Part-Time Student Car Loan 2026: No Down Payment Canada

Table of Contents

- Key Takeaways

- The Unvarnished Truth: Why 'No Down Payment' for Part-Time Students is a High Bar

- Lender Logic: Understanding Risk Assessment for Students

- The 'No Down Payment' Promise: What It Really Means (and Doesn't)

- Defining the 'Part-Time Student' Profile: What Lenders Are Looking For Beyond Your Transcript

- Income Stability vs. Income Volume: The Part-Time Paradox

- The Credit Score Conundrum: Building Your Financial Reputation While Studying

- Debt-to-Income Ratio: Balancing Student Loans and Loan Applications

- Residency and Stability: Proving Your Roots

- Crafting an Irresistible Application: Strategies to Boost Your Approval Odds

- The Power of the Co-Signer: Leveraging Established Credit

- Demonstrating Responsible Financial Habits: Beyond the Credit Score

- Building a 'Financial Story': Presenting Your Case Proactively

- Secured Loans and Alternatives: When Traditional Paths Are Blocked

- Navigating the Financial Maze: Interest Rates, Hidden Fees, and Smart Budgeting

- Decoding Interest Rates: What Drives Them for Student Loans

- Beyond the Monthly Payment: Unmasking Hidden Costs of Car Ownership

- Strategic Budgeting for Student Drivers: Making Every Dollar Count

- Where to Turn: Banks, Dealerships, and Alternative Lending Avenues

- Traditional Banks and Credit Unions: The Gold Standard (and Their Hurdles)

- Dealership Financing: Convenience vs. Cost for Student Buyers

- Specialty and Subprime Lenders: A Last Resort? Understanding the Trade-offs

- Online Lenders and Loan Aggregators: Streamlined Applications, Varied Outcomes

- Making the Smart Car Choice: Vehicles That Align with Student Budgets

- New vs. Used: The Financial Implications for Student Borrowers

- Reliability and Resale Value: Future-Proofing Your Investment

- Insurance Premiums: How Vehicle Choice Impacts Your Monthly Outlay

- Beyond Approval: Sustaining Your Loan and Building Future Credit

- Mastering On-Time Payments: The Cornerstone of Credit Building

- The Refinancing Opportunity: Lowering Costs as Your Credit Grows

- Leveraging Your Car Loan for a Stronger Financial Future

- Your Strategic Path to Approval: Final Steps and Empowering Mindset

- Preparing Your Documentation Checklist: No Stone Unturned

- The Art of Negotiation: Securing the Best Terms

- A Proactive Mindset: Persistence and Patience Pay Off

- Frequently Asked Questions About Part-Time Student Car Loans (No Down Payment)

Navigating the journey of higher education in Canada often means balancing studies with work, and for many part-time students, reliable transportation is a crucial piece of that puzzle. Whether it’s for commuting to campus, getting to a part-time job, or simply managing daily life, a car can be a game-changer. But the idea of securing a car loan, especially with no down payment, can feel like a daunting challenge in 2026. Limited income, a nascent credit history, and the perceived risk can make lenders hesitant.

At SkipCarDealer.com, we understand these complexities. We’re here to demystify the process, offering a clear roadmap for part-time students in Canada aiming to drive off the lot without an initial cash outlay. This comprehensive guide will equip you with the knowledge, strategies, and insights needed to turn your car ownership dream into a reality, even with a part-time student status and no down payment.

Key Takeaways

- No Down Payment is Challenging but Achievable: Lenders view part-time students with no down payment as higher risk, but strategic preparation can significantly improve your odds.

- Income Stability Trumps Volume: Lenders prioritize consistent, verifiable part-time income over sporadic, large sums.

- Credit Building is Crucial: Start building a positive credit history early, even with small steps like secured credit cards or utility payments.

- Co-Signers Are Your Superpower: A financially stable co-signer can dramatically strengthen your application, leveraging their established credit.

- Budget Beyond the Payment: Factor in insurance, fuel, maintenance, and registration. The monthly loan payment is just one piece of the puzzle.

- Shop Smart for Both Car and Loan: Research reliable, economical vehicles and compare offers from banks, dealerships, and specialized lenders.

- Persistence Pays Off: If initially denied, use it as a learning opportunity to refine your financial profile and try again.

The Unvarnished Truth: Why 'No Down Payment' for Part-Time Students is a High Bar

Can a part-time student get a car loan with no down payment in Canada? Yes, it is possible, but it requires a strategic approach and understanding of lender expectations. While challenging due to typically limited income and credit history, demonstrating financial stability, utilizing a co-signer, and choosing an affordable vehicle can significantly improve approval chances for a zero-down car loan.

For many aspiring car owners, the concept of securing a vehicle with no money down is incredibly appealing. It removes a significant upfront financial barrier, making car ownership seem more accessible. However, when you add the 'part-time student' status into the mix, this aspiration enters a realm of increased complexity. Lenders, by their nature, are risk-averse, and a no-down-payment scenario for someone with a potentially limited income and credit history signals a higher risk profile.

It's not that lenders don't want to help; it's that they need to ensure the loan is repayable. A down payment acts as a buffer, reducing the loan amount and showing the borrower's commitment. Without it, the lender carries more risk, which often translates to more stringent requirements or less favourable terms for the borrower.

Lender Logic: Understanding Risk Assessment for Students

Financial institutions evaluate loan applications based on a comprehensive risk assessment. For part-time students, several factors often raise red flags from a lender's perspective. Your income, while present, might be lower or perceived as less stable than that of a full-time employee. Your credit history might be non-existent or very thin, making it difficult for lenders to gauge your past repayment behaviour.

A down payment directly mitigates this risk. It reduces the total amount borrowed, thereby lowering the lender's exposure. It also signifies your personal investment in the vehicle, indicating a higher likelihood of you making consistent payments. Without this initial commitment, lenders have to rely more heavily on other indicators of financial responsibility and repayment capacity.

The 'No Down Payment' Promise: What It Really Means (and Doesn't)

When you see advertisements for "no down payment" car loans, it's crucial to understand the fine print. These offers are certainly real, but they often come with specific conditions. For part-time students, these conditions can be particularly challenging to meet without additional support, such as a strong co-signer.

The trade-offs for zero-down financing typically include higher interest rates, especially for applicants with less-than-perfect credit. The loan term might also be extended to keep monthly payments manageable, which means you'll pay more in interest over the life of the loan. Stricter eligibility criteria, such as a higher minimum income or a more established credit history, are also common for these offers.

Here’s a comparison of typical car loan scenarios for students in 2026:

| Scenario Factor | With 10% Down Payment (Good Credit) | No Down Payment (Good Credit) | No Down Payment (Limited/Fair Credit - Student) |

|---|---|---|---|

| Vehicle Price | $25,000 | $25,000 | $20,000 (More affordable car) |

| Down Payment | $2,500 | $0 | $0 |

| Loan Amount | $22,500 | $25,000 | $20,000 |

| Interest Rate (APR) | 6.99% - 8.99% | 7.99% - 9.99% | 10.99% - 14.99% |

| Loan Term | 60 months | 72 months | 72 months |

| Estimated Monthly Payment | $450 - $465 | $420 - $445 | $350 - $395 |

| Total Interest Paid (Approx.) | $4,500 - $5,400 | $5,200 - $6,900 | $5,200 - $8,400 |

As you can see, opting for no down payment, especially with limited credit, generally results in higher interest rates and a greater total cost over the loan's lifetime. It means you’ll be paying more for the convenience of not having to provide cash upfront.

Defining the 'Part-Time Student' Profile: What Lenders Are Looking For Beyond Your Transcript

While your academic pursuits are admirable, lenders are primarily interested in your financial profile. For a part-time student seeking a car loan in Canada, especially with no down payment, lenders scrutinize several key attributes. They want to see a clear picture of your ability and willingness to repay the loan.

Income Stability vs. Income Volume: The Part-Time Paradox

It's a common misconception that students need a high income to qualify for a car loan. While a higher income certainly helps, for part-time students, income stability and consistency are often more critical than sheer volume. Lenders prefer to see a steady, verifiable income stream, even if it's from a part-time job, over a sporadic or inconsistent one.

They will look at how long you've been employed, the reliability of your hours, and whether your income is sufficient to cover the projected loan payments and your existing living expenses. Proof of income, such as pay stubs, employment letters, or bank statements, will be essential. If you receive bursaries or scholarships, those can also be considered income, bolstering your application. For more on how non-traditional income can help, check out our guide on Bursary Income? That's Your Car Loan Superpower, British Columbia.

The Credit Score Conundrum: Building Your Financial Reputation While Studying

Your credit score is a numerical representation of your creditworthiness. For many part-time students, this score might be non-existent ("thin file") or relatively low due to limited borrowing history. Lenders use this score to predict how likely you are to repay your loan. A low or non-existent score is a hurdle for a no-down-payment loan.

However, you can actively build your credit. Consider getting a secured credit card, where you deposit money as collateral. Using it responsibly and paying the balance in full each month can quickly establish a positive credit history. Ensuring on-time payments for things like cell phone bills, utilities, and even rent (if reported) can also contribute to your financial reputation. Remember, patience and consistency are key to building good credit. If you're starting from scratch, don't despair; many Canadians have successfully navigated this. Our article Zero Credit Score. Zero Problem. Your Car Loan Starts Now, Vancouver. offers more insights.

Debt-to-Income Ratio: Balancing Student Loans and Loan Applications

Lenders calculate your Debt-to-Income (DTI) ratio, which compares your total monthly debt payments to your gross monthly income. This ratio is a critical indicator of your ability to take on more debt. For students, existing student loans, credit card balances, or other lines of credit will all contribute to your DTI.

A high DTI ratio can signal to lenders that you're overextended, making them less likely to approve a new loan, especially without a down payment. Aim for a DTI below 40%, though lower is always better. Understanding and managing your current debt is paramount before applying for a car loan.

Residency and Stability: Proving Your Roots

Lenders also look for signs of stability, and residency history is a significant one. A stable living arrangement and a consistent address suggest a lower risk. If you've moved frequently or have a short residency history at your current address, it can be seen as a minor red flag.

Providing proof of residency, such as utility bills or lease agreements in your name, can help establish your stability. The longer you've lived at your current address, and the more consistent your contact information, the more comfortable a lender will be with your application.

Crafting an Irresistible Application: Strategies to Boost Your Approval Odds

Even with the challenges of being a part-time student seeking a no-down-payment car loan, there are powerful strategies you can employ to make your application stand out. Proactivity and a well-thought-out approach can significantly improve your chances of approval in 2026.

The Power of the Co-Signer: Leveraging Established Credit

One of the most effective ways for a part-time student to secure a car loan with no down payment is through a co-signer. A co-signer is someone, typically a parent or guardian, with an established credit history and stable income who agrees to be equally responsible for the loan. Their financial strength essentially backs your application, mitigating the risk for the lender.

If you default on payments, the co-signer is legally obligated to cover them. This significantly reduces the lender's risk and can open doors to better interest rates and approval for zero-down options. It's a serious commitment for both parties, so ensure open communication and a clear understanding of responsibilities.

Pro Tip: Choosing the Right Co-Signer: Not Just Anyone Will Do

When selecting a co-signer, look for someone with excellent credit, a stable and sufficient income, and a low debt-to-income ratio. Their financial health directly impacts your loan terms. Discuss the commitment thoroughly with them, ensuring they understand their legal obligations before they agree to co-sign.

Demonstrating Responsible Financial Habits: Beyond the Credit Score

While a credit score is a primary indicator, it's not the only one. Lenders are increasingly looking at a broader picture of financial responsibility. You can showcase this by providing evidence of consistent, on-time payments for rent, utility bills (electricity, internet, phone), and even subscription services. These don't always appear on traditional credit reports but can be used as supplementary evidence of your reliability.

Gathering bank statements that show consistent savings, even small amounts, can also demonstrate fiscal prudence. These elements help paint a picture of a responsible individual, even if your formal credit history is still developing.

Building a 'Financial Story': Presenting Your Case Proactively

Don't just fill out the application form; tell your financial story. If you have a legitimate reason for a limited credit history (e.g., you're young and haven't needed credit before), or if your part-time income has recently increased, articulate this to the lender. A cover letter or a brief conversation explaining your situation, your academic goals, and your commitment to repayment can humanize your application.

Highlight your steady employment, even if part-time, your budgeting efforts, and any positive financial behaviours. Show them you've thought this through and have a plan to manage the loan responsibly.

Secured Loans and Alternatives: When Traditional Paths Are Blocked

If a conventional no-down-payment loan proves elusive, consider alternative paths. A secured personal loan, for instance, might be an option. This involves using an asset (like savings, or even the car itself in some cases) as collateral. While it might require an initial asset, it could be a stepping stone to a car loan.

Another approach is to start with a less expensive vehicle that requires a smaller loan amount, making it easier to qualify for. Building a strong repayment history on a smaller loan can then open doors to better financing options in the future, possibly even through refinancing. If you've faced prior rejections, don't give up. Learn from the experience and explore different avenues. Our article They Said 'No' After Your Proposal? We Just Said 'Drive! offers encouragement and solutions for those who've been denied elsewhere.

Navigating the Financial Maze: Interest Rates, Hidden Fees, and Smart Budgeting

Securing a car loan is just the first step. Understanding the true cost of vehicle ownership is paramount, especially for a part-time student managing a budget. Beyond the principal amount, interest rates and a host of hidden fees can significantly impact your financial well-being.

Decoding Interest Rates: What Drives Them for Student Loans

The Annual Percentage Rate (APR) is the total cost of borrowing money, including the interest rate and certain fees. For part-time students, especially those with limited credit or no down payment, APRs can be higher than average. This is because lenders perceive a greater risk.

Interest rates can be fixed (staying the same throughout the loan term) or variable (fluctuating with market rates). Fixed rates offer predictability, which is often preferable for budget-conscious students. Your credit profile, the loan term, the specific lender, and current market conditions (like the Bank of Canada's prime rate) all influence the rate you receive. In 2026, with fluctuating economic conditions, rates can vary significantly.

Here’s a snapshot of typical APR ranges for car loans in Canada for different credit profiles:

| Credit Profile | Typical APR Range (2026 Context) | Example Monthly Payment (on $20,000 over 60 months) |

|---|---|---|

| Excellent (760+) | 5.99% - 7.99% | $385 - $400 |

| Good (660-759) | 7.99% - 10.99% | $400 - $430 |

| Fair (560-659) | 10.99% - 15.99% | $430 - $485 |

| Limited/Poor (Below 560, or thin file) | 14.99% - 29.99%+ | $480 - $600+ |

As a part-time student, you might fall into the 'Fair' or 'Limited/Poor' category initially, which means higher rates are likely, especially without a down payment. This makes understanding the total cost of interest crucial.

Beyond the Monthly Payment: Unmasking Hidden Costs of Car Ownership

The monthly loan payment is just one piece of the financial puzzle. Many first-time car owners are surprised by the additional, often substantial, costs of car ownership. These "hidden" expenses can quickly derail a student's budget if not anticipated.

- Car Insurance: This is often the largest recurring cost after the loan payment, especially for young drivers. Premiums vary widely based on your age, driving record, vehicle type, and location in Canada.

- Fuel: Gas prices fluctuate, but they are a constant expense. Your commute distance and the vehicle's fuel efficiency will dictate this cost.

- Maintenance and Repairs: Oil changes, tire rotations, brake pads, and unexpected repairs are inevitable. Budget at least $50-$100 per month for these.

- Registration and Licensing: Annual provincial fees are required to keep your vehicle legal on the road.

- Extended Warranties: While optional, some dealerships push these. Carefully evaluate if they're necessary for a used, reliable vehicle.

Pro Tip: The 'Total Cost of Ownership' Calculator: Your Essential Pre-Purchase Tool

Before committing to a car, use an online 'Total Cost of Ownership' calculator. These tools help you estimate annual expenses for specific car models, including depreciation, fuel, insurance, maintenance, and fees. This comprehensive view will reveal if the car truly fits your student budget.

Here's an example breakdown of monthly car ownership costs for a typical student in Canada:

| Expense Category | Estimated Monthly Cost | Notes for Students |

|---|---|---|

| Car Loan Payment | $350 - $450 | Based on a $20,000 - $25,000 loan, 72 months, student interest rates. |

| Car Insurance | $150 - $300+ | Highly variable by age, vehicle, driving record, and province (e.g., Ontario & BC often higher). |

| Fuel | $100 - $250 | Depends on mileage and vehicle's fuel efficiency (e.g., 20L/week at $1.80/L = $144/month). |

| Maintenance & Repairs | $50 - $100 | Budget for oil changes, tires, and unexpected issues. More for older cars. |

| Registration & Licensing | $10 - $20 | Annual fee divided by 12 months. Varies by province. |

| Total Estimated Monthly Cost | $660 - $1120+ | This is a significant portion of a part-time student's budget. |

Strategic Budgeting for Student Drivers: Making Every Dollar Count

Creating a realistic and detailed budget is non-negotiable for student car owners. You need to account for tuition, books, rent, groceries, and now, all the costs associated with your car. Start by tracking your income and all your expenses for a month or two to get a clear picture of your financial flow.

Look for areas to cut back. Can you reduce discretionary spending? Can you increase your work hours slightly without impacting your studies? Prioritize your loan payments and car-related expenses to avoid late fees and protect your credit score. Consider opening a separate savings account specifically for car maintenance and unexpected repairs.

Where to Turn: Banks, Dealerships, and Alternative Lending Avenues

Once you understand the financial landscape, the next step is knowing where to apply for your car loan. Different lenders have different criteria, and what works for one part-time student might not work for another, especially when aiming for no down payment in 2026.

Traditional Banks and Credit Unions: The Gold Standard (and Their Hurdles)

Major banks (like RBC, TD, Scotiabank, BMO, CIBC) and local credit unions are often considered the 'gold standard' for car loans due to generally competitive interest rates. They typically offer transparent terms and excellent customer service. However, their requirements can be quite stringent, particularly for part-time students seeking zero-down financing.

They usually prefer applicants with a strong credit history, a stable full-time income, and a low debt-to-income ratio. While credit unions might be slightly more flexible due to their community-focused nature, both will likely require a co-signer or a substantial down payment if your financial profile is still developing. If you have an existing banking relationship, start there, as they might be more willing to work with you.

Dealership Financing: Convenience vs. Cost for Student Buyers

Car dealerships often offer in-house financing or work with a network of lenders. This option provides immense convenience, as you can apply for the loan and purchase the car all in one place. Dealerships are often more flexible and might have special programs or incentives for students, or be more willing to approve loans for those with limited credit, sometimes even without a down payment.

However, this convenience can sometimes come at a cost. Dealerships may mark up interest rates to profit from the financing, or push for longer loan terms that increase the total interest paid. Always compare their offers with pre-approvals you might get elsewhere. Read all documents carefully before signing.

Specialty and Subprime Lenders: A Last Resort? Understanding the Trade-offs

When traditional banks and even some dealerships say no, specialty or subprime lenders often step in. These lenders specialize in providing loans to higher-risk applicants, including those with bad credit, limited credit history, or non-traditional income sources (like many part-time students). They are often more focused on your ability to pay now rather than your past credit history.

The trade-off for this increased accessibility is significantly higher interest rates, often in the double digits or even higher. While they might be your only option for a no-down-payment loan, it's crucial to understand the long-term cost. Use these loans as a stepping stone to rebuild your credit, with the goal of refinancing into a lower-interest loan later. If you've been turned down elsewhere, don't lose hope. Sometimes, these specialized lenders are exactly what you need. For more about navigating challenging approvals, read They Said 'No' After Your Proposal? We Just Said 'Drive!

Online Lenders and Loan Aggregators: Streamlined Applications, Varied Outcomes

The digital age has brought a surge in online lenders and loan aggregators (platforms that connect you with multiple lenders). These platforms often offer streamlined application processes, quick pre-approvals, and the convenience of applying from anywhere. They can be particularly useful for students who want to shop around for the best rates without visiting multiple physical locations.

However, outcomes can vary widely. While some online lenders are reputable and offer competitive rates, others might cater to higher-risk borrowers with less favourable terms. Always check reviews, ensure the lender is legitimate in Canada, and read all terms and conditions carefully. Be wary of any promises that seem too good to be true.

Making the Smart Car Choice: Vehicles That Align with Student Budgets

Your choice of vehicle is one of the most impactful decisions you'll make when pursuing a car loan as a part-time student. A financially savvy choice can make the difference between a manageable expense and a crippling debt. Focus on practicality, reliability, and affordability for 2026.

New vs. Used: The Financial Implications for Student Borrowers

The debate between new and used cars is crucial for students. New cars offer the latest features, warranties, and peace of mind. However, they depreciate rapidly, losing a significant portion of their value in the first few years. This means a larger loan amount, higher monthly payments, and potentially higher insurance costs.

Used cars, on the other hand, are generally much more affordable. They've already taken the biggest depreciation hit, meaning you get more car for your money. While they might have more kilometres and potentially fewer features, a reliable used car can be a far more sensible choice for a student budget. The lower purchase price translates to a smaller loan, making approval easier, especially without a down payment.

Here’s a quick comparison:

| Factor | New Car (e.g., $30,000) | Used Car (e.g., $18,000) |

|---|---|---|

| Initial Cost | Higher | Lower |

| Depreciation | Very High (especially year 1-3) | Lower, slower rate |

| Loan Amount (No Down Payment) | $30,000 | $18,000 |

| Monthly Payment (approx. 72 months, 12% APR) | $575 | $345 |

| Insurance Premiums | Potentially Higher | Generally Lower |

| Maintenance | Minimal (covered by warranty) | Higher potential for out-of-warranty repairs |

Reliability and Resale Value: Future-Proofing Your Investment

When selecting a used car, prioritize models known for their reliability and good resale value. Brands like Honda, Toyota, Mazda, and some Hyundai/Kia models consistently rank high in these categories. A reliable car means fewer unexpected repair costs, which is critical for a tight student budget.

Furthermore, a car with good resale value means that when you're ready to upgrade after graduation, you'll get more back for your investment. Research specific models and years using reputable automotive review sites and consumer reports in Canada. Look for cars with a strong service history and consider a pre-purchase inspection by an independent mechanic.

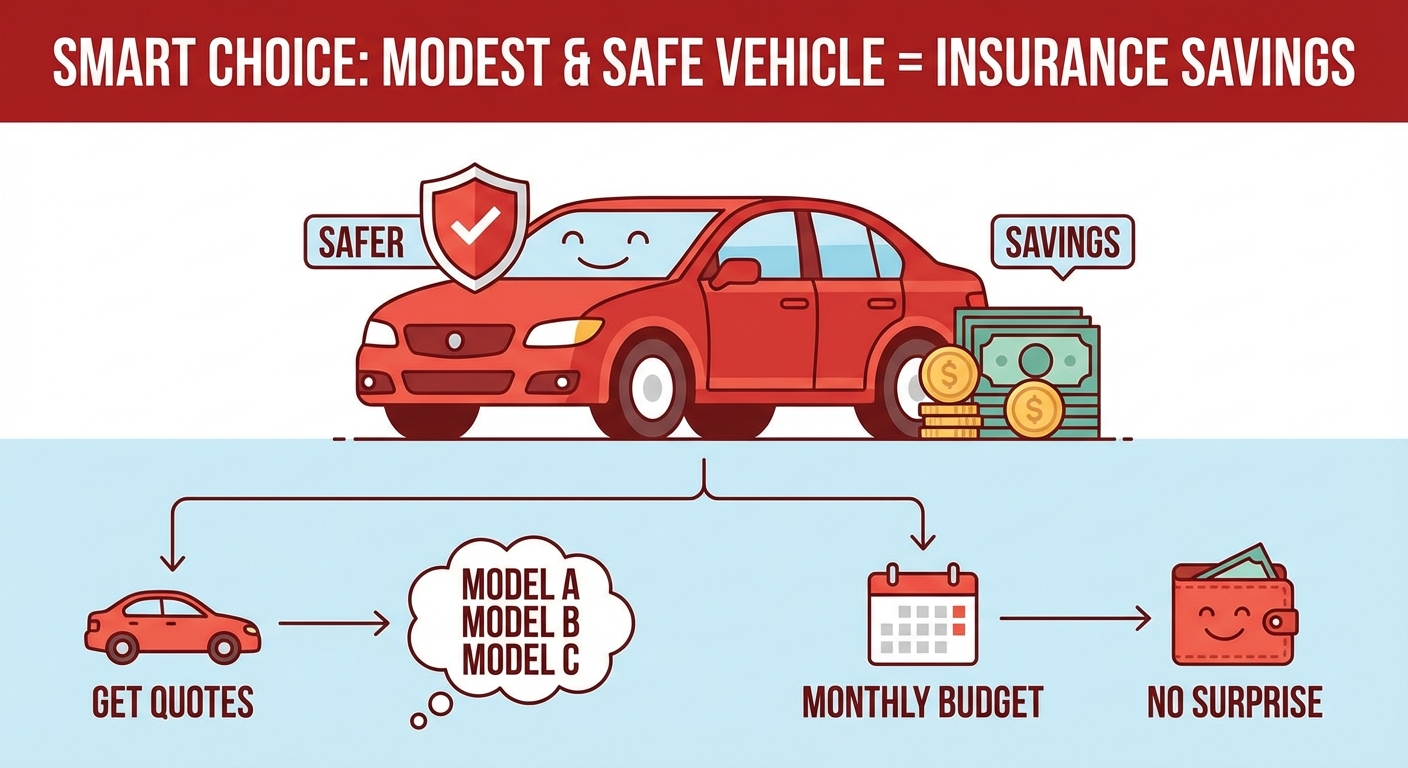

Insurance Premiums: How Vehicle Choice Impacts Your Monthly Outlay

Your choice of vehicle significantly impacts your car insurance premiums. Factors like the car's make, model, year, safety features, engine size, and even colour can influence your rates. Generally, newer, more expensive, high-performance, or frequently stolen vehicles will command higher insurance costs.

For students, opting for an older, more modest, and statistically safer vehicle can lead to substantial savings on insurance. Before you commit to a car, get insurance quotes for a few different models you're considering. This foresight can prevent a nasty surprise in your monthly budget.

Beyond Approval: Sustaining Your Loan and Building Future Credit

Congratulations, you've secured your part-time student car loan with no down payment! But the journey doesn't end there. Responsible loan management is crucial not only for keeping your car but also for building a robust financial future in Canada.

Mastering On-Time Payments: The Cornerstone of Credit Building

Making every single payment on time is the single most important action you can take. Your payment history accounts for the largest portion of your credit score (typically 35%). Late payments can severely damage your credit, making it harder to get future loans, mortgages, or even rent an apartment.

Set up automatic payments from your bank account to ensure you never miss a due date. Create reminders on your phone or calendar a few days before each payment is due. Treat your car loan payment with the same priority as your tuition or rent. Consistency here will pay dividends for years to come.

The Refinancing Opportunity: Lowering Costs as Your Credit Grows

As a part-time student, you likely started with a higher interest rate due to your credit profile. The good news is that as you make consistent, on-time payments, your credit score will improve. Once your credit score is in a better range (e.g., after 12-24 months of perfect payments), you might be eligible to refinance your car loan.

Refinancing involves taking out a new loan, often with a lower interest rate, to pay off your existing loan. This can significantly reduce your monthly payments and the total amount of interest you pay over the remaining loan term, potentially saving you thousands of dollars. Keep an eye on your credit score and current interest rates, and explore this option once your financial standing strengthens. For detailed guidance on this, our article Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit is an excellent resource.

Leveraging Your Car Loan for a Stronger Financial Future

View your car loan not just as a means to get a car, but as a powerful tool for building your financial future. Successfully managing a car loan demonstrates to future lenders that you are a reliable borrower. This positive credit history will open doors to better rates on credit cards, personal loans, and eventually, a mortgage for your first home.

A well-managed car loan becomes a foundational element of your credit report. It proves you can handle significant debt responsibly, which is invaluable as you transition from student life to a professional career in 2026 and beyond.

Pro Tip: Automate Your Payments: Never Miss a Beat

Set up automatic payments from your bank account to your loan provider. This eliminates the risk of human error or forgetfulness, ensuring your payments are always made on time, every time. It's the simplest and most effective way to protect your credit score.

Your Strategic Path to Approval: Final Steps and Empowering Mindset

Securing a part-time student car loan with no down payment in Canada in 2026 is a journey that requires preparation, persistence, and a proactive mindset. By following these final steps, you can approach the application process with confidence and maximize your chances of success.

Preparing Your Documentation Checklist: No Stone Unturned

Before you even step foot in a dealership or fill out an online application, gather all necessary documentation. Being organized demonstrates responsibility and speeds up the approval process. Here's a comprehensive list:

- Proof of Identity: Government-issued ID (driver's license, passport).

- Proof of Residency: Utility bills, lease agreement, or bank statements with your current address.

- Proof of Income: Recent pay stubs (3-6 months), employment letter, bank statements showing consistent deposits, tax returns, or documentation of bursaries/scholarships.

- Proof of Enrollment: Student ID card, letter of enrollment from your educational institution.

- Bank Statements: To show financial stability and consistent cash flow.

- Co-Signer Information (if applicable): Their ID, income proof, and credit history details.

The Art of Negotiation: Securing the Best Terms

Don't be afraid to negotiate. This applies not only to the price of the car but also to the loan terms. Even a slight reduction in the interest rate can save you hundreds, if not thousands, of dollars over the life of the loan. Shop around and get pre-approvals from multiple lenders before going to the dealership. This gives you leverage.

Be prepared to walk away if the terms aren't favourable. Understand all fees, including administrative fees, documentation fees, and any extended warranty pitches. Question everything and ensure you're comfortable with every aspect of the deal before signing on the dotted line.

A Proactive Mindset: Persistence and Patience Pay Off

The journey to securing a no-down-payment car loan as a part-time student might have its challenges. You might face initial rejections, or be offered less-than-ideal terms. The key is to remain persistent and patient. View any denial as feedback, not a failure.

Ask lenders why your application was denied and what steps you can take to improve your financial profile. Continuously work on building your credit, managing your debt, and increasing your income stability. With the right strategy and a determined mindset, you can achieve your goal of car ownership in Canada.