Your Government Cheque Just Rewrote Your Car Loan. Seriously, Vancouver.

Table of Contents

- Your Government Cheque Just Rewrote Your Car Loan. Seriously, Vancouver.

- Key Takeaways

- The Vancouver Story: Why Your Government Cheque is a Power Player in Your Car Loan Saga

- Beyond the Myth: How Lenders *Really* View Government Assistance as Stable Income

- The Refinancing Advantage: Unlocking Lower Payments, Better Terms, and Financial Breathing Room

- Navigating the Lender Labyrinth: Who Will Say 'Yes' to Your Government Cheque and Why?

- Types of Lenders and Their Approach:

- Your Refinancing Toolkit: What Documents and Details You'll Need to Assemble

- The Nitty-Gritty of Savings: Calculating Your Potential and Uncovering Hidden Costs

- Calculating Your Potential Savings:

- Uncovering Hidden Costs:

- Real-Life Refinancing Scenarios: From Calgary's Commutes to Ottawa's Accessibility Needs

- Scenario 1: Lowering Payments in Toronto on ODSP

- Scenario 2: Consolidating Debt with PWD in Vancouver, British Columbia

- Scenario 3: Improved Credit in Calgary, Alberta on AISH

- Beyond the Loan: Maximizing Your Vehicle's Value and Future Financial Planning

- Maintaining Your Vehicle's Value:

- Understanding Insurance Implications:

- Proactive Financial Planning:

- Your Next Steps to Rewriting Your Loan: A Practical Checklist for Approval

- Refinancing Your Car Loan on Government Assistance: Your Burning Questions Answered (FAQ)

Your Government Cheque Just Rewrote Your Car Loan. Seriously, Vancouver.

Key Takeaways

- Refinancing your car loan while receiving government assistance is not only possible but can lead to significant financial improvements.

- Many Canadian lenders view stable government income (like ODSP, PWD, AISH, CPPD) as reliable and predictable, making you an eligible candidate for better loan terms.

- You can potentially secure lower monthly payments, reduce your interest rate, and improve your overall financial health by leveraging your stable income.

- Dispelling common myths, this article provides practical steps, document checklists, and lender insights to help you navigate the refinancing process successfully.

- For residents in high-cost areas like Vancouver, this strategy can transform a burdensome car loan into a manageable asset, freeing up crucial cash flow.

In the bustling streets of Vancouver, where the cost of living feels like a constant uphill battle, every dollar counts. For many Canadians, a car isn't a luxury; it's a lifeline – for work, appointments, family, and accessing essential services. But what if your car loan feels like another heavy burden, made even more challenging because your primary income comes from government assistance? What if we told you that your government cheque isn't a barrier to better loan terms, but potentially your biggest asset?

It's time to shatter some persistent myths. At SkipCarDealer.com, we understand that life in Canada, especially in vibrant but expensive cities like Vancouver, requires innovative financial thinking. If you're currently on government assistance and have a car loan that's weighing you down, get ready. Your government cheque just rewrote your car loan. Seriously, Vancouver.

The Vancouver Story: Why Your Government Cheque is a Power Player in Your Car Loan Saga

Let's talk about Vancouver. With its breathtaking scenery comes a price tag that can be intimidating. Rent is high, groceries are costly, and transportation is essential. For individuals relying on government assistance programs, managing these expenses can feel like a high-wire act. There's a common, yet profoundly incorrect, assumption that receiving government support automatically puts you in a "bad income" category for lenders. This simply isn't true for many programs.

Imagine you took out a car loan a while ago, perhaps when your financial situation was less stable, or your credit wasn't as strong. The interest rate might be higher than you'd like, and those monthly payments feel like they're eating too much of your budget. Now, you're receiving stable government support – perhaps Persons with Disabilities (PWD) benefits in British Columbia, Ontario Disability Support Program (ODSP) in Ontario, or Assured Income for the Severely Handicapped (AISH) in Alberta. These aren't temporary handouts; they are often consistent, long-term income streams designed to provide stability.

This stability is the key. Lenders, at their core, are looking for predictability. They want to know you can reliably make your payments. A steady government cheque, deposited like clockwork, often presents a more predictable income pattern than some forms of casual employment or fluctuating freelance work. This is precisely why your government cheque isn't just income; it's a power player that can be leveraged to secure better car loan terms through refinancing. It's about transforming a financial burden into a manageable asset, giving you more breathing room in the demanding Vancouver economy, or any other Canadian city.

Beyond the Myth: How Lenders *Really* View Government Assistance as Stable Income

The misconception that disability or social assistance income automatically disqualifies you from securing a favourable loan is widespread, but it's often outdated or simply misinformed. Modern lenders, particularly those specializing in non-traditional income streams, understand that not all income comes from a traditional 9-to-5 job. They differentiate between unstable, temporary income and consistent, long-term government support.

What lenders prioritize is the stability and predictability of your income. Government assistance programs, by their very nature, are designed to provide a consistent financial baseline. When assessing your application for refinancing, lenders will look at:

- Duration of Benefits: Are these benefits long-term or temporary? Programs like Canada Pension Plan Disability (CPPD), Ontario Disability Support Program (ODSP), Assured Income for the Severely Handicapped (AISH) in Alberta, and Persons with Disabilities (PWD) in British Columbia are typically viewed as long-term and stable.

- Consistency of Payments: Do these payments arrive regularly, on the same schedule? This is easily verifiable through bank statements.

- Benefit Amount: Is the income sufficient to cover your proposed car loan payments, along with your other essential living expenses?

- Other Income Sources: Do you have any supplementary income, even part-time work or other benefits (like Child Tax Benefit, which can also be a significant factor for parents, as discussed in our article British Columbia Parents: Your Child Tax Benefit Just Cut Your Car Payments)?

Even Employment Insurance (EI) can be considered, especially in specific long-term scenarios, such as maternity/parental leave or certain sickness benefits, where the duration is clearly defined and consistent. Lenders have become more sophisticated in their understanding of the diverse income landscapes of Canadians.

To make the strongest case for your stable government income, gather comprehensive documentation. This includes official award letters from the government agency detailing your benefit amount and duration, as well as bank statements showing regular, uninterrupted deposits over the past 6-12 months. The more clearly you can demonstrate consistency, the more confident lenders will be in your ability to repay. Don't just tell them; show them with undeniable proof.

By understanding how lenders truly evaluate these income streams, you can confidently approach the refinancing process, knowing your government cheque is a legitimate, stable income source.

The Refinancing Advantage: Unlocking Lower Payments, Better Terms, and Financial Breathing Room

Refinancing your car loan isn't just about getting a new interest rate; it's a strategic financial move that can significantly improve your cash flow and overall financial health. For someone on government assistance, where every dollar is carefully budgeted, the benefits can be transformative.

Here’s how refinancing can give you a substantial advantage:

- Lower Monthly Payments: This is often the primary goal. By securing a lower interest rate or extending your loan term (or both), you can reduce the amount you pay each month. This frees up cash for other necessities, savings, or even just a little more peace of mind in a high-cost city like Toronto or Vancouver.

- Reduced Interest Paid Over Loan Term: A lower interest rate means you pay less for the privilege of borrowing money. Over the life of the loan, this can translate into hundreds, or even thousands, of dollars saved. This money stays in your pocket, not the lender's.

- Flexible Loan Terms: Depending on your situation, you might want to shorten your loan term to pay it off faster and save on total interest, or extend it to significantly lower your monthly payments. Refinancing gives you the flexibility to adjust the terms to better suit your current financial reality.

- Improved Cash Flow: With lower monthly payments, you gain more control over your budget. This improved cash flow can make a significant difference in your daily life, reducing financial stress and allowing you to build an emergency fund or address other financial goals.

Perhaps when you first got your car loan, your credit score wasn't ideal, or you were perceived as a higher risk. Since then, you might have diligently made payments, your credit history has subtly improved, and your income source (government assistance) has proven to be incredibly stable. These factors make you a more attractive borrower now than you were initially. Lenders are often willing to offer better terms to someone who demonstrates a consistent payment history and reliable income, even if that income is from government programs. Even if you're dealing with negative equity, as explored in our article Underwater Car Loan? Perfect. We'll Refinance It, Toronto!, refinancing can still be a viable path to better terms.

Navigating the Lender Labyrinth: Who Will Say 'Yes' to Your Government Cheque and Why?

Finding the right lender is crucial when refinancing with government assistance as your primary income. Not all lenders are created equal, and their appetite for different income types varies. Understanding who to approach and what they prioritize can save you significant time and frustration.

Types of Lenders and Their Approach:

- Major Canadian Banks (e.g., RBC, TD Canada Trust, BMO):

- Pros: Reputable, often offer competitive rates for strong credit profiles.

- Cons: Can be more rigid in their income assessment, sometimes preferring traditional employment income. They might have stricter credit score requirements. However, if your government benefits are substantial and long-term (like CPPD), they might consider it.

- Approach: Best for those with very stable, long-term government benefits and a reasonably good credit history.

- Credit Unions (e.g., Vancity, Coast Capital Savings in British Columbia, Meridian Credit Union in Ontario):

- Pros: Often more community-focused and flexible than big banks. They tend to look at the 'whole picture' of your financial situation rather than just strict criteria. They can be more understanding of non-traditional income sources.

- Cons: Rates might not always be as low as the absolute best bank rates for prime borrowers, but often better than subprime lenders.

- Approach: An excellent starting point. Their local presence and member-centric philosophy can be a huge advantage for applicants on government assistance.

- Online Lenders & Specialty Finance Companies:

- Pros: Many specialize in non-traditional income streams and imperfect credit. They are often quicker to process applications and have more flexible underwriting criteria. Companies like SkipCarDealer.com connect you with a network of such lenders.

- Cons: Interest rates can be higher than traditional banks or credit unions, especially if your credit is challenged.

- Approach: Ideal if you've been turned down by traditional banks or credit unions, or if your credit history is less than perfect. They are often very familiar with various Canadian government assistance programs.

- Dealership Financing Arms:

- Pros: Convenient, as they can handle the financing directly when you're looking at a new vehicle (though this article focuses on refinancing your existing loan). Some dealerships work with a wide network of lenders, including those open to government assistance income.

- Cons: May prioritize their own internal financing products or specific partners, which might not always be the absolute best deal for you.

- Approach: Can be a good option if you’re also considering upgrading your vehicle or if they have specific programs for unique financial situations.

The key is to seek out lenders who are familiar with and willing to accept government assistance programs as verifiable income. Don't be discouraged by an initial "no" from a lender that simply isn't set up to assess your specific income type. There are many options available across Canada, from Calgary to Montreal, that are ready to work with you.

Never accept the first offer you receive. Leverage comparison sites, financial brokers (like SkipCarDealer.com), and directly approach multiple lenders. Each inquiry might cause a slight, temporary dip in your credit score, but the potential savings from securing a better interest rate far outweigh this minor impact. Brokers specializing in non-traditional income can be invaluable, as they already know which lenders are most likely to say 'yes' to your unique financial situation.

Your Refinancing Toolkit: What Documents and Details You'll Need to Assemble

Preparation is paramount when applying for car loan refinancing. Having all your documents in order not only speeds up the process but also presents you as a responsible and organized borrower. Lenders appreciate clarity and completeness.

Here's a practical checklist of what you'll need to assemble:

- Proof of Government Assistance Income:

- Official award letters or benefit statements from the issuing government body (e.g., Employment and Social Development Canada for CPPD, Ministry of Social Development and Poverty Reduction for PWD in British Columbia, Ministry of Children, Community and Social Services for ODSP in Ontario).

- Bank statements showing regular, consistent deposits of your government benefits over the past 6-12 months. This is crucial for demonstrating stability.

- Current Car Loan Statements:

- Most recent statement showing your current outstanding balance, interest rate, monthly payment, and remaining term.

- Your loan account number and the current lender's contact information.

- Details on any early termination penalties (prepayment penalties) that might apply if you pay off your current loan early.

- Vehicle Information:

- Vehicle Identification Number (VIN).

- Make, model, year, and trim level of your car.

- Current odometer reading (mileage).

- Proof of insurance.

- Personal Identification:

- Government-issued photo ID (e.g., driver's license, provincial ID card).

- Proof of residency (e.g., utility bill, bank statement with your address).

- Your Credit Report:

- You should obtain a copy of your credit report from Equifax and TransUnion, Canada's two major credit bureaus, before applying. This allows you to understand your current credit score and identify any potential errors. For more on navigating credit, consider our guide Zero Credit? Perfect. Your Canadian Car Loan Starts Here.

- Lenders will check your credit, looking for your payment history, credit utilization (how much credit you're using compared to what's available), and public records (bankruptcies, consumer proposals).

- Strategies for Improving Your Credit Score: Even incremental improvements can help. Ensure all your bills are paid on time, keep credit card balances low, and avoid applying for new credit in the months leading up to your refinance application.

- Debt-to-Income Ratio Considerations:

- Lenders will also calculate your debt-to-income (DTI) ratio, which is the percentage of your gross monthly income that goes towards debt payments. While government assistance counts as income, ensure your existing debts (including housing, other loans, credit cards) don't make your DTI too high.

Having this toolkit ready will streamline the application process and demonstrate to lenders that you are a serious and organized applicant, increasing your chances of approval for better terms.

The Nitty-Gritty of Savings: Calculating Your Potential and Uncovering Hidden Costs

Understanding the potential savings from refinancing is exciting, but it's equally important to be aware of any hidden costs. A thorough calculation will reveal the true benefit of rewriting your car loan.

Calculating Your Potential Savings:

The primary ways you save are through a lower interest rate and/or adjusting your loan term.

- Interest Rate Reduction: Even a small reduction can lead to significant savings over time.

- Example: You have a $15,000 loan at 10% over 3 years. Monthly payment is approx. $483. Total interest paid: approx. $2,388.

- Refinance to 6%: Monthly payment drops to approx. $456. Total interest paid: approx. $1,416.

- Savings: $27 per month, and $972 in total interest!

- Term Adjustment (often combined with rate reduction):

- Extending the Term: Lowers monthly payments, but you might pay more interest overall.

- Example: Same $15,000 loan, 10% over 3 years ($483/month).

- Refinance to 6% over 5 years: Monthly payment drops to approx. $290. Total interest paid: approx. $2,398.

- Savings: $193 per month in cash flow! But total interest paid is almost the same as the original, shorter, higher-rate loan.

- Shortening the Term: Increases monthly payments, but saves on total interest.

- Extending the Term: Lowers monthly payments, but you might pay more interest overall.

Use an online car loan calculator to play with different rates and terms. This will give you a clear picture of what's possible.

Uncovering Hidden Costs:

While the benefits are clear, be vigilant about potential fees and charges:

- Early Termination Penalties on Your Existing Loan: Some loan agreements include clauses that charge a fee if you pay off the loan before its scheduled end date. Check your current loan documents carefully.

- New Administrative Fees: Your new lender might charge an origination fee, documentation fee, or other administrative charges to set up the new loan. Always ask for a full breakdown of all fees.

- Appraisal Costs: In some cases, especially if there's a question about the vehicle's value or if you're doing a cash-out refinance, an appraisal might be required, and you might be responsible for the cost.

- Impact of Extending Your Loan Term: As shown above, while extending the term significantly reduces your monthly payments, it almost always results in paying more interest over the life of the loan. This is a trade-off between immediate cash flow and long-term cost. Evaluate if the monthly savings are worth the extra long-term interest.

- Negative Equity Considerations: If you owe more on your car than it's currently worth (negative equity), some lenders might roll this into your new loan, increasing your principal. While this can still lead to lower monthly payments, it means you're paying interest on a larger amount.

By understanding both the potential savings and the potential costs, you can make an informed decision that truly benefits your financial situation.

Context: A diverse group of Canadians (some visibly using mobility aids or with service animals) reviewing financial documents on a tablet or laptop, with a modern, accessible vehicle subtly visible in the background, symbolizing financial empowerment and mobility.

Real-Life Refinancing Scenarios: From Calgary's Commutes to Ottawa's Accessibility Needs

To illustrate the versatility of refinancing with government assistance, let's explore a few real-life scenarios across Canada.

Scenario 1: Lowering Payments in Toronto on ODSP

- Applicant: Maria, living in Toronto, Ontario, receives ODSP benefits. She has an older sedan with a few years left on her loan, at a high 12% interest rate. Her initial credit wasn't great, but she's made all payments on time for the past two years.

- Goal: Significantly lower monthly payments to free up cash flow for rising living costs in Toronto.

- Refinancing Outcome: Maria applies to a credit union known for its flexibility. Leveraging her consistent ODSP income and improved payment history, she refinances the remaining $8,000 balance at 7% over a slightly extended term. Her monthly payments drop from $270 to $195, saving her $75 each month, which is crucial for her budget.

Scenario 2: Consolidating Debt with PWD in Vancouver, British Columbia

- Applicant: David, a Vancouver, British Columbia resident on PWD benefits, has a relatively new, accessible minivan that he relies on. He also has some high-interest credit card debt that's becoming unmanageable. His car loan rate is 8%, and his credit score has seen some improvement.

- Goal: Consolidate high-interest debt and lower his overall monthly financial obligations.

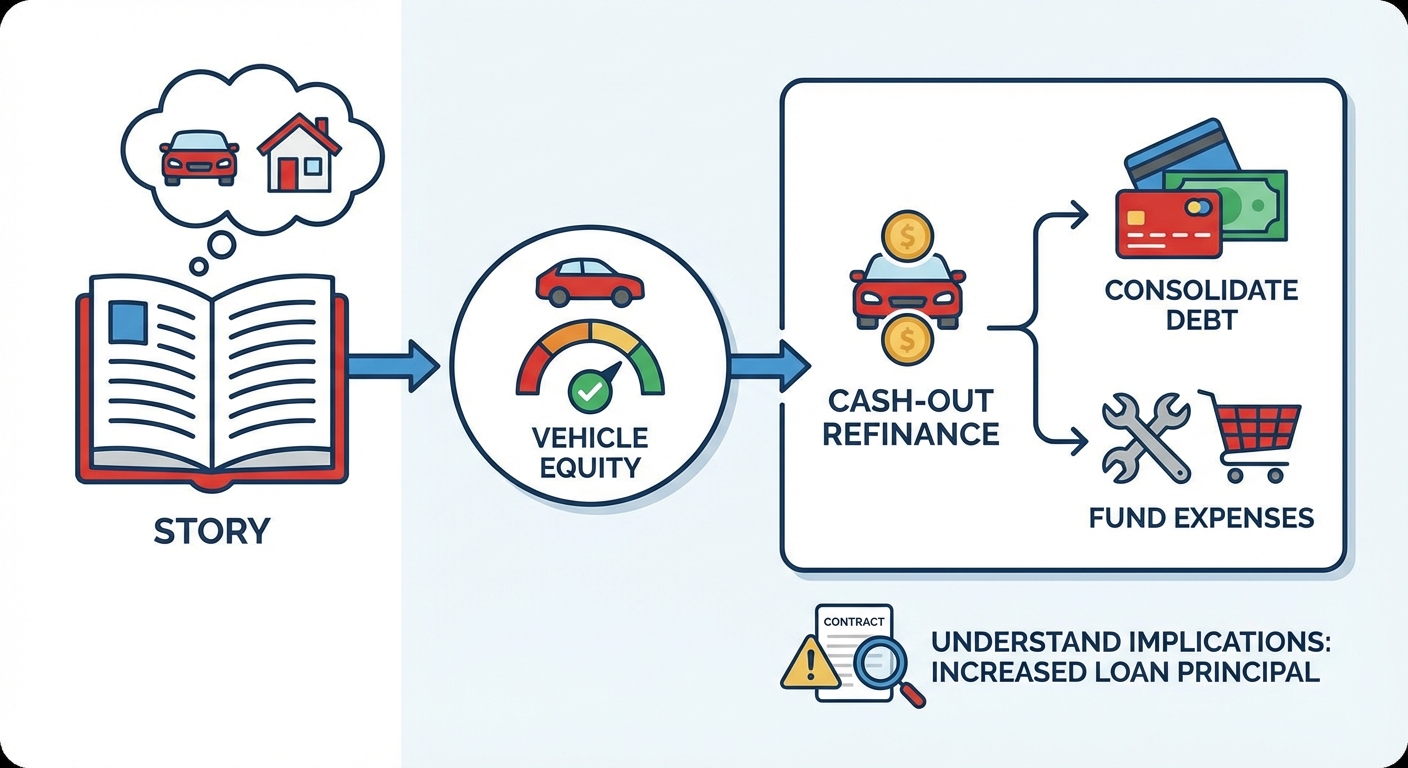

- Refinancing Outcome: David approaches an online specialty lender. Because his vehicle has significant equity (it's worth more than he owes), he qualifies for a cash-out refinance. He refinances his $20,000 car loan at 6.5% and takes out an additional $5,000 (using his vehicle's equity) to pay off his credit cards. His new combined car loan payment is slightly higher than his original car payment, but his overall monthly debt payments are drastically reduced due to eliminating the high-interest credit card debt. This strategy is similar to what's discussed in our article EI? Your Car Doesn't Care. Cash Out Its Title, even though David isn't on EI.

Scenario 3: Improved Credit in Calgary, Alberta on AISH

- Applicant: Sarah, living in Calgary, Alberta, receives AISH benefits. She initially financed her SUV at a high rate (14%) due to a past consumer proposal. Since then, her consumer proposal has been discharged (or she has been making consistent payments), and her credit score has steadily climbed.

- Goal: Capitalize on her improved credit to secure a much lower interest rate.

- Refinancing Outcome: Sarah applies through SkipCarDealer.com, connecting with a lender specializing in individuals with improving credit. Her AISH income is seen as stable, and her recent positive credit history is heavily weighted. She refinances her $12,000 loan at 8.5%, reducing her monthly payment by $50 and saving over $1,000 in total interest over the remaining term.

These scenarios highlight that whether you're dealing with an older vehicle, require accessibility modifications, or simply want to improve your cash flow, stable government assistance can be a powerful tool in your refinancing journey across Canadian cities like Edmonton, Ottawa, or any other region.

Beyond the Loan: Maximizing Your Vehicle's Value and Future Financial Planning

Refinancing your car loan is a significant achievement, but it's just one step on your path to greater financial stability. Once you've secured better terms, it's essential to look ahead and maximize the benefits.

Maintaining Your Vehicle's Value:

- Regular Maintenance: Stick to the manufacturer's recommended service schedule. A well-maintained vehicle holds its value better and avoids costly repairs down the line.

- Keep Records: Maintain a file of all service records, oil changes, and repairs. This documentation proves the care you've given your vehicle, which is valuable if you decide to sell or trade it in later.

- Cleanliness: A clean interior and exterior not only make your car more enjoyable but also contribute to its resale value.

Understanding Insurance Implications:

When you refinance, you'll have a new lender. This typically means you'll need to inform your insurance company of the change. Your new lender will likely be listed as a loss payee on your policy. Ensure your coverage meets the new lender's requirements (e.g., collision and comprehensive coverage are often mandatory).

Proactive Financial Planning:

With potentially lower monthly car payments, you have a golden opportunity to strengthen your overall financial position.

- Budgeting Strategies: Revisit your budget. How will you allocate the extra cash flow? Can you put more towards other high-interest debts, or start building an emergency fund?

- Building an Emergency Fund: Aim for at least 3-6 months of essential living expenses. This fund provides a critical safety net for unexpected costs, reducing reliance on credit and preventing future financial stress.

- Planning for Future Vehicle Needs: Even after refinancing, start thinking long-term. Will this vehicle meet your needs in 3-5 years? Begin setting aside a small amount regularly for a future down payment or vehicle replacement fund.

Set up automatic payments for your refinanced car loan. This ensures that payments are made on time, every time, without you having to remember. On-time payments are a cornerstone of a healthy credit score, directly impacting your ability to secure favourable rates for future loans or credit products. Plus, it helps you avoid late fees, keeping more money in your pocket.

Your Next Steps to Rewriting Your Loan: A Practical Checklist for Approval

Ready to take control and rewrite your car loan? Here’s your actionable, step-by-step guide to navigate the refinancing process:

- Assess Your Current Loan:

- Gather your latest loan statement. What's your current interest rate, outstanding balance, monthly payment, and remaining term?

- Check for any prepayment penalties.

- Check Your Credit Score:

- Obtain free copies of your credit report from Equifax and TransUnion. Understand your score and look for any discrepancies.

- Identify areas where you might make small improvements before applying.

- Assemble Your Documents:

- Collect all proof of income (government award letters, 6-12 months of bank statements showing deposits).

- Have your vehicle's VIN, mileage, and current insurance details ready.

- Prepare personal ID and proof of residency.

- Research and Compare Lenders:

- Start with credit unions, then explore online lenders and specialty finance companies known for working with non-traditional income.

- Use platforms like SkipCarDealer.com to connect with multiple lenders who understand your situation.

- Don't be afraid to ask direct questions about how they view government assistance.

- Get Multiple Quotes:

- Apply to 3-5 different lenders to get a range of offers.

- Compare not just the interest rate, but also the loan terms, monthly payments, and any fees.

- Review the Terms and Conditions Carefully:

- Read the fine print of each offer. Understand the total cost of the loan, including all fees.

- Ensure you're comfortable with the new monthly payment and the overall loan term.

- Finalize Your Loan:

- Once you've chosen the best offer, work with the lender to finalize the paperwork.

- They will typically pay off your old loan directly, and your new payments will begin with the new lender.

By diligently following these steps, you empower yourself to take control of your car loan and move towards a more financially secure future. Your government cheque is more than just support; it's a foundation for building a better financial reality.

Refinancing Your Car Loan on Government Assistance: Your Burning Questions Answered (FAQ)

Context: A clear, easy-to-understand infographic or chart illustrating a 'before and after' scenario of a car loan, highlighting the reduction in monthly payments and/or total interest paid after refinancing. This visual reinforces the core benefit.