Being your own boss is the Canadian dream. You set your own hours, choose your clients, and build something from the ground up. But when it comes time to pull into a dealership for a new set of wheels, that dream can quickly feel like a hurdle. Traditional banks often look at self-employed individuals-whether you're a freelance graphic designer in Toronto, a contractor in Calgary, or a shop owner in Halifax-with a bit of skepticism. Why? Because your income doesn't come in a neat, predictable T4 package every two weeks.

The good news is that the lending landscape in Canada has shifted. You no longer need a standard pay stub to prove you're a reliable borrower. You just need a different set of keys to open the door to financing. This guide pulls back the curtain on the "approval secrets" used by successful entrepreneurs to secure competitive car loans without the headache.

Key Takeaways

- Documentation is King: Your Notice of Assessment (NOA) and T1 General are the most critical documents for Canadian lenders.

- The Two-Year Rule: Most traditional lenders require at least two years of self-employment history, though alternative lenders offer more flexibility.

- The Tax Deduction Paradox: Heavy write-offs reduce your taxable income, which can lower your borrowing power; 'grossing up' income is a common lender tactic to counter this.

- Credit Health Matters: A score above 650 opens doors to prime rates, while specialized lenders cater to those rebuilding credit.

- Preparation Pays: A down payment of 10-20% significantly increases approval odds for self-employed applicants.

The Reality of Self-Employed Car Loans in Canada

Lenders love predictability. When a T4 employee applies for a loan, the lender sees a steady stream of income that is guaranteed (mostly) by an employer. When you apply as a self-employed individual, the lender sees a business owner whose income might fluctuate based on the season, the economy, or the timing of client payments. This perceived risk is what creates the "Self-Employed Gap."

The 'Gig Economy' Shift

Canadian financial institutions aren't stuck in the dark ages. With nearly 15% of the Canadian workforce now identifying as self-employed or gig workers, lenders have had to adapt. Big banks and boutique finance firms alike have developed specific "Self-Employed Programs." These programs move away from the rigid "line 15000" (total income) requirement and look more holistically at your business's health. They understand that a consultant might have a slow January but a massive March.

Stated Income vs. Verified Income

You might have heard of "Stated Income" loans. In the past, you could simply tell a lender what you made, and they would take your word for it if your credit score was high enough. Those days are largely over in the Canadian automotive space. Today, lenders move toward "Verified Income." This doesn't mean you need a pay stub; it means you need to prove your income through third-party documents like tax filings and bank statements. While some "B-lenders" still offer stated income options for those with large down payments, they usually come with much higher interest rates.

Preparing Your Financial Profile for Success

Before you even step onto a lot, you need to see your finances through the eyes of a credit analyst. They aren't looking at your gross revenue; they are looking at your ability to satisfy a monthly obligation after all your other bills are paid.

Assessing Your Credit Score (The Canadian Context)

In Canada, your credit story is told by two main narrators: Equifax and TransUnion. For self-employed borrowers, your personal credit score is often the primary factor in the decision-making process, especially if your business isn't incorporated. A score of 700+ is the "Gold Standard" for prime rates. However, if you find yourself in the 600-680 range, you can still get approved, but you may face slightly higher interest rates or be required to provide more documentation.

If your score needs a lift, start by checking for errors. It sounds simple, but a misreported late payment from three years ago could be costing you thousands in interest. You can also use a "credit lift" strategy by paying down your revolving credit lines (credit cards) to below 30% of their limit. This shows you aren't "maxed out" and can handle a new monthly payment.

The Debt-to-Income (DTI) Ratio

This is the math that breaks most applications. Lenders calculate your DTI by adding up your monthly debt obligations (mortgage/rent, existing loans, credit card minimums) and dividing it by your gross monthly income. For self-employed people, the "income" part of that equation is often the net income after expenses. If your DTI is over 40%, you are entering the danger zone for many prime lenders. Reducing your monthly overhead before applying is just as effective as earning more money when it comes to getting approved.

The Ultimate Documentation Checklist

Organization is your best friend. When a finance manager asks for proof of income, and you hand them a neatly organized folder (or a clean PDF bundle), it signals that you are a low-risk, professional borrower. Here is what you need to gather:

- The Notice of Assessment (NOA): This is the most important document. It is the form the CRA sends you after they process your tax return. Lenders look at the "Tax Year" and "Line 15000" to verify what you officially reported. Most lenders want to see the last two years.

- T1 General Tax Returns: While the NOA is a summary, the T1 General shows the full breakdown of your business income and expenses. It helps lenders understand your industry and the stability of your earnings.

- Bank Statements: Expect to provide 3 to 6 months of statements. Lenders are looking for consistent deposits that match your reported income.

- Business Incorporation Papers or Master Business License: This proves that your business is a legal entity and shows how long you've been operating. Length of time in business is a major factor in "stability" scores.

Navigating the Tax Write-Off Trap

Here is the irony of being a small business owner in Canada: Your accountant wants your net income to be as low as possible to save you money on taxes. However, your lender wants your net income to be as high as possible to prove you can afford a car. This is the "Tax Write-Off Trap."

If you earned $100,000 but wrote off $70,000 in expenses, a bank sees a person who only makes $30,000 a year. On paper, you might not qualify for a $50,000 SUV, even if you have $50,000 sitting in your bank account.

Lender 'Add-Backs'

Specialized lenders understand this paradox. They use a process called "Add-Backs." They take your net income and "add back" certain non-cash expenses that don't actually leave your pocket. Common add-backs include:

- Depreciation (Capital Cost Allowance)

- Home office expenses

- A portion of your vehicle expenses

- One-time business startup costs

By using these add-backs, a lender might "gross up" your income by 15% to 25%, making your financial profile look much stronger than your tax return suggests.

Identifying the Right Lender for Your Situation

Not all lenders are created equal. Depending on your time in business and your credit score, you will fall into one of three main categories in the Canadian market.

| Lender Type | Best For | Typical Interest Rate | Difficulty |

|---|---|---|---|

| Big Five Banks (A-Lenders) | 2+ years self-employed, 700+ credit score, clear NOAs. | 4.9% - 8.9% | High |

| Alternative/B-Lenders | 1-2 years in business, seasonal income, 600-700 score. | 9.9% - 15.9% | Moderate |

| In-House Financing | New business (<1 year), credit challenges, cash-heavy income. | 16% - 29% | Low |

The Big Five Banks (A-Lenders)

TD, RBC, Scotiabank, BMO, and CIBC offer the best rates, but they are the most rigid. They generally require two full years of self-employment history. If you are in your first year of business, even with a 800 credit score, they may decline you simply due to "lack of stability."

Alternative and B-Lenders

Companies like Santander, Avante, or Rifco specialize in borrowers who don't fit the standard bank "box." They are more willing to look at bank statements rather than just NOAs. They understand the nuances of the self-employed life but will charge a slightly higher interest rate to offset the perceived risk.

In-House Financing (Buy Here Pay Here)

This is where the dealership itself lends you the money. It's the most flexible option because they aren't answering to a bank's underwriting department. While the rates are high, it's a viable way to get a vehicle you need for work while building your credit for a future refinance.

Strategic Moves to Guarantee Approval

If you're worried your application is on the fence, there are three "power moves" you can make to tip the scales in your favour.

The Power of the Down Payment

Lenders call this "Skin in the Game." When you put 15% or 20% down, the lender's risk drops significantly. If you default, they know they can recover the remaining loan balance by selling the car. For a self-employed applicant, a substantial down payment can often bypass the need for extensive income verification. It proves you have been successful enough to save liquid capital.

Leveraging a Co-signer

If your business is very new, bringing in a co-signer with a steady T4 income can be the "magic bullet." The lender combines your business income with the co-signer's stable salary, drastically reducing the risk profile. Just remember: the co-signer is legally responsible if you miss a payment, so this requires a high level of trust.

Choosing the Right Vehicle

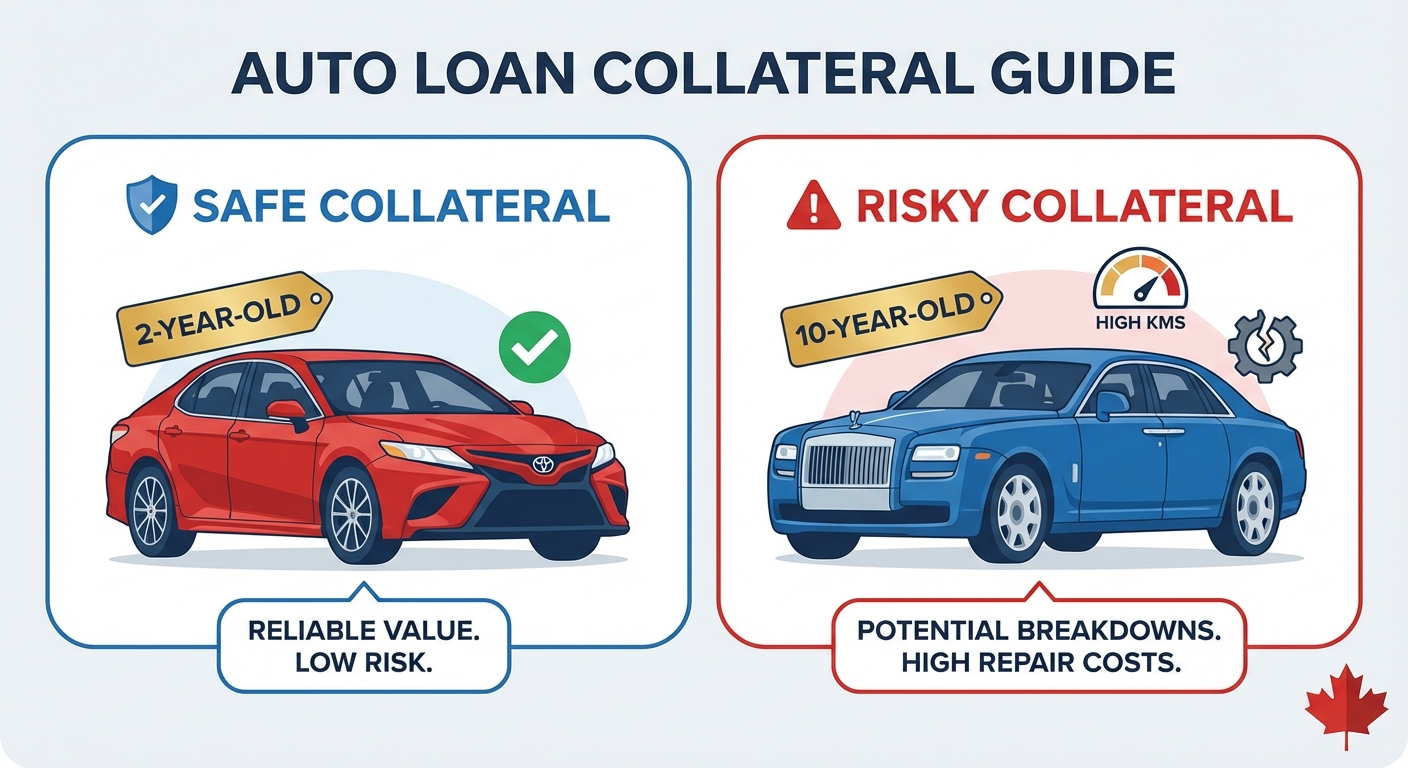

Lenders view the car as collateral. If you are self-employed, they prefer to lend on vehicles that hold their value. A 2-year-old Toyota or Honda is seen as "safe" collateral. A 10-year-old luxury car with high kilometres is seen as "risky" because it could break down, leaving you with a repair bill you can't pay and a car that isn't worth the loan balance.

The Application Process: Step-by-Step

You've gathered your papers and checked your score. Now, it's time to execute the play.

- Step 1: Pre-Qualification: Start with a pre-qualification. This usually involves a "soft" credit pull that doesn't hurt your score. It gives you a ballpark of what you can afford.

- Step 2: Gathering the Proof of Income (POI): Have your PDF files ready. Ensure they are clear, legible, and complete. Don't just send the first page of your NOA; send the whole thing.

- Step 3: The Finance Manager Interview: Be prepared to talk about your business. If you had a dip in income in 2023, explain why (e.g., "I spent that year investing in new equipment which is now generating 30% more revenue"). Context matters.

- Step 4: Reviewing the Loan Agreement: Check the fine print. Look for "Pre-payment Penalties." As a business owner, you might have a windfall month where you want to pay off $5,000 of the loan. You want a loan that allows you to do this without penalty.

Tax Benefits of Your New Vehicle

One of the perks of being self-employed is that the government essentially helps you pay for the car-if you use it for business. In Canada, you have two main ways to claim these expenses.

Capital Cost Allowance (CCA)

You can't deduct the full cost of the car in one year. Instead, you depreciate it over time. Most passenger vehicles fall into Class 10 (30% depreciation per year) or Class 10.1 (for more expensive cars). This "paper loss" reduces your taxable income, effectively giving you a discount on the vehicle.

Interest Deductibility

Unlike a personal car loan where the interest is just a cost of living, the interest on a business vehicle loan is often tax-deductible. If you use the car 70% for business, you can deduct 70% of the interest paid that year. This makes the "real" interest rate much lower than what is stated on your contract.

Mileage vs. Actual Expense Method

You can either track every litre of gas and every oil change (Actual Expense) or claim a flat rate per kilometre driven for business. For most small business owners with newer, fuel-efficient vehicles, the per-kilometre rate is simpler and often more lucrative. However, if you are driving a heavy-duty truck with high maintenance costs, the actual expense method might save you more.

Frequently Asked Questions (FAQ)

Can I get a car loan if I've been self-employed for less than a year?

Yes, but it is more challenging. You will likely need a significant down payment (20%+) or a co-signer. Some lenders have "New to Business" programs that look at your previous industry experience. For example, if you were an employed plumber for 10 years and just started your own plumbing company six months ago, lenders will often count that previous experience toward your stability.

Do I need a GST/HST number to get approved?

Not necessarily for the loan itself, but having one helps prove the legitimacy of your business. If your gross revenue is over $30,000, the CRA requires you to have one. Lenders use the existence of a GST/HST account as a "verification of business activity" marker.

What if my income is mostly cash?

Cash is notoriously hard to finance. If you don't deposit your cash into a bank account and don't report it on your taxes, lenders essentially consider that income non-existent. To get approved, you must start depositing your cash and showing it on your bank statements for at least 6 months prior to applying.

Can I use my business name for the loan, or must it be personal?

You can do both. A "Commercial Auto Loan" is in the business name. However, for small businesses and sole proprietorships, the lender will almost always require a "Personal Guarantee." This means if the business fails to pay, you are personally responsible. Most entrepreneurs find it easier to get a personal loan and then "lease" the car back to their business for tax purposes.

Does a car loan help build my business credit?

If the loan is in your business name and the lender reports to a commercial credit bureau (like Equifax Commercial), then yes. However, most standard car loans report to your personal credit profile. This is still beneficial, as a strong personal score is the foundation for future business lines of credit or commercial mortgages.

Driving Your Business Forward

Securing a car loan while self-employed in Canada isn't about jumping through hoops; it's about providing the right map for the lender to follow. By moving from "stated" to "verified" income, managing your tax deductions strategically, and choosing the right lending partner, you can secure rates that are just as competitive as any T4 employee.

Remember that your vehicle is more than just transportation; it's a tool for your business. Whether you're meeting clients, hauling equipment, or simply rewarding yourself for your hard work, the right financing plan ensures that your new car is an asset, not a burden. Take the time to organize your NOAs, clean up your bank statements, and walk into the dealership with the confidence of a business owner who knows exactly where they stand.