Your Cash Stays Put. Assets Just Bought Your Car, No Down Payment, Toronto.

Table of Contents

- Key Takeaways: Unlocking Your Vehicle Purchase with Asset-Backed Power

- The Toronto Driver's Dilemma: Why 'No Down Payment' Resonates Now More Than Ever

- Beyond the Paycheque: What Exactly Constitutes 'Asset Income' for a Car Loan in Canada?

- The Spectrum of Acceptable Assets:

- The Lender's Lens: How Financial Institutions Assess Your Asset Portfolio for Vehicle Financing

- Valuation Methodologies:

- Risk Assessment: What Makes an Asset 'Attractive' to a Lender?

- Credit Score's Role (Still Relevant!):

- Pro Tip: Consolidate Your Financial Information

- Navigating the Loan Labyrinth: Asset-Backed vs. Traditional vs. Private Sale Loans

- The TD Canada Perspective (and beyond):

- Direct Asset-Backed Loans:

- Personal Loans (Secured by Assets):

- Hybrid Approaches:

- Exploring Interest Rates:

- The 'No Down Payment' Reality: What It Truly Means for Your Finances in Ontario

- Understanding 100% Financing:

- Opportunity Cost of Assets: Is Leveraging Your Assets Always the Best Financial Move?

- The 'Hidden' Costs: Beyond the Sticker Price and Interest Rate

- Pro Tip: Always Run a Detailed Total Cost of Ownership (TCO) Calculation

- Your Application Blueprint: Steps to Approval for Asset-Income Car Loans in Toronto

- Step 1: Asset Audit & Valuation

- Step 2: Income Verification (Even from Assets)

- Step 3: Credit Health Check

- Step 4: Lender Selection Strategy

- Step 5: The Application Process

- Step 6: Negotiation Tactics

- Pro Tip: Do Your Research First, Then Apply Strategically

- Beyond Toronto: Regional Nuances in Asset-Backed Lending Across Canada

- Ontario's Market:

- Western Canada (e.g., Vancouver, Calgary):

- Eastern Canada (e.g., Halifax):

- Quebec (e.g., Montreal):

- How Provincial Legislation Can Vary:

- The Road Ahead: Safeguarding Your Assets While Enjoying Your New Ride

- Understanding the Risks:

- Mitigation Strategies:

- Pro Tip: Consult with a Financial Planner Before Committing

- Your Next Steps to Approval: Driving Towards Smart Car Ownership in Toronto

- Frequently Asked Questions (FAQ): Your Asset-Backed Car Loan Queries Answered

Key Takeaways: Unlocking Your Vehicle Purchase with Asset-Backed Power

- Discover how your existing wealth, beyond a traditional salary, can secure a vehicle loan with no upfront cash in cities like Toronto.

- Learn the critical difference between using assets as collateral and using asset-generated income for loan qualification.

- Understand that 'no down payment' doesn't mean 'no risk'; strategic planning is paramount.

- Identify the diverse range of assets lenders consider, from real estate to investment portfolios.

- Get actionable steps to navigate the Canadian lending landscape for asset-income-backed car purchases.

The Toronto Driver's Dilemma: Why 'No Down Payment' Resonates Now More Than Ever

The hum of the Gardiner Expressway, the bustling streets of Yonge and Bloor, or the quiet suburban lanes of Mississauga and Brampton – driving in the Greater Toronto Area is an undeniable necessity for many. Yet, acquiring a vehicle in this vibrant, high-cost region presents a unique set of financial hurdles. Saving for a significant down payment can feel like an insurmountable task when faced with soaring housing costs, rising inflation, and the general expense of urban living in Toronto and its surrounding areas.

This reality has led many Canadians, particularly those in competitive markets like Ontario, to seek alternative pathways to vehicle ownership. What if your existing wealth, accumulated through smart investments or property, could pave the way for a new car without requiring you to touch your hard-earned cash reserves? This is precisely the premise of leveraging assets or asset-generated income for a car loan, offering a strategic solution to bypass the traditional down payment requirement.

There's a common misconception that such financial strategies are solely the domain of the ultra-rich. However, with careful planning and an understanding of how lenders assess your financial picture, utilizing your assets can be an accessible and intelligent move for a broader range of individuals. It's about recognizing the value in what you already possess and using it to your advantage, rather than letting your liquid cash dwindle.

Throughout this comprehensive guide, we'll delve deep into the mechanics of asset-backed car financing. We'll explore the benefits it offers, the potential risks to be aware of, and provide practical, actionable steps to help you navigate the Canadian lending landscape. Whether you're an entrepreneur with business assets, a homeowner with significant equity, or an investor with a robust portfolio, discover how your wealth can become your key to driving off the lot with a new vehicle, no upfront cash required.

Beyond the Paycheque: What Exactly Constitutes 'Asset Income' for a Car Loan in Canada?

When applying for a car loan, the traditional focus often revolves around your employment income – your salary or wages. But for a growing number of Canadians, especially those with diverse financial portfolios, wealth extends far beyond the regular paycheque. This is where the concept of 'asset income' and leveraging assets themselves comes into play, fundamentally altering how lenders assess your capacity to repay a loan.

It's crucial to differentiate between two related but distinct concepts: using income derived from assets and using the value of the assets themselves as leverage or collateral. Both can contribute to securing a no-down-payment car loan, but they function differently in the eyes of a lender.

- Asset Income: This refers to the regular, verifiable cash flow generated by your assets. Examples include rental income from investment properties, dividends from stocks, interest earned on investments (like GICs or bonds), or distributions from trusts. Lenders see this as a consistent revenue stream, much like a salary, that enhances your debt-servicing capacity.

- Assets as Leverage/Collateral: This involves pledging specific assets directly to the lender as security for the loan. In this scenario, the lender isn't necessarily looking at the *income* the asset generates, but rather its *value* and the ability to liquidate it if you default. Your equity in real estate or the market value of an investment portfolio could serve this purpose.

The Spectrum of Acceptable Assets:

Lenders consider a wide array of assets when evaluating your loan application. The key is their stability, liquidity, and verifiable value. Here’s a breakdown of commonly accepted asset types across Canada:

- Real Estate Equity: This is one of the most powerful assets. If you own a home, townhouse, or condominium, especially in robust markets like Toronto, Vancouver, or Montreal, the equity you’ve built can be a significant resource. Home Equity Lines of Credit (HELOCs) are a popular way to tap into this equity, providing a flexible source of funds. Alternatively, if you have unencumbered property (property without an existing mortgage or lien), you could potentially use it directly as collateral for a loan. Rental income from investment properties also falls under asset income.

- Investment Portfolios: Your diversified investment holdings can speak volumes about your financial strength. This includes:

- Stocks and Bonds: Publicly traded securities can be used, though lenders will assess their volatility.

- Mutual Funds and Exchange-Traded Funds (ETFs): Diversified funds are often viewed more favourably than individual volatile stocks.

- Guaranteed Investment Certificates (GICs): These are highly attractive due to their fixed returns and low risk.

- Registered Accounts (TFSAs, RRSPs): While direct pledging of these accounts is complex due to tax implications and withdrawal rules, their underlying value can be considered as part of your overall net worth, signaling strong financial health. Some institutions might offer loans against the value of these accounts.

- Business Assets: For entrepreneurs and self-employed individuals in bustling business hubs like Calgary or Quebec City, your business assets can be leveraged. This might include accounts receivable, equipment, inventory, or even the established goodwill of your business, provided it has a clear, verifiable value and generates consistent income.

- Collectibles & Valuables: High-value art, luxury vehicles (beyond the one you're purchasing), precious metals, or rare antiques can sometimes be considered. However, these often require specialized appraisals and may be accepted only by niche lenders due to their unique valuation challenges and lower liquidity compared to other assets.

- Guaranteed Income Streams: Beyond traditional employment, many individuals receive stable, predictable income from other sources. This includes annuities, pension payouts, or structured settlements from insurance claims. Lenders view these as highly reliable income streams, significantly bolstering your repayment capacity. For example, if you're receiving a settlement, a lender might view this future income favourably, much like our article on Nova Scotia: Your Settlement's Coming. Your Car Just Arrived. highlights.

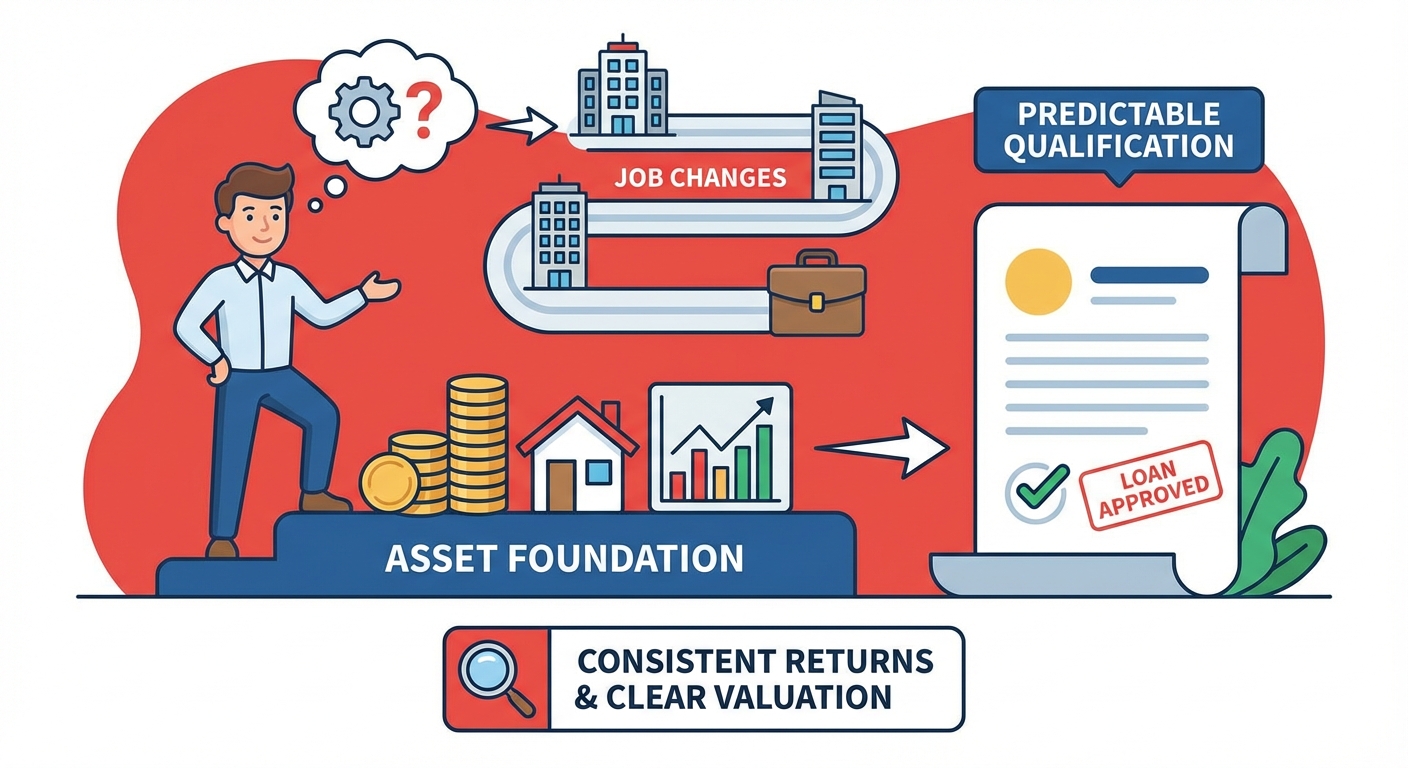

Lenders are primarily concerned with the 'income stability' derived from these assets. Unlike a fluctuating salary that might be subject to economic downturns or job changes, well-managed assets can provide a more predictable and often more substantial foundation for loan qualification. They look for a history of consistent returns or a clear valuation that can be easily converted to cash if necessary.

Context: An infographic illustrating various types of assets (house, stock chart, business ledger, luxury watch) flowing into a 'car loan' bubble, emphasizing diversification.

Context: An infographic illustrating various types of assets (house, stock chart, business ledger, luxury watch) flowing into a 'car loan' bubble, emphasizing diversification.The Lender's Lens: How Financial Institutions Assess Your Asset Portfolio for Vehicle Financing

Understanding how lenders view your assets is paramount to a successful no-down-payment car loan application. It's not just about *having* assets; it's about how those assets are valued, their inherent risks, and how they contribute to your overall financial profile. Banks, credit unions, and specialized lenders across Canada, from TD Canada to local credit unions in Prince Edward Island, apply specific methodologies to evaluate your wealth.

Valuation Methodologies:

When you present an asset, lenders don't just take its face value. They conduct their own due diligence to determine its true worth and suitability as collateral or as a source of verifiable income.

- Market Value vs. Liquidation Value: For assets like real estate or publicly traded stocks, lenders often consider both the current market value (what it could sell for today) and its liquidation value (what it could sell for quickly under duress). The liquidation value is usually lower, reflecting the risk of a forced sale.

- Haircuts and Loan-to-Value (LTV) Ratios: Lenders rarely lend 100% against an asset's market value. They apply a 'haircut' – a percentage reduction – to account for market fluctuations and the costs of liquidation. For instance, a stock portfolio might only be recognized at 50-70% of its market value for loan purposes, while real estate might have an LTV of 70-80% for a HELOC. This means if your property is valued at $800,000 and you have a $400,000 mortgage, your equity is $400,000, but a lender might only approve a loan for 70-80% of that equity.

- Appraisals: For less liquid assets like real estate, collectibles, or business assets, professional appraisals are mandatory. These provide an independent, expert assessment of the asset's worth, giving the lender confidence in its value.

Risk Assessment: What Makes an Asset 'Attractive' to a Lender?

Lenders are inherently risk-averse. They seek assets that minimize their exposure and provide a clear path to recovery if a loan goes south.

- Liquidity: How quickly and easily can the asset be converted to cash without significant loss of value? Publicly traded stocks are generally highly liquid, whereas a unique piece of art or a specialized business asset might be less so. Highly liquid assets are preferred.

- Volatility: Is the asset's value stable or prone to significant swings? Real estate, while subject to market cycles, is generally considered less volatile than, say, speculative growth stocks. Stable assets reduce the lender's risk profile.

- Encumbrances: Are there any existing liens, charges, or debts against the asset? A property with an existing mortgage or a business asset already pledged as collateral will have less available equity to secure a new loan. Lenders prefer assets that are 'free and clear' or have substantial unencumbered value.

Credit Score's Role (Still Relevant!):

Even with substantial assets, your credit score remains a critical factor. A high net worth doesn't automatically negate a poor credit history. Lenders use your credit score (from agencies like Equifax and TransUnion) to assess your past repayment behaviour and financial responsibility. A strong credit score signals that you are a reliable borrower, even if your income stream is unconventional. Conversely, a low credit score, even with significant assets, might lead to higher interest rates or stricter loan terms. If you're concerned about your credit score, remember that Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto. highlights the importance of finding the right lender.

Pro Tip: Consolidate Your Financial Information

When applying for an asset-backed loan, presentation is key. Have detailed statements, professional appraisals, and clear income proofs ready for all declared assets. Organize everything meticulously. A well-prepared, transparent application speaks volumes to lenders, demonstrating your financial acumen and seriousness, which can expedite the approval process and potentially lead to better terms.

Navigating the Loan Labyrinth: Asset-Backed vs. Traditional vs. Private Sale Loans

When it comes to financing a vehicle in Canada, you have a spectrum of options. Understanding how asset-backed financing fits into this landscape, and how it compares to traditional and private sale loans, is essential for making an informed decision. Let's look at the different avenues available, particularly through the lens of a major institution like TD Canada and other specialized lenders.

The TD Canada Perspective (and beyond):

Major banks like TD Canada, RBC, BMO, Scotiabank, and CIBC offer various car loan products. Their approach to asset-backed lending can vary, often being more conservative than specialized lenders but offering competitive rates for well-qualified applicants.

- Private Sale Vehicle Loan: TD, like many banks, offers financing specifically for vehicles purchased from a private seller. In this scenario, the vehicle itself typically serves as the primary collateral. The bank provides the funds upfront, allowing you to pay the seller directly. How do assets influence this? While your assets might not be direct collateral, evidence of significant asset income or a strong net worth can significantly strengthen your application, potentially securing a lower interest rate and a higher approved amount, even if the primary collateral is the vehicle. For more on private sales, especially with different credit situations, you might find our guide on Bad Credit? Private Sale? We're Already Writing the Cheque. helpful.

- TD Auto Finance (Dealership Loans): This is financing arranged directly through a dealership, often facilitated by major banks. Here, assets might play a more indirect role. While the vehicle is still the primary collateral, your asset income and overall financial picture can influence the lender's risk assessment, potentially leading to approval for a larger loan amount or a better interest rate than someone with only a traditional paycheque. This can be especially beneficial if you're aiming for a luxury vehicle, where a strong asset base can demonstrate your capacity to handle higher payments, much like the considerations in Your Luxury Ride. No Pay Stub Opera.

Direct Asset-Backed Loans:

These are loans where specific, high-value assets (like investment portfolios or real estate equity) are directly pledged as collateral. This is distinct from simply using asset *income* to qualify.

- Pros:

- Potentially Lower Interest Rates: The strong security provided by your assets significantly reduces the lender's risk, often translating into more favourable interest rates compared to unsecured loans or even traditional car loans where only the vehicle is collateral.

- Higher Loan Amounts: The substantial value of your assets can secure a much larger loan, allowing you to purchase a more expensive vehicle.

- No Down Payment Needed: This is the core appeal – your assets are doing the heavy lifting, preserving your cash.

- Preserves Liquidity: You don't have to sell off investments or dip into savings to make a down payment.

- Cons:

- Risk of Asset Forfeiture: If you default on the loan, the lender has the right to seize and sell your pledged assets to recover their funds.

- Margin Calls (for Investment-Backed Loans): If the market value of your pledged investment portfolio drops significantly, the lender might issue a 'margin call,' requiring you to provide additional collateral or pay down a portion of the loan immediately.

- Complex Setup: These loans often involve more paperwork, legal agreements, and potentially higher setup fees due to the detailed valuation and pledging process of assets.

Personal Loans (Secured by Assets):

Another approach is to secure a general personal loan using your assets, and then use that cash to purchase the car outright. This can offer more flexibility in terms of where you buy the car (private sale vs. dealership) and how you structure the purchase. However, if the personal loan isn't explicitly tied to the asset's value and merely uses it for qualification, the interest rates might be higher than a direct asset-backed car loan.

Hybrid Approaches:

Many loan structures combine elements. For instance, you might use your strong asset income to demonstrate repayment capacity, while the new vehicle itself still serves as the primary collateral. This can be a sweet spot, offering good rates without directly pledging all your core assets.

Exploring Interest Rates:

Interest rates (fixed vs. variable) are heavily influenced by the security you provide. In the current Canadian economic climate, with fluctuating interest rates, the stability offered by asset backing can be a significant advantage. Lenders are more likely to offer competitive fixed rates for asset-backed loans, providing payment predictability, whereas variable rates might be tied to the prime rate and fluctuate, potentially increasing your payments over time.

| Loan Type | Primary Collateral | Down Payment Typically Required | Interest Rate Potential | Risk to Applicant's Assets |

|---|---|---|---|---|

| Traditional Car Loan (Dealership/Bank) | The vehicle being purchased | Often required (0-20%+) | Moderate (based on credit/income) | Low (only the car is at risk) |

| Direct Asset-Backed Loan | Pledged personal assets (e.g., real estate, investments) | No down payment needed | Potentially Lower (due to strong security) | High (pledged assets at risk) |

| Personal Loan (Secured by Assets) | General assets (can be flexible) | No down payment needed (cash used directly) | Moderate to Higher (depending on specific collateral/terms) | Moderate to High (secured assets at risk) |

| Private Sale Loan (Vehicle as Collateral) | The vehicle being purchased | Often required (0-20%+) | Moderate (based on credit/income) | Low (only the car is at risk) |

The 'No Down Payment' Reality: What It Truly Means for Your Finances in Ontario

The allure of a "no down payment" car loan is powerful, especially in financially demanding cities like Toronto. It offers immediate access to a new vehicle without depleting your liquid savings. However, it's crucial to understand the full financial implications of 100% financing and how leveraging your assets for this purpose impacts your broader financial health.

Understanding 100% Financing:

When you secure a no-down-payment loan, you are essentially borrowing the full purchase price of the vehicle, plus any applicable taxes, fees, and interest, from day one. This has several direct consequences:

- Impact on Total Interest Paid: A larger principal amount borrowed means you'll pay more in total interest over the life of the loan, even if you secure a favourable interest rate. The interest accrues on the entire vehicle cost from the outset.

- Higher Monthly Payments: Without a down payment to reduce the principal, your monthly loan payments will be higher compared to a loan with an initial cash injection. This requires careful budgeting to ensure the payments are comfortably sustainable within your cash flow, even with your asset income.

- Negative Equity Risk: Vehicles typically depreciate rapidly, especially in the first few years. With 100% financing, you're likely to be in a position of 'negative equity' for a significant period, meaning you owe more on the car than it's worth. This can be problematic if you need to sell the car early or if it's totaled in an accident and your insurance payout doesn't cover the outstanding loan amount.

Opportunity Cost of Assets: Is Leveraging Your Assets Always the Best Financial Move?

While leveraging assets avoids a cash down payment, it's not without its own form of cost – the 'opportunity cost.' This is the value of the next best alternative that you forego when making a choice.

- What are you giving up by pledging assets or using their income? If you pledge an investment portfolio, you might miss out on potential growth or dividends from those specific assets. If you use rental income, that cash flow is now committed to car payments instead of reinvestment or other financial goals. It's vital to weigh the interest paid on the car loan against the potential returns your assets could generate if left untouched or invested elsewhere.

- Comparing Potential Returns vs. Loan Interest: If your investments are generating a 7% annual return, and your car loan interest rate is 5%, you might be better off selling a portion of your investments for a down payment (or even the full car purchase) rather than paying interest. Conversely, if your investments are yielding lower returns than your loan interest, leveraging them could make more financial sense, preserving cash that might otherwise be underperforming.

The 'Hidden' Costs: Beyond the Sticker Price and Interest Rate

The cost of car ownership extends far beyond the purchase price and loan interest. These 'hidden' costs are particularly relevant in a city like Toronto, where expenses can quickly add up.

- Insurance Premiums: Ontario has some of the highest car insurance rates in Canada. Financing a brand-new vehicle, especially a luxury model, will likely result in higher premiums, as you'll need comprehensive coverage to protect the lender's interest.

- Registration Fees, Provincial Sales Tax (PST) in Ontario, Licensing: These upfront costs are often not included in the financed amount and must be paid out of pocket. For Ontario residents, the PST (8% on the purchase price) can be a substantial sum.

- Maintenance and Repairs: New cars require routine maintenance, and older vehicles can incur significant repair costs. Budgeting for these is essential.

- Fuel: Gas prices fluctuate, but they are a constant and significant expense, especially for daily commutes in the GTA.

- Depreciation: Your car's value will decline over time. While not an out-of-pocket cost, it impacts your net worth and the equity you hold in the vehicle.

Pro Tip: Always Run a Detailed Total Cost of Ownership (TCO) Calculation

Before committing to any car loan, especially one with no down payment, calculate the total cost of ownership. Use online tools or consult a financial advisor to factor in all expenses: loan payments (principal + interest), insurance, fuel, maintenance, registration, and even potential parking costs in Toronto. This comprehensive view helps you understand the long-term financial commitment, not just the attractive monthly payment, ensuring your new ride is a sustainable asset, not a financial burden.

Your Application Blueprint: Steps to Approval for Asset-Income Car Loans in Toronto

Securing an asset-income or asset-backed car loan, particularly in a competitive market like Toronto, requires a methodical and well-prepared approach. It's about presenting your financial story in the most compelling way possible. Here’s a step-by-step blueprint to guide you through the process:

Step 1: Asset Audit & Valuation

Begin by meticulously cataloging all your eligible assets. This isn't just a mental inventory; it's about gathering concrete proof of ownership and value.

- Document Everything: Collect statements for investment accounts (stocks, bonds, mutual funds, GICs, TFSAs, RRSPs), property deeds, rental agreements and income statements, business financial statements, and any other relevant documentation for valuable collectibles or guaranteed income streams.

- Obtain Professional Appraisals: For assets like real estate, business assets, or high-value collectibles, professional appraisals are critical. These provide an unbiased, expert assessment of the asset's current market value, which lenders will rely on heavily. Ensure the appraisers are reputable and recognized in Canada.

Step 2: Income Verification (Even from Assets)

Just as a traditional employee provides pay stubs, you need to provide clear, verifiable proof of your asset-generated income.

- Clear Statements: Present bank statements showing consistent rental income deposits, dividend payouts, interest payments, or trust distributions over a sustained period (typically 12-24 months).

- Tax Documents: Provide your Canada Revenue Agency (CRA) Notice of Assessment and tax returns (T1 General) for the past two to three years, which will show reported asset income.

- Business Financials: If using business income, provide detailed profit and loss statements, balance sheets, and cash flow statements, preferably prepared by an accountant.

Step 3: Credit Health Check

Even with substantial assets, your credit score and history are vital. Lenders will always review this to assess your past financial behaviour.

- Obtain Your Credit Report and Score: Request copies from both Equifax and TransUnion, Canada's primary credit bureaus. Review them carefully for any errors or discrepancies.

- Address Discrepancies: If you find inaccuracies, dispute them immediately. A clean credit report can significantly improve your chances of approval and secure better rates.

- Understand Your Score: Familiarize yourself with what constitutes a "good" or "excellent" credit score in Canada. Work to improve it if necessary before applying.

Step 4: Lender Selection Strategy

Not all lenders are created equal, especially when it comes to unconventional income or asset-backed loans. Tailor your search to lenders most likely to appreciate your financial profile.

- Traditional Banks (RBC, BMO, Scotiabank, CIBC, TD Canada Trust): While they offer competitive rates, their appetite for direct asset-backed lending (beyond standard HELOCs) can vary. They often prefer highly liquid, easily verifiable assets. Engage with their wealth management divisions if applicable, as they might have more tailored solutions.

- Credit Unions: Often more flexible and community-focused, credit unions in regions like rural Ontario or across the Prairies may be more willing to work with unique financial situations and develop customized loan products.

- Specialized Lenders: For high-net-worth individuals, those with complex business assets, or unique asset classes, specialized lenders (e.g., private wealth lenders, some non-bank financial institutions) are often the best choice. They have the expertise to value and structure loans against a broader range of assets.

Step 5: The Application Process

Once you've selected potential lenders, it's time to formally apply.

- What to Expect: Be prepared for a detailed financial review. Lenders will want to understand your entire financial picture, including liabilities (existing debts, mortgages, etc.) alongside your assets and income.

- Key Documents Required: Beyond asset and income proofs, you'll need government-issued ID, proof of residence, and details of the vehicle you intend to purchase.

- Interview Tips: Be open, honest, and proactive in providing information. Clearly articulate your financial strategy and demonstrate your understanding of the loan terms.

Step 6: Negotiation Tactics

Your strong asset position can be a significant bargaining chip.

- Leverage Your Security: Emphasize the stability and value of your assets as collateral or income source. This reduces the lender's risk, giving you leverage to negotiate for lower interest rates or more flexible terms.

- Compare Offers: Don't settle for the first offer. If you've approached multiple suitable lenders, compare their terms, rates, and fees. Use a competitive offer from one lender to negotiate a better deal with another.

Pro Tip: Do Your Research First, Then Apply Strategically

While it's tempting to apply to multiple lenders simultaneously to compare rates, doing so can result in multiple 'hard inquiries' on your credit report, which can temporarily lower your credit score. Instead, conduct thorough research on lenders' policies and requirements before submitting a formal application. Once you've identified the most suitable options, aim to apply to a limited number, perhaps two or three, within a short timeframe (e.g., 14-30 days) to minimize the impact on your score. This demonstrates a focused approach to securing financing.

Beyond Toronto: Regional Nuances in Asset-Backed Lending Across Canada

While the principles of asset-backed lending remain consistent, the application and prevalence of these methods can exhibit interesting regional nuances across Canada. The local economic climate, housing markets, and even provincial legislation can subtly influence how lenders approach your asset portfolio, whether you're in Halifax or Vancouver.

Ontario's Market:

As discussed, Ontario, particularly the Greater Toronto Area, is characterized by high demand for vehicles and a diverse lending environment. The robust real estate market here often makes home equity a primary asset for securing loans. Lenders in Ontario are generally well-versed in asset-backed financing, given the sophisticated financial landscape of the province. You'll find a wide array of options from major banks to specialized lenders, making it a competitive market where strong asset profiles can yield excellent rates.

Western Canada (e.g., Vancouver, Calgary):

Provinces like British Columbia and Alberta boast strong real estate markets (especially Vancouver) and significant resource-based economies. Consequently, Home Equity Lines of Credit (HELOCs) and property-backed loans are exceptionally popular for unlocking liquidity. For entrepreneurs in Calgary's energy sector or Vancouver's tech scene, business assets and investment portfolios are also frequently leveraged. Lenders in these regions are accustomed to dealing with high-net-worth individuals and those with substantial asset bases, making asset-backed solutions a common and often streamlined option.

Eastern Canada (e.g., Halifax):

While generally a smaller market than the economic powerhouses of Ontario or British Columbia, Eastern Canada, including provinces like Nova Scotia and New Brunswick, still offers viable asset-backed lending solutions. Local credit unions, in particular, often play a more prominent role here. They tend to be more community-focused and may offer tailored, flexible solutions for clients with unique asset profiles, perhaps even considering less conventional assets or income streams that larger national banks might overlook. The personal relationship built with a local lender can be a significant advantage.

Quebec (e.g., Montreal):

Quebec operates under a unique civil law system, which can influence legal aspects of finance, including collateral registration and consumer protection. While the types of assets considered are similar, the specific legal documentation and processes for pledging assets might differ from common law provinces. Lenders in Montreal and across Quebec are adept at navigating these provincial regulations, and it's essential for applicants to understand these nuances. Bilingual services and specific provincial financial products are also more prevalent.

How Provincial Legislation Can Vary:

Provincial legislation concerning consumer protection, collateral registration, and property rights can impact asset-backed lending. For example, some provinces might have different regulations regarding what types of assets can be easily pledged or how quickly they can be repossessed in case of default. The local economic climate also plays a role; a booming housing market makes real estate equity more attractive to lenders, while a downturn might lead to more conservative lending practices.

The Road Ahead: Safeguarding Your Assets While Enjoying Your New Ride

Embracing asset-backed financing to purchase your car with no down payment can be a financially astute move, preserving your cash and leveraging your existing wealth. However, like any significant financial decision, it comes with inherent risks. Acknowledging and strategically mitigating these risks is paramount to protecting your financial future while enjoying the freedom of your new vehicle.

Understanding the Risks:

- Asset Forfeiture if Loan Terms are Breached: This is the most significant risk. If you use an asset as direct collateral and fail to meet your loan obligations (e.g., missing payments), the lender has the legal right to seize and liquidate that asset to recover the outstanding debt. This could mean losing your investment portfolio, a piece of property, or other valuable possessions.

- Market Volatility Affecting Pledged Assets: For assets like stocks, bonds, or even real estate, market values can fluctuate. If the value of your pledged assets drops significantly, the lender might issue a 'margin call' (especially for investment-backed loans), requiring you to provide additional collateral or pay down the loan immediately. This can put immense pressure on your finances.

- Over-Leveraging and Its Impact on Your Overall Financial Health: Taking on too much debt, even with substantial assets, can strain your financial resilience. If unforeseen circumstances arise (e.g., a job loss, health issue, or market downturn), being heavily leveraged can make it difficult to meet your obligations, potentially impacting your credit score and other financial goals.

Mitigation Strategies:

Prudent planning can significantly reduce your exposure to these risks.

- Building an Emergency Fund *Separate* from Pledged Assets: Maintain a robust emergency fund (typically 3-6 months of living expenses) in liquid, accessible cash, completely separate from any assets you've pledged. This fund acts as a buffer against unexpected financial shocks, ensuring you can continue making loan payments even if your primary income source is disrupted.

- Diversifying Your Asset Portfolio: Avoid putting all your eggs in one basket. If you're leveraging investments, ensure your remaining portfolio is well-diversified to minimize the impact of volatility in any single asset class.

- Regularly Reviewing Loan Terms and Market Conditions: Stay informed. Periodically review your loan agreement and current market conditions for your pledged assets. If you have a variable interest rate loan, monitor interest rate trends. If your assets are volatile, keep an eye on their performance. This proactive approach allows you to make adjustments before problems escalate.

- Considering Loan Protection Insurance: Some lenders offer loan protection insurance, which can cover your payments in case of job loss, disability, or critical illness. While an added cost, it provides an extra layer of security, safeguarding your assets and your financial stability.

Pro Tip: Consult with a Financial Planner Before Committing

Before you finalize any asset-backed loan, especially for a significant purchase like a car, sit down with a qualified financial planner. They can provide an objective assessment of your risk tolerance, analyze the long-term implications of leveraging your specific assets, and ensure the loan aligns with your broader financial goals and wealth management strategy. Their expertise can help you make a truly informed decision and avoid potential pitfalls.

Your Next Steps to Approval: Driving Towards Smart Car Ownership in Toronto

The journey to car ownership in a dynamic city like Toronto doesn't always have to begin with a substantial cash down payment. As we've explored, leveraging your existing assets or the income they generate offers a powerful and increasingly popular alternative. It's a strategy that allows your accumulated wealth to work for you, preserving your liquid cash for other essential needs or investment opportunities.

However, the key to successfully navigating this path lies in informed decision-making. It requires due diligence in understanding the different types of assets lenders consider, the valuation methods they employ, and the precise terms of your loan. Comparing options, scrutinizing interest rates, and being fully aware of the hidden costs and potential risks are all non-negotiable steps.

By taking control of your financial journey, performing thorough research, and preparing a robust application, you can unlock the power of your assets to secure the vehicle you need. Whether it's the convenience of a new sedan for your daily commute in Scarborough, a rugged SUV for weekend getaways from Burlington, or a sleek electric vehicle for downtown Toronto, your assets can be the engine that drives your approval.

Empower yourself with knowledge, strategize your approach, and get ready to experience the freedom of the open road, knowing your financial foundation remains strong.

Context: A diverse group of people (family, young professional, senior) happily interacting with a new car at a dealership or private sale setting, symbolizing successful car acquisition.

Context: A diverse group of people (family, young professional, senior) happily interacting with a new car at a dealership or private sale setting, symbolizing successful car acquisition.