Bank Statements: The Only Resume Your Car Loan Needs. Drive, Alberta!

Table of Contents

- Key Takeaways: Your Fast Track to Car Loan Approval with Bank Statements in Alberta

- The Unconventional Resume: Why Your Bank Statements Speak Volumes in Alberta's Auto Market

- Beyond the Pay Stub: Who Truly Benefits from Bank Statement Car Loans in Alberta?

- Decoding Your Deposits: What Lenders Really Hunt For in Your Financial Records

- The Alberta Advantage: Navigating Bank Statement Car Loans in Calgary, Edmonton, and Beyond

- Bank vs. Dealership vs. Boutique Lender: Who's Best for Your Bank Statement Story?

- Traditional Banks and Credit Unions

- In-House Dealership Financing

- Specialized Alternative Lenders (Boutique Lenders)

- Beyond the Balance: Boosting Your Approval Odds When Bank Statements Lead the Way

- The Fine Print & Hidden Hurdles: Unmasking Rates, Fees, and Loan Traps in Alberta

- Crafting Your Financial Narrative: A Step-by-Step Guide to Preparing Your Bank Statements

- Specific Wheels, Specific Rules: Getting Approved for a Truck in Fort McMurray or an SUV in Lethbridge

- From Application to Ignition: What Happens After You Submit Your Bank Statement Loan Application

- Your Next Steps to Approval: Driving Away Confidently in Alberta

- Frequently Asked Questions (FAQ) about Bank Statement Car Loans in Alberta

Key Takeaways: Your Fast Track to Car Loan Approval with Bank Statements in Alberta

- Bank Statements Are a Powerful Resume: For many Albertans, traditional pay stubs don't tell the whole income story. Your bank statements offer a clear, credible alternative, showcasing real financial activity and consistency.

- Ideal for Non-Traditional Earners: Self-employed individuals, freelancers, gig workers, cash-based business owners, and new immigrants in Alberta will find bank statement loans particularly beneficial, often being their best path to approval.

- Lenders Prioritize Consistency: When reviewing your statements, lenders are looking for regular, predictable deposits that demonstrate stable income, typically over 3 to 6 months. Avoid frequent overdrafts or unexplained large withdrawals.

- Alberta's Diverse Market: Whether you're in Calgary, Edmonton, or a smaller community, understanding local lender appetites and specializing in non-traditional income can significantly improve your chances.

- Boost Your Odds: A down payment, a decent credit score (even if not perfect), and a low debt-to-income ratio can substantially strengthen your application, complementing your bank statement proof.

- Prepare Meticulously: Organize your statements, highlight income, and be ready to explain any unusual transactions. Clarity and transparency build lender confidence.

The Unconventional Resume: Why Your Bank Statements Speak Volumes in Alberta's Auto Market

Forget the dusty old pay stub. In today's dynamic Alberta economy, your bank statements are emerging as the most compelling resume your car loan needs. The way Canadians earn a living has evolved dramatically, and with it, the methods lenders use to assess creditworthiness. Traditional employment, with its predictable bi-weekly paycheques, is no longer the sole standard. From the bustling streets of Calgary to the resource-rich landscapes around Fort McMurray, a growing number of Albertans are navigating the gig economy, embracing self-employment, or managing diverse income streams that simply don't fit neatly into a standard "proof of income" box.

Think about it: are you a skilled tradesperson taking on contract work, a freelance designer shaping digital experiences, or perhaps an entrepreneur running a thriving local business in Edmonton? Your income might be robust, but it may not always come with a T4 slip or a consistent pay stub from a single employer. This is where your bank statements step in, transforming from mere transaction records into a powerful narrative of your financial stability. They tell a story of consistent deposits, responsible spending, and a clear ability to manage your money – a story that many modern lenders are increasingly eager to hear.

The auto market in Alberta, much like the rest of Canada, is adapting to this shift. Dealerships and financial institutions are recognizing that a rigid adherence to traditional income verification can exclude a significant segment of creditworthy individuals. By focusing on your actual cash flow and financial behaviour as evidenced by your bank statements, they can gain a much more accurate and holistic understanding of your capacity to repay a car loan. This approach isn't just a workaround; it's a legitimate, increasingly common path to getting behind the wheel of the vehicle you need and deserve. For more on how lenders are adapting to modern employment, consider reading our guide on Banks Need Pay Stubs. We Need Your Drive. Gig Worker Car Loans.

Beyond the Pay Stub: Who Truly Benefits from Bank Statement Car Loans in Alberta?

While bank statement car loans are an option for many, they are a game-changer for specific groups of Albertans whose financial realities don't align with traditional lending criteria. If you find yourself in one of these categories, bank statements aren't just an alternative; they are often the most direct and effective route to car loan approval.

Self-Employed Individuals and Entrepreneurs: Alberta's entrepreneurial spirit is strong, from independent consultants in Calgary to small business owners in Red Deer. If you own your own business, even if it's a sole proprietorship, your income often comes in irregular lumps, not uniform paycheques. Bank statements provide the necessary proof of consistent business revenue and personal drawings, showcasing your financial health without requiring a stack of T4s.

Freelancers and Gig Economy Workers: Whether you're driving for a ride-sharing app in Edmonton, delivering food, offering creative services online, or doing contract work in the oil and gas sector, your income can fluctuate. Lenders using bank statements can analyze several months of deposits to identify a reliable average income, even if individual paydays vary. This flexibility is crucial for the growing number of Albertans thriving in the gig economy.

Cash-Based Business Owners: For those who run businesses where a significant portion of transactions are in cash – think local markets, small retail operations, or service providers – traditional income proof can be challenging. Bank statements, especially when coupled with diligent deposits, clearly illustrate your cash flow and earning potential, making your financial story transparent to lenders. For more insight into how cash income can be leveraged for car loans, check out our article Cash Income Only? That's Not a Problem, It's Your Car Loan, Vancouver.

New Immigrants to Alberta: Canada welcomes people from all over the world, and Alberta is a popular destination. Newcomers often face the hurdle of not having an established Canadian credit history or a long track record of employment that traditional lenders require. However, if they have been consistently working and depositing their income into a Canadian bank account for a few months, these statements can serve as crucial proof of financial activity and earning capacity.

Individuals with Fluctuating or Non-Traditional Income Streams: This broad category includes anyone whose income doesn't follow a strict weekly or bi-weekly schedule. Perhaps you receive commission-based pay, seasonal income from tourism in Banff or Jasper, or even substantial child tax benefits (though typically not standalone, they can supplement other income). Bank statements allow lenders to assess the overall pattern of your financial inflows, providing a more comprehensive picture than a single pay stub ever could. For specific insights into leveraging self-employment for car loans, explore our guide Self-Employed Canada: Your Car's Equity Just Wrote a Cheque.

In essence, if your income is real, consistent, and provable through your bank account, but doesn't come with the typical employment documentation, a bank statement car loan is designed for you. It's about demonstrating financial responsibility and repayment capacity through the most accurate reflection of your actual money management.

Decoding Your Deposits: What Lenders Really Hunt For in Your Financial Records

When you present your bank statements as your "financial resume," lenders aren't just glancing at the final balance. They're performing a meticulous audit, looking for specific indicators that paint a clear picture of your financial habits and your ability to manage a car loan. Understanding what they scrutinize can significantly improve your preparation and, ultimately, your approval odds.

Consistency of Income: This is arguably the most critical factor. Lenders want to see a reliable pattern of deposits. They're less concerned with the exact day your money comes in and more interested in the regularity of it. Do you consistently receive funds every week, bi-weekly, or monthly? Even if the amounts fluctuate slightly, a steady flow demonstrates a dependable income stream. A sudden, large, unexplained deposit followed by long periods of inactivity will raise red flags.

Average Monthly Deposits: Beyond consistency, lenders will calculate your average monthly income based on your deposits over several months. This figure is crucial for determining how much car loan you can realistically afford. They'll look at gross deposits before expenses are factored in, understanding that your net income is what you truly have available after your operational costs are covered.

Expense Patterns and Financial Habits: It's not just about what comes in; it's also about what goes out. Lenders will examine your spending habits. Do you regularly overdraw your account? Are there numerous non-sufficient funds (NSF) fees? While an occasional oversight might be forgivable, a pattern of poor financial management, indicated by frequent overdrafts or bounced cheques, signals higher risk. Conversely, statements showing responsible budgeting, savings, and timely bill payments (even if not directly related to the loan) will work in your favour.

Red Flags to Watch Out For:

- Frequent Overdrafts/NSF Fees: As mentioned, these indicate a struggle to manage cash flow.

- Large Unexplained Withdrawals: While some large withdrawals are normal, a series of significant cash withdrawals without a clear purpose can be suspicious. Lenders want to ensure your funds aren't being siphoned off for risky ventures.

- Unexplained Deposits: Just as large withdrawals can be red flags, so too can massive, one-time deposits without any context. Lenders need to understand the source of your income.

- Excessive Gambling Transactions: Frequent or large transactions to online casinos or betting sites can indicate financial instability or risky behaviour.

- Account Churning: If you frequently open and close bank accounts, it can suggest an attempt to hide financial history or avoid obligations.

Importance of a Clear Financial History: Lenders prefer statements that are easy to read and understand. Avoid submitting heavily redacted documents unless absolutely necessary, and be prepared to explain any unusual or complex transactions. The clearer your financial story, the easier it is for a lender to approve you.

Good statement indicators include regular deposits from recognizable sources (even if they're varied clients for a freelancer), consistent account balances that don't hover near zero, and a lack of punitive fees. Bad indicators, on the other hand, show erratic income, frequent dips into overdraft, and a general lack of financial control. Presenting a clean, consistent financial narrative through your bank statements is your strongest asset.

The Alberta Advantage: Navigating Bank Statement Car Loans in Calgary, Edmonton, and Beyond

Alberta's economy is distinct, driven by diverse industries from energy and agriculture to technology and tourism. This unique economic landscape influences the lending environment, particularly for those relying on non-traditional income proof like bank statements. Understanding these regional nuances can be a significant advantage as you seek your next vehicle.

Urban Centres vs. Rural and Industrial Areas:

- Calgary and Edmonton: As Alberta's largest urban centres, Calgary and Edmonton boast a wider array of lenders, including major banks, credit unions, and a robust network of dealerships with in-house financing. These cities often have a higher concentration of individuals working in the gig economy, tech startups, or professional services, making lenders here more accustomed to reviewing diverse income streams. They're well-versed in assessing bank statements for freelancers, consultants, and self-employed professionals.

- Fort McMurray and Grande Prairie: These regions are heavily influenced by the oil and gas sector. While incomes can be high, they are often project-based, contract-driven, or subject to industry fluctuations. Lenders in these areas are often more familiar with assessing short-term contracts or self-employment income patterns common in the energy industry. They understand that a worker might have high earnings for 6-9 months, followed by a period of lower activity.

- Lethbridge and Red Deer: These mid-sized cities serve as hubs for agriculture, manufacturing, and local businesses. Lenders here are often attuned to the rhythms of local economies, including seasonal employment or the steady but sometimes cash-intensive nature of small businesses. Building a relationship with a local credit union or dealership can be particularly beneficial, as they often have a deeper understanding of the specific economic realities of their community members.

Lender Appetite and Programs: Some lenders, especially specialized alternative lenders and certain dealerships, actively market themselves as being flexible with income proof, specifically catering to self-employed or non-traditional income earners. They have developed specific underwriting criteria to evaluate bank statements effectively. Traditional banks, while becoming more flexible, might still prefer a more straightforward income verification process, though this is slowly changing.

Provincial Regulations and Consumer Protections: In Alberta, car loans are governed by provincial consumer protection legislation, such as the Consumer Protection Act. This act ensures fair trading practices, prohibits misleading advertising, and provides a framework for dispute resolution. While it doesn't specifically address bank statement loans, it ensures that all car loan agreements, regardless of income verification method, must be transparent and fair. Always ensure your lender is licensed and operating in accordance with Alberta's regulations.

Navigating the Alberta market requires a strategic approach. It's about knowing where your income story will resonate most effectively. Whether you're in the heart of urban commerce or contributing to the province's vital resource industries, there are lenders ready to assess your financial capacity based on the real-world evidence in your bank statements.

Bank vs. Dealership vs. Boutique Lender: Who's Best for Your Bank Statement Story?

When you're looking to secure a car loan with bank statements as your primary proof of income, the choice of lender can significantly impact your approval odds, interest rates, and overall loan experience. There are three main avenues to explore, each with its own advantages and disadvantages.

Traditional Banks and Credit Unions

Pros:

- Typically Lower Interest Rates: If you have a strong credit history and your bank statements show exceptional consistency and financial health, traditional banks often offer the most competitive interest rates.

- Established Reputation: Familiarity and trust come with major financial institutions.

- Comprehensive Financial Relationship: If you already bank with them, they might have a better understanding of your financial history.

Cons:

- Stricter Criteria: Traditional banks can be more rigid in their lending policies. While some are adapting to bank statement loans, they might still prefer more conventional income verification, especially for higher loan amounts or if your income is highly variable.

- Less Flexibility: They may be less willing to work with applicants who have lower credit scores or very complex income structures.

- Slower Processing: Approval processes can sometimes take longer due to multiple layers of review.

In-House Dealership Financing

Pros:

- Convenience: You can apply for financing and purchase your vehicle all in one place, simplifying the process.

- Access to Multiple Lenders: Dealerships often work with a network of banks and financial institutions, increasing your chances of finding an approval, even with bank statements. They act as brokers.

- Flexibility for Challenged Credit: Many dealerships are equipped to handle a broader spectrum of credit profiles and non-traditional income proofs, especially those with "special finance" departments.

- Negotiating Power: They might be willing to absorb some risk or offer incentives to close a vehicle sale.

Cons:

- Potentially Higher Rates: While convenient, the interest rates might be slightly higher than what you could get from a direct bank loan, as the dealership adds its own margin.

- Limited Options for Comparison: While they offer multiple lenders, you might not get the full market comparison you would by shopping around independently.

Specialized Alternative Lenders (Boutique Lenders)

Pros:

- High Approval Odds for Bank Statement Loans: These lenders specialize in non-traditional income verification. Their entire business model is built around assessing risk based on bank statements, credit history (even poor credit), and other alternative data.

- Greater Flexibility: They are often more understanding of unique financial situations, fluctuating income, and past credit challenges. For specific help with challenging credit, explore Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

- Faster Approvals: Their streamlined processes are designed for quick decision-making.

Cons:

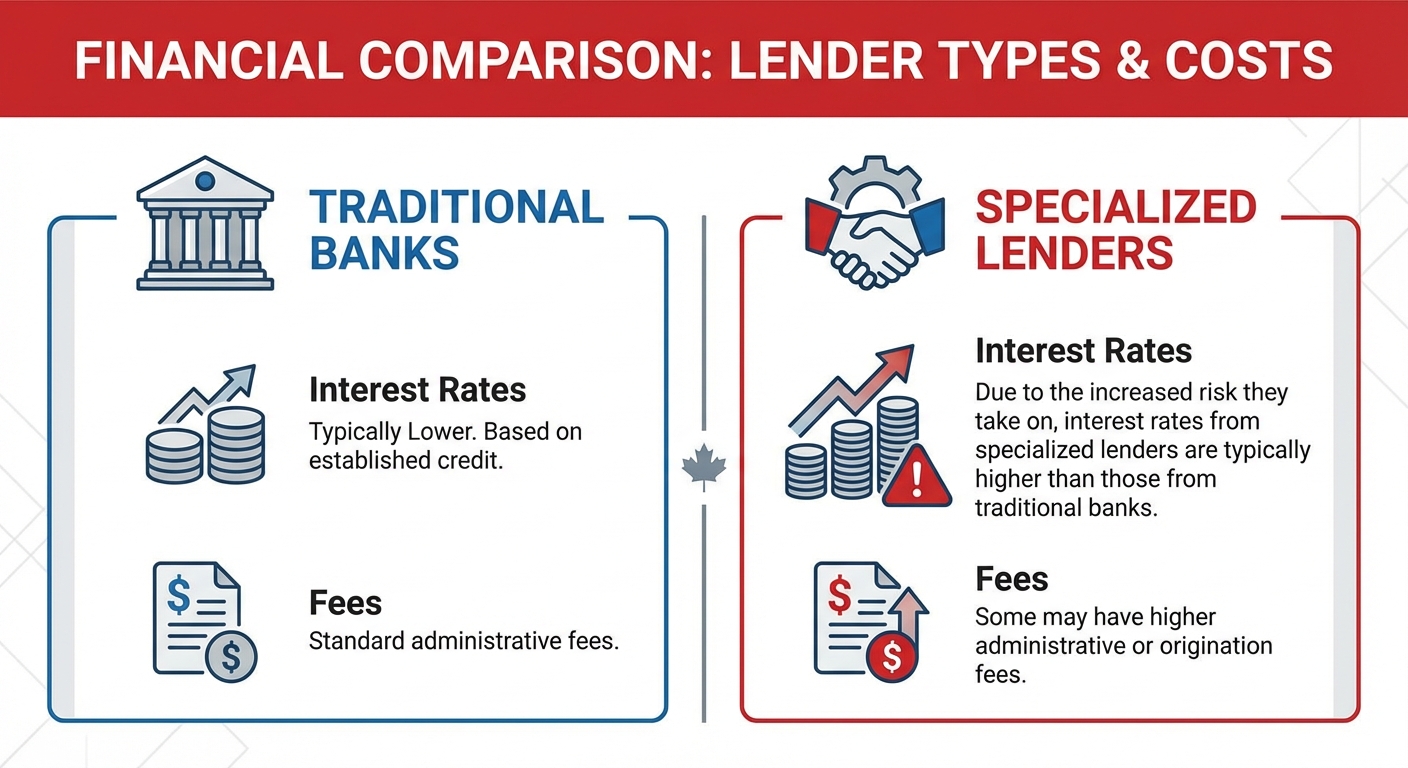

- Higher Interest Rates: Due to the increased risk they take on, interest rates from specialized lenders are typically higher than those from traditional banks.

- Fees: Some may have higher administrative or origination fees.

Here's a quick comparison:

Context: An infographic or visual comparison chart illustrating the differences in approval criteria, typical rates, and flexibility between traditional banks, dealership financing, and specialized alternative lenders for bank statement loans.

| Lender Type | Approval Criteria (Bank Statements) | Typical Interest Rates | Flexibility & Speed |

|---|---|---|---|

| Traditional Banks/Credit Unions | High consistency, good credit, clear income sources preferred. | Lower (Prime rates for strong applicants) | Less flexible, potentially slower. |

| In-House Dealership Financing | Moderate flexibility, works with multiple lenders, considers various income proofs. | Moderate to slightly higher (Varies by lender network) | Good flexibility, often fast (to close sale). |

| Specialized Alternative Lenders | High flexibility, focus on consistent deposits, more forgiving of credit challenges. | Higher (Reflects increased risk) | Very flexible, often fast approvals. |

Your best bet depends on your specific financial profile. If your bank statements are impeccable and your credit is strong, start with a traditional bank. If you have some credit challenges or highly variable income, a dealership or a specialized lender might be your most direct path to approval in Alberta.

Beyond the Balance: Boosting Your Approval Odds When Bank Statements Lead the Way

While your bank statements are paramount when seeking a car loan without traditional pay stubs, they are part of a larger financial picture. Lenders, even those specializing in non-traditional income, consider several other factors to assess your overall risk and determine your loan eligibility. Focusing on these elements can significantly improve your chances of approval and potentially secure more favourable terms in Alberta.

The Importance of Credit Score (Even a Low One): Your credit score remains a significant indicator of your financial responsibility, even when bank statements are your main income proof. It reflects your history of borrowing and repaying debt. A higher credit score signals a lower risk to lenders. However, a low or even poor credit score isn't an automatic disqualifier. Lenders who accept bank statements are often more accommodating of past credit challenges. They'll look for signs of improvement, recent responsible financial behaviour, and weigh your consistent income (as shown in your statements) against your credit history. The goal is to demonstrate that despite past setbacks, you are now financially stable and capable of managing new debt.

The Power of a Down Payment: A down payment is one of the most effective ways to bolster your loan application. It directly reduces the amount you need to borrow, thereby lowering the lender's risk. When you put money down, you demonstrate your commitment to the purchase and your ability to save. This is particularly impactful when relying on bank statements, as it provides tangible evidence of your financial discipline. Even a modest down payment can make a significant difference in approval odds and interest rates.

Having a Co-Signer: If your credit score is particularly low or your bank statements show some inconsistency, a co-signer with good credit can dramatically increase your approval chances. A co-signer essentially guarantees the loan, taking on the responsibility for repayment if you default. This provides an additional layer of security for the lender. Ensure your co-signer understands their obligations fully before proceeding.

Demonstrating Financial Stability Through Other Means:

- Low Debt-to-Income (DTI) Ratio: Lenders assess your DTI by comparing your total monthly debt payments to your gross monthly income. A lower DTI (ideally below 40-45%) indicates that you have ample disposable income to handle a new car payment. Even with bank statement income, demonstrating a manageable DTI is crucial.

- Property Ownership: Owning property (even if it's not being used as collateral for the car loan) can indicate financial stability and a significant asset base, which can be viewed favourably by lenders.

- Other Assets: Savings accounts, investments, or other significant assets, even if not directly used as collateral, can reassure lenders about your overall financial health and ability to weather unexpected expenses.

- Employment History (even if self-employed): While you're using bank statements for income proof, a long, stable history of self-employment or contract work (even if with different clients) can show a consistent ability to generate income.

By actively addressing these supplementary factors, you present a more robust and appealing financial profile, making it easier for lenders in Alberta to say "yes" to your car loan application.

The Fine Print & Hidden Hurdles: Unmasking Rates, Fees, and Loan Traps in Alberta

Securing a car loan using bank statements is a viable path, but it's essential to approach it with an informed perspective, particularly regarding the potential costs and pitfalls. Bank statement loans, by their nature, often carry a higher perceived risk for lenders, which can translate into different terms and conditions.

How Interest Rates Might Differ: The most significant difference you'll likely encounter is in the interest rate. Because lenders are taking on a greater perceived risk by relying on non-traditional income verification, they often compensate by charging higher interest rates compared to loans secured with conventional, easily verifiable income and excellent credit. The exact rate will depend on several factors:

- Your Credit Score: Even with bank statements, a better credit score will typically lead to a lower interest rate.

- Consistency of Income: The more stable and predictable your bank statement income appears, the better your rate.

- Down Payment: A substantial down payment reduces the loan amount and the lender's risk, often resulting in a lower rate.

- Lender Type: As discussed, specialized lenders, while more flexible, often have higher rates than traditional banks.

It's crucial to understand that while an interest rate might be higher than what someone with a perfect credit history and a salaried job receives, it should still be reasonable for your specific financial situation. Be wary of excessively high rates that seem disproportionate to your profile.

Potential Administrative Fees: Beyond the interest rate, some lenders, particularly alternative or specialized ones, may charge additional administrative or origination fees. These fees are typically for processing your application and setting up the loan. Always ask for a full breakdown of all fees associated with the loan. These should be clearly disclosed upfront and not hidden in the fine print.

What to Watch Out For in Loan Agreements:

- Prepayment Penalties: Check if there are any penalties for paying off your loan early. While some lenders charge them, many consumer-friendly loans in Alberta allow you to make extra payments or pay off the loan in full without penalty.

- Balloon Payments: Ensure there are no unexpected large payments due at the end of the loan term. Most standard car loans have consistent monthly payments.

- Add-ons and Extras: Be vigilant about optional add-ons like extended warranties, rust protection, or life insurance that might be subtly included in the loan agreement. While some might be valuable, ensure you understand what you're paying for and if it's truly necessary.

- Unclear Terms: Every aspect of the loan agreement – the loan amount, interest rate, term length, monthly payment, and any fees – should be crystal clear. If anything is confusing, ask for clarification before signing.

Identifying Predatory Lending Practices: In Alberta, consumer protection laws aim to prevent predatory lending. Be suspicious of:

- Guaranteed Approvals: No legitimate lender can guarantee approval without reviewing your financial situation.

- High-Pressure Sales Tactics: Don't feel rushed into signing. Take your time to review the agreement.

- Lack of Transparency: If a lender is unwilling to clearly explain terms or provide a written breakdown of costs, walk away.

- Exorbitant Rates: While rates might be higher, they shouldn't be usurious. Research typical rates for bank statement loans in Alberta to gauge what's reasonable.

By being diligent, asking questions, and understanding the full scope of your loan agreement, you can navigate the fine print and secure a bank statement car loan that serves your needs fairly and transparently.

Crafting Your Financial Narrative: A Step-by-Step Guide to Preparing Your Bank Statements

Presenting your bank statements effectively is key to a smooth approval process. Think of it as crafting a clear, compelling financial narrative that instils confidence in the lender. Here’s how to prepare your documents for submission:

- Determine the Number of Months Required: Most lenders will ask for 3 to 6 months of bank statements. If your income fluctuates seasonally or is highly variable, it's often beneficial to provide up to 12 months to demonstrate your annual earning capacity and consistency over a full cycle. Always clarify the exact requirement with your prospective lender.

- Choose the Right Account(s): Provide statements from the primary account where your income is consistently deposited and where you manage most of your day-to-day expenses. If you have multiple accounts where income is deposited (e.g., a business account and a personal account), be prepared to provide statements for all relevant accounts to show the complete picture.

- Download or Obtain Official Statements: Online bank statements downloaded directly from your bank's portal are generally accepted. Ensure they are clear, legible, and include your name, account number, and the bank's logo. Avoid screenshots or unofficial printouts that lack these identifiers. Many banks allow you to download statements in PDF format, which is ideal.

- Redact Sensitive Information (Carefully): While lenders need to see your income and expenses, you can typically redact your full account number (showing only the last few digits), and any highly personal transaction details that are irrelevant to your income or ability to repay the loan. However, err on the side of providing more information rather than less; too much redaction can raise suspicion. Never redact anything that would obscure income deposits or regular bill payments.

- Highlight Key Income Deposits: Make it easy for the lender to see your income. Use a highlighter (if printing) or digital annotation tools to mark regular deposits. If your income comes from various sources (e.g., multiple freelance clients), you might add a small note (e.g., "Freelance Income - Client A") if it helps clarify.

- Explain Unusual or Large Transactions: If there are any significant, one-time deposits or withdrawals that aren't typical, be proactive in providing a brief, clear explanation. For example, "Sale of old vehicle," "Tax refund," or "Large payment for completed contract." This transparency builds trust and prevents the lender from having to guess or make negative assumptions.

- Address Any Red Flags: If you've had an occasional overdraft or an NSF fee, be prepared to explain it. Acknowledge it briefly and explain what steps you've taken to prevent it from happening again. Honesty is appreciated more than trying to hide it.

- Organize and Present Professionally: Compile your statements in chronological order. If submitting electronically, combine them into a single, well-organized PDF document. A tidy presentation reflects your attention to detail and financial discipline.

Your bank statements are your opportunity to tell a compelling story of financial capability. By preparing them meticulously, you ensure that story is clear, credible, and persuasive to potential lenders in Alberta.

Specific Wheels, Specific Rules: Getting Approved for a Truck in Fort McMurray or an SUV in Lethbridge

The type of vehicle you wish to purchase plays a significant role in a lender's decision, even when your bank statements are the primary proof of income. This is especially true across Alberta, where vehicle preferences can vary greatly by region and lifestyle. The vehicle's value directly impacts the loan size, which in turn influences the lender's risk assessment.

New vs. Used Vehicles:

- New Vehicles: Generally command higher prices, leading to larger loan amounts. Lenders might require a stronger financial profile (more consistent bank statement income, better credit) for new vehicle loans. However, new vehicles often come with lower interest rates from manufacturer-backed financing due to lower depreciation risk.

- Used Vehicles: Typically result in smaller loan amounts, which can be easier to get approved for with bank statements, especially if you have a lower income or a less-than-perfect credit history. Used vehicles might have higher interest rates, though, due to higher perceived risk and shorter expected lifespan.

Luxury vs. Economy Vehicles:

- Luxury Vehicles: A high-value luxury car (e.g., a high-end Mercedes in Calgary) will necessitate a substantial loan. Lenders will scrutinize your bank statements much more intensely to ensure your income comfortably supports the payments, insurance, and maintenance costs associated with such a vehicle.

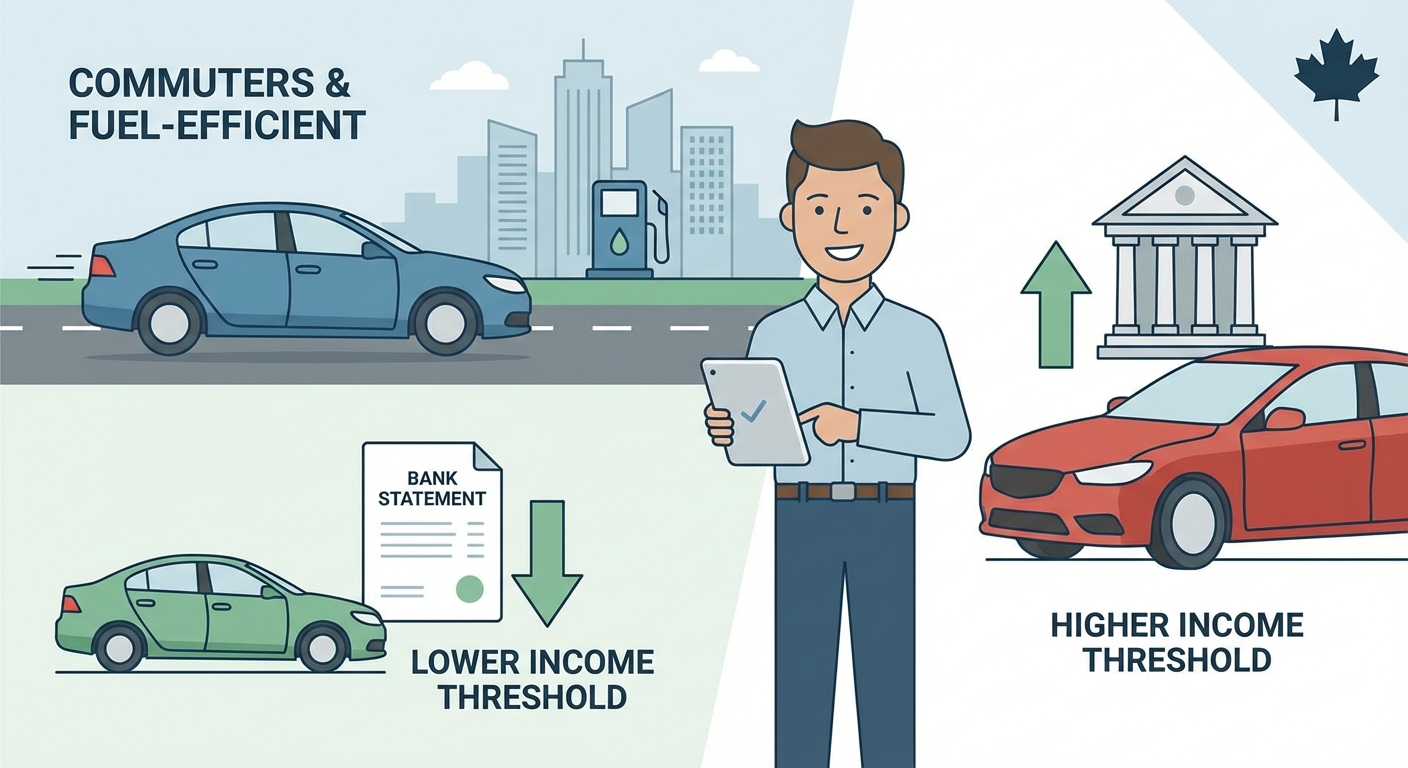

- Economy Vehicles: A more affordable sedan or compact SUV (e.g., a Honda Civic in Edmonton) presents less risk. The lower loan amount makes it more accessible for those relying on bank statements, as the payment burden is more manageable relative to their income.

Trucks vs. Sedans/SUVs – Regional Preferences:

Alberta's diverse geography and industries heavily influence vehicle choices, and lenders are aware of this.

- Trucks in Fort McMurray or Grande Prairie: These regions are synonymous with the energy sector, where robust pickup trucks are often a necessity for work and daily life. Lenders in these areas are accustomed to financing large trucks. If your bank statements demonstrate a consistent, high income typical of the oil and gas industry, financing a truck, even a high-value one, can be feasible. The lender understands the utility and often the business necessity of such a vehicle in these specific markets.

- SUVs in Calgary or Edmonton: SUVs are incredibly popular in Alberta's major cities, offering versatility for families and navigating varied weather conditions. Financing an SUV is generally straightforward, assuming your bank statements show adequate income for the vehicle's price point. Lenders in these urban centres are highly familiar with SUV financing applications.

- Sedans in Lethbridge or Red Deer: While trucks and SUVs are common, sedans still hold their place, especially for commuters or those seeking more fuel-efficient options. For a smaller, more economical sedan, the income threshold shown in your bank statements will be lower, making approval potentially easier.

Context: A stylized map of Alberta with key cities (Calgary, Edmonton, Fort McMurray, Lethbridge) highlighted, each with an icon representing a common vehicle type popular in that area (e.g., truck for Fort McMurray, SUV for Calgary).

Impact of Vehicle Value on Loan Size and Risk Assessment: Ultimately, the more expensive the vehicle, the larger the loan, and the higher the risk for the lender. When using bank statements, demonstrating that your income can comfortably cover the payment for your desired vehicle, along with your other expenses, is paramount. A lender will always assess your debt-to-income ratio based on your proven bank statement income and the proposed vehicle payment. Choosing a vehicle that aligns with your demonstrable income significantly strengthens your application.

From Application to Ignition: What Happens After You Submit Your Bank Statement Loan Application

You've meticulously prepared your bank statements, gathered all necessary documentation, and submitted your car loan application. Now, what's next? Understanding the post-submission process can help manage your expectations and ensure a smooth journey from application to driving away in your new (or new-to-you) vehicle in Alberta.

Lender Review Times: The time it takes for a lender to review your application can vary significantly. Traditional banks or credit unions might take a few business days, especially if your file requires manual underwriting due to non-traditional income. Dealership financing departments, working with multiple lenders, often aim for same-day or next-day approvals to facilitate a quick sale. Specialized alternative lenders are often the quickest, sometimes providing decisions within hours, as their processes are streamlined for these types of applications.

Potential Requests for Additional Documentation: It's common for lenders to request supplementary information. Don't be surprised if they ask for:

- More Bank Statements: If you initially provided three months, they might ask for six, or even twelve if your income is highly seasonal.

- Letters of Explanation: For unusual transactions, significant gaps in income, or specific credit report items.

- Proof of Residency: Utility bills or lease agreements to confirm your address.

- References: Sometimes, especially with lower credit scores.

- Business Registration Documents: If you're self-employed, they might want to see your business license or articles of incorporation.

- Confirmation of Assets: Statements for savings accounts, investments, or property tax assessments.

Responding promptly and accurately to these requests can expedite your approval. The faster you provide what they need, the quicker they can make a decision.

Negotiation Tips (If Approved):

- Interest Rate: If you receive an approval, don't be afraid to negotiate the interest rate, especially if you have multiple offers. Highlight your strong points (e.g., substantial down payment, long employment history, low DTI).

- Loan Term: A shorter loan term means higher monthly payments but less interest paid overall. A longer term offers lower monthly payments but more interest. Find a balance that suits your budget.

- Fees: Inquire about any administrative or origination fees and see if they can be reduced or waived.

- Vehicle Price: Remember, the loan is separate from the vehicle's price. Negotiate the vehicle price first, then discuss financing.

The Final Steps to Signing and Driving Away:

- Review the Loan Agreement: Before signing, meticulously read the entire loan agreement. Ensure all terms (interest rate, payment schedule, total amount financed, fees) match what was discussed and agreed upon. Don't hesitate to ask questions about anything unclear.

- Understand Your Obligations: Be fully aware of your monthly payment, due date, and what happens if you miss a payment.

- Insurance: You'll need to arrange for comprehensive car insurance before you can drive off the lot. Lenders will require proof of insurance.

- Sign and Drive: Once everything is in order and you're comfortable with the terms, sign the paperwork. Congratulations! You're ready to drive away in your new (or new-to-you) vehicle, powered by the strength of your bank statements.

This journey, from initial application to ignition, is a testament to your financial readiness and the evolving landscape of car financing in Alberta.

Your Next Steps to Approval: Driving Away Confidently in Alberta

The road to owning a car in Alberta, even without traditional pay stubs, is more accessible than you might think. Your bank statements are not just a collection of transactions; they are a powerful, dynamic representation of your financial life, proving your income and demonstrating your ability to manage a loan. For the self-employed, the gig worker, the freelancer, or anyone with non-traditional income, this approach levels the playing field, allowing your true financial story to be heard and understood by lenders.

You now possess the knowledge to strategically prepare your financial documents, understand what lenders prioritize, navigate the unique lending environment of Alberta, and identify the best financing avenues. You know that consistency in your deposits, a responsible approach to expenses, and a clear presentation of your financial history are your strongest assets. Furthermore, bolstering your application with a down payment, a co-signer, or by demonstrating a low debt-to-income ratio can significantly enhance your approval odds and secure more favourable terms.

Don't let the absence of a traditional pay stub deter you from getting the vehicle you need to thrive in Alberta. Whether you're commuting in Calgary, working in the fields near Lethbridge, or enjoying the vast landscapes of this incredible province, a reliable car is often essential. Take these insights, apply them diligently, and prepare to confidently present your bank statements as the only resume your car loan truly needs.