Your Down Payment Went Missing. Your Interest Rate Didn't Get the Memo, Edmonton.

Table of Contents

- Your Down Payment Went Missing. Your Interest Rate Didn't Get the Memo, Edmonton.

- Key Takeaways

- Decoding the 'Zero-Down' Myth: What Lenders See That You Might Miss

- Beyond the Brochure: Defining a True Zero-Down Car Loan

- The Lender's Lens: Risk Assessment, Loan-to-Value (LTV), and Your Credit Score

- The Uncomfortable Truth: How Zero Down Payments Inflate Your Interest Rate

- Pro Tip: Understanding Your LTV – The Silent Interest Rate Driver

- The Interest Rate Equation: More Than Just a Number, It's a Lifestyle Choice

- Anatomy of an Auto Loan Interest Rate: Beyond the Down Payment

- The Compounding Conundrum: How Higher Rates Amplify Total Cost

- Beyond Interest: The Hidden Costs of Driving Away with Nothing Down

- The Negative Equity Trap: Underwater from Day One

- Inflated Monthly Payments: Straining Your Budget in Cities Like Calgary and Vancouver

- Insurance Implications: The Added Layer of Protection (and Cost)

- Pro Tip: Always Calculate Total Cost of Ownership, Not Just Monthly Payments

- Who Benefits from Zero Down? (And Who Should Absolutely Avoid It)

- The Unicorn Borrower: When Zero Down *Might* Make Sense

- The At-Risk Applicant: Why Most Should Steer Clear

- The 'Emergency' Scenario: Mitigating Risk When There's No Other Option

- Pro Tip: Don't Use a Car Loan to Solve Other Financial Problems

- Navigating the Canadian Auto Loan Landscape: Banks vs. Dealerships vs. Specialized Lenders

- Traditional Banks (e.g., RBC, TD Canada Trust): The Rigorous Path

- Dealership Financing: Convenience, Compromise, and Captive Lenders

- Specialized & Subprime Lenders: The Higher-Risk, Higher-Cost Option

- The Role of Auto Loan Brokers in Canada

- Pro Tip: Get Pre-Approved from Your Bank *Before* Visiting the Dealership

- Strategies for Lowering Your Interest Rate (Even Without a Hefty Down Payment)

- Building Your Credit Score: A Canadian's Guide to Financial Health

- Shortening Your Loan Term: The Trade-Off Between Monthly Payments and Total Interest

- Choosing the Right Vehicle: Depreciation and Lender Perception

- Finding a Co-signer: Leveraging Trust for Better Terms

- Your Old Car as Your New Down Payment: Maximizing Trade-In Value

- Pro Tip: Even a Small Down Payment Makes a Big Difference

- The Edmonton Specifics: Car Ownership in a Dynamic City

- Cost of Living & Loan Affordability in Edmonton

- Insurance Rates in Alberta: Another Factor to Consider

- Navigating Local Dealerships and Financing Offers in Edmonton

- Pro Tip: Research Local Market Conditions for Both Car Prices and Insurance Before Committing

- Your Next Steps to Approval (and Financial Freedom)

- Crafting Your Personalized Car Loan Action Plan

- The Fine Print Matters: Reading Your Loan Agreement Thoroughly

- When to Walk Away: Recognizing a Bad Deal

- Pro Tip: Prioritize Financial Health Over Instant Gratification

- Frequently Asked Questions About Zero-Down Car Loans in Canada

Your Down Payment Went Missing. Your Interest Rate Didn't Get the Memo, Edmonton.

Picture this, Edmonton: You've found the perfect vehicle. Maybe it's a rugged pickup to tackle Alberta's winters, or a sleek SUV for family adventures to the Rockies. The dealership offers you a fantastic "zero money down" deal, and the idea of driving away without touching your savings sounds incredibly appealing. It feels like a win-win, a shortcut to getting behind the wheel.

But then, the monthly payments hit different. They're higher than you anticipated. The total cost over the loan term looks… staggering. What happened? Your down payment went missing, alright, but your interest rate didn't get the memo to follow suit. In fact, it might have decided to stick around and bring a few friends.

In a dynamic market like Edmonton, where vehicle prices and the cost of living continue to climb, understanding the true cost of a zero-down car loan isn't just smart – it's crucial. This isn't about shaming anyone for wanting a new car; it's about empowering you with the knowledge to make the best financial decision for your future. Because while the allure of "no money down" is strong, the reality of how it impacts your interest rate and overall financial health can be a harsh wake-up call.

Key Takeaways

- Zero Down = Higher Interest: Lenders view zero-down loans as higher risk, almost universally leading to a higher interest rate on your car loan.

- Immediate Negative Equity: Driving off the lot with no down payment almost guarantees you'll be "underwater" on your loan from day one, meaning you owe more than the car is worth.

- Increased Total Cost: Even a small percentage increase in interest on a zero-down loan can add thousands of dollars to your total cost over the loan term.

- Hidden Costs Abound: Beyond interest, expect inflated monthly payments, and potentially mandatory, expensive insurance like GAP coverage.

- Credit Score is King (Still): A strong credit score remains your best weapon against high interest rates, even with no down payment.

- Pre-Approval is Power: Getting pre-approved from your bank before visiting a dealership gives you leverage and a benchmark for better rates.

- Edmonton Specifics: Consider local cost of living and insurance rates when calculating affordability, as they compound the impact of higher interest.

Decoding the 'Zero-Down' Myth: What Lenders See That You Might Miss

The phrase "zero-down car loan" sounds like a magic bullet. Imagine driving away in a brand-new vehicle without parting with a single cent upfront. It's a powerful marketing tool, and for good reason – it appeals to our immediate desires and our instinct to preserve cash. But for lenders, "zero money down" isn't about magic; it's about mathematics, risk assessment, and a clear understanding of human behaviour.

Beyond the Brochure: Defining a True Zero-Down Car Loan

First, let's clarify what a true zero-down car loan actually means. It's not just about not handing over a cheque. A genuine zero-down loan means no cash payment, no trade-in value applied, and no deferred payments that act as a hidden upfront cost. It means the entire purchase price of the vehicle, plus any applicable taxes and fees, is financed. This distinction is crucial, as some dealerships might advertise "low money down" or imply that your trade-in is your down payment, which isn't the same as truly financing 100% of the vehicle's cost.

The Lender's Lens: Risk Assessment, Loan-to-Value (LTV), and Your Credit Score

When you apply for a car loan, lenders aren't just looking at your ability to make monthly payments. They're assessing risk. Their primary concern is whether you will default on the loan, and if you do, how easily they can recoup their losses. This is where the Loan-to-Value (LTV) ratio becomes paramount.

LTV is a simple calculation: the amount you're borrowing divided by the vehicle's appraised value. For example, if you borrow $30,000 for a car valued at $30,000, your LTV is 100%. If you put down $3,000, borrowing $27,000 for the same car, your LTV drops to 90%. A higher LTV, inherent in zero-down loans, signals greater risk to the lender because there's no immediate equity protecting their investment. If you default, they have to repossess and sell a vehicle that might be worth less than what you owe, leading to a loss for them.

Your credit score, a numerical representation of your creditworthiness, is another critical component of this risk assessment. Lenders use scores from Canadian bureaus like Equifax and TransUnion to gauge your history of paying debts. A strong credit score demonstrates a lower risk of default, making lenders more comfortable. However, even with excellent credit, a zero-down loan still presents a higher LTV, which will always be a factor in the interest rate you're offered. For more on navigating credit scores in Canada, check out our guide on The Truth About the Minimum Credit Score for Ontario Car Loans.

The Uncomfortable Truth: How Zero Down Payments Inflate Your Interest Rate

Now, let's get to the heart of the matter: does not having a down payment increase car loan interest? The answer, almost unequivocally, is yes. Here's why:

- Increased Lender Risk: As discussed, a zero-down loan means a 100% LTV (or even higher once taxes and fees are financed). From the moment you drive off the lot, the vehicle's value typically drops due to depreciation. The lender has no buffer against this immediate loss of value. To compensate for this heightened risk, they charge a higher interest rate. It's their way of pricing in the potential for loss.

- Lack of Borrower Equity: A down payment represents your immediate equity in the vehicle. It's your financial stake. Without it, you have no equity. This means if you face financial hardship early in the loan term, you might be more likely to walk away, as you have nothing to lose financially in the vehicle itself. Lenders see this lack of personal investment as a higher risk.

- Immediate Negative Equity: This is a major concern. With no down payment, you're almost guaranteed to owe more than the car is worth from day one. This state of "negative equity" is a red flag for lenders. If they have to repossess, they're starting from a deficit.

- Absence of a 'Good Faith' Investment: A down payment, regardless of its size, demonstrates your commitment to the purchase. It's a "good faith" investment that shows you're serious about the vehicle and the loan obligation. Without it, that signal of commitment is absent, further increasing the perceived risk for the lender.

So, while the advertisements might highlight the convenience, the financial reality is that the absence of a down payment directly translates into a higher cost of borrowing for you, the consumer.

Pro Tip: Understanding Your LTV – The Silent Interest Rate Driver

Calculate your LTV before you even apply. Divide the amount you plan to borrow by the vehicle's MSRP or agreed-upon price. If it's 100% or more, be prepared for a higher interest rate. Aiming for an LTV of 80-90% (meaning a 10-20% down payment) will significantly improve your chances of securing a lower rate. The lower your LTV, the less risk for the lender, and the better your potential interest rate.

The Interest Rate Equation: More Than Just a Number, It's a Lifestyle Choice

An interest rate isn't just a percentage point on a piece of paper; it's a financial lever that dictates how much of your hard-earned money you'll be paying for the privilege of driving your vehicle. When you opt for a zero-down loan, this lever often shifts dramatically, impacting not just your car budget but your overall financial flexibility.

Anatomy of an Auto Loan Interest Rate: Beyond the Down Payment

While the down payment (or lack thereof) is a significant factor, several other elements contribute to the interest rate you're offered:

- Credit History: This is paramount. Lenders scrutinize your payment history, outstanding debts, and credit utilization. A high FICO score (used by Equifax and TransUnion in Canada) reflects a strong history of responsible borrowing and significantly improves your chances for lower rates. Conversely, a lower score, especially with no down payment, can lead to exorbitant rates.

- Loan Term: Shorter loan terms (e.g., 36 or 48 months) generally come with lower interest rates because the lender's money is tied up for a shorter period, reducing their risk. Longer terms (60, 72, or even 84 months) reduce monthly payments but almost always carry higher interest rates and mean you pay significantly more over the life of the loan.

- Vehicle Age and Type: Newer vehicles, especially those with strong resale value, are generally seen as less risky collateral and may qualify for lower rates. Older or less reliable vehicles, or those with high depreciation rates, might command higher interest.

- Prevailing Market Rates in Canada: The Bank of Canada's benchmark interest rate influences all lending rates. When the Bank of Canada raises rates, consumer loan rates, including auto loans, typically follow suit.

The Compounding Conundrum: How Higher Rates Amplify Total Cost

Even a seemingly small difference in interest rate can balloon into thousands of dollars over the lifespan of a car loan. This is due to the power of compounding interest, especially when applied to a larger principal amount (as is the case with zero-down loans). Let's use a hypothetical example for a $30,000 vehicle purchase in Alberta:

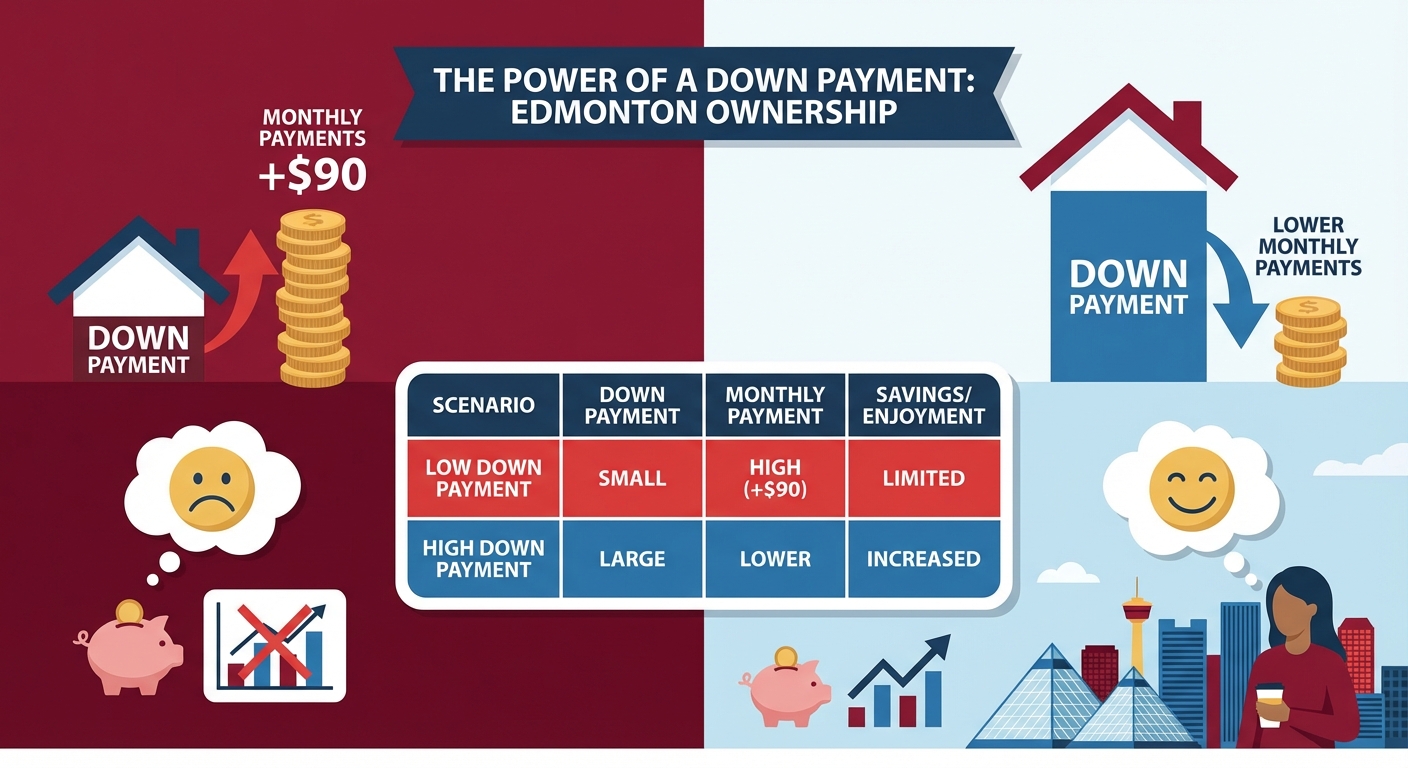

Imagine you're buying a $30,000 vehicle with a 72-month (6-year) loan term. We'll compare two scenarios:

- Scenario A: Zero Down Payment (financing $30,000)

- Scenario B: 10% Down Payment (financing $27,000 after $3,000 down)

Due to the increased risk of the zero-down option, the lender offers a higher interest rate.

Real Numbers: Zero Down vs. The Smart Start (10% Down)

| Feature | Scenario A: Zero Down | Scenario B: 10% Down ($3,000) |

|---|---|---|

| Vehicle Price | $30,000 | $30,000 |

| Down Payment | $0 | $3,000 |

| Loan Amount | $30,000 | $27,000 |

| Interest Rate (e.g.) | 8.99% | 6.49% |

| Loan Term | 72 Months | 72 Months |

| Estimated Monthly Payment | ~$547 | ~$460 |

| Total Interest Paid | ~$9,404 | ~$6,120 |

| Total Cost of Vehicle (Loan + Down Payment) | ~$39,404 | ~$36,120 |

As you can see, the zero-down option, with its higher interest rate, costs you over $3,200 more in interest alone, and your monthly payments are nearly $90 higher. That's money that could be going into savings, investments, or simply enjoying more of what Edmonton has to offer. This table clearly illustrates the powerful impact a down payment has on your total cost of ownership.

Beyond Interest: The Hidden Costs of Driving Away with Nothing Down

The higher interest rate is just the tip of the iceberg. Zero-down car loans often come with a host of less obvious, but equally significant, financial pitfalls that can erode your financial stability and create long-term headaches.

The Negative Equity Trap: Underwater from Day One

This is perhaps the most insidious hidden cost. When you finance 100% of a vehicle's purchase price, including taxes and fees, you almost immediately owe more than the car is worth. Why? Because new cars depreciate rapidly – often losing 10-20% of their value in the first year alone. This state of "negative equity" or being "underwater" means your car is worth less than your outstanding loan balance.

Imagine buying a new pickup truck in Edmonton for $45,000 with no money down. Within a few weeks, that truck might only be worth $40,000 on the resale market, but you still owe $45,000 (plus interest). This becomes a major problem if you need to sell or trade in your vehicle before the loan is paid off. You'll have to pay the difference out of pocket to clear the old loan before you can even think about a new one. This trap is particularly pronounced in the Canadian market where rapid depreciation is common for certain vehicle types.

Inflated Monthly Payments: Straining Your Budget in Cities Like Calgary and Vancouver

It's simple math: a larger principal (because you didn't put money down) combined with a higher interest rate inevitably leads to significantly larger monthly payments. While a lower monthly payment might seem attractive, stretching the loan term to achieve it only exacerbates the interest problem.

In high-cost-of-living cities like Calgary and Vancouver, where housing, groceries, and fuel costs are already substantial, an inflated car payment can severely strain your budget. It leaves less disposable income for emergencies, leisure, or saving for other financial goals. What might seem like a manageable payment on paper can quickly become a burden when real-life expenses pile up.

Insurance Implications: The Added Layer of Protection (and Cost)

Because zero-down loans carry higher risk for lenders, they often require specific, and sometimes more expensive, insurance coverage. The most common requirement is GAP (Guaranteed Asset Protection) insurance. GAP insurance covers the "gap" between what you owe on your loan and what your standard auto insurance policy would pay out if your vehicle is stolen or totalled.

Since you're likely in a negative equity position with a zero-down loan, GAP insurance protects the lender (and indirectly, you) from owing a substantial amount on a car you no longer possess. While it provides peace of mind, it's an additional monthly or upfront cost that you wouldn't necessarily have with a traditional loan and a healthy down payment.

Pro Tip: Always Calculate Total Cost of Ownership, Not Just Monthly Payments

Don't fall into the trap of only looking at the monthly payment. Demand to see the total cost of the vehicle over the entire loan term, including all interest, fees, and any required additional insurance. This comprehensive view will reveal the true financial burden and help you avoid buyer's remorse.

Who Benefits from Zero Down? (And Who Should Absolutely Avoid It)

While the pitfalls of zero-down loans are numerous, there are rare scenarios where such an option might be considered. However, for the vast majority of Canadian car buyers, it's a risky proposition.

The Unicorn Borrower: When Zero Down *Might* Make Sense

A zero-down loan might be a viable option for a very specific type of borrower, often referred to as a "unicorn":

- Exceptionally High Credit Score: Individuals with perfect credit (800+) who can still command very low interest rates despite the higher LTV.

- Significant Liquid Assets: Someone with a substantial emergency fund or other highly liquid investments that would make an immediate down payment unnecessary and allow them to pay off the loan quickly if needed.

- Specific Investment Strategies: Borrowers who have an investment opportunity where their cash could generate a return significantly higher than the car loan's interest rate. This is rare and requires sophisticated financial planning.

Even for these "unicorn" borrowers, the decision to go zero-down is usually a strategic financial move, not a necessity driven by a lack of funds.

The At-Risk Applicant: Why Most Should Steer Clear

For the majority of borrowers, especially those in the following categories, a zero-down loan is particularly dangerous:

- Average or Poor Credit: If your credit score is anything less than excellent, a zero-down loan will almost certainly come with a prohibitively high interest rate, making the total cost astronomical.

- Tight Budgets: If your budget is already stretched thin, the higher monthly payments and potential for negative equity from a zero-down loan can easily push you into financial distress. This is particularly true in cities like Edmonton where the cost of living can be challenging.

- Consolidating Other Debts: Using a car loan as a means to free up cash for other debts is a dangerous cycle that often leads to deeper financial trouble. A car loan should not be a solution for existing debt.

- Unstable Employment or Income: If your income is irregular or your job security is uncertain, committing to higher monthly payments for a zero-down loan is a significant risk. For those relying on benefits, while SkipCarDealer.com can help with unique situations, it's essential to understand the full financial implications. For example, if you're on EI, understanding your budget before considering a zero-down loan is critical. You can learn more about specific situations by reading our article on EI Benefits? Your Car Loan Just Got Its Paycheck.

The 'Emergency' Scenario: Mitigating Risk When There's No Other Option

Sometimes, life happens, and you might find yourself in an unavoidable situation where a zero-down loan is your only immediate option for essential transportation. In such cases, mitigation strategies are key:

- Pay It Off Faster: If possible, commit to making extra payments whenever you can to reduce the principal and accelerate the payoff, thereby minimizing total interest paid.

- Refinance Later: Work diligently to improve your credit score and save up a small down payment. After 6-12 months of consistent, on-time payments, you might be able to refinance the loan at a lower interest rate, especially once you've built some equity.

- Choose an Affordable Vehicle: Opt for the most reliable, fuel-efficient, and affordable vehicle that meets your needs, rather than overextending for a luxury model.

Pro Tip: Don't Use a Car Loan to Solve Other Financial Problems

A car loan is for purchasing a vehicle, not for consolidating credit card debt, funding a vacation, or creating liquidity for other expenses. Using it as a workaround for other financial problems will almost always lead to a more precarious financial situation in the long run.

Navigating the Canadian Auto Loan Landscape: Banks vs. Dealerships vs. Specialized Lenders

Understanding where to get your car loan is as important as understanding the terms. Canada offers several avenues for financing, each with its own approach to zero-down options.

Traditional Banks (e.g., RBC, TD Canada Trust): The Rigorous Path

Major Canadian banks like RBC, TD Canada Trust, CIBC, Scotiabank, and BMO typically offer the most competitive interest rates for car loans. However, they also tend to have the strictest lending criteria, especially for zero-down options. They generally require:

- An excellent credit score.

- A stable employment history and verifiable income.

- A low debt-to-income ratio.

While they might offer zero-down promotions occasionally, these are usually reserved for their most creditworthy clients. For most, a down payment will be required to secure their best rates.

Dealership Financing: Convenience, Compromise, and Captive Lenders

Dealerships offer unparalleled convenience, often allowing you to arrange financing, purchase, and drive away with a vehicle all in one visit. They work with a network of lenders, including traditional banks, specialized lenders, and their own captive finance companies (e.g., Ford Credit, Toyota Financial Services, Honda Financial Services).

- Captive Lenders: These are often the source of enticing zero-down, low-interest promotions, especially for new vehicles. They aim to move specific models and can offer rates that independent lenders cannot match, but these are usually for highly qualified buyers.

- Marked-Up Rates: Dealerships may also mark up the interest rate offered by a third-party lender to earn a commission. This means you might not be getting the absolute best rate available to you.

While convenient, it's crucial to be vigilant and compare offers when financing through a dealership.

Specialized & Subprime Lenders: The Higher-Risk, Higher-Cost Option

These lenders cater to borrowers who may not qualify for traditional bank loans due to lower credit scores, unique income situations, or those specifically seeking zero-down options. Companies like SkipCarDealer.com work with a network of such lenders to help individuals secure financing when traditional paths are closed.

- Higher Interest Rates: Due to the increased risk associated with their clientele, specialized and subprime lenders almost always charge significantly higher interest rates. This is especially true for zero-down loans, as the risk is compounded.

- Fees and Terms: Be prepared for potential additional fees and stricter terms. It's vital to read the fine print carefully.

While these options can be a lifeline for many Canadians, particularly in provinces like Ontario and Quebec where diverse financial needs are common, understanding the higher cost is non-negotiable.

The Role of Auto Loan Brokers in Canada

Auto loan brokers, like SkipCarDealer.com, act as intermediaries, connecting borrowers with a network of lenders. Their advantages include:

- Access to Multiple Lenders: They can shop your application around to many lenders, increasing your chances of approval.

- Expertise: They understand the nuances of the Canadian lending market and can guide you through the process, especially for challenging credit situations.

- Convenience: One application can reach multiple lenders, saving you time and effort.

However, ensure transparency regarding any fees they might charge and always compare their best offer with any direct quotes you receive.

Pro Tip: Get Pre-Approved from Your Bank *Before* Visiting the Dealership

This is arguably one of the most powerful strategies for car buyers. A pre-approval from your own bank (or credit union) gives you a benchmark interest rate and a clear budget. You walk into the dealership as a cash buyer, empowering you to negotiate on the car price, rather than being pressured into less favourable dealership financing. If the dealership can beat your pre-approval rate, fantastic! If not, you have a solid alternative.

Strategies for Lowering Your Interest Rate (Even Without a Hefty Down Payment)

While a down payment is a powerful tool, it's not the only way to influence your interest rate. Even if a large sum isn't feasible right now, there are proactive steps you can take to secure a better deal.

Building Your Credit Score: A Canadian's Guide to Financial Health

Your credit score is a critical determinant of your interest rate. Improving it is an ongoing process, but the benefits are substantial:

- Pay Bills On Time, Every Time: This is the single most important factor. Late payments severely damage your score.

- Reduce Debt: Lowering your credit card balances and other revolving debt improves your credit utilization ratio, which lenders view favourably.

- Don't Close Old Accounts: Longer credit histories are generally better. Keep old credit cards open, even if you don't use them often.

- Monitor Your Credit Reports: Regularly check your reports from Equifax and TransUnion for errors and fraudulent activity. You're entitled to a free copy annually.

For individuals with a limited or non-existent credit history, building credit can be a challenge. For insights into navigating this, especially for newcomers, consider reading our article on Foreign Credit: Not Useless. Your Car Loan Starts Here, Edmonton, Alberta.

Shortening Your Loan Term: The Trade-Off Between Monthly Payments and Total Interest

A shorter loan term (e.g., 48 or 60 months instead of 72 or 84) typically results in a lower interest rate. While your monthly payments will be higher, you'll pay significantly less interest over the life of the loan. Lenders prefer shorter terms because their money is exposed for less time, reducing their risk. If you can comfortably afford higher monthly payments, this is an excellent strategy to save on total interest.

Choosing the Right Vehicle: Depreciation and Lender Perception

The type of vehicle you choose can subtly influence your interest rate. Vehicles with strong resale value and slower depreciation curves (e.g., certain Toyota, Honda, or Subaru models) are considered less risky collateral by lenders. They know they can recoup more of their investment if they have to repossess and sell the vehicle. Conversely, vehicles known for rapid depreciation might lead to higher rates. Consider a slightly used model (1-3 years old) as an alternative; it has already taken the brunt of initial depreciation, offering better value and potentially better loan terms.

Finding a Co-signer: Leveraging Trust for Better Terms

If you have a lower credit score or limited income, a co-signer with excellent credit can significantly improve your approval odds and help you secure a lower interest rate. A co-signer legally agrees to be responsible for the loan payments if you default. However, this is a serious commitment for both parties:

- Pros: Better rates, easier approval.

- Cons: The co-signer's credit is also affected by your payment history, and they are fully liable if you can't pay.

Only consider a co-signer if you are absolutely confident in your ability to make all payments on time.

Your Old Car as Your New Down Payment: Maximizing Trade-In Value

Your existing vehicle can be a powerful tool to reduce your new car loan's principal and interest. Don't just accept the first trade-in offer:

- Research Market Value: Use online tools (e.g., Kelley Blue Book Canada, Canadian Black Book) to understand your car's true market value.

- Condition Matters: Clean your car thoroughly, address minor repairs, and have maintenance records ready.

- Get Multiple Quotes: Visit several dealerships or even consider selling it privately if you have the time and patience to get the best price.

Every dollar you get for your trade-in directly reduces the amount you need to finance, lowering your LTV and making you a more attractive borrower.

Pro Tip: Even a Small Down Payment Makes a Big Difference

Even if you can't manage a 10% or 20% down payment, aim for something. A 5% down payment, for example, signals good faith to the lender, reduces your LTV, and can make a noticeable difference in the interest rate you're offered. It also immediately puts you in a slightly better equity position, mitigating the negative equity trap.

The Edmonton Specifics: Car Ownership in a Dynamic City

Edmonton, Alberta, presents its own unique set of considerations for car buyers. Understanding the local economic and automotive landscape is key to making informed financial decisions, especially when it comes to higher-interest, zero-down loans.

Cost of Living & Loan Affordability in Edmonton

While Edmonton's cost of living is generally more affordable than Vancouver or Toronto, it's still a major Canadian city with significant expenses. Housing costs, utility bills, and fuel prices all factor into a resident's monthly budget. A higher car loan payment, a common outcome of zero-down financing with higher interest rates, can quickly put a strain on your finances, leaving less room for other necessities or discretionary spending. It's crucial to budget meticulously, ensuring your car payment (including fuel, insurance, and maintenance) doesn't consume too large a portion of your income.

Insurance Rates in Alberta: Another Factor to Consider

Alberta's insurance rates have seen fluctuations and can be higher than in some other Canadian provinces. Several factors influence your premiums, including your driving record, the type of vehicle, and your postal code. When you finance a higher-value vehicle with no down payment, you're not only dealing with a larger loan principal and higher interest, but you're also likely to face higher insurance premiums, especially if the lender requires comprehensive coverage or GAP insurance. This can significantly increase your total monthly vehicle ownership cost, potentially making that zero-down deal far less appealing.

Navigating Local Dealerships and Financing Offers in Edmonton

Edmonton has a competitive automotive market with numerous dealerships representing various brands. You'll likely encounter a range of financing promotions, including "zero money down" offers. While these can be tempting, remember to:

- Compare Across Dealerships: Don't settle for the first offer. Visit multiple dealerships and compare their interest rates, terms, and the total cost of the vehicle.

- Read the Fine Print: Pay close attention to the details of any financing promotion. Are there hidden fees? Does the interest rate jump after a certain period?

- Leverage Your Pre-Approval: As mentioned, having a pre-approval from your bank gives you significant bargaining power.

For new residents to Alberta, navigating the local credit landscape can be a learning curve. For more tailored advice, you might find our article on Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers helpful.

Pro Tip: Research Local Market Conditions for Both Car Prices and Insurance Before Committing

Before you even step into a dealership, use online resources to research average car prices for your desired model in Edmonton and get insurance quotes. This local knowledge empowers you to spot inflated prices or unrealistic payment expectations, leading to smarter decision-making.

Your Next Steps to Approval (and Financial Freedom)

Securing a car loan, especially without a down payment, requires diligence and a clear strategy. Don't rush into a decision that could impact your financial health for years. By following these steps, you can navigate the process with confidence.

Crafting Your Personalized Car Loan Action Plan

- Budget Realistically: Determine exactly how much you can comfortably afford each month for a car payment, insurance, fuel, and maintenance. Be honest with yourself.

- Check Your Credit Score: Obtain your credit report from Equifax and TransUnion. Understand your score and address any errors.

- Save, Even a Little: If possible, start saving for even a small down payment (5-10%). Every dollar helps reduce your principal and potentially your interest rate.

- Get Pre-Approved: Contact your bank or credit union for pre-approval. This gives you a baseline for comparison.

- Research Vehicles: Choose a reliable vehicle that fits your needs and budget, considering its depreciation rate.

- Compare Offers: Don't commit to the first offer. Shop around different lenders and dealerships.

The Fine Print Matters: Reading Your Loan Agreement Thoroughly

Before you sign anything, read your loan agreement meticulously. This document is legally binding, and ignorance is not an excuse. Pay special attention to:

- Interest Rate (APR): Ensure it matches what was quoted.

- Loan Term: Understand the total number of months you'll be paying.

- Total Cost of Loan: This figure includes the principal plus all interest and fees.

- Prepayment Penalties: Check if there are any penalties for paying off the loan early.

- Fees: Look for any administrative fees, documentation fees, or other charges.

- Insurance Requirements: Confirm if GAP insurance or specific coverage levels are mandatory.

If anything is unclear, ask questions until you fully understand. Don't be afraid to take the document home to review it without pressure.

When to Walk Away: Recognizing a Bad Deal

Empower yourself to say no. A bad car loan can be a long-term financial burden. Walk away if:

- The interest rate is excessively high and doesn't align with your credit profile.

- The monthly payments strain your budget, leaving no room for emergencies.

- The total cost of the loan (principal + interest) feels astronomical.

- You feel pressured or rushed into making a decision.

- The dealership or lender isn't transparent about terms or fees.

- The deal doesn't make financial sense for your long-term goals.

Pro Tip: Prioritize Financial Health Over Instant Gratification

A new car can be exciting, but the temporary thrill of driving a shiny new vehicle shouldn't come at the expense of your financial well-being. Prioritize a sustainable, affordable car loan that fits comfortably within your budget, even if it means waiting a bit longer or choosing a slightly less expensive model.