Active Collections? Your Car Loan Just Got Active, Toronto!

Table of Contents

- Active Collections? Your Car Loan Journey in Toronto (and Beyond) Starts Now!

- Key Takeaways: Your Roadmap to Car Loan Approval with Active Collections in Canada

- Unpacking 'Active Collections': What It Truly Means for Your Wheels in Canada

- The Anatomy of an Active Collection in Canada: What's on Your Report?

- Beyond the Score: How Lenders Interpret Active Collections on Your Application

- Pro Tip: Know Your Enemy: Pull Your Credit Report *Before* Applying

- The Ripple Effect: How Active Collections Impact Your Interest Rates and Loan Terms

- The 'Yes, You Can!' Blueprint: Proven Pathways to Car Loan Approval with Active Collections Across Canadian Cities

- Strategy 1: The Specialist Lender Advantage – Why Traditional Banks Aren't Your First Stop

- Strategy 2: The Down Payment Power-Up – Offsetting Risk with Your Own Capital

- Pro Tip: The Down Payment Dilemma: How Much is Enough to Make a Difference?

- Strategy 3: The Co-Signer Compass – Navigating Approval with a Strong Financial Partner

- Strategy 4: The Vehicle Choice Advantage – Strategic Selection for Easier Approval

- Strategy 5: The 'Explain Your Story' Approach – Transparency and Proactivity

- Pro Tip: Crafting Your Narrative: Be Honest, Be Proactive, Be Prepared

- Navigating the Numbers: Beyond the Monthly Payment – Rates, Terms, and What *Really* Costs You

- Decoding Interest Rates: What to Expect with Active Collections in Canada

- The True Cost of a Longer Loan Term: A Detailed Example

- Hidden Fees and Charges: Scrutinizing Your Loan Agreement in Ontario (and Beyond)

- Pro Tip: Read Every Line: Don't Rush the Loan Agreement – Your Wallet Depends On It

- Payment Protection Insurance (PPI) and Other Add-ons: Necessity or Extra Cost?

- Regional Realities: How Car Loan Approval with Active Collections Varies by Province and City in Canada

- Ontario's Specific Landscape: Toronto, Ottawa, and Burlington

- Western Canada Insights: Alberta (Calgary, Edmonton) and British Columbia (Vancouver)

- Eastern Canada Perspectives: Nova Scotia (Halifax) and New Brunswick (Fredericton, Saint John)

- Quebec's Distinct System: Montreal, Quebec City, and Unique Legal Frameworks

- The Role of Local Dealerships: Leveraging Expertise in Your City

- Pro Tip: Leverage Local Knowledge: Find a Dealership with a Proven Track Record in Your City

- Beyond Approval: Building a Brighter Financial Future with Your New Car Loan

- Making Payments on Time, Every Time: The Cornerstone of Credit Repair

- Addressing the Active Collections: Strategies for Resolution

- Diversifying Your Credit Portfolio Responsibly

- The Power of Patience: Understanding the Timeframe for Credit Improvement

- When to Refinance: Seizing Opportunities for Lower Rates

- Myth Busters and Common Pitfalls: Separating Fact from Fiction in Car Loan Applications

- Myth 1: 'I can't get a car loan with *any* collections on my credit.'

- Myth 2: 'Paying off my collections immediately guarantees a prime interest rate.'

- Myth 3: 'All car lenders treat collections the same way.'

- Pitfall 1: The 'Shotgun' Approach – Applying Everywhere at Once

- Pitfall 2: Not Reading the Fine Print – Overlooking Crucial Details

- Pitfall 3: Falling for 'Guaranteed Approval' Scams

- Your Next Steps to Approval: A Step-by-Step Action Plan for Securing Your Car Loan in Canada

- Step 1: Thoroughly Assess Your Current Credit Health

- Step 2: Budget Realistically – Beyond Just the Car Payment

- Step 3: Gather All Necessary Documents

- Step 4: Research Specialist Lenders and Dealerships in Your Area

- Step 5: Prepare Your Story and Questions for the Lender

- Step 6: Compare Offers Wisely – Focus on Total Cost, Not Just Monthly Payments

- Frequently Asked Questions (FAQ): Your Burning Questions Answered About Car Loans with Active Collections

Active Collections? Your Car Loan Journey in Toronto (and Beyond) Starts Now!

You’ve seen the perfect vehicle online, maybe a reliable sedan for your Toronto commute or a rugged SUV for weekend trips out of Calgary. You click to apply for financing, your heart thumping with a mix of excitement and dread. Why dread? Because you know there are "active collections" on your credit report. The immediate thought is often, "There's no way I'll get approved for a car loan in Canada with this on my record."

Let's hit pause on that assumption right now. While active collections undoubtedly present a hurdle, they are far from an insurmountable barrier to securing a car loan. At SkipCarDealer.com, we understand the complexities of Canadian credit, and we’re here to tell you that approval is not just a pipe dream; it's an achievable goal with the right strategy, knowledge, and a partner who understands your unique situation. This isn't about magic; it's about smart, informed action. Ready to shift gears on your car loan journey?

Key Takeaways: Your Roadmap to Car Loan Approval with Active Collections in Canada

- Yes, Approval is Possible: Don't let active collections deter you. Many Canadians successfully secure car loans even with challenged credit. Your situation is not unique, and solutions exist.

- Specialist Lenders are Your Allies: Traditional banks might close their doors, but a vibrant ecosystem of subprime lenders and specialized dealership financing departments are equipped and willing to work with you.

- Strategy is Key: Approaching your application strategically – with a down payment, a co-signer, or a thoughtful vehicle choice – can dramatically improve your approval odds and loan terms.

- Know Your Numbers: Understanding interest rates, loan terms, and potential hidden costs is crucial to making an informed decision and avoiding pitfalls. Don't just look at the monthly payment.

- Beyond the Loan: Securing and diligently managing a car loan with active collections isn't just about getting a vehicle; it's a powerful opportunity to rebuild and rehabilitate your credit profile for a brighter financial future.

Unpacking 'Active Collections': What It Truly Means for Your Wheels in Canada

Before we dive into solutions, let's clearly define what "active collections" truly signify on your credit report and how they're perceived by lenders across Canada. It’s not just a scary term; it’s a specific mark on your financial history that requires understanding.

The Anatomy of an Active Collection in Canada: What's on Your Report?

An active collection occurs when a debt you owe to an original creditor (like a bank, credit card company, or utility provider) goes unpaid for an extended period, typically 90 to 180 days past due. At this point, the original creditor may "charge off" the debt and either sell it to a third-party collection agency or assign it to an internal collections department. When this happens, a new entry appears on your credit report, indicating that the account is now "in collections" or "sent to collections."

In Canada, this information is primarily tracked by the two major credit bureaus: Equifax and TransUnion. Both will show details such as the original creditor, the collection agency, the date the collection was opened, the amount owed, and the status (e.g., "open," "paid," "settled"). Common types of debts that end up in collections include overdue credit card balances, personal loans, utility bills (hydro, gas, internet), medical debts (less common as direct collections but can stem from uninsured services), and even old gym memberships. These entries typically remain on your credit report for up to six or seven years from the date of the last activity, regardless of whether they are paid off.

Beyond the Score: How Lenders Interpret Active Collections on Your Application

While your credit score (like a FICO score or a Beacon score) takes a significant hit from active collections, lenders look beyond just the number. They're trying to piece together a story about your financial habits and risk profile. Key questions lenders consider include:

- How Recent Are the Collections? A collection from six months ago is viewed with more concern than one from five years ago. Recent activity suggests ongoing financial instability.

- What Type of Debt? A utility bill collection might be seen differently than a defaulted credit card or a past car loan. Lenders often prioritize debts related to secured loans.

- What's the Amount? A collection for $150 might be less alarming than one for $5,000. The magnitude indicates the potential scale of financial distress.

- How Many Collections? A single isolated collection might be an oversight; multiple collections suggest a broader pattern of financial difficulty.

- Are They Paid or Unpaid? An active, unpaid collection is a much greater red flag than one that has been settled or paid in full, even if it still appears on your report.

Lenders, especially those specializing in non-prime financing, are risk assessors. They understand that life happens – job loss, illness, divorce, or unexpected expenses can lead to financial challenges. What they want to see is an applicant who is now stable, responsible, and committed to managing new debt obligations.

Pro Tip: Know Your Enemy: Pull Your Credit Report *Before* Applying

Before you even think about stepping foot into a dealership or submitting an online application, order your full credit reports from both Equifax and TransUnion. This isn't just a suggestion; it's a critical first step. Why? Because you need to know exactly what lenders will see. Identify all active collections, verify their accuracy, and dispute any errors immediately. Understanding your starting point allows you to prepare your strategy and explanations, giving you a significant advantage. You can usually get a free copy of your credit report annually.

The Ripple Effect: How Active Collections Impact Your Interest Rates and Loan Terms

The presence of active collections on your credit report directly correlates with higher interest rates and potentially stricter loan conditions. Lenders view you as a higher risk, and higher risk always translates to a higher cost of borrowing. Instead of qualifying for prime rates (which might be 5-9% depending on market conditions and the type of loan), you'll likely be looking at subprime rates, which can range from 10% to 29.9% or even higher, depending on the lender and your overall credit profile. You might find our article, Your Credit Score is NOT Your Rate. Get a Fair Loan, Toronto., particularly insightful here.

Beyond rates, loan terms might also be affected. Lenders could offer shorter repayment periods to reduce their risk, or conversely, longer terms with higher interest to make the payments seem more affordable, which significantly increases the total cost of the loan. They might also require a larger down payment or a co-signer, which brings us to our next section.

The 'Yes, You Can!' Blueprint: Proven Pathways to Car Loan Approval with Active Collections Across Canadian Cities

Now that we understand what active collections are, let's explore the concrete strategies that can turn a "no" into a "yes" for your car loan application, whether you're in Vancouver, Montreal, or any other Canadian city.

Strategy 1: The Specialist Lender Advantage – Why Traditional Banks Aren't Your First Stop

When you have active collections, your local big-five bank (RBC, TD, BMO, CIBC, Scotiabank) is probably not your best bet. Their lending criteria are typically rigid, favouring applicants with pristine credit. Instead, your focus should be on subprime lenders, alternative finance companies, and specialized dealership financing departments. These lenders are specifically set up to assess higher-risk applicants. They understand that credit scores don't tell the whole story and are often more willing to look at your current income stability, employment history, and your ability to make payments going forward, rather than dwelling solely on past missteps. Dealerships like SkipCarDealer.com, for instance, have established relationships with a wide network of such lenders, increasing your chances of finding an approval in Toronto, Edmonton, or Halifax.

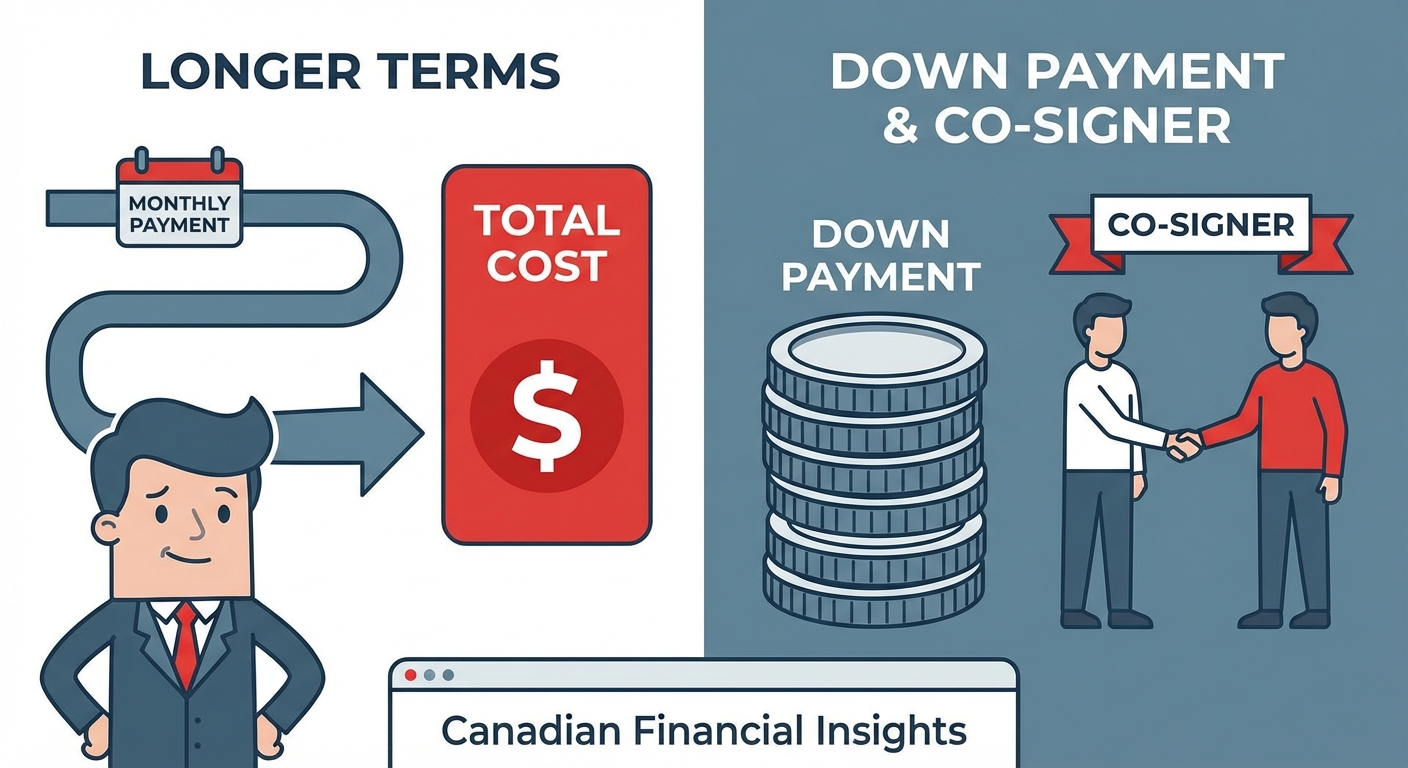

Strategy 2: The Down Payment Power-Up – Offsetting Risk with Your Own Capital

One of the most effective ways to improve your approval odds and potentially secure better rates is to offer a substantial down payment. From a lender's perspective, a down payment reduces the amount they need to finance, thereby reducing their risk. It also demonstrates your commitment and financial capability. When you put your own money down, you're investing in the vehicle and showing the lender that you have skin in the game. This can be a game-changer for applicants with active collections. Even a 10-20% down payment can make a significant difference. For more insights on this, you might find our article Your Down Payment Just Called In Sick. Get Your Car. helpful.

Pro Tip: The Down Payment Dilemma: How Much is Enough to Make a Difference?

While any down payment helps, aiming for 10-20% of the vehicle's purchase price is often considered "significant" by subprime lenders. For a $15,000 vehicle, that's $1,500 to $3,000. If you can't manage that much, save as much as you realistically can. Every dollar you put down reduces the loan amount and signals responsibility to the lender. It's an investment in your approval and potentially lower monthly payments.

Strategy 3: The Co-Signer Compass – Navigating Approval with a Strong Financial Partner

If you have a trusted family member or friend with excellent credit who is willing to co-sign your loan, this can dramatically boost your approval chances. A co-signer essentially guarantees the loan, meaning if you default, they are legally responsible for the payments. This significantly reduces the risk for the lender. However, it's crucial to understand the responsibilities involved for all parties. A co-signer's credit will be impacted if you miss payments, and it affects their ability to secure new credit. Only consider this option with someone who fully understands the commitment and whom you trust implicitly to maintain your payments.

Strategy 4: The Vehicle Choice Advantage – Strategic Selection for Easier Approval

Your choice of vehicle also plays a crucial role. Opting for a more affordable, reliable used vehicle over a brand-new, high-value luxury car is a smarter move when you have active collections. Lenders assess the collateral value of the vehicle. A lower-priced, reliable used car represents less risk to them because if you default, it's easier to recover their losses through repossession and resale. They also look at the vehicle's depreciation rate. A car that holds its value well is more attractive collateral. Stick to practical, budget-friendly options that meet your needs without overextending your financial capacity.

Strategy 5: The 'Explain Your Story' Approach – Transparency and Proactivity

Don't hide from your credit history. Be prepared to offer a concise, honest explanation for the collections. This isn't about making excuses, but providing context. Did you experience a job loss, a medical emergency, or a divorce? Highlight any mitigating circumstances that led to the collections, and, crucially, demonstrate recent financial responsibility. Show what you've learned and how you've changed your habits. Perhaps you've secured a stable job, created a budget, or are actively working to resolve outstanding debts. This proactive approach can humanize your application and show lenders you're serious about rebuilding.

Pro Tip: Crafting Your Narrative: Be Honest, Be Proactive, Be Prepared

When preparing your explanation, focus on facts, not emotions. State the reason briefly, explain what steps you've taken to stabilize your finances since then, and emphasize your commitment to making future payments on time. Practice what you'll say so it comes across as confident and sincere. Having this ready shows maturity and a proactive attitude, which can sway a lender.

Navigating the Numbers: Beyond the Monthly Payment – Rates, Terms, and What *Really* Costs You

Securing approval is just the first step. Understanding the financial intricacies of your car loan, especially with active collections, is paramount to avoiding future financial strain. It's easy to get fixated on the "affordable" monthly payment, but the true cost lies deeper.

Decoding Interest Rates: What to Expect with Active Collections in Canada

As discussed, active collections elevate your risk profile, meaning you will face higher interest rates. While prime rates for new car loans might hover in the single digits, those with active collections typically fall into the subprime category. You should realistically expect interest rates anywhere from 10% to 29.9%. The exact rate will depend on several factors: the severity and recency of your collections, the size of your down payment, your income stability, and the specific lender. It's crucial to compare offers, but also to have realistic expectations. Don't be surprised by rates that seem high compared to what you might hear advertised for perfect credit scores.

The True Cost of a Longer Loan Term: A Detailed Example

A common tactic to make monthly payments seem more manageable is to extend the loan term. While a lower monthly payment might feel like a relief, it drastically increases the total amount of interest you'll pay over the life of the loan. Let's look at an example for a $20,000 car loan at a 15% interest rate:

| Loan Term | Monthly Payment (Approx.) | Total Interest Paid (Approx.) | Total Cost (Approx.) |

|---|---|---|---|

| 48 Months (4 Years) | $557 | $6,736 | $26,736 |

| 60 Months (5 Years) | $476 | $8,560 | $28,560 |

| 72 Months (6 Years) | $428 | $10,816 | $30,816 |

As you can see, extending the loan by just two years (from 48 to 72 months) on a $20,000 loan at 15% interest adds over $4,000 to the total cost. Always weigh the benefit of a lower monthly payment against the long-term financial burden of increased interest.

Hidden Fees and Charges: Scrutinizing Your Loan Agreement in Ontario (and Beyond)

The sticker price of the car and the interest rate aren't the only costs you need to consider. Loan agreements can contain various additional fees that can add up. Be vigilant and ask about:

- Administration Fees: Often charged by dealerships for processing paperwork.

- PPSA (Personal Property Security Act) Registration Fees: In provinces like Ontario, this is a legal requirement to register the lender's interest in the vehicle as collateral.

- Loan Origination Fees: Some lenders charge a fee for setting up the loan.

- Documentation Fees: For preparing all the necessary documents.

- Lien Registration Fees: Similar to PPSA, ensures the lender has a claim on the vehicle.

Always ask for a complete breakdown of all fees before signing anything. In some cases, these fees might be negotiable, or at least you'll be fully aware of the total cost.

Pro Tip: Read Every Line: Don't Rush the Loan Agreement – Your Wallet Depends On It

When you're presented with the final loan agreement, take your time. Do not feel pressured to sign immediately. Read every single clause, even the fine print. If something is unclear, ask for clarification. Understand the total amount financed, the interest rate, the full payment schedule, any penalties for late payments, and whether there are any prepayment penalties if you decide to pay off the loan early. Your diligence here can save you hundreds, if not thousands, of dollars.

Payment Protection Insurance (PPI) and Other Add-ons: Necessity or Extra Cost?

Lenders and dealerships often offer optional add-on products like Payment Protection Insurance (PPI), extended warranties, anti-theft protection, or rust proofing. While some of these might offer genuine value in certain situations, others can be an unnecessary expense, especially when you're already facing higher interest rates due to active collections. PPI, for example, covers your loan payments in case of job loss, disability, or critical illness. For some, this peace of mind is worth the cost; for others, it's an expensive extra. Always ask for a clear explanation of what each product covers, its exact cost, and whether it's truly necessary for your situation. You are generally not obligated to purchase these to secure the loan.

Regional Realities: How Car Loan Approval with Active Collections Varies by Province and City in Canada

Canada is a vast country, and while federal regulations provide a baseline, local economies, provincial laws, and regional lending practices can introduce nuances to obtaining a car loan with active collections.

Ontario's Specific Landscape: Toronto, Ottawa, and Burlington

Ontario, being Canada's most populous province, has a highly competitive automotive and lending market. Major cities like Toronto, Ottawa, and Burlington see a significant presence of both traditional and subprime lenders. This competition can sometimes work in your favour, as specialist lenders are actively seeking to serve the large population segment with challenged credit. Consumer protection laws in Ontario are robust, offering some safeguards, but it's still crucial to be diligent. Dealerships in Toronto, for example, often have dedicated finance managers who specialize in non-prime approvals, leveraging their network to find solutions even with active collections.

Western Canada Insights: Alberta (Calgary, Edmonton) and British Columbia (Vancouver)

Western Canada presents its own unique dynamics. Alberta's economy, historically tied to oil and gas, can experience fluctuations that impact lending appetites. In cities like Calgary and Edmonton, lenders are often highly attuned to employment stability in these sectors. British Columbia, particularly Vancouver, faces a high cost of living, which can affect an applicant's debt-to-income ratio. Lenders in these regions might place a stronger emphasis on consistent income and a reasonable debt-service ratio, even for subprime loans. Specialized lenders in Vancouver and Calgary are adept at navigating these regional economic factors to provide viable financing options.

Eastern Canada Perspectives: Nova Scotia (Halifax) and New Brunswick (Fredericton, Saint John)

In the Maritimes, including Nova Scotia (Halifax) and New Brunswick (Fredericton, Saint John), the lending landscape can sometimes be more community-focused. While national subprime lenders operate here, local dealerships often have long-standing relationships with regional credit unions and smaller finance companies. These lenders might offer a more personalized assessment, sometimes even considering local references or unique employment situations. The market might be less saturated with options compared to larger provinces, making it even more important to work with a reputable dealership that understands the local financing ecosystem.

Quebec's Distinct System: Montreal, Quebec City, and Unique Legal Frameworks

Quebec operates under a distinct civil law system, which can influence credit reporting and consumer protection. While the major credit bureaus still track collections, certain legal aspects, such as how debts are pursued or how consumer proposals are handled, can differ. Lenders in Montreal and Quebec City are well-versed in these provincial specificities. It’s important to ensure any loan agreement adheres to Quebec’s consumer protection laws and that you understand any legal nuances that might affect your obligations or rights.

The Role of Local Dealerships: Leveraging Expertise in Your City

Regardless of where you are in Canada – be it Winnipeg, Saskatoon, St. John's, or Prince Edward Island – local dealerships often serve as invaluable resources. They typically have established networks of lenders, including those specializing in challenged credit. A good dealership finance department understands the specific requirements and risk assessments of various lenders and can help match your profile to the most suitable options. They can also provide a more personalized approach, guiding you through the application process and helping you present your financial story in the best possible light. This local expertise is often the key to unlocking approval.

Pro Tip: Leverage Local Knowledge: Find a Dealership with a Proven Track Record in Your City

Do your research. Look for dealerships in your specific geographic area (e.g., "bad credit car loans Toronto" or "car financing with collections Calgary") that have positive reviews from customers who have faced similar credit challenges. A dealership that openly advertises their ability to help with challenged credit is likely connected to the necessary specialist lenders and has experience navigating these situations. This significantly streamlines your search and increases your chances of success.

Beyond Approval: Building a Brighter Financial Future with Your New Car Loan

Congratulations, you've secured your car loan! But the journey doesn't end there. In fact, this is where a significant opportunity begins – the chance to use this loan as a powerful tool for credit rehabilitation and long-term financial health.

Making Payments on Time, Every Time: The Cornerstone of Credit Repair

This cannot be stressed enough: consistent, on-time payments are the single most important factor in improving your credit score. Every single payment you make on time is reported to the credit bureaus as positive activity. It demonstrates reliability and responsibility, slowly but surely eroding the negative impact of past collections. Set up automatic payments if possible, and ensure you have sufficient funds in your account to avoid missed payments. This is your chance to prove you're a responsible borrower.

Addressing the Active Collections: Strategies for Resolution

While making new payments on time is crucial, you should also consider strategies for addressing your existing active collections. Options include:

- Negotiating a 'Pay for Delete': This is where you offer to pay the collection agency in exchange for them removing the entry from your credit report. It's not always successful, as agencies aren't obligated to do this, but it's worth a try. Get any agreement in writing.

- Settling for Less: You can negotiate to pay a reduced amount to settle the debt. While it won't remove the collection from your report, it will change its status from "unpaid" to "settled," which is viewed more favourably by lenders.

- Paying in Full: If feasible, paying the full amount owed is the cleanest option. Again, the collection will likely remain on your report for its full duration (up to 7 years), but its status will show as "paid in full," which is the best possible outcome for an existing collection.

Addressing these outstanding debts shows further commitment to financial responsibility and will contribute positively to your overall credit health over time. For those dealing with more complex debt situations, understanding options like consumer proposals can be critical. Our article, The Consumer Proposal Car Loan You Were Told Was Impossible., offers valuable context here.

Diversifying Your Credit Portfolio Responsibly

Once you've established a solid payment history with your car loan, you can gradually introduce other forms of credit responsibly. A secured credit card, for example, can be an excellent way to build positive credit without taking on high risk. The key is to use it sparingly, pay the balance in full each month, and avoid accumulating new debt. A diverse credit mix, managed responsibly, further enhances your credit profile.

The Power of Patience: Understanding the Timeframe for Credit Improvement

Credit repair is not an overnight process. It takes time, consistency, and patience. While you might start seeing incremental improvements within 6-12 months of consistent positive activity, significant rehabilitation can take 2-3 years or even longer. Active collections, even when paid, typically remain on your report for up to 7 years. Focus on building good habits now, and the positive changes will follow.

When to Refinance: Seizing Opportunities for Lower Rates

As your credit score improves, you might qualify for better interest rates. After 12-18 months of consistent, on-time car loan payments, consider exploring refinancing options. Refinancing means taking out a new loan, often with a lower interest rate, to pay off your existing car loan. This can significantly reduce your total interest paid and potentially lower your monthly payments. This strategy is precisely what we discuss in our guide, Underwater Car Loan? Perfect. We'll Refinance It, Toronto!

Myth Busters and Common Pitfalls: Separating Fact from Fiction in Car Loan Applications

The world of subprime auto financing is rife with misconceptions and potential traps. Let's clear the air and highlight common mistakes to avoid.

Myth 1: 'I can't get a car loan with *any* collections on my credit.'

Busted! This is perhaps the most pervasive myth. While challenging, it is absolutely possible to get a car loan with active collections. As this article demonstrates, specialist lenders exist precisely for this demographic. The key is understanding the strategies and working with the right partners who specialize in non-prime financing.

Myth 2: 'Paying off my collections immediately guarantees a prime interest rate.'

Busted! While paying off collections is highly beneficial and demonstrates responsibility, it doesn't instantly erase the past impact on your credit score. Credit repair is a process that takes time. The collection entry itself will remain on your report for its full duration (up to 7 years), though its status will change to "paid." You'll still likely start with a subprime rate, but paying off collections is a crucial step towards qualifying for better rates down the line.

Myth 3: 'All car lenders treat collections the same way.'

Busted! Absolutely not. Traditional banks (like the major Canadian chartered banks) have very strict lending criteria and are generally highly averse to active collections. Specialist subprime lenders, however, have different risk assessment models. They are designed to work with individuals with challenged credit, understanding that circumstances can lead to collections. Their criteria are more flexible, focusing more on current income and ability to pay.

Pitfall 1: The 'Shotgun' Approach – Applying Everywhere at Once

This is a common mistake that can actually harm your credit further. Each time you apply for credit, a "hard inquiry" is placed on your credit report. Multiple hard inquiries in a short period can lower your credit score and make you look desperate to lenders, further reducing your chances of approval. Instead, be strategic. Research specialist lenders and dealerships, and apply to a few carefully chosen options.

Pitfall 2: Not Reading the Fine Print – Overlooking Crucial Details

As mentioned earlier, rushing through the loan agreement is a recipe for disaster. Hidden fees, unfavourable terms, or unexpected clauses can significantly increase the true cost of your loan. Take your time, ask questions, and ensure you understand every aspect of the agreement before you sign.

Pitfall 3: Falling for 'Guaranteed Approval' Scams

Be extremely wary of any lender or dealership that promises "guaranteed approval" regardless of your credit history. While approval is highly possible, no legitimate lender can guarantee it without any assessment. These "guaranteed" offers often come with predatory interest rates, exorbitant fees, or highly unfavourable terms designed to exploit vulnerable borrowers. If it sounds too good to be true, it almost certainly is.

Your Next Steps to Approval: A Step-by-Step Action Plan for Securing Your Car Loan in Canada

You've absorbed a lot of information, and now it's time to put it into action. Here's your clear, sequential plan to secure your car loan in Canada, even with active collections.

Step 1: Thoroughly Assess Your Current Credit Health

Order your full credit reports from both Equifax and TransUnion. Review them carefully for accuracy. Identify all active collections: their type, amount, and recency. Dispute any errors immediately. Understand your credit scores from both bureaus. This foundational step is non-negotiable.

Step 2: Budget Realistically – Beyond Just the Car Payment

Determine how much car you can truly afford. This isn't just about the monthly loan payment. Factor in insurance (which will likely be higher with challenged credit), fuel costs, maintenance, registration fees, and potential repair costs. Create a comprehensive budget that includes all car-related expenses to avoid overextending yourself.

Step 3: Gather All Necessary Documents

Preparation is key. Have these documents ready: proof of income (pay stubs, employment letters, tax assessments for self-employed individuals), proof of residency (utility bills, lease agreements), valid government-issued identification, and any prepared explanations for your collections. The more organized you are, the smoother the process will be.

Step 4: Research Specialist Lenders and Dealerships in Your Area

Focus your search on dealerships (like SkipCarDealer.com) and lenders known for working with challenged credit. Use online reviews and recommendations. If you're in Toronto, Edmonton, or Halifax, look for those with a proven track record. Avoid the shotgun approach to applications.

Step 5: Prepare Your Story and Questions for the Lender

Practice explaining your financial situation, focusing on improvements and stability, not just excuses. Prepare a list of questions about interest rates, loan terms, fees, and any optional add-ons. Being informed and proactive shows responsibility.

Step 6: Compare Offers Wisely – Focus on Total Cost, Not Just Monthly Payments

If you receive multiple offers, compare them meticulously. Look beyond the monthly payment to the total cost of the loan, including all interest and fees. Understand the full terms and conditions before making a decision. Choose the loan that best fits your budget and long-term financial goals.