Maximize Your Approval Odds for New Business Car Loan 2026

Table of Contents

- Key Takeaways

- The Strategic Imperative: Why a New Business Vehicle Loan Matters for Growth in 2026

- Beyond Transportation: How a New Vehicle Fuels Operational Efficiency, Elevates Brand Image, and Supports Scaling Strategies

- Understanding the 'New' Vehicle Advantage: Depreciation Benefits, Warranty Coverage, and Long-Term Total Cost of Ownership (TCO) for Businesses

- Navigating the 2026 Lending Landscape: Economic Forecasts, Interest Rate Predictions, and Supply Chain Considerations Influencing Vehicle Availability and Financing Terms

- Decoding the Lender's Mindset: What Drives Business Car Loan Approval Decisions?

- The 'Five C's' of Business Credit: A Deep Dive into Capital, Capacity, Collateral, Conditions, and Character – How Each is Assessed

- Personal vs. Business Credit Scores: Understanding Their Intricate Interplay and Why Both Are Scrutinized, Especially for New or Small Businesses

- Debt-to-Income (DTI) and Debt Service Coverage Ratio (DSCR) for Businesses: How Lenders Calculate Your Precise Repayment Capacity and Risk

- Risk Assessment Models: What Specific Data Points and Metrics Are Most Critical for a New Business Seeking Significant Vehicle Financing

- Phase 1: Fortifying Your Business Foundation for Loan Approval

- Mastering Your Financial Documentation: Beyond Standard Tax Returns – What Lenders *Really* Want to See for a Robust Application

- Detailed Income Statements and Balance Sheets: 2-3 Years of History, or Meticulously Crafted, Realistic Projections for Startups

- Comprehensive Cash Flow Analysis: Demonstrating Consistent Liquidity and the Ability to Meet All Financial Obligations, Including Loan Payments

- A Compelling Business Plan with Robust Financial Projections: Articulating Your Venture's Viability, Growth Strategy, and the Vehicle's Role Within It

- Business Bank Statements: Proof of Consistent Deposits, Responsible Account Management, and Operational Stability

- Client Contracts and Recurring Revenue Proof: Especially Valuable for Service-Based Businesses to Show Predictable Income Streams

- Phase 2: Optimizing Your Credit Profile (Both Personal & Business)

- The Personal Credit Score's Undeniable Influence: How Your Individual Credit Health Directly Impacts Your Business's Borrowing Power

- Actionable Strategies to Boost Your Personal Credit Score: Focusing on Payment History, Credit Utilization, Credit Mix, and Credit Age

- Building Business Credit from Scratch: Essential, Step-by-Step Actions for New Businesses

- Monitoring and Correcting Errors: Proactive Steps to Ensure Accuracy and Integrity on Both Your Personal and Business Credit Reports

- Phase 3: Strategic Vehicle Selection – More Than Just a Purchase

- Aligning Vehicle Choice with Business Needs and Lender Confidence

- Utility vs. Luxury: How the Perceived Necessity and Practicality of the Vehicle Impact Lender Assessment and Approval Likelihood

- Total Cost of Ownership (TCO) Deep Dive: Factoring in Insurance, Maintenance, Fuel/Charging Costs, and Depreciation Over the Vehicle's Lifespan

- Electric Vehicles (EVs) and Hybrid Considerations for 2026: Understanding Available Tax Incentives, Long-Term Operational Savings, and Evolving Lender Perspectives on EV Financing

- Resale Value and Collateral Strength: Why Certain Vehicles Are Considered 'Safer Bets' for Lenders Due to Their Market Stability

- The 'New' vs. 'Used' Debate for Businesses: Specific Advantages of New Vehicles for Warranty, Reliability, and Brand Image, and How These Factors Influence Loan Terms and Approval Odds

- Phase 4: Navigating the Lending Landscape – Where to Find the Best Fit

- Beyond the Dealership: Exploring Diverse Financing Avenues for Your Business

- Traditional Banks: Strengths, Typical Requirements, and What Established Banks Seek in Business Clients for Vehicle Loans

- Credit Unions: Often More Flexible and Relationship-Focused, Potentially Offering Better Terms for Smaller Businesses or Those with Developing Credit

- Dealership Financing: Convenience vs. Competitive Rates – Understanding Their Role as Intermediaries and Their Network of Lenders

- Specialized Business Lenders: Tailored Solutions for Unique Situations, Specific Industries, or Businesses with Higher-Risk Profiles

- Online Lenders and Fintech Platforms: Speed and Accessibility, But a Critical Analysis of Terms, Fees, and Reputation is Paramount

- Manufacturer Financing Programs: Often Highly Competitive Rates and Incentives Specifically for New Vehicles, Including Potential Fleet Purchase Programs

- Phase 5: Crafting Your Loan Application for Irresistible Approval

- The Art of Presentation: Making Your Business Case Shine Beyond the Numbers

- The Cover Letter/Executive Summary: A Concise, Compelling Pitch That Highlights Your Business's Strengths and the Strategic Need for the Vehicle

- Detailed Financial Projections with Clear Assumptions: Backing Up Your Growth Story with Realistic, Well-Supported Numbers

- Explaining Inconsistencies: Proactively Addressing Any Dips in Revenue, Unusual Expenses, or Gaps in Employment with Clear, Honest Explanations

- Personal Guarantees and Co-Signers: Understanding When They Are Necessary, How They Strengthen Your Application, and Their Implications

- The Power of a Strong Down Payment: How a Substantial Upfront Investment Significantly Reduces Lender Risk and Can Improve Loan Terms

- Phase 6: Post-Approval and Long-Term Financial Stewardship

- Understanding Your Loan Agreement in Detail: Scrutinizing Interest Rates (Fixed vs. Variable), Loan Terms, and Any Early Repayment Clauses

- Insurance Requirements for Business Vehicles: Navigating Commercial Policies, Liability Limits, and Comprehensive Coverage Needs

- Tax Implications and Deductions: Consulting with an Accountant on Vehicle Depreciation, Eligible Operating Costs, and Sales Tax (GST/HST) Considerations

- Maintaining a Healthy Business Credit Score: Strategies for Consistent Payments, Prudent Borrowing, and Regular Credit Monitoring

- Future-Proofing Your Fleet: Planning for Business Expansion, Potential Vehicle Upgrades, and Managing Multiple Vehicle Loans Responsibly

- Addressing Common Roadblocks: What to Do If Your Application Is Denied

- Understanding the 'Why': Lenders Are Legally Obligated to Provide Specific Reasons for Denial – Leverage This Information

- Actionable Steps Post-Denial: Strategies for Rebuilding Credit, Adjusting Loan Expectations, or Seeking Alternative, Less Conventional Financing Options

- Exploring Less Traditional Avenues: Lease-to-Own Programs, Asset-Backed Lending, or Smaller, Incremental Loans to Build a Track Record

- The Invaluable Role of a Mentor or Business Advisor in Navigating Financial Challenges and Refining Your Approach

- Your Next Steps to Securing a New Business Vehicle Loan in 2026

- A Final Comprehensive Checklist for Readiness: From Meticulous Documentation to Strategic Lender Selection

- Embracing a Long-Term Financial Strategy for Sustained Business Growth and Easier Access to Future Financing

- The Unparalleled Confidence of a Well-Prepared Entrepreneur: Why Preparation Is Your Ultimate, Decisive Advantage in the Lending Process

Key Takeaways

- Proactive financial preparation is paramount: Understand your business credit, personal credit, and cash flow inside out before approaching lenders.

- Strategic lender selection is crucial: Banks, credit unions, specialized business lenders, and dealerships each have unique advantages and requirements.

- Your business plan and detailed financial projections are as important as past performance, especially for newer ventures seeking 'new' vehicle loans.

- The vehicle choice itself can influence approval odds; align it with clear business needs and demonstrated financial capacity.

- Don't underestimate the power of a strong down payment and a meticulously prepared, transparent application package.

The Strategic Imperative: Why a New Business Vehicle Loan Matters for Growth in 2026

Seeking a new business car loan in Vancouver, or any bustling Canadian city, isn't just about acquiring a vehicle. It's a strategic move, a calculated investment designed to propel your enterprise forward. In the dynamic business landscape of 2026, securing the right financing for a new vehicle can be a game-changer, but it demands meticulous preparation and a deep understanding of the lending process.

Maximizing your approval odds for a new business car loan in 2026 hinges on presenting a robust financial profile, a clear business case, and strategically navigating the diverse lending options available. It’s about convincing lenders that your business is a sound investment, capable of sustained growth and consistent loan repayment.

Beyond Transportation: How a New Vehicle Fuels Operational Efficiency, Elevates Brand Image, and Supports Scaling Strategies

A new business vehicle is far more than just a means of transport. For many Canadian businesses, it's an indispensable asset that directly impacts operational efficiency. Think of a reliable delivery van for a Montreal e-commerce startup, a professional sedan for a Calgary consultant meeting clients, or a specialized truck for a Vancouver construction firm.

New vehicles bring enhanced reliability, reducing downtime and costly repairs that can cripple productivity. They often feature the latest technology, improving navigation, fuel efficiency, and connectivity – all contributing to a smoother, more effective operation. Furthermore, a clean, modern vehicle elevates your brand image, projecting professionalism and reliability to clients and partners. This subtle yet powerful impression can be invaluable in competitive markets, building trust and credibility.

Strategically, a new vehicle also supports scaling. As your business grows, so does the demand on your resources. Proactive vehicle acquisition ensures you have the capacity to meet increased demand, expand into new territories, or offer new services, directly facilitating your growth trajectory.

Understanding the 'New' Vehicle Advantage: Depreciation Benefits, Warranty Coverage, and Long-Term Total Cost of Ownership (TCO) for Businesses

While a used vehicle might offer a lower initial price point, a new business vehicle often presents compelling long-term advantages. One significant benefit for businesses is depreciation. In Canada, vehicles used for business purposes are eligible for Capital Cost Allowance (CCA), allowing you to deduct a portion of the vehicle's cost over several years. While specific rules apply, new vehicles typically offer a larger depreciable base, leading to greater tax write-offs in the initial years.

Warranty coverage is another major draw. New vehicles come with comprehensive manufacturer warranties, covering major components and often providing roadside assistance for several years or thousands of kilometres. This protection minimizes unexpected repair costs, offering budget predictability and peace of mind. For businesses, avoiding unscheduled downtime and expensive fixes is crucial for maintaining operational continuity.

When considering the Total Cost of Ownership (TCO), a new vehicle can sometimes surprise you. While the purchase price is higher, modern new vehicles often boast superior fuel efficiency, lower maintenance costs in early years, and advanced safety features that can reduce insurance premiums. When factoring in these elements, along with reduced repair risks and higher resale value, the long-term TCO for a new vehicle can be highly competitive, especially for a business that relies heavily on its fleet.

Navigating the 2026 Lending Landscape: Economic Forecasts, Interest Rate Predictions, and Supply Chain Considerations Influencing Vehicle Availability and Financing Terms

The 2026 lending landscape for business vehicle loans will be shaped by several factors. Economic forecasts suggest a period of cautious optimism, with central banks carefully managing inflation. This means interest rates, while potentially stabilizing, may remain elevated compared to historical lows. Lenders will continue to prioritize strong credit profiles and demonstrable repayment capacity.

Supply chain considerations, though easing from recent years, can still influence vehicle availability and pricing. Manufacturers are generally more robust, but specific models or trims might still experience delays or premium pricing. This underscores the importance of planning ahead and potentially ordering your desired vehicle well in advance.

For businesses seeking financing in 2026, understanding these macroeconomic currents is vital. It means being prepared for potentially higher interest rates than a few years ago, and recognizing that lenders will be more discerning. Strong applications with clear financial health will stand out. For more nuanced insights into managing your finances, check out our guide on Underwater Car Loan? Perfect. We'll Refinance It, Toronto!, which offers strategies for challenging financial situations.

Decoding the Lender's Mindset: What Drives Business Car Loan Approval Decisions?

To secure a new business vehicle loan in 2026, you need to think like a lender. What are they looking for? What gives them confidence that your business will repay its debt? It boils down to a thorough risk assessment, evaluating both your business's health and your personal financial reliability.

The 'Five C's' of Business Credit: A Deep Dive into Capital, Capacity, Collateral, Conditions, and Character – How Each is Assessed

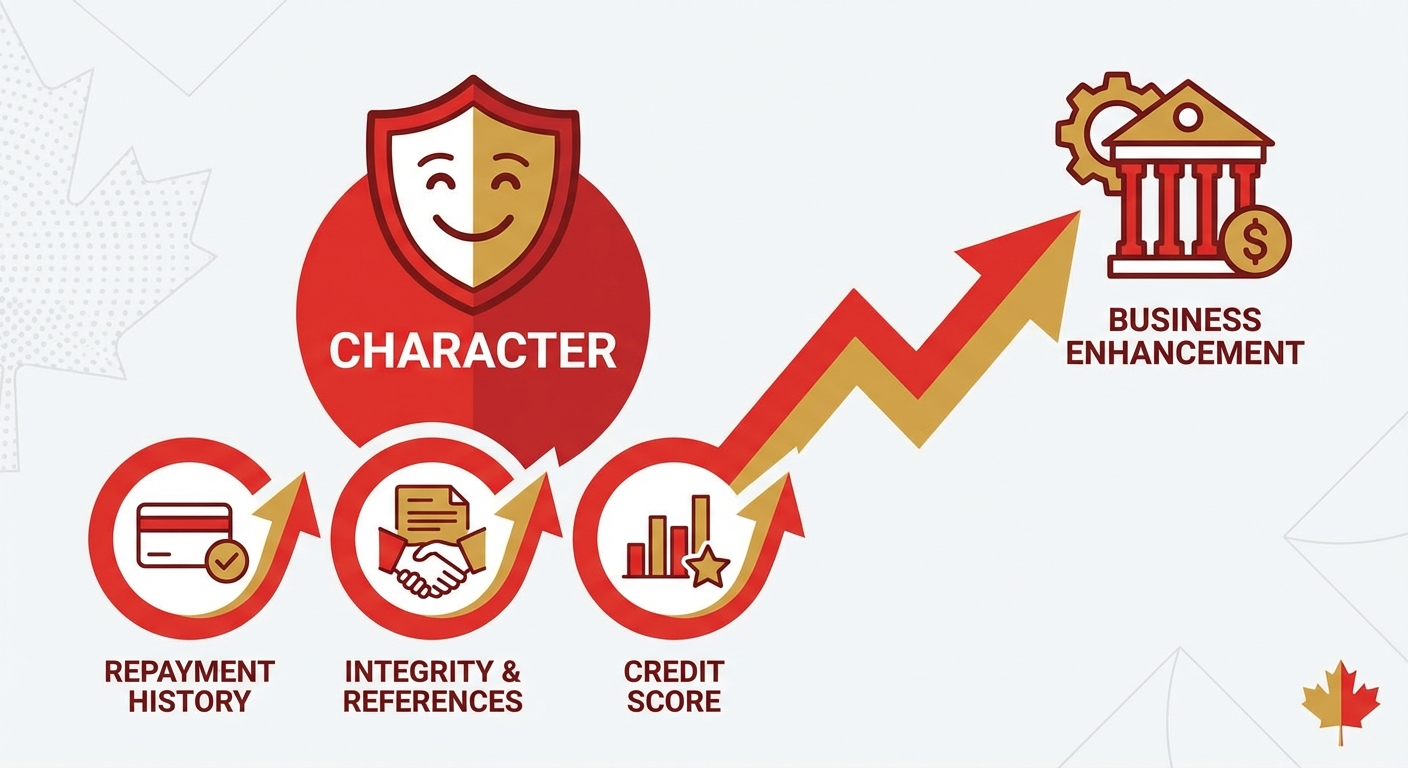

Lenders often use the "Five C's" framework to evaluate a business loan application:

- Capital: This refers to the money you've personally invested in your business. A significant owner investment demonstrates commitment and reduces the lender's risk. It shows you have "skin in the game."

- Capacity: Your business's ability to repay the loan. Lenders scrutinize cash flow, profitability, and existing debt obligations. They want to see a clear, consistent track record of generating sufficient income to cover all expenses, including the new loan payment.

- Collateral: Assets that can secure the loan. For a vehicle loan, the vehicle itself serves as collateral. However, lenders may also look at other business assets or require a personal guarantee, especially for newer ventures.

- Conditions: The overall economic and industry conditions affecting your business. A strong market, stable economy, and growth potential in your sector will be viewed favourably. Lenders also consider the purpose of the loan – how the vehicle will enhance your business.

- Character: Your business's and your personal repayment history and integrity. This is often assessed through credit scores, past loan performance, and references. Lenders want to work with trustworthy borrowers.

Context: An infographic visually breaking down the 'Five C's' of business credit, with clear definitions and icons for each element.

Context: An infographic visually breaking down the 'Five C's' of business credit, with clear definitions and icons for each element.

Personal vs. Business Credit Scores: Understanding Their Intricate Interplay and Why Both Are Scrutinized, Especially for New or Small Businesses

For new businesses or small to medium-sized enterprises (SMEs) in Canada, the line between personal and business credit can be blurry for lenders. Often, your personal credit score (Equifax, TransUnion) will be heavily weighed, as it provides a historical snapshot of your financial responsibility. A strong personal credit score (typically 680+ for prime rates) indicates you manage debt well, even if your business is still building its own credit history.

Business credit scores (Experian Business, Equifax Business, Dun & Bradstreet) assess your company's payment history with vendors, suppliers, and other business lenders. While personal credit might open the door, a developing business credit profile demonstrates your company's growing financial independence and reliability. Lenders want to see both, but for younger businesses, personal credit often acts as the primary foundation. For a deeper dive into credit score requirements, explore The Truth About the Minimum Credit Score for Ontario Car Loans.

Debt-to-Income (DTI) and Debt Service Coverage Ratio (DSCR) for Businesses: How Lenders Calculate Your Precise Repayment Capacity and Risk

Lenders use specific metrics to quantify your repayment capacity. For individuals, it's often Debt-to-Income (DTI) ratio. For businesses, the equivalent is often the Debt Service Coverage Ratio (DSCR). This ratio compares your business's net operating income to its total debt service (principal and interest payments on all debts, including the proposed new car loan). A DSCR of 1.25 or higher is generally considered favourable, meaning your business generates 1.25 times the income needed to cover its debt obligations.

Example DSCR Calculation:

If your business has a net operating income of $100,000 per year and total annual debt payments (existing + new car loan) of $80,000, your DSCR would be $100,000 / $80,000 = 1.25. This indicates a healthy capacity to manage debt.

Risk Assessment Models: What Specific Data Points and Metrics Are Most Critical for a New Business Seeking Significant Vehicle Financing

Beyond the Five C's and DSCR, lenders employ sophisticated risk assessment models. For new businesses, these models put extra emphasis on:

- Cash Flow Projections: Highly detailed, realistic, and well-supported forecasts of future income and expenses.

- Industry Stability: Is your business operating in a stable or volatile sector? Lenders prefer industries with consistent demand.

- Management Experience: The experience and track record of the business owner and key management personnel.

- Market Opportunity: A clear understanding of your target market, competitive advantages, and growth potential in cities like Toronto or Vancouver.

- Contingency Plans: How your business would handle unexpected downturns or challenges.

These data points provide a holistic view of your business's viability and its ability to weather economic fluctuations, reassuring lenders that their investment is secure.

Phase 1: Fortifying Your Business Foundation for Loan Approval

Before you even look at vehicles, the most critical step is to build an unshakeable financial foundation for your business. This phase is all about meticulous documentation and proving your business's financial health.

Mastering Your Financial Documentation: Beyond Standard Tax Returns – What Lenders *Really* Want to See for a Robust Application

While tax returns (T1 or T2, depending on your business structure) are foundational, lenders require a much broader picture of your financial reality. They want to understand the intricate details of your operations and cash flow. Simply providing a summary isn't enough; they need granularity.

Detailed Income Statements and Balance Sheets: 2-3 Years of History, or Meticulously Crafted, Realistic Projections for Startups

Income Statements (Profit & Loss): These show your business's revenues, expenses, and profit over a specific period (e.g., quarterly, annually). Lenders want to see a consistent trend of profitability and revenue growth. For established businesses, 2-3 years of statements are usually required. For startups, you’ll need meticulously crafted projections, backed by market research and clear assumptions, showing how you anticipate generating revenue and profit.

Balance Sheets: These provide a snapshot of your business's assets, liabilities, and equity at a specific point in time. Lenders use balance sheets to assess your business's financial strength, liquidity, and leverage. A healthy balance sheet demonstrates that your assets outweigh your liabilities and that you have sufficient equity.

Comprehensive Cash Flow Analysis: Demonstrating Consistent Liquidity and the Ability to Meet All Financial Obligations, Including Loan Payments

Cash flow is king. An income statement might show profit, but a cash flow statement reveals if you have enough actual cash coming in and going out to meet your obligations. Lenders will examine your cash flow statements (historical and projected) to ensure you have consistent liquidity. They want to see that your operational cash flow is robust enough to cover not just your existing expenses, but also the new vehicle loan payments, without relying on external financing to simply stay afloat.

A Compelling Business Plan with Robust Financial Projections: Articulating Your Venture's Viability, Growth Strategy, and the Vehicle's Role Within It

Especially for newer businesses, a well-researched, compelling business plan is non-negotiable. This document should clearly articulate:

- Your business model and value proposition.

- Market analysis: target audience, competition, and industry trends (e.g., in the Vancouver or Toronto market).

- Operational plan: how your business functions day-to-day.

- Marketing and sales strategy.

- Management team's experience and expertise.

- Crucially: Detailed financial projections (income statements, balance sheets, cash flow for 3-5 years) with clear, conservative assumptions.

- And specifically for this loan: How the new vehicle integrates into your strategy, why it’s necessary, and how it will contribute to revenue or efficiency.

Business Bank Statements: Proof of Consistent Deposits, Responsible Account Management, and Operational Stability

Lenders will request several months (typically 6-12) of business bank statements. These statements offer a raw, unfiltered look at your business's day-to-day financial activity. They provide proof of consistent deposits, demonstrate responsible management of funds, and reveal any overdrafts or bounced cheques, which are significant red flags. Clean, active bank statements signal operational stability and financial discipline.

Client Contracts and Recurring Revenue Proof: Especially Valuable for Service-Based Businesses to Show Predictable Income Streams

For service-based businesses, or those with contract-based revenue, providing copies of key client contracts can significantly strengthen your application. This offers tangible proof of predictable income streams, which lenders value highly. Long-term contracts, retainer agreements, or subscription models demonstrate stability and reduce the perceived risk of inconsistent cash flow.

Phase 2: Optimizing Your Credit Profile (Both Personal & Business)

Your credit profile is a critical component of your loan application. Lenders use it to gauge your reliability as a borrower. This phase focuses on building and maintaining excellent credit, both personally and for your business.

The Personal Credit Score's Undeniable Influence: How Your Individual Credit Health Directly Impacts Your Business's Borrowing Power

Even if your business is incorporated, your personal credit score remains highly influential, especially for new or small businesses. Lenders view it as a strong indicator of your financial character and discipline. A high personal credit score (e.g., above 700) can unlock better interest rates and more favourable terms for your business loan. Conversely, a poor personal credit score can severely limit your options, even if your business itself seems promising. This is particularly true for businesses seeking their first significant financing, as the business credit file may still be thin.

Actionable Strategies to Boost Your Personal Credit Score: Focusing on Payment History, Credit Utilization, Credit Mix, and Credit Age

Improving your personal credit score takes time and consistent effort:

- Payment History (35% of score): Always pay all your bills on time, every time. Even a single late payment can significantly hurt your score.

- Credit Utilization (30% of score): Keep your credit card balances low relative to your credit limits. Aim for under 30% utilization. For example, if you have a $10,000 credit limit, try to keep your balance below $3,000.

- Length of Credit History (15% of score): The longer your credit accounts have been open and in good standing, the better. Don't close old accounts, even if you don't use them frequently.

- Credit Mix (10% of score): Having a healthy mix of credit types (e.g., credit cards, lines of credit, installment loans) can be beneficial, showing you can manage different forms of debt responsibly.

- New Credit (10% of score): Avoid applying for too much new credit in a short period, as this can temporarily lower your score.

Building Business Credit from Scratch: Essential, Step-by-Step Actions for New Businesses

Building business credit is a distinct process from personal credit, and it's essential for long-term growth and independent financing:

- Obtaining a DUNS Number: Register with Dun & Bradstreet to get a D-U-N-S (Data Universal Numbering System) number. This is a unique nine-digit identifier for your business and is often a prerequisite for establishing business credit.

- Registering with Major Business Credit Bureaus: Ensure your business is registered with Equifax Business and Experian Business. These bureaus collect data on your company's financial behaviour.

- Establishing Trade Lines: Seek out vendors and suppliers who report payments to business credit bureaus. Start with small purchases and pay promptly. Net-30 accounts (where payment is due in 30 days) are a common way to build trade credit.

- Utilizing Business Credit Cards: Apply for a dedicated business credit card. Use it for business expenses and pay the balance in full and on time. This is one of the most effective ways to build a separate business credit history.

- Exploring Small Business Loans: Even a small, manageable business loan (e.g., for equipment or inventory) that is repaid diligently can help establish a positive payment history on your business credit report.

Monitoring and Correcting Errors: Proactive Steps to Ensure Accuracy and Integrity on Both Your Personal and Business Credit Reports

Regularly review both your personal and business credit reports for accuracy. Errors can occur and can negatively impact your scores. Obtain free copies of your personal credit reports annually from Equifax and TransUnion. For business credit, you may need to purchase reports or sign up for monitoring services from Experian Business or Dun & Bradstreet. If you find discrepancies, dispute them immediately with the respective credit bureau. Timely correction ensures your financial profile accurately reflects your payment behaviour.

Phase 3: Strategic Vehicle Selection – More Than Just a Purchase

The vehicle you choose for your business is not just a functional asset; it's a financial decision that profoundly impacts your loan approval odds and long-term costs. Lenders assess its suitability and value as collateral.

Aligning Vehicle Choice with Business Needs and Lender Confidence

Your vehicle selection must demonstrably align with your business needs. A commercial van for a delivery service is a clear operational necessity, whereas a high-end luxury sedan for a solo freelance graphic designer might raise questions about financial prudence and perceived risk. Lenders want to see that your investment is rational and supports your core business functions, not excessive. The more clearly you can justify the vehicle's role in generating revenue or improving efficiency, the greater the lender's confidence.

Utility vs. Luxury: How the Perceived Necessity and Practicality of the Vehicle Impact Lender Assessment and Approval Likelihood

Lenders favour practicality and utility over luxury when it comes to business vehicle financing, especially for new or smaller businesses. A vehicle that is perceived as essential for operations – think trades vehicles, service vans, or fleet cars – generally faces fewer hurdles. Luxury vehicles, while potentially enhancing brand image, often come with higher price tags, higher insurance costs, and faster depreciation, increasing the lender's risk. If you are considering a luxury vehicle for your business, particularly in a market like Vancouver, be prepared to present an exceptionally strong financial case and a clear justification for its necessity. For specific challenges in this area, you might find our article on Vancouver Luxury Car Loan: No Canadian Credit? (2026) insightful.

Total Cost of Ownership (TCO) Deep Dive: Factoring in Insurance, Maintenance, Fuel/Charging Costs, and Depreciation Over the Vehicle's Lifespan

Smart businesses look beyond the sticker price. The Total Cost of Ownership (TCO) is a critical metric. It encompasses:

- Purchase Price: The initial cost of the vehicle.

- Financing Costs: Interest paid over the life of the loan.

- Insurance: Commercial vehicle insurance can be significantly more expensive than personal insurance. Premiums vary based on vehicle type, usage, driver history, and location (e.g., Toronto vs. a rural area).

- Maintenance & Repairs: Routine servicing, unexpected repairs, tires, etc. New vehicles typically have lower initial maintenance costs due to warranties.

- Fuel/Charging Costs: A major ongoing expense. Consider efficiency ratings and the cost of gasoline or electricity.

- Depreciation: The loss in value over time. Some vehicles hold their value better than others.

- Taxes & Fees: Licensing, registration, provincial sales tax (PST/GST/HST).

A comprehensive TCO analysis demonstrates your understanding of the financial implications and your ability to manage all associated costs, boosting lender confidence.

| Category | Estimated Monthly Cost | Notes |

|---|---|---|

| Loan Payment (7.5% APR) | $900 | Based on $45,000 financed, 60 months. Varies with rates/term. |

| Commercial Insurance | $150 - $350+ | Depends on vehicle, business type, driver record, location (e.g., Vancouver can be higher). |

| Fuel/Charging | $200 - $500+ | Highly dependent on mileage, vehicle efficiency, fuel type. |

| Maintenance Fund | $50 - $100 | Allocate for routine service, tires, minor repairs (even under warranty). |

| Depreciation (Estimated) | $300 - $600 | Non-cash cost, but real loss of asset value. Important for resale. |

| Total Estimated Monthly TCO | $1,600 - $2,450+ | Excludes initial down payment, taxes, and registration fees. |

Electric Vehicles (EVs) and Hybrid Considerations for 2026: Understanding Available Tax Incentives, Long-Term Operational Savings, and Evolving Lender Perspectives on EV Financing

The year 2026 sees continued growth in the EV and hybrid market. For businesses, these vehicles offer potential benefits:

- Government Incentives: Federal and provincial rebates (e.g., in BC, Quebec, or Ontario) can significantly reduce the upfront cost of purchasing an EV.

- Operational Savings: Lower fuel costs (electricity is generally cheaper than gasoline) and reduced maintenance (fewer moving parts) can lead to substantial long-term savings.

- Environmental Image: Using EVs can enhance your business's green credentials, appealing to environmentally conscious clients.

Lenders are increasingly comfortable financing EVs, viewing them as a growing segment with strong market demand. However, they will still assess the total cost, including charging infrastructure needs, and the business case for adoption. Ensure you factor in the availability of charging options and potential installation costs if required at your business premises.

Resale Value and Collateral Strength: Why Certain Vehicles Are Considered 'Safer Bets' for Lenders Due to Their Market Stability

Lenders look at the vehicle as collateral. In the event of default, they need to recover their investment by reselling the vehicle. Therefore, vehicles with strong resale value and market stability are generally considered "safer bets." Popular models, those with a reputation for reliability, and vehicles with high demand in the used market (e.g., certain pick-up trucks, cargo vans, or efficient sedans) offer better collateral strength. This can translate to more favourable loan terms and higher approval odds. Niche or highly specialized vehicles might be harder to value and resell, potentially increasing lender risk.

The 'New' vs. 'Used' Debate for Businesses: Specific Advantages of New Vehicles for Warranty, Reliability, and Brand Image, and How These Factors Influence Loan Terms and Approval Odds

While used vehicles offer cost savings, new vehicles provide distinct advantages for businesses:

- Full Warranty Coverage: Minimizes unexpected repair costs and downtime, which is crucial for business operations.

- Latest Technology: Improved fuel efficiency, safety features, and connectivity can boost productivity.

- Enhanced Brand Image: A new, well-maintained vehicle projects professionalism and success to clients.

- Favourable Loan Terms: New vehicles often qualify for lower interest rates and longer terms due to their higher value and lower perceived risk as collateral. Manufacturer financing incentives are almost exclusively for new vehicles.

Lenders generally view new vehicles as less risky due to their predictable maintenance schedules and higher initial value, which often translates to better loan terms for well-qualified businesses.

Phase 4: Navigating the Lending Landscape – Where to Find the Best Fit

The Canadian lending landscape is diverse, offering various avenues for business vehicle financing. Understanding the strengths and typical requirements of each can help you find the best fit for your specific business needs.

Beyond the Dealership: Exploring Diverse Financing Avenues for Your Business

While dealerships offer convenience, exploring all available options is crucial to securing the most competitive rates and terms. Don't limit your search to just one type of lender.

Traditional Banks: Strengths, Typical Requirements, and What Established Banks Seek in Business Clients for Vehicle Loans

Major Canadian banks (like RBC, TD, BMO, CIBC, Scotiabank) are a common source for business loans. Their strengths include competitive rates for well-qualified borrowers, a wide range of financial products, and established relationships for businesses that already bank with them. They typically seek:

- Established businesses with at least 2-3 years of operating history.

- Strong financial statements (income, balance, cash flow).

- Excellent business credit history and often strong personal credit from the owner(s).

- A clear, detailed business plan and justification for the vehicle.

- Demonstrable capacity to repay the loan (e.g., strong DSCR).

Banks can be rigorous in their application process but often offer the most favourable terms for stable, profitable businesses.

Credit Unions: Often More Flexible and Relationship-Focused, Potentially Offering Better Terms for Smaller Businesses or Those with Developing Credit

Credit unions, being member-owned, often offer a more personalized and flexible approach to lending. They may be more willing to work with smaller businesses, startups, or those with developing credit histories, especially if you have an existing relationship with them. Their strengths include:

- Potentially lower interest rates or fees compared to some traditional banks.

- More flexible underwriting criteria, especially for local businesses.

- Relationship-based lending, where your overall business and personal banking history with them can be a significant factor.

Requirements will still include financial documentation and a business plan, but they might be more accommodating to unique situations.

Dealership Financing: Convenience vs. Competitive Rates – Understanding Their Role as Intermediaries and Their Network of Lenders

Dealerships offer immense convenience, acting as a one-stop shop for vehicle purchase and financing. They work with a network of lenders, including banks, captive finance companies (manufacturer-owned), and other financial institutions. Their strengths are:

- Streamlined application process, often with on-the-spot approvals.

- Access to manufacturer special rates and incentives, particularly for new vehicles.

- Ability to find financing for a wider range of credit profiles.

However, while convenient, dealership financing may not always offer the absolute lowest rates unless it's a manufacturer-subsidized program. It's essential to compare their offers with pre-approved loans from banks or credit unions.

Specialized Business Lenders: Tailored Solutions for Unique Situations, Specific Industries, or Businesses with Higher-Risk Profiles

Beyond traditional institutions, specialized business lenders focus on specific niches. These might include lenders specializing in equipment financing, industry-specific loans (e.g., for transportation or construction), or alternative lenders catering to businesses with less-than-perfect credit or unique cash flow patterns. Their strengths are:

- Flexibility and understanding of specific industry challenges.

- Willingness to consider unconventional collateral or revenue streams.

- Faster approval times in some cases.

The trade-off can be higher interest rates or fees due to the increased risk they undertake. These can be good options for businesses that might struggle with traditional bank criteria.

Online Lenders and Fintech Platforms: Speed and Accessibility, But a Critical Analysis of Terms, Fees, and Reputation is Paramount

The digital age has brought a surge of online lenders and fintech platforms. They offer speed, convenience, and often more accessible criteria than traditional banks, making them popular for quick financing needs. Their advantages include:

- Rapid application and approval processes (sometimes within hours).

- Minimal paperwork, often relying on digital data analysis.

- Broader eligibility, potentially catering to a wider range of credit scores.

However, thorough due diligence is crucial. Interest rates and fees can sometimes be higher, and terms might be less flexible. Always research their reputation, read reviews, and fully understand all terms and conditions before committing. Some may not report to business credit bureaus, limiting your credit-building opportunities.

Manufacturer Financing Programs: Often Highly Competitive Rates and Incentives Specifically for New Vehicles, Including Potential Fleet Purchase Programs

For new vehicles, manufacturer financing (e.g., Ford Credit, GM Financial, Toyota Financial Services) can be highly competitive. These programs are designed to encourage sales of their vehicles and often offer:

- Very low-interest rates (sometimes 0% or promotional rates for well-qualified buyers).

- Lease options with favourable terms.

- Special incentives or rebates for specific models.

- Fleet purchase programs for businesses acquiring multiple vehicles, offering volume discounts and tailored support.

These programs are typically for new vehicles and require strong credit scores, but they are often the best deal if you meet the criteria.

| Lender Type | Typical Interest Rate Range (APR) | Key Requirements | Pros | Cons |

|---|---|---|---|---|

| Traditional Banks | 6.5% - 12.0% | 2-3+ years in business, strong financials, excellent credit (personal & business) | Competitive rates, established relationships, diverse products | Rigid approval process, slower, less flexible for new businesses |

| Credit Unions | 6.0% - 13.5% | Good credit, may be more flexible for newer businesses with existing relationship | Relationship-focused, potentially flexible terms, competitive rates | Membership required, geographic limitations, slower than online |

| Dealership Financing | 5.5% - 18.0% | Varies greatly by lender in network; often requires decent personal credit | Convenience, manufacturer incentives, fast approval | Rates can be higher without manufacturer subsidy, less transparency |

| Specialized/Online Lenders | 9.0% - 29.0%+ | More flexible, may consider less-than-perfect credit or unique situations | Speed, accessibility, tailored solutions for specific industries/risks | Higher rates & fees, less personal service, potential for predatory lenders |

Phase 5: Crafting Your Loan Application for Irresistible Approval

Once you've done your groundwork and explored lenders, it's time to assemble your application. This isn't just about ticking boxes; it's about telling a compelling story of your business's strength and potential.

The Art of Presentation: Making Your Business Case Shine Beyond the Numbers

Your loan application is your business's resume to the lender. It needs to be professional, coherent, and persuasive. While the numbers are paramount, how you present them – and the narrative you build around them – can significantly influence the lender's perception. A well-organized, easy-to-understand application package reflects positively on your business acumen and attention to detail.

The Cover Letter/Executive Summary: A Concise, Compelling Pitch That Highlights Your Business's Strengths and the Strategic Need for the Vehicle

Start with a strong cover letter or executive summary. This should be a concise, compelling pitch (1-2 pages maximum) that:

- Introduces your business and its mission.

- Highlights your key strengths (e.g., consistent profitability, strong client base, experienced management).

- Clearly states the loan amount requested and its specific purpose (the new vehicle).

- Articulates the strategic importance of the vehicle to your business's growth, efficiency, or service delivery.

- Briefly summarizes your financial health and repayment capacity.

This is your chance to make a strong first impression and frame the entire application positively.

Detailed Financial Projections with Clear Assumptions: Backing Up Your Growth Story with Realistic, Well-Supported Numbers

For newer businesses, or those seeking significant growth, your financial projections are critical. These must be detailed (monthly for the first year, quarterly for the next two, annually thereafter) and accompanied by clear, conservative assumptions. For example, if you project a 20% revenue increase, explain *how* that will be achieved (e.g., new contracts, market expansion, increased advertising). Vague or overly optimistic projections will raise red flags. Lenders want to see a realistic path to profitability and sufficient cash flow to service the debt.

Explaining Inconsistencies: Proactively Addressing Any Dips in Revenue, Unusual Expenses, or Gaps in Employment with Clear, Honest Explanations

No business journey is perfectly linear. If your financial statements show a dip in revenue, unusual expenses, or if you have gaps in your personal employment history, address these proactively. Provide clear, honest explanations within your application or in an accompanying letter. For example, a temporary revenue dip might be due to a major client loss that has since been replaced, or a large one-time expense for new equipment. Transparency builds trust. Trying to hide or obscure such details will almost certainly lead to denial. For situations involving past financial difficulties, understanding options like those discussed in Car Loan After Bankruptcy & 400 Credit Score 2026 Guide can be helpful.

Personal Guarantees and Co-Signers: Understanding When They Are Necessary, How They Strengthen Your Application, and Their Implications

For new or small businesses, lenders often require a personal guarantee from the business owner. This means you are personally liable for the loan if your business defaults. It significantly reduces the lender's risk and is a common requirement. While it adds personal exposure, it can be essential for securing approval. Similarly, a co-signer with strong credit can strengthen an application, effectively adding another layer of repayment assurance for the lender. Understand the full implications of a personal guarantee before agreeing to it.

The Power of a Strong Down Payment: How a Substantial Upfront Investment Significantly Reduces Lender Risk and Can Improve Loan Terms

A substantial down payment is one of the most powerful ways to boost your approval odds and secure better loan terms. It signals commitment, reduces the loan-to-value (LTV) ratio, and directly lowers the lender's risk. Lenders see a strong down payment as a sign of financial stability and confidence in your business. It also reduces the total amount you need to borrow, which can translate to lower monthly payments and less interest paid over the life of the loan. While 10-20% is often recommended, the more you can put down, the better. For more on the impact of down payments, see Your Down Payment Went Missing. Your Interest Rate Didn't Get the Memo, Edmonton.

Phase 6: Post-Approval and Long-Term Financial Stewardship

Congratulations, your loan is approved! But the journey doesn't end there. Diligent management of your loan and continued financial stewardship are crucial for your business's long-term health and future borrowing capacity.

Understanding Your Loan Agreement in Detail: Scrutinizing Interest Rates (Fixed vs. Variable), Loan Terms, and Any Early Repayment Clauses

Before signing, thoroughly read and understand every detail of your loan agreement. Pay close attention to:

- Interest Rate: Is it fixed (stays the same) or variable (can change)? Variable rates might start lower but carry the risk of increasing.

- Loan Term: The duration of the loan (e.g., 60 or 72 months). Longer terms mean lower monthly payments but more interest paid overall.

- Payment Schedule: When and how often payments are due.

- Fees: Any origination fees, administrative charges, or late payment penalties.

- Early Repayment Clauses: Some loans have penalties for paying off the loan ahead of schedule. Ensure you understand if this applies.

If anything is unclear, ask for clarification from the lender. Don't sign until you are fully comfortable with all terms.

Insurance Requirements for Business Vehicles: Navigating Commercial Policies, Liability Limits, and Comprehensive Coverage Needs

A personal auto insurance policy is insufficient for a business vehicle. You will need commercial vehicle insurance, which generally has higher liability limits and specific coverage for business use (e.g., transporting goods, client visits, tools). Understand the minimum coverage required by your lender and province, but also consider additional comprehensive and collision coverage to protect your asset. Discuss your specific business operations with an insurance broker to ensure you have adequate protection.

Tax Implications and Deductions: Consulting with an Accountant on Vehicle Depreciation, Eligible Operating Costs, and Sales Tax (GST/HST) Considerations

Business vehicle expenses offer significant tax deductions in Canada. Consult with a qualified accountant to fully understand:

- Capital Cost Allowance (CCA): How to deduct the cost of the vehicle over time.

- Eligible Operating Costs: Deductible expenses include fuel, maintenance, insurance, registration fees, and interest on the loan. Accurate mileage logs are essential for calculating the business-use portion of these expenses.

- GST/HST Input Tax Credits (ITCs): How to recover the GST/HST paid on the vehicle purchase and related expenses if your business is registered for GST/HST.

Proper record-keeping is vital to maximize these deductions and ensure compliance with CRA regulations.

Maintaining a Healthy Business Credit Score: Strategies for Consistent Payments, Prudent Borrowing, and Regular Credit Monitoring

The approval of this loan is an opportunity to further build your business credit. Continue making all loan payments on time, every time. This consistent positive payment history will strengthen your business credit score. Practice prudent borrowing by not overextending your business with excessive debt. Regularly monitor your business credit reports to catch any errors or fraudulent activity, ensuring the integrity of your credit profile for future financing needs.

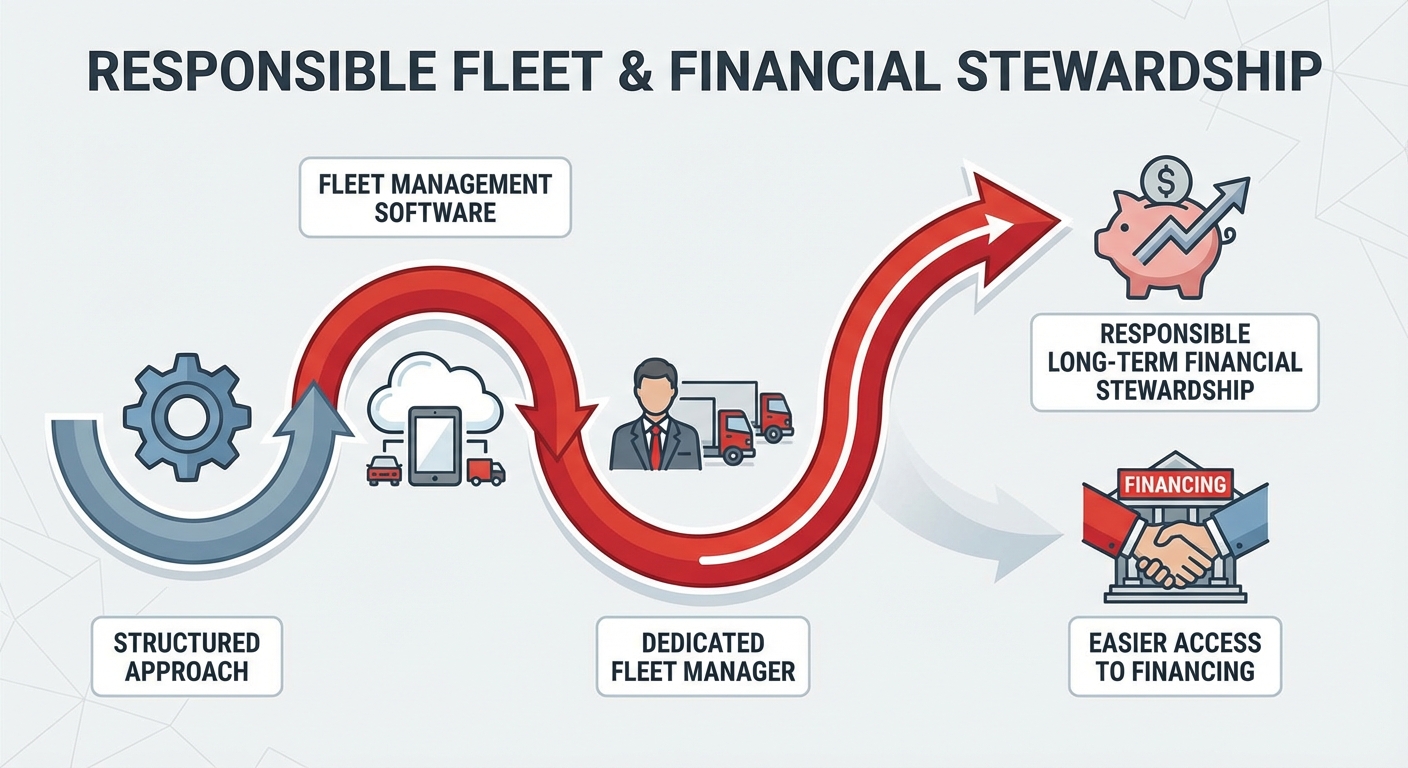

Future-Proofing Your Fleet: Planning for Business Expansion, Potential Vehicle Upgrades, and Managing Multiple Vehicle Loans Responsibly

Look beyond the current vehicle. As your business grows, you may need additional vehicles or upgrades. Plan for this by maintaining a strong financial position, reducing debt, and continuing to build excellent credit. If managing multiple vehicle loans, ensure your cash flow can comfortably support all payments, and consider a structured approach to fleet management, potentially utilizing fleet management software or a dedicated fleet manager. Responsible long-term financial stewardship ensures easier access to financing when your business needs it most.

Context: A professional photograph of a business owner reviewing a loan document or financial statements with a trusted financial advisor, symbolizing diligent financial stewardship and planning.

Context: A professional photograph of a business owner reviewing a loan document or financial statements with a trusted financial advisor, symbolizing diligent financial stewardship and planning.

Addressing Common Roadblocks: What to Do If Your Application Is Denied

Even with the best preparation, a loan application can sometimes be denied. Don't view this as a dead end, but rather an opportunity to learn and refine your approach.

Understanding the 'Why': Lenders Are Legally Obligated to Provide Specific Reasons for Denial – Leverage This Information

If your application is denied, the lender is legally required to provide you with the specific reasons. This feedback is invaluable. It might be due to insufficient cash flow, a low credit score, too much existing debt, or issues with your business plan. Whatever the reason, demand clarity. This information is your roadmap for improvement.

Actionable Steps Post-Denial: Strategies for Rebuilding Credit, Adjusting Loan Expectations, or Seeking Alternative, Less Conventional Financing Options

Based on the lender's feedback, take actionable steps:

- Rebuilding Credit: If credit score was an issue (personal or business), focus on improving it. Pay down debts, dispute errors, and establish new positive trade lines.

- Adjusting Loan Expectations: Perhaps the vehicle was too expensive, or the requested loan amount too high for your current financial standing. Consider a more affordable vehicle or a smaller loan.

- Strengthening Financials: If cash flow or profitability were concerns, focus on boosting revenue, cutting unnecessary expenses, and improving your financial statements over several months.

- Refining Your Business Plan: If the plan was deemed weak, revise it with more robust projections, market analysis, and a clearer strategic justification for the vehicle.

Exploring Less Traditional Avenues: Lease-to-Own Programs, Asset-Backed Lending, or Smaller, Incremental Loans to Build a Track Record

If traditional financing remains elusive, consider alternative options:

- Lease-to-Own Programs: These can offer lower monthly payments and a path to ownership, often with more flexible credit requirements.

- Asset-Backed Lending: If your business has other valuable assets (equipment, inventory, accounts receivable), some lenders will use these as collateral.

- Smaller, Incremental Loans: Start with a smaller loan, perhaps for less expensive equipment or working capital. Successfully repaying this can build a positive track record, making it easier to secure larger loans in the future.

- Grants and Subsidies: Research government grants or programs for businesses, especially those in specific industries or promoting innovation.

Each of these options has different terms and risks, so always evaluate them thoroughly.

The Invaluable Role of a Mentor or Business Advisor in Navigating Financial Challenges and Refining Your Approach

Don't go it alone. A business mentor or financial advisor can provide invaluable guidance. They can help you:

- Analyze your financials objectively.

- Identify weaknesses in your business plan or credit profile.

- Connect you with suitable lenders or alternative financing options.

- Refine your application and presentation strategy.

Their experience and insights can be the difference between repeated rejections and eventual approval.

Your Next Steps to Securing a New Business Vehicle Loan in 2026

Securing a new business car loan in 2026 for your Vancouver-based enterprise, or anywhere else in Canada, requires diligence, strategic planning, and a clear understanding of what lenders expect. It's a journey that demands your full attention, but the rewards—enhanced operational efficiency, improved brand image, and accelerated growth—are well worth the effort.

A Final Comprehensive Checklist for Readiness: From Meticulous Documentation to Strategic Lender Selection

Before you hit 'submit' on that application, run through this final checklist:

- Financial Documentation: Are your income statements, balance sheets, and cash flow analyses up-to-date and meticulously prepared? Do you have 6-12 months of clean business bank statements?

- Business Plan: Is your business plan comprehensive, compelling, and do its financial projections include clear, conservative assumptions? Does it clearly justify the need for the new vehicle?

- Credit Profile: Have you reviewed and optimized both your personal and business credit scores? Have you addressed any errors?

- Vehicle Selection: Is your chosen vehicle aligned with genuine business needs, and have you analyzed its Total Cost of Ownership?

- Lender Research: Have you researched and identified at least 3-4 potential lenders whose offerings align with your business profile?

- Application Package: Is your application complete, transparent, and presented professionally, including a strong cover letter/executive summary?

- Down Payment: Have you maximized your down payment to reduce risk and improve terms?

- Contingency: Are you prepared to explain any financial inconsistencies or past challenges?

Embracing a Long-Term Financial Strategy for Sustained Business Growth and Easier Access to Future Financing

Think beyond this single loan. The process of preparing for and securing this business vehicle loan is an excellent opportunity to establish robust financial habits that will serve your business for years to come. Maintaining strong financial records, consistently monitoring your credit, and prudently managing debt will make future financing—whether for expansion, equipment, or additional vehicles—a much smoother and more favourable process. A strong financial foundation is the bedrock of sustained business growth.

The Unparalleled Confidence of a Well-Prepared Entrepreneur: Why Preparation Is Your Ultimate, Decisive Advantage in the Lending Process

Walking into a lender's office (or submitting an online application) with a meticulously prepared, transparent, and compelling package instills confidence – both in yourself and in the lender. It shows professionalism, attention to detail, and a deep understanding of your business's financial health and trajectory. This level of preparation is your ultimate, decisive advantage in securing that crucial new business car loan in 2026. Good luck, and drive your business forward!