Your Income's a Playlist, Not a Single. Get Your Car, Edmonton.

Table of Contents

- The Overture: Embracing Your Financial Playlist for Car Loan Success in Canada

- Key Takeaways

- II. Deconstructing the 'Playlist': What 'Varied Income' Really Means to Canadian Lenders

- A. Beyond the 9-to-5 Paystub: A Spectrum of Canadian Income Sources

- B. Why Lenders Hear 'Risk' When You Play a Different Tune

- III. Composing Your Financial Score: Documenting Your Varied Income for Success

- A. Your Financial Dossier: The Essential Instruments for Canadian Lenders

- B. The Art of Presentation: Making Your 'Playlist' Cohesive for Loan Officers

- IV. The Conductor's Baton: Your Credit Score and Its Role in Loan Approval Across Canada

- A. Understanding Your Credit 'Harmony': What Canadian Lenders Seek

- B. Tuning Up Your Score: Strategies for Improvement and Resilience

- C. The Double Challenge: Low Credit Score with Varied Income – Mitigation Strategies

- V. Your 'Album' of Loan Options: Finding the Right Lender for Varied Income in Canada

- A. Traditional Banks vs. Credit Unions: The Familiar Tracks

- B. Dealership Finance: The One-Stop 'Record Store'

- C. Online Lenders and Specialized Brokers: The Indie Labels

- D. The Duet Partner: Leveraging a Co-Signer for Better Harmony

- E. Secured Loans: The 'Backing Track' of Collateral

- VI. – Context: A vibrant infographic illustrating diverse income streams (e.g., laptop for freelance, delivery vehicle for gig work, artist's palette, construction helmet, multiple small money bags) all converging and flowing into a larger, modern car icon. Text overlay reads: 'Your Diverse Income Fuels Your Drive: Documenting Every Stream'.

- VII. Navigating the Edmonton & Alberta Auto Market: Local Harmonies for Your Loan

- A. Edmonton-Specific Lenders and Dealerships: Finding Local Support

- B. The Used Car Market in Alberta: A Stepping Stone to Approval

- C. Provincial Regulations & Consumer Protections in Alberta: What You Need to Know

- VIII. Budgeting Your 'Car Tune': Beyond the Monthly Payment in Canada

- A. The True Cost of Car Ownership: A Full Score

- B. Debt-to-Income Ratio (DTI): Your Financial Meter for Lenders

- IX. The Application Audition: Presenting Your Best Performance to Lenders

- A. Pre-Approval vs. Full Application: Understanding the Process

- B. What to Expect During the Interview: Discussing Your Varied Income Confidently

- C. Common Pitfalls to Avoid: Don't Hit a Flat Note

- X. Avoiding the 'Bad Tracks': Spotting Predatory Loans and High-Interest Traps in Canada

- A. Understanding APR: The True Cost of Borrowing

- B. Red Flags of Unscrupulous Lenders: What to Watch Out For

- C. The Cycle of Debt: How High-Interest Loans Can Derail Your Financial Playlist

- XI. Your Financial Encore: Building Credit and Refinancing for a Better Tune

- A. Making Every Payment Count: The Power of Consistent, On-Time Payments

- B. The Refinancing Option: When and How to Seek a Better Interest Rate

- C. Graduating to Prime Lending: Your Long-Term Goal for Financial Flexibility

- XII. – Context: A confident individual (perhaps a young professional or a skilled tradesperson, reflecting diverse income) at a modern car dealership desk in Edmonton, signing car loan papers with a friendly finance manager. A sleek new or well-maintained used car is visible in the background, and a subtle, recognizable Edmonton landmark or skyline element is visible through a window, symbolizing local success and a smooth transaction.

- XIII. Your Next Steps to Approval: Hitting the Right Notes in Edmonton and Beyond

- XIV. FAQ: Your Soundcheck for Varied Income Car Loans in Canada

The Overture: Embracing Your Financial Playlist for Car Loan Success in Canada

In the vibrant, ever-evolving economic landscape of Canada, the traditional 9-to-5 job with a predictable bi-weekly paycheque is no longer the sole rhythm of income. More and more Canadians, particularly in dynamic cities like Edmonton and across Alberta, are composing their own financial playlists – a diverse mix of freelance gigs, multiple contracts, seasonal work, or self-employment ventures. While this variety offers incredible flexibility and opportunity, it can sometimes feel like a discordant note when you’re trying to secure a car loan. Lenders, historically accustomed to the steady beat of a single employer, might initially hear "risk" where you hear "resourcefulness." But here's the good news: your varied income isn't a barrier; it's simply a different kind of symphony that needs to be presented effectively. At SkipCarDealer.com, we understand that your financial story is unique, and we're here to help you translate your diverse income streams into a compelling case for car loan approval. Think of your income not as a single, repetitive track, but as a rich, multi-layered playlist, each song contributing to your overall financial strength. This article will guide you through mastering the art of presenting your financial playlist to Canadian lenders, ensuring you hit all the right notes to get behind the wheel of your next vehicle in Edmonton, Calgary, or anywhere else in this great country.

Key Takeaways

- Key Takeaway 1: Impeccable documentation is your most powerful instrument. Gather every piece of financial proof – tax returns, bank statements, contracts – to build a robust case for your income consistency and reliability.

- Key Takeaway 2: Your credit score still conducts the orchestra of approval. While varied income requires extra care, a strong credit history remains fundamental. Work on improving and maintaining your score.

- Key Takeaway 3: Specialized lenders and brokers are often your best concert venue. Traditional banks might be hesitant, but many lenders and brokers specialize in understanding and approving non-traditional income profiles.

- Key Takeaway 4: Budgeting for the entire 'album' (not just the monthly payment) is non-negotiable. Factor in insurance, fuel, maintenance, and other ownership costs to ensure your car loan is sustainable.

- Key Takeaway 5: Local Edmonton and Alberta knowledge can fine-tune your approval process. Understanding local market conditions, dealerships, and provincial regulations can give you an edge.

II. Deconstructing the 'Playlist': What 'Varied Income' Really Means to Canadian Lenders

When you tell a Canadian lender your income is "varied," their ears perk up, but not always in the way you might hope. For them, "varied" often translates to "less predictable" or "harder to verify." Understanding this perception is the first step in effectively managing it. It's not that your income isn't legitimate or substantial; it's about how its ebb and flow align with a lender's risk assessment models.

A. Beyond the 9-to-5 Paystub: A Spectrum of Canadian Income Sources

Let's define what typically falls under the "varied income" umbrella in Canada. If your earnings don't arrive like clockwork from a single, salaried employer, you're likely in this category. This includes:

- Self-Employed Individuals and Freelancers: From graphic designers in Montreal to consultants in Vancouver, those who run their own businesses or work on a contract-by-contract basis. Their income fluctuates based on client acquisition, project scope, and market demand. For more insights on leveraging your bank accounts as proof, check out our article: Self-Employed? Your Bank Account *Is* Your Proof. Get Approved.

- Gig Economy Workers: This booming sector includes rideshare drivers in Toronto, food delivery personnel in Calgary, remote contractors, and task-based service providers. Their income is directly tied to the hours they work and the demand for their services, leading to significant weekly or monthly variations. If you're an Uber driver, your phone truly is your paystub – learn how to leverage it: Uber Driver Car Loan: Your Phone *Is* Your Pay Stub.

- Commission-Based Roles: Sales professionals, real estate agents, and others whose earnings are heavily reliant on sales performance. While they might have a small base salary, the bulk of their income is variable.

- Seasonal Employment: Workers in industries like tourism, agriculture, or construction often experience periods of high earnings followed by leaner months, common in provinces like British Columbia or Prince Edward Island.

- Multiple Part-Time Jobs: Juggling several part-time positions to make ends meet, which can result in inconsistent hours and varied paycheques from different sources.

- Pension, Disability, and Government Benefits: While often consistent, these sources are non-employment income and require specific documentation to be verified by lenders. This includes CPP, OAS, Employment Insurance (EI), or provincial support programs. Our article on Your Child Tax Benefit: The Unexpected Car Loan Key in Vancouver highlights how even less traditional benefits can count.

- Investment Income: Rental property income, dividends, or interest income can contribute to your overall financial picture but are generally considered supplementary rather than primary for car loan purposes unless they are very substantial and consistent.

B. Why Lenders Hear 'Risk' When You Play a Different Tune

Lenders are primarily concerned with two things: your ability to repay the loan and the stability of that ability over the loan term. When assessing varied income, they focus on:

- Stability and Predictability: A salaried employee provides a clear, consistent income stream. Varied income, by its nature, can fluctuate. Lenders want to see a history of consistent earnings, even if the monthly amount isn't identical. They'll look for patterns and averages over a longer period.

- Verification Challenges: Pay stubs are easy to verify. Commission statements, invoices, and bank deposits from various sources require more scrutiny and documentation. This extra effort translates to perceived higher risk for the lender.

- Consistency Over Sheer Volume: Earning $10,000 one month and $2,000 the next, even if the average is good, is less appealing than a steady $6,000 every month. Lenders prioritize reliability to ensure you can meet your monthly car loan payments without strain during leaner periods.

- Proof of Sustainable Business/Work: For self-employed individuals, lenders want to ensure the business is viable and not just a temporary venture. This involves looking at business registration, financial statements, and tax history.

III. Composing Your Financial Score: Documenting Your Varied Income for Success

This is where you turn your potential liabilities into assets. The key is to provide a clear, comprehensive, and compelling narrative of your income. Think of it as presenting a meticulously arranged musical score, where every note (document) is in its rightful place, contributing to the overall harmony.

A. Your Financial Dossier: The Essential Instruments for Canadian Lenders

A definitive list of documents is crucial for varied income applicants. The more thorough and organized you are, the smoother the process will be.

- Tax Returns (T1 Generals, Notices of Assessment (NOA)): For the past 2-3 years. These are arguably the most important documents as they are government-verified proof of your total declared income, including self-employment earnings, commissions, and benefits. They provide a long-term snapshot of your financial health.

- Comprehensive Bank Statements: 3-6 months of both personal and any business accounts. These are vital for showing consistent deposits from various sources, demonstrating the regular flow of your income. Highlight large, recurring deposits. For self-employed individuals, these are often considered critical.

- Contracts and Invoices: Proof of ongoing work or future projects. If you're a freelancer, copies of current contracts, recent invoices issued, and evidence of payments received strengthen your case.

- Letters of Employment/Engagement: Even for short-term clients or contracts, a letter from a client or agency confirming your engagement, duration, and expected compensation can be highly beneficial.

- Official Proof of Government Benefits: If your income includes CPP (Canada Pension Plan), OAS (Old Age Security), EI (Employment Insurance), WCB (Workers' Compensation Board), or provincial support programs (like AISH in Alberta), provide official statements or letters confirming these benefits and their regularity.

- Business Registration Documents: For self-employed individuals, proof of business registration (e.g., sole proprietorship registration, articles of incorporation) adds legitimacy to your income source.

Pro Tip: Start compiling these documents meticulously before you even begin browsing for a car. Having everything organized demonstrates preparedness and professionalism to lenders, showing them you're serious and responsible.

B. The Art of Presentation: Making Your 'Playlist' Cohesive for Loan Officers

Beyond just collecting documents, how you present them matters immensely. Don't make the loan officer piece together your financial puzzle.

- Create an Income Summary Sheet: A simple, one-page document that summarizes your income sources, average monthly earnings over the last 6-12 months, and highlights consistency. Include a brief explanation of each income stream and how it contributes to your overall stability. For instance, if you have a base salary plus commission, clearly separate and average them. If you freelance for multiple clients, list your top few and their average contributions.

- Highlight Patterns and Averages: Point out the consistent patterns in your bank statements. Even if monthly totals vary, demonstrate that you consistently have income flowing in. Calculate your average monthly income over the last 6-12 months and be prepared to explain any significant dips or spikes.

- Future Projections (Realistic): If you have confirmed future contracts or projects, mention them. While lenders prefer historical data, a strong outlook for continued work can be reassuring, especially if you have long-term client relationships.

- Be Prepared to Explain Fluctuations: Don't shy away from discussing variations in your income. Instead, be ready to explain them confidently. For example, "My income dipped in Q1 due to seasonal slowdown, but historically rebounds strongly in Q2 and Q3."

IV. The Conductor's Baton: Your Credit Score and Its Role in Loan Approval Across Canada

Even with a varied income, your credit score remains a critical factor in securing a car loan in Canada. It's the conductor of your financial orchestra, dictating the tempo of approval and the harmony of your interest rate. Canadian lenders primarily refer to reports from Equifax and TransUnion.

A. Understanding Your Credit 'Harmony': What Canadian Lenders Seek

Your credit report is a detailed history of your borrowing and repayment behaviour. Lenders scrutinize several key components:

- Payment History (35%): This is the most significant factor. Consistently paying bills on time (credit cards, utility bills, other loans) demonstrates reliability. Late payments are a major red flag.

- Credit Utilization (30%): How much credit you're using compared to your available credit limit. Keeping your credit card balances low (ideally below 30% of your limit) signals responsible credit management.

- Length of Credit History (15%): A longer history of responsible credit use is generally better, as it provides more data points for lenders to assess.

- Types of Credit (10%): A mix of credit (e.g., credit card, line of credit, installment loan) can be viewed positively, showing you can manage different types of debt.

- New Credit/Inquiries (10%): Applying for too much new credit in a short period can suggest financial distress and may temporarily lower your score.

B. Tuning Up Your Score: Strategies for Improvement and Resilience

A strong credit score can significantly offset some of the perceived risk associated with varied income, making you a more attractive borrower.

- Consistently Pay Bills on Time: This cannot be stressed enough. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Existing Debt: Focus on paying down high-interest debts, especially credit card balances. This not only improves your credit utilization but also frees up cash flow.

- Become an Authorized User: If a trusted family member with excellent credit is willing, becoming an authorized user on one of their credit cards can help you build credit history, provided they manage the account responsibly.

- Explore Credit Builder Loans: Some financial institutions and credit unions offer small, secured loans designed specifically to help individuals build or rebuild credit.

- Regularly Check Your Credit Report: Obtain free copies of your credit report from Equifax and TransUnion annually. Review them for errors and dispute any inaccuracies.

Pro Tip: Avoid opening or closing new credit accounts (e.g., store credit cards) in the months leading up to your car loan application. This can temporarily impact your score or raise red flags about your financial stability to lenders.

C. The Double Challenge: Low Credit Score with Varied Income – Mitigation Strategies

Securing a car loan with both varied income and a low credit score presents a compounded difficulty, but it's not impossible.

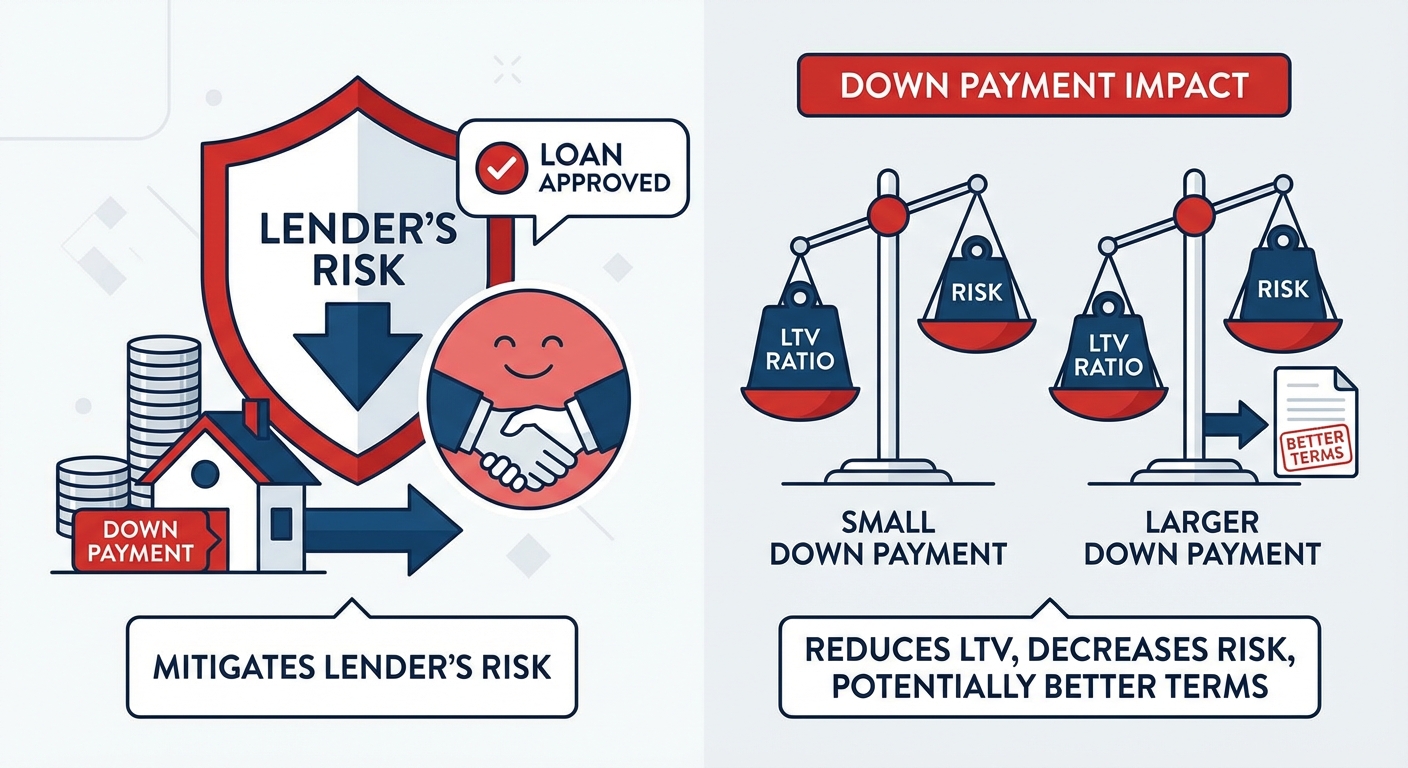

- Larger Down Payment: A substantial down payment reduces the amount you need to borrow, making the loan less risky for the lender. This can significantly improve your chances of approval and potentially secure a better interest rate. For those with varied income, even a small down payment can make a difference.

- Seek Specialized Lenders: Traditional banks might be a tough sell. Focus your efforts on lenders and brokers who specialize in bad credit or non-traditional income loans. They often have more flexible criteria.

- Consider a Co-Signer: A co-signer with excellent credit and a stable income can significantly strengthen your application. Their creditworthiness effectively backs your loan, reducing the lender's risk.

- Start with a More Affordable Vehicle: Opting for a less expensive used car can make the loan more manageable and increase your approval odds. As you make consistent payments, you'll build credit for a better vehicle later.

V. Your 'Album' of Loan Options: Finding the Right Lender for Varied Income in Canada

The Canadian lending landscape is diverse, offering various avenues for car loans. Knowing which lenders are most receptive to varied income applications is crucial for a successful search.

A. Traditional Banks vs. Credit Unions: The Familiar Tracks

- Major Canadian Banks (e.g., RBC, TD, BMO, Scotiabank, CIBC): These institutions often have stringent criteria, preferring borrowers with consistent, verifiable employment income. While they offer competitive rates, varied income applicants might face more hurdles or require a strong credit score and substantial documentation. Building a long-term relationship with your bank, however, can sometimes open doors.

- Local Credit Unions (e.g., Servus Credit Union in Alberta, Vancity in British Columbia): Credit unions are often more community-focused and may offer more personalized service. They might be more willing to consider your unique financial situation and varied income streams, especially if you have an established banking relationship with them. Their underwriting processes can sometimes be more flexible than large banks.

B. Dealership Finance: The One-Stop 'Record Store'

Car dealerships frequently offer in-house financing or work with a network of lenders, including captive finance companies (e.g., Toyota Financial Services, Ford Credit, GM Financial).

- Convenience: Applying directly at the dealership offers a streamlined process, as they handle all the paperwork and liaison with lenders.

- Flexibility: Dealerships often have access to a wider range of lenders, some of whom specialize in non-traditional loans. This can be particularly beneficial for varied income applicants.

- Special Programs: Captive finance companies sometimes have programs designed to help specific buyer segments, which might include those with unique income situations.

C. Online Lenders and Specialized Brokers: The Indie Labels

The digital age has brought forth a new wave of lenders and brokers who cater specifically to individuals with subprime credit or non-traditional income.

- Accessibility: These platforms are often easier to access, with quick online applications and pre-approvals.

- Specialization: They understand the nuances of varied income and have developed risk assessment models that go beyond traditional pay stubs. They might focus more on your bank statements and overall financial stability rather than just employment history.

- Brokers' Network: Brokers act as intermediaries, connecting you with multiple lenders who are most likely to approve your application based on your specific profile. They save you time and multiple credit inquiries.

Pro Tip: When considering online lenders or brokers, rigorously research their reviews and verify their legitimacy through official channels (e.g., Better Business Bureau, provincial consumer protection agencies) to avoid predatory practices. Always ensure they are licensed in your province.

D. The Duet Partner: Leveraging a Co-Signer for Better Harmony

A co-signer can significantly boost your chances of approval, especially if you have a varied income and/or a less-than-perfect credit score.

- Benefits: A co-signer with strong credit and stable income adds a layer of security for the lender, reducing their risk. This can lead to approval, better interest rates, and more favourable terms.

- Responsibilities: It's crucial that both parties understand the commitment. The co-signer is equally responsible for the loan. If you miss payments, their credit score will be negatively impacted, and they could be liable for the full amount.

- Ideal Co-Signer Qualities: Someone with excellent credit, stable employment, a low debt-to-income ratio, and a clear understanding of their responsibilities.

E. Secured Loans: The 'Backing Track' of Collateral

Most car loans are secured loans, meaning the vehicle itself serves as collateral. If you default on the loan, the lender can repossess the car.

- Implications for Varied Income Applicants: For those with less established credit or inconsistent income, secured loans are the norm. The collateral mitigates some of the lender's risk, making them more willing to approve the loan.

- Down Payment Impact: A larger down payment reduces the loan-to-value (LTV) ratio, further decreasing the lender's risk and potentially leading to better terms.

VI.  – Context: A vibrant infographic illustrating diverse income streams (e.g., laptop for freelance, delivery vehicle for gig work, artist's palette, construction helmet, multiple small money bags) all converging and flowing into a larger, modern car icon. Text overlay reads: 'Your Diverse Income Fuels Your Drive: Documenting Every Stream'.

– Context: A vibrant infographic illustrating diverse income streams (e.g., laptop for freelance, delivery vehicle for gig work, artist's palette, construction helmet, multiple small money bags) all converging and flowing into a larger, modern car icon. Text overlay reads: 'Your Diverse Income Fuels Your Drive: Documenting Every Stream'.

VII. Navigating the Edmonton & Alberta Auto Market: Local Harmonies for Your Loan

While the principles of securing a car loan apply across Canada, understanding the specific nuances of the Edmonton and broader Alberta market can fine-tune your approach and increase your chances of success.

A. Edmonton-Specific Lenders and Dealerships: Finding Local Support

Edmonton boasts a robust auto market with numerous dealerships and financial institutions. Many local players are well-versed in the unique economic rhythms of Alberta, including the prevalence of varied income earners in sectors like oil and gas, skilled trades, and the growing tech and gig economies.

- Local Dealerships: Many Edmonton car dealerships, both new and used, have in-house finance departments that work with a wide array of lenders. They often have relationships with lenders who are more flexible with varied income documentation. Don't hesitate to visit them in person; a face-to-face conversation can sometimes make a difference.

- Credit Unions: As mentioned, credit unions like Servus Credit Union, Connect First Credit Union, or Vision Credit Union, with strong roots in Alberta, might be more sympathetic to varied income profiles, especially if you have an existing relationship with them.

- Advantages of In-Person Consultations: While online applications are convenient, for varied income situations, an in-person meeting allows you to explain your financial situation more comprehensively and answer questions directly, building trust with the finance manager.

B. The Used Car Market in Alberta: A Stepping Stone to Approval

Alberta has a dynamic used car market, which can be a significant advantage for those with challenging loan approvals.

- Lower Price Points: Used cars are generally more affordable than new vehicles, meaning you need to borrow less. A smaller loan amount is inherently less risky for lenders, increasing your approval odds.

- Reputable Dealerships: Edmonton and Calgary, in particular, have numerous reputable used car dealerships that specialize in working with a diverse range of credit and income profiles. They often have access to lenders who are more understanding of varied income.

- Building Credit: Starting with a more affordable used car loan and making consistent payments is an excellent way to build a positive credit history, which can pave the way for a better loan on a newer vehicle down the line.

C. Provincial Regulations & Consumer Protections in Alberta: What You Need to Know

Alberta has specific consumer protection laws that apply to vehicle purchases and financing.

- Consumer Protection Act: This act governs contracts and transactions, including vehicle sales. It outlines your rights regarding disclosure of information, cooling-off periods (though less common for vehicle purchases), and ensures fair business practices.

- Lender Licensing: Ensure any lender or broker you work with is properly licensed in Alberta. You can verify this through provincial regulatory bodies.

- Contract Clarity: Always review your loan contract carefully. Alberta's regulations require clear disclosure of all costs, interest rates, and terms. Do not sign anything you don't fully understand.

VIII. Budgeting Your 'Car Tune': Beyond the Monthly Payment in Canada

Securing a car loan is just the first note in your car ownership symphony. For varied income earners, understanding and budgeting for the full cost of ownership is paramount to long-term financial stability and avoiding unexpected expenses.

A. The True Cost of Car Ownership: A Full Score

Many first-time buyers, or those new to managing varied income, often focus solely on the monthly car payment. This is a critical oversight.

- Insurance Premiums: In Alberta, like other provinces, insurance rates are influenced by factors such as your age, driving record, the type of vehicle you purchase, where you live (e.g., urban Edmonton vs. rural Alberta), and your claims history. These costs can vary significantly and must be factored into your budget.

- Fuel Costs: Alberta generally benefits from lower provincial fuel taxes compared to some other provinces like Ontario or British Columbia. However, global oil prices still dictate pump prices. Consider your daily commute and average kilometres driven.

- Maintenance and Repairs: All vehicles require regular maintenance (oil changes, tire rotations) and will eventually need repairs. Build an emergency fund specifically for these unforeseen costs. This is particularly important for used cars.

- Registration and Licensing Fees: In Alberta, you'll have annual registration fees for your vehicle and a one-time cost for your driver's license.

- Winter Tires: For Canadian driving conditions, especially in Alberta, winter tires are not just recommended, they are a safety necessity. Factor in the cost of purchasing and installing them.

Pro Tip: Obtain multiple insurance quotes before you finalize your car purchase. Insurance costs can significantly impact your overall budget, especially for newer drivers or specific vehicle types in Alberta. What seems like an affordable car can become expensive with high premiums.

B. Debt-to-Income Ratio (DTI): Your Financial Meter for Lenders

Lenders use your DTI to assess your ability to manage monthly payments. It's the percentage of your gross monthly income that goes towards debt payments.

- How it's Calculated: Total monthly debt payments (including the new car loan, credit cards, other loans, rent/mortgage) divided by your gross monthly income. Lenders typically prefer a DTI below 36-43%.

- Critical Role in Affordability: A high DTI signals that you might be overextended, making lenders hesitant, especially with varied income.

- Strategies for Improving Your DTI:

- Reduce Existing Debts: Pay down credit card balances or personal loans.

- Increase Verifiable Income: Ensure all your income streams are meticulously documented.

- Consider a Smaller Loan: Opt for a less expensive car to reduce your monthly payment.

IX. The Application Audition: Presenting Your Best Performance to Lenders

Once you've composed your financial score and understood the associated costs, it's time for the application. Approaching this stage strategically can make all the difference.

A. Pre-Approval vs. Full Application: Understanding the Process

- Pre-Approval: This is an initial assessment where a lender reviews your basic financial information and credit report to give you an estimate of how much you can borrow and at what interest rate. It often involves a "soft" credit inquiry, which doesn't negatively impact your credit score. Pre-approval gives you buying power and clarity on your budget before you shop for a car.

- Full Application: Once you've chosen a vehicle, you submit a complete application with all your detailed documentation. This involves a "hard" credit inquiry, which will have a minor, temporary impact on your credit score.

B. What to Expect During the Interview: Discussing Your Varied Income Confidently

Be prepared to discuss your income in detail, even if it feels repetitive.

- Articulate Stability: Focus on the consistency of your income over time, rather than just monthly totals. Explain how you manage fluctuations.

- Highlight Reliability: If you have long-standing client relationships or a history of consistent project work, emphasize this.

- Financial Management: Be ready to discuss your budgeting strategies and how you've prepared for potential leaner periods. Show them you have a plan.

- Answer Questions Honestly: Transparency builds trust. If there are gaps in your income or unusual expenses, explain them clearly and logically.

C. Common Pitfalls to Avoid: Don't Hit a Flat Note

Steer clear of these common mistakes that can derail your application.

- Applying to Too Many Lenders: Multiple hard credit inquiries in a short period can lower your credit score and make you appear desperate for credit. Stick to a few well-researched options.

- Incomplete Documentation: Missing documents can cause significant delays or outright rejection. Ensure your financial dossier is complete and organized.

- Misrepresenting Income: Never inflate or misrepresent your income. Lenders will verify your claims, and dishonesty can lead to immediate rejection and potentially legal consequences.

- Rushing the Process: Take your time to gather documents, compare offers, and understand terms. A rushed decision can lead to regret or a less favourable loan.

X. Avoiding the 'Bad Tracks': Spotting Predatory Loans and High-Interest Traps in Canada

For individuals with varied income or less-than-perfect credit, the risk of encountering predatory lending practices is higher. Educating yourself is your best defense.

A. Understanding APR: The True Cost of Borrowing

- Annual Percentage Rate (APR): This is the actual yearly cost of funds over the term of a loan, including interest and any other fees or costs associated with the transaction. It's the most crucial number to compare when evaluating loan offers.

- Beyond Monthly Payment: Don't just look at the monthly payment. A lower monthly payment might simply mean a longer loan term, resulting in you paying significantly more in interest over the life of the loan. Always compare the APR and the total cost of the loan.

B. Red Flags of Unscrupulous Lenders: What to Watch Out For

- Guaranteed Approval: No legitimate lender can guarantee approval without reviewing your financial situation. Be wary of anyone making such promises.

- Hidden Fees: Read the fine print carefully. Watch out for undisclosed administrative fees, application fees, or insurance add-ons that significantly inflate the loan cost.

- Excessive Interest Rates: While varied income might lead to higher rates, be cautious of rates that seem astronomically high compared to market averages, even for higher-risk borrowers.

- Pressure Tactics: Lenders who pressure you to sign immediately, discourage you from reading the contract, or refuse to answer your questions are red flags.

- Vague Contract Terms: Ensure all terms – interest rate, loan term, total repayment amount, late payment penalties – are clearly spelled out in writing.

C. The Cycle of Debt: How High-Interest Loans Can Derail Your Financial Playlist

Taking on a high-interest car loan, especially when your income is varied, can lead to a vicious cycle of debt.

- unaffordable Payments: High interest rates mean a significant portion of your payment goes towards interest, not the principal, making it harder to pay down the loan.

- Negative Equity: You might owe more on the car than it's worth, particularly if the interest rate is very high and the car depreciates quickly.

- Long-Term Financial Strain: A high-interest loan can strain your budget for years, making it difficult to save, invest, or handle other financial emergencies.

XI. Your Financial Encore: Building Credit and Refinancing for a Better Tune

Getting your car loan approved is a major milestone, but it's also an opportunity to set yourself up for future financial success. Think of it as the first track in a new album, with better, more harmonious songs to come.

A. Making Every Payment Count: The Power of Consistent, On-Time Payments

This is the most direct way to improve your credit score and financial standing.

- Builds Credit History: Every on-time car loan payment is reported to credit bureaus, positively contributing to your payment history (the largest factor in your score).

- Opens Future Doors: A history of responsible car loan payments can make it easier to qualify for mortgages, lines of credit, or other loans at prime rates in the future.

B. The Refinancing Option: When and How to Seek a Better Interest Rate

If you secured your initial loan with a higher interest rate due to varied income or a lower credit score, refinancing can be a game-changer.

- When to Consider:

- Your credit score has significantly improved since you got the original loan.

- Interest rates in the market have dropped.

- Your income has become more stable and verifiable.

- You want to lower your monthly payments or reduce the total interest paid.

- How to Refinance: Shop around for new loan offers from different lenders. They will assess your current financial situation and credit score. If approved for a lower rate, the new loan will pay off your old loan, and you'll begin making payments to the new lender.

C. Graduating to Prime Lending: Your Long-Term Goal for Financial Flexibility

Your ultimate goal should be to improve your financial health to the point where you qualify for prime lending rates.

- Lower Costs: Prime rates mean significantly lower interest payments over the life of any loan, saving you thousands of dollars.

- Greater Flexibility: Access to prime lending opens up more financial products and services, giving you greater borrowing power and flexibility.

- Continued Financial Discipline: Maintain good financial habits – consistent payments, low debt utilization, regular credit monitoring – to stay in the prime lending tier.

XII.  – Context: A confident individual (perhaps a young professional or a skilled tradesperson, reflecting diverse income) at a modern car dealership desk in Edmonton, signing car loan papers with a friendly finance manager. A sleek new or well-maintained used car is visible in the background, and a subtle, recognizable Edmonton landmark or skyline element is visible through a window, symbolizing local success and a smooth transaction.

– Context: A confident individual (perhaps a young professional or a skilled tradesperson, reflecting diverse income) at a modern car dealership desk in Edmonton, signing car loan papers with a friendly finance manager. A sleek new or well-maintained used car is visible in the background, and a subtle, recognizable Edmonton landmark or skyline element is visible through a window, symbolizing local success and a smooth transaction.

XIII. Your Next Steps to Approval: Hitting the Right Notes in Edmonton and Beyond

Your income's playlist might be diverse, but it can absolutely lead to car loan approval. The key is preparation, transparency, and choosing the right partners. Here’s how to move forward confidently:

- Compile Your Financial Dossier: Gather every piece of documentation we discussed in Section III. Organize it meticulously. This is your foundation.

- Know Your Credit Score: Obtain your credit reports from Equifax and TransUnion. Understand your score and take steps to improve it if necessary.

- Build a Realistic Budget: Factor in all costs of car ownership, not just the monthly payment. Ensure your varied income can comfortably support this commitment.

- Seek Specialized Help: Don't limit yourself to traditional banks. Explore dealerships, credit unions, and online brokers who specialize in varied income approvals.

- Be Transparent and Confident: Clearly articulate your income streams, how you manage fluctuations, and your commitment to responsible repayment.

At SkipCarDealer.com, we specialize in understanding the unique financial rhythms of Canadians, no matter how varied your income playlist might be. We're here to help you find the right lender and the right vehicle to get you driving in Edmonton, Calgary, or across Canada.