Nova Scotia Bad Credit Auto Loan: Finance Insurance 2026

Table of Contents

- Key Takeaways

- The Intertwined Realities: Auto Loans, Insurance, and Your Credit Profile

- Beyond the Loan: Why Your Credit Score Echoes in Insurance Premiums

- Securing a Vehicle Loan with a Less-Than-Perfect Credit History

- The Core Question: Integrating Insurance Costs into Your Vehicle Loan

- Is It Possible? Unpacking the Mechanics of Premium Financing

- The Financial Implications: What You're Really Paying For

- Navigating the Subprime Auto Loan Landscape: What to Expect

- Finding the Right Fit: Banks, Dealerships, and Specialty Lenders

- Application Essentials: Preparing Your Documentation for Success

- Understanding Loan Terms: Interest Rates, Repayment Periods, and Fees

- The Insurance Conundrum: Managing High Premiums with Challenging Credit

- Strategies to Mitigate Elevated Insurance Costs

- Vehicle Choice Matters: How Your Car Impacts Your Insurance Burden

- Weighing the Decision: When Financing Insurance Makes Sense (and When It Doesn't)

- The Immediate Need vs. Long-Term Financial Health

- Alternatives to Financing Your Premiums

- Your Next Steps to Approval and Affordable Driving

- Pre-Approval Power: Knowing Your Limits Before You Shop

- Negotiation Tactics: Empowering Yourself at the Dealership

- Post-Purchase Strategies: Monitoring Your Credit and Insurance

Key Takeaways

- Financing Insurance is Possible, But Costly: While rolling car insurance premiums into a bad credit auto loan in Nova Scotia (and across Canada) is an option, it significantly increases the overall cost of ownership due to accrued interest.

- Credit Impacts Both Loan & Insurance: Your credit score not only dictates the interest rate on your auto loan but also heavily influences your car insurance premiums, often leading to higher rates for those with challenging credit.

- Transparency is Crucial: Always demand an itemized breakdown of all loan components, especially when considering financing insurance, to understand the true cost and avoid hidden fees.

- Strategic Vehicle Choice Matters: Opting for a vehicle that is cheaper to insure can substantially offset the higher costs associated with bad credit auto loans and insurance premiums.

- Alternatives Exist: Explore options like direct monthly insurance payments or smaller personal loans for premiums before committing to financing them through a high-interest auto loan.

- Improve Your Credit for Future Savings: Making timely loan payments and actively managing your credit can lead to better rates on future insurance policies and loan refinancing opportunities.

The Intertwined Realities: Auto Loans, Insurance, and Your Credit Profile

Can you finance car insurance premiums with a bad credit auto loan in Nova Scotia? Yes, it is often possible, especially in the 2026 market, but it comes with significant financial considerations. Lenders or dealerships, particularly those specializing in subprime auto loans, may offer to roll the cost of your vehicle's insurance premiums into your overall car loan. While this can provide immediate relief by reducing upfront out-of-pocket expenses, it means you'll be paying interest on your insurance over the entire term of your auto loan, potentially increasing the total cost considerably.

Beyond the Loan: Why Your Credit Score Echoes in Insurance Premiums

Your credit history isn't just a concern for lenders; it's a critical factor for car insurance providers across Canada, including Nova Scotia. Insurers use credit-based insurance scores as a predictive tool to assess risk. Statistical analysis has shown a correlation between a consumer's credit behaviour and their likelihood of filing an insurance claim.

For someone with a less-than-perfect credit history, this often translates into higher insurance premiums. Insurers view individuals with lower credit scores as potentially higher risk, leading to elevated rates to offset that perceived risk. This means you could be facing a double whammy: a high-interest auto loan due to bad credit, and higher insurance premiums for the same reason.

Factors insurers consider include your payment history, outstanding debt, length of credit history, and new credit applications. These elements collectively paint a picture of your financial responsibility, impacting how much you pay to protect your vehicle. For more on how credit scores can impact your financial options, consider reading our guide on 450 Credit? Good. Your Keys Are Ready, Toronto.

Securing a Vehicle Loan with a Less-Than-Perfect Credit History

The subprime lending market in Canada is robust, offering solutions for individuals with challenging credit histories. These loans are designed for those who may have been turned down by traditional banks due to past financial missteps like bankruptcies, consumer proposals, or missed payments. Lenders in this space understand that life happens, and they focus on your current ability to pay, rather than solely on your past credit missteps.

While approval is more accessible, it's crucial to set realistic expectations for interest rates and terms. Subprime auto loans naturally carry higher interest rates to compensate lenders for the increased risk. In 2026, typical rates for subprime borrowers could range from 15% to over 30% APR, depending on the severity of your credit issues, income stability, and the loan amount.

Dispelling common myths:

- Myth: You can't get a loan with bad credit. Fact: Specialty lenders and dealerships actively cater to bad credit borrowers.

- Myth: All bad credit loans are scams. Fact: While vigilance is key, many reputable lenders offer legitimate, regulated subprime loans.

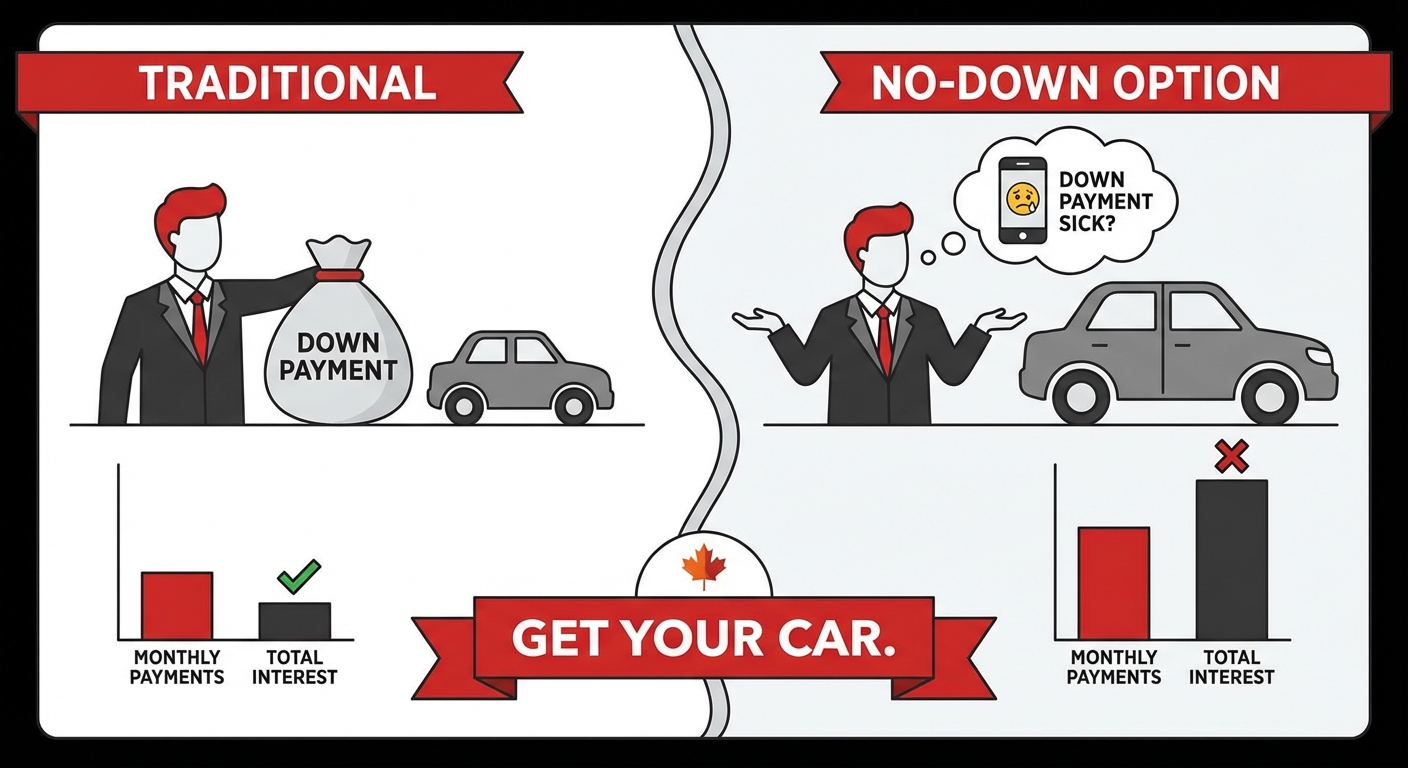

- Myth: You need a huge down payment. Fact: While a down payment helps, many lenders offer no-down-payment options, though this can increase your monthly payments and total interest paid. You can even get your car if Your Down Payment Just Called In Sick. Get Your Car.

Context: A visual representation of the interconnected financial factors in vehicle ownership – a flowchart illustrating how a credit score influences both loan approval and insurance premiums, or a stack of documents representing the hurdles of bad credit financing.

Context: A visual representation of the interconnected financial factors in vehicle ownership – a flowchart illustrating how a credit score influences both loan approval and insurance premiums, or a stack of documents representing the hurdles of bad credit financing.

The Core Question: Integrating Insurance Costs into Your Vehicle Loan

Is It Possible? Unpacking the Mechanics of Premium Financing

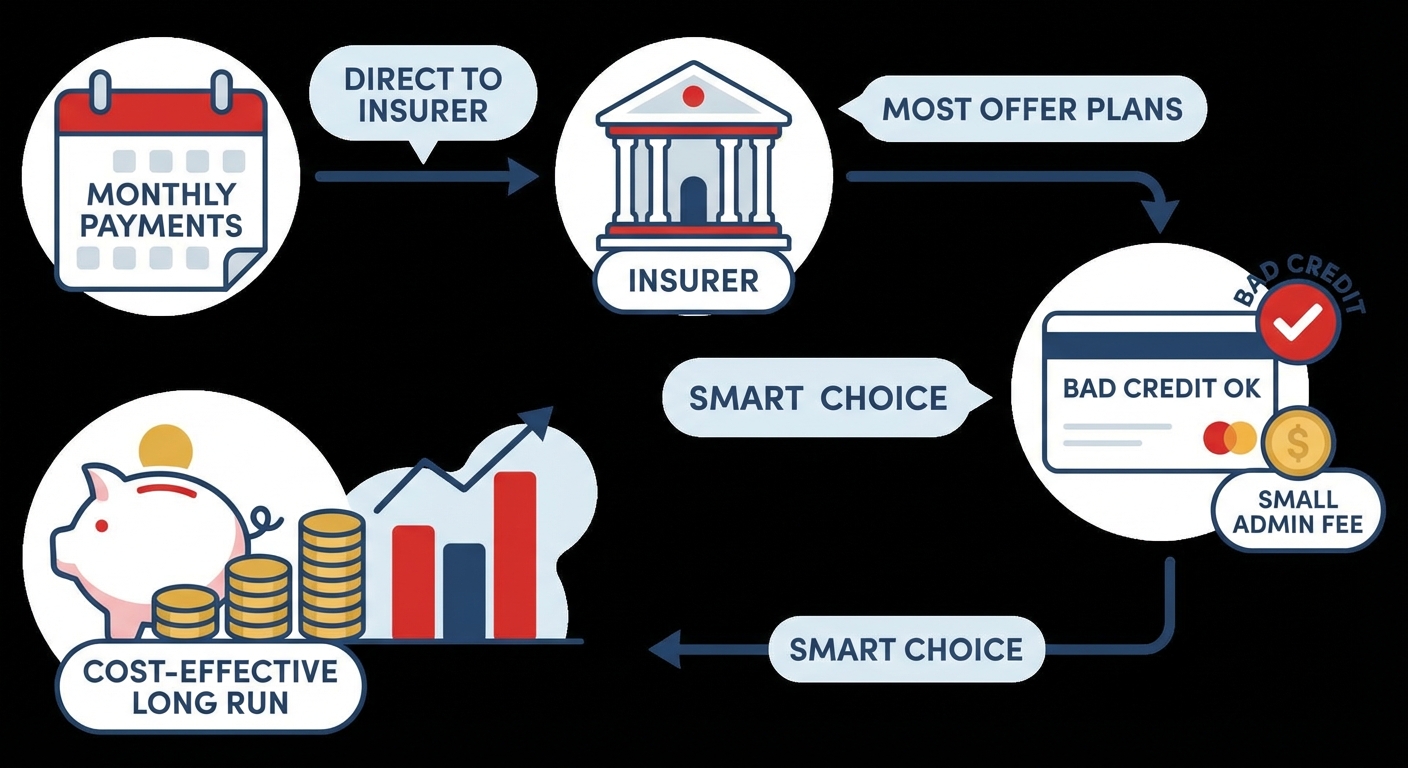

Yes, it is indeed possible to roll your car insurance premiums into your auto loan, particularly when dealing with subprime lenders or specific dealership financing programs in 2026. This practice, while not universal, is offered by some to facilitate vehicle ownership for individuals who might struggle with the upfront lump-sum payment of insurance, or even the initial monthly payments.

Here's how it typically works:

- Lender Facilitation: Some lenders have partnerships with insurance providers or offer a "protection package" that includes a year's worth of insurance. They pay the insurance provider directly on your behalf.

- Dealership Convenience: Dealerships, especially those with in-house financing or strong subprime lending connections, can act as intermediaries. They bundle the insurance cost into the total vehicle price, which is then financed.

- All-Inclusive Appeal: From a consumer perspective, this offers convenience. You get one consolidated monthly payment for both your car and its insurance, eliminating a separate bill. This can be particularly appealing when facing tight budgets or limited immediate cash flow.

However, it's crucial to understand the lender's rationale. By facilitating insurance financing, they ensure the vehicle is immediately and continuously insured, protecting their asset (the car) against damage or theft. This reduces their risk, but at a cost to you.

The Financial Implications: What You're Really Paying For

While convenient, financing your insurance premiums through your auto loan comes with a significant financial cost. You are essentially paying interest on your insurance premium for the entire duration of your car loan, which could be 60, 72, or even 84 months. Insurance is typically a short-term expense, renewed annually, but by rolling it into a long-term loan, you extend its cost exponentially.

Let's break down the true cost with an example for 2026: Consider a $2,000 annual car insurance premium. If you have a bad credit auto loan with an APR of 22% over 60 months:

| Scenario | Monthly Payment (Loan Only) | Monthly Payment (Loan + Insurance) | Total Interest Paid (Loan Only) | Total Interest Paid (Loan + Insurance) | Additional Interest on Insurance |

|---|---|---|---|---|---|

| $25,000 Car Loan, 60 months, 22% APR | ~$697 | N/A | ~$16,820 | N/A | N/A |

| With $2,000 Insurance Financed (total $27,000) | N/A | ~$753 | N/A | ~$18,180 | ~$1,360 |

In this example, financing a $2,000 insurance premium at a 22% APR over 60 months adds approximately $56 to your monthly payment. More critically, it adds about $1,360 in interest alone just for that initial year's insurance premium. If you renew and finance insurance again in subsequent years, this cost compounds. You are paying interest on your interest, extending the repayment period for an expense that should ideally be paid off annually.

Pro Tip: Always request an itemized breakdown of all costs associated with your vehicle loan, including any financed insurance premiums, before committing. Understand precisely how much extra you'll pay in interest on the insurance component. A reputable lender or dealership should be able to provide this clear disclosure.

Navigating the Subprime Auto Loan Landscape: What to Expect

Finding the Right Fit: Banks, Dealerships, and Specialty Lenders

Securing a vehicle loan with challenging credit in 2026 requires understanding the different types of lenders available. Each avenue has its own set of advantages and disadvantages:

| Lender Type | Advantages | Disadvantages | Typical APR Range (Bad Credit, 2026) |

|---|---|---|---|

| Traditional Banks/Credit Unions | Lower interest rates for prime/near-prime borrowers, strong reputation, relationship banking. | Very strict credit criteria, less likely to approve deep subprime borrowers. | 9.99% - 14.99% (for near-prime) |

| Dealership Financing (Indirect) | Convenience (one-stop shop), access to multiple lenders (prime & subprime), potential for special offers. | Less transparency on lender selection, may mark up interest rates, focus on monthly payment vs. total cost. | 14.99% - 29.99%+ |

| Specialized Subprime Lenders | High approval rates for bad credit, focus on current income/stability, flexible terms. | Highest interest rates, may require additional collateral or co-signers, less well-known. | 19.99% - 39.99%+ |

For those with bad credit, specialized subprime lenders or dealership financing are often the most viable options. Dealerships often work with a network of lenders, including those who specialize in higher-risk loans. It's crucial to identify reputable lenders, checking for online reviews, transparency in their terms, and clear communication. Avoid any lender that guarantees approval without reviewing your financial situation or pressures you into signing quickly.

Application Essentials: Preparing Your Documentation for Success

Regardless of your credit score, a thorough and well-prepared application can significantly improve your chances of approval and potentially better terms. When applying for a subprime auto loan in 2026, lenders will be looking for stability and your current ability to repay. Here's what you'll typically need:

- Proof of Income: Recent pay stubs (2-3 months), employment verification letters, bank statements showing direct deposits, or tax returns if self-employed. Lenders want to see consistent income.

- Proof of Residency: Utility bills, lease agreements, or mortgage statements showing a stable address.

- Proof of Identity: Government-issued ID (driver's license, passport).

- Banking Information: Account numbers for direct debit payments.

- References: Sometimes required, typically non-family members.

A significant down payment or a valuable trade-in can greatly strengthen your application. This demonstrates your commitment and reduces the amount you need to borrow, thereby lowering the lender's risk. Even a few hundred dollars can make a difference. For those who have recently gone through a consumer proposal, there are specific strategies to secure a loan. Learn more about Post-Proposal Car Loan: Your Credit Score Just Got a Mulligan.

Understanding Loan Terms: Interest Rates, Repayment Periods, and Fees

Demystifying your loan agreement is paramount. Don't just look at the monthly payment; understand the full scope of your financial commitment.

- Annual Percentage Rate (APR): This is the most crucial figure. APR includes not just the interest rate but also any additional fees, giving you the true annual cost of borrowing. A 20% interest rate might have a 22% APR due to fees.

- Repayment Period: The loan term, usually expressed in months (e.g., 60, 72, 84). Longer terms mean lower monthly payments, but you'll pay significantly more in total interest over the life of the loan.

- Fees: Be aware of potential fees, such as:

- Origination Fees: A charge for processing the loan.

- Documentation Fees: For preparing paperwork.

- Late Payment Fees: Penalties for missed payments.

- Prepayment Penalties: Less common in Canada, but check if you're penalized for paying off your loan early.

Always read the fine print. Ask questions until you fully understand every clause. A responsible lender will take the time to explain everything clearly. For example, a $20,000 loan at 18% APR over 60 months would have a monthly payment of approximately $507, with total interest paid around $10,400. Extend that to 84 months, and the monthly payment drops to about $402, but the total interest paid balloons to roughly $13,760 – an extra $3,360 in interest for the "convenience" of a lower monthly payment.

The Insurance Conundrum: Managing High Premiums with Challenging Credit

Strategies to Mitigate Elevated Insurance Costs

Even with challenging credit, there are proactive steps you can take in 2026 to reduce your car insurance premiums. High rates don't have to be a permanent fixture:

- Comparative Shopping: This is your most powerful tool. Get quotes from at least three to five different insurance providers. Rates can vary wildly for the exact same coverage. Don't settle for the first quote you receive.

- Adjust Deductibles & Coverage Limits: Increasing your deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium. Similarly, assessing if you truly need maximum coverage for an older vehicle might save you money. Be cautious not to under-insure, especially if your loan requires comprehensive coverage.

- Explore Available Discounts: Ask every insurer about discounts. Common ones include:

- Multi-policy (bundling home and auto)

- Good driver/claims-free history

- Loyalty discounts

- Anti-theft device discounts

- Student discounts

- Telematics/usage-based insurance programs (see Pro Tip below)

- Improve Your Credit: While not an immediate fix, consistently making timely payments on your auto loan and other debts will gradually improve your credit score. As your score rises, so too will your chances of securing lower insurance rates in the future.

Vehicle Choice Matters: How Your Car Impacts Your Insurance Burden

The type of vehicle you choose has a profound impact on your insurance premiums, especially when combined with a challenging credit profile. Insurers assess risk based on several factors related to the car itself:

- Make and Model: Certain brands or models are statistically more expensive to repair or replace. Luxury cars, high-performance vehicles, and those with rare parts often command higher premiums.

- Age of Vehicle: Newer cars are generally more expensive to insure due to higher replacement costs and advanced technology. Older, well-maintained vehicles can sometimes be cheaper to insure.

- Safety Features: Cars with advanced safety features (e.g., automatic emergency braking, lane-keeping assist) can sometimes qualify for discounts because they reduce the likelihood of accidents or severe damage.

- Theft Risk: Vehicles that are frequently stolen or prone to vandalism will have higher comprehensive coverage costs. Research common theft rates for models you're considering.

When you have bad credit and are already facing higher loan interest and insurance base rates, choosing a vehicle that is typically less expensive to insure becomes even more critical. Opt for reliable, moderately priced cars with good safety ratings and lower theft rates. This strategic decision can significantly alleviate your overall monthly financial burden.

Pro Tip: Actively explore usage-based insurance (telematics) programs if offered by insurers in Nova Scotia or across Canada. These programs use a device or app to monitor your driving habits (speed, braking, mileage). Your responsible driving could lead to significant premium reductions, offsetting the impact of your credit score over time.

Weighing the Decision: When Financing Insurance Makes Sense (and When It Doesn't)

The Immediate Need vs. Long-Term Financial Health

Deciding whether to finance your car insurance premiums through your auto loan is a complex balancing act. It often boils down to an immediate need versus your long-term financial health.

When it might make sense:

- Immediate Necessity: If you absolutely need a vehicle for work or essential travel in 2026, and you genuinely cannot afford the upfront or initial monthly insurance payments any other way, financing it might be the only bridge to getting on the road.

- Temporary Cash Flow Issue: If you anticipate a significant improvement in your cash flow very soon (e.g., a bonus, tax refund, or new job starting next month) that will allow you to pay off the insurance portion quickly or refinance.

- Lender Requirement: Some lenders, especially with deep subprime loans, may make it a condition of approval to ensure continuous coverage, effectively forcing the issue.

When it generally doesn't make sense:

- High Interest Rates: If your auto loan carries a very high APR (e.g., over 20-25%), the interest accrued on the insurance premium becomes exorbitant. The convenience simply isn't worth the additional thousands you might pay.

- Long Loan Terms: Financing a short-term expense (annual insurance) over a very long loan term (72 or 84 months) results in paying interest on interest for an extended period, significantly inflating the overall cost.

- Sustainable Alternatives: If you have other, more affordable ways to pay for insurance, even if it requires a bit of budgeting, avoid financing it through a high-interest auto loan.

Alternatives to Financing Your Premiums

Before opting to roll your insurance into your auto loan, consider these more financially prudent alternatives:

| Payment Method | Pros | Cons | Cost Impact |

|---|---|---|---|

| Direct Monthly Payments to Insurer | Breaks down cost, often interest-free (or low fees), doesn't add to loan principal. | Requires separate budgeting, may have small administrative fees. | Minimal additional cost. |

| Lump-Sum Annual Payment | Often qualifies for a discount (5-10%), no interest paid. | Requires significant upfront cash. | Lowest overall cost. |

| Small Personal Loan (Short-Term) | Keeps insurance separate from auto loan, potentially lower interest than subprime auto loan. | Requires separate application/credit check, adds another monthly payment. | Moderate additional cost (depends on personal loan APR). |

| Secured Credit Card (with caution) | Can help build credit if managed responsibly. | High interest rates if not paid off quickly, potential for debt spiral. | High additional cost if not paid off monthly. |

Budgeting and saving for your insurance premiums separately, even if it means monthly payments directly to the insurer, is almost always the more cost-effective choice in the long run. Even with a bad credit history, most insurers will offer monthly payment plans, though they might charge a small administrative fee.

Context: An infographic or visual metaphor depicting the 'scales of decision' – balancing the immediate convenience of financing insurance against the long-term financial cost, or a comparison chart of different payment options.

Context: An infographic or visual metaphor depicting the 'scales of decision' – balancing the immediate convenience of financing insurance against the long-term financial cost, or a comparison chart of different payment options.

Your Next Steps to Approval and Affordable Driving

Pre-Approval Power: Knowing Your Limits Before You Shop

One of the most strategic moves you can make when seeking a bad credit auto loan in 2026 is to get pre-approved before you even set foot on a dealership lot. Pre-approval offers several significant advantages:

- Empowered Negotiation: You walk into the dealership knowing exactly how much you can spend and at what interest rate. This allows you to negotiate the vehicle price and trade-in value separately from the financing, reducing the chance of being swayed by high-pressure sales tactics.

- Realistic Budgeting: Pre-approval gives you a concrete budget, preventing you from falling in love with a car you can't truly afford.

- Simplified Process: With financing already in place (or at least a strong offer), the purchasing process at the dealership becomes much smoother and faster.

- Insurance Conversation: Knowing your pre-approved loan terms can help you better discuss and understand the implications of financing insurance, should that option arise.

Even with bad credit, many specialized lenders offer pre-approval processes that can be completed online or over the phone. This gives you invaluable leverage and peace of mind.

Negotiation Tactics: Empowering Yourself at the Dealership

Negotiating for a vehicle, especially with a subprime loan, requires a clear strategy. Dealerships often focus on the monthly payment, but you need to look at the big picture:

- Separate the Deals: Negotiate the vehicle price first, as if you were paying cash. Once that's settled, then discuss your trade-in (if applicable), and finally, the financing terms. Do not let them bundle these discussions.

- Focus on Total Cost: Always ask for the total cost of the loan over its full term, not just the monthly payment. This helps you grasp the true expense.

- Be Prepared to Walk Away: Your greatest negotiating power is your willingness to leave if the terms aren't right. There are always other dealerships and other cars.

- Question Add-ons: Be wary of unnecessary add-ons like extended warranties, rustproofing, or fabric protection unless you've thoroughly researched and deemed them valuable. These are often high-profit items for dealerships.

When discussing insurance financing, specifically ask for the exact cost of the premium and the additional interest you'll pay on that amount over the loan term. Don't be afraid to compare this to getting insurance quotes on your own.

Post-Purchase Strategies: Monitoring Your Credit and Insurance

Getting your vehicle is just the beginning. Active management of your loan and insurance can lead to significant long-term savings and credit improvement:

- Make Timely Payments: This is the single most important action to rebuild your credit. Every on-time payment on your auto loan will positively impact your credit score over time, paving the way for better rates in the future.

- Monitor Your Credit Report: Regularly check your credit report (you're entitled to a free copy annually from Equifax and TransUnion in Canada). Look for errors and track your progress.

- Review Insurance Annually: Your financial situation and credit score aren't static. As your credit improves, your insurance rates may decrease. Shop around for new quotes every year, especially at renewal time, or if your circumstances change (e.g., marriage, moving, vehicle modifications).

- Consider Refinancing: After 12-18 months of consistent, on-time payments, your credit score may have improved enough to qualify for a lower interest rate. Refinancing your auto loan can save you thousands over the remaining term.

Pro Tip: Your financial situation isn't static. Review your insurance policy annually and get new quotes from multiple providers. Even a slight improvement in your credit score or a year of claims-free driving can unlock significant savings, allowing you to potentially stop financing your premiums.