The transition from a lecture hall to the professional world is one of the most exhilarating-and stressful-periods of your life. In Canada, where the geography is vast and the winters are unforgiving, that transition almost always requires a reliable set of wheels. Whether you are commuting to your first "real" job in downtown Toronto or heading to a specialized coop placement in rural Alberta, a vehicle is often the bridge between your education and your career. However, for many Canadian students, the prospect of securing a car loan feels like a classic "chicken and egg" problem: you need a car to get to the job, but you need the job history to get the car loan.

The reality is that "Student Car Loans in Canada" aren't just a marketing gimmick; they are a specialized financial ecosystem designed to bridge this exact gap. Lenders recognize that while you might be "cash poor" today, your degree or diploma makes you "asset rich" in terms of future earning potential. This guide is your comprehensive roadmap to navigating that ecosystem, moving you from graduation day to the driver's seat with the best possible terms.

Key Takeaways

- The Grad Advantage: Specialized graduate programs offer lower interest rates and deferred payment options that standard loans simply can't match.

- The 90-Day Window: Your eligibility for "New Grad" incentives typically peaks within 90 days of your graduation date (before or after).

- Documentation is Collateral: In the absence of a long credit history, your diploma and a signed job offer letter act as your primary security.

- Long-Term Health: Your first car loan is the single most effective way to build a robust Canadian credit score, provided you manage it correctly.

- Total Cost Focus: Approval is about more than the monthly payment; it's about proving you can handle insurance, maintenance, and fuel.

Understanding the Landscape: What is a Student Car Loan?

When you walk into a dealership or a bank, you might see advertisements for "First Time Buyer" programs. While these are helpful, they are not the same as a dedicated Student or Graduate Auto Loan. Standard subprime loans often come with predatory interest rates because the lender views a "no-credit" applicant as a high risk. In contrast, a Canadian Graduate Loan is a prime or near-prime product. Banks like Scotiabank, RBC, and TD have specific departments that look at your academic credentials as a predictor of financial stability.

Defining Student-Specific Financing in Canada

Unlike a standard loan that relies heavily on your past three years of income, a student-specific loan looks at your future. These programs are designed for students in their final year of study or those who have graduated within the last 24 to 36 months. The primary difference lies in the underwriting. A standard loan might require two years of continuous employment; a grad loan might only require a letter of intent from a future employer and a copy of your transcripts.

The Role of Major Canadian Banks

Major institutions, particularly Scotiabank with their "Start Right" and specialized automotive programs, dominate this space. They partner with dealerships across the country to offer "on-the-spot" financing. This means the dealership's finance manager can pull up a specific "Grad Tier" rate that is significantly lower than what a non-student with the same credit profile would receive. They aren't just lending you money for a car; they are trying to win your loyalty for future products like mortgages and investments.

Eligibility Secrets: The Criteria That Actually Matter

To get approved, you need to understand the "Big Four" requirements. Lenders in Canada have a very specific set of boxes they need to tick before they can release funds to a student. If you walk in prepared with these documents, your approval chances jump by nearly 80%.

Academic Requirements for Approval

Not all certificates are created equal in the eyes of a lender. Most Canadian "Grad Programs" require a minimum of a two-year accredited college diploma or a three-year university degree. If you are finishing a one-year certificate program, you may still qualify for first-time buyer incentives, but you might miss out on the ultra-low "Grad Rates."

There is also the "Final Year Loophole." Many students wait until they have their physical diploma in hand to apply. This is a mistake. Most lenders will approve you if you are within four months of graduation, provided you can show a transcript that proves you are on track to complete your requirements. This allows you to have your transportation secured before the post-grad job hunt begins in earnest.

Income and Employment Verification

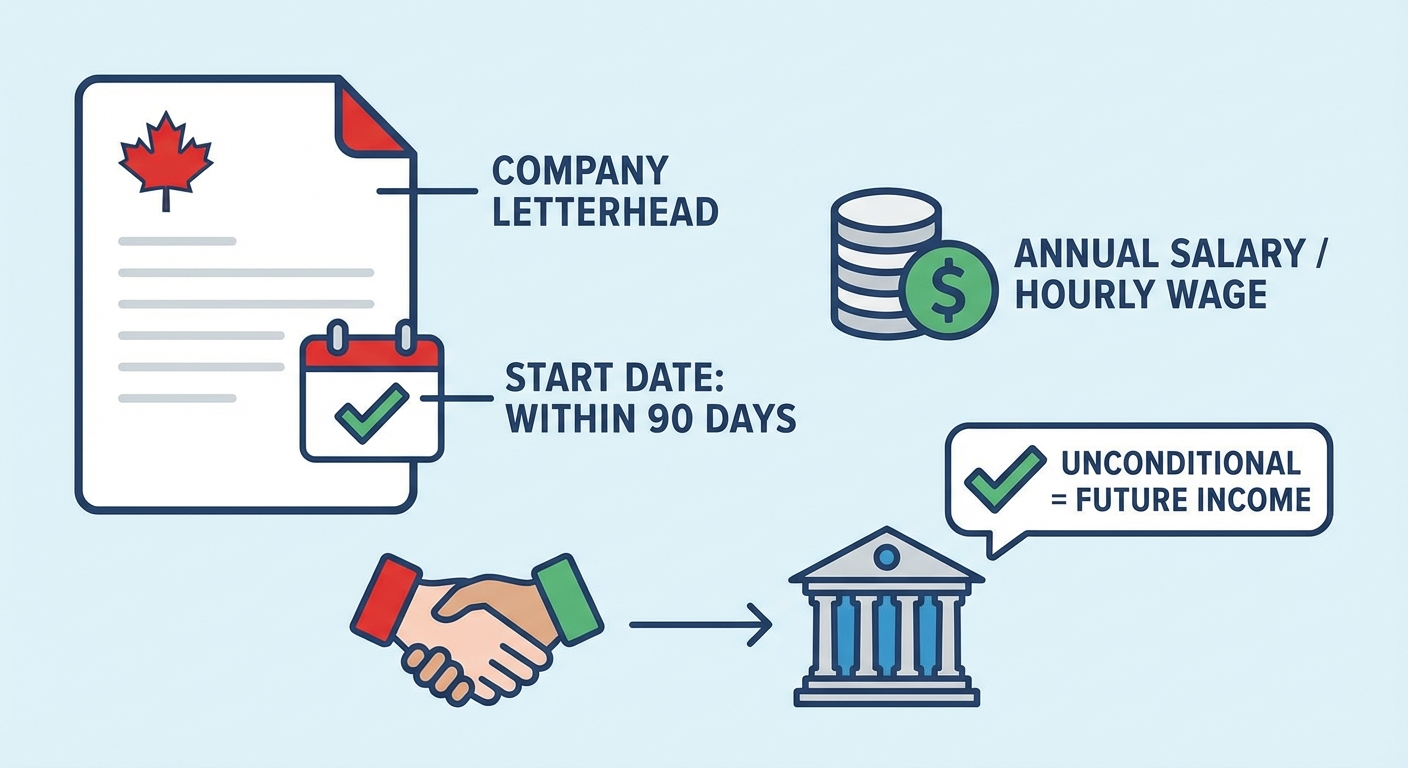

How do you prove income if you haven't started your job yet? This is where the "Letter of Intent" or "Offer Letter" becomes your most powerful tool. A valid offer letter must be on company letterhead, state your start date (usually within 90 days), and clearly outline your annual salary or hourly wage. If the letter is "unconditional," lenders will treat that future income as if it is already hitting your bank account.

Minimum Income Thresholds

Even with a grad program, most lenders want to see a "pathway to serviceability." This usually means a projected gross income of at least $30,000 to $35,000 per year. If your first job out of school pays less than this, you may need to look at a smaller loan amount or consider a co-signer to bridge the gap.

The Scotiabank Blueprint: Analyzing Top-Tier Grad Programs

Scotiabank is often cited as the gold standard for Canadian student automotive financing. Their program structure serves as a great template for what you should expect from a high-quality lender. They focus on "Near-New" vehicles and offer features that cater to the volatile cash flow of a recent graduate.

| Feature | Standard Auto Loan | Scotiabank Grad Program |

|---|---|---|

| Interest Rates | 6.99% - 15.99% (No Credit) | 4.99% - 7.99% (Tier 1 Grad) |

| Down Payment | Often 10-20% Required | 0% Down Options Available |

| First Payment Deferral | 30 Days | Up to 90 Days |

| Maximum Vehicle Age | Up to 10 Years | Up to 3 Years (Recommended) |

Leveraging Special Features

The 90-Day No-Payment Grace Period is a double-edged sword. It's fantastic for a new grad who needs to save up for their first month's rent or buy professional work clothes. However, you must remember that interest still accrues during those 90 days. If you use this feature, try to make a small "interest-only" payment in month two to prevent your principal balance from growing before you've even made your first official payment.

New vs. Used: The "Near-New" Sweet Spot

Lenders love "Near-New" vehicles-cars that are 1 to 3 years old with low mileage. Why? Because these vehicles have already taken their biggest depreciation hit, but they are still under factory warranty. For a student, this represents the lowest risk of a mechanical breakdown that could derail your ability to make loan payments. Approvals are often easier for a $25,000 car that is 2 years old than for a $15,000 car that is 8 years old.

Credit Scores and the Student Applicant

Most Canadian students suffer from a "Thin Credit File." This simply means you haven't had enough credit products for long enough for the credit bureaus (Equifax and TransUnion) to generate a reliable score. Many students worry that "no credit" is the same as "bad credit." In the eyes of an auto lender, this couldn't be further from the truth.

Thin Credit vs. Bad Credit

A "Thin File" is a blank canvas. Lenders see you as an opportunity. "Bad Credit," which involves missed payments, collections, or bankruptcies, is a red flag. If you have no credit, the lender will rely entirely on your graduation status and income. If you have a credit card that you've paid off every month for a year, you are in an even better position. Even a $500 limit student Visa card is enough to prove you understand the mechanics of borrowing and repaying.

The Role of a Co-signer

If your income is slightly below the threshold or your credit score is non-existent, a co-signer (usually a parent or guardian) can be a powerful ally. A co-signer isn't just a backup; their credit score is blended with yours. This can result in an interest rate that is 2-3% lower. The best part? After 12 to 24 months of on-time payments, many lenders allow you to apply for a "Co-signer Release," effectively moving the loan entirely into your name once your own credit score has matured.

Budgeting for the "Total Cost of Ownership" (TCO)

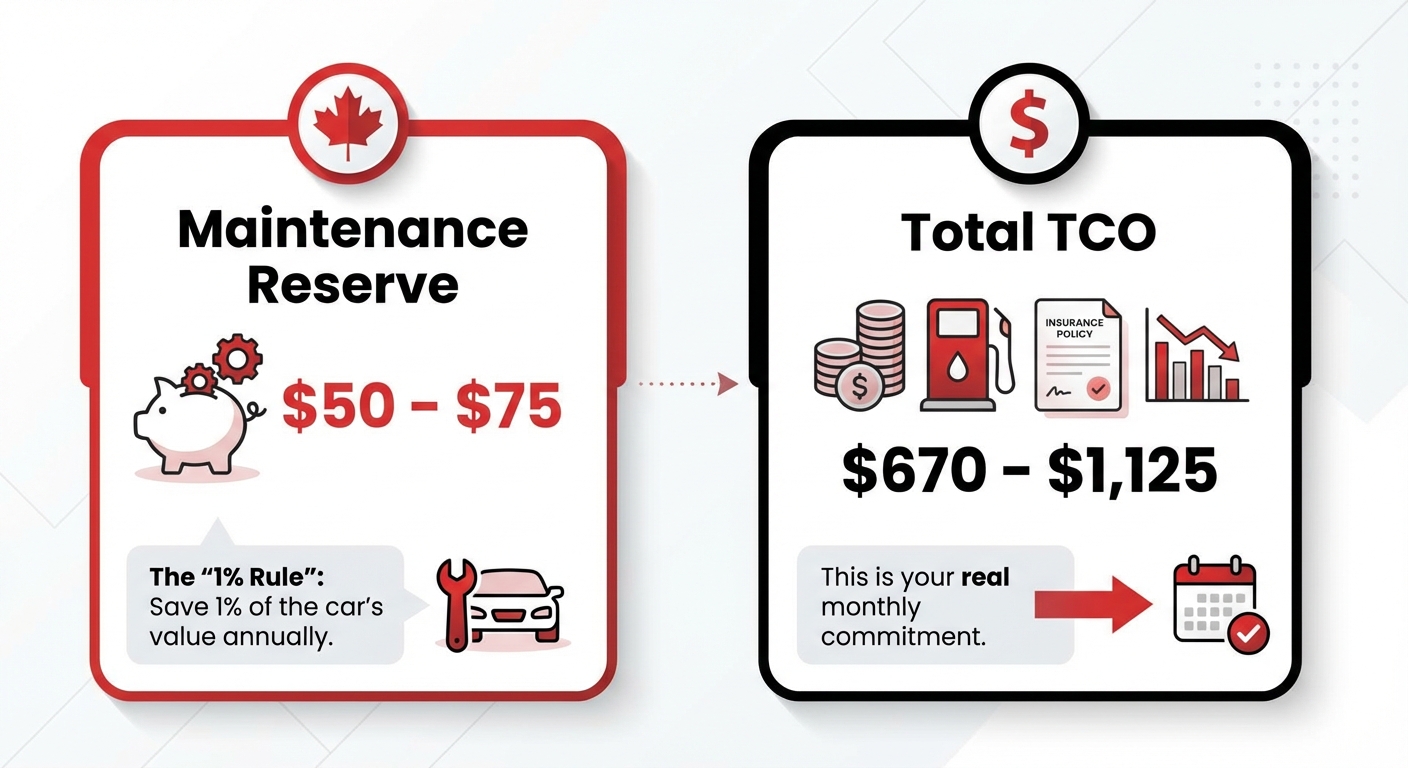

One of the biggest mistakes students make is budgeting only for the monthly loan payment. In Canada, the "sticker price" of the loan is only about 60% of what it actually costs to keep a car on the road. When a lender looks at your debt-to-income ratio, they are factoring in these hidden costs, and you should too.

Beyond the Monthly Payment

Insurance is the silent budget-killer for Canadian drivers under 25. Depending on your province (Ontario is notoriously expensive, while Quebec is generally lower), your insurance premium could be nearly as high as your car payment. Lenders require you to carry "Full Coverage" (Collision and Comprehensive) as a condition of the loan. You cannot just get basic liability coverage on a financed vehicle.

| Expense Category | Estimated Monthly Cost (CAD) | Notes |

|---|---|---|

| Loan Payment | $350 - $500 | Based on a $25k loan @ 6% for 60 months. |

| Insurance | $150 - $350 | Varies heavily by age, postal code, and driving record. |

| Fuel | $120 - $200 | Based on 1,200km/month driving. |

| Maintenance Reserve | $50 - $75 | The "1% Rule": Save 1% of the car's value annually. |

| Total TCO | $670 - $1,125 | This is your real monthly commitment. |

The Application Process: A Step-by-Step Guide

Getting approved isn't just about having the right papers; it's about the order in which you present them. Follow this three-phase approach to ensure you don't get stuck with a sub-optimal deal.

Phase 1: Pre-Approval and Research

Before you ever set foot on a dealership lot, get a pre-approval. This doesn't have to be a formal bank document; it can be as simple as speaking with a specialist at SkipCarDealer to see what "tier" you qualify for. Knowing you are approved for $30,000 at 5.9% prevents a salesperson from trying to put you into a high-interest 12% loan later.

Phase 2: Choosing the Right Vehicle

Reliability ratings aren't just for peace of mind; they affect your loan. Lenders are more likely to approve a loan for a Honda Civic or Toyota Corolla because these vehicles hold their value. If you default, the bank knows they can sell the car quickly. If you try to buy a niche luxury car with high maintenance costs, the lender might see that as an added risk to your "disposable income" and deny the application.

Phase 3: At the Dealership

When you arrive, be upfront. Tell the finance manager: "I am a recent graduate, and I want to utilize the Scotiabank Graduate Program (or equivalent)." This signals that you are an informed buyer. When they present the final contract, look closely at "Gap Insurance." For a student with 0% down, Gap Insurance is actually a smart move-it covers the difference between what you owe and what insurance pays if the car is totaled, which is common in the first two years of a loan.

Common Pitfalls to Avoid

The excitement of a first car can lead to some expensive mistakes. Avoid these three traps to keep your financial future on track.

The Danger of Long-Term Loans: You might be tempted by an 84-month (7-year) loan because the monthly payment is tiny. Do not do this. You will be "underwater" (owing more than the car is worth) for almost the entire duration of the loan. Stick to 60 months (5 years) or less. If you can't afford the 60-month payment, you can't afford the car.

High-Interest "Buy Here Pay Here" Lots: These lots often target students with "Guaranteed Approval." The catch? Interest rates of 20% to 30%. These loans are designed to fail. If a major bank or a reputable dealership won't approve you, it's better to wait six months and build your credit than to sign a predatory contract.

Over-extending on "Future" Income: That $60,000 salary sounds like a lot until you factor in Canadian taxes, CPP, EI, and your student loan repayments (like OSAP). Always budget your car based on your "Net" (take-home) pay, not your "Gross" (before-tax) salary.

Frequently Asked Questions

Can international students get car loans in Canada?

Yes, but it is more complex. International students typically need a study permit that is valid for the duration of the loan term. Additionally, since they lack a Canadian credit history, a larger down payment (usually 20-30%) or a Canadian co-signer is often required. Some specialized lenders focus specifically on newcomers and international students.

What is the minimum credit score required for a grad auto loan?

There is no "magic number" because grad programs are designed for people with "thin" credit. However, if you have established credit, a score of 650 or higher usually guarantees you the best "Tier 1" rates. If you have no score at all, your academic transcripts and job offer letter take priority over the score itself.

Can I get a loan if I am a part-time student?

Most dedicated "Graduate Programs" require you to have been a full-time student. If you are part-time, you may not qualify for the special "Grad Rates," but you can still apply for standard financing. You will need to rely more heavily on your current income and employment history than your student status.

How does a car loan affect my OSAP or student grants?

In most provinces, including Ontario, owning a vehicle is an allowable expense and does not directly reduce your OSAP funding, provided the vehicle is not considered a "luxury asset." However, the monthly loan payment will be factored into your overall financial "need." It is always best to check with your provincial financial aid office if you are receiving significant grants.

Is it better to lease or buy as a recent graduate?

Leasing offers lower monthly payments and keeps you under warranty, which is great for a fixed budget. However, leases have strict kilometer limits (usually 16,000 to 24,000 km per year). If your new job involves a long commute, buying is usually the better financial move. Buying also allows you to build equity in an asset that you can eventually trade in.

Securing your first car loan as a Canadian student is a strategic move that goes far beyond just getting a way to get to work. By leveraging specialized graduate programs, you are essentially getting a "head start" on your financial life. These programs acknowledge your hard work in the classroom by offering you terms that the general public has to spend years working for. Treat your vehicle as a tool for career growth, manage your payments with discipline, and you will find that your first car loan is the foundation upon which your entire Canadian credit profile is built. The road to independence is open; you just need the right paperwork to start the engine.