Car Financing for Entrepreneurs Without T4 | SkipCarDealer

Table of Contents

- Key Takeaways for the Time-Crunched Entrepreneur

- The T4-less Paradox: Why Traditional Lenders Get It Wrong

- The 'Algorithm Barrier': How Automated Systems Reject Strong Applicants

- From 'Unemployed' to 'Entrepreneur': Shifting the Lender's Perspective

- The T4-less Application Blueprint: Documents that Shout 'Credible'

- The Foundation: 6-12 Months of Business Bank Statements

- The Corroboration: Notices of Assessment (NOA) & T1 Generals

- The Proof of Work: Invoices, Contracts, and Project Agreements

- The Down Payment: Your Ultimate Tool of Leverage

- Decoding Lender Logic: How They Calculate Your 'Real' Income

- The 'Add-Back' Method: Uncovering Your True Earning Power

- Credit Score vs. Cash Flow: Which Carries More Weight?

- Real-World Scenarios: The Freelancer vs. The Contractor

- Lender Showdown: Where to Secure Your T4-less Car Loan

- The Big Banks: High Hurdles, Low Flexibility

- Credit Unions: The Community Advantage

- Specialized Dealerships & Financiers: The Path of Least Resistance

- The Tax Trinity: GST/HST, Write-Offs, and Your Car Loan

- Financing Personally vs. Through Your Corporation: A Critical Decision

- Maximizing Your Deductions: Interest, CCA, and Operating Expenses

- The GST/HST Input Tax Credit (ITC) Advantage

- The 2026 Shift: How Digital Banking & AI are Changing T4-less Approvals

- The Rise of Open Banking and Real-Time Income Verification

- AI-Powered Underwriting: A Double-Edged Sword

- Your Roadmap to the Driver's Seat: A 3-Step Action Plan

- Step 1: The 30-Day Document Assembly

- Step 2: The Pre-Approval Pulse Check

- Step 3: Connect with a T4-less Financing Specialist

- Frequently Asked Questions (FAQ)

You’re building something from the ground up. You work harder than anyone you know, your income is solid, and your business is growing. But when you walk into a traditional bank for a car loan, the first question they ask is, "Can I see your T4?" Suddenly, your success feels invisible. You're not an employee; you're the engine. In the world of automated lending, that can feel like a dead end. But it’s not.

Welcome to the definitive 2026 guide on car financing for entrepreneurs without T4 Canada. This isn't about finding a loophole; it's about fundamentally changing the conversation. It's about showing lenders the true, verifiable strength of your business and securing the vehicle you need to keep it moving forward. At SkipCarDealer.com, we specialize in translating entrepreneurial success into financing approvals. Let's get you in the driver's seat.

Key Takeaways for the Time-Crunched Entrepreneur

- Your Income Story Matters More Than a T4: Lenders who specialize in self-employed financing prioritize consistent, provable income over a specific tax slip. Your bank statements, contracts, and Notices of Assessment are your primary tools to demonstrate financial stability.

- Interest Rates Are Negotiable, Not Fixed: While rates for T4-less financing can start higher, they are not set in stone. A strong application, a healthy down payment (10-20%), and a good credit score give you significant negotiating power to secure a competitive rate.

- Personal vs. Business Financing is a Strategic Choice: Financing under your business name can build valuable corporate credit and separate liabilities, but often requires more documentation. Personal financing is typically faster and simpler but mixes your business and personal financial worlds.

- Specialized Lenders Are Your Best Bet: Don't waste time with big banks that rely on automated systems designed for T4 employees. Specialized lenders and financing partners like SkipCarDealer understand the nuances of entrepreneurial income and are equipped to approve you.

The T4-less Paradox: Why Traditional Lenders Get It Wrong

Getting car financing as a Canadian entrepreneur without a T4 is possible by presenting a comprehensive proof-of-income portfolio to lenders specializing in self-employed financing. This includes 6-12 months of business bank statements, two years of Notices of Assessment (NOA), and supporting documents like contracts or invoices to demonstrate consistent cash flow and business viability.

The 'Algorithm Barrier': How Automated Systems Reject Strong Applicants

Ever felt like you were rejected by a robot? You probably were. Major Canadian banks rely heavily on automated underwriting software. This software is programmed with a simple, rigid logic: T4 slip = stable, verifiable income. Application without T4 = anomaly, high risk, flag for rejection.

This "algorithm barrier" doesn't account for the realities of modern entrepreneurship. It doesn't understand seasonal cash flow, large one-time project payments, or strategic tax write-offs. Your rejection isn't a reflection of your financial health; it's a failure of their outdated system to comprehend it. In our experience, some of the most successful business owners are the ones who get automatically declined by these inflexible systems.

From 'Unemployed' to 'Entrepreneur': Shifting the Lender's Perspective

The key to success is a crucial mindset shift. You are not "lacking" a T4. You are presenting a different, and often more robust, picture of financial health. Your job is to stop thinking like an employee and start presenting your application like a CFO.

Instead of a single, predictable salary, you have a diverse portfolio of income. Your bank statements show the cash flow, your tax returns show the long-term history, and your contracts show the future. When you frame it this way, you're no longer an applicant trying to fit into a broken system; you're a business owner presenting a compelling case for investment to a financial partner.

The T4-less Application Blueprint: Documents that Shout 'Credible'

A successful application is a story well told. Your documents are the chapters, and each one needs to build a narrative of stability, consistency, and reliability. Here’s how to assemble a file that leaves no room for doubt.

The Foundation: 6-12 Months of Business Bank Statements

This is the single most important part of your application. Lenders aren't just looking at the final balance; they are performing a deep analysis of your cash flow. Here's what they *really* see:

- Consistency of Deposits: Are you receiving regular payments? Even if the amounts fluctuate, a pattern of incoming cash is vital. It proves ongoing business activity.

- Average Monthly Balance: Do you maintain a healthy buffer, or is your account frequently near zero before the next deposit? A strong average balance shows good financial management.

- NSF Charges & Overdrafts: Non-Sufficient Funds charges are a massive red flag. They signal to an underwriter that you are struggling with cash flow management, making you a higher risk for loan payments.

Pro Tip: Dedicate Your Business Account

Commingling funds is one of the fastest ways to get your application denied. Using a single account for business revenue, personal groceries, and e-transfers to friends creates a nightmare for underwriters. Open a dedicated business chequing account and run 100% of your business income and expenses through it for at least 6 months before applying. It presents a clean, professional, and easily verifiable financial picture.

The Corroboration: Notices of Assessment (NOA) & T1 Generals

Your last two years of tax filings are crucial. Many entrepreneurs worry because they've maximized their deductions, resulting in a lower "net income" on Line 15000 of their tax return. Don't be.

Experienced lenders understand this. They know that a savvy business owner writes off legitimate expenses to lower their tax burden. The NOAs serve two purposes:

- They prove you are in good standing with the Canada Revenue Agency (CRA).

- They provide a two-year history of business operation, proving you're not a fleeting startup.

We'll cover how lenders look past your net income in the next section.

The Proof of Work: Invoices, Contracts, and Project Agreements

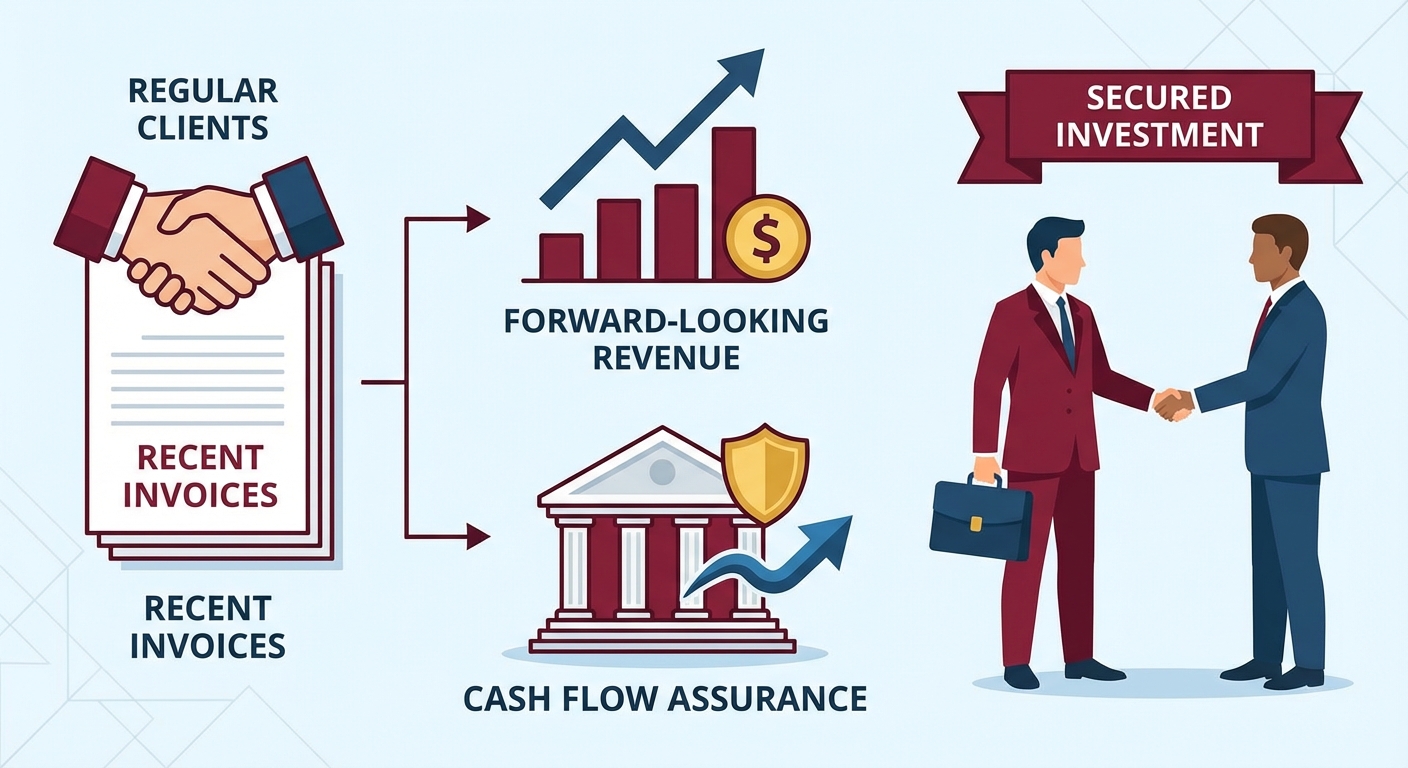

Bank statements show the past. Tax returns confirm it. But what about the future? This is where you can truly set your application apart.

If you have signed contracts for upcoming projects, include them. If you're a freelancer with a roster of regular clients, provide a summary of recent invoices. This documentation demonstrates forward-looking revenue and assures the lender that the cash flow they see in your bank statements is likely to continue, securing their investment in you.

The Down Payment: Your Ultimate Tool of Leverage

In T4-less financing, cash is king. A significant down payment is the most powerful statement you can make. It fundamentally changes the risk equation for the lender.

Putting 10-20% down on the vehicle does three things instantly:

- Reduces the Loan-to-Value (LTV) Ratio: The lender is financing less of the asset's total value, minimizing their potential loss if you default.

- Shows Financial Capacity: It proves you have savings and aren't living deposit-to-deposit.

- Gives You "Skin in the Game": You have a vested financial interest in protecting the asset and making your payments.

While zero-down options exist, a strong down payment almost always results in a higher chance of approval and, crucially, a lower interest rate.

Decoding Lender Logic: How They Calculate Your 'Real' Income

This is where specialized lenders separate themselves from the big banks. They don't just look at the bottom line on your tax return. They act like forensic accountants to understand your true, usable cash flow.

The 'Add-Back' Method: Uncovering Your True Earning Power

The 'add-back' method is the secret sauce of self-employed financing. Underwriters know that your declared net income is an accounting figure for tax purposes, not a reflection of the cash your business generates. They will take your net income and "add back" certain non-cash expenses to find your real ability to service a loan.

Common add-backs include:

- Capital Cost Allowance (CCA): This is the depreciation you claim on assets. It's a paper expense; no cash actually leaves your account.

- One-Time Major Purchases: Did you buy a significant piece of equipment last year? An underwriter can add that cost back to normalize your income.

- Home Office Expenses: A portion of your mortgage, utilities, and property taxes can be added back.

- Business Use of Personal Vehicle Expenses: The costs you've already written off for your current vehicle.

By understanding this method, you can confidently submit your tax returns, knowing a smart lender will see the true financial power behind the numbers.

Credit Score vs. Cash Flow: Which Carries More Weight?

For an entrepreneur, cash flow and credit score are in a delicate dance. One cannot completely save the other, but they heavily influence each other in the eyes of a lender.

Here’s the breakdown we see every day:

| Scenario | Credit Score | Business Cash Flow | Lender's Perspective & Likely Outcome |

|---|---|---|---|

| The Solid Performer | Excellent (760+) | Strong & Consistent | Prime Approval. You're a top-tier applicant. Expect the best rates (e.g., 7.99% - 9.99% in today's market) and terms. You have negotiating power. |

| The Cash-Rich Builder | Fair (620-680) | Very Strong & Verifiable | High Chance of Approval. The powerful cash flow overcomes the bruised credit. Lenders will focus on your ability to pay. Expect a moderate rate (e.g., 10.99% - 15.99%), but approval is very likely. For more on this, check out our guide on Car Loan After Bankruptcy & 400 Credit Score 2026 Guide. |

| The High-Score/Low-Cash | Excellent (760+) | Weak or Inconsistent | Challenging. A great credit score proves you pay your debts, but it can't create money that isn't there. Lenders will be wary of your ability to handle a new payment. Approval may require a massive down payment or a co-signer. |

| The Rebuilder | Poor (<620) | Weak or New | Very Difficult. This is the highest-risk category. Approval is not impossible with specialized lenders but will require a substantial down payment (25%+) and will come with high interest rates (20%+). |

Pro Tip: Perform a "Credit Tune-Up" 3-6 Months Before Applying

Don't wait until you're at the dealership to check your credit. Pull your own report from Equifax or TransUnion. Dispute any errors. Most importantly, focus on your credit utilization ratio. If you have credit cards with high balances, pay them down to below 30% of their limit. This single action can often boost your score by 20-50 points in just a couple of months, unlocking better interest rates.

Real-World Scenarios: The Freelancer vs. The Contractor

Let's look at two common entrepreneurial profiles:

'Sarah,' the Freelance Graphic Designer: Sarah's income is inconsistent. She might land a $15,000 project one month and only bill $3,000 the next. For a traditional bank, this is terrifying. For a specialist, it's normal.

- Her Strategy: Sarah would provide 12 months of bank statements to show her strong *average* monthly income. She would include the signed contracts for her large projects to prove her earning potential. Her income is like a playlist of different songs, not a single repeating track. For more on this, check out our guide on Your Income's a Playlist, Not a Single. Get Your Car, Edmonton.

'Mike,' the General Contractor: Mike's business bank account shows huge revenue—maybe $40,000 in a month. But he also has massive expenses for materials and subcontractors. His net profit is much smaller.

- His Strategy: Mike needs a lender who understands the 'add-back' method. He would provide his T1 Generals and be prepared to walk the underwriter through his Statement of Business Activities (T2125), pointing out material costs versus his actual gross profit. His application focuses on profitability, not just raw revenue.

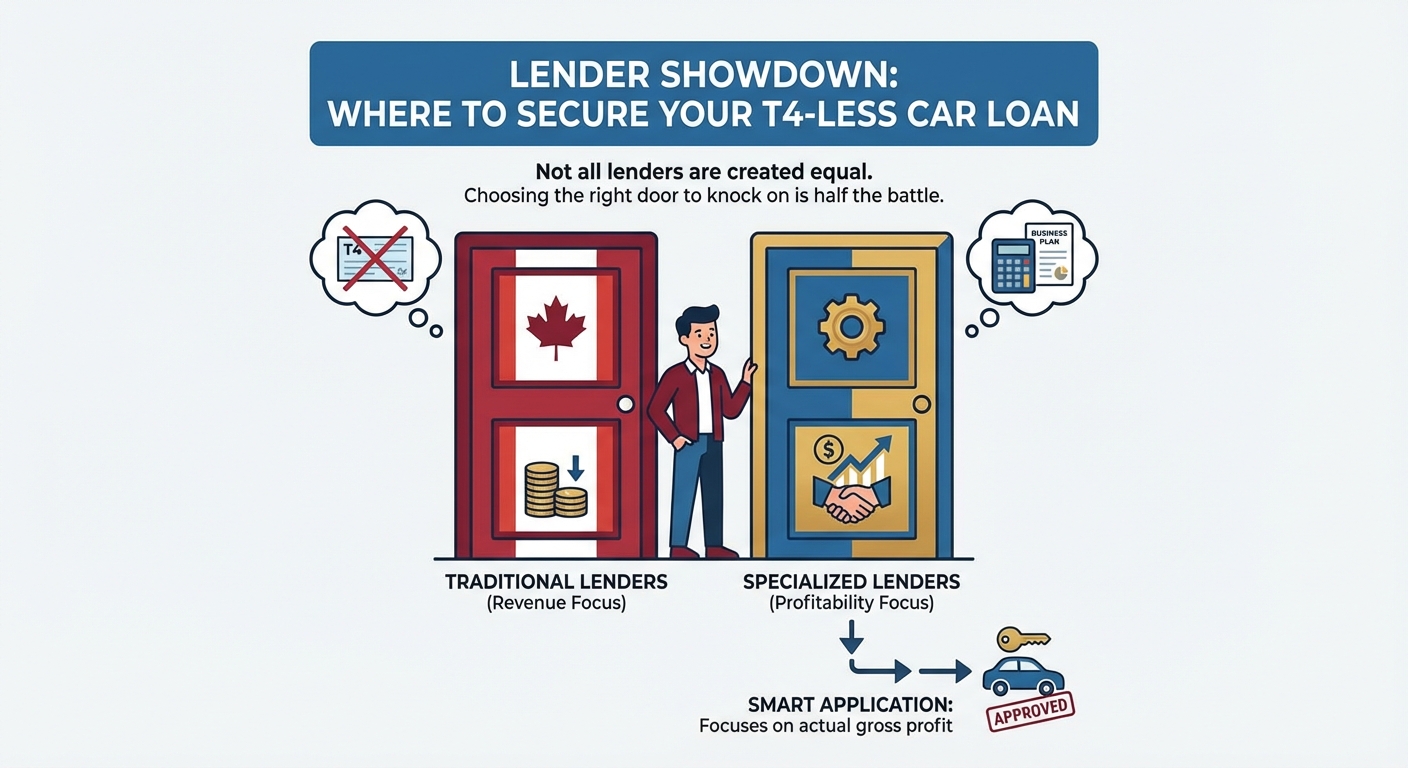

Lender Showdown: Where to Secure Your T4-less Car Loan

Not all lenders are created equal. Choosing the right door to knock on is half the battle.

The Big Banks: High Hurdles, Low Flexibility

The major chartered banks (RBC, TD, BMO, etc.) are generally the most difficult path for a T4-less entrepreneur. Their business model is built on high volume and automated, low-risk lending. While they may have a "small business" division, it's often not streamlined for a simple vehicle loan. You can expect rigid documentation requirements and little room for negotiation if your file doesn't fit their perfect box.

Credit Unions: The Community Advantage

Credit unions can be an excellent option. As member-owned institutions, they often have a mandate to serve their local community, which includes small business owners. They may be more willing to engage in manual underwriting, where a human being reviews your entire financial story. If you have an existing relationship with a local credit union, it's a worthwhile conversation to have.

Specialized Dealerships & Financiers: The Path of Least Resistance

This is our world. Services like SkipCarDealer exist specifically because the traditional models fail so many entrepreneurs. We don't rely on just one lender; we have established relationships with a wide network of financial institutions, including many that *only* work with self-employed and non-traditional income applicants.

The advantage is twofold:

- Expertise: We know exactly how to package your documents to highlight your strengths for these specific lenders.

- Access: We can send your single application to multiple lenders who are pre-disposed to approve it, creating competition that results in better rates and terms for you.

This approach dramatically increases approval rates and turns a frustrating, multi-step process into a single, streamlined experience.

The Tax Trinity: GST/HST, Write-Offs, and Your Car Loan

Buying a vehicle for your business isn't just a purchase; it's a financial strategy. Understanding the tax implications is critical to maximizing its value.

Financing Personally vs. Through Your Corporation: A Critical Decision

If your business is incorporated, you have a choice: buy the car personally or have the corporation buy it.

- Personal Financing: Simpler and faster. The loan is tied to your personal credit. However, if your business fails, you are still personally liable for the debt. Bookkeeping can be messier as you have to track and claim business usage.

- Corporate Financing: The loan is in the business's name. This builds corporate credit and separates your personal liability. If the vehicle is used more than 50% for business, this is often the cleanest method for accounting. However, it can require more documentation, like Articles of Incorporation.

Pro Tip: Consult Your Accountant First

This decision has long-term tax and liability implications. Before you sign any paperwork, have a quick chat with your accountant. They can advise on the best structure (personal vs. corporate) for your specific business situation and tax strategy. This 15-minute call can save you thousands of dollars down the road.

Maximizing Your Deductions: Interest, CCA, and Operating Expenses

When you use a vehicle for business, you can deduct a portion of its costs against your income. The three main categories are:

- Loan Interest: The interest portion of your monthly car payments is a deductible business expense.

- Capital Cost Allowance (CCA): This is the CRA's term for depreciation. You can deduct a percentage of the vehicle's value each year. The rules and classes can be complex, so professional advice is recommended.

- Operating Expenses: A percentage of all your running costs—gas, insurance, maintenance, repairs, even car washes—can be deducted based on the ratio of business kilometres to total kilometres driven. Keep a detailed logbook!

The GST/HST Input Tax Credit (ITC) Advantage

If your business is a GST/HST registrant, you can claim Input Tax Credits (ITCs) on the GST/HST paid on the purchase of the vehicle and its operating expenses. This is a direct recovery of the tax paid, effectively lowering the net cost of the car. For a $50,000 vehicle in a province with 13% HST, that's a potential ITC of $6,500—a massive saving that many entrepreneurs overlook.

The 2026 Shift: How Digital Banking & AI are Changing T4-less Approvals

The world of financing is on the cusp of a major transformation, and it's good news for entrepreneurs.

The Rise of Open Banking and Real-Time Income Verification

Open Banking is a framework that will allow you, the consumer, to securely grant financial institutions direct access to your banking data. Instead of you downloading and emailing months of PDF statements, a lender will be able to use a secure API to analyze your cash flow in real-time.

For T4-less applicants, this is a game-changer. It replaces cumbersome paperwork with instant, undeniable proof of income, making the process faster, more accurate, and more accessible.

AI-Powered Underwriting: A Double-Edged Sword

Artificial Intelligence is already being used in underwriting, and its role will only grow. This presents both an opportunity and a risk. A poorly designed AI could simply reinforce the old biases against non-T4 income. However, a sophisticated AI can be trained to recognize complex entrepreneurial income patterns far better than a human underwriter.

It can analyze thousands of data points to see the stability in your fluctuating income, identify trends, and make more accurate risk assessments. Preparing your "digital financial footprint"—maintaining clean, dedicated business accounts—will be more important than ever to ensure the AI sees you in the best possible light.

Your Roadmap to the Driver's Seat: A 3-Step Action Plan

Feeling empowered? Good. Now let's turn knowledge into action. Here is your exact plan to get approved.

Step 1: The 30-Day Document Assembly

Starting today, get your financial house in order. Create a digital folder on your computer and begin gathering the essentials.

- ☑ Download the last 6 full months of your business bank account statements (in PDF format). Aim for 12 if you have them.

- ☑ Locate your Notices of Assessment from the CRA for the last two completed tax years.

- ☑ Gather supporting documents: A copy of your business registration/license, your GST/HST number, and 2-3 examples of recent client invoices or contracts.

Having this package ready makes you a prepared, serious applicant.

Step 2: The Pre-Approval Pulse Check

Before you even think about a specific car, get pre-approved. A pre-approval from a specialized service like SkipCarDealer is typically a "soft inquiry" on your credit file, meaning it doesn't impact your score. It gives you a realistic budget to work with and transforms you from a window shopper into a qualified buyer with immense negotiating power.

Step 3: Connect with a T4-less Financing Specialist

This is the final, crucial step. Don't go it alone. Work with experts who live and breathe this stuff. A specialist can review your document package, identify any potential weaknesses, and match you with the specific lenders in their network most likely to offer you the best terms. This strategic matchmaking is the difference between a frustrating denial and driving away in the vehicle your business deserves.