Walking onto a dealership lot and driving away in a brand-new vehicle without handing over a single loonie upfront feels like a financial magic trick. In the current Canadian economic climate, where the cost of living-from groceries to rent-continues to climb, the appeal of a $0 down car loan is undeniable. Why tie up thousands of dollars in a depreciating asset when you could keep that cash in your emergency fund or use it to pay down high-interest credit card debt?

However, while the "no money down" sign in the dealership window looks inviting, the mechanics behind the scenes are complex. Getting approved for 100% financing requires more than just a firm handshake. It involves navigating the specific requirements of Canadian lenders, understanding how interest rates fluctuate with the Bank of Canada's decisions, and knowing which levers to pull to make yourself the "ideal" borrower. This guide pulls back the curtain on the approval process, offering you the insider secrets needed to secure a zero-down deal without falling into common financial traps.

Key Takeaways

- Credit is King: While subprime options exist, a credit score above 700 is the most reliable "secret" to securing zero down at a prime interest rate.

- Income Thresholds: Most Canadian lenders look for a minimum gross monthly income of $1,800 to $2,500 to offset the risk of 100% financing.

- LTV Matters: Lenders calculate the Loan-to-Value (LTV) ratio; zero-down loans often exceed 100% LTV once taxes and fees are included, which increases the interest rate premium.

- The Interest Trade-off: Choosing zero down usually means paying more in total interest over the life of the loan compared to a traditional 10% or 20% down payment.

- Protection is Mandatory: Because you start with zero equity, GAP insurance is highly recommended to protect you if the car is totalled or stolen early in the term.

What Exactly is a Zero Down Car Loan?

In the simplest terms, a zero-down car loan-often referred to as 100% financing-means the lender provides the entire purchase price of the vehicle, including sales tax (GST/HST/PST), documentation fees, and any added products like extended warranties. You aren't required to provide a cash deposit at the time of signing. Instead, the total "out-the-door" price is rolled into your monthly or bi-weekly payments.

From a lender's perspective, this is a high-risk move. When you put money down, you have "skin in the game." If you walk away from the loan, you lose that initial investment. With zero down, the lender carries all the risk. This is why they use the Loan-to-Value (LTV) ratio as their primary metric. If you buy a car for $30,000 but the loan is for $34,000 (to cover taxes and fees), your LTV is approximately 113%. Most prime lenders in Canada prefer an LTV of 100% or less, which is why a down payment is usually requested to bridge that gap.

The Mechanics of Approval: What Lenders Look For

To get that "Yes" from a bank or a captive lender (like Toyota Financial or Ford Credit), you need to meet specific criteria. Canadian lenders categorize borrowers into "Tiers."

1. Credit Score Thresholds

If your credit score is 700 or higher, you are in "Tier 1" territory. For these buyers, zero-down approvals are almost automatic, provided their income supports the payment. You can often access promotional rates as low as 0% to 4.99% from manufacturers. If your score sits between 640 and 699, you are "Near-Prime." You'll likely get approved for zero down, but your interest rate might be 2% to 4% higher than the best available rates. Below 640 is the "Subprime" zone. Here, zero down becomes difficult. Lenders may demand $500 to $2,000 down to mitigate the risk of your credit history.

2. Income and Employment Stability

Lenders want to see that you have a consistent "ability to pay." Most Canadian institutions require at least three to six months at your current job. If you are self-employed, be prepared to provide two years of Notices of Assessment (NOAs) from the CRA. For those with T4 income, a recent pay stub showing your year-to-date earnings is usually enough. Lenders generally want to see your monthly car payment take up no more than 15% to 20% of your gross monthly income.

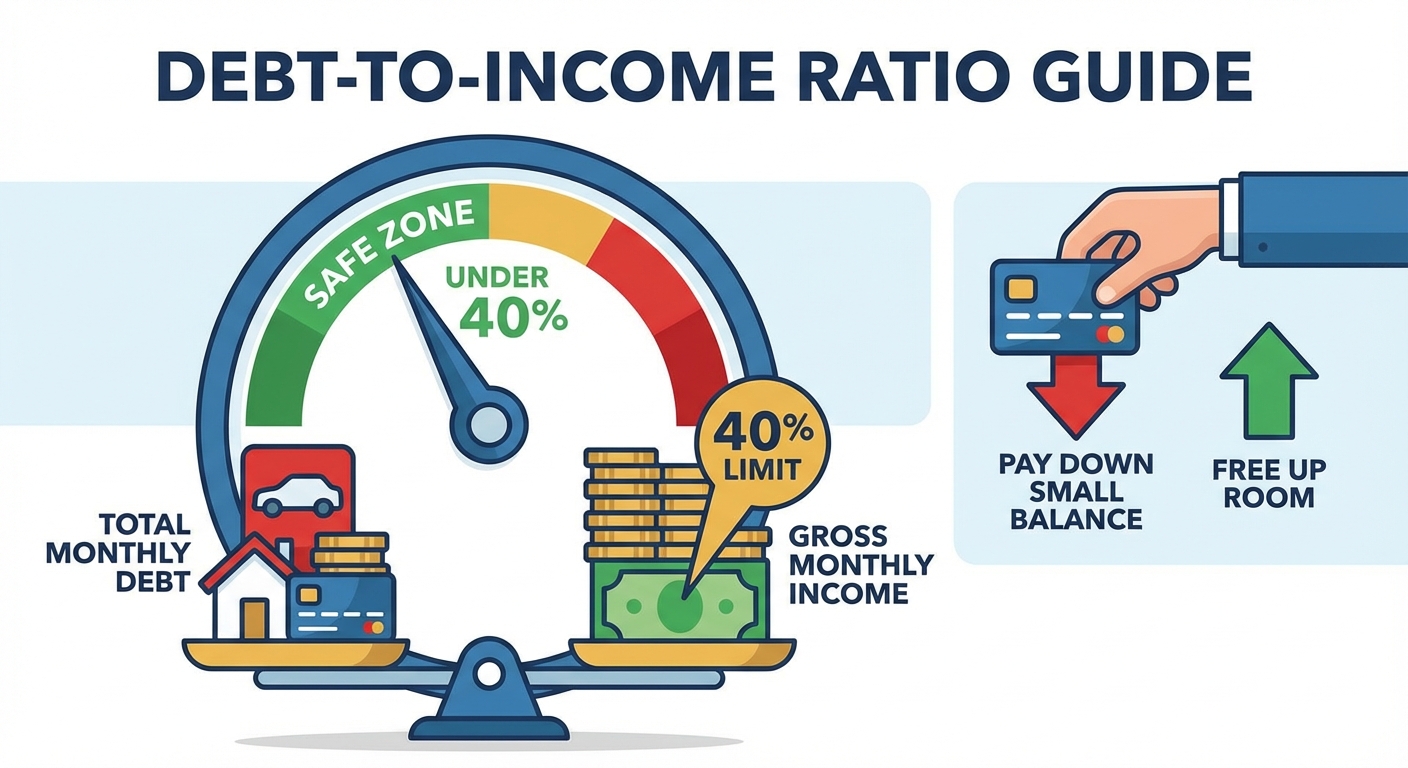

3. Debt-to-Income (DTI) Ratios

Lenders don't just look at your income; they look at what you already owe. They use the Total Debt Service (TDS) ratio. This includes your rent or mortgage, credit card minimums, student loans, and the proposed car payment. If these combined costs exceed 40% to 45% of your gross income, the lender will likely decline a zero-down application, even if you have a great credit score.

Comparing the Cost: $0 Down vs. 10% Down

It is vital to understand that "zero down" isn't free money; it is a loan on a larger principal amount. The table below illustrates how a 10% down payment affects the total cost of ownership for a typical $30,000 vehicle in Canada (assuming a 7.99% interest rate and 13% HST).

| Feature | Zero Down Scenario | 10% Down Scenario |

|---|---|---|

| Vehicle Price (incl. 13% HST) | $33,900 | $33,900 |

| Down Payment | $0 | $3,390 |

| Loan Principal | $33,900 | $30,510 |

| Monthly Payment (60 Months) | $687.52 | $618.77 |

| Total Interest Paid | $7,351.20 | $6,616.20 |

| Total Cost of Loan | $41,251.20 | $40,516.20 |

As the table shows, opting for zero down increases your monthly commitment by roughly $68 and costs you an extra $735 in interest over five years. For many Canadians, that $68/month is worth the trade-off of keeping $3,390 in their savings account for emergencies.

Where to Find Zero Down Financing in Canada

Not all lenders are created equal. Depending on your financial profile, you should target different institutions to find the best zero-down terms.

The Big Five Banks

Institutions like RBC, TD, and Scotiabank have massive automotive lending wings. They offer the most competitive rates for zero-down loans, but they are also the most selective. They generally require a credit score of 680+ and a clean credit history (no recent bankruptcies or consumer proposals). The benefit here is the ability to manage your loan through your existing online banking portal.

Captive Lenders

These are the financing arms of the manufacturers (e.g., Honda Financial Services). They often use zero-down offers as an incentive to move inventory. You might see "0% APR" or "0% Down" promotions. Be careful: often, you have to choose between a low interest rate and a cash rebate. If you choose zero down, ensure you aren't forfeiting a $3,000 "cash purchase" discount that would have made the car cheaper overall.

Online Aggregators and Private Lenders

For those who don't fit the traditional bank "box," online platforms are the go-to. These lenders specialize in "B-tier" or subprime lending. They are much more flexible with zero-down approvals but will charge a higher interest rate to compensate for the risk. This is a great path for those looking to rebuild their credit while getting the vehicle they need for work.

Step-by-Step Guide to Getting Approved

Getting approved isn't just about showing up; it's about strategy. Follow these steps to ensure you get the best possible terms.

- Get Pre-Approved: Before you even look at a car, get a pre-approval. This tells you exactly how much a lender is willing to give you with zero down. It turns you into a "cash buyer" in the eyes of the dealer, giving you more leverage to negotiate the price.

- Gather Your Documents: Canadian lenders are strict about documentation. You will need a valid Canadian driver's licence, your two most recent pay stubs, and a void cheque or pre-authorized debit form. If you've lived at your current address for less than two years, have a utility bill ready to prove residency.

- Select the Right Vehicle: Lenders have "book values" (using Canadian Black Book or GALVES). If you try to buy a used car for $20,000 that is only "booked" at $15,000, the lender will not approve a zero-down loan because the LTV is too high. Stick to vehicles that are priced fairly relative to their market value.

- Review the 'Out the Door' Price: Before signing, ensure the dealer hasn't added "ghost fees"-things like nitrogen in tires or etched windows-which inflate the loan amount and make your zero-down approval harder to maintain.

The Risks of Zero Down: Negative Equity and 'The Flip'

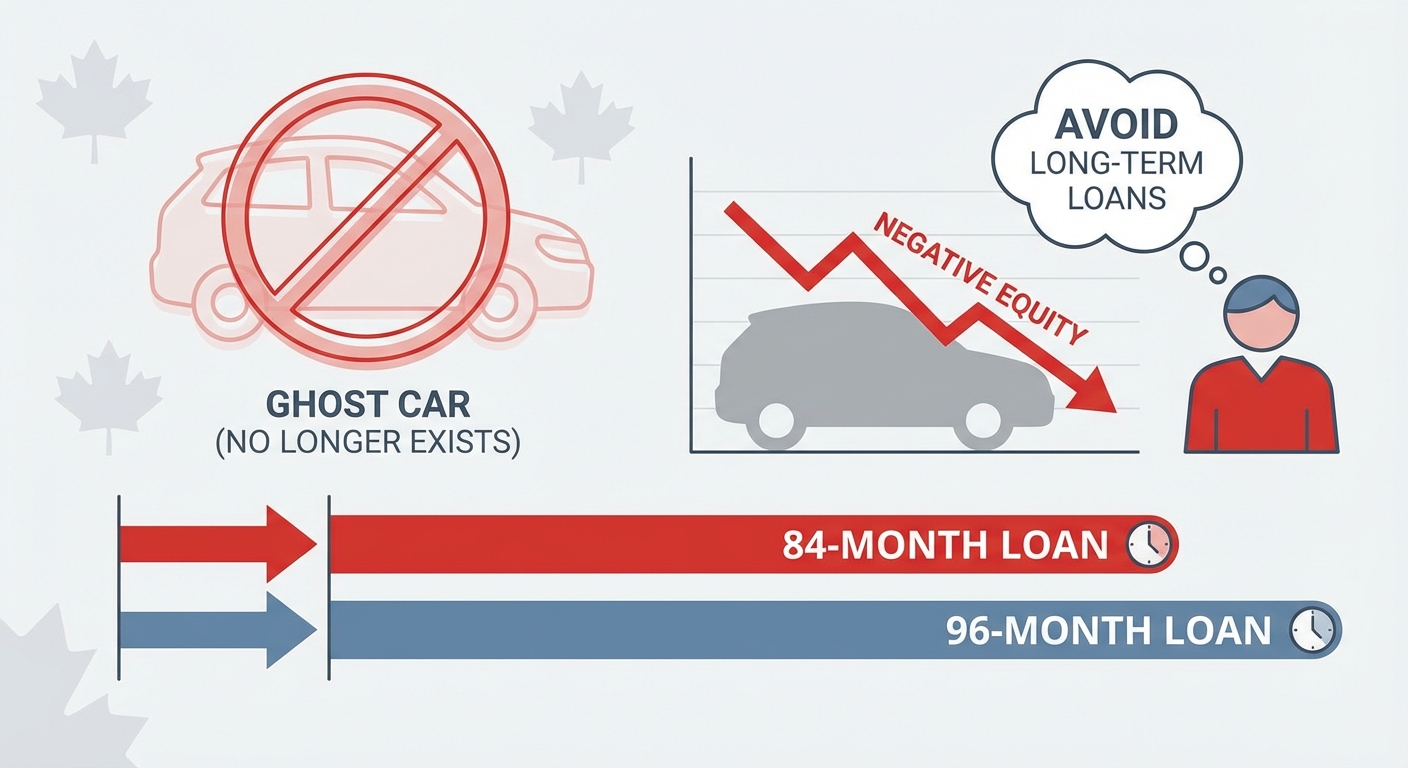

The biggest danger of a zero-down loan in Canada is "Negative Equity," also known as being "underwater" or "upside down." This happens because a new car can lose 10% to 20% of its value the moment it is driven off the lot. If you didn't put any money down, you instantly owe more to the bank than the car is worth.

This becomes a problem if you need to sell the car early or if the car is involved in an accident. If the car is worth $25,000 but your loan balance is $32,000, and the car is totalled, your insurance company will only pay the "fair market value" of $25,000. You are still legally responsible for the $7,000 "gap."

This is why GAP Insurance is non-negotiable for zero-down buyers. It covers that $7,000 difference, ensuring you aren't paying for a "ghost car" that no longer exists. Furthermore, avoid the temptation of 84-month or 96-month (7 or 8 year) loans. While they make the monthly payment lower, you will remain in a negative equity position for almost the entire duration of the loan.

New vs. Used: Which is Better for Zero Down?

The choice between a new or used vehicle significantly impacts your zero-down approval odds. New cars are generally easier to finance with zero down because manufacturers offer incentives and the "book value" is clearly defined. Lenders view new cars as lower risk because they are under warranty and less likely to have mechanical failures that cause the borrower to stop making payments.

Used cars, however, often come with higher interest rates. Because the value of a used car is more subjective, lenders are more cautious. However, if you find a Certified Pre-Owned (CPO) vehicle, you get the best of both worlds: a lower total loan amount than a new car, but with the manufacturer-backed confidence that allows for zero-down financing at reasonable rates.

Hidden Costs to Watch Out For

When you aren't putting money down, every extra dollar added to the contract is being financed at interest. Be on the lookout for:

- Documentation and Admin Fees: These can range from $300 to $900. While standard in Canada, they add to your LTV.

- Loan Origination Fees: Often found with subprime lenders, these are fees just for setting up the loan.

- The 'Zero Down Premium': Some lenders will offer you a loan with 10% down at 6.99%, but if you want zero down, they bump the rate to 8.99%. Always ask for the rate comparison.

- Compulsory Add-ons: Some dealers may tell you that the lender "requires" you to buy an extended warranty or rust proofing to get approved for zero down. In most provinces, this is a violation of tied-selling regulations.

Check if your lender allows "Penalty-Free Prepayments." This is a secret weapon for zero-down borrowers. It allows you to make extra payments whenever you have spare cash, which goes directly toward the principal. This helps you reach "break-even" equity much faster, reducing the total interest you pay.

Strategies to Improve Your Chances if Refused

If a lender says no to your zero-down request, don't panic. You have options to turn that "No" into a "Yes."

First, consider adding a co-signer. A co-signer with strong credit and income can "vouch" for you, essentially allowing you to piggyback on their credit score to secure 100% financing. Just ensure the co-signer understands they are 100% liable if you miss a payment.

Second, look at your revolving debt. If your credit cards are maxed out, your score will be suppressed. Paying them down so you are using less than 30% of your limit can result in a 20 to 50 point credit score jump within a single billing cycle, which might be enough to move you into a higher approval tier.

Finally, if you are truly stuck, consider a small "down payment" of just $500. While it isn't "zero down," it often changes the lender's risk calculation enough to trigger an approval that would have otherwise been a decline.

Frequently Asked Questions (FAQ)

Can I get a zero down car loan with bad credit in Canada?

Yes, it is possible, but it is more challenging. Specialized subprime lenders and "Buy Here Pay Here" dealerships offer zero-down options for those with poor credit. However, you should expect significantly higher interest rates, sometimes reaching 20% or more. In these cases, it is often better to provide a small down payment to lower the interest rate and make the monthly payments more manageable.

Does a no-money-down loan hurt my credit score?

The loan itself does not hurt your credit score more than a traditional loan. In fact, consistently making your payments on time will improve your credit score over time. The only minor impact is the "hard inquiry" performed by the lender when you apply, which may cause a temporary dip of a few points. The high balance relative to the original loan amount (high utilization) doesn't typically affect installment loan scoring as much as it does for credit cards.

Are there specific Canadian provinces where zero down is harder to get?

Generally, the rules are consistent across Canada. However, provincial regulations regarding maximum interest rates and consumer protection (like OMVIC in Ontario or AMVIC in Alberta) can influence how dealers structure these deals. In provinces with higher sales tax (like the 15% HST in the Maritimes), the LTV ratio climbs faster, which can sometimes make lenders more cautious about 100% financing.

Can I trade in a car that still has a balance for a zero down loan?

Yes, this is very common. If your trade-in is worth more than you owe, that equity acts as a down payment. If you owe more than the car is worth (negative equity), some lenders allow you to "roll" that debt into the new zero-down loan. However, this is risky as it significantly increases your loan amount and interest costs. This is often called "the flip" and should be avoided if possible.

How long does the approval process take?

With modern digital lending platforms, the initial approval for a zero-down loan can happen in as little as 15 minutes to 24 hours. If you have all your documentation (ID, pay stubs) ready, you can often complete the entire process and drive away in your new vehicle within the same day.

Securing a zero-down car loan in Canada is about balancing the immediate convenience of keeping your cash with the long-term reality of interest costs and depreciation. By understanding your credit tier, managing your debt-to-income ratio, and being aware of the risks like negative equity, you can navigate the dealership experience with confidence. A zero-down loan is a powerful financial tool when used correctly-just ensure you have the right protections in place, like GAP insurance, and a clear plan to pay down the principal as quickly as possible. Before you head to the dealership, take a moment to check your credit score and gather your documents; being prepared is the ultimate "approval secret."