Zero Down Car Loan After Debt Settlement 2026

Table of Contents

- Key Takeaways

- The Phoenix Rising: Driving Forward Post-Debt Resolution in 2026

- Decoding 'Zero Down': The Post-Settlement Auto Financing Equation

- Pro Tip: Your Credit Report is Your Resume

- The Strategic Blueprint: Cultivating Loan-Readiness Before You Apply

- Rebuilding Your Credit Narrative: Beyond just time – active steps to demonstrate reliability and financial discipline.

- Fortifying Your Financial Foundation: Income stability and debt-to-income optimization as critical approval factors.

- The Power of a Purposeful Budget: Proving affordability and commitment to managing new financial obligations.

- Navigating the Lender Labyrinth: Identifying Your Best Allies

- Traditional Financial Institutions: The long game and the exceptions for post-resolution applicants.

- Specialized Auto Finance Providers: Designed for the journey back – understanding their unique criteria.

- Credit Unions: A member-centric approach to lending that can offer more personalized consideration.

- Dealership Financing Hubs: Convenience, but at what cost? Assessing the pros and cons.

- Pro Tip: Pre-Approval is Your Negotiation Power

- Assembling Your Approval Arsenal: Documents and Disclosures That Speak Volumes

- Proof of Debt Resolution Completion: Your official clean slate – demonstrating the successful conclusion of your financial restructuring.

- Comprehensive Income Verification: Beyond a single pay stub – providing a holistic view of your earnings.

- Residency and Identity Validation: Standard but crucial requirements for any loan application.

- Personal References (Optional but Potent): Character witnesses for your financial journey, if requested or deemed beneficial.

- The Real Price Tag: Unmasking Interest Rates, Terms, and Hidden Costs

- The 'Rebuilding' Rate: Managing expectations for initial interest rates post-debt resolution.

- Strategic Loan Terms: Balancing monthly affordability with the total cost of the loan.

- Ancillary Products and Add-ons: Separating value from unnecessary expense during the purchasing process.

- Pro Tip: Always Question the 'Why'

- Your Vehicle Choice: A Silent Partner in Your Approval Odds

- The 'Affordable' Advantage: How a modest vehicle choice reduces lender risk and enhances approval chances.

- New vs. Used: Depreciation, Warranty, and Lender Perspective.

- Understanding Vehicle Equity and Loan-to-Value (LTV): The importance of not being 'upside down' on your loan.

- Beyond the Purchase: Accelerating Your Financial Recovery

- Establishing Impeccable Payment History: The most powerful credit builder post-loan acquisition.

- Exploring Refinancing Opportunities: The strategic path to better terms and lower costs as your credit improves.

- Continuous Credit Monitoring and Management: Staying in control of your financial narrative.

- Pro Tip: Automate for Success, Review for Control

- When 'Zero Down Immediately' Isn't the First Step: Alternative Pathways

- The Power of a Small Down Payment: Even a modest contribution can significantly improve your position with lenders.

- Secured Loans with Collateral: Leveraging existing assets (if applicable) to secure more favorable loan conditions.

- Leasing: A Short-Term Solution with Long-Term Considerations.

- Patience and Purposeful Saving: The ultimate zero-risk strategy for future vehicle acquisition.

- Your Roadmap to Driving Forward with Confidence

- Frequently Asked Questions (FAQ)

Navigating the Canadian auto financing landscape can feel like a complex journey, especially when you're on the path of financial recovery. For many, a debt settlement marks a significant milestone – a fresh start after navigating challenging financial waters. But the burning question often remains: "Can I get a zero down car loan immediately after debt settlement in Canada?" The short answer is that while "immediately" presents considerable hurdles, securing a zero down car loan in 2026 is absolutely within reach with the right strategy, patience, and a clear understanding of what lenders prioritize.

At SkipCarDealer.com, we understand that life happens, and a past financial event doesn't define your future. We specialize in helping Canadians, including those who have recently completed a debt settlement, find reliable transportation solutions. This comprehensive guide will equip you with the knowledge and actionable strategies to not only secure a car loan but to do so on terms that support your ongoing financial rebuilding journey in 2026.

Key Takeaways

- Patience is a Virtue: While 'immediately' is challenging, strategic preparation significantly improves your odds.

- Credit Rebuilding is Paramount: Your payment history after debt resolution is your most powerful asset.

- Specialized Lenders are Key: Traditional financial institutions may be less accessible; explore alternative providers.

- Understanding 'Zero Down': It's less about lack of funds and more about lender confidence in your financial stability.

- Vehicle Choice Matters: Opting for an affordable, reliable vehicle reduces lender risk and increases approval chances.

The Phoenix Rising: Driving Forward Post-Debt Resolution in 2026

Canadians seeking a zero down car loan immediately after debt settlement face a unique set of circumstances. While challenging, it's not impossible. Lenders will scrutinize your recent financial history, but demonstrating stability and a commitment to rebuilding can open doors to financing options, particularly from specialized lenders.

Acknowledging the past, embracing the future: Why this journey is unique for individuals who have navigated debt resolution.

Embarking on the journey to secure a car loan after a debt settlement is a testament to resilience and a commitment to a healthier financial future. You've faced your financial challenges head-on, made difficult decisions, and emerged with a clearer path. This experience, while impactful on your credit, also provides a unique narrative: you've addressed past issues, and you're now focused on responsible financial management. Lenders, especially those specializing in non-prime financing, often see this as an opportunity to help you re-establish your creditworthiness.

Dispelling myths vs. revealing realities: Setting realistic expectations for securing vehicle financing after a significant financial event.

One common myth is that you'll be blacklisted from all financing for years after a debt settlement. The reality is more nuanced. While your credit score will take a hit and traditional banks may be hesitant initially, there are numerous lenders in Canada who specialize in helping individuals rebuild. The key is understanding that "zero down immediately" might be an ambitious goal without significant credit rebuilding, but accessible financing with strategic planning is very much a reality.

The shift in perspective: From debt burden to financial empowerment and responsible asset acquisition.

Your debt settlement wasn't an ending; it was a reset. This new perspective allows you to approach car financing not as another burden, but as a strategic step towards financial empowerment. Acquiring a reliable vehicle can be essential for work, family, and daily life, directly contributing to your ability to earn income and manage responsibilities. By securing a car loan and consistently making on-time payments, you're actively building a positive credit history, transforming a past challenge into a foundation for future financial success.

Decoding 'Zero Down': The Post-Settlement Auto Financing Equation

Unpacking the concept: What 'zero down' truly signifies in a rebuilt financial landscape, distinguishing it from general financing.

When lenders offer 'zero down' financing, it fundamentally means they are confident enough in your ability to repay the entire loan amount, including the vehicle's full purchase price, without requiring an upfront cash investment from you. For someone post-debt settlement, this confidence is harder to earn. It's not just about having no cash for a down payment; it's about the lender perceiving minimal risk. In a rebuilt financial landscape, 'zero down' often requires a stronger post-settlement credit history, stable income, and sometimes, a higher interest rate to offset the increased risk the lender is taking.

The immediate credit aftermath: Understanding your credit score's new story and how it influences lender perception.

After a debt settlement, your credit score will likely have taken a significant dip. A debt settlement will remain on your credit report for a number of years (typically 6-7 years from the date of settlement or last activity, depending on the credit bureau and province). This history tells lenders that you've had difficulty managing debt in the past. Your credit score, which might range from 300-600 post-settlement, is a primary indicator of risk. Lenders will look for evidence of new, positive credit activity and consistent payments since the settlement.

The 'risk' factor: Why lenders are cautious and how your post-settlement actions mitigate this.

Lenders are in the business of assessing risk. A debt settlement signals a higher risk profile. They want to know that the circumstances leading to the settlement have been resolved and that you are now a reliable borrower. Your post-settlement actions are crucial here: timely payments on any new credit, stable employment, and a responsible approach to budgeting all serve to mitigate this perceived risk. Every positive financial action you take from this point forward helps to rewrite your credit narrative.

Pro Tip: Your Credit Report is Your Resume

Learn to read your credit report, understand its components (payment history, amounts owed, length of credit history, new credit, credit mix), and identify areas for improvement. This document is your primary advocacy tool. Get free copies from Equifax and TransUnion annually and dispute any inaccuracies immediately. Understanding your report helps you explain your financial situation confidently to lenders.

The Strategic Blueprint: Cultivating Loan-Readiness Before You Apply

Securing a zero down car loan after debt settlement in 2026 isn't about luck; it's about meticulous preparation. Your financial story post-settlement needs to be one of stability and responsibility. Here’s how to build that narrative:

Rebuilding Your Credit Narrative: Beyond just time – active steps to demonstrate reliability and financial discipline.

Time alone won't fully heal your credit. You need to actively participate in its recovery. This means demonstrating a consistent ability to manage new credit responsibly.

- Secured credit products: Utilizing these as stepping stones to re-establish positive payment histories. A secured credit card, for instance, requires a deposit that acts as your credit limit. Using it sparingly and paying it off in full and on time each month sends strong positive signals to credit bureaus. Small secured loans can also serve this purpose, diversifying your credit mix.

- Consistent bill payments: The foundational element for building trust with future lenders. Ensure all your bills – utilities, phone, rent, and any new credit accounts – are paid on time, every time. Late payments, even on non-credit accounts, can sometimes be reported and negatively impact your financial standing.

Fortifying Your Financial Foundation: Income stability and debt-to-income optimization as critical approval factors.

Lenders need assurance that you can comfortably afford your car payments. Your income and existing debt levels are key indicators.

- Demonstrating consistent earnings: Providing verifiable proof of stable employment or income sources. This could include recent pay stubs (typically 2-3 months), employment letters, or bank statements showing regular deposits. For those with non-traditional income, like gig workers in Toronto or Vancouver, consistent income over several months is vital. For more on how non-traditional income can secure you a car loan, see our article on Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

- Minimizing existing debt: Reducing your overall debt burden to present a lower-risk profile to lenders. A lower debt-to-income (DTI) ratio signals that you have more disposable income to put towards a car loan. Pay down high-interest debts and avoid taking on new significant obligations before applying for an auto loan.

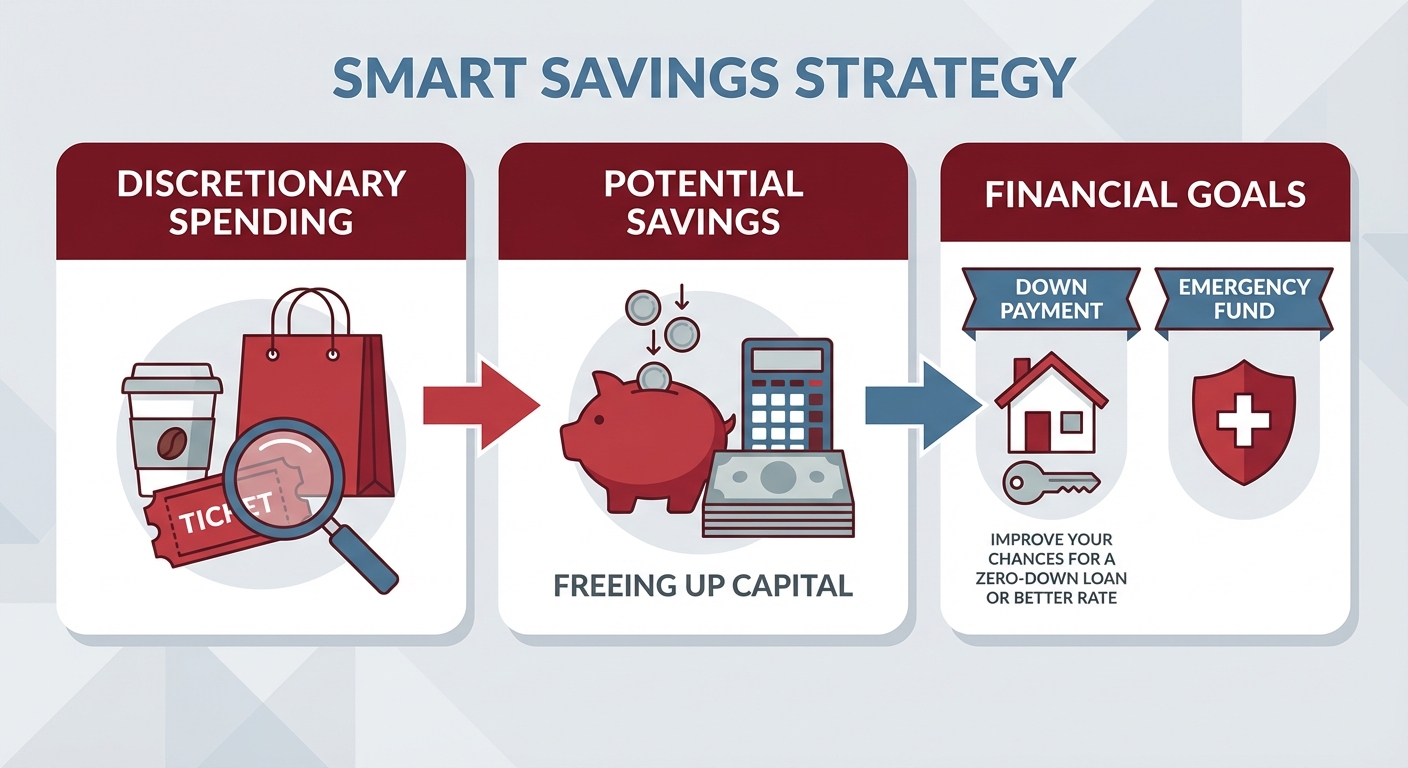

The Power of a Purposeful Budget: Proving affordability and commitment to managing new financial obligations.

A well-structured budget demonstrates financial maturity and planning, which can be persuasive to lenders.

- Tracking expenses: Gaining granular insight into your spending habits to identify savings opportunities. Knowing exactly where your money goes allows you to make informed decisions about affordability.

- Identifying discretionary spending for potential savings: Freeing up capital for a down payment or emergency fund. Even a small down payment can drastically improve your chances for a zero-down loan, or at least a more favourable interest rate.

Navigating the Lender Labyrinth: Identifying Your Best Allies

Finding the right lender is paramount when seeking a zero down car loan after debt settlement in 2026. Different types of financial institutions have varying appetites for risk and different criteria for approval.

Traditional Financial Institutions: The long game and the exceptions for post-resolution applicants.

Major banks (like RBC, TD, BMO, Scotiabank, CIBC) are typically the most conservative lenders. They often require a significant period of positive credit history post-settlement (e.g., 2-3 years) and a higher credit score. Securing a zero down loan from a traditional bank immediately after settlement is highly unlikely.

- Building a relationship: Leveraging existing banking history or long-standing accounts. If you've had a checking or savings account in good standing with a particular bank for many years, they might be slightly more lenient, but don't count on it for a zero-down offer right away.

- The role of co-signers: When a helping hand from a financially strong individual can make a significant difference. A co-signer with excellent credit and stable income can dramatically improve your chances of approval, and potentially secure a lower interest rate, even for a zero-down loan. However, remember that a co-signer is equally responsible for the debt.

Specialized Auto Finance Providers: Designed for the journey back – understanding their unique criteria.

These lenders, often referred to as subprime or non-prime lenders, are your strongest allies post-debt settlement. They understand that not everyone has perfect credit and focus more on your current ability to pay and your commitment to rebuilding.

- Understanding their criteria and flexibility: How these lenders assess risk differently and what they prioritize. They look beyond just your credit score, considering factors like stable employment, income, residency stability, and your post-settlement payment behaviour. Many specialize in The Consumer Proposal Car Loan You Were Told Was Impossible.

- The trade-off: Accepting potentially higher interest rates for increased approval chances. Because they take on more risk, their interest rates will be higher than prime rates. This is the cost of re-establishing your credit and getting back on the road.

Credit Unions: A member-centric approach to lending that can offer more personalized consideration.

Credit unions are member-owned financial cooperatives. Their community focus often translates into a more personalized approach to lending, especially for long-standing members.

- Community focus: How credit unions might be more understanding of individual circumstances. If you've been a member in good standing with a credit union, they might be willing to look past some credit challenges, particularly if you have a strong relationship with them.

Dealership Financing Hubs: Convenience, but at what cost? Assessing the pros and cons.

Many dealerships have in-house finance departments that work with a network of lenders, including specialized subprime providers. This offers a convenient one-stop shop.

- Access to multiple lenders vs. potential for markups: Understanding the dealership's role as an intermediary. Dealerships can often find a lender willing to approve you, but it's crucial to be aware that they may add a markup to the interest rate offered by the lender. Always compare offers.

Pro Tip: Pre-Approval is Your Negotiation Power

Secure pre-approval from at least one specialized lender before stepping onto a dealership lot. This gives you a benchmark offer, empowers you to negotiate better terms, and allows you to focus on the vehicle, not just the financing. Pre-approval means you know what you can afford and what interest rate to expect.

Assembling Your Approval Arsenal: Documents and Disclosures That Speak Volumes

When you apply for a zero down car loan after debt settlement in Canada in 2026, transparency and thorough documentation are your best friends. Lenders want to see a clear picture of your financial situation and your commitment to your fresh start.

Proof of Debt Resolution Completion: Your official clean slate – demonstrating the successful conclusion of your financial restructuring.

This is perhaps the most critical document. It confirms that your past debts have been officially settled and you are no longer burdened by them.

- Certificates and discharge documents: Essential paperwork to confirm your debt resolution status. Whether it's a discharge certificate for a bankruptcy, a letter of completion for a consumer proposal, or official correspondence confirming a debt settlement, have these readily available.

Comprehensive Income Verification: Beyond a single pay stub – providing a holistic view of your earnings.

Lenders need to be confident in your ability to make consistent monthly payments. The more robust your income verification, the better.

- Bank statements, tax assessments, employment letters: A robust portfolio to demonstrate consistent income. Provide recent bank statements (3-6 months) showing regular income deposits. If you're self-employed or a gig worker in Vancouver or Calgary, your Notice of Assessment (NOA) from the Canada Revenue Agency (CRA) and detailed income/expense ledgers will be crucial. An employment letter confirming your position, salary, and start date is also highly valued. For more on proving income without traditional pay stubs, check out our guide for Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

Residency and Identity Validation: Standard but crucial requirements for any loan application.

These are basic checks to confirm who you are and where you live.

- Government-issued ID (driver's license, passport).

- Utility bills or rental agreements to confirm your address.

Personal References (Optional but Potent): Character witnesses for your financial journey, if requested or deemed beneficial.

While not always required, some specialized lenders might ask for personal references to get a better sense of your character and reliability, especially if your credit history is very thin post-settlement.

The Real Price Tag: Unmasking Interest Rates, Terms, and Hidden Costs

When considering a zero down car loan after debt settlement in 2026, it's vital to look beyond just the monthly payment. Understanding the total cost of the loan and any associated fees will ensure you make an informed decision and avoid future financial strain.

The 'Rebuilding' Rate: Managing expectations for initial interest rates post-debt resolution.

It's important to set realistic expectations for your interest rate. Given your recent debt settlement, you will likely be offered rates higher than those for prime borrowers. This is the lender's way of mitigating the increased risk they are taking.

- Why rates might be higher, and how to plan for it: Understanding the risk premium associated with your credit history. In 2026, prime rates for new car loans in Canada might range from 6.99% to 8.99%. For someone post-debt settlement, you could be looking at rates anywhere from 14.99% to 29.99%, depending on your overall financial profile, the specific lender, and the province (e.g., Toronto vs. Montreal). Plan your budget with this in mind, focusing on affordability and the potential for refinancing later.

Typical Canadian Car Loan Interest Rates (2026 Estimate)

| Credit Profile | Estimated Interest Rate Range | Monthly Payment (on $25,000, 72 months) |

|---|---|---|

| Excellent (750+) | 6.99% - 8.99% | $425 - $455 |

| Good (680-749) | 9.99% - 12.99% | $475 - $515 |

| Fair/Subprime (600-679) | 14.99% - 19.99% | $550 - $620 |

| Post-Settlement/Rebuilding (<600) | 20.00% - 29.99% | $630 - $780+ |

Note: These are estimates for 2026 and can vary based on lender, vehicle, term, and provincial market conditions.

Strategic Loan Terms: Balancing monthly affordability with the total cost of the loan.

The length of your loan term (e.g., 60 months, 72 months, 84 months) significantly impacts both your monthly payment and the total interest paid over the life of the loan.

- Shorter terms for less interest vs. longer terms for lower payments: A detailed analysis of the trade-offs. A shorter term means higher monthly payments but you pay less interest overall. A longer term means lower monthly payments, making it more affordable in the short term, but you'll pay significantly more in interest over the life of the loan. For instance, a $25,000 loan at 20% interest over 60 months is about $660/month, with ~ $14,600 in interest. The same loan over 84 months is about $550/month, but with ~ $21,200 in interest. Evaluate what you can truly afford without stretching your budget too thin.

Ancillary Products and Add-ons: Separating value from unnecessary expense during the purchasing process.

When finalizing your car purchase, dealerships often present various add-ons. Be discerning.

- Extended warranties, GAP insurance, credit protection: When these add-ons make financial sense and when to decline.

- Extended Warranties: Can be useful for used vehicles, especially if you're concerned about repair costs. However, ensure the coverage is comprehensive and the cost is reasonable. Expect $1,500 - $4,000+.

- GAP (Guaranteed Asset Protection) Insurance: Highly recommended for zero-down loans or when buying a rapidly depreciating vehicle. If your car is stolen or totaled, GAP covers the difference between what your insurance pays out and what you still owe on the loan. Costs typically $500 - $1,000+.

- Credit Protection/Life Insurance: Generally not recommended. These pay off your loan if you become disabled or pass away, but often have high premiums and limited benefits. Consider if your existing life or disability insurance covers this.

Be aware of other common fees:

- Documentation Fee: A dealer's fee for processing paperwork. Can range from $300 to $700 in provinces like Alberta or Nova Scotia.

- PPSA (Personal Property Security Act) Registration: Registers the lien on the vehicle. Small fee, typically $10-$20, varies by province.

- Taxes: Always factor in sales tax (GST/PST/HST) on the vehicle's purchase price, which can add thousands to the total.

Pro Tip: Always Question the 'Why'

Don't be afraid to ask for clarification on every fee, charge, and interest rate. Ask what each add-on costs, what it covers, and if it's mandatory. Transparency is your right. If you don't understand it, don't sign for it. You can often decline add-ons or purchase similar coverage independently for less.

Your Vehicle Choice: A Silent Partner in Your Approval Odds

The type of vehicle you choose can significantly influence a lender's decision, especially when you're seeking a zero down car loan after debt settlement in 2026. Your choice reflects your financial prudence and directly impacts the lender's risk.

The 'Affordable' Advantage: How a modest vehicle choice reduces lender risk and enhances approval chances.

Lenders are more comfortable financing a lower-priced vehicle because their potential loss is smaller if you default. Opting for an economical and reliable car demonstrates fiscal responsibility.

- Focusing on reliable, lower-cost options: Demonstrating fiscal responsibility in your selection. Think about a well-maintained, mid-range used sedan or a smaller SUV from a reputable brand (e.g., Honda Civic, Toyota Corolla, Hyundai Elantra). These cars hold their value reasonably well and are less expensive to repair.

New vs. Used: Depreciation, Warranty, and Lender Perspective.

The choice between new and used vehicles has significant implications for financing, particularly for those rebuilding credit.

- Used cars: Often a more accessible entry point for those rebuilding credit due to lower price points. A used car will have a lower purchase price, meaning a smaller loan amount and thus less risk for the lender. While they lack the factory warranty of a new car, certified pre-owned (CPO) vehicles often come with extended warranties, offering a good balance of cost and peace of mind.

- Lender's view on asset value and resale: How the vehicle's inherent value impacts the loan's risk profile. Lenders prefer vehicles that retain their value well, as this provides better collateral for the loan. New cars depreciate rapidly the moment they leave the lot, which can make them a higher risk for lenders if you're seeking a zero-down loan.

Understanding Vehicle Equity and Loan-to-Value (LTV): The importance of not being 'upside down' on your loan.

Loan-to-Value (LTV) is the ratio of the loan amount to the vehicle's market value. A zero-down loan means your initial LTV is 100% (or more, if you finance taxes and fees). This means you have no equity in the vehicle from day one.

- Being "upside down" (owing more than the car is worth) is a common issue with zero-down loans, especially on new cars that depreciate quickly. This is where GAP insurance becomes crucial. Lenders prefer a lower LTV as it reduces their risk. Even a small down payment can help create immediate equity and reduce your LTV. For strategies on avoiding negative equity, refer to our guide: Ditch Negative Equity Car Loan | 2026 Canada Guide.

Beyond the Purchase: Accelerating Your Financial Recovery

Securing your zero down car loan is a significant achievement, but it's just the beginning of leveraging this opportunity to solidify your financial recovery. Your actions post-purchase are critical for long-term success in 2026 and beyond.

Establishing Impeccable Payment History: The most powerful credit builder post-loan acquisition.

Every single on-time payment you make on your car loan is a positive entry on your credit report, building a strong foundation for your future creditworthiness.

- On-time, every time: The golden rule for rebuilding and improving your credit score. Missed or late payments can severely damage the progress you've made. Prioritize your car loan payments above almost all other discretionary spending.

Exploring Refinancing Opportunities: The strategic path to better terms and lower costs as your credit improves.

As you consistently make payments and your credit score gradually improves, you'll become eligible for better interest rates.

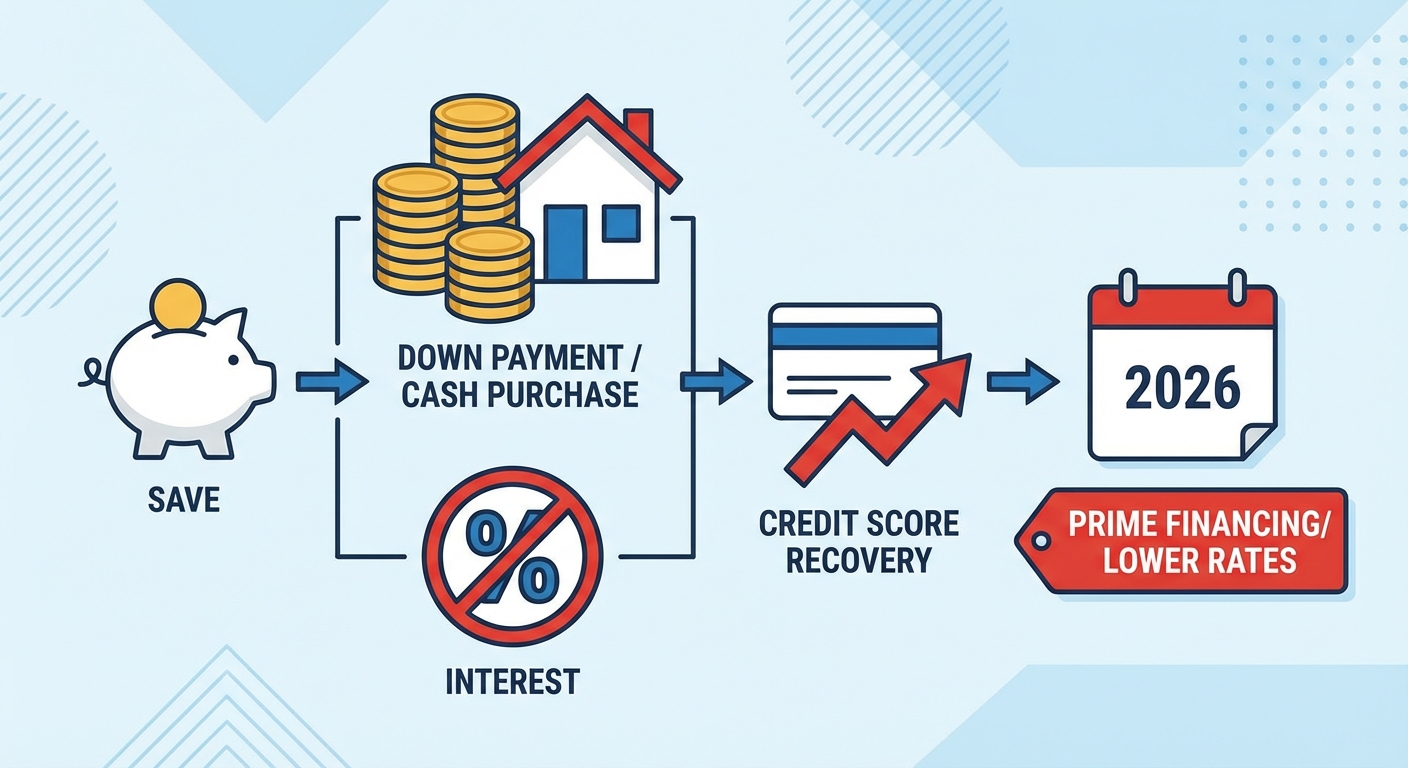

- When to consider refinancing and how to qualify: Criteria for securing a more favorable loan. After 12-18 months of impeccable payment history, check your credit score. If it has significantly improved (e.g., increased by 50-100 points or more), consider applying to refinance your car loan. This could lead to a lower interest rate, reducing your monthly payments or the total interest paid over the loan term. Lenders will look for that consistent payment history and an improved credit score.

Continuous Credit Monitoring and Management: Staying in control of your financial narrative.

Your credit health is an ongoing process, not a one-time fix. Proactive monitoring helps you stay on track and catch issues early.

- Regular credit report checks and score tracking: Proactive steps to identify errors and measure progress. Check your credit reports from Equifax and TransUnion at least once a year (it's free!). Utilize credit monitoring services (many banks and credit card companies offer free versions) to track your score and get alerts about any suspicious activity.

Pro Tip: Automate for Success, Review for Control

Set up automatic payments for your car loan to avoid missed deadlines – this is the easiest way to ensure on-time payments. However, regularly review your bank statements to ensure accuracy, prevent fraud, and verify that the correct amount is being debited. Automation is convenient, but vigilance is key.

When 'Zero Down Immediately' Isn't the First Step: Alternative Pathways

While a zero down car loan after debt settlement in 2026 is achievable, sometimes the best strategy involves taking a slightly different route. These alternatives can significantly improve your chances of approval or secure you more favorable terms in the long run.

The Power of a Small Down Payment: Even a modest contribution can significantly improve your position with lenders.

Even if you're aiming for zero down, don't dismiss the impact of a small initial investment. A down payment shows commitment and reduces the lender's risk.

- How a down payment reduces lender risk and potentially unlocks better rates and terms. Putting down just 5-10% (e.g., $1,500 - $2,500 on a $25,000 car) can make a substantial difference. It reduces your loan-to-value (LTV) ratio, immediately giving you equity in the vehicle. This signals to lenders that you have some 'skin in the game' and are less likely to default, potentially opening the door to lower interest rates and more flexible terms.

Secured Loans with Collateral: Leveraging existing assets (if applicable) to secure more favorable loan conditions.

If you have other assets, such as a paid-off second vehicle or other significant property, some lenders might consider a secured loan against that collateral. This reduces their risk considerably.

- Be cautious: This strategy comes with the risk of losing the collateral if you default on the car loan.

Leasing: A Short-Term Solution with Long-Term Considerations.

Leasing can sometimes be an option, particularly if you need a newer vehicle with lower monthly payments.

- Pros and cons for individuals post-debt resolution: Understanding the limitations and benefits.

- Pros: Typically lower monthly payments than financing, as you're only paying for the depreciation of the vehicle during the lease term. You often get to drive a newer vehicle.

- Cons: You don't own the car at the end of the term. Mileage restrictions can be costly if exceeded. Early termination penalties can be severe. It doesn't build equity. For someone rebuilding credit, the long-term financial benefit of ownership and equity building through financing is often preferred.

Patience and Purposeful Saving: The ultimate zero-risk strategy for future vehicle acquisition.

If "immediately" isn't critical, taking more time to save up can be the most financially sound approach.

- This strategy allows you to save for a larger down payment, or even the full cash purchase, thereby avoiding interest entirely. It also provides more time for your credit score to recover naturally, potentially opening doors to prime financing at much lower rates in 2026.

Your Roadmap to Driving Forward with Confidence

Securing a zero down car loan after debt settlement in Canada for 2026 is an ambitious but entirely achievable goal. It demands a strategic approach, unwavering commitment to financial rebuilding, and a clear understanding of the lending landscape. You've embarked on a journey of financial recovery, and acquiring a reliable vehicle can be a crucial step in cementing that progress.

Recap of key strategies: Emphasizing preparation, informed decision-making, and proactive credit rebuilding.

Remember, the path to approval is paved with proactive steps: meticulously rebuilding your credit through consistent payments, fortifying your financial foundation with stable income and a manageable debt-to-income ratio, and diligently budgeting. Understand that specialized lenders are your best bet initially, and pre-approval is a powerful negotiation tool. Be transparent with your documentation and critically evaluate all terms, rates, and add-ons.

Empowerment for the next steps: A call to action for individuals to take control of their financial journey and secure their vehicle.

You are in control of your financial narrative. By applying the strategies outlined in this guide, you can confidently navigate the complexities of post-settlement auto financing. Don't let past challenges deter you from securing the transportation you need for your future. Start your application today and take that definitive step towards driving forward.

The long-term vision: How smart choices now pave the way for a healthier financial future.

This car loan is more than just transportation; it's a tool for credit rehabilitation. By managing it responsibly, you're not just getting from A to B; you're building a stronger financial future, improving your credit score, and opening doors to even better financial opportunities down the road. At SkipCarDealer.com, we are committed to helping you make those smart choices every step of the way.