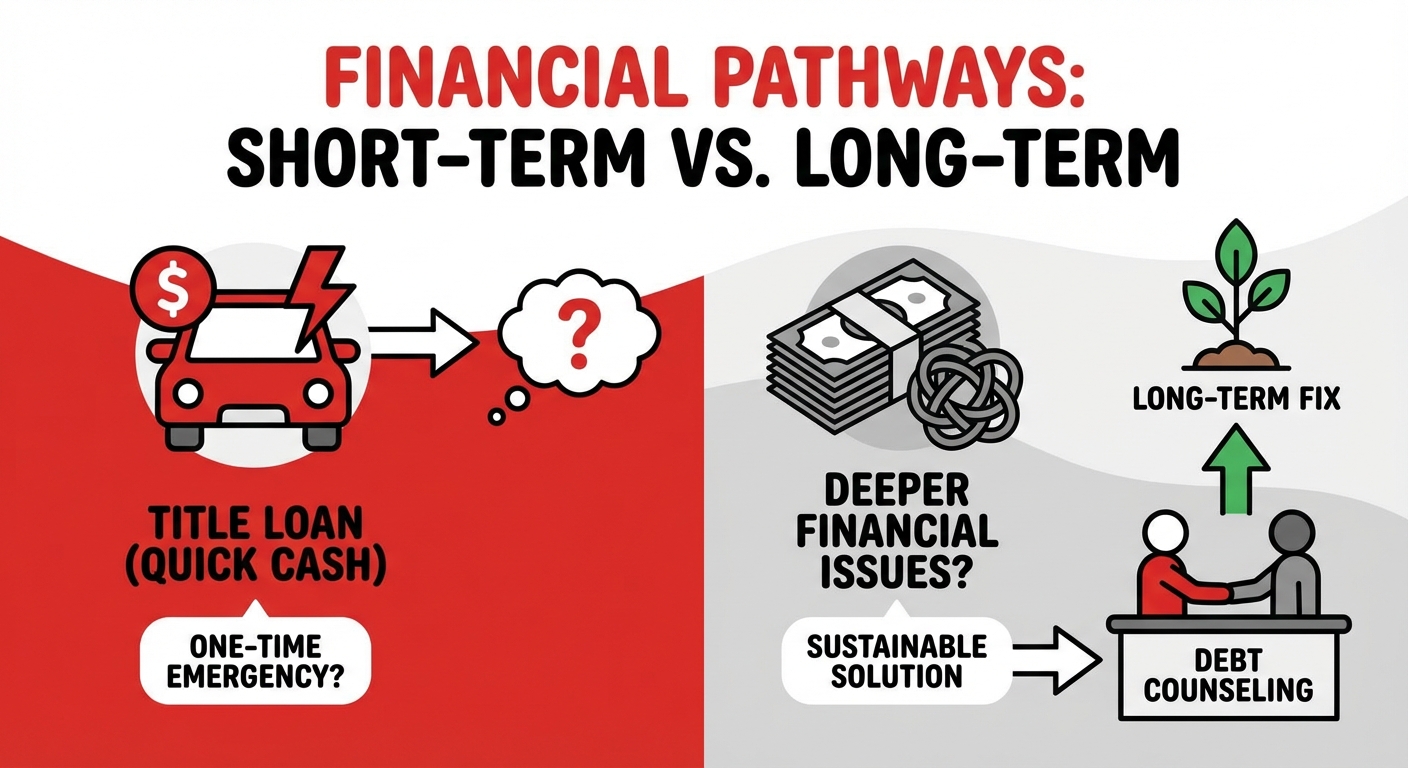

- Your financial distress is chronic rather than a one-time emergency; a title loan will only provide temporary relief and could worsen a long-term problem.

- You are unsure if you can consistently meet the high monthly payments.

Exploring Other Borrowing Options for Vancouverites:

- Secured Personal Loans (if you have other assets): If you own other valuable assets (not your car), you might qualify for a secured personal loan from a bank or credit union, often at a much lower interest rate than a title loan.

- Credit Union Micro-Loans or Consolidation Options: Credit unions often have more flexible lending criteria than large banks and may offer smaller loans or debt consolidation options for members, sometimes with better terms than alternative lenders.

- Borrowing from Family or Friends: While sometimes awkward, this can be the most cost-effective option if you have a trusted support network. Always put the agreement in writing to avoid misunderstandings.

- Debt Management Plans or Credit Counseling Services: If debt is a recurring issue, a non-profit credit counselling agency can help you create a budget, negotiate with creditors, and develop a sustainable repayment plan without taking on new high-interest debt.

- Bad Credit Personal Loans: Some lenders specialize in personal loans for those with poor credit, which may still have lower APRs than title loans and don't put your car at risk. For more on this, check out our guide on Bad Credit? Private Sale? We're Already Writing the Cheque.

Improving Your Financial Health for Future Borrowing: Steps to rebuild credit and create a sustainable budget.

Regardless of your immediate borrowing needs, investing in your long-term financial health is always beneficial:

- Create a Detailed Budget: Track your income and expenses rigorously to identify areas where you can save.

- Build an Emergency Fund: Even a small amount saved can prevent the need for high-interest loans in future emergencies.

- Pay Bills on Time: Consistent on-time payments are crucial for improving your credit score.

- Reduce Debt: Focus on paying down high-interest debts first.

- Monitor Your Credit: Regularly check your credit report for errors and understand your score.

Pro Tip: Assessing Your Financial Situation Before Committing to Any High-Interest Loan – A Comprehensive Self-Evaluation.

Before applying for a title loan, perform a brutally honest self-assessment. Can you genuinely afford the monthly payments without jeopardizing other essential expenses? Have you exhausted all other, less expensive options? Is this a one-time emergency or a symptom of deeper financial issues? If it's the latter, debt counseling is a more sustainable solution. Understand that a title loan is a powerful tool for quick cash, but it's not a long-term financial fix.

Your Next Steps to Approval (or Avoidance): A Strategic Checklist for Vancouver Drivers

Navigating the world of vehicle title loans in Vancouver requires careful thought and strategic action. Whether you ultimately decide to pursue one or explore alternatives, being informed is your best defense.

A concise, actionable summary for readers making a decision.

Your car title holds significant power, offering a rapid path to cash when traditional lenders are out of reach. However, this power comes with considerable responsibility due to high costs and the risk of losing your vehicle. Proceed with caution, armed with knowledge, and always prioritize your long-term financial well-being.

Pre-application checklist: What to have ready and what to research.

- Verify Your Title: Ensure it's lien-free and in your name. Check with ICBC if unsure.

- Assess Your Vehicle: Understand its market value based on age, make, model, mileage, and condition.

- Gather Documents: Have your ID, proof of residency, income, and insurance ready.

- Research Lenders: Check their reputation, read reviews, and verify their legitimacy with Consumer Protection BC.

- Calculate Costs: Estimate the total cost of the loan (principal + interest + all fees) over the full term.

During the application: Questions to ask and red flags to watch for.

- Ask for Clarity: Demand a clear breakdown of all fees, the APR, and the full repayment schedule.

- Inquire About Penalties: Understand late payment and early repayment penalties.

- Know Default Terms: Be fully aware of what constitutes a default and the repossession process.

- Watch for Red Flags: Be wary of guaranteed approval, upfront fees, or pressure tactics.

Post-approval: Managing your repayments and potential exit strategies.

- Adhere to Repayment Schedule: Make every payment on time to avoid fees and default.

- Consider Early Repayment: If possible, pay off the loan sooner to reduce interest costs.

- Avoid Rollovers: Do not roll over the loan; it's a debt trap.

- Seek Help Early: If you foresee repayment difficulties, contact the lender and credit counselling services immediately.

Final thoughts: Empowering Vancouver residents with knowledge for responsible financial choices.

The decision to use your car title for a loan is a significant one. While it can provide much-needed liquidity in an emergency, it's not a decision to be taken lightly. By understanding the requirements, costs, risks, and alternatives, you can make an empowered and responsible financial choice that serves your needs without jeopardizing your future. At SkipCarDealer.com, we are committed to providing you with the insights you need to navigate these complex financial waters with confidence.