Your Car's Title: The Only Income Verification Edmonton Needs.

Table of Contents

- Key Takeaways: Your Snapshot Guide to No Income Verification Car Title Loans in Edmonton

- Beyond Pay Stubs: Why Edmontonians Turn to Their Car Title for Quick Cash

- The Modern Financial Landscape

- Urgent Needs, Unconventional Solutions

- Privacy and Discretion

- The 'Edmonton Advantage'

- The Mechanics of 'No Income Verification': How Your Car Becomes Your Credit Score

- Deconstructing the Myth: What 'No Income Verification' Truly Means in Edmonton's Lending Landscape

- The Valuation Equation: How Your Car's Worth Translates to Loan Potential

- Navigating the Application Maze: From Online Click to Cash in Hand

- The Digital Gateway: A Step-by-Step Walkthrough of the Online Application Process

- The In-Person Touch: What to Expect During Vehicle Inspection and Document Signing

- The True Cost of Convenience: Demystifying Rates, Fees, and Repayment

- Beyond the APR: Unmasking All Potential Costs of Your Car Title Loan

- Tailoring Your Repayment: Understanding Loan Terms from 12 Months to 5 Years

- Keeping Your Keys: The Psychological & Practical Benefits of Driving Your Asset

- The Freedom Factor: Why Retaining Vehicle Use is a Game-Changer

- Beyond Credit Checks: The Path for Bad Credit, No Credit, and Newcomers in Edmonton

- The Road Ahead: Risks, Responsibilities, and Responsible Borrowing

- The Elephant in the Garage: Understanding the Risk of Vehicle Repossession

- Is It Always the Right Choice? Exploring Alternatives to Car Title Loans

In Edmonton's bustling economy, where innovation meets tradition, financial landscapes are evolving. The rise of the gig economy, the entrepreneurial spirit, and diverse employment models mean that a traditional pay stub doesn't always tell the full story of one's financial capacity. For many Edmontonians, their most valuable asset isn't always liquid cash in the bank, but the reliable vehicle sitting in their driveway. This is where the power of a car title loan, often touted as a "no income verification" solution, steps in, offering a unique bridge to quick, accessible funds. But what exactly does "no income verification" truly mean, and how can your car's title unlock financial flexibility in Alberta's capital? This comprehensive guide will navigate the intricacies of car title loans in Edmonton, demystifying the process, revealing the true costs, and empowering you to make informed decisions. Whether you're facing an unexpected expense, bridging a business cash flow gap, or simply need quick access to capital without the traditional hurdles, your vehicle might just be the key.

Key Takeaways: Your Snapshot Guide to No Income Verification Car Title Loans in Edmonton

- Asset-Backed Lending: Your vehicle's equity, not your pay stub, is the primary factor for approval. Lenders focus on the tangible value of your car.

- Speed & Accessibility: Expect rapid approvals (often within hours) and fewer hurdles, making these loans accessible for those with non-traditional income or credit challenges.

- Keep Your Keys: Unlike pawn loans, you retain full use of your vehicle throughout the loan term, maintaining your daily mobility in Edmonton.

- Flexible Terms: Loan amounts typically range from $1,000 to $50,000, with repayment periods up to 5 years, allowing for customizable financial solutions.

- Interest Rates Vary: Annual Percentage Rates (APRs) can range from 7.5% to 29%, influenced by vehicle value, loan amount, and term. Understanding these rates is crucial.

- Repossession Risk: Non-payment can lead to your vehicle being repossessed, underscoring the importance of a solid repayment plan and responsible borrowing.

- Edmonton Specifics: Understand local regulations and reputable lenders serving Edmonton and surrounding areas like St. Albert and Sherwood Park to ensure a smooth process.

Beyond Pay Stubs: Why Edmontonians Turn to Their Car Title for Quick Cash

Edmonton, a city known for its vibrant energy and diverse economy, presents a unique financial landscape. For many residents, the traditional nine-to-five job with a consistent bi-weekly pay stub is becoming less common. This shift is a significant driver behind the growing appeal of car title loans that don't hinge on conventional income verification.

The Modern Financial Landscape

The rise of the gig economy, self-employment, and contract work has transformed how many Edmontonians earn their living. From independent contractors in the oil and gas sector to freelance creatives, app-based delivery drivers, and small business owners, income streams are often dynamic, project-based, or seasonal. While these roles offer immense flexibility and autonomy, they can pose challenges when seeking traditional loans that heavily rely on fixed, verifiable income. Banks and credit unions, often bound by strict underwriting criteria, may struggle to assess the irregular income patterns common in these modern professions. Car title loans offer a refreshing alternative, focusing on a tangible asset rather than a fluctuating income statement. For more insights on how self-employment impacts your ability to secure funds, check out Self-Employed, Car Stuck? Skip the Pay Stub. Get Repair Cash.

Urgent Needs, Unconventional Solutions

Life in Edmonton, like anywhere, can throw unexpected curveballs. A sudden medical emergency, an urgent home repair, or an unforeseen business cash flow gap can create immediate and critical needs for funds. When time is of the essence, and traditional loan applications involve lengthy approval processes and stringent documentation, the speed and accessibility of a car title loan become a lifeline. These loans are designed for rapid disbursement, often getting funds into your hands within hours, which can be crucial in time-sensitive situations.

Privacy and Discretion

For some, the appeal of a car title loan also lies in its discretion. The process often feels less intrusive than a traditional bank loan, which might involve deep dives into personal financial history, employment records, and extensive credit checks. While lenders still need to ensure repayment capacity, the focus shifts away from scrutinizing every detail of your personal income, offering a more private and streamlined experience. This can be particularly appealing for individuals who value their financial privacy or those in sensitive professional roles.

The 'Edmonton Advantage'

Edmonton's diverse economy, with its strong sectors in energy, technology, healthcare, and retail, coupled with a dynamic population, creates a specific demand for flexible lending solutions. The city's growth attracts newcomers, entrepreneurs, and individuals navigating various life stages, all of whom may benefit from lending options that look beyond a conventional credit score or employment history. Car title loans, by leveraging an existing asset, cater directly to this need, providing a practical solution for a wide cross-section of Edmonton's residents.

Pro Tip: Understanding Your True Financial Need vs. Loan Desire

Before diving into a car title loan, take a moment to critically assess your financial situation. Is this loan addressing a genuine, urgent need, or is it a desire for discretionary spending? While flexible, car title loans come with costs. Ensure it's the most appropriate solution for your specific situation, considering alternatives and your ability to repay without strain.The Mechanics of 'No Income Verification': How Your Car Becomes Your Credit Score

The phrase "no income verification" can sound almost too good to be true, leading some to misunderstand the underlying mechanics of these asset-backed loans. In Edmonton, as elsewhere, it doesn't mean a complete absence of financial assessment; rather, it signifies a fundamental shift in what lenders prioritize.

Deconstructing the Myth: What 'No Income Verification' Truly Means in Edmonton's Lending Landscape

It's not *zero* assessment: While direct income verification (like pay stubs or employer letters) might not be the primary hurdle, lenders still assess your repayment capacity. They need assurance that you can comfortably meet your monthly obligations. This often involves looking at bank statements to observe consistent deposits, evaluating your existing debt load, and conducting basic affordability checks. The goal is to ensure the loan is not putting you into a precarious financial position. It's less about *where* your income comes from and more about *if* you have a consistent flow of funds to repay the loan. The shift from credit score and traditional income: The most significant departure from conventional lending is the reduced emphasis on your credit score. For many Edmontonians with less-than-perfect credit or those new to Canada who haven't established a credit history, this is a game-changer. The focus moves squarely to the tangible asset – your vehicle's equity and your clear title. Your car acts as the primary collateral, significantly mitigating the lender's risk. This is why these loans are often accessible even when your credit history might disqualify you from traditional options. For more on this, read our article Alberta Car Loan: What if Your Credit Score Doesn't Matter?. Key qualifying factors: So, what *do* lenders scrutinize?

- Vehicle Ownership: You must be the legal owner of the vehicle.

- Clear Title: The vehicle's title must be free of major liens, or you must have significant equity if a minor lien exists.

- Residency: Proof of residency in Edmonton or surrounding areas (e.g., St. Albert, Sherwood Park).

- Valid Insurance: Your vehicle must have valid, comprehensive insurance.

- Photo ID: Government-issued identification.

- Vehicle Condition: The car's overall state, age, and mileage play a crucial role in its valuation.

The Valuation Equation: How Your Car's Worth Translates to Loan Potential

Your car's market value is the cornerstone of your loan potential. Lenders don't just pick a number; they conduct a thorough appraisal to determine how much equity you can leverage. Factors influencing appraisal: A deep dive into how make, model, year, mileage, condition (interior, exterior, mechanical), and local market demand in Edmonton and Alberta impact the loan amount offered. A newer, low-mileage SUV in excellent condition will naturally command a higher loan amount than an older, high-mileage sedan with visible wear and tear. Luxury brands often retain their value better, allowing for larger loans, while economy cars, though reliable, might offer smaller sums. Lenders also consider the ease of resale in the local Edmonton market should repossession become necessary. Specific examples: Consider these scenarios:

- High-Value SUV (e.g., 3-year-old Ford Explorer, 60,000 km, excellent condition): Could qualify for a loan up to $20,000 - $30,000, depending on its specific trim and market demand.

- Mid-Range Sedan (e.g., 7-year-old Honda Civic, 120,000 km, good condition): Might secure a loan in the $5,000 - $10,000 range.

- Older, High-Mileage Sedan (e.g., 12-year-old Chevrolet Cobalt, 250,000 km, fair condition): Loan potential could be closer to $1,000 - $3,000, as its resale value is significantly lower.

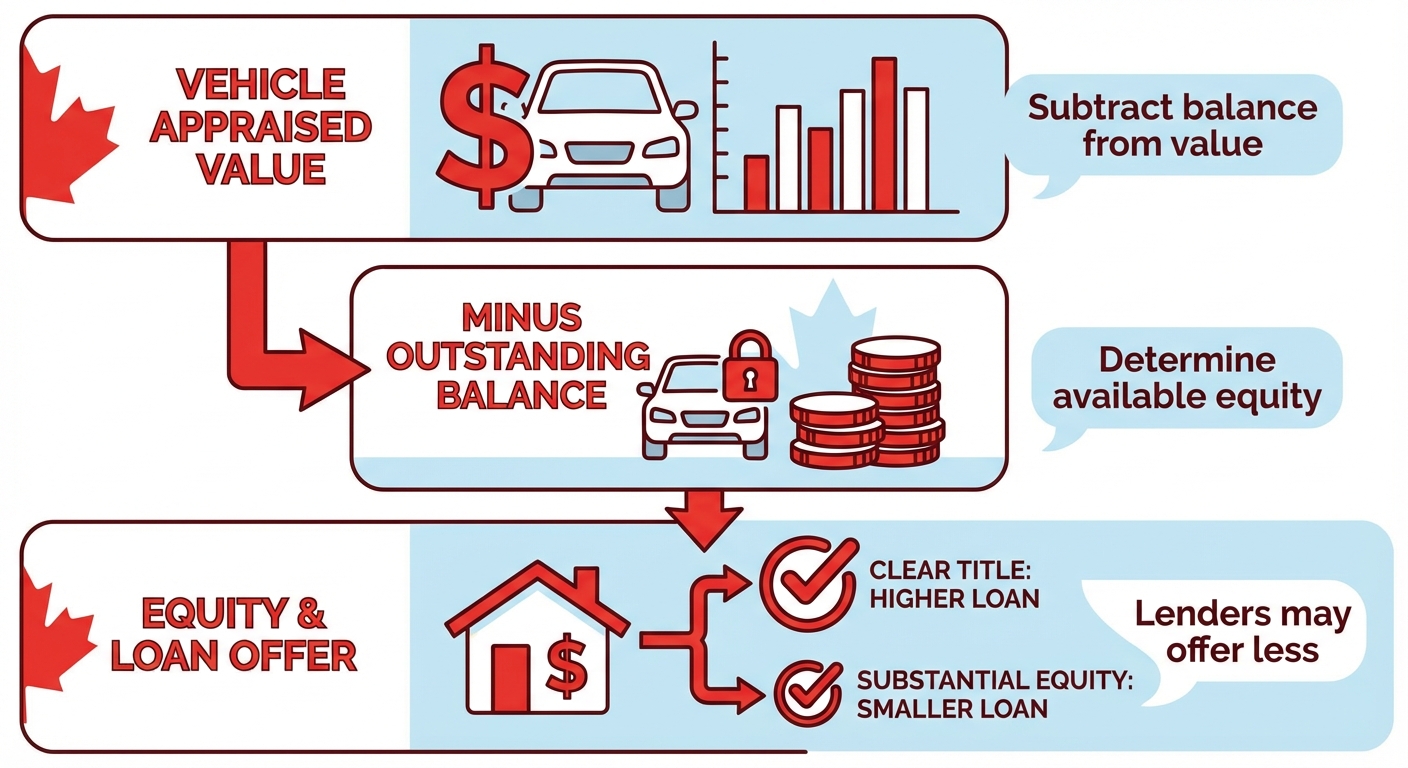

The 'lien' factor: How having an existing loan on your vehicle affects eligibility and loanable amount is critical. If you still owe money on your car, the lender will subtract that outstanding balance from the vehicle's appraised value to determine your available equity. Some lenders might still offer a loan if you have substantial equity, but the amount will be less than if the title were completely clear.

Context: A detailed infographic or image illustrating the key factors that determine a vehicle's appraisal value for a car title loan, perhaps with examples of 'good' vs. 'poor' condition indicators.

Context: A detailed infographic or image illustrating the key factors that determine a vehicle's appraisal value for a car title loan, perhaps with examples of 'good' vs. 'poor' condition indicators.

Pro Tip: Maximizing Your Vehicle's Appraisal Value

Before applying, take steps to enhance your car's perceived value. Clean it thoroughly, inside and out. Gather all maintenance records to demonstrate good care. Address minor issues like burnt-out lights or low tire pressure. If you know your car's retail value, it helps you negotiate. The better your car looks and performs, the higher the appraisal and, potentially, the larger your loan.Navigating the Application Maze: From Online Click to Cash in Hand

The application process for a car title loan in Edmonton is typically designed for speed and convenience, often beginning with a simple online inquiry. Understanding each step ensures a smooth transition from application to receiving funds.

The Digital Gateway: A Step-by-Step Walkthrough of the Online Application Process

Initial inquiry and pre-qualification: Most lenders offer an online form where you provide basic information about yourself and your vehicle. This usually includes your contact details, the make, model, year, and approximate mileage of your car. This initial step helps lenders quickly assess if your vehicle meets their basic criteria for a title loan and provides you with a preliminary estimate of your loan potential. It's a quick way to gauge eligibility without commitment. Required documentation: Once pre-qualified, you'll be asked to submit more detailed documentation. Having these ready can significantly speed up the process. A comprehensive list typically includes:

- Government-Issued ID: Driver's licence or passport.

- Vehicle Registration: Proof your vehicle is registered in your name in Alberta.

- Proof of Insurance: Valid and comprehensive insurance coverage for your vehicle.

- Bank Statement: Recent statements (e.g., 90 days) to demonstrate consistent deposits and ability to repay.

- Proof of Residency: A utility bill or lease agreement showing your Edmonton address.

- Clear Vehicle Title: The original vehicle ownership document.

For a detailed list of what to prepare, you might find our guide Approval Secrets: Exactly What Paperwork You Need for Alberta Car Financing helpful. The 'fully own' vs. 'have a lien' distinction: This is a critical point.

- Fully Own (Clear Title): If you outright own your vehicle with no outstanding loans, you have 100% equity, making you eligible for the maximum loan amount based on your car's value. The process is straightforward, as the lender simply places a lien on your clear title.

- Have a Lien (Existing Loan): If you still owe money on your vehicle, your equity is the difference between its market value and your outstanding loan balance. Some lenders may still offer a loan, but the amount will be restricted to your available equity. In some cases, the new title loan might even be used to pay off the existing lien, consolidating your debt, but this is less common for "no income verification" products and often depends on the lender's specific policies.

Speed of approval: Marketing claims often promise approval "within a few hours," and this can indeed be true for the initial pre-qualification and conditional offer. However, the realistic timeline for cash in hand can vary. Factors like how quickly you provide all required documents, the ease of scheduling a vehicle inspection, and the lender's internal processing times can influence the final disbursement. While some might get funds the same day, others might see it take 1-2 business days.

The In-Person Touch: What to Expect During Vehicle Inspection and Document Signing

The physical appraisal: After your online application, the lender will need to physically inspect your vehicle. This can happen in one of two ways: either you bring your car to the lender's office in Edmonton, or some lenders offer a mobile service where an appraiser comes to your location (home or work) within Edmonton or surrounding areas. During this inspection, the appraiser will verify the vehicle's make, model, year, mileage, and assess its overall condition, noting any damage, wear, or mechanical issues. This step confirms the car's market value and finalizes the loan amount offer. Understanding the loan agreement: This is arguably the most crucial step. You will be presented with a detailed loan agreement. It's imperative to read and understand every clause before signing. Key components include:

- Title Transfer (Temporary): The lender will place a lien on your vehicle's title. While you retain physical possession and use of your car, the lender temporarily holds the legal claim to the title as collateral until the loan is fully repaid.

- Repayment Schedule: This outlines your monthly or bi-weekly payment amounts, due dates, and the total number of payments.

- Interest Calculation: Understand how interest is applied and calculated throughout the loan term.

- Default Clauses: Clearly define what constitutes a default (e.g., missed payments) and the consequences, including potential repossession.

- Your Rights: Be aware of your rights as a borrower under Alberta consumer protection laws.

Pro Tip: What Questions to Ask Before Signing on the Dotted Line

Don't hesitate to ask questions. A reputable lender will be transparent. Inquire about: all fees (administrative, processing), late payment penalties, early repayment policies (are there penalties for paying off early?), and the exact process for default and repossession. Ensure you understand the total cost of borrowing and what happens if your circumstances change.The True Cost of Convenience: Demystifying Rates, Fees, and Repayment

While the speed and accessibility of car title loans are undeniable advantages, it's paramount for Edmonton borrowers to fully grasp the total cost involved. Beyond the advertised interest rate, various fees and repayment structures contribute to the overall expense.

Beyond the APR: Unmasking All Potential Costs of Your Car Title Loan

Detailed breakdown of interest rates: Car title loans in Alberta, like other provinces, can have a wide range of Annual Percentage Rates (APRs), typically from 7.5% to 29%. Several factors place a borrower at the higher or lower end:

- Vehicle Equity: The more equity you have, the lower the perceived risk for the lender, potentially leading to a better rate.

- Loan Amount: Larger loans might sometimes come with slightly lower rates due to economies of scale for the lender.

- Loan Term: Shorter terms often have lower overall interest paid, even if the monthly payment is higher, whereas longer terms can accrue more interest over time.

- Perceived Risk: While "no income verification" reduces some risk, lenders still assess factors like consistent bank deposits and existing debt to gauge your ability to repay.

Administrative fees: Be prepared for various upfront or ongoing administrative charges. These can include:

- Processing Fees: A one-time fee for handling your application.

- Documentation Costs: Charges associated with preparing loan documents and registering the lien.

- Lien Registration Fees: Costs for registering the lender's interest on your vehicle's title with the provincial registry.

Always ask for a full breakdown of all fees to avoid surprises. Late payment penalties: Missing a payment or delaying it can incur significant penalties. These typically involve:

- Late Payment Fees: A fixed charge for each missed or late payment.

- Increased Interest: Some agreements may stipulate a higher interest rate on overdue amounts.

- Default Charges: If you default on the loan, additional fees related to collection efforts or repossession could be applied.

Early payout clauses: Many reputable lenders in Alberta offer the benefit of "no penalties for early payout." This is a crucial feature that can save borrowers substantial interest. If you find yourself in a better financial position sooner than expected, paying off the loan early will reduce the total interest you pay over the life of the loan. Always confirm this clause in your loan agreement. Calculating total cost: To illustrate, let's consider hypothetical examples for different loan amounts and terms:

| Loan Amount | Interest Rate (APR) | Loan Term | Monthly Payment (approx.) | Total Interest Paid (approx.) | Total Repaid (approx.) |

|---|---|---|---|---|---|

| $5,000 | 19% | 12 months | $460 | $520 | $5,520 |

| $5,000 | 24% | 24 months | $265 | $1,360 | $6,360 |

| $15,000 | 14% | 36 months | $515 | $3,540 | $18,540 |

| $15,000 | 22% | 60 months | $425 | $10,500 | $25,500 |

As you can see, the interest paid can significantly increase with longer terms and higher APRs.

Tailoring Your Repayment: Understanding Loan Terms from 12 Months to 5 Years

The psychology of longer terms: While a 5-year repayment term might offer appealingly low monthly payments, it's essential to understand the trade-off. Lower monthly payments often mean you're paying interest for a longer duration, leading to a higher overall cost of borrowing. This can be tempting when cash flow is tight, but it's a decision that requires careful consideration of the long-term financial impact. The power of shorter terms: Conversely, opting for the shortest repayment term you can comfortably afford is often the most cost-effective strategy. While monthly payments will be higher, you'll pay off the principal faster, drastically reducing the total interest accrued over the life of the loan. Budgeting for repayment: Integrating loan payments into your existing financial plan is crucial for avoiding default. Create a detailed budget that accounts for all your income and expenses, ensuring that your car title loan payment is a manageable part of your monthly outlay.

Pro Tip: Creating a Realistic Repayment Plan

Don't just agree to a payment schedule; actively plan for it. Use budgeting tools or spreadsheets to map out your income and expenses. Set up automatic payments with your bank if possible to avoid missed due dates. Consider setting reminders on your phone or calendar. A well-thought-out repayment plan is your best defense against default and accumulating unnecessary fees.Keeping Your Keys: The Psychological & Practical Benefits of Driving Your Asset

One of the most compelling advantages of a car title loan, especially for Edmonton residents, is the ability to retain full use of your vehicle. This isn't just a convenience; it's a crucial factor that distinguishes title loans from other forms of secured lending.

The Freedom Factor: Why Retaining Vehicle Use is a Game-Changer

Contrast with traditional pawn loans: Unlike a traditional pawn loan where you surrender your item (in this case, your car) to the lender until the loan is repaid, a car title loan allows you to keep driving. For many Edmontonians, a vehicle is not just a luxury but a necessity for work, running errands, taking children to school, and navigating the city's sometimes challenging climate. Maintaining mobility and independence is crucial for daily life and avoiding disruption during a financial crunch. Psychological impact: The peace of mind that comes from not losing a primary mode of transportation cannot be overstated. Knowing you can continue your daily routine, fulfill work obligations, and attend to family needs without interruption provides significant psychological relief during what is often an already stressful financial period. It allows you to address immediate financial needs without creating new logistical problems.

Beyond Credit Checks: The Path for Bad Credit, No Credit, and Newcomers in Edmonton

How this loan type levels the playing field: Car title loans offer a vital financial pathway for individuals who might be shut out by traditional lenders. This includes those with less-than-perfect credit histories, individuals who have experienced bankruptcy or consumer proposals, or even those with no established credit history at all. For newcomers to Canada, including those settling in Edmonton, who are still building their financial footprint, car title loans can provide access to funds when other options are unavailable. The primary collateral is the vehicle itself, making your credit score a secondary, if not irrelevant, concern. This is particularly relevant for new Canadians establishing themselves in Alberta; for more information, consider reading Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers. The potential (or lack thereof) for building credit: It's important to understand that while car title loans provide access to funds regardless of your credit score, they generally do not help *build* your credit score. Most car title lenders do not report your payment history (positive or negative) to major credit bureaus. This means that while making timely payments will prevent default and repossession, it won't directly improve your credit score. Conversely, defaulting on a car title loan may not directly impact your credit score either, but it will lead to repossession of your vehicle, which has severe financial consequences.

Pro Tip: Don't Assume You Won't Qualify

Even if you have a poor credit score, no credit history, or are a newcomer to Canada, don't automatically assume a car title loan isn't an option. Because the vehicle itself serves as the primary collateral, the criteria are different from unsecured loans. Many Edmonton lenders specialize in these situations. It's always worth exploring your options and getting a pre-qualification.The Road Ahead: Risks, Responsibilities, and Responsible Borrowing

While car title loans offer undeniable advantages, they are a significant financial commitment. Understanding the inherent risks and your responsibilities as a borrower is paramount to navigating this road successfully and avoiding potential pitfalls.

The Elephant in the Garage: Understanding the Risk of Vehicle Repossession

When and how repossession can occur: The most serious risk associated with a car title loan is the potential for vehicle repossession. If you default on your loan – typically by missing multiple payments or violating other terms of the agreement – the lender has the legal right to seize your vehicle. The process usually involves:

- Default Notice: Lenders are generally required to provide a notice of default, informing you of the missed payments and giving you a grace period to rectify the situation.

- Repossession: If the default is not cured, the lender can then arrange for your vehicle to be repossessed. This can happen without further warning, often by a third-party repossession agent.

- Sale of Vehicle: After repossession, the lender will typically sell the vehicle to recover the outstanding loan amount and associated costs (towing, storage, sale fees). If the sale price doesn't cover the full debt, you may still be liable for the remaining balance.

Legal rights and consumer protections: In Alberta, consumer protection laws offer some safeguards for borrowers of secured loans. These laws dictate how lenders must operate, including notice requirements before repossession and rules regarding the sale of repossessed goods. It's crucial to be aware of your rights and to seek legal advice if you believe a lender is not adhering to these regulations. Steps to take if you face repayment difficulties: Proactive communication is key. If you anticipate or experience difficulty making payments, contact your lender immediately. They may be willing to work with you on a revised payment plan, offer a temporary deferral, or explore other solutions to avoid default and repossession. Ignoring the problem will only exacerbate it. Seeking financial counselling from a non-profit organization can also provide valuable guidance.

Is It Always the Right Choice? Exploring Alternatives to Car Title Loans

While car title loans are a valuable tool, they are not always the best solution for every financial situation. It's wise to explore alternatives before committing.

| Alternative | Pros | Cons | When it Might be Better |

|---|---|---|---|

| Secured Personal Loan | Lower interest rates than title loans, can build credit. | Requires collateral (not necessarily car), stricter approval criteria. | If you have other assets to pledge and better credit. |

| Unsecured Personal Loan | No collateral needed, can build credit. | Requires good credit, higher interest rates than secured loans. | If you have good credit and need a smaller amount. |

| Lines of Credit | Flexible borrowing and repayment, lower interest than credit cards. | Requires good credit, interest can add up if not managed. | For ongoing, flexible access to funds with good credit. |

| Credit Cards | Quick access to funds, widely accepted. | Very high interest rates if not paid off monthly. | For very short-term, small emergencies that can be repaid quickly. |

| Selling Your Vehicle | Eliminates debt, provides substantial cash. | Loss of transportation, may not get full market value quickly. | If you no longer need the vehicle or can manage without it. |

| Borrowing from Family/Friends | Often interest-free, flexible terms. | Can strain personal relationships if not repaid, no formal agreement. | For small, short-term needs with a trusted support network. |

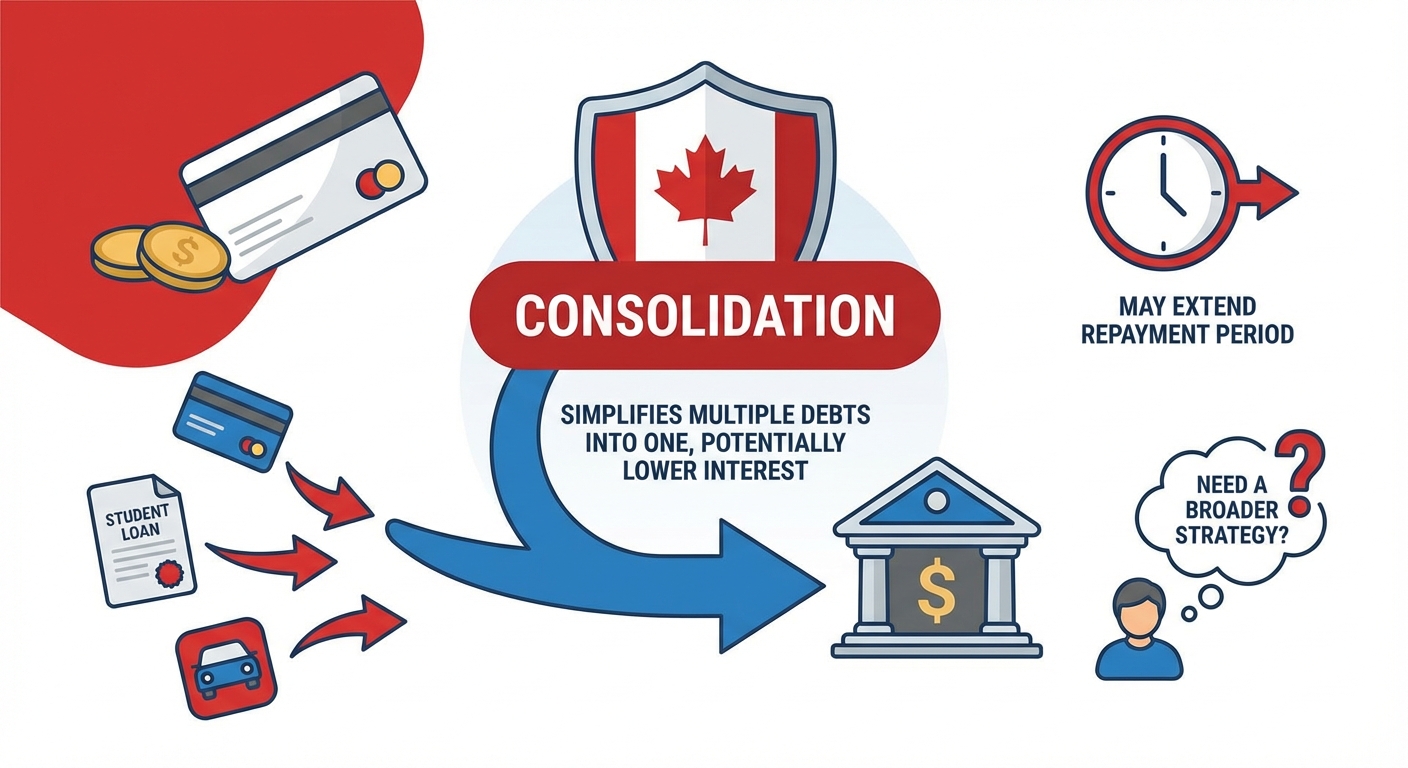

| Debt Consolidation | Simplifies multiple debts into one, potentially lower interest. | Requires a new loan, may extend repayment period. | If you have multiple high-interest debts and need a broader strategy. |

Context: A decision tree flowchart titled 'Is a Car Title Loan Right for You?' guiding the reader through questions about their financial situation and leading to various solutions including car title loans or alternatives.