Your Car Title Just Got a Job. You Still Get to Drive, Toronto.

Table of Contents

- Your Car Title Just Got a Job. You Still Get to Drive, Toronto.

- Key Takeaways

- 1. Opening Act: Your Car's Unexpected Side Hustle in Toronto

- The Unseen Value: How Your Vehicle's Title Can Work for You (While You Keep Driving)

- Setting the Scene: Why Toronto Drivers Are Looking for Flexible Financial Solutions

- 3. Why Toronto Drivers Turn to Their Titles: Navigating Financial Bumps with Your Vehicle

- The Credit Conundrum: When Traditional Banks Say No, Your Car Says Maybe

- Urgent Cash Needs: Bridging Gaps for Unexpected Expenses (Medical, Repairs, etc.)

- Beyond the Bank: Understanding the Appeal of Alternative Lending in the Greater Toronto Area

- 4. Unpacking the 'How': Your Car Title Loan Journey in Ontario

- What Exactly is a Car Title Loan in the Greater Toronto Area? (Beyond the Basic Definition)

- Who Qualifies? Demystifying Eligibility for Toronto Residents

- From Application to Approval: The Step-by-Step Process for Unlocking Your Car's Equity

- Your Car's Value: How Lenders in Toronto Appraise Your Ride and Determine Loan Amounts

- 5. The Price of Convenience: Understanding the Real Costs of Borrowing Against Your Car in Ontario

- Beyond the Principal: Decoding Interest Rates and APRs in Ontario's Title Loan Market

- The Hidden Hurdles: Fees, Charges, and What to Watch Out For in Toronto

- The Repayment Roadmap: Structuring Your Loan & Avoiding Pitfalls

- 6. The Road Less Traveled: What Happens If You Can't Pay? (Repossession Realities in Ontario)

- The Gravest Risk: Losing Your Car – A Toronto Perspective

- Beyond Repossession: The Lingering Impact on Your Credit Score and Future Borrowing Ability

- What to Do If You're Struggling: Proactive Steps to Prevent Repossession

- 7. Navigating the Regulatory Landscape: Ontario's Rules for Title Loans

- Who's Watching the Watchmen? Provincial Oversight vs. the Federal Hands-Off Approach

- Licensing and Consumer Protection in Ontario: What You Need to Know About Your Rights

- A Glimpse Beyond Ontario: How Regulations Differ Across Canada (e.g., Alberta, British Columbia) and Why It Matters

- 8. Alternative Routes: Exploring Other Financial Options for Toronto Residents

- Secured vs. Unsecured Loans: A Broader Look at Borrowing

- Credit Unions and Community Lenders: Exploring Lower-Cost Options (If Credit Allows)

- Debt Consolidation and Credit Counseling Services in Toronto: Holistic Solutions

- Borrowing from Friends or Family: Weighing the Personal Implications

- 9. Making the Smart Choice: Vetting Title Loan Lenders in the GTA

- Beyond the Advertisements: Key Questions to Ask Every Potential Lender

- Online vs. Brick-and-Mortar: Which Lender Type is Right for Your Needs in Toronto, Ottawa, or Hamilton?

- 10. Your Next Steps to Approval (or Reconsideration): A Toronto Driver's Checklist

- Final Decision Points: Is a Car Title Loan Truly Your Best Option?

- The Prepared Borrower: Gathering Documents and Comparing Offers Systematically

- Moving Forward: Actionable Advice for Securing Your Loan Responsibly

- 11. Frequently Asked Questions About Car Title Loans in Toronto

Your Car Title Just Got a Job. You Still Get to Drive, Toronto.

Toronto, the vibrant heart of Canada, is a city of endless possibilities, but also one where life can throw unexpected financial curveballs. From a sudden home repair in North York to an unforeseen medical bill in Scarborough, or even a vehicle breakdown on the Gardiner Expressway, urgent cash needs can arise when least expected. When traditional lenders seem to close their doors, many Canadians find themselves exploring alternative avenues – and for a growing number of Toronto drivers, their fully-paid car title might just be the solution they've overlooked. This isn't about selling your beloved vehicle or even parking it. It’s about leveraging the unseen value of your car's ownership document to secure much-needed funds, all while keeping your keys and continuing your daily commute. But like any financial decision, understanding the full picture – the good, the bad, and the potentially risky – is absolutely critical.

Key Takeaways

- Keep Your Car: Car title loans allow you to borrow money using your vehicle's clear title as collateral, meaning you retain possession and continue driving.

- Credit Isn't the Only Factor: Lenders primarily assess your car's value and your ability to repay, making them an option for those with less-than-perfect credit in Toronto and across Ontario.

- High Costs, High Risks: Be aware that title loans come with significantly higher interest rates and fees compared to traditional loans. The gravest risk is repossession of your vehicle if you default.

- Legal and Regulated: Car title loans are legal in Ontario and regulated by provincial laws, but it's crucial to choose a licensed and transparent lender.

- Explore Alternatives: While convenient, title loans should be considered a last resort. Always explore all other financial options before committing.

1. Opening Act: Your Car's Unexpected Side Hustle in Toronto

Imagine your car, not just as a means of transport, but as a silent financial partner, ready to step up when you need it most. In the bustling streets of Toronto, from the downtown core to the quiet neighbourhoods of Etobicoke, your vehicle's title holds a surprising amount of untapped potential. It's a document that, for most of its life, simply sits in a filing cabinet, confirming your ownership. But what if that piece of paper could work for you, providing a lifeline when other options dry up?

The Unseen Value: How Your Vehicle's Title Can Work for You (While You Keep Driving)

The concept is straightforward: a car title loan allows you to borrow money by using your vehicle's clear title as collateral. This means you temporarily transfer the legal ownership (the lien on the title) to the lender, but you retain physical possession of your car. You continue to drive it to work, pick up the kids, and run errands. It's a unique lending model that leverages an asset you already own, offering a pathway to funds without disrupting your daily life, as long as you meet your repayment obligations.

Setting the Scene: Why Toronto Drivers Are Looking for Flexible Financial Solutions

Life in Toronto, while exciting, can also be expensive and unpredictable. The high cost of living, coupled with unexpected expenses like emergency home repairs, urgent medical bills, or sudden job loss, can quickly deplete savings. Many individuals find themselves in situations where traditional banks and credit unions are unwilling to lend due to a less-than-perfect credit history or a lack of conventional collateral. This is where alternative lending solutions, such as car title loans, enter the picture, offering a flexible and often faster way to access capital for those who need it most. For more on navigating financial challenges in the city, check out our guide on Flat Tire, Flat Credit? Toronto, We've Got Your Fix.

3. Why Toronto Drivers Turn to Their Titles: Navigating Financial Bumps with Your Vehicle

When life throws a wrench into your financial plans, the search for solutions can be stressful. For many in Toronto and across the Greater Toronto Area (GTA), their fully-owned vehicle represents a tangible asset that can be quickly converted into cash.

The Credit Conundrum: When Traditional Banks Say No, Your Car Says Maybe

One of the primary reasons individuals consider car title loans is a challenging credit history. Traditional lenders, such as banks, often rely heavily on credit scores to assess risk. If you've faced financial setbacks – perhaps a past bankruptcy, a consumer proposal, or simply a history of missed payments – securing a conventional loan can feel impossible. Car title loans, however, are primarily secured by the value of your vehicle. While lenders will still look at your income to ensure repayment ability, a low credit score is often not an automatic disqualifier. This makes them an accessible option for many who feel shut out by mainstream financial institutions.

Urgent Cash Needs: Bridging Gaps for Unexpected Expenses (Medical, Repairs, etc.)

Life doesn't wait for your next paycheck. An emergency root canal, a sudden transmission failure on your SUV, or an unexpected home repair can easily run into thousands of dollars. When savings are depleted and credit cards are maxed out, a car title loan can provide the immediate funds necessary to cover these critical expenses, preventing further financial distress. The speed of approval and disbursement is often a major draw for those facing time-sensitive financial pressures.

Beyond the Bank: Understanding the Appeal of Alternative Lending in the Greater Toronto Area

The appeal of alternative lending stems from its flexibility and speed. Unlike the often lengthy and rigorous application processes of traditional banks, title loan lenders in the GTA can typically approve and fund loans much faster, sometimes within the same day. This convenience is a significant factor for individuals who need quick access to cash without extensive paperwork or credit checks. It offers a discreet and efficient solution for those who value expediency over the lower interest rates of conventional loans.

Pro Tip: Before diving in, thoroughly assess if a title loan is your *only* viable option. Explore all alternatives first, including borrowing from family, negotiating with creditors, or seeking assistance from non-profit credit counselling services.

4. Unpacking the 'How': Your Car Title Loan Journey in Ontario

So, how exactly does this process work in the province of Ontario, particularly for residents of the Greater Toronto Area? Let's break down the mechanics.

What Exactly is a Car Title Loan in the Greater Toronto Area? (Beyond the Basic Definition)

A car title loan, often known as a vehicle equity loan, is a short-term, high-interest loan where the borrower uses their car's clear title as collateral. The "clear title" means you own the car outright, free of any existing liens or outstanding financing. The loan amount is typically a percentage of your car's appraised value, allowing you to access a portion of the equity you've built up in your vehicle. The lender places a lien on your vehicle's title, which is removed once the loan is fully repaid. While you maintain physical possession of your car, the lender technically holds the legal right to repossess it if you default on the loan.

Who Qualifies? Demystifying Eligibility for Toronto Residents

Qualifying for a car title loan in Ontario involves several key criteria, designed to ensure both your ability to repay and the lender's security.

Clear Title & Car Ownership: The Non-Negotiable Foundation

This is the bedrock of a car title loan. You must be the legal, registered owner of the vehicle, and the title must be clear – meaning there are no outstanding loans, leases, or other liens against it. If you still have a car loan, you typically won't qualify for a title loan until that loan is fully paid off.

Proof of Income: Demonstrating Your Ability to Repay (Even with Low Credit)

While your credit score might not be the primary factor, your ability to repay the loan is paramount. Lenders will require proof of a stable income, which can come from various sources: employment, self-employment, government benefits like EI or CPP, or even certain disability payments. The key is demonstrating a consistent cash flow that can cover the loan payments. For individuals who are self-employed, showing bank statements can often serve as sufficient income proof. For more details, explore our article on Self-Employed? Your Bank Statement is Our 'Income Proof'.

Age, Residency, and Other Prerequisites for Borrowers in Ontario

Generally, you must be at least 18 years old (the age of majority in Ontario), a Canadian citizen or permanent resident, and reside in Ontario. You'll also need valid government-issued identification, proof of address (e.g., utility bill), and often proof of valid car insurance.

From Application to Approval: The Step-by-Step Process for Unlocking Your Car's Equity

The process for obtaining a car title loan is often designed for speed and convenience.

Online vs. In-Store Lenders: The Convenience Factor in Toronto, Mississauga, and Brampton

Many lenders operate both online and with physical locations throughout the GTA, including Toronto, Mississauga, and Brampton. Online applications offer the convenience of applying from home, often with pre-approvals in minutes. In-store options might provide a more personalized experience and immediate document verification. Both typically aim for rapid processing.

Required Documents: What You'll Need to Gather (ID, Proof of Address, Insurance, etc.)

To streamline the process, have these documents ready:

- Valid Government-Issued Photo ID (e.g., driver's license)

- Vehicle Ownership/Registration (proof of clear title)

- Proof of Address (e.g., utility bill, lease agreement)

- Proof of Income (e.g., pay stubs, bank statements, benefit letters)

- Proof of Active Vehicle Insurance

- Void Cheque or Pre-Authorized Debit Form (for repayment)

- Photos of your vehicle (if applying online)

Your Car's Value: How Lenders in Toronto Appraise Your Ride and Determine Loan Amounts

The amount you can borrow is directly tied to your vehicle's market value. Lenders will conduct an appraisal to determine this.

Factors Beyond Make and Model: Year, Mileage, Condition, and Market Demand

While a 2018 Honda Civic in North York will have a base value, its specific condition, mileage, maintenance history, and even current market demand for that model will heavily influence the appraisal. A car with low mileage and excellent upkeep will naturally command a higher loan amount than a similar model with significant wear and tear.

Specific Examples: Valuing Sedans, SUVs, and Even Luxury Vehicles in the Ontario Market

A well-maintained 2019 Toyota RAV4 in Markham might qualify for a higher loan than an older sedan, simply due to its higher market value and demand as an SUV. Even luxury vehicles, like a 2017 Mercedes-Benz C-Class in Yorkville, can be used for title loans, potentially unlocking larger loan amounts due to their inherent higher value, assuming all other criteria are met. The appraisal process is thorough and designed to give a fair assessment of your vehicle's worth in the current Ontario market.

5. The Price of Convenience: Understanding the Real Costs of Borrowing Against Your Car in Ontario

While car title loans offer quick access to funds, it's crucial to understand the associated costs. This is not "free" money; it comes with a price, and that price is often significantly higher than traditional lending options.

Beyond the Principal: Decoding Interest Rates and APRs in Ontario's Title Loan Market

The interest rate is the core cost of borrowing. In Ontario, car title loans are subject to provincial regulations, but their interest rates can still be substantial.

Why Title Loan Interest Rates Are Significantly Higher Than Traditional Loans

The primary reason for higher interest rates is the increased risk lenders undertake. Borrowers often have lower credit scores or limited access to conventional credit, making them a higher risk profile. The convenience and speed of these loans also contribute to their premium pricing. While a bank loan might offer an APR (Annual Percentage Rate) in the single or low double digits, car title loans can have APRs that are significantly higher, sometimes reaching triple digits depending on the lender and specific terms.

Calculating Your Total Cost: What a 'Short-Term' Loan Truly Means for Your Wallet

Understanding the total cost means looking beyond just the monthly payment. You need to calculate the sum of all principal repayments plus all interest and fees over the entire loan term. A "short-term" loan, which might seem manageable initially, can become very expensive if extended or refinanced. For instance, a $3,000 loan repaid over 6 months with a high APR could accrue hundreds or even thousands of dollars in interest alone.

The Hidden Hurdles: Fees, Charges, and What to Watch Out For in Toronto

Interest isn't the only cost. Be vigilant for various fees that can add up quickly.

Origination Fees, Administrative Charges, and Processing Costs

Many lenders charge upfront fees for processing your application, setting up the loan, or administrative tasks. These can range from a small percentage of the loan amount to a flat fee and should be clearly disclosed in your loan agreement.

Late Payment Penalties, NSF Fees, and Other Costly Surprises

Missing a payment, even by a day, can trigger significant late payment penalties. If your payment bounces due to insufficient funds (NSF), you'll likely incur an NSF fee from both your bank and the lender. These fees can quickly snowball, making it harder to catch up and increasing the overall cost of your loan.

The Repayment Roadmap: Structuring Your Loan & Avoiding Pitfalls

Understanding your repayment schedule and options is key to successfully managing your title loan.

Understanding Payment Schedules: Weekly, Bi-Weekly, or Monthly Options

Lenders often offer flexible repayment schedules to align with your pay cycles. You might choose weekly, bi-weekly, or monthly payments. While more frequent payments can help reduce the total interest paid over time, ensure the chosen schedule is realistic for your budget.

Early Repayment Clauses: Penalties vs. Potential Savings

Some loan agreements may include clauses regarding early repayment. Ideally, you want a loan that allows you to pay it off early without penalty, as this can significantly reduce the total interest you pay. Always confirm this detail before signing.

Pro Tip: Always demand a comprehensive, itemized breakdown of *all* fees and interest charges before signing any agreement. Do not proceed if a lender is not fully transparent or if they pressure you into signing without fully understanding the terms.

6. The Road Less Traveled: What Happens If You Can't Pay? (Repossession Realities in Ontario)

This is arguably the most critical section. While car title loans offer a solution, the consequences of default are severe.

The Gravest Risk: Losing Your Car – A Toronto Perspective

The fundamental risk of a car title loan is repossession. If you fail to make your payments as agreed, the lender has the legal right to take possession of your vehicle.

The Legal Process of Vehicle Repossession in Ontario: What to Expect

In Ontario, lenders must follow specific legal procedures for repossession, typically involving providing notice of default before seizing the vehicle. Once repossessed, the lender can sell your car to recoup their losses. If the sale price doesn't cover the outstanding loan amount, you may still be responsible for the deficiency.

The Immediate Impact: Commuting, Work, and Family Life in Toronto Without a Vehicle

Losing your car in a city like Toronto can be devastating. For many, a vehicle is essential for commuting to work, especially if public transit isn't a viable option for a specific route or shift. It impacts childcare, grocery shopping, and overall quality of life. The loss of a vehicle can quickly create a cascade of other problems, further exacerbating financial stress.

Beyond Repossession: The Lingering Impact on Your Credit Score and Future Borrowing Ability

A defaulted title loan and subsequent repossession will severely damage your credit score. This negative mark can remain on your credit report for several years, making it incredibly difficult to secure any future loans, mortgages, or even rental agreements. It can trap you in a cycle of high-interest borrowing.

What to Do If You're Struggling: Proactive Steps to Prevent Repossession

If you foresee difficulties in making your payments, do not wait until you default.

Pro Tip: If you anticipate payment difficulties, contact your lender *immediately* to discuss potential solutions or payment adjustments. Open communication can sometimes prevent repossession, as some lenders may be willing to work with you on a revised payment plan or temporary deferral rather than going through the repossession process.

7. Navigating the Regulatory Landscape: Ontario's Rules for Title Loans

Understanding the regulatory framework is crucial for protecting yourself as a borrower in Ontario.

Who's Watching the Watchmen? Provincial Oversight vs. the Federal Hands-Off Approach

In Canada, consumer protection and lending regulations are largely a provincial responsibility, especially for short-term, high-cost loans like car title loans. While the federal government has laws concerning interest rates (e.g., the Criminal Code caps interest at 60% APR), provinces like Ontario have specific legislation to govern alternative lenders. This means that regulations can differ significantly from province to province.

Licensing and Consumer Protection in Ontario: What You Need to Know About Your Rights

Ontario has established rules to protect consumers who use alternative lending services.

Key Legislation and Regulations Governing Alternative Lenders in Ontario (e.g., Consumer Protection Act, 2002)

The Consumer Protection Act, 2002 (CPA) in Ontario, along with its associated regulations, provides a framework for consumer rights and responsibilities in various transactions, including certain types of loans. While not specifically designed solely for title loans, it generally applies to credit agreements. Lenders must be licensed and adhere to specific disclosure requirements, providing clear information about interest rates, fees, and terms. They must also follow rules regarding collections and repossession.

Where to Report Issues: Contacting the Financial Services Regulatory Authority of Ontario (FSRA)

If you believe a lender is not adhering to provincial regulations or if you have a complaint, the Financial Services Regulatory Authority of Ontario (FSRA) is the provincial regulator responsible for overseeing various financial sectors, including mortgage brokers, credit unions, and some aspects of consumer lending. They are the appropriate body to contact for concerns about licensed lenders in Ontario.

A Glimpse Beyond Ontario: How Regulations Differ Across Canada (e.g., Alberta, British Columbia) and Why It Matters

It's important to recognize that what's legal and regulated in Ontario might be different elsewhere. For example, some provinces have stricter caps on the cost of borrowing or different licensing requirements. In Alberta, specific regulations also govern high-cost credit. This variation emphasizes the importance of understanding the specific rules in your province. For instance, while car title loans are an option in Ontario, regulations around them in British Columbia might have slightly different nuances. This provincial variation is why an article like "Your Car's Title: The Only Income Verification Edmonton Needs" focuses on Alberta-specific conditions.

Pro Tip: Always verify that any title loan lender you consider in Ontario is properly licensed and registered with the FSRA. A legitimate lender will be transparent about their credentials and provide their license number upon request. You can typically search for licensed entities on the FSRA website.

8. Alternative Routes: Exploring Other Financial Options for Toronto Residents

While car title loans can be a solution, they are often a high-cost one. It's always wise to explore all other available financial avenues before committing.

Secured vs. Unsecured Loans: A Broader Look at Borrowing

Understanding the difference between secured and unsecured loans is fundamental. A car title loan is a secured loan, meaning it's backed by collateral (your car). This reduces the risk for the lender but increases the risk for you, as you could lose the asset. Unsecured loans, like personal loans or credit cards, are not backed by collateral. They rely heavily on your creditworthiness, and if you default, there's no asset for the lender to seize (though your credit score will be severely impacted). Generally, unsecured loans have lower interest rates if you have good credit, but are harder to obtain with bad credit.

Credit Unions and Community Lenders: Exploring Lower-Cost Options (If Credit Allows)

If your credit isn't severely damaged, or even if it is and you have a strong relationship, local credit unions can often offer more flexible and lower-cost personal loans than traditional banks. They are member-focused and sometimes more willing to work with individuals on a case-by-case basis. Community lenders or non-profit organizations might also offer micro-loans or financial assistance programs.

Debt Consolidation and Credit Counseling Services in Toronto: Holistic Solutions

If you're struggling with multiple debts, a debt consolidation loan could simplify your payments and potentially reduce your overall interest. However, this usually requires decent credit. Alternatively, non-profit credit counseling services in Toronto can provide invaluable, unbiased advice. They can help you create a budget, negotiate with creditors, and explore options like debt management plans or consumer proposals, which are structured ways to deal with debt. They can offer a holistic approach to your financial well-being. For more insights on dealing with consumer proposals, you might find our article Your Consumer Proposal? We're Handing You Keys. helpful, though it focuses on vehicle financing specifically.

Borrowing from Friends or Family: Weighing the Personal Implications

While often the lowest-cost option, borrowing from friends or family comes with its own set of complexities. It can strain personal relationships if not handled with clear agreements and consistent repayment. If you go this route, treat it as a formal loan, with clear terms, repayment schedules, and documentation to avoid misunderstandings.

Pro Tip: Before committing to a high-interest title loan, consult with a non-profit credit counseling agency in Toronto. They can offer unbiased advice on all available financial options and help you determine the best path forward for your specific situation. This step is free and confidential.

9. Making the Smart Choice: Vetting Title Loan Lenders in the GTA

If, after careful consideration of all alternatives, you determine a car title loan is your best or only option, choosing the right lender is paramount. Not all lenders are created equal.

Beyond the Advertisements: Key Questions to Ask Every Potential Lender

Don't be swayed solely by catchy slogans or promises of instant cash. Dig deeper to protect yourself.

Transparency of Terms, Customer Service Reputation, and Online Reviews

A reputable lender will be completely transparent about all loan terms, including interest rates, all fees, and repayment schedules, without any hidden clauses. Check online reviews and ratings (Google Reviews, Better Business Bureau) to gauge their customer service reputation. Are there consistent complaints about hidden fees or aggressive collection practices? A lender with a strong track record of positive customer experiences is a better bet.

Understanding the Full Loan Agreement: Don't Rush the Fine Print

This cannot be stressed enough: read every single line of the loan agreement before you sign. Ask questions about anything you don't understand. Pay close attention to:

- The exact APR and total cost of the loan.

- All fees (origination, administrative, late payment, NSF).

- The repayment schedule and what happens if you miss a payment.

- The repossession clause and procedures.

- Any early repayment penalties.

Do not feel pressured to sign immediately. Take the document home if necessary and review it thoroughly.

Online vs. Brick-and-Mortar: Which Lender Type is Right for Your Needs in Toronto, Ottawa, or Hamilton?

Both online and physical lenders have their pros and cons.

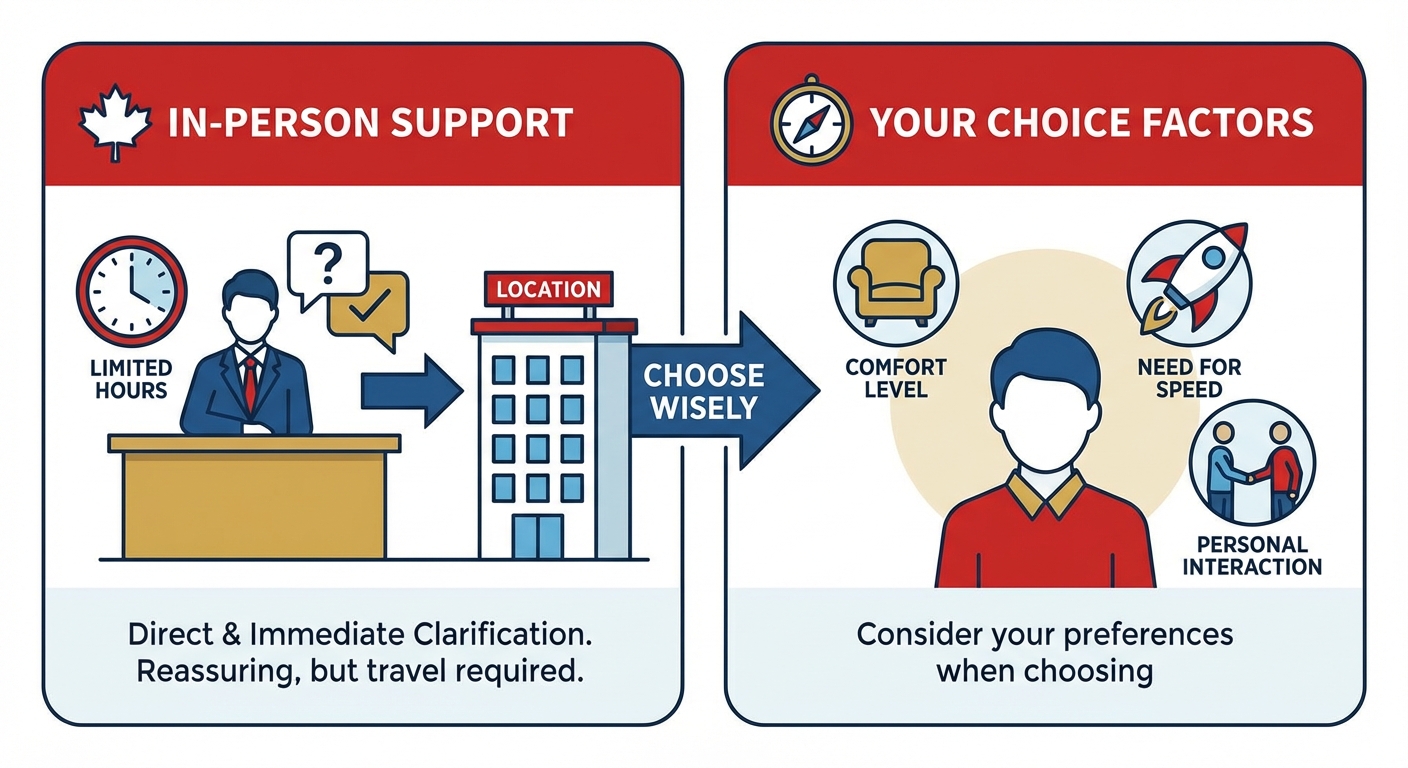

Online Lenders: Offer convenience, speed, and often operate 24/7. They might have a broader reach across Ontario, serving cities like Toronto, Ottawa, or Hamilton with ease. However, you might miss the face-to-face interaction and immediate answers to complex questions.

Brick-and-Mortar Lenders: Provide in-person service, allowing you to ask questions directly and get immediate clarification. This can be reassuring for some. However, their hours are limited, and you'll need to travel to their location.

Consider your comfort level, need for speed, and desire for personal interaction when choosing.

10. Your Next Steps to Approval (or Reconsideration): A Toronto Driver's Checklist

You've absorbed a lot of information. Now it's time to put it into action, whether that means moving forward with a title loan or exploring other paths.

Final Decision Points: Is a Car Title Loan Truly Your Best Option?

Before you proceed, ask yourself these critical questions:

- Have I exhausted all other, lower-cost financial options?

- Do I fully understand the interest rates, fees, and total cost of this loan?

- Am I confident in my ability to make every single payment on time, without fail?

- Do I understand the severe consequences, including vehicle repossession, if I cannot repay?

- Is the lender transparent, licensed, and reputable?

If you have any doubts about your ability to repay or the transparency of the lender, reconsider.

The Prepared Borrower: Gathering Documents and Comparing Offers Systematically

If you decide to proceed, be prepared.

- Gather all required documents: ID, vehicle ownership, proof of income, proof of address, insurance, void cheque.

- Get multiple quotes: Don't settle for the first offer. Contact several licensed lenders in Ontario and compare their proposed loan amounts, interest rates, fees, and repayment terms.

- Read every agreement carefully: As reiterated, this is non-negotiable.

Moving Forward: Actionable Advice for Securing Your Loan Responsibly

If a car title loan is your chosen route, approach it with caution and responsibility. Borrow only what you absolutely need, and have a clear, realistic plan for repayment. Treat this loan with the utmost seriousness, as your vehicle and financial future depend on it.