450 Credit? Good. Your Keys Are Ready, Toronto.

Table of Contents

- Key Takeaways

- Your Expressway to Used Car Ownership: Key Takeaways for Toronto's 450 Credit Holders

- Demystifying the 450 Credit Score in Toronto: What Lenders Really See

- Understanding the FICO/Equifax/TransUnion Scale in Canada: Where 450 Sits

- Why Traditional Banks (e.g., RBC, TD Canada Trust) Often Say 'No' to 450 Scores

- The Rise of Subprime Lending: How a Specialized Market Caters to Your Situation

- Beyond the Number: What Other Factors Influence a Lender's Decision for Low Credit Scores (income stability, residency in places like Toronto or Ottawa)

- Your Green Light: How a Used Car Loan with 450 Credit is Achievable in Ontario

- The 'Why' Behind the 'Yes': Lenders Focused on Credit Rebuilding

- Guaranteed Auto Loans: Understanding What They Are (and Aren't) for Low Scores

- The Power of a Down Payment: How Even a Small Amount Can Transform Your Application

- The Co-Signer Advantage: When a Reliable Co-Signer Can Unlock Doors

- The Real Cost: Navigating Interest Rates and Hidden Fees for Low-Credit Loans

- Decoding APR: What to Expect for a 450 Credit Score in the Canadian Market

- Beyond Interest: Administrative Fees, Loan Origination Fees, and Other Charges

- The Impact of Loan Term: Shorter vs. Longer – Finding the Balance for Affordability

- Total Cost of Ownership: Factoring in Insurance (often higher for new drivers/bad credit) and Maintenance for Used Cars

- Toronto's Used Car Scene: Finding the Right Vehicle & Lender for Your Situation

- The 'Sweet Spot' for Used Cars: Which Models and Price Ranges Make Sense for Low Credit

- Specialized Dealerships in the Greater Toronto Area: How to Find and Vet Them

- Online Loan Brokers vs. Direct Dealership Financing: Which Path is Best for You?

- Avoiding Scams: Red Flags to Watch Out For in the Low-Credit Lending Landscape

- Crafting Your Approval Story: Strategies Beyond Your Credit Score

- Proof of Stable Income: Pay Stubs, Employment Letters, and Bank Statements

- Residency Stability: Demonstrating Your Roots in Toronto or Other Ontario Cities

- Debt-to-Income Ratio: Why It Matters and How to Improve Yours

- The Power of Explanation: Addressing Past Credit Issues Honestly and Proactively

- From Application to Keys: Your Step-by-Step Journey to Ownership

- The Initial Inquiry: What Information Will Be Requested?

- Understanding Hard vs. Soft Credit Inquiries: Impact on Your Score

- The Approval Notification: What to Look for in Your Loan Offer

- Finalizing the Deal: Reviewing Contracts, Warranties, and Additional Products

- Beyond the Loan: Using Your Used Car to Rebuild Credit in Ontario

- The Mechanics of Credit Rebuilding: How Timely Payments Impact Your Score

- Monitoring Your Progress: Utilizing Credit Monitoring Services (e.g., Credit Karma Canada)

- Next Steps: Qualifying for Better Rates and Future Loans (mortgages, personal loans)

- The Ripple Effect: How a Good Payment History Can Improve Other Aspects of Your Financial Life

- Your Next Steps to Keys in Hand, Toronto!

- Frequently Asked Questions About 450 Credit Car Loans in Canada

Driving in Toronto is more than just getting from A to B; it's about freedom, opportunity, and navigating the vastness of this incredible city and beyond, into the sprawling landscapes of Ontario. But what if your credit score, specifically a 450, seems like a roadblock on your journey to car ownership? Many believe a low score means an automatic "no" from lenders, leaving them feeling stuck, relying on public transit or rideshares. We're here to tell you that’s simply not true.

At SkipCarDealer.com, we understand that a credit score is just one piece of your financial puzzle. Life happens, and sometimes, those challenges leave a mark on your credit report. A 450 credit score, while considered "very poor" by traditional metrics, does not mean your dream of owning a reliable used car in Toronto is out of reach. In fact, it can be the starting point of a significant financial turnaround.

This comprehensive guide is tailored for you, the resilient Torontonian (or resident of any vibrant Ontario city like Ottawa, Hamilton, or Mississauga) with a 450 credit score. We’ll demystify the process, reveal the specialized pathways to approval, and equip you with the knowledge to not only secure a used car loan but also to leverage it as a powerful tool for credit rebuilding. Your keys are not just ready; they’re waiting for you to take the wheel and drive towards a brighter financial future.

Key Takeaways

- Yes, it's possible: Specialized lenders in Ontario, including those we partner with, focus on credit rebuilding and understand that past financial challenges don't define your future.

- Expect higher rates, but focus on the long-term credit rebuilding opportunity: While a 450 score typically means higher interest rates, view this loan as an investment in improving your credit, leading to better rates down the road.

- Preparation is key: A down payment, even a modest one, or a reliable co-signer can significantly strengthen your application and improve your loan terms.

- Toronto offers diverse options: From specialized dealerships focusing on subprime lending to online platforms like SkipCarDealer.com, you have more avenues than you might think.

- This loan is a stepping stone: A successfully managed car loan is a powerful way to demonstrate financial responsibility, transforming your credit score and opening doors to future financial opportunities.

Your Expressway to Used Car Ownership: Key Takeaways for Toronto's 450 Credit Holders

Don't let a low credit score sideline your vehicle dreams. For many in Toronto and across Ontario, the thought of securing a car loan with a 450 credit score feels like an uphill battle, a non-starter. The truth, however, is far more empowering. Obtaining a used car loan, even with a credit score in the 'very poor' range, is not only possible but a strategic move for many who are committed to rebuilding their financial standing. This isn't just about getting a car; it's about gaining independence, accessing opportunities, and, crucially, building a positive payment history that can transform your credit score over time.

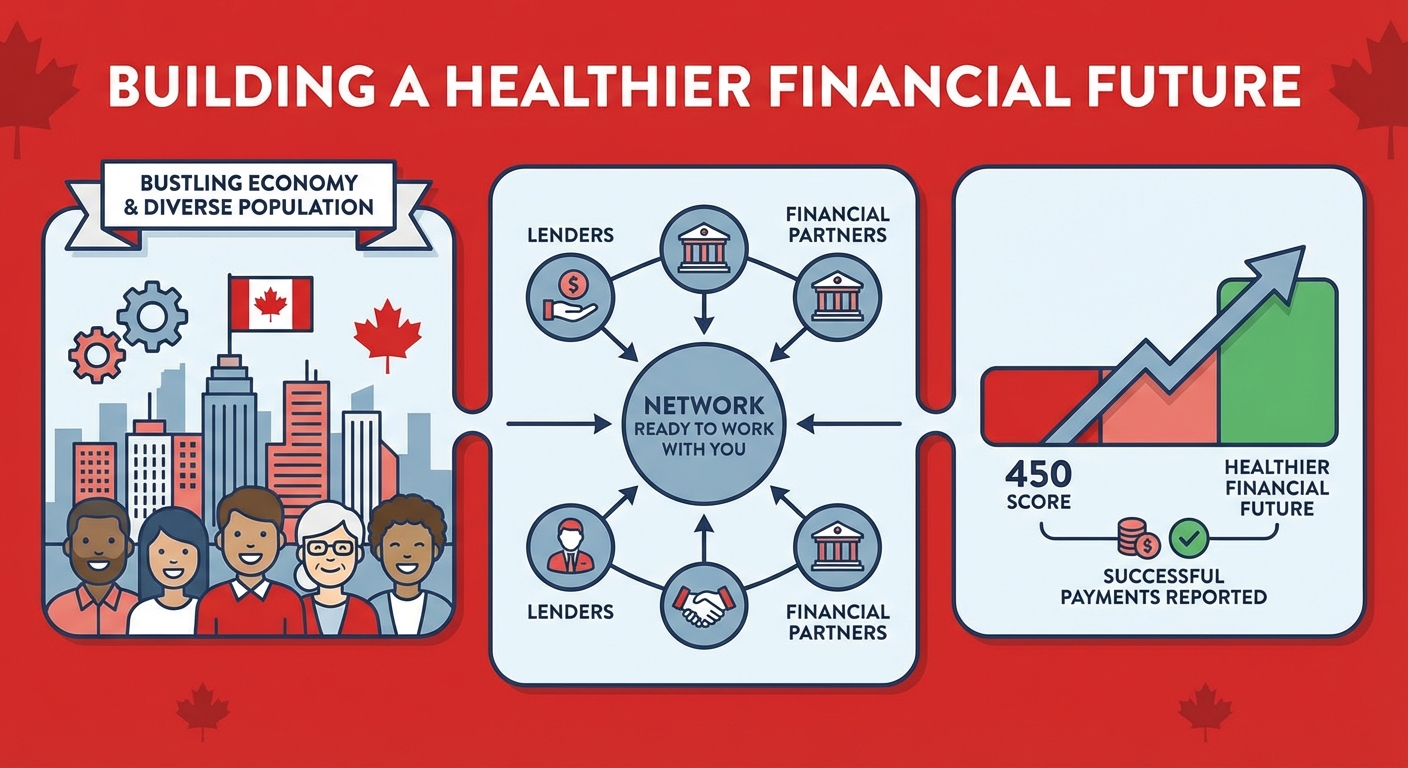

Specialized lenders and dealerships understand that life throws curveballs. They don't just see a number; they see an individual with a job, a need, and a commitment to improve. These financial institutions are structured to assess your current ability to pay, focusing on factors like stable income, residency, and your willingness to make a down payment, rather than solely fixating on past credit missteps. While the initial terms might not be as favourable as someone with excellent credit, the goal here is twofold: get reliable transportation and begin the journey of credit restoration. Toronto, with its bustling economy and diverse population, hosts a network of such lenders ready to work with you. Remember, every successful payment reported to credit bureaus chips away at that 450 score, paving the way for a healthier financial future.

Demystifying the 450 Credit Score in Toronto: What Lenders Really See

Let's be upfront: a 450 credit score places you in the 'very poor' category across Canada. This number isn't just arbitrary; it's a summary of your past financial behaviour, from missed payments to high debt utilization. Understanding what this score signifies to different types of lenders is the first step in navigating your car loan journey in Toronto.

Understanding the FICO/Equifax/TransUnion Scale in Canada: Where 450 Sits

In Canada, credit scores typically range from 300 to 900. Both Equifax and TransUnion, the two primary credit bureaus, use similar scales. A score of 450 is firmly at the lower end, signaling to lenders a higher risk of default. Generally, the breakdown is:

- Excellent: 760-900

- Very Good: 720-759

- Good: 660-719

- Fair: 580-659

- Poor: 500-579

- Very Poor: 300-499

Your 450 score clearly sits within the 'Very Poor' bracket, indicating significant challenges or a history of missed payments, collections, or even a consumer proposal or bankruptcy in your past.

Why Traditional Banks (e.g., RBC, TD Canada Trust) Often Say 'No' to 450 Scores

Major banks operate under strict risk assessment models. For them, a 450 credit score represents an elevated risk that doesn't align with their typical lending criteria for conventional auto loans. They often prioritize borrowers with 'Good' to 'Excellent' credit, offering the lowest interest rates to those with proven financial stability. While these banks might consider you for other financial products if you have a long-standing relationship, for an auto loan with a 450 score, their automated systems are likely to issue a swift denial. This isn't personal; it's a reflection of their business model and risk appetite.

The Rise of Subprime Lending: How a Specialized Market Caters to Your Situation

This is where the landscape shifts in your favour. The Canadian financial market, particularly in urban centres like Toronto, Montreal, and Vancouver, has seen a significant rise in specialized subprime lenders. These are financial institutions and dealerships that specifically cater to individuals with low credit scores (often below 600-650). They have developed different risk assessment strategies, understanding that a low credit score doesn't necessarily mean an unwillingness to pay, but rather a past struggle or lack of credit history. They look beyond the number.

Beyond the Number: What Other Factors Influence a Lender's Decision for Low Credit Scores (income stability, residency in places like Toronto or Ottawa)

For subprime lenders, your 450 score is just the beginning of the conversation. They delve deeper into your current financial situation, emphasizing factors such as:

- Stable Income: Do you have consistent employment and a verifiable income? This is paramount. Lenders want to see that you have the monthly cash flow to comfortably afford loan payments, regardless of your past credit history. A steady job in Toronto or the surrounding Greater Toronto Area (GTA) can be a significant asset.

- Debt-to-Income Ratio: Even with a low score, if your current debt obligations are low relative to your income, it signals more disposable income for a car payment.

- Residency Stability: How long have you lived at your current address in Toronto, Mississauga, or other Ontario cities? A stable residency suggests reliability and predictability.

- Down Payment: A significant down payment reduces the lender's risk and shows your commitment to the loan.

- Co-Signer: Having a co-signer with good credit can dramatically improve your chances of approval and potentially secure a better interest rate.

These factors provide a more holistic picture of your financial viability, allowing specialized lenders to offer solutions where traditional banks cannot. For those who've heard "no" elsewhere, particularly after a significant financial event, our article They Said 'No' After Your Proposal? We Just Said 'Drive! offers further insights into how specialized lenders can help.

Your Green Light: How a Used Car Loan with 450 Credit is Achievable in Ontario

This isn't a fantasy; it's a tangible reality for many Canadians, particularly in a robust market like Ontario. Securing a used car loan with a 450 credit score hinges on understanding the specific mechanisms and types of lenders designed to support your journey. It's about finding the right partners who see your potential for credit rebuilding, not just your past.

The 'Why' Behind the 'Yes': Lenders Focused on Credit Rebuilding

Why would a lender approve someone with a 450 credit score? The answer lies in their business model: credit rebuilding. These lenders understand that life events (job loss, illness, divorce, business struggles) can severely impact credit scores. They also know that a car is often a necessity for employment, family responsibilities, and daily life in cities like Toronto, Ottawa, or London. By offering you a loan, they are not only providing a service but also creating an opportunity for you to demonstrate responsible financial behaviour. When you make timely payments, your credit score improves, and the lender profits from the interest over the loan term. It's a win-win scenario when managed responsibly.

Guaranteed Auto Loans: Understanding What They Are (and Aren't) for Low Scores

You might encounter marketing language promising "guaranteed auto loans" or "100% approval." While these claims should always be approached with caution, there's a kernel of truth for those with very low credit. For specialized lenders, if you meet basic criteria – such as having a stable job, sufficient income, and residency in Canada (especially in a major province like Ontario or Alberta) – your chances of approval are extremely high. This isn't a guarantee in the literal sense (no lender can truly guarantee a loan without *any* conditions), but it means they have a high approval rate for subprime borrowers who meet their specific, more flexible criteria. They focus on your ability to pay *now*, rather than solely on your past credit history. This means even if you've been through a consumer proposal, there are still pathways to approval.

The Power of a Down Payment: How Even a Small Amount Can Transform Your Application

A down payment is perhaps the single most impactful factor you can control to improve your chances of approval and secure better terms with a 450 credit score. When you put money down, you reduce the loan amount the lender has to finance, thereby reducing their risk. It also demonstrates your commitment and financial stability. Even a modest down payment of a few hundred dollars can make a significant difference. For example, in a competitive market like Toronto, a down payment can distinguish your application from others. It shows you have some savings and are serious about your purchase.

The Co-Signer Advantage: When a Reliable Co-Signer Can Unlock Doors

If a down payment isn't feasible, or even if it is, a co-signer can be a game-changer. A co-signer, typically a family member or close friend with good credit, agrees to be equally responsible for the loan if you default. This significantly mitigates the risk for the lender, as they now have two parties liable for the debt. With a co-signer, you might qualify for a lower interest rate than you would on your own, saving you hundreds or even thousands of dollars over the loan term. Ensure your co-signer understands their responsibilities fully, as their credit will also be impacted by the loan.

Pro Tip: Gathering Your Financial Arsenal – Documents Needed for Approval

Before you even apply, gather these essential documents to streamline the process and present yourself as a responsible borrower, even with a 450 credit score:

- Proof of Income: Recent pay stubs (3-4), employment letter, T4s, or bank statements showing consistent deposits.

- Proof of Residency: Utility bills (hydro, internet), phone bill, or rental agreement showing your Toronto or Ontario address.

- Proof of Identity: Valid driver's license (G, G2, or G1 in Ontario) and another piece of government-issued ID.

- Banking Information: Void cheque or direct deposit form for setting up automatic payments.

- References: Sometimes requested, non-family references.

Having these ready shows preparedness and seriousness, making the lender's job easier and your approval faster.

The Real Cost: Navigating Interest Rates and Hidden Fees for Low-Credit Loans

Transparency is vital when dealing with a 450 credit score. While a loan is achievable, understanding the financial implications is paramount. Loans for individuals with low credit scores typically come with higher interest rates and potentially more fees than those for prime borrowers. Being fully informed allows you to budget effectively and make the best decision for your financial health in Toronto.

Decoding APR: What to Expect for a 450 Credit Score in the Canadian Market

APR, or Annual Percentage Rate, is the total cost of borrowing expressed as a yearly rate, including both interest and certain fees. For borrowers with a 450 credit score in the Canadian market, especially in Ontario, expect APRs to be significantly higher than the rates advertised for prime borrowers. While someone with excellent credit might see rates as low as 0-5%, individuals with a 450 score could face APRs ranging anywhere from 10% to 29.99% or even higher, depending on the lender, loan term, and vehicle. This higher rate compensates the lender for the increased risk they are taking. It's crucial to compare offers, even within this higher range, as a few percentage points can mean thousands of dollars over the life of the loan.

Beyond Interest: Administrative Fees, Loan Origination Fees, and Other Charges

Interest isn't the only cost. Be vigilant for additional fees that can inflate the total cost of your loan:

- Administrative Fees: Charges for processing your loan application.

- Loan Origination Fees: A fee for setting up the loan, often a percentage of the loan amount.

- Documentation Fees: For preparing the paperwork.

- PPSR (Personal Property Security Registration) Fees: A provincial fee in Ontario to register the lender's security interest in the vehicle.

- Extended Warranty or Protection Plans: While sometimes valuable, these are often added to the loan amount, increasing your interest burden. Always question if they are mandatory or optional.

Always ask for a detailed breakdown of all costs before signing any agreement. In some cases, these fees might be negotiable or waived, particularly if you have strong negotiating points like a substantial down payment.

The Impact of Loan Term: Shorter vs. Longer – Finding the Balance for Affordability

The loan term (the length of time you have to repay the loan) significantly impacts your monthly payment and the total interest paid. Here's a quick comparison:

| Loan Term | Monthly Payment | Total Interest Paid | Pros for 450 Credit | Cons for 450 Credit |

|---|---|---|---|---|

| Shorter (e.g., 36-48 months) | Higher | Lower | Pay off debt faster, build credit quicker, less total interest. | Higher monthly burden, might be harder to qualify for with a 450 score due to higher payment. |

| Longer (e.g., 60-84 months) | Lower | Higher | More affordable monthly payments, easier to qualify for, less strain on budget. | Pay more in total interest, slower credit rebuilding, increased risk of negative equity. |

For a 450 credit score, lenders might push for longer terms to make payments more manageable, increasing their overall profit from interest. Aim for the shortest term you can realistically afford to minimize interest costs and accelerate your credit rebuilding journey.

Total Cost of Ownership: Factoring in Insurance (often higher for new drivers/bad credit) and Maintenance for Used Cars

Beyond the loan itself, remember the other costs of car ownership, especially in a city like Toronto where insurance rates can be notoriously high. With a low credit score, and potentially if you're a newer driver or have a history of claims, your insurance premiums could be significantly higher. Always get insurance quotes before finalizing a car purchase. Additionally, used cars, while more affordable upfront, will inevitably require maintenance. Factor in a budget for routine servicing, unexpected repairs, and fuel. A comprehensive understanding of the total cost of ownership will prevent financial surprises.

Pro Tip: Calculating Your True Monthly Payment and Total Loan Expense

Don't just look at the advertised monthly payment. Use an online car loan calculator to input the principal amount, the APR, and the loan term. Then, add estimated monthly insurance premiums, fuel costs, and a buffer for maintenance. This gives you a realistic picture of your true monthly car-related expenses. For instance, if you're looking at a $15,000 used car with a 20% APR over 60 months, your monthly payment might be around $380. Add $200 for Toronto insurance and $150 for fuel, and suddenly you're looking at over $700/month. Be honest with yourself about what you can truly afford.

Toronto's Used Car Scene: Finding the Right Vehicle & Lender for Your Situation

Toronto's diverse automotive market offers unique opportunities and challenges for every buyer, especially those navigating a 450 credit score. The key is to be strategic in both your vehicle choice and your lender selection, focusing on reputable options that specialize in bad credit car loans.

The 'Sweet Spot' for Used Cars: Which Models and Price Ranges Make Sense for Low Credit

When your credit score is 450, your priority should be reliability and affordability, not luxury or brand new. The 'sweet spot' typically lies with reliable, fuel-efficient used vehicles in the $10,000 to $20,000 range. Brands known for their longevity and lower maintenance costs, such as Honda Civic/CRV, Toyota Corolla/RAV4, Mazda3, or Hyundai Elantra, are excellent choices. Avoid older, high-mileage luxury vehicles, as their maintenance costs can quickly become a financial burden, negating any initial savings. Focus on vehicles that are 3-7 years old with reasonable mileage (under 150,000 kilometres) and a clean Carfax report. These vehicles have depreciated significantly but still have plenty of life left, offering a good balance of cost and reliability.

Specialized Dealerships in the Greater Toronto Area: How to Find and Vet Them

The GTA is home to many dealerships that specialize in helping customers with less-than-perfect credit. These aren't always the big brand-name dealerships, but independent used car lots or specific finance departments within larger groups that have relationships with subprime lenders. Look for dealerships advertising "bad credit car loans," "credit rebuilding programs," or "guaranteed approval" (though approach the last with caution, as discussed). When vetting them:

- Check Reviews: Look for online reviews on Google, Yelp, or dealer review sites. Pay attention to comments about transparency, customer service, and post-sale support.

- Ask for Lender Affiliations: Reputable dealerships will be transparent about the lenders they work with.

- Verify Licensing: Ensure they are registered with the Ontario Motor Vehicle Industry Council (OMVIC), which regulates vehicle sales in Ontario.

Online Loan Brokers vs. Direct Dealership Financing: Which Path is Best for You?

You have two main avenues for securing financing:

- Online Loan Brokers (like SkipCarDealer.com): These platforms act as intermediaries, connecting you with a network of lenders, including those specializing in subprime financing.

- Pros: Convenience (apply from home), access to multiple offers with one application (minimizes hard inquiries), specialized in bad credit, often faster pre-approvals.

- Cons: Less direct control over the specific vehicle until approved, communication can sometimes be less personal than in-person.

- Pros: One-stop shop (find car and financing), potential for negotiation on the vehicle price simultaneously.

- Cons: May only present offers from a limited number of lenders, risk of multiple hard credit inquiries if they "shop around" without your explicit consent.

For a 450 credit score, an online broker can often be more efficient in finding you an approval, as they cast a wider net among subprime lenders. This can be especially true for those in cities like Calgary or Edmonton where similar specialized networks exist. For more on navigating challenging credit situations, consider reading our article on Unmasking 'Bad Credit' Car Lenders: Red Flags You Miss, Quebec.

Avoiding Scams: Red Flags to Watch Out For in the Low-Credit Lending Landscape

Unfortunately, where there's vulnerability, there can be exploitation. Be wary of these red flags:

- Guaranteed Approval without any qualification questions: True "guarantees" are rare. Legitimate lenders will always ask about your income and employment.

- Upfront Fees for Loan Processing: Never pay a fee just to apply for a loan. Legitimate lenders deduct fees from the loan amount or include them in the APR.

- Pressure to Buy Add-Ons: Aggressive upselling of unnecessary warranties or protection packages.

- Vague or Incomplete Contracts: Ensure all terms (APR, total cost, loan term, payment schedule) are clearly laid out before signing.

- Request for Personal Banking Passwords: A legitimate lender will never ask for your online banking login details.

Pro Tip: Leveraging Pre-Approval to Strengthen Your Negotiating Position

Getting pre-approved for a loan before you step onto a dealership lot is incredibly powerful. It gives you a clear understanding of how much you can afford and at what interest rate. This transforms you from a buyer who needs financing to a buyer with cash in hand (or at least, a pre-approved loan). You can then negotiate the vehicle price based on your budget, rather than being swayed by monthly payment figures that may hide high interest rates. Pre-approvals usually involve a soft credit check, which doesn't harm your score, giving you confidence as you shop around Toronto for the perfect used car.

Crafting Your Approval Story: Strategies Beyond Your Credit Score

Your 450 score isn't the whole story. Lenders, especially those specializing in subprime loans, look at your overall financial picture. This section details how to present a compelling case, showcasing stability and responsibility despite past credit challenges. Think of it as building a narrative around your numbers, demonstrating your current reliability and future commitment.

Proof of Stable Income: Pay Stubs, Employment Letters, and Bank Statements

This is arguably the most critical factor for a lender when your credit score is low. Consistent, verifiable income directly addresses their primary concern: your ability to make payments. Provide recent pay stubs (at least three to four), an official employment letter stating your position, salary, and start date, and bank statements showing regular income deposits. If you're self-employed in a vibrant city like Toronto or Vancouver, ensure your bank statements clearly demonstrate steady business income. Lenders want to see a history of employment, ideally for at least 3-6 months with the same employer.

Residency Stability: Demonstrating Your Roots in Toronto or Other Ontario Cities

Just as stable employment suggests reliability, so does stable residency. Lenders prefer borrowers who have lived at the same address for an extended period (e.g., 1-2 years or more). This indicates a settled lifestyle and makes you easier to locate if there are any issues. Provide utility bills, a driver's license, or a rental agreement with your current Toronto, Mississauga, or Hamilton address. If you've moved recently, be prepared to explain why and provide previous address history. Newcomers to Canada, even with limited credit history, can also find options, as explored in articles like Approval Secrets: How to Secure the Best Car Loan Rates for Alberta Newcomers.

Debt-to-Income Ratio: Why It Matters and How to Improve Yours

Your Debt-to-Income (DTI) ratio is a crucial metric for lenders. It compares your total monthly debt payments to your gross monthly income. For example, if your total monthly debt payments (rent/mortgage, credit card minimums, other loan payments) are $1,500 and your gross monthly income is $4,000, your DTI is 37.5% ($1,500 / $4,000). Lenders generally prefer a DTI below 40-50%, including the new car payment. A lower DTI indicates you have more disposable income to handle an additional car payment. To improve yours, consider paying down any high-interest debt, even small amounts, before applying for a car loan.

The Power of Explanation: Addressing Past Credit Issues Honestly and Proactively

Don't hide from your past credit challenges. Instead, address them head-on. If your 450 score is due to specific circumstances (e.g., job loss, medical emergency, divorce), prepare a brief, honest explanation. Show how those issues are now resolved or under control. This demonstrates maturity and transparency, which can build trust with a lender. For instance, if you went through a consumer proposal, explain that it's now complete and you're rebuilding. Lenders appreciate honesty and a clear plan for the future.

Pro Tip: Cleaning Up Your Credit Report Before You Apply

Before you even think about a loan application, get a copy of your credit report from Equifax and TransUnion (Canadians are entitled to a free copy annually). Review it for errors or inaccuracies. Dispute any incorrect information, as even a small mistake could be dragging your score down. Close any unused credit cards (but be careful not to close your oldest accounts, which help your credit age). Paying down small outstanding debts or making a few on-time payments on existing accounts can offer a slight boost to your 450 score, making a difference in the eyes of a subprime lender.

From Application to Keys: Your Step-by-Step Journey to Ownership

The application process can feel daunting, particularly when you're starting with a 450 credit score. However, by breaking down each stage, from initial inquiry to driving off the lot, we can provide clarity and confidence for your journey to car ownership in Toronto.

The Initial Inquiry: What Information Will Be Requested?

When you first reach out to a specialized lender or apply through a platform like SkipCarDealer.com, you'll typically be asked for basic personal and financial information. This includes your full name, date of birth, current address (in Toronto or other Ontario cities), employment details (employer, duration, income), and contact information. Be prepared to answer questions about your current debt obligations, any existing loans, and whether you have a down payment or a co-signer. This initial inquiry is usually a 'soft' credit check, which doesn't negatively impact your credit score.

Understanding Hard vs. Soft Credit Inquiries: Impact on Your Score

- Soft Inquiry: Occurs when you check your own credit, or when a lender pre-screens you for an offer. It doesn't affect your credit score and is not visible to other lenders. Initial pre-approvals often use soft inquiries.

- Hard Inquiry: Occurs when you formally apply for credit (like a car loan). It temporarily lowers your credit score by a few points and remains on your report for two years. Multiple hard inquiries in a short period can signal risk to lenders.

It's important to be strategic. Apply to one or two specialized lenders or use a broker that can shop your application to multiple lenders with a single hard inquiry (or by grouping inquiries within a 14-45 day window so they count as one for scoring purposes).

The Approval Notification: What to Look for in Your Loan Offer

Once approved, you'll receive a loan offer outlining the terms. Carefully review:

- APR (Annual Percentage Rate): This is the most crucial number. Compare it across any offers you receive.

- Loan Amount: Ensure it matches your needs for the vehicle you're eyeing.

- Loan Term: The number of months you have to repay.

- Monthly Payment: Confirm it fits comfortably within your budget.

- Total Cost of Loan: This includes the principal plus all interest and fees.

- Any Fees: Look for administrative, origination, or documentation fees.

Don't be afraid to ask questions if anything is unclear. Transparency is key, especially with a 450 credit score loan.

Finalizing the Deal: Reviewing Contracts, Warranties, and Additional Products

Once you've chosen an offer and a vehicle, you'll move to finalize the contract. Read every line of the loan agreement and the vehicle purchase agreement. Be aware of any additional products that might be offered, such as extended warranties, rustproofing, or paint protection. While some may offer value, others might be unnecessary and significantly inflate your loan amount and thus your interest payments. Understand if these are optional or mandatory, and negotiate if you can. If you are buying a used car in Toronto, ensure all included features and terms are explicitly written in the contract.

Pro Tip: Don't Settle for the First Offer – Comparison Shopping is Key

Even with a 450 credit score, you have options. Never feel pressured to accept the very first loan offer you receive. Apply with 2-3 reputable specialized lenders or use a trusted online broker to compare terms. Even a 1-2% difference in APR can save you hundreds, if not thousands, of dollars over the life of the loan. This comparison shopping is crucial, whether you're in Toronto, Montreal, or even a smaller community in British Columbia. Leverage any pre-approvals to negotiate the best possible deal.

Beyond the Loan: Using Your Used Car to Rebuild Credit in Ontario

Securing the loan is just the beginning of a powerful journey. This section focuses on the long-term benefits and strategies for leveraging your new car loan to significantly improve your credit score, opening doors to better financial opportunities in the future. Your used car isn't just transportation; it's a credit-building machine.

The Mechanics of Credit Rebuilding: How Timely Payments Impact Your Score

Your payment history is the single largest factor (around 35%) influencing your credit score. Every single on-time payment you make on your car loan will be reported to Equifax and TransUnion, the major credit bureaus in Canada. These positive reports will gradually, but steadily, improve your 450 credit score. Over time, as you consistently make payments, your score will climb, demonstrating to future lenders that you are a reliable borrower. This is the core reason why a subprime car loan can be such a strategic financial move.

Monitoring Your Progress: Utilizing Credit Monitoring Services (e.g., Credit Karma Canada)

Don't just make payments; actively monitor your progress. Services like Credit Karma Canada or Borrowell offer free access to your credit score and report, often updated weekly or monthly. Regularly checking your score allows you to see the direct impact of your on-time payments. It also helps you identify any potential errors on your report and stay informed about your credit health. Seeing your score rise from 450 to 500, then 550, and beyond, can be incredibly motivating and reinforce good financial habits.

Next Steps: Qualifying for Better Rates and Future Loans (mortgages, personal loans)

As your credit score improves, a world of better financial opportunities opens up. After 12-18 months of consistent, on-time car loan payments, you might qualify to refinance your car loan for a lower interest rate, saving you money. More importantly, a stronger credit score (e.g., in the 600s or 700s) will make you eligible for more favourable terms on personal loans, credit cards, and eventually, even a mortgage in Toronto or any other Canadian city. Your car loan is a foundational step towards achieving broader financial goals.

The Ripple Effect: How a Good Payment History Can Improve Other Aspects of Your Financial Life

The benefits extend beyond just getting better loan rates. A good credit score can:

- Lower Insurance Premiums: Some insurance providers check credit scores, and a better score can lead to lower rates on car and home insurance.

- Easier Rental Approvals: Landlords often check credit when you apply for an apartment in competitive markets like Toronto.

- Better Employment Opportunities: Some employers, particularly in financial roles, may check credit as part of their background checks.

- Greater Financial Confidence: Knowing you've overcome past challenges and built a stronger financial foundation is empowering.

Pro Tip: Setting Up Automatic Payments to Never Miss a Due Date

The single best way to ensure consistent, on-time payments and maximize your credit rebuilding efforts is to set up automatic payments directly from your bank account. This eliminates the risk of forgetting a payment, avoids late fees, and guarantees that positive payment history is reported to the credit bureaus every month. Schedule it for a day or two after your paycheque typically clears to avoid any insufficient funds issues. This simple step can dramatically accelerate your journey from a 450 credit score to a much healthier one.

Your Next Steps to Keys in Hand, Toronto!

You've got the knowledge; now it's time for action. This clear, actionable checklist will guide you from reading this article to driving your used car in Toronto, ready to embark on your credit rebuilding journey.

- Assess Your Budget & Financial Health: Honestly evaluate your monthly income, expenses, and current debt. Determine how much you can realistically afford for a car payment (including insurance, fuel, and maintenance) without stretching yourself too thin.

- Gather Necessary Documents: Collect all proof of income, residency, and identification. Having these ready will significantly speed up the application process.

- Research Specialized Lenders in Toronto/Ontario: Look for dealerships and online platforms, like SkipCarDealer.com, that specialize in bad credit car loans. Read reviews and verify their reputation.

- Consider Down Payment & Co-Signer Options: If possible, save for a down payment. If not, explore a reliable co-signer to strengthen your application and potentially lower your interest rate.

- Apply for Pre-Approval: Submit an application for pre-approval. This often involves a soft credit check and will give you a clear idea of your loan amount and estimated APR before you even start looking at cars.

- Compare Loan Offers & Negotiate: Don't jump at the first offer. Compare terms from multiple sources. Use your pre-approval to negotiate the best possible price on your chosen used vehicle.

- Drive Away Responsibly & Rebuild Your Credit: Once you have your keys, set up automatic payments and commit to making every payment on time. This is your chance to transform your financial future, one responsible payment at a time.