Negative Equity in Ontario? Your 'No' Just Became 'Yes'.

Table of Contents

- Negative Equity in Ontario? Your 'No' Just Became 'Yes'.

- The Unspoken Truth: Yes, Refinancing Negative Equity in Ontario is Possible (And Here's How)

- The Ghost in Your Garage: Deconstructing Negative Equity in Ontario's Auto Market

- The 'No' Just Became 'Yes': Why Refinancing is Your Strategic Advantage Over Trading In

- The Ontario Playbook: Navigating Eligibility and the Refinancing Process

- The Money Maze: Interest Rates, Hidden Costs, and Maximizing Your Savings

- When Refinancing Isn't Enough: Alternative Paths and Damage Control

- Your Next Steps to Approval: Turning 'No' Into a Definitive 'Yes'

Negative Equity in Ontario? Your 'No' Just Became 'Yes'.

You’re driving your car through the streets of Toronto, Ottawa, or perhaps a quieter stretch of highway in cottage country. The engine hums, the radio plays, and everything feels fine. But then, a nagging thought creeps in: "Am I still paying too much for this vehicle?" Or worse, "What if my car is worth less than I owe on it?" That, my friend, is the unsettling reality of negative equity, a common financial predicament for many Ontario drivers. For too long, the prevailing wisdom has been that if you're "underwater" on your car loan, your options are limited – essentially, you're stuck. But what if we told you that's simply not true? What if your 'no' just became a resounding 'yes'?

At SkipCarDealer.com, we understand the unique challenges and opportunities within the Canadian auto finance landscape, particularly here in Ontario. We're here to dismantle the myth that refinancing a car with negative equity is impossible. It's not just possible; it's a strategic move that can liberate you from high payments, crushing interest, and the feeling of being trapped by your vehicle. Let's dive in and transform that financial burden into a path towards freedom.

The Unspoken Truth: Yes, Refinancing Negative Equity in Ontario is Possible (And Here's How)

For many Ontario car owners, the idea of refinancing a vehicle when you owe more than it's worth feels like a financial paradox. How can a lender give you *more* money for a car that’s already a liability? This common misconception often leads drivers to make costly mistakes, like trading in their underwater vehicle only to roll the negative equity into an even larger, more expensive new loan. But the truth is, refinancing negative equity in Ontario is not only a viable option but often a smart one when approached with the right strategy.

Key Takeaways:

- Dispelling the Myth: Refinancing a car with negative equity in Ontario is not only possible but often a strategic move to regain control over your financial situation and alleviate the stress of high monthly payments.

- The Core Strategy: It's about combining your existing loan with a new, more favourable one. This often involves extending the loan term to reduce monthly payments, securing a significantly lower interest rate, or a combination of both to make the debt more manageable.

- Your Toolkit: Success hinges on understanding key factors: your current credit standing, the accurate market value of your vehicle, and the landscape of available lender options in the Canadian market.

- The 'Why Now?': Current economic conditions, including fluctuating interest rates and shifts in the used car market, can significantly influence the feasibility and benefits of your refinancing journey. Acting proactively is key.

- Immediate Action: Don't delay. Start by assessing your current loan, your vehicle's value, and your credit profile today to unlock potential savings and begin your journey towards positive equity.

The core strategy behind refinancing negative equity isn't about magic; it's about financial engineering. You're not just getting a new loan; you're restructuring your existing debt. This typically involves extending the loan term to reduce your monthly payments, or, ideally, securing a new loan with a significantly lower interest rate than your current one. In some cases, a lender might even be willing to finance a loan-to-value (LTV) ratio above 100%, especially if you have strong credit or a co-signer. It's about finding a financial institution willing to take on that slightly elevated risk in exchange for a reliable borrower.

To navigate this successfully, you need a robust toolkit. This includes a clear understanding of your credit score and history, an accurate assessment of your vehicle's current market value, and a comprehensive look at the various lenders in Ontario who specialize in or are open to this type of refinancing. The current market conditions in Ontario, including interest rate fluctuations and the ebb and flow of used car demand, can significantly impact your options. For example, if interest rates have dropped since you originally financed your car, or if your credit score has improved, you might be in an excellent position to save substantially.

Don't let the weight of negative equity hold you back. Taking immediate action to assess your situation is the first, most crucial step towards unlocking potential savings and regaining control of your finances. This isn't just about reducing a payment; it's about strategically moving towards a healthier financial future where your car is an asset, not a burden.

The Ghost in Your Garage: Deconstructing Negative Equity in Ontario's Auto Market

Negative equity, often referred to as being "underwater" or "upside down" on your car loan, is more than just a financial term; it’s a tangible weight. It means your outstanding loan balance is greater than the current market value of your vehicle. Imagine owing $25,000 on a car that, if you sold it today, would only fetch $20,000. That $5,000 difference is your negative equity, and it can feel like an insurmountable obstacle, trapping you in a cycle of debt.

The Ontario Context: How Provincial Sales Tax (HST), Insurance, and Registration Costs Factor In

In Ontario, the journey into negative equity often begins the moment you drive a new car off the lot. Why? Because you pay the Harmonized Sales Tax (HST) – a hefty 13% – on the purchase price. This tax, along with initial registration fees and the immediate cost of insurance, doesn't add to your car's resale value, but it does add to your initial outlay or the amount financed. So, if you bought a $30,000 car, you instantly owe $3,900 in HST, pushing your initial "cost" to $33,900, even though the car's underlying value remains $30,000. This immediate gap can plunge you into negative equity from day one, especially if you made a small or no down payment.

The Silent Killer: Depreciation's Relentless March

Depreciation is the primary culprit behind negative equity. It's the natural decline in a vehicle's value over time due to wear and tear, age, and obsolescence. And it's relentless.

- Understanding the first year's drop: The most significant depreciation occurs in the first year of ownership, particularly for new vehicles. A car can lose 20-30% of its value in the first 12 months, and sometimes even more the moment it leaves the dealership. This rapid initial drop often outpaces the rate at which you pay down your loan principal, creating a quick path to negative equity.

- Market factors in Ontario: The Canadian auto market, including Ontario, is subject to unique forces. Supply chain issues, which have plagued the industry in recent years, can either inflate or deflate used car values depending on the availability of new vehicles. Demand shifts, often influenced by economic trends, consumer preferences (e.g., SUV vs. sedan), and fuel prices, specifically impact what buyers are willing to pay for used cars across the province. A sudden spike in gas prices, for instance, can significantly depress the value of large, fuel-inefficient trucks and SUVs.

How Did I Get Here? Common Pitfalls Leading to Negative Equity

Many factors contribute to negative equity, and often it's a combination of several:

- Long loan terms with high interest rates: Stretching payments over 7 or even 8 years might make them seem affordable, but it means you're paying mostly interest for a longer period, slowing down principal reduction. High interest rates exacerbate this, ensuring your loan balance shrinks at a snail's pace while depreciation speeds ahead.

- Small or no down payment: A substantial down payment creates immediate equity, providing a buffer against depreciation. Without it, you start with little to no equity, making you vulnerable to depreciation from the outset.

- Rolling over previous negative equity: This is a common and dangerous trap. When you trade in an old car with negative equity, dealers often fold that outstanding balance into the new car loan. You're then paying for a car you no longer own, on top of your new vehicle, compounding your debt and almost guaranteeing you'll be underwater on the new car very quickly.

- Rapid depreciation of specific vehicle makes/models: Some cars simply hold their value better than others. Vehicles with a reputation for poor reliability, high maintenance costs, or models that undergo frequent, significant redesigns can depreciate faster in the Canadian market due to brand perception or a sudden influx of newer models.

Pro Tip #1: The Monthly Equity Check-Up

Don't wait for a crisis. Regularly compare your loan balance to your car's market value. In Canada, reputable valuation tools like Canadian Black Book (for dealers) and AutoTrader's valuation tool (for private sales) are invaluable. This proactive step can flag negative equity before it becomes a major problem, allowing for earlier intervention and more options. Knowing your numbers is the first step to taking control.

The 'No' Just Became 'Yes': Why Refinancing is Your Strategic Advantage Over Trading In

When faced with negative equity, many drivers in Ontario instinctively think of trading in their vehicle. It seems like the easiest way out – a fresh start with a new car. However, this often leads to a financial trap. Refinancing, on the other hand, offers a strategic advantage, allowing you to tackle the problem directly rather than simply transferring it.

The Trade-In Trap vs. The Refinance Release

Let's be clear: trading in a car with negative equity rarely solves the problem; it usually exacerbates it. When you trade in an underwater vehicle, the dealership subtracts your car's actual trade-in value from your outstanding loan balance. The difference – your negative equity – is then added to the price of your new car. This means you're financing not only the new vehicle but also the remaining debt from the old one. You end up with a larger loan, higher monthly payments, and you start a fresh cycle of negative equity on a brand-new car.

Refinancing, conversely, has a different goal: to reduce your existing burden on your current vehicle. It’s about making the loan you already have more manageable and more affordable. You’re not adding new debt; you’re restructuring old debt. This approach aims to chip away at the principal, lower your interest costs, and ultimately move you towards a position of positive equity without taking on the additional cost and commitment of a new vehicle.

Unlocking Financial Breathing Room: The Core Benefits of Refinancing

Refinancing isn't just about avoiding a trap; it's about actively improving your financial health. Here’s how:

- Lower Monthly Payments: This is often the most immediate and appealing benefit. By strategically extending your loan term (e.g., from 3 years remaining to 5 years) or securing a significantly better interest rate, your monthly payment can drop considerably. This directly impacts your immediate budget, freeing up cash flow for other expenses or savings.

- Reduced Interest Over Time: A lower Annual Percentage Rate (APR) is your best friend in the fight against debt. Even a small reduction in interest can lead to substantial long-term savings, often amounting to hundreds or even thousands of dollars over the life of the loan. This means more of your payment goes towards the principal, not just the cost of borrowing.

- Path to Positive Equity: By reducing your interest costs and potentially freeing up cash to make extra principal payments, refinancing can help you chip away at the principal faster. This accelerates your journey towards positive equity, where your car is finally worth more than you owe, giving you true financial flexibility.

- Avoiding Dealer Pressure: When you refinance, you deal directly with lenders, not a car salesperson. This removes the high-pressure sales environment of a new car dealership, allowing you to make a clear-headed financial decision based solely on improving your existing loan terms.

Is It Always the Right Move? When Refinancing Makes Sense (and When it Doesn't)

While refinancing is powerful, it's not a universal solution. It's crucial to assess if it's the right fit for your specific situation.

Scenarios where refinancing is a clear winner:

- Significant improvement in credit score: If your credit score has improved substantially since you took out your original loan, you're likely eligible for much better interest rates.

- Substantial drop in market interest rates: If prevailing auto loan rates have fallen since you financed your car, you can capitalize on the lower cost of borrowing.

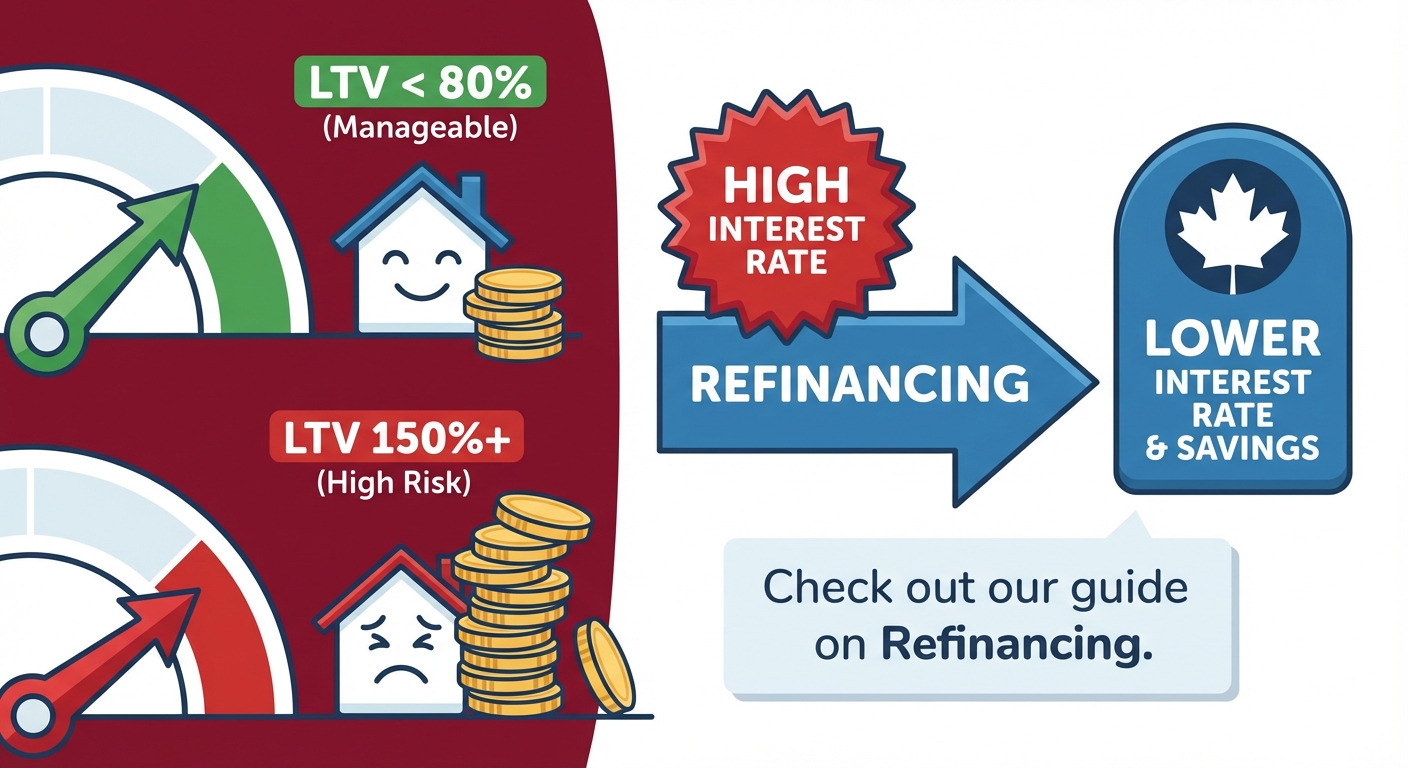

- A manageable amount of negative equity: Lenders are more willing to approve refinancing for negative equity if the loan-to-value (LTV) ratio isn't excessively high (e.g., 120% LTV is more manageable than 150%+).

- Your current loan has a very high interest rate: If you were approved for a high-interest loan initially due to poor credit, refinancing can offer significant savings. For more on this, check out our guide on

The Ontario Playbook: Navigating Eligibility and the Refinancing Process

Refinancing a car with negative equity in Ontario requires understanding the specific criteria lenders look for and a systematic approach to the application process. It's not just about your credit score; it's a holistic assessment of your financial health and the vehicle itself.

Beyond the Credit Score: What Ontario Lenders *Really* Look For

While your credit score is undoubtedly a primary gatekeeper, it's one piece of a larger puzzle. Lenders in Ontario assess several factors to determine your eligibility and the terms of your refinancing offer:

- Credit History & Score: This is often the first thing lenders check. Your credit score (typically from Equifax and TransUnion in Canada) reflects your payment history, outstanding debt, length of credit history, and types of credit. A higher score indicates lower risk and usually qualifies you for better interest rates. For more insights into how your score impacts your loan, read The Truth About the Minimum Credit Score for Ontario Car Loans.

- Debt-to-Income Ratio (DTI): This ratio measures your total monthly debt payments against your gross monthly income. Lenders use it to assess your overall capacity to take on new debt. If your DTI is too high, it signals that you might be overleveraged, even if your credit score is decent.

- Vehicle Specifics: The car itself plays a significant role. Lenders consider its age, mileage, make, and model. Some institutions shy away from very old, high-mileage, or niche cars due to concerns about their resale value and the difficulty of recouping losses if you default. Generally, vehicles less than 7-10 years old with under 150,000-200,000 kilometres are preferred.

- Loan-to-Value (LTV) Ratio: This is the crucial metric for negative equity refinancing. It compares your outstanding loan balance to the car's current market value. When you have negative equity, your LTV is above 100%. Lenders assess risk based on how high this ratio is and often have internal thresholds. Some might approve an LTV up to 120-130%, while others might be more conservative.

- Proof of Residence & Income: Standard documentation for Ontario residents includes utility bills or lease agreements for proof of address, recent pay stubs or employment letters for income verification, and bank statements. For self-employed individuals, this might involve tax assessments and business financial statements. For more on this, check out Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed.

The Refinancing Roadmap: A Step-by-Step Guide for Ontario Drivers

Navigating the refinancing process can seem daunting, but by breaking it down, you can approach it with confidence:

- Step 1: Know Your Numbers: Accurately determine your current loan balance (call your current lender), interest rate, and remaining term. Crucially, get an up-to-date estimate of your car's market value using reputable Canadian valuation tools like Kelley Blue Book Canada or AutoTrader's valuation tool. This will clearly show your exact negative equity amount.

- Step 2: Polish Your Profile: Take actionable steps to improve your credit score. Pay down small outstanding debts, dispute any inaccuracies on your credit report, and ensure all your payments are made on time. Even a small improvement can open doors to better rates.

- Step 3: Gather Your Documents: Proactively collect all necessary paperwork. This typically includes recent pay stubs (at least two), bank statements, your existing loan documents, and proof of valid Ontario car insurance. Having these ready streamlines the application process.

- Step 4: Shop Around – The Ontario Lender Landscape: Don't settle for the first offer. Explore options from major Canadian banks (e.g., RBC, TD, CIBC, Scotiabank, BMO), local credit unions (e.g., Meridian, Alterna), online lenders specializing in auto finance (like SkipCarDealer.com), and even some dealerships that partner with third-party refinancing companies. Each lender has different risk appetites and offerings for negative equity.

- Step 5: Compare Offers & Understand the Fine Print: Look beyond just the interest rate. Scrutinize application fees, any prepayment penalties on the *new* loan (though less common with refinancing), and the overall terms and conditions. A slightly higher rate with no fees might be better than a lower rate with significant upfront costs.

Pro Tip #3: Leverage a Co-Signer Strategically

If your credit isn't perfect, or if your negative equity is substantial, a co-signer with strong credit can be a game-changer. Their excellent credit history can significantly improve your approval odds and potentially secure a much lower interest rate. However, ensure they fully understand the commitment and implications – they are equally responsible for the loan.

The Money Maze: Interest Rates, Hidden Costs, and Maximizing Your Savings

Navigating the world of auto loan refinancing means understanding more than just your monthly payment. It's about dissecting interest rates, uncovering hidden costs, and employing smart strategies to maximize your savings in the long run.

The Anatomy of an Interest Rate in Ontario

Your interest rate is the cost of borrowing money, and it's heavily influenced by several factors:

- Prime Rate Influence: The Bank of Canada's decisions on the overnight rate significantly influence the prime rate, which in turn ripples through all lending rates, including auto loans offered by Canadian lenders. When the BoC raises rates, borrowing becomes more expensive, and vice-versa.

- Risk-Based Pricing: Lenders price risk. Your credit score, debt-to-income ratio, and the amount of negative equity directly impact the interest rate you're offered. A higher risk profile (e.g., lower credit score, high LTV) will typically result in a higher interest rate to compensate the lender for the increased chance of default.

- Fixed vs. Variable: This is a crucial decision for your refinancing strategy in Ontario's current economic climate.

Feature Fixed Interest Rate Variable Interest Rate Definition Rate remains the same for the entire loan term. Rate fluctuates with market interest rates (e.g., Prime Rate). Predictability High; monthly payments are stable and predictable. Low; monthly payments can change, making budgeting harder. Risk Low; protected if market rates increase. High; payments increase if market rates rise, but decrease if they fall. Initial Rate Often slightly higher than initial variable rates. Often lower than initial fixed rates, but can change. Best For Budget-conscious borrowers who value stability, or in a rising rate environment. Borrowers comfortable with risk, or in a falling/stable rate environment. Ontario Context Popular choice for long-term budget planning amidst economic uncertainty. Less common for auto loans, but some lenders offer it; requires close monitoring of BoC rates. Beyond the APR: Unmasking Hidden Refinancing Costs

The interest rate isn't the only cost. Be vigilant for these potential hidden fees:

- Application Fees: While less common for standard auto loan refinancing in Ontario, some specialized lenders or brokers might charge a small fee to process your application. Always ask upfront.

- Lender Fees: These can include origination fees, administrative charges, or other processing costs. They might be a flat fee or a percentage of the loan amount, and they can add to your total loan amount if rolled in.

- PST/HST Implications: While not a direct refinancing cost, understand that if you eventually sell your refinanced car, the buyer will pay HST on the purchase price. This is a general car ownership cost, but it's part of the broader financial picture.

- Prepayment Penalties: Crucially, does your *current* loan have one? Some older or subprime loans might include penalties for paying off the loan early. If so, this fee could significantly offset any savings from refinancing if not accounted for. Always review your original loan agreement carefully before proceeding.

Strategies to Secure the Best Deal

You have power in this process. Here’s how to wield it:

- Improving Your Credit Before Applying: As discussed, this is the single most impactful action. Even a 20-point jump in your credit score can move you into a better rate tier, saving you thousands over the loan term.

- Negotiating with Lenders: Don't just accept the first offer. If you receive multiple offers, use them as leverage. Inform other lenders that you have a better offer and ask if they can beat it. Competition works in your favour.

- Shortening Your Loan Term (If Feasible): While extending your loan term reduces monthly payments, shortening it saves significantly on total interest paid over the life of the loan. If your budget allows for a slightly higher payment, opt for a shorter term. Finding the right balance between affordability and total cost is key.

Context: An infographic comparing the total cost (monthly payments, total interest) of a typical Ontario car loan (e.g., $30,000 car, $5,000 negative equity) before and after refinancing (e.g., from 9% to 5% APR, or extending term), highlighting clear financial savings in both monthly payments and overall interest paid.

When Refinancing Isn't Enough: Alternative Paths and Damage Control

While refinancing is a powerful tool, there are situations where it might not be immediately feasible or sufficient to address severe negative equity. In such cases, understanding alternative paths and implementing damage control strategies is essential.

If Refinancing Isn't an Option (Yet):

Sometimes, due to a very high loan-to-value (LTV) ratio, poor credit, or an aging vehicle, traditional refinancing might not be approved. Don't despair; you still have options:

- Making Extra Payments: Even small, consistent additional payments directly reduce your principal balance. This accelerates the path to positive equity and reduces the total interest you pay over the loan term. Aim to add even an extra $25 or $50 to each payment if possible.

- Selling Your Car Privately (and covering the difference): This is a drastic but sometimes necessary step if the negative equity is too large to refinance and you simply want out of the loan. You would sell the car for its market value and then be responsible for paying the difference between the sale price and your outstanding loan balance out of pocket. This requires having available funds, but it can provide a clean break.

- Debt Consolidation (Cautions): Rolling the negative equity into a personal loan or line of credit might seem appealing. However, be cautious. Personal loans often come with higher interest rates than secured auto loans and typically have shorter repayment terms, which could lead to higher monthly payments. Only consider this if you can secure a significantly lower interest rate than your current car loan and are confident you can manage the payments.

- Temporary Payment Deferrals (Extreme Cases): In times of severe financial hardship, your current lender might offer a short-term payment deferral. While this provides immediate relief, be aware that interest usually continues to accrue during the deferral period, and the loan term may be extended, potentially increasing your total cost. This should be viewed as a last resort and a temporary fix, not a long-term solution.

The Importance of Financial Literacy

Your best long-term defense against negative equity and other financial pitfalls is robust financial literacy. Understanding how to read your credit report, creating and sticking to a realistic budget, and effectively managing your overall debt are crucial skills. These empower you to make informed decisions, avoid common traps, and build a stable financial future.

Pro Tip #4: Consult a Credit Counsellor

If you're overwhelmed by debt, including substantial negative equity, and feel like you're running out of options, a non-profit credit counselling service in Ontario can provide personalized, unbiased advice. They can help you explore all available options, including debt management plans, and guide you towards a sustainable financial recovery without pushing specific products.

Your Next Steps to Approval: Turning 'No' Into a Definitive 'Yes'

The journey from being burdened by negative equity to securing a more favourable car loan in Ontario is a marathon, not a sprint. But with a clear action plan and persistence, you can turn a seemingly impossible 'no' into a definitive 'yes'.

The Action Plan Checklist:

To maximize your chances of approval and secure the best possible refinancing terms, follow this comprehensive checklist:

- Verify your credit report and score: Obtain copies from both Equifax and TransUnion Canada. Review them meticulously for any errors and understand the factors impacting your score.

- Obtain precise details of your current car loan: This includes your exact outstanding balance, current interest rate, and the remaining term. Have all these documents readily accessible.

- Get accurate, up-to-date vehicle valuations: Use multiple reputable Canadian sources like Canadian Black Book, Kelley Blue Book Canada, and AutoTrader's valuation tool to get a realistic estimate of your car's market value.

- Prepare all necessary personal and financial documentation in advance: This includes recent pay stubs, bank statements, proof of residency, and your current car insurance