EI? Your Car Doesn't Care. Cash Out Its Title.

Table of Contents

- EI? Your Car Doesn't Care. Cash Out Its Title.

- Key Takeaways: Your Snapshot Guide to Car Title Loans on EI in Canada

- The EI Enigma & Your Car's Equity: Can They Coexist in Canadian Lending?

- Decoding the 'Car Title Loan': Your Vehicle as a Financial Lever, Not Just Transport

- Beyond the Paycheck: How Lenders Assess EI as 'Income' for Repayment Capacity

- The True Cost of Convenience: Unmasking Interest Rates, Fees, and the APR Nightmare

- The Perilous Path: Understanding Default, Repossession, and the Long-Term Credit Score Fallout

- The Great Canadian Divide: Navigating Provincial & Territorial Regulations for Title Loans

- Your Approval Blueprint: Eligibility Criteria Beyond the Pay Stub for EI Recipients

- The Lender Landscape: Where to Find a Title Loan (and Why Banks Say No)

- Strategic Borrowing for EI Recipients: Minimizing Risk & Maximizing Your Chances

- Beyond the Car Title: Exploring Alternative Financial Lifelines in Canada

EI? Your Car Doesn't Care. Cash Out Its Title.

Life in Canada can throw unexpected curveballs. One moment you're working, the next you might find yourself navigating the complexities of Employment Insurance (EI) benefits. While EI offers a crucial safety net, it can also complicate financial matters, especially when urgent cash is needed. Your car, often seen as just a mode of transport, holds a hidden financial power: its title.

This comprehensive guide from SkipCarDealer.com explores how you might leverage your vehicle's equity through a car title loan, even while receiving EI. We'll demystify the process, expose the costs, highlight the risks, and equip you with the knowledge to make an informed decision about this often misunderstood financial tool in the Canadian landscape.

Key Takeaways: Your Snapshot Guide to Car Title Loans on EI in Canada

- EI Can Be Considered Income: While traditional banks shy away, many alternative title loan lenders in Canada *do* consider EI benefits as a verifiable, albeit temporary, source of income for repayment capacity.

- Asset-Based Lending: Car title loans are primarily secured by your vehicle's clear title, not your credit score. This makes them accessible to individuals with poor credit or non-traditional income like EI.

- You Keep Your Car: A key feature is that you retain possession and use of your vehicle throughout the loan term, as long as payments are made. The lender holds the title as collateral.

- High Costs are Standard: Be prepared for significantly higher interest rates (APR) and various fees compared to conventional loans. These loans are a costly form of credit.

- Provincial Regulations Vary: Title loan regulations are not federal; they differ significantly by province and territory in Canada. Always verify lender licensing and consumer protection laws in your region.

- Repossession Risk is Real: Failing to make payments can lead to your vehicle being repossessed, and you could still owe a deficiency balance.

- Explore Alternatives First: Due to the high costs and risks, it's crucial to explore all other financial options before resorting to a car title loan, especially when on EI.

The EI Enigma & Your Car's Equity: Can They Coexist in Canadian Lending?

The question is straightforward: can you secure a car title loan in Canada while receiving Employment Insurance benefits? For many Canadians facing a temporary job loss, this is a pressing concern. The short answer is often "yes," but with significant caveats and a clear understanding of how these loans operate.

Traditional lending, such as personal loans from major banks or credit unions, heavily relies on a consistent, employment-based income and a strong credit history. When you're on EI, your income source is temporary, and your credit score might be less than perfect, making these avenues challenging. However, car title loans operate on a different principle: asset-based lending.

Instead of primarily assessing your creditworthiness or the stability of your employment income, title loan lenders are primarily interested in the equity you hold in your vehicle. Your car, in this scenario, isn't just a way to get around; it's a tangible asset that can be leveraged for cash. This fundamental difference is why EI status, which might be a barrier for a conventional loan, can be acceptable to a title loan provider. They see the value in your vehicle as collateral, significantly mitigating their risk, even if your income stream is temporary government assistance. It's a pragmatic approach to lending that bridges the gap for many who are otherwise locked out of mainstream credit.

For more on how EI can be viewed by lenders in other contexts, check out our guide on EI Income? Your Car Loan Just Said 'Welcome Aboard!'

Decoding the 'Car Title Loan': Your Vehicle as a Financial Lever, Not Just Transport

So, what exactly is a car title loan? Also known as auto title loans, vehicle collateral loans, or pink slip loans (though "pink slip" is more of a US term, the concept applies), these are secured loans where you use your vehicle's clear title as collateral. The defining characteristic is that the loan amount is based on a percentage of your car's market value, not your credit score.

The mechanism is relatively simple: you provide the lender with your vehicle's original, lien-free title. "Lien-free" is crucial – it means you own the car outright, with no outstanding loans or leases against it. In exchange for the loan, the lender temporarily takes possession of your car's title. This transfer of title ensures that if you default on the loan, the lender has the legal right to repossess and sell your vehicle to recover their funds.

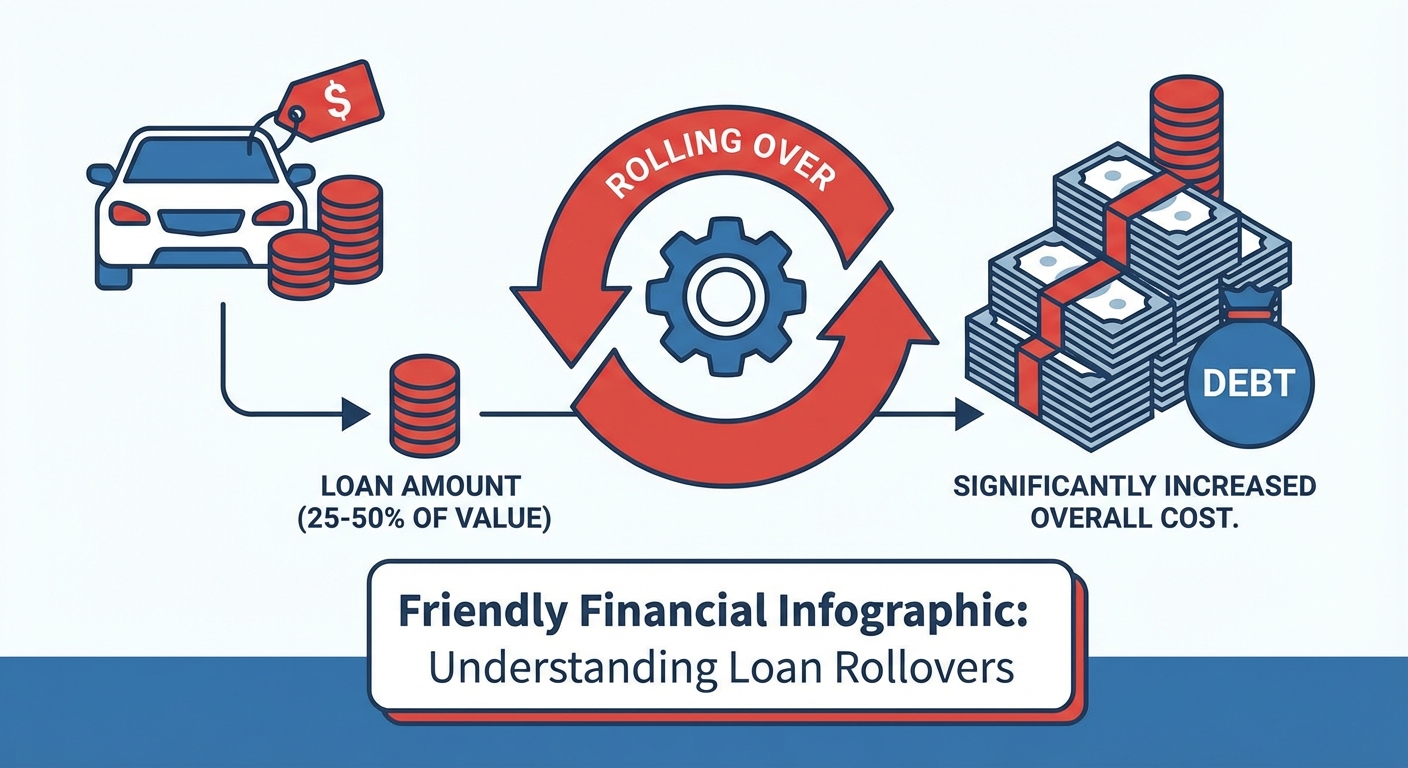

The critical distinction here, and often the primary appeal, is that you *keep and use* your car throughout the loan term. You don't hand over your keys; you continue driving your vehicle for work, errands, or whatever your daily needs entail. This makes title loans a viable option for those who need immediate cash but cannot afford to lose access to their transportation. The loan term is typically short, often 30 days, but can be extended, leading to what's known as "rolling over" the loan, which significantly increases the overall cost. The loan amount you can receive typically ranges from 25% to 50% of your car's wholesale value, depending on the lender and the vehicle's condition.

Beyond the Paycheck: How Lenders Assess EI as 'Income' for Repayment Capacity

When you're on Employment Insurance, the idea of getting a loan can seem daunting. Traditional lenders often prefer the stability of a full-time employment income. However, alternative title loan lenders assess income differently. For them, the critical factor isn't necessarily *where* the income comes from, but its *verifiability* and *consistency* during the loan term.

Many title loan providers in Canada will consider EI benefits as a legitimate, albeit temporary, source of income for assessing your repayment capacity. They understand that life happens, and people need financial solutions during transitional periods. What they look for is proof that you are indeed receiving EI, the amount, and for how long. This helps them determine if you have sufficient cash flow to cover the loan payments.

To establish your repayment capacity while on EI, lenders will typically require specific documentation. This often includes:

- EI Statements: Official documents from Service Canada confirming your EI eligibility, benefit amount, and payment schedule.

- Bank Records: Recent bank statements showing regular deposits of your EI benefits. This verifies that the funds are actually landing in your account.

- Other Verifiable Income: If you have any other small, consistent income sources (e.g., part-time work, child benefits, disability payments), these can also strengthen your application.

The lender's risk assessment primarily focuses on whether your total verifiable income (including EI) is sufficient to cover the loan payments without jeopardizing your basic living expenses. While the car's equity is the primary security, demonstrating an ability to repay is still paramount. The temporary nature of EI might influence the loan amount offered or the repayment terms, as lenders will be cautious about extending credit beyond the expected duration of your benefits. Transparency and thorough documentation are key to a smoother application process.

Pro Tip: Document Everything!

Gather all your EI statements, bank records showing EI deposits, and any other verifiable income sources *before* approaching a lender. Transparency and organized documentation can significantly streamline the application process and demonstrate your ability to manage finances, even with temporary income.

For some lenders, especially those focusing solely on asset-based lending, your car's title can be the primary proof. For instance, in some regions, it's widely accepted that Your Car's Title: The Only Income Verification Edmonton Needs.

The True Cost of Convenience: Unmasking Interest Rates, Fees, and the APR Nightmare

Car title loans offer quick access to cash, but this convenience comes at a significant financial cost. It's imperative for any Canadian considering this option to fully understand the financial implications, which extend far beyond a simple interest rate. The true cost is often hidden in the Annual Percentage Rate (APR) and a myriad of fees.

Interest Rates: Title loan interest rates are notoriously high, often in the triple digits when calculated annually. While a loan might be advertised with a monthly interest rate (e.g., 20-30% per month), this translates to an APR of 240% to 360% or even higher. Compare this to a typical bank loan or credit card, which might range from 7% to 25% APR. The difference is staggering.

Fees: Beyond interest, title loan lenders often charge various fees that inflate the total cost. These can include:

- Loan Origination Fees: A charge for processing the loan application.

- Administrative Fees: For managing the loan account.

- Processing Fees: For handling the paperwork and title transfer.

- Documentation Fees: For preparing the loan documents.

- Lien Fees: For registering the lien on your vehicle's title.

- Late Payment Penalties: Substantial fees for missed or delayed payments.

- Rollover Fees: If you extend the loan term, you'll likely pay additional fees and interest on the original principal.

The cumulative effect of these high interest rates and fees can quickly lead to a debt cycle. Many borrowers find themselves unable to repay the full amount by the due date, leading them to "roll over" the loan. This means paying only the interest and fees, then taking out a new loan for the original principal amount. Each rollover incurs new fees and interest, trapping borrowers in a cycle where they pay far more than the original loan amount, often without reducing the principal.

Here's a simplified comparison to illustrate the cost difference:

| Loan Type | Typical APR Range | Common Fees | Risk of Debt Cycle |

|---|---|---|---|

| Car Title Loan | 240% - 360%+ | Origination, Admin, Processing, Lien, Late, Rollover | High |

| Credit Card (Cash Advance) | 20% - 30% | Cash advance fee, Annual fee, Late fee | Moderate |

| Personal Loan (Bank/Credit Union) | 7% - 25% | Origination fee (less common), Late fee | Low-Moderate |

Understanding the APR is crucial because it represents the total cost of borrowing, including interest and most fees, expressed as an annual percentage. Always ask for the full APR before signing any agreement. The convenience of a car title loan is undeniable when you need quick cash, but it's a financial decision that demands a clear-eyed understanding of its true, often exorbitant, cost.

The Perilous Path: Understanding Default, Repossession, and the Long-Term Credit Score Fallout

While car title loans offer a temporary solution, it's critical to understand the severe consequences if you're unable to meet your repayment obligations. This "perilous path" can lead to significant financial distress, starting with the very asset you used to secure the loan: your vehicle.

What Happens if You Default?

A default occurs when you fail to make your loan payments as agreed in the contract. Since a car title loan is secured by your vehicle, the lender has a legal right to repossess it. The process for repossession in Canada varies slightly by province, but generally, it involves the lender hiring a repossession agent to seize your car. This can happen without prior warning in many cases, as you've already signed over the right to the title as collateral.

Once repossessed, the lender will typically sell your vehicle, usually through an auction, to recover the outstanding loan amount. The sale price at auction is often significantly lower than the car's market value, meaning it might not cover the full debt.

The Deficiency Balance:

If your car sells for less than the outstanding loan amount, you could be liable for a "deficiency balance." This means you would still owe the lender the difference between the sale price and the remaining loan amount, plus any repossession and sale costs. So, not only do you lose your car, but you could also still be in debt, with the lender potentially pursuing legal action to collect the remaining balance.

Long-Term Credit Score Fallout:

Defaulting on a secured loan, particularly one that results in repossession, has a devastating and long-lasting impact on your credit score. This negative mark will appear on your credit report for several years (typically six to seven years in Canada), making it extremely difficult to obtain any form of credit in the future – whether it's a mortgage, a car loan, or even a credit card. Lenders will view you as a high-risk borrower, leading to denials or significantly higher interest rates if you are approved at all. This can severely limit your financial flexibility and opportunities for years to come.

The decision to take out a car title loan, especially when on EI, should be weighed against these significant risks. Ensure your repayment plan is realistic and sustainable to avoid falling into this perilous situation. For those looking to rebuild their credit after such events, understanding options like Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit can be a crucial step.

The Great Canadian Divide: Navigating Provincial & Territorial Regulations for Title Loans

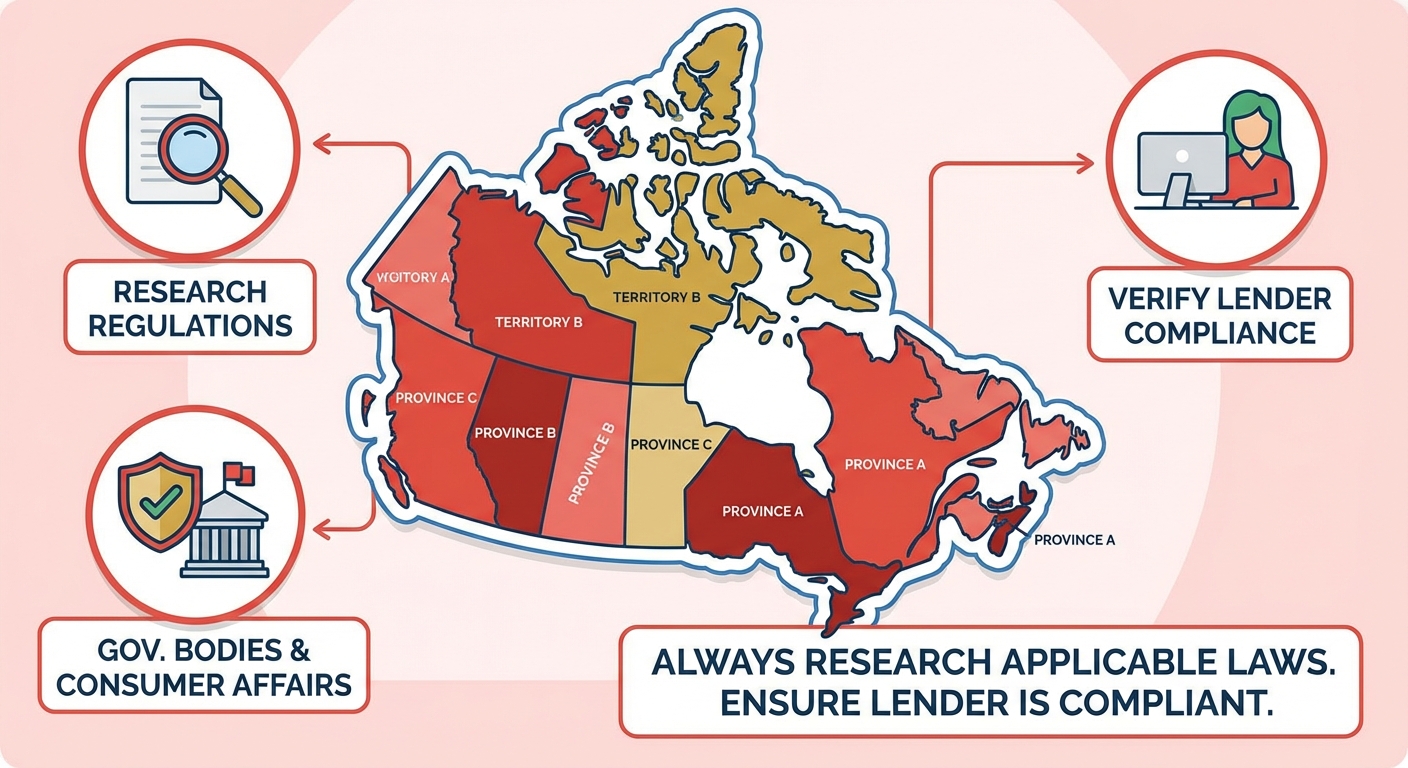

One of the most critical aspects to understand about car title loans in Canada is their regulatory landscape. Unlike traditional banking, which is federally regulated, title loans fall under provincial and territorial jurisdiction. This means there isn't a single, uniform set of rules across the country, leading to significant variations in how these lenders operate, the maximum interest rates they can charge, and the consumer protections available to you.

Some provinces have more robust consumer protection laws and specific regulations for high-cost credit products, including title loans. These might include caps on interest rates, limits on fees, and stricter requirements for lender licensing and disclosure. Other provinces or territories might have less stringent oversight, potentially exposing borrowers to higher costs and fewer protections.

Key areas where provincial regulations can differ include:

- Licensing Requirements: Lenders must be licensed to operate in certain provinces, ensuring they meet specific standards.

- Maximum Interest Rates: Some provinces impose limits on the interest rates that can be charged for high-cost credit.

- Fee Structures: Regulations might dictate what types of fees can be charged and their maximum amounts.

- Disclosure Requirements: Lenders may be required to clearly disclose all terms, conditions, and costs of the loan, including the APR.

- Cooling-Off Periods: Some provinces might offer a period during which you can cancel the loan without penalty.

- Repossession Rules: The legal process and requirements for vehicle repossession can vary.

It is your responsibility as a borrower to be aware of the specific laws in your province or territory. Always research the regulations that apply to you and ensure any lender you consider is compliant. Provincial Consumer Affairs offices or similar government bodies are excellent resources for this information.

Pro Tip: Verify Lender Licensing!

Before engaging with any title loan provider, check their registration and licensing status with your provincial or territorial Consumer Affairs office. This ensures they operate legally and adhere to local regulations, offering you a layer of protection.

Here's a general overview of how regulations might differ (note: specific details can change, always verify current laws):

| Province/Territory | Regulatory Approach (General) | Key Consumer Protections (Examples) |

|---|---|---|

| Ontario | Relatively robust; specific rules for high-cost credit. | Licensing required; disclosure rules; limits on some fees. |

| Alberta | Regulations for high-cost credit products. | Licensing required; cap on interest rates for some loans. |

| British Columbia | Consumer Protection Act applies to high-cost credit. | Licensing required; disclosure rules; restrictions on certain practices. |

| Quebec | Strict consumer protection laws; generally lower interest rate caps. | Very strict rules on interest rates and fees; strong consumer rights. |

| Manitoba | Rules for high-cost credit. | Licensing; disclosure; limits on fees. |

| Saskatchewan | Regulations for payday loans often apply to similar high-cost credit. | Licensing; disclosure. |

| Atlantic Provinces | Varying degrees of regulation; often focus on disclosure. | Licensing in some; disclosure of costs. |

| Northern Territories | Often less specific regulation for these products. | General consumer protection laws apply. |

Your Approval Blueprint: Eligibility Criteria Beyond the Pay Stub for EI Recipients

While traditional loans scrutinize your credit score and employment history, the eligibility criteria for a car title loan are different, making them more accessible for individuals on EI. The "approval blueprint" for a title loan centres on your vehicle's value and your ability to demonstrate a plan for repayment, even if that plan is based on temporary government benefits.

Here’s what lenders truly look for:

- Clear, Lien-Free Title: This is the absolute cornerstone. You must own your vehicle outright, meaning there are no outstanding loans, leases, or other financial claims against its title. The title must be in your name.

- Vehicle Equity: The loan amount you can receive is directly tied to your vehicle's market value. Lenders will assess your car's make, model, year, mileage, and overall condition to determine its wholesale value. Generally, newer vehicles with lower mileage and good condition will qualify for higher loan amounts.

- Current Registration: Your vehicle must be properly registered in your name in your province or territory.

- Comprehensive Insurance: Many lenders require you to have comprehensive insurance coverage on your vehicle for the duration of the loan. This protects their collateral in case of an accident or theft.

- Proof of Identity: Valid government-issued photo identification (e.g., driver's license).

- Proof of Residency: A utility bill or other document showing your current address.

- Proof of Repayment Capacity (EI Specific): As discussed, this will involve providing official EI statements and bank records showing regular deposits. Lenders need to be confident that you can make the scheduled payments.

The Role of Credit Score: For traditional loans, your credit score is paramount. For car title loans, its role is often minimal or non-existent. Because the loan is secured by a tangible asset (your car), lenders are less reliant on your credit history as an indicator of risk. This is why car title loans are often marketed to individuals with bad credit or no credit history. While a credit check might still be performed, it's typically for verification purposes rather than a primary determinant of approval.

How EI Status Influences Loan Amount: While EI can be accepted as income, its temporary nature might influence the loan amount offered. Lenders may be more conservative, offering a lower percentage of your car's equity or a shorter repayment term, especially if your EI benefits are nearing their end. The goal is to ensure that the loan can be repaid within the expected duration of your benefits or a reasonable transition period.

The Lender Landscape: Where to Find a Title Loan (and Why Banks Say No)

If you're looking for a car title loan in Canada, you won't find them at your local branch of a major bank or credit union. These traditional financial institutions generally do not offer car title loans. Why? Their business model is built on assessing credit risk through credit scores, income stability, and traditional collateral. They prefer unsecured loans or secured loans with lower risk profiles and established regulatory frameworks.

Instead, car title loans are primarily offered by alternative lenders. These typically fall into two categories:

- Storefront Lenders: These are physical locations, often found in strip malls or commercial areas, that specialize in various forms of high-cost credit, including title loans, payday loans, and cheque cashing services. They offer face-to-face service and often boast quick approvals.

- Online Lenders: The internet has become a major hub for title loan providers. Many companies operate entirely online, offering convenient application processes that can be completed from home. They often promise fast funding, sometimes within hours.

Identifying Reputable Lenders and Red Flags:

When dealing with alternative lenders, due diligence is paramount. Not all lenders operate ethically or transparently. Here’s how to identify reputable lenders and what red flags to watch out for:

Reputable Lenders:

- Clear Disclosure: They provide all loan terms, including the full APR, fees, and repayment schedule, upfront and in writing before you commit.

- Licensed and Registered: They are properly licensed and registered to operate in your province or territory (as discussed in the "Great Canadian Divide" section).

- Transparent Communication: They answer all your questions clearly and don't pressure you into signing.

- Reasonable Application Process: While fast, it still involves verification of your vehicle and repayment capacity.

Red Flags:

- No Written Contract: Refusal to provide a detailed written loan agreement.

- Vague or Hidden Fees: Reluctance to disclose all fees or an inability to explain the full APR.

- Guaranteed Approval Without Verification: Be wary of anyone promising guaranteed approval without any verification of your vehicle, title, or income.

- Pressure Tactics: High-pressure sales tactics to get you to sign immediately.

- Requests for Upfront Fees: Asking for significant fees before any loan funds are disbursed.

- Lack of Physical Address or Contact Info (Online Lenders): Reputable online lenders will have clear contact information and a physical business address.

- Excessive Interest Rates Beyond Provincial Caps: If the rate seems unbelievably high, it might be illegal in your province.

Always take your time, read the fine print, and don't be afraid to walk away if something feels off. The convenience of speed should never outweigh the need for transparency and legal compliance.

Strategic Borrowing for EI Recipients: Minimizing Risk & Maximizing Your Chances

For individuals on Employment Insurance, taking out a car title loan requires a particularly strategic approach. The temporary nature of EI benefits means you need to be extra diligent in minimizing risks and maximizing your chances of successful repayment. This isn't just about getting the loan; it's about getting through it without deeper financial distress.

Here's how to approach strategic borrowing:

- Negotiate Terms (Where Possible): Don't assume the first offer is non-negotiable. Some lenders might have a small degree of flexibility on loan amounts, repayment schedules, or even fees, especially if you have a high-value vehicle and strong documentation of your EI benefits. Always ask if there's any room for adjustment.

- Understand the Fine Print: This cannot be stressed enough. Read every single clause of the loan agreement before signing. Pay close attention to:

- The full APR, not just the monthly interest rate.

- All associated fees (origination, administrative, late, rollover).

- The exact repayment schedule and due dates.

- The consequences of default, including repossession clauses and potential deficiency balances.

- Any clauses about rolling over the loan.

- Create a Realistic Repayment Plan: Align your repayment plan with your EI benefit schedule. If you receive benefits bi-weekly, try to arrange bi-weekly payments that fit comfortably within your budget. Never commit to payments that stretch your finances thin, especially given the temporary nature of EI. Factor in all your essential living expenses first.

- Avoid Rolling Over the Loan: This is the most critical strategy to avoid a debt trap. Rolling over the loan means you pay the interest and fees, but the principal balance remains untouched, leading to a new loan with new fees. It's a costly cycle that can quickly make the loan unmanageable. If you anticipate difficulty making a payment, communicate with your lender *before* the due date to explore options.

- Borrow Only What You Absolutely Need: While your car might qualify for a larger loan, only borrow the minimum amount necessary to cover your immediate emergency. The less you borrow, the less interest and fewer fees you'll accrue.

- Have an Exit Strategy: How will you repay the loan in full? Is it when you return to work? From a specific lump sum? Having a clear plan beyond just relying on EI benefits can provide a crucial safety net.

Pro Tip: Budget for the Worst-Case Scenario!

When planning your repayment, assume your EI benefits might end sooner than expected or that an unforeseen expense could arise. Build a small buffer into your budget. If you can't realistically afford the payments even with this buffer, a title loan might be too risky for your current situation.

Beyond the Car Title: Exploring Alternative Financial Lifelines in Canada

Given the high costs and significant risks associated with car title loans, especially when on EI, it is always prudent to explore alternative financial lifelines first. While immediate cash needs can feel overwhelming, there might be safer, more affordable options available in Canada.

Here are several alternatives to consider before cashing out your car's title:

- Credit Counselling: Non-profit credit counselling agencies across Canada offer free or low-cost advice. They can help you assess your financial situation, create a budget, negotiate with creditors, and explore debt management plans that might be more suitable than taking on new high-interest debt.

- Government Assistance Programs (Beyond EI): Explore other federal, provincial, or municipal programs you might qualify for. These could include housing assistance, utility bill support, food banks, or other emergency relief funds designed to help Canadians facing financial hardship.

- Secured Personal Loans (Using Other Assets): If you have other valuable assets besides your car (e.g., GICs, RRSPs, non-registered investments, or even certain household items like jewellery or electronics for pawn loans), you might be able to secure a personal loan against them at a much lower interest rate than a title loan. However, be aware of the risks of using retirement savings.

- Borrowing from Family or Friends: While it can be uncomfortable, asking trusted family members or friends for a short-term loan can be a much cheaper and more flexible option. Always put the terms in writing to avoid misunderstandings and preserve relationships.

- Responsible Use of Credit Cards (if available): If you have an existing credit card with available credit, a cash advance might be an option. While cash advances have higher interest rates than purchases, they are typically still significantly lower than car title loans. Be disciplined about repayment to avoid accumulating credit card debt.

- Employer Advance or Severance Pay: If your EI is due to a recent job loss, check if your former employer offers any severance pay, vacation pay payout, or other final compensation that could bridge the gap.

- Community Loans or Microfinance: Some local credit unions or community organizations offer small loans with reasonable terms to individuals in need, often with financial literacy support.

Here's a comparison of some alternatives:

| Alternative |

|---|