Your Paycheque Does a Waltz? We Still Fund Your Car, Vancouver.

Table of Contents

- Your Paycheque Does a Waltz? We Still Fund Your Car, Vancouver.

- Key Takeaways: Navigating Inconsistent Income for Vehicle Financing

- Your Paycheque's Rhythmic Dance: The Vancouverite's Guide to Car Loans

- Pro Tip: Start Tracking Your Income Meticulously *Now*

- Unmasking the 'High-Risk' Label: Your Path to a Driver's Seat in Canada

- Pro Tip: Don't Assume You're Automatically 'High Risk' Without Exploring All Options

- Crafting Your Financial Narrative: Strategies for Approval

- Pro Tip: Highlight Recurring Clients, Long-Term Contracts, or Seasonal Peaks

- The Search for Your Financing Partner: Where to Turn in British Columbia (and Beyond)

- Pro Tip: Shop Around But Be Mindful of Hard Credit Checks

- Beyond the Approval: Understanding Your Loan and Managing Your Ride

- Pro Tip: Always Ask for a Full Amortization Schedule

- Pro Tip: Consider Bi-Weekly Payments

- Your Next Steps to Approval: Driving Forward with Confidence

- Frequently Asked Questions (FAQ) about Vehicle Financing for Inconsistent Income

Your Paycheque Does a Waltz? We Still Fund Your Car, Vancouver.

Life in Vancouver, British Columbia, is a dynamic dance. From the bustling film industry to thriving tech startups, the vibrant tourism sector, and the ever-present independent contractor scene, many Vancouverites navigate careers where a steady, predictable bi-weekly paycheque isn't the norm. Your income might fluctuate with the seasons, ebb and flow with project deadlines, or simply reflect the entrepreneurial spirit of the modern gig economy. If your paycheque does a graceful waltz – sometimes abundant, sometimes a bit more reserved – you might wonder if securing a car loan in Canada is an impossible feat. The good news? It’s not. While traditional lenders might initially flinch at inconsistent income, a nuanced understanding of your financial landscape, strategic preparation, and the right financing partner can absolutely put you in the driver's seat. At SkipCarDealer.com, we understand the rhythm of diverse incomes and are here to help you navigate the path to vehicle ownership, right here in British Columbia.

Key Takeaways: Navigating Inconsistent Income for Vehicle Financing

- Inconsistent income doesn't automatically disqualify you; it just requires a different, more strategic approach to financing.

- Proof of income stability – even if not fixed – is paramount. Lenders look for patterns, not just steady numbers.

- Specialized lenders and specific strategies (like larger down payments or co-signers) can significantly boost approval odds.

- Understanding the true cost beyond the monthly payment is crucial for long-term financial health and avoiding payment stress.

- Local expertise, especially in dynamic markets like Vancouver, British Columbia, can unlock unique opportunities and tailored solutions.

Your Paycheque's Rhythmic Dance: The Vancouverite's Guide to Car Loans

The dream of cruising along the Sea-to-Sky Highway, commuting efficiently across the Lions Gate Bridge, or simply having the freedom to explore all that British Columbia offers often hinges on having reliable transportation. But for many, the path to car ownership isn't a straight line paved with consistent pay stubs. Welcome to the world of variable income, a reality for a growing number of Canadians.

The Gig Economy Grind: Why Traditional Lenders Flinch at Fluctuating Funds

Why do traditional lenders like banks often hesitate when faced with inconsistent income? It boils down to one word: risk. Lenders operate on the principle of predictability. They want to be confident that you can make your car loan payments, month after month, for the entire duration of the loan term. A fluctuating income stream introduces an element of uncertainty that can make their risk assessment more complex. Think of it from their perspective: a borrower with a fixed, salaried income presents a clear picture of their repayment capacity. There's a set amount coming in every two weeks or month, making it easier to calculate a comfortable debt-to-income (DTI) ratio. When income varies wildly, establishing that consistent capacity becomes a greater challenge. They're not necessarily questioning your ability or work ethic; they're simply trying to mitigate their own financial exposure. Common examples of inconsistent income are abundant across Canada:

- Freelancers and Independent Contractors: From graphic designers in Toronto to web developers in Montreal, and consultants in Calgary, these professionals rely on project-based work, leading to varying monthly earnings.

- Commission-Based Sales Professionals: Real estate agents in Vancouver, car sales associates in Edmonton, or financial advisors across major Canadian cities often see their income directly tied to sales performance, which can fluctuate.

- Seasonal Workers: British Columbia's tourism industry (think ski resorts in Whistler or Okanagan wineries) and resource sectors (forestry, fishing) employ many individuals whose income peaks during certain times of the year and dips during others.

- Gig Economy Workers: Drivers for ride-sharing services, delivery personnel for food apps, or task-based workers – their earnings depend directly on demand and hours worked. For more on how these earnings can qualify you, check out our guide on Pay Stub? Nah. Your DoorDash Deposits Just Bought a Car, Ontario.

The primary challenge here is the calculation of your Debt-to-Income (DTI) ratio. Lenders use DTI to determine if you have enough income to comfortably manage your existing debts, plus the new car payment. When your monthly earnings vary dramatically, calculating a reliable DTI becomes a moving target, which can make lenders cautious.

Pro Tip: Start Tracking Your Income Meticulously *Now*

Even if your income is inconsistent, showing a clear history of earnings is your most powerful tool. Use spreadsheets, accounting software, or even a simple journal to track all your income and expenses. Aim to compile data over at least 12-24 months. This detailed record allows you to demonstrate clear patterns, calculate reliable averages, and prove your financial consistency to lenders, even if individual months differ.

Unmasking the 'High-Risk' Label: Your Path to a Driver's Seat in Canada

When you have an inconsistent income, it’s easy to feel pigeonholed into a "high-risk" category. However, understanding what truly constitutes this label and how lenders view your unique financial situation is the first step toward finding a solution.

Beyond the Stereotype: Who Really Needs 'Vehicle Financing for Inconsistent Income'?

It's crucial to understand that needing "vehicle financing for inconsistent income" is not solely about having a poor credit score. While a low credit score certainly adds a layer of complexity, the primary challenge for individuals with fluctuating earnings is often rooted in *income verification* and the *perceived stability* of that income. Many people mistakenly believe that if their income isn't fixed, they automatically have "bad credit." This isn't true. You can have an excellent credit score – a history of paying all your bills on time, low credit utilization, and a diverse credit mix – yet still struggle with car loan approval if your income documentation doesn't fit the traditional mould. Conversely, someone with a stable, high income might have a terrible credit score due to past missteps, facing different challenges. Distinguishing between low credit score issues and income variability challenges is vital, as they often require different solutions. While bad credit needs rebuilding, inconsistent income needs strategic presentation and alternative lenders. A strong payment history, even with fluctuating earnings, can significantly mitigate some of the risk associated with income variability. If you can demonstrate a consistent track record of managing your existing debts responsibly, even during lean months, lenders will view you more favourably. It shows financial discipline and a commitment to your obligations, regardless of the ups and downs of your paycheque.

Pro Tip: Don't Assume You're Automatically 'High Risk' Without Exploring All Options

Many individuals with variable income have excellent financial management skills. Your income might not be fixed, but if you consistently save, manage debt well, and have a good credit score, you're a far less risky borrower than someone with stable income but a history of missed payments. Don't let the 'inconsistent income' label deter you; your overall financial health speaks volumes.

The Lender's Lens: What Financial Institutions Are *Really* Looking For

When assessing your application, lenders look beyond just a single pay stub. They're trying to piece together a comprehensive picture of your financial habits and your ability to repay the loan. Here's a detailed breakdown of how they assess risk for borrowers with non-traditional incomes:

- Average Monthly Income: This is paramount. Lenders will calculate your average monthly earnings over a significant period (typically 6-24 months) to understand your true capacity to pay. They want to see that your average income is sufficient to cover your existing expenses plus the new car payment.

- Payment History and Credit Score: These remain vital indicators of your financial responsibility. A good credit score demonstrates that you've managed past debts well, regardless of how your income was earned. For guidance on improving your credit, you might find our article on Flat Tire, Flat Credit? Toronto, We've Got Your Fix. helpful.

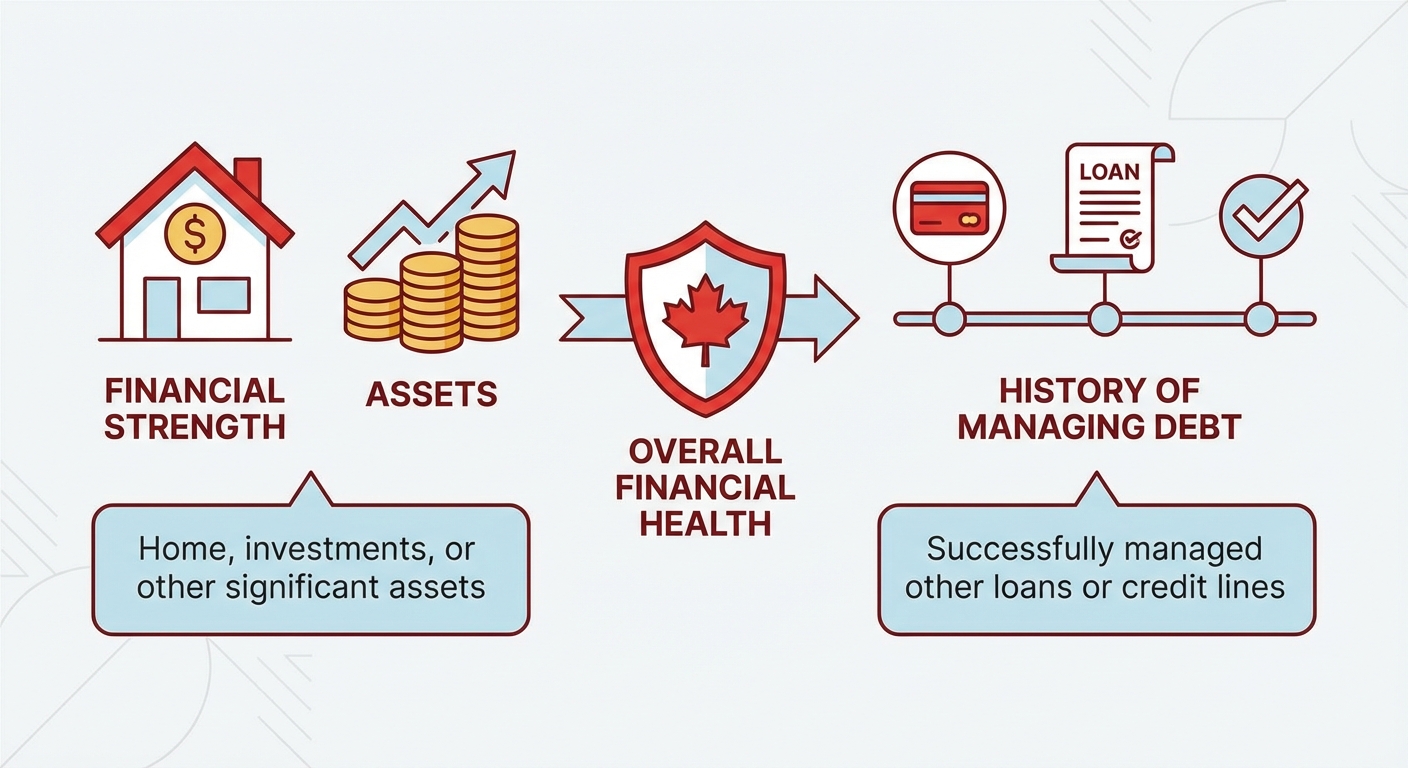

- Stability Indicators: Lenders look for signs of stability, even if the income itself fluctuates. This includes:

- Length of Employment/Self-Employment: How long have you been in your current field or running your business? A longer track record suggests more stability.

- Savings Accounts: A healthy savings account indicates financial prudence and provides a buffer for leaner months.

- Other Assets: Ownership of a home, investments, or other significant assets can demonstrate overall financial strength.

- History of Managing Debt: Have you successfully managed other loans or credit lines, even through periods of variable income?

Crafting Your Financial Narrative: Strategies for Approval

Securing a car loan with inconsistent income isn't about hiding your financial situation; it's about presenting it clearly, comprehensively, and strategically. You need to tell your financial story in a way that instills confidence in lenders.

The Art of Income Storytelling: Presenting Your Fluctuating Funds with Confidence

Since a simple bi-weekly pay stub might not paint the full picture, you'll need to gather a more robust set of documents to prove your income and financial stability.

- Comprehensive Bank Statements: This is arguably your most important tool. Providing 6-12 months, or even 24 months, of bank statements allows lenders to see the actual flow of money into your accounts. They can identify patterns, average your earnings, and observe your financial habits (e.g., consistent savings, absence of overdrafts). These statements paint a clear picture of your real-world income, even if it varies.

- Tax Returns: Your official tax documents are irrefutable proof of your earnings. For Canadian lenders, this includes:

- T1 General: Your personal income tax return.

- T4A Slips: For self-employed individuals, independent contractors, or those receiving commission income.

- Detailed Business Statements: If you operate a small business, providing profit and loss statements can offer a granular view of your business's financial health.

- Contracts and Invoices: For freelancers and contractors, providing active contracts with clients, a portfolio of past work demonstrating consistent engagement, and recent invoices (paid and outstanding) can prove ongoing income potential and a reliable client base.

- Letters from Employers: If you're in a commission-based or seasonal role, a letter from your employer outlining your average earnings, typical commission structures, or expected bonuses can provide valuable context and bolster your application.

Pro Tip: Highlight Recurring Clients, Long-Term Contracts, or Seasonal Peaks

When presenting your income documents, don't just hand them over. Point out any aspects that demonstrate stability or predictability. Do you have a few anchor clients who consistently provide work? Are there specific seasonal periods where your income reliably spikes? These details can help lenders see a reliable baseline and future potential, even if your monthly income isn't fixed.

Boosting Your Odds: Leveraging Down Payments, Co-Signers, and Collateral

Even with meticulously documented income, there are powerful strategies you can employ to significantly improve your approval odds and potentially secure better loan terms.

- The Power of a Substantial Down Payment: This is one of the most effective ways to reduce lender risk. A larger upfront payment means you're borrowing less, which reduces the lender's exposure and signals your commitment. It also lowers your monthly payments and the total interest paid over the life of the loan. Even a 10-20% down payment can make a significant difference.

- Finding the Right Co-Signer: A co-signer with stable income and good credit can bridge the gap in your application. They essentially "guarantee" the loan, taking on legal responsibility for repayment if you default. This significantly reduces the lender's risk. However, a co-signer must fully understand their responsibilities, as their credit will be affected by the loan, and they will be liable for payments if you cannot make them.

- Using Existing Assets as Collateral: In some cases, if you own a valuable asset outright (like a paid-off vehicle or property), you might be able to use it as collateral to secure the loan. This can make the loan less risky for the lender. However, this option comes with its own risks, as the asset could be repossessed if you fail to make payments. For more information on using existing assets, read our guide on Your Car Title Just Got a Job. You Still Get to Drive, Toronto.

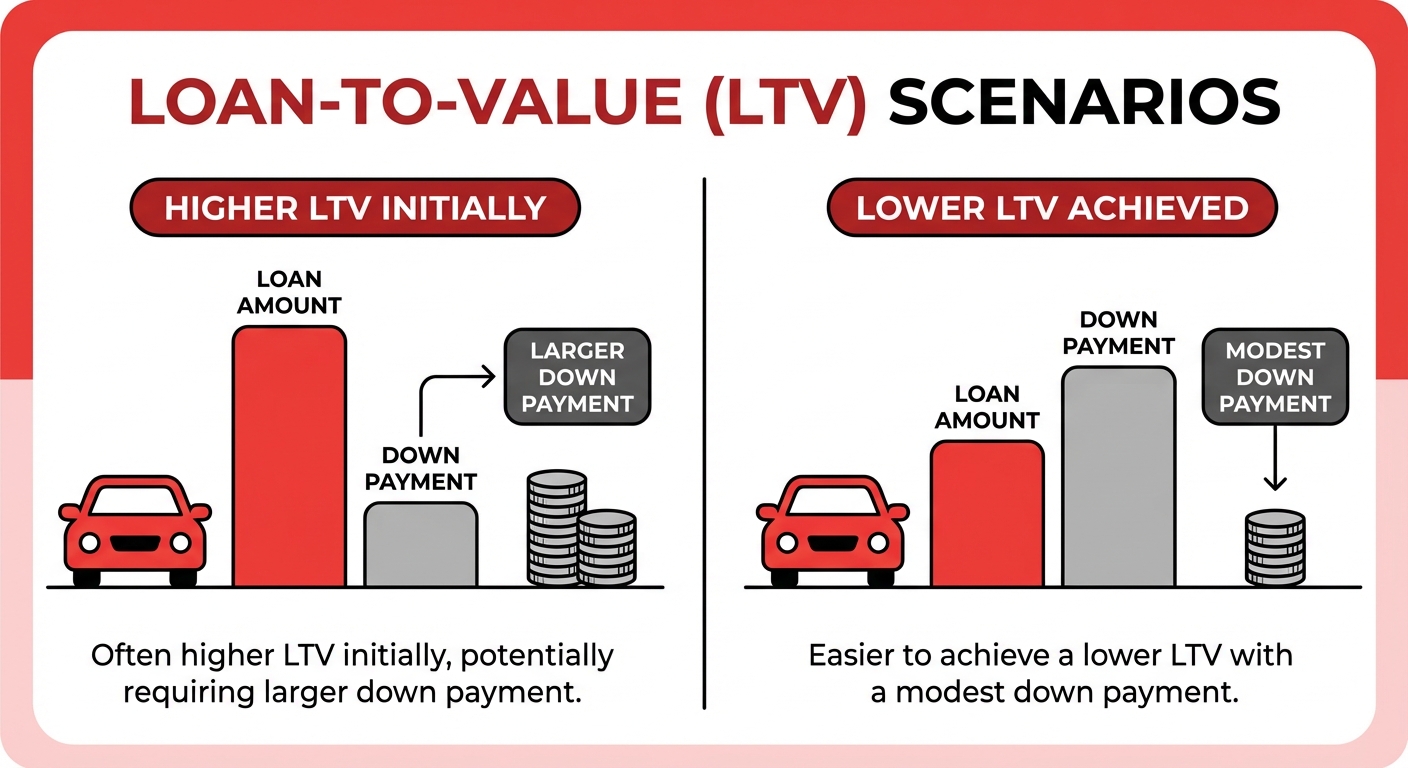

- The Benefits of Reducing the Loan-to-Value (LTV) Ratio: All these strategies (down payment, collateral) work to reduce the LTV ratio, which is the amount you're borrowing compared to the car's value. A lower LTV means less risk for the lender, making your application more appealing.

Credit Score CPR: Even When Your Income Jumps Around

While income is a primary concern, your credit score remains a critical component of any loan application. A strong credit score demonstrates your reliability in managing debt, irrespective of how your income is generated. Even if your income fluctuates, there are quick wins to help improve your credit score:

- Pay Off Small Outstanding Debts: Clearing up small balances on credit cards or old bills can quickly boost your score by reducing your credit utilization.

- Dispute Any Errors: Obtain your credit report from both Equifax Canada and TransUnion Canada. Carefully review it for any inaccuracies and dispute them immediately. Errors can unfairly drag down your score.

- Keep Credit Utilization Low: Aim to use no more than 30% of your available credit on any credit card. Lower utilization signals responsible credit management.

- Monitor Your Score: Services like Credit Karma Canada or Borrowell offer free credit monitoring, allowing you to stay informed about your score and identify areas for improvement.

Getting your full credit report *before* you apply for financing is a smart move. This proactive approach allows you to correct any errors and fully understand your financial standing, putting you in a stronger negotiating position.

The Search for Your Financing Partner: Where to Turn in British Columbia (and Beyond)

Finding the right lender is half the battle when dealing with inconsistent income. Different financial institutions have different appetites for risk and varying criteria for approval.

Banks vs. Dealerships vs. Specialized Lenders: A Head-to-Head Battle for Your Business

Understanding the landscape of lenders in Canada is crucial for those with fluctuating income.

| Lender Type | Pros for Inconsistent Income | Cons for Inconsistent Income | Typical Interest Rates (Approx.) |

|---|---|---|---|

| Traditional Banks (e.g., RBC, TD Canada Trust, Scotiabank) | Lowest interest rates if approved, well-established. | Stricter income requirements, prefer consistent salaries, less flexible with non-traditional income. | Often 5-10% (for excellent credit) |

| Dealership Financing (e.g., Ford Credit, Honda Financial Services, local Vancouver dealerships) | Work with a network of various lenders (prime, subprime), more flexible, can offer promotional rates, convenience of one-stop shopping. | Rates can vary widely depending on the lender they partner with, less direct negotiation. | Can range from 5% (prime) to 20%+ (subprime) |

| Specialized Lenders (focus on 'high-risk' or 'subprime' loans) | Designed for unique financial situations, higher approval rates for inconsistent income, more understanding of non-traditional income. | Generally come with higher interest rates to offset increased risk, more fees possible. | Typically 8-29.9% |

| Credit Unions | Member-focused, sometimes more understanding of individual circumstances, especially local ones in British Columbia communities. | May still have strict income verification, approval can be slower. | Often competitive, similar to banks but more flexible. |

Navigating the Vancouver Market: Local Insights and Resources

Vancouver, British Columbia, presents a unique set of challenges and advantages for car buyers. The higher cost of living in the Lower Mainland can impact personal budgets, making every dollar count. However, the diverse job market, with its strong gig economy presence, also means many lenders and dealerships in the region are accustomed to working with non-traditional income streams. When searching for a dealership, look for those in Vancouver, Surrey, or Burnaby that explicitly advertise "flexible financing," "all credit approved," or "bad credit car loans." These dealerships typically have established relationships with a broader network of lenders, including those who specialize in financing for individuals with inconsistent income. Their finance managers often possess a deeper understanding of the regional economy and employment landscape, making them better equipped to present your unique financial story to the right lending partners.

Pro Tip: Shop Around But Be Mindful of Hard Credit Checks

It's always wise to compare offers from several lenders or dealerships. However, be aware that each 'hard' credit inquiry can temporarily ding your credit score. To minimize impact, aim to get a few competitive offers within a short timeframe (e.g., 14-30 days). Credit bureaus often treat multiple inquiries for the same type of loan within this window as a single inquiry.

Beyond the Approval: Understanding Your Loan and Managing Your Ride

Getting approved is a fantastic first step, but truly understanding your loan terms and choosing the right vehicle are equally critical for long-term financial success, especially with an inconsistent income.

Decoding the Fine Print: Interest Rates, Terms, and Hidden Costs for Inconsistent Income Loans

When you receive a loan offer, it's essential to scrutinize every detail to fully grasp the commitment you're making.

- Annual Percentage Rate (APR): This is the true cost of borrowing, expressed as a yearly percentage. It includes not just the interest rate but also any additional fees or charges rolled into the loan. A higher APR means a more expensive loan overall.

- Loan Term Length: This is the duration over which you'll repay the loan.

- Shorter Terms (e.g., 36-48 months): Result in higher monthly payments but significantly less total interest paid over the life of the loan. This can be challenging with inconsistent income but saves money in the long run.

- Longer Terms (e.g., 60-84 months): Offer lower, more manageable monthly payments, which can be appealing for those with fluctuating income. However, you'll pay substantially more in total interest over the longer period.

- Pre-payment Penalties: Before signing, always ask if there are any penalties for paying off your loan early. If your income stabilizes and you want to pay down the principal faster, you want to ensure you won't incur extra fees for doing so.

- Administration Fees, Documentation Fees, PPSA Fees: These are common charges in Canadian provinces like Alberta, Ontario, and British Columbia. They can add to the total cost of your loan, so ensure you understand what each fee covers and if it's negotiable.

Pro Tip: Always Ask for a Full Amortization Schedule

This document provides a detailed breakdown of every single payment you'll make over the life of the loan. It clearly shows how much of each payment goes towards the principal (the amount you borrowed) versus the interest. Reviewing this will reveal the true cost of your loan and help you plan your finances effectively.

Choosing Your Wheels Wisely: How Vehicle Type Impacts Your Loan

The type of vehicle you choose can have a profound impact on your overall financial health, particularly when managing an inconsistent income.

| Factor | New Car | Used Car |

|---|---|---|

| Initial Cost | Higher principal amount. | Lower principal amount. |

| Interest Rates | Often lower promotional rates, but higher overall loan value. | Can be slightly higher depending on age/lender, but lower loan value. |

| Depreciation | Rapid depreciation in the first few years (significant loss of value). | Most major depreciation has already occurred, slower value loss. |

| Reliability/Maintenance | Manufacturer's warranty covers many issues, lower initial repair costs. | Potential for higher maintenance/repair costs, may require extended warranty. |

| Insurance Costs (British Columbia) | Generally higher due to higher vehicle value, especially for luxury or performance models. | Often lower, but can vary based on make/model, age, and driver history. |

| Loan-to-Value (LTV) | Often higher LTV initially, potentially requiring larger down payment. | Easier to achieve a lower LTV with a modest down payment. |

When your income fluctuates, prioritizing reliability and low maintenance costs is paramount. An unexpected major repair bill can quickly derail your budget. Also, remember that insurance costs in British Columbia, regulated by ICBC, can be a significant monthly expense, especially for newer, luxury, or high-performance vehicles. Factor this into your budget carefully.

Making the Payments Work: Budgeting for the Unpredictable

The key to successfully managing a car loan with inconsistent income is proactive, flexible budgeting.

- Creating a 'Buffer Fund': During high-income months, make it a priority to set aside extra cash specifically to cover car payments during leaner periods. This financial cushion is your safety net.

- Setting Up Automatic Payments: If your income has predictable peaks, try to align automatic payments with those times. Alternatively, setting up a conservative bi-weekly payment schedule can help you stay on track and often reduces the total interest paid over time.

- Regular Budget Reassessment: Your financial situation is dynamic. Continuously review and adjust your budget, especially if your income patterns change significantly or unexpected expenses arise. This allows you to stay agile and make necessary adjustments.

- Exploring Additional Income Streams or Side Gigs: If you find yourself consistently struggling to meet payments, consider taking on additional work to create more stability and peace of mind. For instance, your DoorDash deposits or Uber hustle could be your key to a car loan. For more insights, check out Vancouver: Your SkipTheDishes Hustle *Is* Your Car Loan. Negative Equity? Approved.

Pro Tip: Consider Bi-Weekly Payments

Opting for bi-weekly payments (26 payments per year) instead of monthly (12 payments) means you'll effectively make an extra payment per year. This accelerates your principal reduction, shortens your loan term, and saves you a considerable amount in total interest over the life of the loan. It's a simple yet powerful strategy for long-term savings.

Your Next Steps to Approval: Driving Forward with Confidence

The journey to car ownership with an inconsistent income might seem complex, but with the right preparation and mindset, it's entirely achievable.

Building a Stronger Financial Future: Beyond the Car Loan

While securing your car loan is the immediate goal, think long-term.

- Strategies to Stabilize Income: Actively seek ways to create more income predictability. This might involve diversifying your freelance clients, negotiating retainer agreements, or exploring job opportunities with a more stable salary component.

- Commitment to Continual Credit Score Improvement: Keep up the good work! Continue paying bills on time, keeping credit utilization low, and monitoring your credit report. A stronger credit score opens doors to better financial products and lower interest rates in the future, potentially allowing you to refinance your car loan for better terms.

- The Importance of Building an Emergency Savings Fund: Life throws curveballs. A robust emergency fund provides a crucial buffer against unexpected expenses or periods of reduced income, ensuring you can meet your car payments and other obligations without stress.

The Power of Persistence: Don't Give Up on Your Transportation Needs

Securing "vehicle financing for inconsistent income" is often a process, not always a one-shot deal. It might require gathering more documentation, exploring different lenders, or adjusting your expectations slightly. But don't let any initial roadblocks discourage you. Transportation is often a necessity, especially in a sprawling city like Vancouver, British Columbia, and solutions exist. With thorough preparation, honesty, and the right financing partner like SkipCarDealer.com, you can absolutely achieve your goal of driving your own car.