Car Loan on AISH with Bad Credit: Your Approval Leverage

Table of Contents

- Key Takeaways: Your Quick-Scan Guide

- The Edmonton Challenge: Why AISH + Bad Credit Feels Like an Uphill Battle

- Deep Dive: How Lenders Actually Calculate Your 'AISH Affordability'

- Pro Tip: Wording is Everything

- Building Your Approval Stack: A 5-Point Pre-Application Checklist

- Decoding the Numbers: What Interest Rates and Loan Terms to Realistically Expect

- Pro Tip: Ask for the "Total Cost of Borrowing"

- Where to Apply in Edmonton: Banks vs. Credit Unions vs. Dealerships

- On the Lot: Your Guide to Navigating Edmonton Dealerships Without Getting Burned

- Pro Tip: The Urgency Test

- The AISH Rules: Will a Car Loan Affect Your Benefits?

- Your Edmonton Roadmap: From Application to Keys in Hand

- Frequently Asked Questions

Living in Edmonton on AISH (Assured Income for the Severely Handicapped) presents its own set of challenges, and needing a vehicle when you also have bad credit can feel like an impossible puzzle. The cold winters, the urban sprawl—a car isn’t a luxury here; it’s a lifeline to medical appointments, groceries, and community. You know your AISH income is stable and guaranteed, but the banks often don't see it that way. This guide is your leverage. We're going to break down the exact strategies for getting a car loan approved in Edmonton for 2026, using your AISH income as the powerful asset it truly is.

Key Takeaways: Your Quick-Scan Guide

- Yes, getting a car loan on AISH with bad credit in Edmonton is possible, but it requires a specific strategy. Traditional lenders might say no, but specialized lenders are looking for clients just like you.

- Your stable AISH income is your biggest asset, but lenders view it differently than employment income because it's non-garnishable. We'll show you how to frame it for success.

- Expect higher interest rates due to the bad credit history. The key is finding a loan that fits your total budget, not just a low monthly payment that stretches for years.

- Specialized dealerships and online lenders are often more flexible than major banks in Alberta. They understand fixed-income applications and have programs designed for them.

- A down payment, even a small one of $500 to $1000, dramatically increases your approval odds and shows lenders you have skin in the game.

The Edmonton Challenge: Why AISH + Bad Credit Feels Like an Uphill Battle

So, can you get a car loan on AISH with bad credit in Edmonton? Absolutely. The process, however, requires understanding the unique perspective of the lender. They see your situation as a double-edged sword, and recognizing this is the first step to building your case for approval.

On one hand, AISH is a lender's dream in terms of stability. It's government-guaranteed income that arrives on the same day every month, without fail. It's not subject to layoffs, reduced hours, or company closures. This consistency is a massive plus.

On the other hand, AISH income is non-garnishable. This is the part that makes traditional banks nervous. If you were to default on the loan, they can't get a court order to take payments directly from your income source as they could with a regular paycheque. This elevates their perceived risk, which is then compounded by a history of bad credit.

In a city like Edmonton, where navigating the Anthony Henday or getting to an appointment at the Royal Alexandra Hospital without a vehicle is a major hurdle, this lending challenge feels personal. You're not just applying for a car; you're applying for independence and mobility. Let's reframe the conversation from their risk to your reliability.

Deep Dive: How Lenders Actually Calculate Your 'AISH Affordability'

When you walk into a bank, they often rely heavily on your credit score and a simple Debt-to-Income (DTI) ratio. For AISH recipients, a more specialized lender looks deeper, focusing on a different metric: the Payment-to-Income (PTI) ratio.

PTI focuses on the proposed vehicle payment (including an estimate for insurance) as a percentage of your gross monthly income. For fixed-income applicants, most subprime lenders want to see this number stay between 15% and 20%.

Here’s how they view your income sources:

- AISH Income: This is your foundation. Lenders count 100% of this guaranteed income.

- Canada Child Benefit (CCB): Most specialized lenders will include 100% of your CCB as stable, verifiable income, significantly boosting your affordability. Big banks are often less willing to do so.

- Other Benefits: Additional benefits like the GST credit may or may not be counted, depending on the lender's specific policies. Always declare everything.

A major bank in Alberta, like ATB or Servus Credit Union, might still be hesitant due to the non-garnishable nature of the income, even if your ratios are perfect. A subprime auto lender, however, sees this every day. They are structured to manage this type of risk, which is why they are often the best path to approval. For a deeper look at navigating credit challenges, our guide on The Consumer Proposal Car Loan You Were Told Was Impossible offers valuable insights that apply to many bad credit situations.

Pro Tip: Wording is Everything

When you fill out a credit application, don't just write "AISH" in the income field. Instead, write "Guaranteed Fixed Government Income." This terminology speaks directly to the underwriter reviewing your file. It immediately frames your income as stable and reliable, shifting their focus from "disability benefits" to "guaranteed revenue."

Building Your Approval Stack: A 5-Point Pre-Application Checklist

Success isn't about luck; it's about preparation. Before you even speak to a lender, you need to assemble your "Approval Stack"—a collection of documents and information that makes it easy for them to say "yes."

- Document Everything: Lenders need to verify your stability. Gather the last 3-6 months of AISH direct deposit statements and corresponding full bank statements (not just screenshots). Also have a recent utility bill or government letter to prove your address in Edmonton. The more organized you are, the more serious you appear.

- Know Your Credit Score (The Real Story): Don't just pull the free number from your banking app. Get your full consumer disclosure report from Equifax or TransUnion for free online. This report tells you why your score is low—a past collection, a few late payments, a high credit card balance. Knowing these details allows you to explain them honestly if a lender asks.

- The Down Payment Game Plan: A down payment is the single most powerful tool you have. It reduces the lender's risk, lowers your monthly payment, and shows you're financially committed. Even $500 can be the difference between a denial and an approval. Start putting aside a small amount from each AISH payment, sell an item you no longer need, or use a portion of a tax refund. It all adds up.

- Find a Co-signer (The Right Way): This can be a great option, but it's a serious commitment. A strong co-signer has a good credit score (over 680), stable income, and low personal debt. They are not just vouching for you; they are legally 100% responsible for the loan if you miss a payment. Discuss the serious pros and cons with any potential co-signer before proceeding.

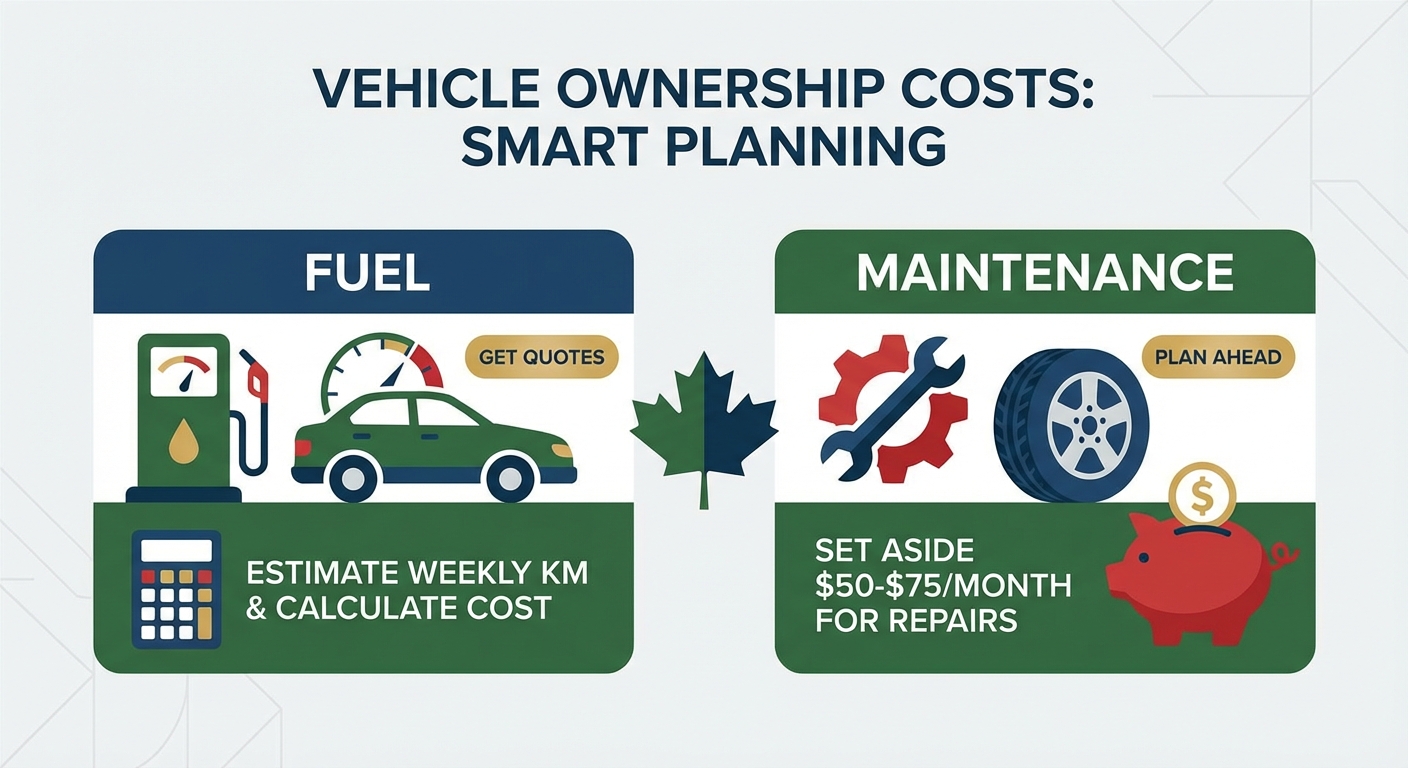

- Budget for the 'Total Cost of Ownership': The loan payment is only part of the story. Before you apply, calculate the real monthly cost. In Edmonton, this means factoring in:

- Loan Payment Estimate: (We'll cover this next)

- Car Insurance: Rates can be higher for new drivers or those with previous claims. Get a few quotes.

- Fuel: Estimate your weekly driving in kilometres and calculate the fuel cost.

- Maintenance: Set aside at least $50-$75 per month for oil changes, tires, and unexpected repairs.

Decoding the Numbers: What Interest Rates and Loan Terms to Realistically Expect

Let's be direct: with AISH as your primary income and a bad credit history, you won't qualify for the 5.99% interest rates you see advertised on TV. Those are reserved for prime borrowers with high scores and employment income. You will be looking at a subprime loan, which means interest rates typically range from 10% to 29.99%.

This isn't meant to discourage you; it's meant to empower you with realistic expectations. The goal is to secure a reliable vehicle with a payment that fits your budget, which will then help you rebuild your credit over time.

The biggest trap is focusing only on the monthly payment. Lenders can make any payment seem low by stretching the loan term out to 72, 84, or even 96 months. Look at how this impacts the total cost of a modest $10,000 vehicle at a subprime rate of 19.99%.

| Loan Term | Monthly Payment | Total Interest Paid | Total Cost of Car |

|---|---|---|---|

| 48 Months (4 years) | $304 | $4,592 | $14,592 |

| 72 Months (6 years) | $233 | $6,776 | $16,776 |

As you can see, the "cheaper" monthly payment of the 72-month loan costs you an extra $2,184 in interest. A shorter term, if your budget allows, saves you a significant amount of money.

Pro Tip: Ask for the "Total Cost of Borrowing"

Every lender in Alberta is legally required to provide you with this number. It cuts through all the confusing talk about interest rates, amortization, and terms. It's a single dollar amount that represents the total interest you will pay over the life of the loan. Always ask for it and compare it between different offers.

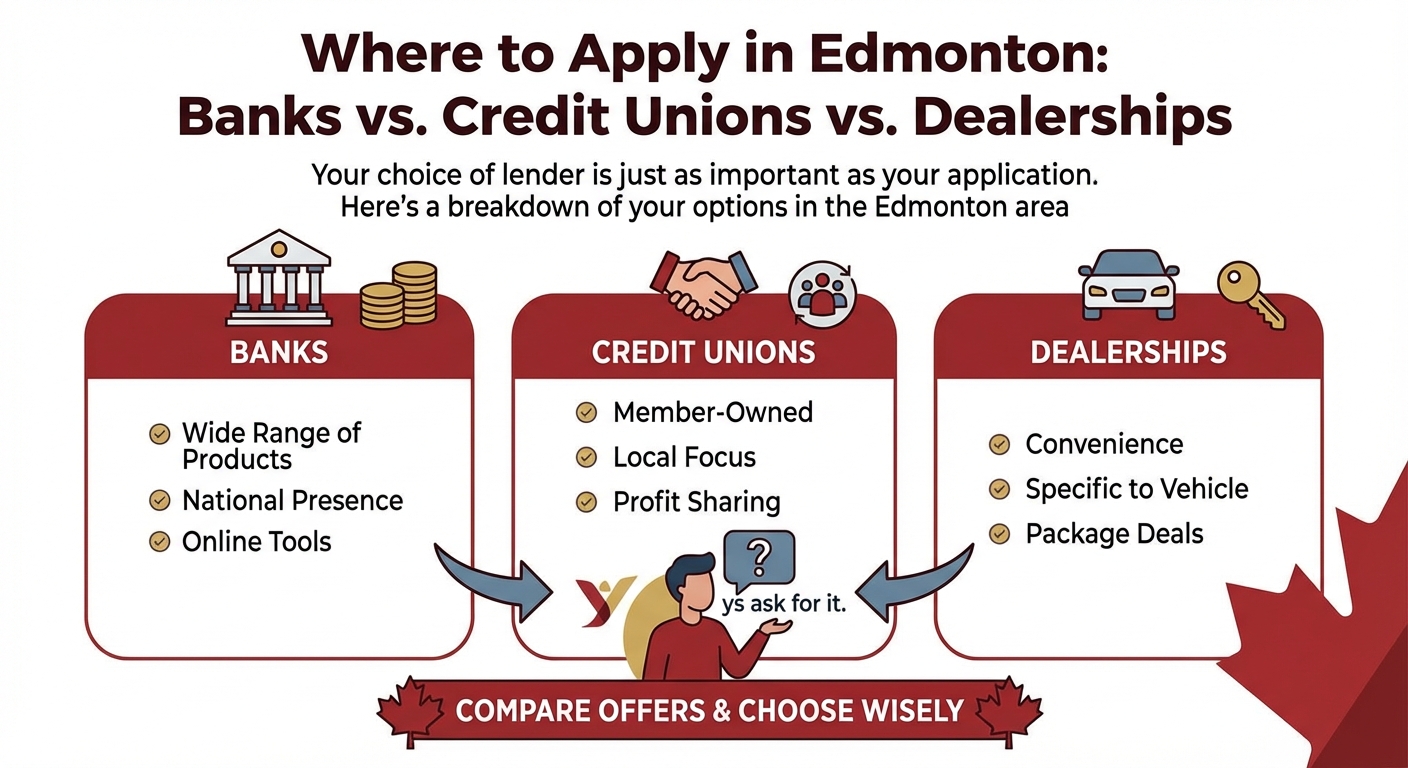

Where to Apply in Edmonton: Banks vs. Credit Unions vs. Dealerships

Your choice of lender is just as important as your application. Here’s a breakdown of your options in the Edmonton area.

| Lender Type | Approval Odds with Bad Credit | Typical Interest Rate Range | Best For... |

|---|---|---|---|

| Big Banks (RBC, TD) | Very Low | 6% - 12% | Prime borrowers with excellent credit and employment income. |

| Alberta Credit Unions (Servus, Connect First) | Low to Moderate | 8% - 18% | Existing members with a long history and a slightly bruised credit score. |

| Dealership Financing (Special Finance Dept.) | Very High | 10% - 29.99% | Most AISH applicants with bad credit. They have direct access to subprime lenders. |

| Online Lenders (Canada Drives, etc.) | High | 12% - 29.99% | Convenience and getting a pre-approval from home to compare offers. |

For most people in your situation, the dealership's special finance department is the most direct path to an approval. They have established relationships with lenders who specialize in non-traditional income and bad credit files. If you're feeling overwhelmed, don't repeat common errors. Check out our guide on Your 2026 Car Loan Questions, Edmonton to arm yourself with knowledge.

On the Lot: Your Guide to Navigating Edmonton Dealerships Without Getting Burned

Once you have a pre-approval, or are ready to visit a dealership, you need a game plan. The goal is to secure a reliable vehicle and a fair loan, not to be taken for a ride.

- Avoid 'Payment Shopping': Never walk in and say, "I can afford $350 a month." This gives the dealership a blank cheque to max out your budget, often by selling you a more expensive car on a very long term. Instead, say, "I'm pre-approved for a loan of $15,000 and I'm looking for a reliable vehicle within that budget."

- Get Pre-Approved First: This is the ultimate power move. Getting pre-approved with a company like SkipTheCarDealer turns you into a cash buyer. You can walk into any dealership in Edmonton, negotiate on the price of the car, and not have to worry about their financing games.

- Understand All-In Pricing: In Alberta, the price you see advertised must be the "all-in" price. The only extra fee that can be added is GST. Be wary of dealerships trying to add extra "admin fees," "freight," or "PDI" on top of the advertised price for used vehicles.

- Know Your Rights: The Alberta Motor Vehicle Industry Council (AMVIC) is Alberta's automotive regulator. They protect consumers. If you feel you've been misled, they are your resource.

Pro Tip: The Urgency Test

If a salesperson or finance manager is pressuring you to sign a deal right now because "the offer is only good for today," it's a major red flag. A legitimate, fair offer will still be there tomorrow. This is a high-pressure tactic designed to prevent you from thinking clearly or comparing offers. Politely thank them for their time and walk away.

The AISH Rules: Will a Car Loan Affect Your Benefits?

This is a common and completely valid fear. The last thing you want is for your effort to gain independence to jeopardize the very income you rely on. Here's the good news.

AISH has asset limits, but a primary vehicle is typically considered an exempt asset. This means the value of your main car does not count towards your asset limit, especially when it's necessary for daily living, attending medical appointments, or participating in the community.

Furthermore, the car loan itself is a debt, not an asset or income. Taking on a loan does not increase your income, so it has no direct impact on the amount of your monthly AISH payment. The money from the lender goes directly to the dealership to pay for the car; it never touches your bank account as cash.

Crucial Caveat: While this is the general rule, every person's situation is unique. It is always best to have a quick conversation with your AISH case worker. Simply state, "I am considering financing a vehicle to help with my mobility. I want to confirm that having a primary vehicle and a car loan will not affect my eligibility or monthly benefits." They can provide a definitive answer for your specific file.

Your Edmonton Roadmap: From Application to Keys in Hand

Feeling empowered? Good. Let's condense this all into a clear, step-by-step action plan for 2026.

- Assess: Use the "Total Cost of Ownership" budget you created. Determine a realistic all-in monthly payment you can comfortably afford, including insurance and fuel.

- Prepare: Gather your "Approval Stack" documents—AISH statements, bank statements, and proof of address. Get your free credit report.

- Pre-Qualify: This is the most important step. Apply with a specialized online lender or a trusted dealership finance department. This gives you a clear budget and interest rate expectation without impacting your credit score multiple times. It's the smart way to shop. If you have no credit history at all, getting started is easier than you think. Our guide, No Credit? Great. We're Not Your Bank, explains how.

- Shop Smart: With your pre-approval amount in hand, focus on reliable, fuel-efficient, and affordable vehicles like a Toyota Corolla, Honda Civic, or Hyundai Elantra. Your goal is reliable transportation, not a status symbol.

- Review & Sign: Before you sign the final bill of sale and loan agreement, read every single line. Match the numbers to your pre-approval. Ensure there are no hidden fees or unwanted extras. Never let yourself be rushed through this final step.