Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

Table of Contents

- Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

- Key Takeaways

- The Self-Employed Paradox: Why Traditional Lenders Say 'No' (and Who Says 'Yes' to Your Drive)

- Unpacking the 'Stable Income' Hurdle: Why Pay Stubs Aren't Your Only Proof

- The Risk Aversion of Big Banks: Understanding Their Traditional Lending Model

- Meet Your Allies: The Specialized Lenders & Brokers Who Understand Entrepreneurship

- Deconstructing 'Poor Credit' in Canada: It's Not a Life Sentence for Car Ownership

- Beyond the FICO Score: What Your Credit Report *Really* Tells Lenders

- Common Credit Imperfections: Bankruptcies, Consumer Proposals, and Late Payments (and How Lenders Respond)

- The 'Second Chance' Philosophy: How Some Lenders Prioritize Your Present Over Your Past

- Your 'Fast Approval' Arsenal: Preparing Your Application for Maximum Impact & Speed

- Proof of Income, Redefined: Bank Statements, Tax Returns (Notice of Assessment), and Invoicing Records

- The Power of Organization: Why a Meticulously Prepared Application is a Fast Application

- Building Your Financial Narrative: Explaining Gaps, Irregularities, and Your Path Forward

- The Approval Algorithm for the 'Impossible': How Specialized Lenders Evaluate You

- Focus on Affordability: Your Debt-to-Income Ratio (DTI) as a Key Indicator

- Collateral Confidence: How the Vehicle Itself Plays a Role in Your Approval

- The Human Element: When Your Story and Stability Outweigh a Low Score

- Navigating the Numbers: Understanding Rates, Terms, and the True Cost of Your Loan

- The Reality of Higher Interest: Why It's Often a Necessary Stepping Stone (and How to Mitigate It)

- Beyond the Monthly Payment: Calculating Your Total Loan Cost Over Time

- Unmasking Hidden Fees: What to Watch Out For in Loan Agreements

- Choosing Your Champion: Dealerships, Brokers, or Online Platforms for Your Unique Situation?

- The 'One-Stop Shop' Dealer: Convenience vs. Potential for Limited Options

- The Broker Advantage: Accessing a Wider Network of Specialized Lenders

- Online Platforms: Speed, Discretion, and Digital Efficiency for the Modern Borrower

- Strategic Car Selection: How Your Vehicle Choice Boosts Approval Odds (and Saves You Money)

- The 'Sweet Spot' for Used Cars: Age, Mileage, and Market Value for Lenders

- Avoiding the Pitfalls: Overpriced or Under-Valued Vehicles that Deter Lenders

- The Impact of Vehicle Type: Sedans vs. Trucks vs. Luxury – What's Most 'Approvable'?

- The Down Payment Dynamo: Supercharging Your Application (Even with a Small Amount)

- Why Lenders Love Down Payments: Reducing Their Risk and Showing Your Commitment

- How a Down Payment Directly Lowers Your Monthly Payments and Total Interest Paid

Your 'Impossible' Car Loan Just Got Approved. Self-Employed, Poor Credit.

For many self-employed Canadians, the dream of owning a reliable vehicle often crashes into a wall of traditional financing hurdles. Add to that the challenge of poor credit, and the idea of securing a car loan can feel not just difficult, but truly impossible. You've likely heard the dismissive "no" from conventional lenders, leaving you feeling frustrated and overlooked. But what if we told you that your 'impossible' car loan just got approved? What if the path to driving away in the vehicle you need, regardless of your employment status or credit history, is not only possible but also surprisingly fast?

At SkipCarDealer.com, we understand the unique entrepreneurial spirit that drives so many Canadians. We know your income might not fit the rigid, salaried mould, and we recognize that past financial challenges don't define your present capability or future potential. This comprehensive guide is designed to shatter the myth that self-employed individuals with poor credit can't get approved for a car loan in Canada. We're here to show you the specialized solutions, streamlined processes, and supportive lenders who are ready to say 'yes' and get you on the road quickly, with dignity and transparency.

Key Takeaways

- The Myth is Busted: Self-employed Canadians with poor credit *can* get approved for car loans, often with fast turnaround times.

- Specialized Lenders are Your Allies: Forget the big banks; alternative lenders and brokers understand and cater to unique financial situations.

- Income Proof is Redefined: Bank statements, tax returns (Notice of Assessment), and invoicing records are valid proof of income for specialized lenders.

- Credit History is Not a Life Sentence: Lenders focusing on subprime auto loans prioritize your current ability to pay and future potential over past mistakes.

- Preparation is Key to Speed: A well-organized application with clear documentation significantly accelerates the approval process.

- Affordability Matters Most: Lenders assess your debt-to-income ratio and the vehicle's collateral value more than a perfect credit score.

- Strategic Choices Pay Off: A modest down payment and a reliable, moderately priced used vehicle can dramatically improve approval odds and loan terms.

- This Loan is a Credit Builder: Timely payments on your car loan are a powerful tool to rebuild and improve your credit score for future financial opportunities.

The Self-Employed Paradox: Why Traditional Lenders Say 'No' (and Who Says 'Yes' to Your Drive)

Being self-employed in Canada is a testament to your ambition and resilience. Whether you're a freelance designer, a skilled tradesperson, a gig economy worker, or a small business owner, you navigate the economic landscape with independence. However, this very independence often creates a paradox when it comes to traditional lending. Big banks and conventional financial institutions thrive on predictability. They prefer the neat, bi-weekly pay stubs of salaried employees, which offer a clear, consistent snapshot of income and perceived stability. Your entrepreneurial journey, with its fluctuating income streams, diverse client base, and necessary business expenses, simply doesn't fit their rigid algorithms.

This isn't a judgment on your financial health; it's a structural limitation of their lending models. They see "irregular income" where specialized lenders see "dynamic earning potential." They see "complex tax returns" where we see "proof of a thriving business." This fundamental difference in perspective is why traditional lenders often say 'no,' even when you are perfectly capable of affording a car loan.

Unpacking the 'Stable Income' Hurdle: Why Pay Stubs Aren't Your Only Proof

The core of the problem lies in the traditional definition of "stable income." For most banks, a pay stub is the golden ticket. It's a simple, undeniable record of employment and earnings. As a self-employed individual, you don't have this, and trying to force your income into that mould is often futile. Your income might come from multiple sources, it might be seasonal, or it might fluctuate month-to-month. This doesn't mean it's unstable; it just means it's different. Specialized lenders understand this and are equipped to evaluate your income through a broader lens. For more on how we approach self-employed income, check out our guide on Self-Employed Ontario: They Want a Pay Stub? We Want You Driving.

The Risk Aversion of Big Banks: Understanding Their Traditional Lending Model

Big banks are, by nature, risk-averse. Their lending models are designed to minimize risk by sticking to well-defined parameters. When an applicant falls outside these parameters – whether it's due to self-employment, a low credit score, or both – they are automatically flagged as higher risk. Their systems are not built to perform the nuanced, individualized assessment that your unique financial situation requires. They prioritize volume and standardization, which unfortunately leaves many deserving self-employed Canadians out in the cold.

Meet Your Allies: The Specialized Lenders & Brokers Who Understand Entrepreneurship

Fortunately, the financial landscape includes allies specifically designed to serve you. Specialized lenders and auto finance brokers are your champions in this process. Unlike big banks, their business model is built around assessing unique situations. They have a deeper understanding of the self-employed income structure and are willing to look beyond a single credit score. They partner with dealerships like SkipCarDealer.com to connect self-employed individuals with poor credit to the financing they need. They see your drive, your work ethic, and your ability to generate income, rather than just a number on a pay stub or a credit report. These are the institutions that say 'yes' when others say 'no,' recognizing your potential and helping you secure the vehicle that fuels your business and personal life.

Deconstructing 'Poor Credit' in Canada: It's Not a Life Sentence for Car Ownership

The term "poor credit" can feel like a heavy burden, a scarlet letter on your financial history. It's often associated with a sense of hopelessness when it comes to securing loans, especially for significant purchases like a car. However, in Canada, having poor credit is absolutely not a life sentence, particularly when it comes to auto financing. Specialized lenders operate on a "second chance" philosophy, understanding that life happens, and past financial stumbles don't dictate your future capability.

Beyond the FICO Score: What Your Credit Report *Really* Tells Lenders

While your credit score (often a FICO Score or similar proprietary score like Beacon in Canada) is a significant factor, it's just one piece of the puzzle. Specialized lenders look beyond that three-digit number to understand the full narrative of your credit report. They examine:

- Payment History: Are there patterns of late payments, or were they isolated incidents? Recent payment history often carries more weight than older events.

- Credit Utilization: How much of your available credit are you using? High utilization can signal risk, but it's also understandable for those rebuilding.

- Types of Credit: Do you have a mix of revolving credit (credit cards) and installment loans (previous car loans, mortgages)?

- Public Records: Bankruptcies, Consumer Proposals, or judgments. While these are significant, they are not insurmountable. For instance, if you've gone through a Consumer Proposal, you might find our article Your Consumer Proposal? We Don't Judge Your Drive. particularly insightful.

- Age of Credit History: A longer history, even with some blemishes, can sometimes be viewed more favourably than a very short, thin file.

The key is that they look for context and current stability, not just past perfection.

Common Credit Imperfections: Bankruptcies, Consumer Proposals, and Late Payments (and How Lenders Respond)

Many Canadians find themselves with poor credit due to a variety of circumstances: job loss, illness, divorce, business setbacks, or simply youthful financial inexperience. The most common imperfections include:

- Late Payments: A few missed payments can drop your score, but demonstrating consistent, on-time payments since then can mitigate the impact.

- Collections: Unpaid accounts sent to collections are serious, but lenders will assess how recent they are and if you've made efforts to resolve them.

- Bankruptcy: This is a significant event, but after discharge, many lenders are willing to offer a "fresh start." They want to see that you've learned from the experience and are now on a stable path.

- Consumer Proposal: A less severe alternative to bankruptcy, a Consumer Proposal shows you've taken proactive steps to manage debt. Lenders often view applicants post-proposal quite favourably, especially if they are adhering to their repayment plan.

Specialized lenders understand these realities. Their response isn't an automatic rejection; it's an assessment of your current financial health and your commitment to rebuilding.

The 'Second Chance' Philosophy: How Some Lenders Prioritize Your Present Over Your Past

The "second chance" philosophy is the cornerstone of subprime auto lending. These lenders recognize that a car is often a necessity, not a luxury, especially for self-employed individuals who rely on transportation for their livelihood. They prioritize your present ability to afford the loan and your future commitment to making payments. They look at factors like your current income stability (even if it's self-employed and non-traditional), your housing stability, your debt-to-income ratio, and your willingness to make a down payment. They understand that a car loan, paid responsibly, is one of the most effective tools for credit repair, allowing you to demonstrate your reliability and build a stronger financial future.

Your 'Fast Approval' Arsenal: Preparing Your Application for Maximum Impact & Speed

When you're self-employed with poor credit, the key to fast approval isn't magic; it's preparation. A meticulously organized and thoughtfully presented application can dramatically cut down processing time and increase your chances of securing the loan you need. Think of your application as your business pitch to the lender – you're selling them on your reliability and your ability to repay.

Proof of Income, Redefined: Bank Statements, Tax Returns (Notice of Assessment), and Invoicing Records

Forget the traditional pay stub. As a self-employed individual, your proof of income is different, but no less valid. Specialized lenders are accustomed to reviewing these alternative documents:

- Bank Statements: Typically, 3-6 months of personal and/or business bank statements are crucial. These demonstrate consistent deposits and your overall cash flow. Lenders look for regular income patterns, even if the amounts vary. This is a primary method for us to verify your income, as detailed in our article Self-Employed? Your Bank Statement is Our 'Income Proof'.

- Tax Returns (Notice of Assessment - NOA): Your most recent one or two NOAs from the CRA are excellent proof of your declared income. They provide an official, government-verified record of your earnings.

- Invoicing Records/Contracts: If you have ongoing contracts or a consistent stream of invoices, these can further support your income claims, especially if your business is project-based.

- Letters from Accountants: A letter from your accountant verifying your income and business stability can add significant credibility.

The Power of Organization: Why a Meticulously Prepared Application is a Fast Application

Time is money, and when you're seeking fast approval, a disorganized application is your biggest enemy. Having all your documents ready, clearly labelled, and easily accessible before you even start the application process will save days, if not weeks. This means:

- Gathering all necessary bank statements, NOAs, and other financial records in advance.

- Having your personal identification (driver's licence, proof of residency) readily available.

- Knowing your monthly expenses and existing debt obligations.

A well-prepared application signals to the lender that you are responsible, serious, and have nothing to hide, which builds trust and speeds things along.

Building Your Financial Narrative: Explaining Gaps, Irregularities, and Your Path Forward

Don't just present numbers; tell your story. If there are gaps in employment, irregular income periods, or specific credit challenges, be prepared to explain them concisely and honestly. Lenders appreciate transparency. For example, if you had a period of low income due to starting a new business venture, explain that. If a medical emergency led to missed payments, state it. Frame your narrative around your current stability and your proactive steps to improve your financial situation. This human element can significantly influence a lender's decision, especially for those working with a 'second chance' philosophy.

Pro Tip: Pre-empt Questions.

Anticipate what a lender might ask about your income or credit history and have concise, honest answers ready. If you know your bank statements show a dip in one month, be ready to explain why (e.g., "I had a large business expense that month, but my average income remains strong"). This proactive approach demonstrates your financial awareness and transparency, building confidence with the lender.

The Approval Algorithm for the 'Impossible': How Specialized Lenders Evaluate You

Forget the rigid, automated algorithms of traditional banks. Specialized lenders for self-employed individuals with poor credit employ a more flexible, holistic approach. They're not just looking for a perfect credit score; they're assessing your overall financial picture and your capacity to manage a new debt. This "approval algorithm" is designed to find reasons to say 'yes,' rather than 'no.'

Focus on Affordability: Your Debt-to-Income Ratio (DTI) as a Key Indicator

One of the most critical metrics for specialized lenders is your Debt-to-Income Ratio (DTI). This ratio compares your total monthly debt payments (including the proposed car loan) to your gross monthly income. Even with poor credit, if your DTI is within an acceptable range, it demonstrates your ability to comfortably make your car payments. Lenders will look at your bank statements and tax returns to calculate a realistic average monthly income, then factor in your existing obligations (rent/mortgage, credit card payments, other loans). A lower DTI indicates less financial strain and a higher likelihood of loan approval.

Collateral Confidence: How the Vehicle Itself Plays a Role in Your Approval

The vehicle you choose is more than just transportation; it's also the collateral for your loan. For lenders, especially those dealing with higher-risk profiles, the value and marketability of the collateral are crucial. A reliable, moderately priced used vehicle holds its value better and is easier for a lender to recover funds from in a worst-case scenario. This reduces their risk and can significantly improve your approval odds. Conversely, trying to finance an overly expensive, luxury, or niche vehicle with poor credit can be a red flag, as it increases the lender's exposure and may be harder to sell if repossession becomes necessary.

The Human Element: When Your Story and Stability Outweigh a Low Score

This is where specialized lenders truly differentiate themselves. They understand that numbers don't always tell the whole story. They often have dedicated finance specialists who take the time to listen to your situation, understand your self-employment model, and assess your overall stability. Factors like consistent residency, a stable employment history (even if self-employed), and a clear plan for your financial future can weigh heavily in your favour. Your willingness to make a down payment or provide a co-signer (if necessary) also signals commitment and reduces lender risk, adding another layer to your "human" approval algorithm.

Navigating the Numbers: Understanding Rates, Terms, and the True Cost of Your Loan

Securing a car loan when you're self-employed with poor credit is a huge win, but it's equally important to understand the financial implications. Transparency about interest rates, loan terms, and the total cost of borrowing will empower you to make informed decisions and avoid any unwelcome surprises down the road.

The Reality of Higher Interest: Why It's Often a Necessary Stepping Stone (and How to Mitigate It)

Let's be upfront: if you have poor credit, your interest rate will likely be higher than someone with excellent credit. This is simply how lenders offset the increased risk they take on. However, don't let this deter you. View it as a necessary stepping stone. This loan isn't just about getting a car; it's about rebuilding your credit. As you make consistent, on-time payments, your credit score will improve, opening the door to refinancing at a lower rate in the future. Check out our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit for more details. To mitigate higher interest:

- Make a Down Payment: Reduces the principal amount borrowed, thus reducing total interest.

- Choose a Shorter Term: While it means higher monthly payments, a shorter loan term significantly reduces the total interest paid over the life of the loan.

- Consider a More Affordable Vehicle: Borrowing less means less interest accrues.

Beyond the Monthly Payment: Calculating Your Total Loan Cost Over Time

It's easy to get fixated on the monthly payment, but it's crucial to understand the total cost of your loan. This includes the principal amount borrowed, plus all the interest you'll pay over the entire loan term. A longer loan term might offer lower monthly payments, but it almost always results in paying significantly more in interest over time. Here's a simplified example:

| Loan Amount | Interest Rate | Term (Months) | Approx. Monthly Payment | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|---|---|

| $20,000 | 12% | 60 | $444.89 | $6,693.40 | $26,693.40 |

| $20,000 | 12% | 84 | $349.37 | $9,346.88 | $29,346.88 |

As you can see, extending the loan by 24 months (from 60 to 84) reduces the monthly payment but adds over $2,600 to the total interest paid. Always ask for the full amortization schedule if available, or use online calculators to get a clear picture.

Unmasking Hidden Fees: What to Watch Out For in Loan Agreements

While reputable lenders are transparent, it's vital to read your loan agreement carefully to identify any potential fees. Common fees might include:

- Loan Origination Fees: A fee charged for processing the loan.

- Documentation Fees: For preparing the paperwork.

- Lien Registration Fees: For registering the lender's lien on the vehicle.

- Prepayment Penalties: Some loans might charge a fee if you pay off the loan early. Always check for this, especially if you plan to refinance quickly.

Always ask for a clear breakdown of all fees. If anything seems unclear or excessive, don't hesitate to ask for clarification.

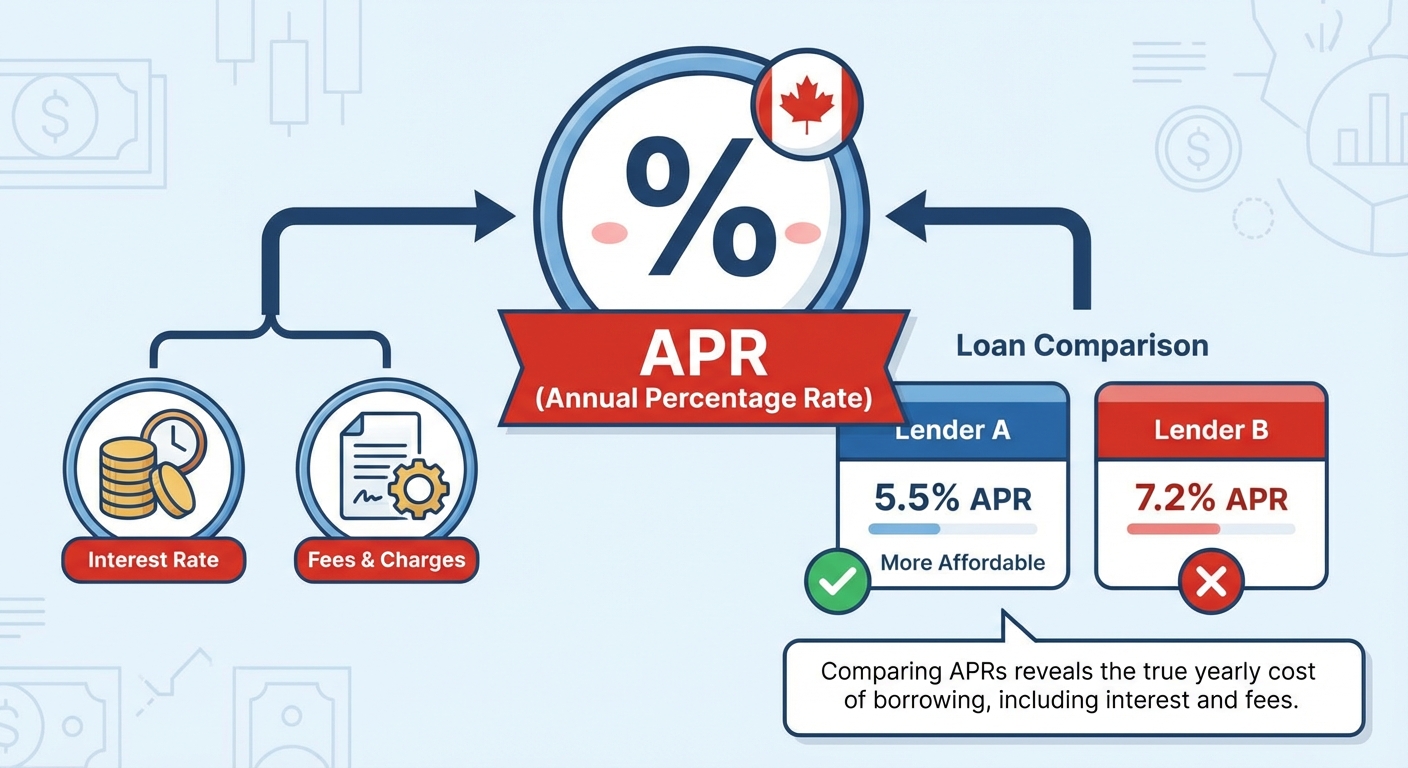

Pro Tip: Always ask for the Annual Percentage Rate (APR).

The APR gives you the true cost of borrowing, as it includes not just the interest rate but also most fees associated with the loan, expressed as a yearly percentage. Comparing APRs from different lenders provides a more accurate picture of which loan is truly more affordable.

Choosing Your Champion: Dealerships, Brokers, or Online Platforms for Your Unique Situation?

When you're a self-employed Canadian with poor credit, knowing where to start your car loan journey can feel overwhelming. Fortunately, there are several avenues, each with distinct advantages. Choosing the right "champion" for your situation can significantly impact your approval speed and the quality of your loan terms.

The 'One-Stop Shop' Dealer: Convenience vs. Potential for Limited Options

Many dealerships, like SkipCarDealer.com, offer in-house financing or work with a network of lenders. This "one-stop shop" approach provides immense convenience. You can choose your vehicle and arrange financing all in one place, often on the same day. For self-employed individuals with poor credit, reputable dealerships often have established relationships with specialized subprime lenders. The advantage here is speed and simplicity – the dealership handles most of the paperwork and communication with lenders on your behalf.

However, the potential downside is that a single dealership might only work with a finite number of lenders. While many will have options for you, it might not be the absolute broadest range available. That said, for those prioritizing ease and a direct path to driving away, a dealer with a strong finance department specializing in unique credit situations is an excellent choice.

The Broker Advantage: Accessing a Wider Network of Specialized Lenders

Auto finance brokers act as intermediaries, connecting you with multiple lenders from their extensive network. Their primary advantage is their ability to shop around on your behalf, potentially finding you the best possible rates and terms by casting a wider net. Brokers often specialize in helping individuals with challenging credit situations, so they are adept at identifying lenders who are most likely to approve self-employed applicants with poor credit.

The broker model can be particularly beneficial if you want to explore as many options as possible without submitting multiple applications yourself, which can negatively impact your credit score with numerous hard inquiries. They present your application to lenders most likely to approve you, streamlining the process.

Online Platforms: Speed, Discretion, and Digital Efficiency for the Modern Borrower

Online platforms offer unparalleled speed and discretion. You can complete an application from the comfort of your home, at any time that suits you. These platforms often leverage technology to quickly match your profile with suitable lenders, providing pre-approval decisions within minutes or hours. This digital efficiency is a huge boon for busy self-employed individuals. Many online platforms also act as brokers, submitting your application to multiple lenders to find the best fit.

The discretion is also a plus – you can explore your options without the pressure of a salesperson. Just ensure you're using a reputable and secure online platform that clearly outlines its process and privacy policies.

Pro Tip: Start with online pre-approval processes from reputable brokers or dealerships.

Many online platforms offer pre-approval processes that use a "soft" credit check, which doesn't negatively impact your credit score. This allows you to explore your potential options and get an idea of what you might qualify for without committing or incurring multiple hard inquiries.

Strategic Car Selection: How Your Vehicle Choice Boosts Approval Odds (and Saves You Money)

Your choice of vehicle is more than just a personal preference when you're seeking a car loan with poor credit and self-employed income. It's a strategic decision that can significantly impact your approval odds, the interest rate you receive, and your long-term financial stability. Lenders view the vehicle as collateral, and certain choices reduce their risk, making them more willing to approve your loan.

The 'Sweet Spot' for Used Cars: Age, Mileage, and Market Value for Lenders

For individuals with poor credit, a used car is almost always the smarter choice. But not just any used car. Lenders prefer vehicles that fall into a "sweet spot":

- Age: Generally, a vehicle that is 3-7 years old. Newer cars depreciate rapidly, increasing lender risk, while older cars might have reliability concerns.

- Mileage: Vehicles with moderate mileage (e.g., between 60,000 km and 150,000 km) are often seen as reliable without being excessively worn.

- Market Value: Lenders prefer vehicles with a clear, established market value. This makes it easier for them to assess the collateral and, if necessary, re-sell the vehicle. Avoid highly customized or niche vehicles that might have a limited resale market.

Choosing a vehicle in this sweet spot demonstrates financial prudence and reduces the lender's perceived risk, making your application more attractive.

Avoiding the Pitfalls: Overpriced or Under-Valued Vehicles that Deter Lenders

Be wary of two extremes:

- Overpriced Vehicles: Trying to finance a brand-new luxury vehicle or an overly expensive used car with poor credit is a common pitfall. It signals a lack of financial realism to lenders and increases their risk significantly. The loan-to-value (LTV) ratio (the amount borrowed compared to the vehicle's market value) will be too high.

- Under-Valued Vehicles (Too Old/High Mileage): While cheap, very old cars with extremely high mileage might be difficult to finance. Lenders worry about their reliability and potential for costly repairs, which could lead to missed payments. The collateral value might also be too low to justify the loan.

The goal is to find a balance – a reliable vehicle that serves your needs without overextending your budget or the lender's risk tolerance.

The Impact of Vehicle Type: Sedans vs. Trucks vs. Luxury – What's Most 'Approvable'?

The type of vehicle can also play a role. Generally:

- Sedans and Hatchbacks: Often the easiest to finance due to their widespread appeal, fuel efficiency, and typically lower price points.

- SUVs and Minivans: Also generally easy to finance, especially family-friendly models, as they have strong market demand.

- Pickup Trucks: Can be financed, but larger, more expensive trucks might be harder to approve with poor credit, unless they are directly tied to your self-employment and can be justified as a business necessity.

- Luxury Vehicles: Very difficult to finance with poor credit due to high price, higher insurance costs, and the perception of discretionary spending rather than necessity.

Pro Tip: Opt for a reliable, moderately priced used vehicle.

It reduces lender risk and makes approval significantly easier. Focus on practicality and affordability in your initial car purchase to secure the loan and begin rebuilding your credit, rather than aiming for your dream car right away.

The Down Payment Dynamo: Supercharging Your Application (Even with a Small Amount)

When you're self-employed with poor credit, a down payment acts like a financial superpower for your car loan application. Even a modest amount can dramatically improve your chances of approval, lower your interest rate, and make your loan more affordable overall. It signals commitment and reduces risk for the lender, making your application stand out.

Why Lenders Love Down Payments: Reducing Their Risk and Showing Your Commitment

From a lender's perspective, a down payment is incredibly attractive for several reasons:

- Reduced Risk: It immediately lowers the amount of money they need to lend. If you put down 10% on a $20,000 car, they're only financing $18,000. This reduces their exposure should you default.

- Instant Equity: A down payment means you have immediate equity in the vehicle. This reduces the chance of being "upside down" (owing more than the car is worth) early in the loan term, which is a significant concern for lenders.

- Proof of Commitment: Saving up for a down payment demonstrates financial discipline and a serious commitment to the purchase. It shows the lender you have "skin in the game" and are less likely to walk away from the loan.

How a Down Payment Directly Lowers Your Monthly Payments and Total Interest Paid

The benefits of a down payment extend directly to your wallet:

- Lower Principal: Less money borrowed means lower monthly payments.

- Less Interest Accrued: Since interest is calculated on the principal balance, a smaller principal balance means you pay less interest over the life of the loan. This can save you hundreds or even thousands of dollars.

Consider this example:

| Loan Amount | Down Payment | Financed Amount | Interest Rate | Term (Months) | Approx. Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|---|

| $20,00 |