The Canadian automotive landscape has shifted dramatically over the last few seasons. If you have stepped onto a dealership lot lately, you have likely noticed that the sticker prices are higher, the inventory is sometimes leaner, and the interest rates are certainly more aggressive than they were a few years ago. Navigating the Canadian auto finance maze is no longer as simple as walking in, picking a colour, and signing on the dotted line. It requires a strategic approach, a bit of "insider" knowledge, and a clear understanding of how lenders north of the border evaluate your worthiness as a borrower.

Why are expert guides in Canada so essential right now? Because the "one-size-fits-all" approach to lending is dead. With the Bank of Canada adjusting overnight rates to combat inflation, the ripple effect on car loans has been significant. A single percentage point difference in your interest rate can translate to thousands of dollars over the life of your loan. This guide is designed to pull back the curtain on the Canadian lending industry, empowering you with the approval secrets that dealerships and banks often keep to themselves. By the time you finish reading, you will have the tools to secure the best possible terms, regardless of your credit history.

Key Takeaways: The Fast Track to Approval

- Credit Benchmarks: Aim for a credit score of 660 or higher to access "Prime" lending rates in Canada.

- The Power of Pre-Approval: Walking into a dealership with a pre-approval letter shifts the power dynamic in your favour, turning you into a "cash buyer" in the eyes of the salesperson.

- Down Payment Impact: Even a 10% to 15% down payment can significantly lower your interest rate and prevent you from falling into a negative equity trap.

- Lender Variety: Don't limit yourself to the Big Five banks; credit unions and online fintech lenders often offer more flexible terms for unique financial situations.

- Total Cost Focus: Never negotiate based solely on the monthly payment; always look at the Total Cost of Borrowing.

Understanding the Credit Ecosystem in Canada

In Canada, your financial reputation is managed primarily by two major credit bureaus: Equifax and TransUnion. While they operate similarly, they often hold slightly different data. When you apply for a car loan, a lender will "pull" your report from one or both of these agencies. This "hard inquiry" provides them with a snapshot of your debt history, your payment consistency, and your current credit utilization. Understanding how these numbers work is the first secret to a smooth approval.

What is the "Magic Number" for car loan eligibility? Generally, the Canadian credit score scale runs from 300 to 900. If your score is above 720, you are in the "Excellent" category and can expect the lowest rates available. Between 660 and 719 is considered "Good," which still qualifies you for most bank programs. Once you dip below 600, you enter the "Subprime" territory. In this bracket, you can still get a loan, but the interest rates will be higher to compensate the lender for the perceived risk.

Types of Car Loan Guides in Canada: Choosing Your Path

Where you get your money is just as important as the car you choose. The Canadian market offers four primary avenues for financing, each with its own set of pros and cons.

| Lender Type | Best For... | Typical Interest Rates | Pros | Cons |

|---|---|---|---|---|

| Big Five Banks | Borrowers with 700+ credit scores. | Lowest (Prime) | Reliable, easy integration with existing accounts. | Very strict approval criteria; slow process. |

| Credit Unions | Local residents wanting a personal touch. | Competitive/Mid-range | More flexible than banks; member-focused. | Often require a membership or "share" purchase. |

| Online Lenders/Fintechs | Speed and non-traditional credit. | Varied (Prime to Subprime) | Fast approvals; 100% digital process. | Can have higher fees than traditional banks. |

| In-House (Buy Here Pay Here) | Borrowers with severe credit issues. | Highest (15% - 29%+) | Almost guaranteed approval. | Extremely expensive; limited vehicle selection. |

Traditional banks like RBC, TD, and Scotiabank are the heavy hitters. They offer "Prime" loans, which are the gold standard. However, they are risk-averse. If you have a thin credit file or a recent bankruptcy, they will likely decline you. This is where Credit Unions and Fintechs shine. They often look beyond the score to your "story"-your employment stability and your debt-to-income ratio.

The Secret Sauce: How Lenders Evaluate Your Application

Most Canadians believe the credit score is the only thing that matters. In reality, it is just one piece of the puzzle. Lenders use specific formulas to determine if you can actually afford the vehicle. The most critical of these are the Gross Debt Service (GDS) and Total Debt Service (TDS) ratios. GDS looks at your housing costs relative to your income, while TDS looks at all your debts-including the potential new car payment-relative to your gross monthly income.

Ideally, lenders want to see your TDS stay below 40% to 44%. If you earn $5,000 a month (gross), and your total debt obligations (rent/mortgage, credit cards, student loans, and the new car) exceed $2,200, you are entering the "danger zone." Even with a 800 credit score, a high TDS can lead to a rejection because the lender fears you are "over-leveraged."

Employment stability is another "secret" factor. Lenders love the number two. Two years at the same job, or at least two years in the same industry, signals stability. If you have just started a new job and are still in the three-month probation period, many Canadian lenders will pause your application until that probation is cleared. They want to know that the income you are reporting is guaranteed to continue.

Interest Rates and Loan Terms: The Math Behind the Monthly Payment

In the Canadian market, you will generally choose between a fixed-rate and a variable-rate loan. Fixed rates are the standard; your interest rate and monthly payment remain identical from the first day to the last. Variable rates are rarer in auto finance but do exist; they fluctuate based on the lender's prime rate. Given the current economic climate, most Canadians opt for fixed rates to ensure budget certainty.

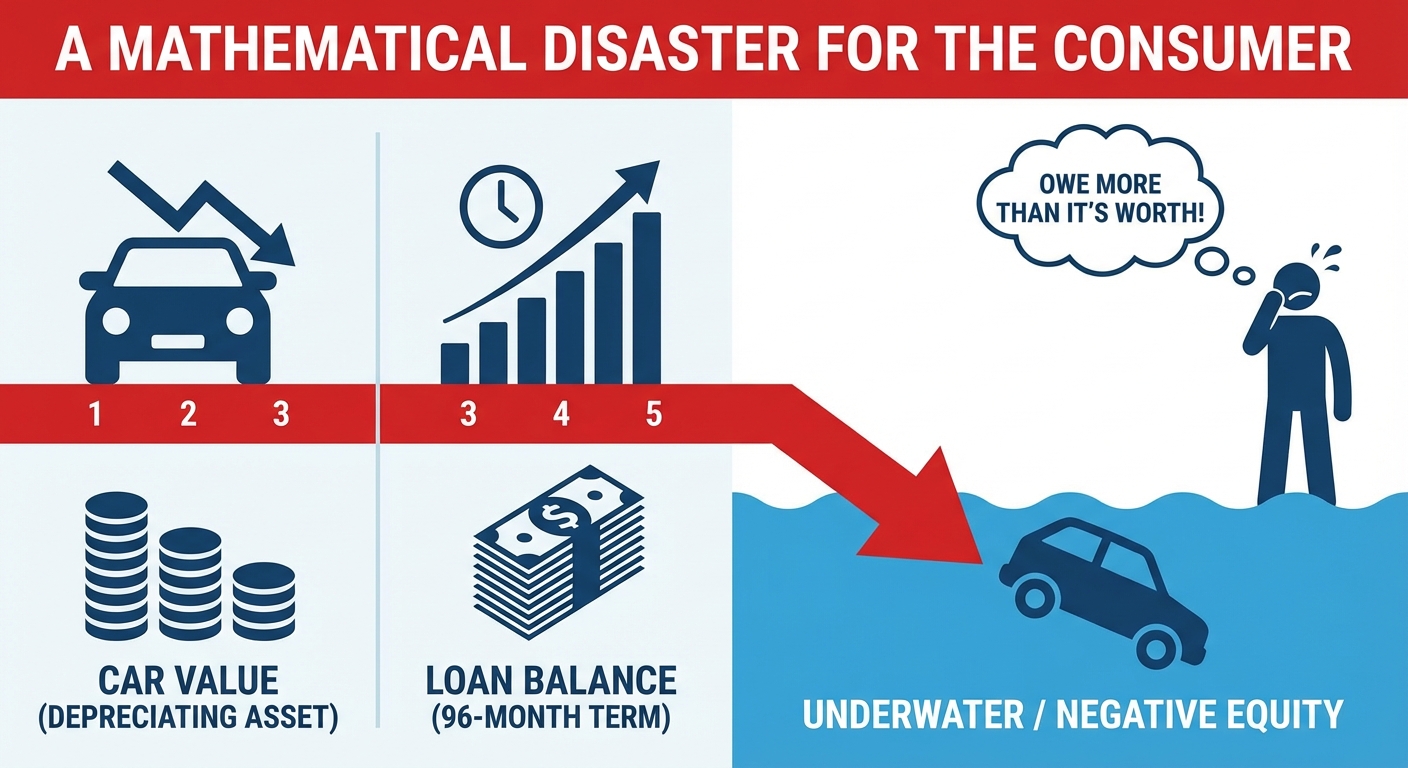

One of the biggest traps in modern car buying is the "extended term" loan. To make expensive SUVs and trucks look affordable, dealerships often push 84-month (7 years) or even 96-month (8 years) loan terms. While this lowers the monthly payment, it is a mathematical disaster for the consumer. Cars are depreciating assets. By the fourth or fifth year of a 96-month loan, you will almost certainly owe more on the car than it is worth. This is known as being "underwater" or having "negative equity."

The age of the vehicle also dictates the rate. Lenders view older cars as higher risks. If the car breaks down and you can't afford to fix it, you might stop making payments. Consequently, a 5-year-old used car will often have an interest rate 2% to 5% higher than a brand-new car, even for the same borrower. Always calculate the "Total Cost of Borrowing" to see if the lower price of a used car is offset by the higher interest rate.

Navigating the Application Process: Step-by-Step

Securing a car loan is a marathon, not a sprint. Following a structured process ensures you don't get swept up in the excitement of the showroom floor and make a hasty financial decision.

Step 1: Budgeting for the 'Total Cost of Ownership'

Your car payment is only a fraction of your monthly automotive expense. In Canada, you must account for high insurance premiums (especially in provinces like Ontario and BC), rising fuel costs, and seasonal maintenance like switching to winter tires. A good rule of thumb is that your car payment should only represent about 60% of your total monthly "car budget."

Step 2: Gathering Documentation

Don't wait until you are in the finance office to look for your papers. You will need:

- Government-issued photo ID.

- Your most recent pay stubs (usually the last two).

- Proof of residency (a utility bill or lease agreement).

- A void cheque or direct deposit form for automated payments.

Step 3: Getting Pre-Approved vs. Pre-Qualified

Pre-qualification is a "soft" estimate of what you might get. Pre-approval is a "hard" commitment from a lender. Always aim for the latter. It gives you a specific interest rate and a maximum loan amount, allowing you to shop with confidence and negotiate the price of the car without the distraction of "monthly payment" shell games.

Step 4: Selecting the Vehicle

Once you know your budget, choose a vehicle that fits the lender's criteria. Some lenders have "age and mileage" restrictions-for example, they may not finance a vehicle older than 10 years or with more than 150,000 kilometres.

Step 5: Finalizing the Contract

Read every line. Ensure the interest rate matches your pre-approval and that there are no hidden "documentation fees" or "window etching" charges that you didn't agree to. In Canada, you have the right to ask for a clear breakdown of the total amount financed.

Specialized Car Loan Programs in Canada

Canada is a land of diversity, and the finance market reflects that. There are specific "guides in Canada" for groups who might not fit the traditional borrower profile.

Newcomers to Canada: If you are a permanent resident or on a work permit, you likely have no Canadian credit history. This doesn't mean you can't get a car. Many banks (like Scotiabank's StartRight or RBC's Newcomer program) offer specialized loans. They focus more on your down payment and your employment contract than your non-existent credit score.

Students and Recent Graduates: Most major manufacturers (Toyota, Honda, Ford, etc.) offer "Graduate Rebates" or specialized financing for those who have finished a degree or diploma within the last 2-3 years. These programs often offer lower rates or a $500-$1,000 cash incentive toward the purchase.

Bankruptcy and Consumer Proposal: If you have experienced financial hardship, you are not barred from vehicle ownership. There are "Second Chance" and "Third Chance" credit lenders in Canada who specialize in these cases. The key is to ensure the lender reports your payments to the credit bureaus, as a car loan is one of the fastest ways to rebuild your credit after a discharge.

The Hidden Cost of 'Add-Ons' and Protection Plans

When you reach the "F&I" (Finance and Insurance) office at a dealership, the real sales pitch begins. This is where the dealership makes a significant portion of its profit. You will be offered a variety of products, and it is vital to know which ones hold value.

GAP Insurance: This covers the "gap" between what you owe on the loan and what your insurance company will pay if the car is totalled. In Canada, if you are putting less than 10% down or taking a loan longer than 60 months, GAP insurance is often a wise investment. However, check if your regular auto insurance offers a "Limited Waiver of Depreciation" (Endorsement 43R in Ontario), which is often much cheaper.

Extended Warranties: These provide peace of mind but are often overpriced. If you are buying a brand with a reputation for high reliability (like a late-model Toyota), you might be better off "self-insuring" by putting that monthly warranty cost into a high-interest savings account instead.

Life and Disability Insurance: Dealerships often suggest "Credit Life" insurance that pays off the loan if you pass away or become disabled. While the idea is sound, the premiums are usually much higher than a standard term life insurance policy from an independent broker. Always compare prices before signing.

Dealer vs. Private Sale Financing

Buying from a private seller on platforms like AutoTrader or Facebook Marketplace can save you money on the purchase price, but it makes financing more complex. Most major banks will not provide a traditional "auto loan" for a private sale; instead, they will offer you a Personal Loan or a Line of Credit.

The difference is significant. An auto loan is "secured" by the car, meaning the interest rate is lower. A personal loan is "unsecured," meaning the bank is taking more risk and will charge you a higher interest rate. If you are set on a private sale, your best bet is often a Home Equity Line of Credit (HELOC) if you own a home, as it offers the lowest possible interest rates for a private transaction.

Common Pitfalls and How to Avoid Them

The road to car ownership is littered with financial potholes. One of the most dangerous is the "Negative Equity Cycle." This happens when you trade in a vehicle that you still owe money on. The dealer will "roll" that remaining debt into your new loan. Suddenly, you are financing $45,000 for a car that is only worth $35,000. This is a recipe for financial disaster, as you will be paying interest on "air" for years to come.

Another trap is the "Straw Purchase." This is when someone with good credit buys a car for someone with bad credit. In Canada, this is often a violation of the loan agreement and can lead to the car being seized or the "straw buyer" being held liable for fraud. It is always better to have the person with poor credit as the primary borrower with a "Co-signer" who shares the responsibility.

Finally, beware of "Guaranteed Approval" advertisements. In the world of finance, nothing is truly guaranteed. These ads often lead to predatory lenders who charge 29.9% interest and include hidden fees that double the cost of the car. Always look for the "Total Cost of Borrowing" statement. By Canadian law, lenders must disclose the total amount of interest and fees you will pay over the entire life of the loan in a clear, easy-to-read format.

Driving Away with the Best Deal

Securing a car loan in Canada doesn't have to be a stressful experience. By understanding the credit ecosystem, managing your debt-to-income ratios, and avoiding the traps of long-term loans and unnecessary add-ons, you can take control of the process. Remember, the dealership is just one "guide in Canada"-you have the right to shop around at banks, credit unions, and online lenders to find the rate that fits your life.

The "secret" to approval isn't luck; it's preparation. Whether you are a newcomer building a future, a student starting your career, or someone rebuilding their financial reputation, the Canadian market has a path for you. Use these tools, stay focused on the total cost, and you will drive away with a deal that feels as good as the new car itself.

Frequently Asked Questions (FAQ)

Can I get a car loan with a 500 credit score in Canada?

Yes, it is possible, but you will likely be restricted to "Subprime" or "In-House" lenders. Expect interest rates between 15% and 25%. To improve your chances, offer a larger down payment (20%+) and provide solid proof of long-term employment. This reduces the lender's risk and may help you secure an approval that would otherwise be declined.

How long does it take to get approved for a car loan?

With modern online lenders and fintechs, you can often get a "pre-approval" within minutes. Traditional banks usually take 24 to 48 hours to review an application. If you are applying at a dealership, they can often get an answer from their network of lenders within a few hours, provided you have all your documentation ready.

Is it better to put a large down payment or keep the cash?

In a high-interest-rate environment, a large down payment is almost always better. It reduces the principal amount of the loan, which means you pay less interest over time. It also protects you from "negative equity." If the interest rate on your loan is higher than the interest you could earn by putting that cash in a savings account or investment, put the money toward the car.

Can I pay off my Canadian car loan early without penalties?

Most standard car loans in Canada are "open-ended," meaning you can pay them off at any time without a penalty. However, some subprime lenders or "Buy Here Pay Here" lots may include "pre-payment penalties" in the fine print. Always confirm that the loan is "open" before you sign the contract.

Does a car loan help build my credit score quickly?

Yes, an auto loan is considered an "instalment loan," which is a key component of your credit mix. By making consistent, on-time payments, you demonstrate to Equifax and TransUnion that you can handle a large debt obligation. Many Canadians see a significant boost to their credit score within 12 to 18 months of maintaining a car loan.

What is the maximum age of a car that banks will finance?

Most major Canadian banks prefer to finance vehicles that are less than 7 to 10 years old. Additionally, they often want the loan to be completed before the car reaches its 12th year. For example, you might get a 4-year loan on an 8-year-old car, but you likely won't get a 7-year loan on that same vehicle.