Self-Employed Canada: Your Car's Equity Just Wrote a Cheque.

Table of Contents

- Key Takeaways: Your Instant Guide to Car Equity for Cash

- The Entrepreneur's Edge: Why Your Car's Equity is Your Next Business Partner

- Beyond the T4: Understanding the Self-Employed Funding Gap

- What Exactly is a 'Cash Out Car Refinance' for the Self-Employed?

- Unlocking the Vault: Who Qualifies for 'No Income Verification' Cash in Canada?

- The Car's Credentials: What Lenders Look For in Your Vehicle

- The Entrepreneur's Profile: Beyond the Pay Stub

- The Road to Funds: Your Step-by-Step 'Cash Out' Journey for Self-Employed Canadians

- Step 1: Assessing Your Financial Landscape & Vehicle Worth

- Step 2: Navigating the Lender Labyrinth: Finding Your Best Match

- Step 3: The Application: What to Prepare (Without T4s)

- Step 4: Approval, Loan Agreement & Fund Disbursement

- Beyond the Rate: Unmasking Hidden Costs and Protecting Your Asset

- The True Cost of Convenience: Deconstructing Fees & Charges

- Understanding the Collateral: The Risk and Reward of Your Car

- Maximizing Your Payout: Smart Moves Before You Apply

- Boosting Your Car's Appeal & Value

- Negotiating for Better Terms: Your Power as an Applicant

- Lender Landscape: Who's Writing These Cheques for Self-Employed Canadians?

- The Rise of Specialized Auto Finance Companies

- The Broker Advantage: Your Navigator in the Funding Maze

- The Smart Money Move: When is Car Equity Your Best Strategic Play?

- Strategic Uses for Your Cash Out Funds

- Comparing Alternatives: Why This Might Be Your Optimal Path

- Navigating the 'No Income Verification' Nuance: What Lenders *Really* Mean

- It's Not a Free Pass: The Reality of Alternative Verification

- Building a Trustworthy Financial Narrative

- Your Next Steps to Approval: A Strategic Checklist for Self-Employed Canadians

- Frequently Asked Questions (FAQ): Your Car Equity & Cash Out Refinance

- Q: Can I refinance my car if I still owe money on it?

- Q: How long does the cash out refinance process typically take for self-employed individuals?

- Q: What if my car is older? Can I still get a cash out refinance?

- Q: Does applying for a cash out refinance affect my credit score?

- Q: Is my car used as collateral for a cash out refinance?

- Q: What's the minimum amount of equity I need in my car to qualify?

- Q: Can I use the cash for any purpose?

As a self-employed Canadian, you understand the unique rhythm of entrepreneurship – the freedom, the drive, and often, the financial gymnastics required to keep your business thriving. Traditional lenders, accustomed to the predictability of T4s, sometimes struggle to grasp the dynamic nature of your income. But what if one of your most valuable assets, sitting right in your driveway, held the key to unlocking the funds you need? Your car isn't just a mode of transport; it's a tangible asset, a potential source of liquid capital. For the self-employed, leveraging your vehicle's equity through a cash out refinance can be a strategic financial move, offering access to cash without the rigid income verification often demanded by conventional banks. Imagine using your car to consolidate high-interest debt, invest in your business, or cover an unexpected expense. It's not just possible; it's a smart play many Canadian entrepreneurs are already making.

Key Takeaways: Your Instant Guide to Car Equity for Cash

- Equity is King: Your vehicle's current market value minus what you owe can be a powerful, accessible source of funds.

- 'No Income Verification' Defined: It doesn't mean zero proof; it means alternative proof of repayment ability (e.g., bank statements, business invoices, consistent cash flow) beyond traditional T4s.

- Strategic Tool: Cash out refinancing is ideal for debt consolidation, business investment, or emergencies, not just frivolous spending.

- Lender Landscape: Specialized auto finance companies and brokers are often more flexible for self-employed individuals than traditional banks.

- Read the Fine Print: Understand all fees, interest rates, and terms to avoid hidden costs and protect your asset.

The Entrepreneur's Edge: Why Your Car's Equity is Your Next Business Partner

Being your own boss in Canada comes with incredible rewards, yet it often presents unique challenges when it comes to securing financing. The traditional lending model, built around steady paycheques and easily verifiable employment histories, frequently overlooks the substantial, albeit non-linear, income streams of entrepreneurs. Your car, however, doesn't care about your tax form; it cares about its market value.

Beyond the T4: Understanding the Self-Employed Funding Gap

The Canadian entrepreneurial spirit is robust, with countless individuals building successful businesses from the ground up. However, the financial landscape for these innovators is distinct. You might have excellent cash flow, substantial revenue, and a thriving enterprise, but if your income doesn't neatly fit into a bi-weekly pay stub, many traditional lenders tend to shy away. They often struggle to interpret diverse income sources like fluctuating contract payments, project-based earnings, or seasonal business peaks and troughs. This creates a significant funding gap, leaving many self-employed individuals searching for alternative solutions when they need capital. This is where the concept of cash out car refinance steps in as a tailored solution. It acknowledges the reality of self-employment and offers a practical way to access funds based on a tangible asset, rather than solely on a traditional employment history.

What Exactly is a 'Cash Out Car Refinance' for the Self-Employed?

At its core, a cash out car refinance is a financial strategy that allows you to borrow money against the equity you've built in your vehicle. Think of it like this: if your car is worth $30,000 and you only owe $10,000 on it, you have $20,000 in equity. A cash out refinance lets you take out a new, larger loan for, say, $25,000. This new loan pays off your existing $10,000 balance, and you receive the remaining $15,000 in cash. You then make payments on the new, larger loan. How does this differ from a standard car loan or a personal loan? A standard car loan is typically for purchasing a vehicle. A personal loan, while offering cash, is often unsecured (meaning no collateral) and can come with higher interest rates, especially for self-employed individuals who might struggle with traditional income verification. A cash out refinance, however, uses your car as collateral, making lenders more comfortable and often leading to better rates and terms than an unsecured personal loan. The core principle is simple: you're leveraging an existing asset – your vehicle's equity – to gain access to liquid cash.

Pro Tip:

Think of your car as a tangible asset on your balance sheet, not just a mode of transport. Just like real estate, its value can be leveraged to fuel your financial goals or provide a much-needed buffer. Understanding this shift in perspective is key to unlocking its potential.

Unlocking the Vault: Who Qualifies for 'No Income Verification' Cash in Canada?

The phrase "no income verification" can be a bit misleading. It doesn't mean lenders don't care if you can repay the loan. Instead, it signifies a willingness to accept alternative forms of income proof that better reflect the financial reality of self-employed individuals. Qualification hinges on a combination of your vehicle's value and your financial narrative.

The Car's Credentials: What Lenders Look For in Your Vehicle

Your car is the primary collateral in a cash out refinance, so its characteristics are paramount. Lenders will thoroughly assess its value and how much equity you possess.

- Equity Thresholds: While there's no hard-and-fast rule, most lenders prefer that you have substantial equity in your vehicle. Ideally, you should have 50% or more equity to make a cash out refinance attractive and provide a meaningful cash payout. If you owe nearly as much as your car is worth, a cash out refinance might not be feasible or offer enough cash to be worthwhile.

- Vehicle Valuation: The age, make, model, mileage, and overall condition of your car are critical. Newer, well-maintained vehicles from popular brands with lower kilometres typically command higher market values and, consequently, offer more potential equity. Lenders will use various tools and sometimes professional appraisals to determine your car's current market value.

- Clear Title vs. Existing Lien: If you own your car outright with a clear title, the process is straightforward. The lender will register a new lien against your vehicle. If you still have an existing loan on your car, the new cash out refinance loan will first pay off that existing lien, and then you'll receive the remaining funds. This is a common scenario and perfectly manageable.

Pro Tip:

Get a professional appraisal or check multiple online valuation tools (e.g., Kelley Blue Book, AutoTrader) to estimate your car's market value before applying. This gives you a realistic expectation of your potential payout and strengthens your negotiating position.

The Entrepreneur's Profile: Beyond the Pay Stub

Since traditional T4s aren't the focus, lenders specializing in self-employed financing look at your broader financial picture to assess your repayment ability.

- Alternative Proof of Income: This is where your financial storytelling comes into play. Instead of a single pay stub, lenders will review:

- Bank Statements: Both personal and business bank statements, typically for the last 3-6 months, to show consistent deposits and cash flow.

- Invoicing History: Copies of recent invoices or contracts that demonstrate ongoing work and income.

- Tax Assessments: While not a T4, your tax returns (specifically Schedule T2125, Statement of Business or Professional Activities) can show gross revenue and business activity, even if taxable income is low due to write-offs.

- Business Registrations: Proof of a legitimate, active business.

- Credit Score Realities: A good credit score always helps, indicating a history of responsible borrowing and timely payments. It can lead to lower interest rates and more favourable terms. However, specialized lenders understand that self-employed individuals might have fluctuating credit scores due to business cycles or past financial challenges. Bad credit isn't an automatic disqualifier, especially if you have significant equity in your car. It will, however, likely result in a higher interest rate to offset the increased risk for the lender. For those concerned about their credit, our guide on Approval Secrets: How to Refinance Your Canadian Car Loan with Bad Credit offers valuable insights.

- Residency and Age: Basic eligibility requirements include being a Canadian resident and typically being of the age of majority in your province or territory.

Pro Tip:

Consistency in your business income, even if fluctuating, is key. Lenders prefer a steady pulse over erratic spikes and drops. Highlight long-term client relationships or recurring revenue streams if you have them.

The Road to Funds: Your Step-by-Step 'Cash Out' Journey for Self-Employed Canadians

Embarking on a cash out refinance journey might seem daunting, but by breaking it down into manageable steps, you can navigate the process with confidence. This roadmap is designed specifically for the self-employed, focusing on the unique aspects of your financial situation.

Step 1: Assessing Your Financial Landscape & Vehicle Worth

Before you even think about applying, take stock of your current situation.

- Determine Your Cash Need and Repayment Capacity: How much money do you truly need, and more importantly, can you comfortably afford the new monthly payments? Be realistic about your business's cash flow and your personal budget.

- Gather All Vehicle Documentation: Collect your vehicle ownership papers (registration), maintenance records, and details of any existing car loan (account number, current balance, lender contact). Having these documents ready streamlines the process.

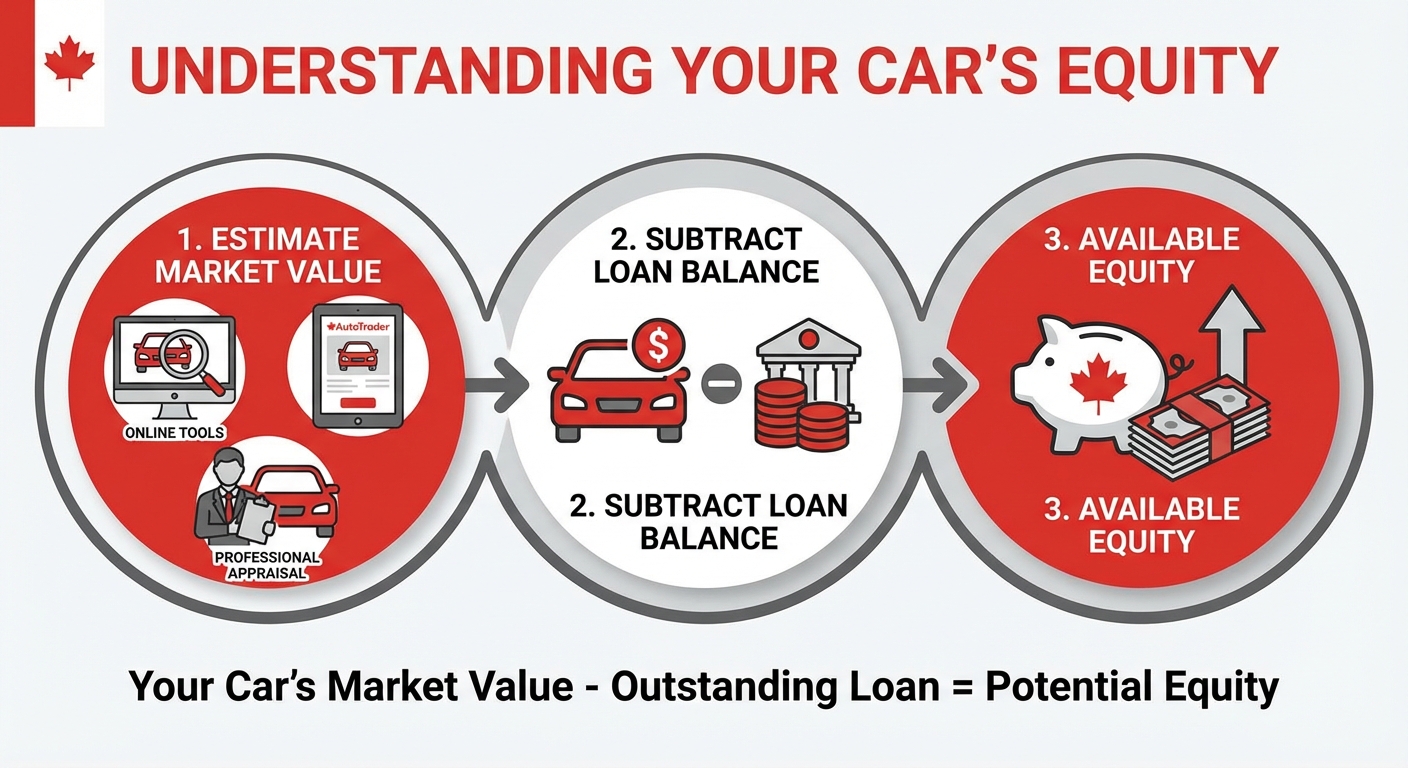

- Estimate Your Car's Market Value and Potential Equity: Use online tools, check comparable listings on AutoTrader, or get a professional appraisal. Subtract any outstanding loan balance from this estimated value to get a rough idea of your available equity.

Step 2: Navigating the Lender Labyrinth: Finding Your Best Match

This is where the self-employed often benefit most from specialized knowledge.

- Specialized Auto Finance Companies vs. Credit Unions vs. Online Brokers:

- Traditional Banks: Often rigid with self-employed income verification.

- Credit Unions: Sometimes more flexible than big banks, especially if you have an existing relationship.

- Specialized Auto Finance Companies: These are often your best bet. They have underwriting models designed for non-traditional income and focus on the asset's value.

- Online Brokers: Invaluable for the self-employed. They work with a network of lenders, including specialized ones, and can match your unique profile with the best available offers, saving you significant time and effort.

- The Importance of Comparing Multiple Offers: Don't just take the first offer you receive. Different lenders will have different rates, terms, and fees. Shopping around ensures you get the most favourable deal.

Pro Tip:

Look for lenders who explicitly advertise 'self-employed car loans' or 'no income verification refinance' as they are better equipped to handle your unique situation. Brokers are particularly adept at finding these niche lenders.

Step 3: The Application: What to Prepare (Without T4s)

Your application will focus on demonstrating repayment capacity through alternative means.

- Detailed Breakdown of Required Alternative Documentation:

- Personal and business bank statements (3-6 months).

- Business registration documents.

- Copies of recent contracts or invoices.

- Tax assessments (Notice of Assessment) showing business income.

- Proof of residency (utility bills, driver's licence).

- Tips for Presenting Your Financial Story Effectively: Organize your documents clearly. If your income fluctuates, be prepared to explain the patterns and demonstrate overall stability. Highlight consistent clients or projects.

- The Role of a Strong Personal Statement or Business Summary: Sometimes, a brief, clear explanation of your business, its history, and your financial stability can significantly bolster your application, especially if your numbers require context.

Pro Tip:

Be transparent about your financial situation. Attempting to hide information or misrepresent your income can lead to immediate rejection and could negatively impact future applications. Honesty and clarity build trust with lenders.

Step 4: Approval, Loan Agreement & Fund Disbursement

Once your application is submitted, the waiting game begins.

- Understanding the Approval Process Timeline: This can vary. With all documentation ready, some specialized lenders can offer approval in a few days. Others might take a week or two, especially if an appraisal is needed.

- Deciphering the Loan Agreement: This is a critical step. Carefully review the interest rate (APR), the loan term (how long you have to repay), all fees, and the payment schedule. Ensure you understand every clause before signing.

- How Funds are Typically Disbursed: Once the agreement is signed and any existing liens are cleared, the funds are usually disbursed via direct deposit to your bank account or, less commonly, by cheque.

Beyond the Rate: Unmasking Hidden Costs and Protecting Your Asset

When considering a cash out car refinance, it’s easy to focus solely on the interest rate. However, a truly informed decision requires a deep dive into all associated costs and a clear understanding of your responsibilities.

The True Cost of Convenience: Deconstructing Fees & Charges

The interest rate is just one piece of the puzzle. Various fees can add to the overall cost of your loan.

- Origination Fees: A charge for processing the loan.

- Administrative Fees: Covering general overheads.

- Appraisal Fees: If the lender requires a professional valuation of your vehicle.

- Lien Registration Costs: Fees for registering the new lien against your car with the provincial authorities.

- Early Payout Penalties: Some loans include penalties if you pay off the loan before its term ends. This can be a significant factor if you anticipate being able to repay the loan quickly. Make sure you understand if this applies and how it's calculated.

- Insurance Implications: Lenders will typically require you to maintain comprehensive and collision insurance on your vehicle for the duration of the loan, as it is their collateral. You might also consider gap insurance, which covers the difference between your car's market value and the loan amount if your vehicle is written off.

Pro Tip:

Always ask for a detailed breakdown of *all* costs associated with the loan, not just the interest rate. Compare the Annual Percentage Rate (APR) across offers, as APR includes both the interest rate and most fees, giving you a more accurate picture of the true cost of borrowing.

Understanding the Collateral: The Risk and Reward of Your Car

Your car is the security for the loan, which is why lenders are more flexible with income verification for the self-employed.

- Your Car as Security: What Happens if You Can't Repay? If you default on the loan, the lender has the legal right to repossess your vehicle to recover their losses. This is a serious consequence and underscores the importance of responsible borrowing.

- The Importance of Responsible Borrowing and Budgeting: Only borrow what you truly need and are confident you can repay. Create a realistic budget that includes your new loan payments.

- Protecting Your Asset Through Consistent Payments: Making consistent, on-time payments not only protects your car but also helps improve your credit score, opening up better financial opportunities in the future.

Maximizing Your Payout: Smart Moves Before You Apply

You've decided a cash out refinance is right for you. Now, how can you ensure you get the most favourable terms and the largest possible payout? A little preparation can go a long way.

Boosting Your Car's Appeal & Value

The better your car looks and performs, the higher its appraised value, and the more equity you can potentially unlock.

- Minor Repairs, Detailing, and Presenting a Well-Maintained Vehicle: Address any obvious cosmetic issues like dents, scratches, or interior wear. A professional detail can significantly enhance its perceived value. Ensure your car is clean, inside and out, for any appraisal.

- Ensuring All Maintenance Records are Up-to-Date: A complete service history demonstrates that you've taken good care of the vehicle. This reassures lenders about its reliability and longevity, potentially leading to a better valuation.

Pro Tip:

Address any minor cosmetic issues or overdue maintenance before the appraisal. A well-cared-for car signals lower risk to lenders and can directly impact the valuation, potentially increasing your loan amount or securing a better rate.

Negotiating for Better Terms: Your Power as an Applicant

Even with alternative income, you have leverage, especially if you're prepared.

- Leveraging Multiple Offers to Get Better Rates or Terms: As mentioned, shopping around is crucial. If you have an offer from one lender, you can often use it to negotiate better terms with another. This competitive environment works in your favour.

- The Flexibility of Specialized Lenders vs. Rigid Traditional Banks: Specialized auto finance companies are often more willing to discuss and tailor terms to your unique situation than large banks. Don't be afraid to ask for what you need.

- Understanding Loan-to-Value (LTV) Ratios and How to Improve Yours: LTV is the loan amount divided by the car's value. A lower LTV (meaning you have more equity) makes you a less risky borrower. You can improve your LTV by paying down your existing loan a bit before refinancing, or by ensuring your car is valued as highly as possible.

Lender Landscape: Who's Writing These Cheques for Self-Employed Canadians?

The Canadian lending market is diverse, but not all players are equally equipped to handle the unique financial profiles of self-employed individuals. Knowing where to look is half the battle.

The Rise of Specialized Auto Finance Companies

These lenders are revolutionizing access to capital for non-traditional income earners.

- How They Cater Specifically to Non-Traditional Income Earners: Specialized auto finance companies understand that a T4 isn't the only measure of financial health. They've developed sophisticated underwriting models that prioritize the collateral value of your vehicle and your demonstrated cash flow, rather than just a fixed salary.

- Their Underwriting Models Focus on Asset Value and Cash Flow: Instead of scrutinizing employment letters, they analyze bank statements, business invoices, and the overall health of your business operations. This asset-based lending approach is a game-changer for entrepreneurs.

- Examples of Types of Lenders: While we won't name specific companies, these often include independent finance companies or divisions of larger financial groups that have carved out a niche in subprime or alternative lending. Many can be found through online platforms that specialize in connecting borrowers with a wide range of lenders, similar to the services offered for various car financing needs, including those for self-employed individuals, which you can learn more about in our article: Approval Secrets: Navigating the Best Used Car Finance Options for Ontario’s Self-Employed.

The Broker Advantage: Your Navigator in the Funding Maze

For self-employed individuals, a good broker can be an invaluable ally.

- How Brokers Connect You with Suitable Lenders: Brokers act as intermediaries. They have established relationships with a network of lenders, including those specialized in self-employed financing. Instead of you applying to multiple lenders one by one, a broker can submit your application to several at once, increasing your chances of approval.

- Saving Time and Effort in Finding the Right Deal: This is especially beneficial for busy entrepreneurs. A broker handles the legwork of finding lenders, comparing offers, and understanding complex terms, allowing you to focus on your business.

- Their Role in Packaging Your Application for Success: A skilled broker knows exactly what information lenders need and how to present your financial story in the most favourable light, maximizing your chances of approval and securing the best possible terms.

Pro Tip:

Choose a broker with strong reviews and a proven track record specifically with self-employed clients. Their expertise in navigating the nuances of non-traditional income verification can make all the difference.

The Smart Money Move: When is Car Equity Your Best Strategic Play?

Accessing cash through your car's equity isn't just about getting funds; it's about making a strategic financial decision. Understanding when and why this option might be superior to others is crucial.

Strategic Uses for Your Cash Out Funds

The cash you receive from a refinance can be a powerful tool when deployed thoughtfully.

- Debt Consolidation: This is one of the most common and impactful uses. If you're carrying high-interest credit card debt or multiple smaller loans, consolidating them into a single, lower-interest car refinance loan can significantly reduce your monthly payments and save you money over time.

- Business Investment: For entrepreneurs, this is a direct way to fuel growth. Whether it's purchasing new equipment, expanding inventory, launching a marketing campaign, or investing in staff training, these funds can provide the necessary capital injection.

- Emergency Fund Creation: Life is unpredictable. Having a readily available emergency fund can prevent future financial crises. Leveraging your car's equity to build this safety net is a prudent move.

- Home Renovations or Major Life Events: While not the primary focus, if other financing options (like a home equity line of credit) are unavailable or less favourable, car equity can serve as a viable option for significant personal expenses.

Comparing Alternatives: Why This Might Be Your Optimal Path

It's always wise to consider all your options, but for the self-employed, car equity often stands out.

- Unsecured Personal Loans: These often come with higher interest rates due to the lack of collateral and can be particularly challenging for self-employed individuals to obtain without traditional income proof.

- Lines of Credit: While flexible, lines of credit often require stronger credit scores or other forms of collateral (like home equity), which might not be accessible to everyone.

- The Unique Accessibility of Car Equity for Self-Employed Individuals: Because your vehicle acts as collateral, lenders are often more willing to approve loans and offer competitive rates, even if your income verification is non-traditional. This makes it a uniquely accessible funding source when other avenues are closed or less attractive.

Pro Tip:

Always have a clear plan for how you will use the cash. This demonstrates financial responsibility to yourself and potential lenders, reinforcing that you're making a calculated, strategic move, not an impulsive one.

Navigating the 'No Income Verification' Nuance: What Lenders *Really* Mean

Let's be absolutely clear about "no income verification." It’s a term that often causes confusion, but understanding its true meaning is vital for self-employed applicants.

It's Not a Free Pass: The Reality of Alternative Verification

The phrase doesn't mean you get a loan without demonstrating an ability to repay. It refers to the *method* of verification.

- Emphasizing that 'no income verification' is about *how* income is verified, not *if* it is verified: Lenders are still assessing your capacity to make payments. They just accept a broader range of documentation to do so.

- The Shift from T4s to Bank Statements, Invoices, Contracts, and Tax Returns (Schedule T2125 for Business Income): Instead of a single document, lenders piece together your financial story from multiple sources. They look for patterns, consistency, and overall financial health. Your tax returns, specifically the T2125 form, are crucial as they show your gross business revenue before deductions, which is often a better indicator of cash flow than your net taxable income.

- How Lenders Assess Your Capacity to Repay Without Traditional Employment Records: They analyze the stability of your business, the consistency of your deposits, the types of clients you serve, and your overall financial behaviour. They're looking for evidence of a viable business and a responsible borrower.

Pro Tip:

Ensure your business and personal finances are well-organized. Clean, consistent records significantly strengthen your application. Separate business and personal accounts if you haven't already; it makes verifying business income much clearer.

Building a Trustworthy Financial Narrative

Your financial habits tell a story. Make sure it's a compelling one.

- The Importance of Consistent Cash Flow Over Time: Even if your income fluctuates seasonally or project-to-project, lenders want to see an overall upward trend or a stable average. Avoid large, unexplained gaps in income.

- How a Strong Credit History (Even if Not Perfect) Supports Your Application: While bad credit isn't an automatic disqualifier for specialized lenders, a history of making payments on time, even for small loans or credit cards, builds trust. It shows you're committed to your financial obligations.

- Demonstrating Stability and Responsibility Through Your Financial Habits: This includes maintaining reasonable bank balances, avoiding frequent overdrafts, and managing existing debts responsibly. These habits paint a picture of a reliable borrower.

Your Next Steps to Approval: A Strategic Checklist for Self-Employed Canadians

- Assess Your Vehicle: Know its value, your existing loan balance, and the equity you realistically have.

- Organize Your Finances: Gather recent bank statements (personal and business), business invoices, contracts, and relevant tax documents (like your T2125).

- Check Your Credit: Understand your current credit score and review your credit report for any inaccuracies.

- Research Lenders/Brokers: Focus on those specializing in self-employed refinancing or those who work with a network of such lenders.

- Compare Offers: Don't settle for the first quote. Look at the Annual Percentage Rate (APR), loan terms, and all associated fees across multiple offers.

- Read the Fine Print: Thoroughly understand the loan agreement before signing, paying close attention to interest rates, fees, and repayment penalties.

- Plan Your Funds: Have a clear, responsible use for the cash you receive, whether it's for debt consolidation, business investment, or an emergency fund.

Frequently Asked Questions (FAQ): Your Car Equity & Cash Out Refinance

Q: Can I refinance my car if I still owe money on it?

A: Yes, absolutely. This is a very common scenario. The new loan will first pay off your existing loan, and you'll receive the difference in cash, assuming you have sufficient equity in your vehicle beyond the outstanding balance.

Q: How long does the cash out refinance process typically take for self-employed individuals?

A: The timeline can vary. With all documentation readily available and working with a specialized lender or broker, it can range from a few days to a couple of weeks. Factors like vehicle appraisal time and the complexity of your financial situation can influence the duration.

Q: What if my car is older? Can I still get a cash out refinance?

A: Yes, it's possible, but the amount of equity available might be less. Some lenders have age limits (e.g., vehicle must be less than 10-12 years old), and the car's overall market value and condition will heavily influence the decision. A well-maintained older car with significant market value stands a better chance.

Q: Does applying for a cash out refinance affect my credit score?

A: Initial pre-qualifications or inquiries often involve a 'soft' credit check, which doesn't impact your score. However, a full application will typically involve a 'hard' inquiry, which may temporarily ding your score by a few points. The impact is usually minor and temporary if you're approved and manage the loan responsibly.

Q: Is my car used as collateral for a cash out refinance?

A: Yes, your vehicle serves as collateral for the new loan. This is precisely why lenders are often more flexible with income verification for self-employed individuals – they have a tangible asset to secure the loan, reducing their risk.

Q: What's the minimum amount of equity I need in my car to qualify?

A: While there's no universal minimum, lenders typically look for you to have at least 20-50% equity in your vehicle. This ensures there's enough value to make the cash out refinance worthwhile for both you and the lender after factoring in the existing loan and any fees.

Q: Can I use the cash for any purpose?

A: Generally, yes. Lenders are primarily concerned with your ability to repay the loan. However, using the funds strategically for purposes like debt consolidation, business investment, or building an emergency fund is always recommended for sound financial management.